Core Scientific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Scientific Bundle

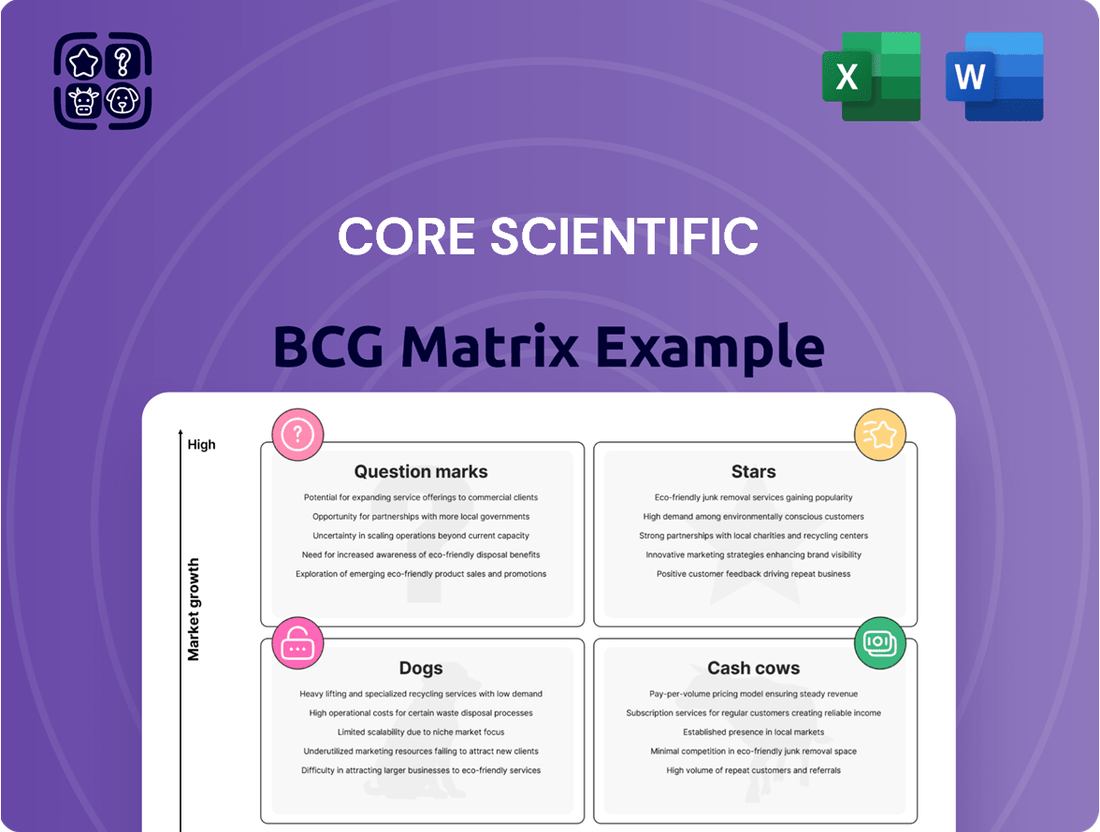

This preview offers a glimpse into the strategic positioning of a company's product portfolio using the renowned BCG Matrix. Understand how your products stack up as Stars, Cash Cows, Dogs, or Question Marks to make informed decisions.

Don't let your strategy be guesswork. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your product investments and achieving market leadership.

Stars

Core Scientific's strategic pivot to high-density colocation for AI/HPC is its star. This segment is experiencing rapid growth, driven by immense demand for specialized, energy-dense data centers essential for cutting-edge AI and low-latency applications.

The company's partnership with AI hyperscaler CoreWeave is a prime example, projecting over $10 billion in cumulative revenue across 12 years. This significant commitment underscores Core Scientific's leadership in a burgeoning market.

Core Scientific's partnership with CoreWeave is a significant driver of its star classification within the BCG matrix. This multi-billion dollar agreement is projected to bring in $1.2 billion in contracted revenue.

The deal is set to contribute an estimated $360 million in annualized colocation revenue by 2026. Core Scientific is actively delivering the initial phases of billable capacity throughout 2025, underscoring the tangible progress of this high-growth initiative.

