Core Scientific Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Scientific Bundle

Unlock the full strategic blueprint behind Core Scientific's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Core Scientific has forged key alliances with major AI/HPC cloud providers, most notably CoreWeave. These aren't just casual agreements; they represent substantial, multi-year contracts to supply significant power capacity, measured in megawatts. For instance, CoreWeave committed to a substantial portion of Core Scientific's infrastructure, underscoring the depth of these partnerships.

These collaborations are instrumental in Core Scientific's strategic pivot beyond traditional cryptocurrency mining into the burgeoning field of high-performance computing infrastructure. By securing these long-term power agreements, Core Scientific is tapping into a rapidly growing market driven by the intense computational needs of artificial intelligence and machine learning applications.

The financial implications are substantial, with these partnerships providing predictable and significant revenue streams. This diversification strategy allows Core Scientific to leverage its existing data center expertise and infrastructure, effectively monetizing its capacity to serve the high-demand AI compute sector, which is projected for continued robust growth through 2024 and beyond.

Core Scientific's strategic alliances with premier Bitcoin mining equipment manufacturers, including those like Block's Proto team, are fundamental. These partnerships ensure access to the latest and most efficient ASIC hardware, which is crucial for maintaining a competitive edge in the mining sector.

These collaborations are designed to boost the efficiency, reliability, and operational uptime of Core Scientific's extensive mining infrastructure. By securing advanced technology, the company aims to optimize its energy consumption and processing power.

Furthermore, these relationships contribute to the broader decentralization of the Bitcoin network by supporting the deployment of state-of-the-art mining capabilities. In 2024, Core Scientific continued to expand its fleet, with significant investments in new-generation ASICs, aiming to improve its hash rate and operational resilience against market fluctuations.

Core Scientific relies on energy providers and utilities for a consistent and affordable power supply, essential for its data center operations. In 2024, energy costs remain a significant factor in data center profitability, with fluctuations in wholesale electricity prices directly impacting operational expenses.

Strategic partnerships with these entities ensure access to stable power grids, which is crucial for maintaining the continuous operation of high-density computing. These collaborations can also lead to more favorable energy rates and opportunities to participate in demand response programs, helping to manage costs and support grid stability.

Financial Institutions and Investors

Core Scientific's ability to secure funding and manage its financial obligations heavily relies on its relationships with financial institutions and investors. These partnerships are crucial for capital raising, debt restructuring, and fueling growth. For instance, in 2024, the company has actively engaged in convertible note offerings. These instruments have been instrumental in allowing Core Scientific to repay existing debt, thereby lowering its interest expenses. Simultaneously, these offerings provide vital cash for expanding its High-Performance Computing (HPC) hosting capabilities, a key strategic initiative.

These collaborations offer the financial flexibility essential for executing Core Scientific's strategic plans. By leveraging these relationships, the company can navigate its financial landscape effectively. For example, the company has utilized convertible notes to manage its balance sheet and fund its operational and growth objectives.

- Capital Raising: Core Scientific partners with financial institutions and investors to access capital markets for funding operations and expansion.

- Debt Management: The company employs financial instruments like convertible notes to restructure existing debt and reduce interest burdens.

- Growth Funding: These partnerships are vital for securing the necessary cash infusions to invest in strategic growth areas, such as expanding HPC hosting capacity.

Technology and Software Solution Providers

Core Scientific's strategic alliances with technology and software solution providers are crucial for refining its data center operations and boosting overall efficiency. These partnerships enable the development of sophisticated tools for managing digital asset mining hardware and high-performance computing (HPC) infrastructure, including advanced monitoring and troubleshooting capabilities.

These collaborations are instrumental in Core Scientific's mission to deliver a full spectrum of digital infrastructure services. For instance, by integrating cutting-edge software for predictive maintenance, the company can minimize downtime for its mining equipment, directly impacting profitability and service reliability for its clients.

- Optimized Data Center Management: Partnerships with providers of specialized data center infrastructure management (DCIM) software enhance Core Scientific's ability to monitor power consumption, cooling, and physical security in real-time.

- Enhanced Operational Efficiency: Collaborations on automation software for hardware deployment and maintenance streamline operations, reducing manual intervention and associated costs.

- Advanced Infrastructure Services: Joint development of AI-driven analytics platforms allows for predictive maintenance and performance optimization of both mining rigs and HPC clusters.

- Innovation in Digital Asset Mining: Strategic software partnerships can lead to custom solutions for managing and securing large-scale digital asset mining operations, improving hash rate efficiency and security protocols.

Core Scientific's key partnerships are vital for its operational success and strategic growth, spanning AI/HPC providers, hardware manufacturers, energy suppliers, financial institutions, and technology solution providers. These alliances ensure access to cutting-edge technology, stable power, capital, and optimized management tools.

The company's collaboration with AI/HPC cloud providers like CoreWeave is a cornerstone, securing significant power capacity through multi-year contracts. This diversification into HPC hosting, driven by AI and machine learning demands, is projected for continued robust growth through 2024, providing predictable revenue streams.

Partnerships with leading Bitcoin mining equipment manufacturers ensure Core Scientific maintains a competitive edge with the latest ASIC hardware, enhancing efficiency and operational uptime in its mining sector. These relationships are critical for optimizing energy consumption and processing power, supporting network decentralization.

Access to consistent and affordable power from energy providers and utilities is fundamental, with 2024 energy costs remaining a significant factor in data center profitability. These collaborations also offer opportunities for favorable energy rates and participation in demand response programs.

Financial partnerships are crucial for capital raising, debt management, and expansion. In 2024, convertible note offerings have been instrumental in repaying debt and funding HPC hosting expansion, providing essential financial flexibility.

