Core Scientific Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Scientific Bundle

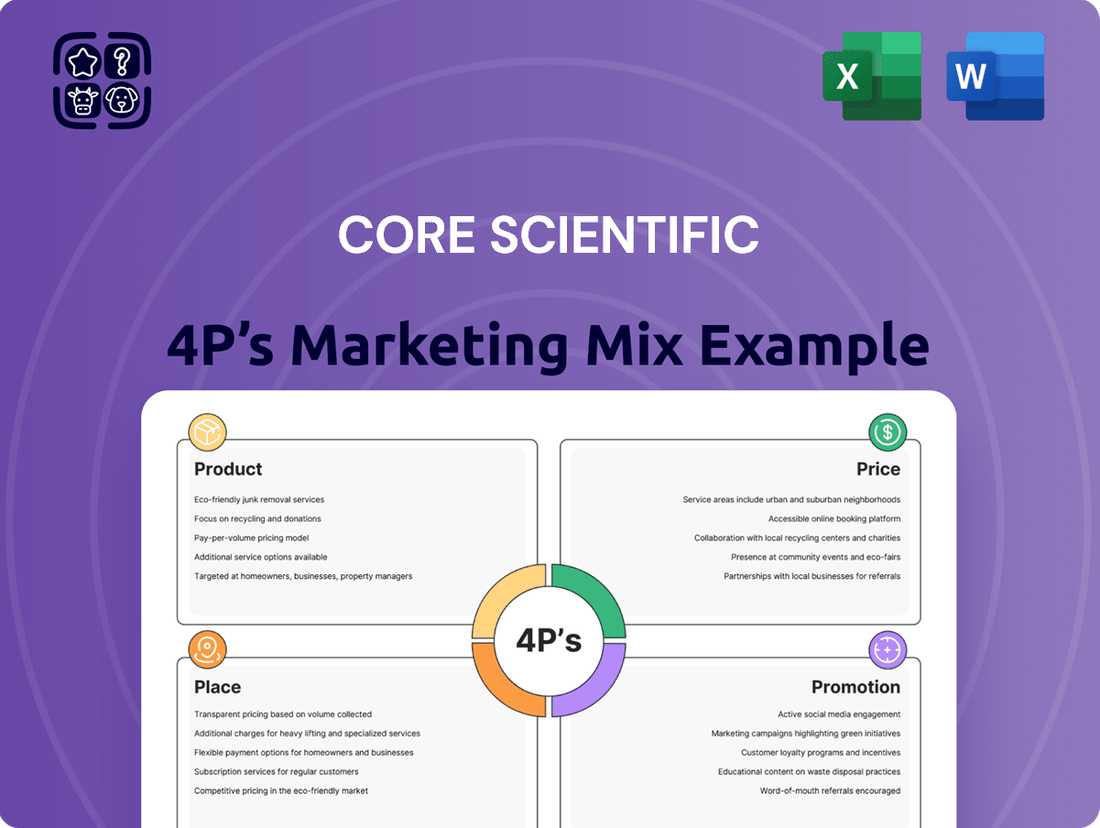

Uncover the strategic brilliance behind Core Scientific's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We dissect their product innovation, pricing strategies, distribution channels, and promotional campaigns, offering actionable insights for your own business growth.

Dive deeper than the surface and gain a complete understanding of how Core Scientific leverages each P to achieve its objectives. This ready-to-use, editable report is your key to unlocking effective marketing strategies.

Save valuable time and resources with our expertly crafted analysis. Get instant access to a detailed breakdown of Core Scientific's marketing mix, perfect for presentations, benchmarking, or strategic planning.

Product

Core Scientific's self-mining operations, primarily focused on Bitcoin, represent a key component of their product strategy. This involves utilizing their extensive fleet of mining hardware to generate digital assets directly.

Historically, this self-mining has been a significant revenue driver for the company. For instance, in the first quarter of 2024, Core Scientific mined 3,472 Bitcoins, contributing substantially to their overall financial performance.

However, the company is undergoing a strategic shift, prioritizing other business areas. This means while self-mining remains a product, its prominence within Core Scientific's broader strategy is evolving, with a focus on optimizing resource allocation.

Core Scientific's blockchain infrastructure services are a cornerstone of their offering, providing essential colocation and hosting for major blockchain computing clients. This means they supply the robust data center facilities, cutting-edge technology, and operational expertise needed for clients to run their own Bitcoin mining hardware. For instance, in Q1 2024, Core Scientific powered 7.4 EH/s for its clients, demonstrating significant capacity.