Core Scientific is making significant strides in expanding its data center infrastructure, a key move to capitalize on the burgeoning demand for High-Performance Computing (HPC) and Artificial Intelligence (AI) workloads. This strategic expansion is designed to bolster its colocation services, a high-growth segment for the company.

A prime example of this commitment is the $1.2 billion data center expansion underway in Texas. This project is on track to deliver 250MW of billable capacity by the close of 2025, with an ambitious target of exceeding 1.3 GW by 2027. Such aggressive infrastructure development is crucial for meeting the increasing power and connectivity needs of modern computing.

Strategic Diversification beyond Bitcoin Mining

Core Scientific is actively diversifying its operations to mitigate risks associated with its core Bitcoin mining business. This strategic shift involves repurposing existing data center infrastructure for High-Performance Computing (HPC) and Artificial Intelligence (AI) workloads.

This move into AI/HPC hosting positions Core Scientific to capitalize on a rapidly expanding market, offering potentially more stable and lucrative revenue streams compared to the inherent volatility of cryptocurrency mining. By reducing its dependence on Bitcoin, the company aims to lessen its vulnerability to price fluctuations and the impact of Bitcoin halving events.

In 2023, Core Scientific generated approximately $177 million in revenue, with a significant portion still tied to Bitcoin mining. However, the company has secured substantial contracts for AI/HPC services, indicating a tangible commitment to this diversification strategy.

- Diversification into AI/HPC: Core Scientific is converting mining data centers to support AI and HPC, aiming for higher growth and profit margins.

- Reduced Bitcoin Reliance: This strategy lessens exposure to Bitcoin price volatility and the impact of halving events.

- Contract Wins: The company has secured significant contracts for AI/HPC hosting, demonstrating market traction.

- Revenue Growth Potential: The AI/HPC sector offers a potentially more stable and scalable revenue base for Core Scientific.

Strong Liquidity and Financial Flexibility for Growth

Core Scientific maintained a robust liquidity position, ending Q1 2025 with $778.6 million in cash and digital assets, despite incurring operational losses. This substantial financial cushion provides significant flexibility for future investments.

This financial strength is instrumental in supporting Core Scientific's strategic objectives, including the expansion of its data center infrastructure and the pursuit of organic growth initiatives. The company is well-positioned to capitalize on market opportunities.

- Strong Liquidity: $778.6 million in cash and digital assets as of Q1 2025.

- Growth Funding: Enables continued data center expansions and organic growth.

- Strategic Flexibility: Supports potential mergers and acquisitions to solidify market leadership.

- Operational Resilience: Financial reserves provide a buffer against short-term operational challenges.

Core Scientific's "Stars" segment is its burgeoning AI/HPC colocation business, fueled by substantial demand for specialized data center capacity. The company's strategic focus on this high-growth area, exemplified by its significant partnership with AI hyperscaler CoreWeave, positions it for substantial revenue expansion. This segment is characterized by its rapid growth potential and strong market demand.

The CoreWeave agreement alone is projected to generate over $10 billion in cumulative revenue across 12 years, with $1.2 billion in contracted revenue already secured. By 2026, this partnership is expected to contribute an estimated $360 million in annualized colocation revenue, with initial billable capacity being delivered throughout 2025. This highlights the tangible progress and immediate impact of this strategic initiative.

Core Scientific's aggressive expansion of its data center infrastructure further solidifies its "Star" status. The ongoing $1.2 billion expansion in Texas is on track to deliver 250MW of billable capacity by the end of 2025, with a target of exceeding 1.3 GW by 2027. This substantial build-out is crucial for meeting the escalating power and connectivity needs of AI and HPC workloads.