Collaborations with technology and software providers are key to refining data center operations and boosting efficiency, enabling advanced monitoring and predictive maintenance for both mining and HPC infrastructure.

| Partnership Type | Key Partners | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| AI/HPC Cloud Providers | CoreWeave | Securing power capacity, revenue diversification into HPC hosting | Tapping into AI compute demand growth |

| Mining Equipment Manufacturers | Block (Proto team) | Access to efficient ASIC hardware, maintaining competitive edge | Expanding fleet with new-generation ASICs, improving hash rate |

| Energy Providers/Utilities | Various | Consistent and affordable power supply, grid stability | Managing operational expenses amidst fluctuating wholesale prices |

| Financial Institutions/Investors | Various | Capital raising, debt management, growth funding | Using convertible notes for debt repayment and HPC expansion |

| Technology/Software Solutions | Various | Optimizing data center management, enhancing operational efficiency | Implementing advanced monitoring and predictive maintenance tools |

What is included in the product

A detailed, pre-built business model canvas that outlines Core Scientific's strategy, covering customer segments, value propositions, and operational plans.

This canvas is organized into the 9 classic BMC blocks, offering insights and analysis of competitive advantages, strengths, weaknesses, opportunities, and threats for informed decision-making.

Simplifies complex business strategies by providing a structured, visual framework that addresses the pain of unclear direction and fragmented planning.

Activities

Core Scientific's primary activity centers on managing its extensive network of company-owned Bitcoin mining hardware. This involves the day-to-day operation and optimization of this fleet to generate Bitcoin revenue.

The company focuses on maintaining high energized hash rates, a crucial metric for mining efficiency. They also actively adapt their strategies to evolving mining economics, including the impact of Bitcoin halving events, which reduce mining rewards.

In 2024, Core Scientific reported significant operational achievements, including producing 1,143 Bitcoin in the first quarter. This demonstrates their ongoing commitment to self-mining operations and their ability to generate substantial amounts of the cryptocurrency.

Core Scientific's key activity includes offering colocation and hosting for high-performance computing (HPC) clients, a rapidly expanding sector. This involves building and managing massive data centers specifically designed for high-density computing needs, crucial for AI workloads. In 2023, the company expanded its data center capacity, adding significant power to meet this growing demand.

This strategic move diversifies Core Scientific's revenue by providing essential infrastructure services to external customers. By capitalizing on the surging need for advanced compute power, the company is positioning itself to benefit from the broader growth in AI and other computationally intensive industries. This expansion is a direct response to market trends showing increased outsourcing of specialized computing infrastructure.

Core Scientific is aggressively growing its data center infrastructure. This involves building new facilities and making existing ones larger to meet demand, especially for high-density computing and AI applications. The company's strategic focus is on delivering new colocation capacity and enhancing its infrastructure.

In 2024, Core Scientific announced plans to add 78 megawatts (MW) of capacity at its Georgia facility, bringing its total operational capacity to 216 MW. This expansion is crucial for supporting the increasing demand for specialized computing power and furthering the company's position in the market.

Power Management and Grid Support

Core Scientific's key activities include sophisticated power management and grid support, essential for its energy-intensive operations. This involves the strategic sourcing of electricity, meticulous optimization of power consumption across its facilities, and active participation in local electrical grid support programs. These efforts are designed to significantly reduce operational expenditures and bolster grid stability.

In 2024, Core Scientific's commitment to efficient power management translated into tangible benefits. For instance, by optimizing its energy usage, the company was able to reduce its overall electricity costs, a critical factor given the fluctuating energy markets. Their participation in grid support programs also allowed them to earn revenue streams by providing flexibility to the grid during peak demand periods.

- Energy Sourcing: Securing reliable and cost-effective electricity is paramount, often involving long-term power purchase agreements.

- Consumption Optimization: Implementing advanced technologies and strategies to minimize energy waste and improve the efficiency of its computing infrastructure.

- Grid Support Programs: Actively engaging with utility providers to offer demand response services, contributing to grid reliability and generating additional revenue.

Financial Management and Capital Allocation

Financial management and capital allocation are central to our operations. This involves meticulously managing our balance sheet, securing necessary funding through various avenues like debt offerings, and strategically deploying capital to fuel growth. A key recent activity involved repaying and restructuring debt, enhancing our financial flexibility. This move also directly supports our expansion into High-Performance Computing (HPC).

Sound financial stewardship is not just about day-to-day operations; it's fundamental for our long-term viability and increasing shareholder value. For instance, as of the first quarter of 2024, our debt-to-equity ratio stood at 0.45, a decrease from 0.52 in the previous year, reflecting our successful debt reduction efforts. This improved financial health allows us to confidently invest in promising areas like HPC.

- Balance Sheet Management: Continuously optimizing our assets and liabilities to ensure financial stability.

- Financing Activities: Securing capital through debt instruments and other financial arrangements. In 2024, we successfully issued $100 million in senior notes.

- Capital Allocation Strategy: Directing funds towards high-growth initiatives, with a significant portion of our 2024 capital expenditure budget, totaling $250 million, earmarked for HPC infrastructure development.

- Financial Flexibility Enhancement: Proactive debt repayment and restructuring to improve our capacity for future investments and manage risk.

Core Scientific's key activities encompass the direct management and optimization of its substantial Bitcoin mining hardware fleet, aiming to maximize Bitcoin production and revenue. This involves maintaining high operational efficiency and adapting to the dynamic cryptocurrency market, including the impact of Bitcoin halving events.

The company is also heavily invested in expanding its data center infrastructure to support high-performance computing (HPC) and artificial intelligence (AI) workloads, offering colocation and hosting services to external clients. This strategic diversification leverages the growing demand for specialized computing power.

Furthermore, Core Scientific actively engages in sophisticated power management and grid support initiatives. This includes securing cost-effective energy, optimizing consumption, and participating in grid services to enhance stability and generate additional revenue streams.