These services go beyond just space and power; they encompass the full lifecycle of mining equipment management. This includes expert deployment, continuous monitoring, proactive troubleshooting, performance optimization, and diligent maintenance, ensuring client operations run smoothly and efficiently. This comprehensive support is crucial in the fast-paced and demanding world of cryptocurrency mining.

Core Scientific's strategic shift towards High-Performance Computing (HPC) hosting is a key product offering, specifically targeting the burgeoning AI market. They are actively retooling their data centers to accommodate the immense power and cooling requirements of GPU-intensive AI computations. This positions them to capitalize on the explosive growth in demand for AI infrastructure.

The company is converting significant data center capacity to support high-density, GPU-based workloads, essential for training and running advanced AI models. This product evolution is directly responsive to the critical need for specialized computing power in the AI sector, a market projected for substantial expansion through 2025 and beyond.

AI & Machine Learning Infrastructure

Core Scientific's AI & Machine Learning Infrastructure product focuses on providing highly scalable, dense data center solutions tailored for the intense demands of AI and machine learning workloads. This involves delivering the essential power, advanced cooling, and robust connectivity necessary to support these cutting-edge applications, establishing them as a fundamental provider for modern data center needs.

Their facilities are specifically engineered to manage the extreme thermodynamic and power loads characteristic of AI computations. For instance, in 2024, Core Scientific has been actively expanding its infrastructure, with a significant portion of its operational capacity dedicated to supporting AI workloads, aiming to provide over 500 MW of power for such applications by the end of the year.

- Scalable High-Density Design: Infrastructure built to accommodate the growing needs of AI/ML.

- Optimized for AI Workloads: Tailored power, cooling, and connectivity for demanding computations.

- Extreme Load Handling: Facilities engineered to manage high power consumption and heat generation.

- Foundational Layer: Positioning as a core provider for the next generation of data center infrastructure.

Data Center Solutions and Support

Core Scientific offers comprehensive data center solutions beyond just colocation. They provide a full spectrum of digital infrastructure, software, and services for third-party clients, covering everything from initial design and construction to ongoing operational management of high-density compute environments.

Their expertise lies in efficiently scaling infrastructure to meet demanding compute requirements, particularly for AI and blockchain applications. This focus ensures optimal power availability and operational efficiency, critical for these intensive workloads. For instance, Core Scientific’s infrastructure is designed to support power densities that are essential for cutting-edge AI model training and large-scale blockchain operations.

- Full-Service Digital Infrastructure: Design, build, installation, and ongoing management of high-density compute environments.

- Specialized Expertise: Tailored solutions for high-value compute needs, including AI and blockchain.

- Scalability and Efficiency: Rapid scaling capabilities with a focus on maximum power availability and efficiency.

- Third-Party Solutions: Offering their robust infrastructure and services to external customers.

Core Scientific's product portfolio centers on providing robust digital infrastructure for high-density computing. This includes their legacy self-mining operations, which generated 3,472 Bitcoins in Q1 2024, and their expanding services for AI and high-performance computing (HPC). They are actively converting data center capacity to support GPU-intensive AI workloads, aiming for over 500 MW dedicated to AI applications by the end of 2024.

| Product Offering | Description | Key Data/Metrics (2024) |

|---|---|---|

| Self-Mining (Bitcoin) | Direct generation of digital assets using company-owned hardware. | 3,472 BTC mined in Q1 2024. |

| Blockchain Infrastructure Services (Colocation) | Hosting and powering third-party mining hardware. | Powered 7.4 EH/s for clients in Q1 2024. |

| AI & HPC Infrastructure Hosting | Data center solutions tailored for AI/ML workloads, including power, cooling, and connectivity. | Targeting >500 MW for AI applications by year-end 2024; significant capacity conversion underway. |

What is included in the product

This analysis offers a comprehensive examination of Core Scientific's Product, Price, Place, and Promotion strategies, providing actionable insights for marketing professionals.

Simplifies complex marketing strategies into actionable insights, making it easier to identify and address product, price, place, and promotion challenges.

Place

Core Scientific strategically positions its data centers across North America, with operational sites in Alabama, Georgia, Kentucky, North Carolina, North Dakota, and Texas, and an upcoming facility in Oklahoma. This widespread network is designed to leverage abundant power resources and ensure operational resilience through geographic diversification. The company boasts significant contracted power capacity, underpinning its large-scale operations.