The company's diversification away from a sole reliance on Bitcoin mining into AI/HPC hosting offers a more stable and potentially lucrative revenue stream, mitigating risks associated with cryptocurrency market volatility. This strategic pivot is supported by strong financial footing, with $778.6 million in cash and digital assets reported as of Q1 2025, enabling continued investment in growth initiatives.

| Metric | Value (as of Q1 2025/2026 projections) | Segment | Significance |

|---|---|---|---|

| CoreWeave Contract Revenue | $1.2 billion (contracted) | AI/HPC Colocation | Key driver of "Star" status, significant revenue potential |

| Projected Annualized Colocation Revenue (from CoreWeave) | $360 million (by 2026) | AI/HPC Colocation | Demonstrates near-term revenue impact |

| Texas Data Center Expansion Capacity | 250MW (by end of 2025) | Infrastructure Development | Supports AI/HPC demand, enhances service offering |

| Total Cash and Digital Assets | $778.6 million (as of Q1 2025) | Financial Position | Enables growth investments and operational resilience |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

The BCG Matrix provides clarity on where to invest, easing the pain of resource allocation decisions.

Cash Cows

Core Scientific's existing self-mining operations are its established Cash Cows. In the first quarter of 2025, these operations were the primary revenue driver, bringing in $67.2 million, which represented a substantial 84.5% of the company's total revenue.

While the Bitcoin halving and a strategic pivot have impacted revenue growth in this segment, it remains a vital source of consistent cash flow. This reliable income stream is crucial for funding new ventures and supporting the company's overall financial stability.

Core Scientific’s Digital Asset Hosted Mining Services act as a stable, albeit evolving, cash cow. This segment offers hosting solutions for other Bitcoin miners, effectively monetizing their existing data center infrastructure and generating consistent revenue and gross profit.

While this business line experienced a dip in revenue and gross profit in 2023 due to contract terminations as Core Scientific strategically shifted focus towards High-Performance Computing (HPC) hosting, it remains a mature revenue stream. For instance, in the first quarter of 2024, Core Scientific reported $95 million in revenue from digital asset hosting, showcasing its continued contribution to the company's financial health despite the strategic pivot.

Core Scientific's established data center infrastructure represents a significant cash cow. The company boasts a widespread network of specialized facilities across the United States, providing a solid foundation for operations.

This extensive physical presence and accumulated operational know-how enable efficient resource management, leading to steady revenue from both its own mining activities and third-party hosting agreements. These prior capital expenditures are now consistently generating cash flow for the company.

Reduced Debt and Strengthened Balance Sheet

Core Scientific's emergence from Chapter 11 in early 2024 marked a significant financial turning point. The company successfully reduced its debt by a substantial $400 million, a move that directly bolsters its balance sheet and financial stability.

This deleveraging has a direct impact on the company's ability to generate and retain cash. Lower debt means reduced interest expenses, freeing up capital that can be reinvested in operations or returned to stakeholders.

- Debt Reduction: $400 million eliminated following Chapter 11 emergence in early 2024.

- Balance Sheet Strengthening: Improved financial health and stability.

- Lower Interest Expenses: Reduced financial burden, increasing cash flow retention.

- Enhanced Operational Capacity: Greater flexibility for investment and growth initiatives.

Operational Efficiency and Power Cost Management

Core Scientific's adept management of operational costs, particularly power, is a key driver of its cash flow generation. This efficiency is crucial in the energy-intensive digital asset mining and data center sectors.

- Power Cost Reduction: In the first quarter of 2025, Core Scientific achieved a notable 33% reduction in power costs.

- Contributing Factors: This decrease was attributed to a combination of lower electricity rates and optimized energy usage.

- Margin Improvement: The savings in power expenses directly translated into enhanced gross margins for the company's mining operations.

- Cash Generation: This operational efficiency bolsters the cash-generating capacity of Core Scientific's established business segments, positioning them as potential cash cows.

Core Scientific's self-mining operations are its primary cash cows, consistently generating significant revenue. In Q1 2025, these operations brought in $67.2 million, accounting for 84.5% of total revenue, demonstrating their foundational role in the company's financial structure.

The digital asset hosted mining services also act as a stable cash cow, leveraging existing infrastructure. Despite a dip in 2023 due to strategic shifts, this segment generated $95 million in revenue in Q1 2024, proving its ongoing contribution.