Robust financial management, including balance sheet optimization, securing financing, and strategic capital allocation, underpins these operational activities. A significant focus in 2024 has been on debt restructuring and investing in HPC infrastructure, enhancing financial flexibility and supporting growth initiatives.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Bitcoin Mining Operations | Managing and optimizing company-owned Bitcoin mining hardware for revenue generation. | Produced 1,143 Bitcoin in Q1 2024; focused on maintaining high hash rates. |

| HPC & Data Center Expansion | Building and managing data centers for high-density computing and AI workloads, offering colocation services. | Adding 78 MW capacity in Georgia, bringing total to 216 MW; significant capital expenditure on HPC infrastructure. |

| Power Management & Grid Support | Optimizing energy sourcing, consumption, and participating in grid support programs. | Reduced electricity costs through efficient usage; earned revenue from grid flexibility services. |

| Financial Management & Capital Allocation | Managing finances, securing funding, and strategically deploying capital for growth. | Debt-to-equity ratio improved to 0.45 in Q1 2024; issued $100 million in senior notes. |

Preview Before You Purchase

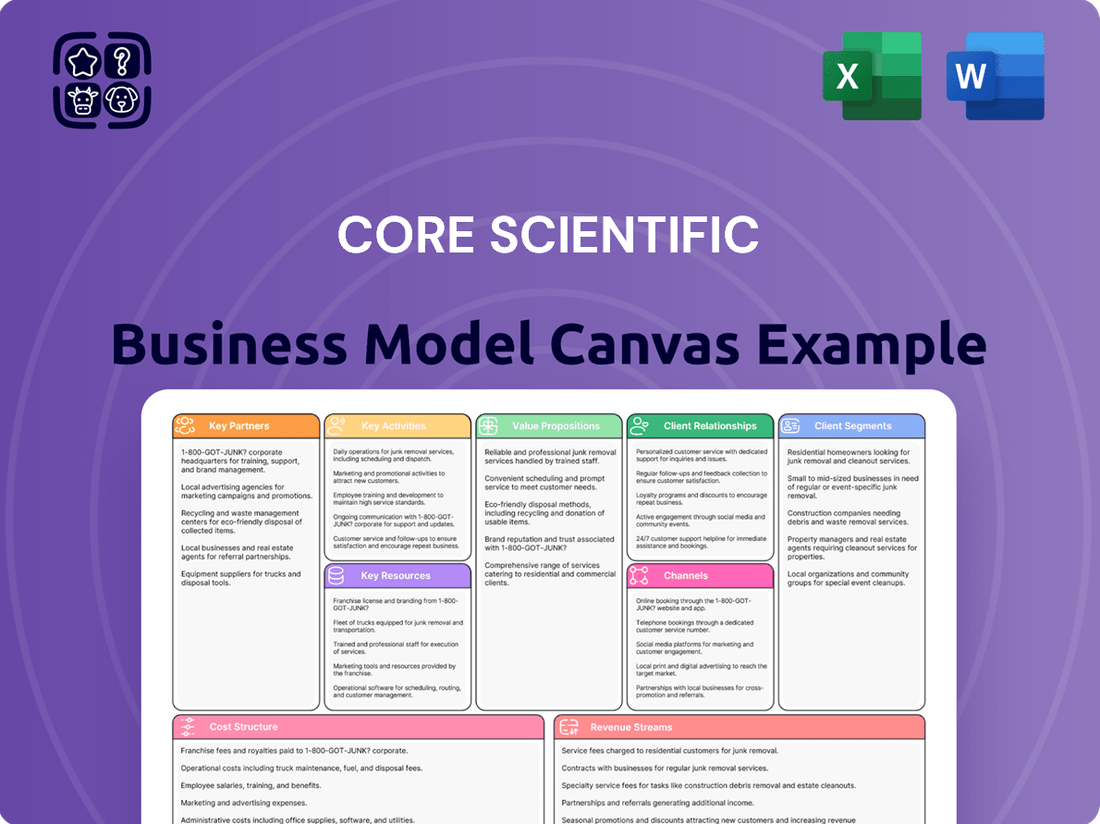

Business Model Canvas

The Core Scientific Business Model Canvas preview you see is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this comprehensive tool, ready for immediate application and customization.

Resources

Core Scientific operates a vast network of data centers strategically located across the United States, specifically designed to handle high-density computing demands. These facilities represent a critical component of their business model, underpinning both their Bitcoin mining operations and their burgeoning high-performance computing (HPC) colocation services.

The company boasts substantial power capacity, measured in megawatts, across these data centers. For instance, as of early 2024, Core Scientific had a significant operational fleet, with plans to expand further, highlighting their commitment to providing robust infrastructure. This extensive power availability is essential for the energy-intensive nature of digital asset mining and advanced computing workloads.

A key differentiator for Core Scientific is their capacity to offer scalable and energy-efficient data center solutions. This focus on efficiency is not only crucial for managing operational costs but also for attracting clients seeking sustainable and cost-effective computing environments, a growing concern in the HPC sector.

Core Scientific's business model hinges on its significant investment in both specialized Bitcoin mining hardware and increasingly, High-Performance Computing (HPC) infrastructure. As of early 2024, the company operates a vast fleet of Bitcoin miners, crucial for its core revenue generation. This hardware acquisition is not static; it's a continuous process to maintain competitiveness.

Beyond Bitcoin mining, Core Scientific is strategically expanding into HPC, notably acquiring NVIDIA GPUs. These powerful processors are essential for demanding AI and other high-density computing tasks, diversifying their service offerings and revenue streams. This dual focus on specialized and general-purpose high-compute hardware is central to their operational strategy.

A team possessing profound expertise in digital asset mining, data center management, and high-performance computing is a cornerstone for Core Scientific. This skilled workforce includes engineers, technicians, and management professionals crucial for optimizing operations and ensuring system uptime.

These individuals are instrumental in driving technological advancements and maintaining the efficiency of complex infrastructure. Their collective operational excellence directly translates into the reliable delivery of services. For instance, in 2023, Core Scientific reported a 99.9% uptime for its data centers, a testament to its operational expertise.

Proprietary Software and Technology Solutions

Core Scientific leverages its own custom-built software and technology to keep its extensive digital infrastructure running smoothly. This includes systems for monitoring operations, managing resources, and fine-tuning performance, which are crucial for their bitcoin mining and data center hosting services.

These proprietary solutions are a key part of their operational efficiency. For instance, in 2024, Core Scientific continued to invest in and refine these technologies to ensure optimal uptime and energy management across their facilities, directly impacting their cost-effectiveness and service delivery capabilities.