Core Scientific's data centers are built for extreme power demands, supporting 50-200+ kW per rack. This high-density design is crucial for AI and high-performance computing, offering a significant advantage in handling the intensive thermodynamic and power loads these technologies generate.

Core Scientific's scalable infrastructure is a cornerstone of its marketing strategy, highlighting its capacity to grow alongside client needs. The company boasts over 1,300 megawatts of contracted power capacity, a significant asset for supporting large-scale digital operations and meeting increasing demand for high-performance computing (HPC) infrastructure.

This robust power foundation enables Core Scientific to expand its data center footprint aggressively. They are pursuing a multi-pronged growth approach, including enhancing existing facilities, developing new campuses designed for high-density computing, and actively considering strategic acquisitions to broaden their reach and capabilities.

The company's forward-looking expansion plans are ambitious, with a target to deploy over 1 gigawatt of operational infrastructure specifically for HPC by 2027. This strategic investment underscores their commitment to providing a virtually limitless infrastructure footprint for their clients' evolving digital demands.

Direct-to-Customer Access

Core Scientific's 'place' in the marketing mix is fundamentally about direct access to their specialized infrastructure. This means clients connect directly to Core Scientific's state-of-the-art data centers, whether for colocation or hosted solutions, bypassing intermediaries.

This direct model is crucial for ensuring clients can leverage the company's optimized, high-density compute environments. For instance, Core Scientific's operations are designed to provide the specific power and cooling efficiencies needed for intensive computing tasks, a benefit directly passed to customers through this placement strategy.

- Direct Data Center Access: Clients utilize Core Scientific's physical facilities for their computing needs.

- Optimized Infrastructure: This placement ensures access to purpose-built, high-density environments.

- Operational Expertise: Clients directly benefit from Core Scientific's management of these specialized facilities.

Logistical Efficiency and Availability

Core Scientific prioritizes logistical efficiency, ensuring their high-performance computing services are readily available to clients. This focus on rapid deployment of dense infrastructure and pre-secured power significantly cuts down delivery times. For instance, in Q1 2024, Core Scientific reported a 98% uptime for their data centers, a testament to their operational reliability and logistical prowess.

This streamlined approach directly boosts customer satisfaction and maximizes sales opportunities for their hosting and colocation offerings. By minimizing lead times and guaranteeing consistent service availability, they solidify their position as a dependable partner in the demanding HPC sector.

Key aspects of their logistical strategy include:

- Expedited Infrastructure Deployment: Ability to quickly set up high-density computing environments.

- Power Pre-Securing: Ensuring robust and readily available power supply to meet client demands.

- High Uptime Guarantees: Maintaining operational continuity, evidenced by their 98% uptime in Q1 2024.

- Strategic Locationing: Placing facilities to optimize accessibility for target client bases.

Core Scientific's 'Place' strategy centers on providing direct access to its specialized, high-density data center infrastructure. This means clients engage directly with their facilities, whether for colocation or hosted solutions, ensuring they can fully leverage the optimized power and cooling efficiencies crucial for intensive computing tasks. Their strategically located sites across North America, with a focus on power-rich regions, facilitate seamless access and operational resilience for their clients.

| Data Center Location | Contracted Power Capacity (MW) | Targeted Use | Key Differentiator |

|---|---|---|---|

| Alabama, Georgia, Kentucky, North Carolina, North Dakota, Texas | 1,300+ | High-Density Computing, AI, HPC | Geographic Diversification, Abundant Power Resources |

| Oklahoma (Upcoming) | N/A (Expansion) | High-Density Computing, AI, HPC | Strategic Expansion for Growth |

Full Version Awaits

Core Scientific 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Core Scientific 4P's Marketing Mix Analysis document you will receive instantly after purchase. You are viewing the exact version of the analysis that is ready for immediate download and use, ensuring no surprises. This isn't a sample; it's the final, high-quality document you'll own upon completing your order.

Promotion

Core Scientific prioritizes direct communication with investors and analysts, utilizing investor presentations, earnings calls, and press releases to clearly articulate its strategic vision, financial health, and expansion prospects. This engagement is crucial for informing stakeholders about its evolving business model, especially its strategic shift towards Artificial Intelligence (AI) and High-Performance Computing (HPC).

The company regularly webcasts these presentations, offering a transparent view of its progress. For instance, in Q1 2024, Core Scientific reported a significant increase in revenue, partly driven by its growing HPC operations, which directly impacts investor perception and analyst valuations.