Efficient power cost management further solidifies these segments as cash cows. A 33% reduction in power costs in Q1 2025 directly improved gross margins, enhancing the cash-generating capability of these established operations.

| Segment | Q1 2025 Revenue | % of Total Revenue (Q1 2025) | Q1 2024 Revenue |

|---|---|---|---|

| Self-Mining Operations | $67.2 million | 84.5% | N/A |

| Digital Asset Hosted Mining Services | N/A | N/A | $95 million |

What You See Is What You Get

Core Scientific BCG Matrix

The BCG Matrix document you are currently previewing is precisely the final, unaltered report you will receive immediately after completing your purchase. This means you get the full, professionally formatted analysis without any watermarks or demo content, ready for immediate strategic application. You can confidently expect the exact same comprehensive breakdown of your business units as stars, cash cows, question marks, and dogs, enabling informed decision-making. This preview ensures transparency, so you know you're acquiring a complete and actionable tool for portfolio management and strategic planning. Invest in clarity and gain immediate access to this essential business analysis resource.

Dogs

Legacy Bitcoin mining rigs often fall into the 'dog' category within a BCG matrix. As the Bitcoin network's difficulty increases and halving events reduce block rewards, older, less efficient hardware struggles to remain profitable. This means these assets consume electricity and capital without generating substantial returns.

For Core Scientific, the cost to mine a single Bitcoin serves as a stark indicator. This cost climbed from $18,853 in Q1 2024 to $56,627 in Q1 2025, highlighting the diminishing profitability of older mining equipment. Such assets tie up resources that could be better allocated elsewhere, making them prime candidates for strategic divestment or repurposing.

Core Scientific has been actively shedding non-core or underperforming hosting contracts, a strategic move that began in 2023. This action is directly tied to the company's pivot towards High-Performance Computing (HPC) hosting, indicating a clear shift in resource allocation.

These terminated agreements were likely those that weren't meeting performance benchmarks or aligning with Core Scientific's evolving business objectives. By exiting these less strategic partnerships, the company is freeing up valuable infrastructure and operational capacity.

For instance, the company's shift away from certain mining clients allowed it to secure new, more lucrative HPC deals. This strategic pruning is essential for optimizing its asset utilization and focusing on higher-margin revenue streams in the burgeoning AI and HPC sectors.

Facilities that prove difficult or uneconomical to upgrade for high-performance computing (HPC) and AI applications are categorized as Dogs in the Core Scientific BCG Matrix. These might include older data centers with insufficient power, cooling, or network capacity that would require substantial investment to meet modern HPC demands. For instance, a facility lacking the necessary robust electrical infrastructure or advanced cooling systems would be a prime candidate for this classification, potentially hindering Core Scientific's strategic pivot towards AI-driven services.

These unsuitable facilities represent assets that do not align with the company's strategic direction and could become financial burdens. They tie up capital without contributing to the growth anticipated from the burgeoning AI market. Core Scientific's ongoing efforts to reconfigure existing sites suggest a proactive approach, but it also implies that some locations may present significant conversion challenges, making them less attractive for future development.

Highly Volatile Bitcoin-Dependent Revenue Streams

Core Scientific's reliance on Bitcoin mining presents a significant challenge, classifying this segment as a potential 'dog' within the BCG matrix. The inherent volatility of Bitcoin prices, coupled with the impact of halving events, creates a precarious revenue model. For instance, the April 2024 halving drastically reduced mining rewards, impacting profitability.

This dependency leads to unpredictable revenue streams. A stark example is Core Scientific's reported 55.7% revenue decline in Q1 2025, directly attributable to these market fluctuations and reward reductions. Without strategic diversification, this concentration risk could severely hinder long-term growth and stability.

- Bitcoin Price Volatility: Bitcoin's price swings directly impact mining revenue.

- Halving Events: The April 2024 halving reduced mining rewards, decreasing profitability.

- Revenue Fluctuations: A 55.7% revenue decline in Q1 2025 highlights the instability.

- Diversification Need: Over-reliance without other revenue sources positions it as a 'dog'.

Cash Traps from Non-Productive Assets

Assets that aren't actively contributing to Core Scientific's primary revenue streams, like its high-growth colocation business or profitable Bitcoin mining, can become cash traps. This includes things like idle mining rigs, data center space not being utilized for colocation services, or facilities that are undergoing upgrades but aren't yet generating revenue. These assets continue to incur costs for maintenance, power, and staffing without bringing in sufficient income.