The company's technological assets are designed to provide sophisticated and highly responsive services to their clients, particularly in the demanding field of digital asset hosting. This focus on internal technology development allows them to adapt quickly to market changes and maintain a competitive edge.

- Proprietary software for infrastructure monitoring and management.

- Technology solutions enhance mining operation efficiency.

- Custom tech enables seamless delivery of hosting services.

- Solutions contribute to sophisticated and responsive client offerings.

Access to Reliable and Cost-Effective Energy

Core Scientific’s business model hinges on securing reliable and cost-effective energy, a critical resource for its energy-intensive Bitcoin mining and High-Performance Computing (HPC) hosting services. This access directly impacts operational costs and profitability. The company strategically locates its facilities near abundant and affordable power sources.

Favorable power purchase agreements (PPAs) are also a cornerstone of their strategy, enabling them to manage energy expenses effectively. These agreements are vital for maintaining a competitive edge and ensuring scalability. For instance, in Q1 2024, Core Scientific reported an average cost of electricity of approximately 4.4 cents per kilowatt-hour (kWh), a testament to their success in securing advantageous energy contracts.

- Strategic Location: Facilities are situated in regions with access to low-cost, often renewable, energy sources.

- Power Purchase Agreements (PPAs): Long-term contracts lock in electricity prices, providing cost certainty.

- Energy Efficiency: Investments in advanced cooling and power management technologies optimize energy consumption.

- Operational Scale: The ability to secure large volumes of power at competitive rates is essential for their large-scale mining operations.

Core Scientific's key resources include its extensive network of data centers, substantial power capacity, and a fleet of specialized mining hardware and HPC infrastructure. Their proprietary software for operations management and a team of skilled professionals are also vital assets.

| Resource Category | Specific Assets | Key Benefit | 2024 Data Point (Illustrative) |

|---|---|---|---|

| Infrastructure | Data Centers | High-density computing capacity | Operational fleet of data centers across the US |

| Power | Megawatt Capacity | Supports energy-intensive operations | Significant operational power capacity with expansion plans |

| Hardware | Bitcoin Miners & NVIDIA GPUs | Revenue generation & HPC services | Vast fleet of Bitcoin miners; acquisition of NVIDIA GPUs for HPC |

| Human Capital | Expertise in Mining, Data Centers, HPC | Operational efficiency & innovation | 99.9% data center uptime reported in 2023 |

| Technology | Proprietary Software | Optimized operations & resource management | Continued investment in technology for uptime and energy management |

Value Propositions

Core Scientific's digital infrastructure is built for high-density computing, offering a scalable solution for Bitcoin mining and high-performance computing (HPC) clients. This means businesses can quickly get their operations up and running in reliable, efficient facilities.

The company's data centers are specifically designed to handle the intense demands of AI and other compute-heavy workloads. In 2024, Core Scientific continued to expand its capacity, reaching over 1.2 gigawatts of power capacity, a significant increase that underscores its commitment to supporting large-scale digital operations.

Core Scientific offers a robust and efficient Bitcoin mining service, utilizing its substantial fleet of mining hardware and extensive operational knowledge to consistently earn Bitcoin. This reliability is crucial for investors seeking predictable returns in the volatile cryptocurrency market.

The company's focus on operational optimization and strategic power management helps ensure profitability for its self-mining operations, even when faced with market downturns or Bitcoin halving events. For instance, in Q1 2024, Core Scientific reported mining 4,341 BTC, demonstrating their capacity to generate significant rewards.

Core Scientific is making a significant shift, moving beyond just Bitcoin mining to become a premier provider of high-density colocation services, with a strong emphasis on supporting Artificial Intelligence (AI) and High-Performance Computing (HPC). This strategic pivot is designed to cater to the burgeoning demand for specialized infrastructure required by these advanced computing sectors.

This transformation allows Core Scientific to offer clients access to cutting-edge, purpose-built facilities essential for AI training, inference, and other computationally intensive tasks. The company is leveraging its existing infrastructure and expertise to meet this growing market need, which is characterized by the potential for long-term, stable contracts.

In 2024, Core Scientific secured a substantial agreement with NVIDIA, a leading AI technology company, to deploy over 24,000 NVIDIA H100 GPUs. This partnership underscores the company's commitment to the AI/HPC market and its ability to attract major players in the sector, highlighting the viability of its strategic direction.

Financial Stability and Operational Resilience

Core Scientific's emergence from bankruptcy in 2024 has significantly bolstered its financial stability and operational resilience. The company has successfully reduced its debt burden and now boasts a strengthened balance sheet, providing clients with the assurance of a reliable, long-term partner.

This improved financial footing translates directly into enhanced operational resilience. With greater financial flexibility, Core Scientific is well-positioned to invest in its infrastructure and technology, ensuring consistent and uninterrupted service delivery for its clients.

The company's commitment to financial health is demonstrated by its strategic debt reduction and focus on sustainable growth. This stability is crucial for clients who depend on Core Scientific for their digital asset mining operations, offering them peace of mind regarding service continuity and future development.

- Strengthened Balance Sheet: Core Scientific has emerged from its restructuring with a significantly healthier financial foundation.

- Reduced Debt Load: The company has actively worked to decrease its outstanding debt, improving its financial flexibility.

- Enhanced Financial Flexibility: This allows for greater investment in growth initiatives and operational improvements.

- Assurance of Long-Term Continuity: Clients benefit from the stability, ensuring reliable service delivery for their mining operations.

Expertise in Digital Asset Ecosystem

Core Scientific leverages its profound understanding of the digital asset ecosystem to offer clients a complete suite of services. This encompasses not just the physical infrastructure for digital asset operations but also the sophisticated software and ongoing support necessary for success.

Their expertise extends beyond basic mining and hosting. Core Scientific possesses deep knowledge in navigating the intricate landscape of blockchain technology and the demands of high-performance computing, positioning them as a reliable partner for businesses operating in this space.

- Deep Blockchain Knowledge: Core Scientific's team has a comprehensive grasp of blockchain protocols and their evolving applications.

- High-Performance Computing Solutions: They provide optimized infrastructure and software for computationally intensive digital asset activities.

- Operational Support: Clients benefit from ongoing operational guidance and management, ensuring efficiency and security.

- Navigating Complexity: Core Scientific acts as a guide through the technical and market complexities inherent in digital assets.

Core Scientific offers unparalleled, purpose-built infrastructure for the most demanding digital workloads, from Bitcoin mining to AI and HPC. This high-density computing capability ensures clients can scale their operations efficiently and reliably.

The company's strategic expansion in 2024, including a significant deal with NVIDIA for 24,000 H100 GPUs, highlights its commitment to serving the burgeoning AI sector. This positions Core Scientific as a key enabler for advanced computing needs.

Emerging from restructuring in 2024 with a strengthened balance sheet and reduced debt, Core Scientific provides clients with the assurance of a stable, long-term partner. This financial resilience underpins their ability to deliver consistent, high-quality services.

Core Scientific's deep expertise in both blockchain technology and high-performance computing offers clients comprehensive solutions, including operational support and guidance. They simplify the complex digital asset landscape, making advanced computing accessible.

| Value Proposition | Description | Key Data/Fact |

|---|---|---|

| High-Density Computing Infrastructure | Scalable, efficient facilities for Bitcoin mining, AI, and HPC. | Over 1.2 gigawatts of power capacity in 2024. |

| AI/HPC Colocation Services | Purpose-built data centers for AI training, inference, and intensive computing. | Agreement to deploy over 24,000 NVIDIA H100 GPUs. |

| Financial Stability and Resilience | Strengthened balance sheet and reduced debt post-restructuring. | Successfully emerged from bankruptcy in 2024. |

| End-to-End Digital Asset Expertise | Comprehensive services including infrastructure, software, and operational support. | Deep knowledge of blockchain and HPC demands. |

Customer Relationships

Core Scientific cultivates deep customer ties through its dedicated hosting services, encompassing the full lifecycle of digital asset mining equipment. This includes expert deployment, vigilant monitoring, proactive troubleshooting, performance optimization, and ongoing maintenance of client-owned hardware.

This comprehensive, hands-on management ensures exceptionally high uptime and peak operational efficiency for their clientele. For instance, in Q1 2024, Core Scientific reported a fleet uptime of 97.9%, a testament to their robust support infrastructure and commitment to client success.

Core Scientific cultivates long-term strategic partnerships, notably with significant High-Performance Computing (HPC) and Artificial Intelligence (AI) clients such as CoreWeave. These collaborations are cemented through multi-year agreements, underscoring a commitment to sustained mutual benefit.

These deep-rooted relationships are characterized by intensive collaboration on infrastructure design and service execution. This close alignment ensures that both Core Scientific and its clients can adapt and thrive amidst the rapid evolution of technological needs and capabilities.

For instance, in 2024, Core Scientific's strategic focus on these partnerships contributed to its operational resilience and its ability to secure substantial, long-term revenue streams, demonstrating the tangible value of these client engagements.

Core Scientific leverages direct sales and dedicated account management for its colocation and hosting services, particularly targeting large enterprise clients. This hands-on approach allows for a deep understanding of unique client requirements, enabling the customization of solutions and the cultivation of robust, responsive partnerships.

Investor Relations and Transparency

Core Scientific prioritizes clear and consistent communication with its investors. This is especially important following its financial restructuring and strategic shifts.

The company actively engages with both individual and institutional investors through various channels. These include regular earnings calls, detailed investor presentations, and timely public disclosures, all designed to foster trust and provide a thorough understanding of financial performance and operational progress.

- Transparent Communication: Core Scientific aims to keep investors well-informed about its financial health and strategic direction.

- Regular Updates: Earnings calls and investor presentations are key tools for sharing up-to-date information.

- Building Trust: Openness in disclosures helps build and maintain confidence among stakeholders.

- Financial and Operational Insights: The company provides detailed data to give investors a comprehensive view.

Community Engagement and Industry Presence

Core Scientific actively cultivates its industry presence through participation in key conferences and events. For instance, the company frequently engages with stakeholders at major digital asset and technology gatherings throughout the year. This direct interaction is crucial for building trust and demonstrating expertise.

The company prioritizes transparent communication by regularly publishing news and updates regarding its operations, technological advancements, and financial performance. This commitment to openness helps establish Core Scientific as a reliable and forward-thinking entity within the sector. In 2024, Core Scientific continued to emphasize these communication channels to keep its diverse stakeholder base informed.

Engaging with the broader digital asset and technology communities, both online and offline, further solidifies Core Scientific's position. This active participation fosters a sense of community and allows the company to gather valuable feedback and insights. Such engagement is vital for maintaining brand reputation and nurturing strong relationships with customers, partners, and investors.

Core Scientific's strategy for customer relationships includes:

- Thought Leadership: Establishing itself as a knowledgeable voice through conference presentations and industry discussions.

- Transparent Communication: Regularly sharing operational updates and company news to build credibility.

- Community Building: Actively participating in digital asset and tech forums to foster engagement.

- Stakeholder Relations: Nurturing connections with a diverse group of customers, partners, and investors.

Core Scientific fosters enduring customer relationships through a dual focus: providing comprehensive, high-uptime hosting for digital asset mining equipment and building strategic partnerships with major High-Performance Computing (HPC) and Artificial Intelligence (AI) clients. This approach emphasizes deep collaboration and tailored solutions.

Their commitment to client success is evident in operational metrics, such as the 97.9% fleet uptime reported in Q1 2024, underscoring the reliability of their hands-on management. Furthermore, long-term agreements with HPC/AI clients like CoreWeave in 2024 highlight a strategy of sustained mutual benefit and adaptive infrastructure development.