For instance, if Core Scientific has a significant amount of computing hardware that is offline or being used for less profitable operations, it represents capital that could be deployed more effectively. In 2024, the company has been focused on optimizing its operations and divesting non-core assets to improve its financial standing. Efficiently managing and utilizing all infrastructure is crucial to avoid these assets becoming financial burdens.

- Idle Infrastructure: Physical data center space not leased for colocation or used for mining operations.

- Underutilized Equipment: Mining hardware or other technological assets that are not running at full capacity or are powered down.

- Operational Costs: Expenses related to power, cooling, maintenance, and security for non-revenue-generating assets.

- Opportunity Cost: Capital tied up in these assets could otherwise be invested in more profitable ventures or used to reduce debt.

Assets classified as Dogs within Core Scientific's BCG matrix are those that exhibit low market share and low growth potential, often representing legacy operations or infrastructure ill-suited for current strategic objectives. These can include older, less efficient Bitcoin mining hardware that struggles with profitability due to increasing network difficulty and reduced block rewards, as seen after the April 2024 halving. Additionally, data center facilities that cannot be economically upgraded for high-performance computing (HPC) and AI applications also fall into this category.

Core Scientific's strategic pivot towards HPC hosting means that assets not contributing to this growth, or those requiring substantial investment for conversion, are prime candidates for the Dog classification. The company's active divestment of underperforming hosting contracts, a trend observed since 2023, directly addresses the need to shed such underperforming assets. This proactive approach aims to free up capital and operational capacity for more lucrative ventures.

The Bitcoin mining segment itself, due to price volatility and the impact of halving events, presents a challenge. A 55.7% revenue decline in Q1 2025, linked to these factors, underscores the inherent instability of this business line without diversification. Consequently, segments or assets that are cash traps, incurring costs without generating sufficient returns, are strategically managed to avoid becoming long-term financial burdens.

| Asset Type | BCG Classification | Rationale | 2024/2025 Data Point |

|---|---|---|---|

| Legacy Bitcoin Mining Rigs | Dog | Low profitability due to rising difficulty and halving events. | Cost to mine Bitcoin increased from $18,853 (Q1 2024) to $56,627 (Q1 2025). |

| Underperforming Hosting Contracts | Dog | Do not meet performance benchmarks or align with evolving business objectives. | Active shedding of non-core contracts since 2023. |

| Data Centers Unsuitable for HPC/AI | Dog | Lack necessary power, cooling, or network capacity for modern demands. | Require substantial investment for upgrades, hindering strategic pivot. |

| Idle or Underutilized Infrastructure | Dog | Incur costs without generating sufficient income or contributing to core revenue. | Focus on optimizing operations and divesting non-core assets in 2024. |

Question Marks

Core Scientific aims to reduce its reliance on CoreWeave, targeting a scenario where CoreWeave accounts for under 50% of its billable capacity by the close of 2028. This strategic pivot to acquire new high-performance computing (HPC) customers is crucial for long-term stability.

The success of this diversification strategy is uncertain, as it hinges on securing new, significant HPC contracts and effectively integrating a broader range of clients. While the demand for AI infrastructure remains robust, the actual market share achieved through these new customer acquisitions will be the true indicator of viability.

Core Scientific's transition of Bitcoin mining sites to high-density High-Performance Computing (HPC) facilities is a significant undertaking, demanding substantial capital and intricate planning. The company's stated goal is to reach 250MW of HPC capacity by the end of 2025, a target that requires meticulous execution.

The actual pace and effectiveness of these conversions, alongside the capacity to satisfy the rigorous technical requirements of AI workloads, remain key variables. Any setbacks in timing or unexpected increases in expenses could directly affect Core Scientific's financial performance and its competitive standing in the burgeoning HPC market.

The future profitability of Core Scientific's colocation gross margins presents a mixed picture. While the colocation sector is generally expected to yield higher margins than traditional cryptocurrency mining, the actual sustained profitability in the dynamic AI/HPC market remains a key consideration.

Core Scientific's Q1 2025 results showed a colocation gross profit of $0.5 million, translating to a 5% gross margin. This figure highlights that despite revenue growth in this segment, demonstrating consistent and scalable profitability is crucial for its long-term success.