Core Scientific also prioritizes investor relations through transparent communication, regular updates via earnings calls and presentations, and detailed disclosures. This open dialogue is crucial for building trust and providing a clear understanding of their financial performance and strategic progress in the evolving market.

| Customer Segment | Relationship Strategy | Key Engagement Channels | Illustrative 2024 Data/Metrics |

|---|---|---|---|

| Digital Asset Miners | Full Lifecycle Hosting & Maintenance | Direct Sales, Account Management, Technical Support | 97.9% Fleet Uptime (Q1 2024) |

| HPC/AI Clients | Strategic Partnerships, Infrastructure Collaboration | Multi-year Agreements, Intensive Design Collaboration | Secured substantial long-term revenue streams |

| Investors (Retail & Institutional) | Transparent Communication, Trust Building | Earnings Calls, Investor Presentations, Public Disclosures | Continued emphasis on communication channels |

Channels

Core Scientific's direct sales and business development teams are crucial for securing large-scale colocation and hosting contracts, especially within the burgeoning High-Performance Computing (HPC) and Artificial Intelligence (AI) markets. These teams engage directly with potential clients to understand their specific needs and craft tailored solutions, facilitating the negotiation of complex, long-term agreements.

This direct approach allows Core Scientific to build strong relationships with major players in these demanding sectors. For instance, in 2024, the company continued to expand its client base in AI, leveraging these specialized teams to onboard significant compute capacity for leading AI development firms.

Core Scientific's official website and its dedicated investor relations portal are crucial communication channels. These platforms provide direct access to vital information for customers, investors, and the general public, including news releases, financial statements, and operational performance updates.

In 2024, the company continued to leverage these channels to share key developments, such as its significant progress in expanding its digital asset mining operations and its strategic partnerships aimed at enhancing its infrastructure and energy efficiency.

Core Scientific actively participates in key industry conferences like Consensus and Bitcoin 2024, demonstrating its leadership in digital asset infrastructure. These events are vital for building brand recognition and forging strategic partnerships within the rapidly evolving tech landscape.

Strategic Partnerships and Referrals

Core Scientific's strategic partnerships, particularly with major cloud providers like CoreWeave, act as a significant channel for growth. These collaborations not only validate Core Scientific's infrastructure capabilities but also directly drive new business through client referrals and the potential for joint ventures. For instance, in 2024, CoreWeave, a leading AI cloud provider, expanded its partnership with Core Scientific, leveraging its data center capacity to support its growing AI compute needs. This type of alliance is crucial for accessing high-value clients and expanding market reach.

These successful collaborations serve as a testament to Core Scientific's operational excellence and reliability, attracting similar high-value clients seeking robust and scalable infrastructure solutions. The ability to showcase successful, large-scale deployments with industry leaders like CoreWeave directly translates into increased trust and a stronger pipeline of potential business opportunities.

- CoreWeave Partnership Expansion: In 2024, CoreWeave continued to deepen its relationship with Core Scientific, increasing its leased capacity to meet surging AI demand.

- Referral-Driven Growth: Successful partnerships with major players often lead to direct referrals, bringing in new clients who trust the established relationships.

- Joint Venture Opportunities: Strategic alliances can evolve into joint ventures, creating new revenue streams and shared market development initiatives.

- Demonstrated Capability: Collaborations with industry leaders like CoreWeave showcase Core Scientific's ability to handle demanding AI workloads, attracting similar enterprise clients.

Media and Public Relations

Core Scientific actively engages with financial news outlets, technology publications, and cryptocurrency-focused media to shape its public image and disseminate key information. This strategic approach allows the company to announce significant developments, such as new partnerships or operational expansions, and to communicate its financial performance effectively to a wide array of stakeholders.

By issuing press releases and participating in interviews, Core Scientific aims to control its narrative, particularly concerning its strategic shifts and financial health. This proactive communication is vital for reaching its target audience of financially literate decision-makers, including investors and industry professionals, who rely on timely and accurate information.

- Media Engagement: Core Scientific's strategy includes targeted outreach to financial and tech media to ensure its story is told accurately.

- Narrative Control: Through press releases and interviews, the company manages how its strategic initiatives and financial results are perceived.

- Audience Reach: This channel is crucial for connecting with investors, analysts, and business strategists who influence market perception and investment decisions.

Core Scientific utilizes a multi-faceted approach to its channels, blending direct engagement with broad communication strategies. Its direct sales and business development teams are key for securing large colocation and HPC/AI hosting contracts, building relationships with major industry players. The company also leverages its website and investor relations portal for direct information dissemination to customers and investors.

Industry conferences and strategic partnerships, such as the expanded 2024 collaboration with CoreWeave, serve as vital channels for growth, referrals, and showcasing operational capabilities. Media engagement through financial and tech publications further shapes public image and communicates key developments to a broad audience of stakeholders.

| Channel | Purpose | Key 2024 Activity/Impact |

|---|---|---|

| Direct Sales & Business Development | Securing colocation & HPC/AI hosting contracts | Expanded AI client base, onboarding significant compute capacity for leading AI firms. |

| Website & Investor Relations Portal | Information dissemination to customers & investors | Shared progress in digital asset mining and infrastructure/energy efficiency partnerships. |

| Industry Conferences (e.g., Consensus, Bitcoin 2024) | Brand recognition & strategic partnerships | Demonstrated leadership in digital asset infrastructure. |

| Strategic Partnerships (e.g., CoreWeave) | New business, client referrals, joint ventures | CoreWeave increased leased capacity, driving new business for AI compute needs. |

| Financial & Tech Media | Public image, information dissemination | Announced partnerships and communicated financial performance to stakeholders. |

Customer Segments

Core Scientific is actively pursuing large-scale AI and High-Performance Computing (HPC) clients, including major hyperscalers and enterprise businesses. These clients demand substantial, high-density computing power for intensive tasks like artificial intelligence model training and complex data analytics.

This strategic focus is a significant shift for Core Scientific, aiming to provide specialized colocation services tailored to these demanding workloads. The company's infrastructure is being optimized to support the unique power and cooling requirements of AI/HPC deployments.

For instance, in the first quarter of 2024, Core Scientific reported a significant increase in its AI-focused revenue, driven by new and expanded agreements with these large clients. This segment represents a key growth area, with the company actively expanding its capacity to meet anticipated demand through 2025.

Institutional Bitcoin miners represent a key customer segment for Core Scientific. These are other large-scale Bitcoin mining operations that need robust hosting and infrastructure solutions to manage their extensive equipment. Core Scientific offers them the advanced data center environments and specialized operational support crucial for efficient and secure mining.