Impact of Regulatory Changes on Digital Asset and AI Industries

The rapidly evolving regulatory frameworks for both digital assets and artificial intelligence (AI) present a significant variable for Core Scientific. As these sectors mature, governments worldwide are introducing new rules that could directly affect how digital assets are managed and how AI infrastructure, particularly power-intensive computing, is operated. For instance, the ongoing discussions around cryptocurrency taxation and environmental impact disclosures could necessitate changes in Core Scientific's operational procedures and reporting.

Future regulations might impose stricter requirements on energy consumption for cryptocurrency mining, which is a cornerstone of Core Scientific's business. Such regulations could increase operational costs through mandatory upgrades to more sustainable power sources or by imposing new taxes on energy usage. This uncertainty around future regulatory mandates directly impacts the long-term market environment for their services, making it a key consideration in their strategic positioning.

The potential for unfavorable regulatory changes creates a question mark over Core Scientific's expansion plans and overall business model. For example, if new regulations limit the types of digital assets that can be mined or impose significant compliance burdens, it could curtail growth opportunities. In 2024, the global regulatory focus on AI's ethical implications and energy demands is intensifying, mirroring concerns already present in the digital asset space, suggesting a potential confluence of regulatory pressures.

- Evolving Digital Asset Regulations: Ongoing legislative efforts in major economies are shaping the future of cryptocurrency mining and digital asset management, potentially impacting operational compliance.

- AI Infrastructure Scrutiny: Increased attention on the energy footprint of large-scale AI data centers, a sector Core Scientific is increasingly involved in, could lead to new energy efficiency mandates.

- Cost Implications: Stricter environmental or operational regulations could necessitate capital expenditures for Core Scientific, potentially increasing its cost of doing business.

- Market Uncertainty: The dynamic nature of these regulatory landscapes introduces a degree of unpredictability regarding future market conditions and Core Scientific's ability to scale effectively.

Ability to Secure Additional Power Resources for Expansion

Core Scientific's expansion hinges on securing substantial power. Their goal of exceeding 1.3 GW by 2027 requires massive energy procurement, making this a key challenge.

The company's ability to negotiate favorable power purchase agreements and manage relationships with local utilities is critical for its growth trajectory. Environmental regulations and the cost of electricity directly impact the viability of new data center sites.

- Projected Power Demand: Core Scientific aims for over 1.3 GW of power capacity by 2027, a significant increase requiring robust energy sourcing.

- Utility Negotiations: Success depends on securing reliable and cost-effective power from utility providers, a complex process involving long-term contracts and regulatory approvals.

- Environmental Factors: Navigating local environmental regulations and ensuring sustainable power sourcing are crucial for permitting and public acceptance of new facilities.

Core Scientific faces significant question marks regarding its diversification into High-Performance Computing (HPC) and its continued reliance on Bitcoin mining. The success of its strategy to reduce dependence on CoreWeave, aiming for CoreWeave to represent less than 50% of billable capacity by the end of 2028, is uncertain. Securing new, substantial HPC contracts and effectively integrating a diverse client base are critical, though the robust demand for AI infrastructure provides a positive backdrop.

The company's ambitious goal to reach 250MW of HPC capacity by the end of 2025 requires meticulous execution of its transition from Bitcoin mining sites. The actual speed and effectiveness of these conversions, coupled with the ability to meet the stringent technical demands of AI workloads, remain key variables. Any delays or unforeseen cost increases could directly impact Core Scientific's financial performance and market competitiveness.

The colocation gross margins present a mixed outlook. While the sector generally offers higher margins than crypto mining, sustained profitability in the dynamic AI/HPC market is not guaranteed. Core Scientific's Q1 2025 colocation gross profit of $0.5 million, representing a 5% gross margin, underscores the need for consistent and scalable profitability to ensure long-term success.

Navigating evolving regulatory frameworks for both digital assets and AI introduces further uncertainty. Potential stricter energy consumption rules for mining or AI data centers could increase operational costs. In 2024, global regulatory focus on AI's ethical implications and energy demands is intensifying, mirroring existing concerns in the digital asset space, suggesting a potential convergence of regulatory pressures that could impact Core Scientific's business model and expansion plans.

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary sales data, customer feedback, and competitive landscape analysis to provide actionable strategic insights.