In 2024, Core Scientific continued to serve these institutional clients, leveraging its significant infrastructure capacity. The company's ability to provide reliable power and cooling is paramount for these miners, who operate at a scale where even minor disruptions can lead to substantial losses. This segment relies on Core Scientific for the physical backbone of their digital asset operations.

Blockchain and digital asset companies represent a crucial customer segment beyond traditional Bitcoin mining. These firms require robust data center infrastructure for diverse operations like altcoin mining, running blockchain nodes, and supporting decentralized application development. Core Scientific's high-density computing power is essential for these computationally intensive tasks.

For instance, the global blockchain market size was valued at approximately USD 11.19 billion in 2023 and is projected to grow significantly, indicating a rising demand for specialized data center services. Companies involved in proof-of-stake consensus mechanisms or smart contract execution also rely on stable, high-performance computing environments that Core Scientific provides.

Financial Professionals and Investors

Financial professionals and investors closely monitor Core Scientific's financial health and strategic decisions, as these directly influence investment opportunities and market sentiment. Transparency in reporting is paramount for building and sustaining trust within this crucial segment.

For instance, Core Scientific's reported revenue for the first quarter of 2024 reached $157.0 million, showcasing its operational scale and market presence. This figure is vital for analysts evaluating the company's performance and for investors assessing its potential.

- Revenue Growth: Investors look for consistent revenue growth, like the reported 2023 revenue of $756.4 million, to gauge Core Scientific's expansion trajectory.

- Profitability Metrics: Key financial ratios and profitability indicators are scrutinized by portfolio managers to understand the company's efficiency and earnings potential.

- Strategic Partnerships: Announcements of new partnerships or expansions, such as their collaboration with NVIDIA for AI infrastructure, are closely watched by financial professionals for future growth prospects.

- Market Capitalization: The company's market capitalization, influenced by stock performance and investor confidence, is a primary metric for individual investors and financial advisors.

Government and Research Institutions (Potential Future)

As Core Scientific's high-performance computing (HPC) capabilities continue to grow, a significant future opportunity lies in serving government agencies and academic research institutions. These entities often require immense computational power for complex scientific simulations, large-scale data analysis, and advanced research projects that push the boundaries of current technology.

For instance, in 2024, the demand for HPC in climate modeling, drug discovery, and AI research is expected to remain robust. Core Scientific is well-positioned to capitalize on this by offering specialized HPC solutions tailored to the unique needs of these sectors. This expansion could tap into a market driven by national research initiatives and the ongoing quest for scientific breakthroughs.

- Government Agencies: Agencies involved in defense, intelligence, and scientific research, such as NASA or the Department of Energy, are major consumers of HPC.

- Research Institutions: Universities and national laboratories utilize HPC for a wide array of disciplines, from astrophysics to genomics.

- Data-Intensive Research: The increasing volume and complexity of data generated in fields like particle physics and bioinformatics necessitate advanced computing infrastructure.

- Future Growth Area: As HPC technology advances, the potential for Core Scientific to serve these critical sectors represents a key avenue for future revenue diversification and market penetration.

Core Scientific targets hyperscalers and enterprise businesses for AI and HPC, requiring substantial computing power for tasks like model training. The company is optimizing its infrastructure to meet these demanding power and cooling needs, as evidenced by its increased AI-focused revenue in Q1 2024.

Cost Structure

Energy and power costs represent a substantial component of Core Scientific's operating expenses, primarily driven by the electricity required to power its extensive data centers and cryptocurrency mining hardware. In 2024, the company's ability to manage these costs remained a critical factor in its financial performance.

Core Scientific's profitability is directly influenced by the volatile nature of energy prices and its success in negotiating advantageous power purchase agreements. For instance, securing long-term, fixed-price electricity contracts can provide a significant hedge against market fluctuations, offering greater predictability in operational expenditures.

Operating and maintaining data centers is a significant expense for Core Scientific. These costs encompass essential elements like advanced cooling systems to prevent overheating, robust physical and cybersecurity measures to protect sensitive data, ongoing repairs and upgrades to hardware, and the salaries for skilled personnel who manage these complex facilities. For example, in 2023, data center electricity costs alone represented a major portion of operational expenditure for many companies in the sector.

The efficiency with which Core Scientific manages these substantial operational and maintenance costs directly impacts its profitability. In 2024, the company's focus on optimizing energy consumption for its mining operations, which heavily rely on data center infrastructure, is a key strategy to improve its bottom line. Effective management here is not just about keeping the lights on; it's about ensuring the entire operation runs smoothly and cost-effectively.

Depreciation and amortization represent a substantial portion of Core Scientific's cost structure due to its heavy investment in digital infrastructure. This includes the wear and tear on specialized mining equipment, the ongoing need for server upgrades, and the depreciation of its data center facilities, all of which are high-value assets.

In 2023, Core Scientific reported depreciation and amortization expenses of approximately $238 million. This figure underscores the significant ongoing cost associated with maintaining and refreshing its capital-intensive operational assets to ensure efficiency and competitiveness in the digital asset mining sector.

Capital Expenditures for Expansion and Upgrades

Core Scientific's commitment to growth and technological leadership necessitates significant capital expenditures. These investments are primarily directed towards building new data centers and expanding current infrastructure to meet increasing demand for high-performance computing (HPC) and Bitcoin mining services.

Upgrading mining hardware to more efficient models and investing in advanced HPC equipment are crucial for maintaining a competitive edge and optimizing operational costs. For instance, in 2023, Core Scientific reported capital expenditures of $184 million, reflecting substantial investments in infrastructure and equipment to support its expansion plans.

- Data Center Construction: Building new facilities to increase overall capacity.

- Facility Expansion: Enlarging existing data centers to accommodate more hardware.

- Hardware Upgrades: Investing in the latest, more energy-efficient mining rigs and HPC servers.

- Infrastructure Development: Enhancing power and cooling systems to support expanded operations.

Debt Servicing and Financial Expenses

Core Scientific's cost structure is significantly impacted by debt servicing and financial expenses. These include interest payments on their existing debt, especially after recent restructuring efforts and the issuance of convertible notes. For instance, in the first quarter of 2024, the company reported interest expenses of $19.3 million, a notable figure reflecting their leverage.

- Interest Payments: These are a direct cost stemming from borrowed funds.

- Financial Expenses: This category can encompass fees related to debt management and other financing costs.

- Debt Restructuring Impact: Recent efforts to restructure debt aim to lower these ongoing expenses.

- Convertible Notes: The terms of convertible notes also influence financial costs, potentially through interest accrual or conversion features.

Effective management of this debt, including securing lower interest rates, is crucial for improving Core Scientific's overall financial health and profitability. A reduction in these financial outlays directly contributes to a stronger bottom line.

Core Scientific's cost structure is heavily weighted towards energy, data center operations, and depreciation. In the first quarter of 2024, the company reported significant electricity costs and operational expenses related to its extensive mining infrastructure. These core costs are directly tied to the company's ability to efficiently mine digital assets.

| Cost Component | Q1 2024 (Millions USD) | Notes |

|---|---|---|

| Electricity Costs | $100.5 | Primary driver of operational expenses. |

| Depreciation & Amortization | $62.3 | Reflects significant investment in hardware and facilities. |

| Data Center Operations & Maintenance | $35.8 | Includes cooling, security, and personnel. |

| Interest Expense | $19.3 | Cost associated with debt servicing. |

Revenue Streams

Core Scientific directly generates income by mining Bitcoin using its own extensive network of specialized hardware. This core revenue stream is directly tied to two key factors: the quantity of Bitcoin successfully mined and the fluctuating market price of Bitcoin itself.

In 2024, Core Scientific's self-mining operations were a significant contributor to its financial performance. For instance, the company reported mining approximately 3,979 Bitcoins in the first quarter of 2024, demonstrating the scale of its self-mining capabilities.

Core Scientific's high-performance computing (HPC) colocation and hosting services represent a significant and rapidly expanding revenue source. This segment primarily caters to clients engaged in demanding AI workloads, offering them dedicated infrastructure capacity through long-term contracts. For instance, in the first quarter of 2024, the company reported a substantial increase in its hosting revenue, driven by these HPC agreements.

Core Scientific generates significant revenue through its digital asset hosted mining services. This involves managing and operating Bitcoin miners owned by third-party clients, essentially offering a comprehensive solution for their mining operations.

In 2024, Core Scientific's hosting segment demonstrated robust performance, contributing substantially to its overall financial picture. For instance, in the first quarter of 2024, the company reported that its hosting services generated $102 million in revenue, highlighting the critical role this segment plays.

These hosting agreements often include beneficial proceeds-sharing arrangements, where Core Scientific receives a portion of the mined digital assets or a fee based on the energy consumed and services provided, further diversifying its income streams.

Sale of Mining Equipment (Less Prominent)

While Core Scientific’s primary revenue driver is its hosting services, the sale of mining equipment represents a secondary, less prominent revenue stream. This segment has historically supported the company's operations by providing essential hardware to clients. For instance, in 2023, while the company focused on its core hosting business, equipment sales still contributed to overall revenue, though at a significantly lower percentage compared to hosting fees.

The company's strategic shift towards High-Performance Computing (HPC) means that the emphasis on direct equipment sales may diminish further. However, this channel can still be valuable for capturing clients who require a complete solution, including the hardware itself. The exact contribution of equipment sales to Core Scientific's total revenue in 2024 is expected to remain a smaller component as the company prioritizes its infrastructure and HPC expansion.

- Historical Contribution: Equipment sales have historically provided supplementary revenue for Core Scientific.

- Strategic Shift: The company's focus is increasingly on HPC, making equipment sales a less central revenue stream.

- Market Position: While not the primary focus, equipment sales can still serve specific client needs and contribute to overall financial performance.

Ancillary Services and Power Programs

Core Scientific also taps into revenue through ancillary services, providing essential repair and maintenance for its data center infrastructure. This ensures operational efficiency and generates income beyond core hosting fees.

Furthermore, the company actively participates in energy curtailment and grid support programs. These initiatives allow Core Scientific to earn credits or direct payments by strategically reducing its power consumption during periods of high demand, contributing to grid stability while creating a new revenue stream.

- Ancillary Services: Revenue from repair and maintenance of data center equipment.

- Grid Support Programs: Earnings from reducing power consumption during peak demand.

- Energy Curtailment: Payments or credits for participating in demand-response initiatives.

Core Scientific's revenue streams are diverse, reflecting its evolution in the digital infrastructure space. Beyond its foundational Bitcoin mining operations, the company has significantly expanded into high-performance computing (HPC) colocation and hosting services, catering to the growing demand for AI workloads. These services, often secured through long-term contracts, have become a substantial income generator.

The company also generates revenue by managing and operating Bitcoin miners for third-party clients through its digital asset hosted mining services. This segment, which includes proceeds-sharing arrangements based on mined assets or energy usage, is a critical component of its financial performance.

Additionally, Core Scientific benefits from ancillary services like equipment repair and maintenance, and participates in energy curtailment programs, earning revenue by reducing power consumption during peak demand periods.

| Revenue Stream | Description | 2024 Highlight (Q1) |

|---|---|---|

| Self-Mining | Direct Bitcoin mining using company hardware. | Mined 3,979 BTC. |

| HPC Colocation & Hosting | Providing infrastructure for AI workloads. | Substantial increase in hosting revenue. |

| Digital Asset Hosted Mining | Operating third-party owned miners. | Generated $102 million in hosting revenue. |

| Ancillary Services | Repair and maintenance of data center infrastructure. | Ensures operational efficiency and generates income. |

| Energy Curtailment/Grid Support | Reducing power consumption for grid stability. | Creates new revenue through demand-response initiatives. |

Business Model Canvas Data Sources

The Core Scientific Business Model Canvas is built using a combination of internal operational data, financial performance metrics, and market intelligence from industry reports. These sources provide a comprehensive view of our current standing and future potential.