Core Scientific's promotional strategy prominently features its significant pivot from Bitcoin mining to becoming a premier digital infrastructure provider for high-performance computing and AI. This transformation is a key narrative in their marketing efforts.

Investor communications and press releases highlight substantial multi-billion dollar agreements, such as the one with CoreWeave, underscoring their diversification and future growth potential. This focus aims to attract both capital investment and valuable strategic alliances.

Core Scientific actively showcases its robust infrastructure capabilities, emphasizing its prowess in developing, constructing, and operating advanced, high-density data centers. This focus highlights their commitment to providing the foundational elements for next-generation computing, particularly for AI applications.

The company frequently points to its significant contracted power capacity, which reached approximately 24 exahash per second (EH/s) by the end of 2023, demonstrating its ability to scale operations and meet the immense energy demands of AI workloads. This substantial capacity is a key differentiator, assuring clients of reliable and expandable resources.

Marketing efforts underscore Core Scientific's deployment of proven, innovative technologies and the expertise of its dedicated team of data center specialists. This combination of cutting-edge technology and seasoned professionals ensures the efficient and effective management of their infrastructure, offering clients a high level of confidence in their operational support.

Public Relations and Media Outreach

Core Scientific actively engages in public relations and media outreach to communicate significant company milestones. This includes disseminating press releases detailing operational advancements, quarterly financial performance, and strategic achievements like securing new agreements or expanding its data center footprint. For instance, in Q1 2024, the company announced a significant increase in its self-mining revenue, which was widely covered by financial news outlets.

These vital announcements are disseminated via established business wire services and dedicated investor relations platforms. This strategic distribution ensures that key information reaches a wide audience, including investors, financial analysts, and professionals within the technology and energy sectors, thereby enhancing transparency and market perception.

Core Scientific's media outreach efforts are designed to cultivate public awareness and bolster its credibility within the industry. By consistently sharing updates on:

- Operational Milestones: Such as achieving new levels of energy efficiency in their mining operations.

- Financial Performance: Highlighting revenue growth and profitability metrics, as seen in their 2024 earnings reports.

- Strategic Partnerships: Announcing collaborations that expand their market reach or technological capabilities.

- Infrastructure Development: Detailing the expansion of their high-performance computing (HPC) and Bitcoin mining infrastructure.

Targeted Client Acquisition

Core Scientific focuses its acquisition efforts on large enterprises, hyperscalers, and niche cloud providers, offering them high-density colocation and HPC hosting. Their direct marketing and sales strategies highlight advantages like accelerated deployment and reduced operational expenses.

The company actively promotes its ability to scale infrastructure seamlessly, a crucial factor for clients investing in AI and demanding significant computing power. This approach is designed to attract significant deals within a competitive market.

Core Scientific’s sales pipeline reflects a growing interest from enterprise clients venturing into AI infrastructure for the first time. This indicates a strategic move to capture new market segments by demonstrating clear value propositions.

- Targeted Segments: Large enterprises, hyperscalers, and specialized cloud providers.

- Value Proposition: Faster deployment, lower total cost of operations, and unlimited scalability.

- Key Market Trend: Growing enterprise adoption of AI infrastructure.

- Sales Focus: Direct marketing and sales for high-density colocation and HPC hosting.

Core Scientific's promotional efforts center on its strategic pivot to AI and HPC, emphasizing its robust infrastructure and multi-billion dollar agreements. They actively communicate milestones and financial performance through investor presentations, earnings calls, and press releases, aiming to attract capital and strategic alliances.

The company highlights its significant contracted power capacity, reaching approximately 24 EH/s by the end of 2023, and its deployment of innovative technologies by a dedicated team. This focus on scalable infrastructure and operational expertise is key to their value proposition for enterprise clients seeking AI solutions.

| Key Promotional Focus | Supporting Data/Examples | Impact |

|---|---|---|

| AI & HPC Infrastructure Pivot | Multi-billion dollar agreements (e.g., CoreWeave); Emphasis on high-density data centers | Attracts capital, strategic alliances, and enterprise clients for AI workloads |

| Operational Capacity & Technology | Contracted power capacity ~24 EH/s (end of 2023); Deployment of proven, innovative technologies | Assures clients of reliable, scalable resources and efficient management |

| Financial & Operational Transparency | Q1 2024 revenue increase driven by HPC; Regular investor presentations and webcasts | Informs stakeholders, influences analyst valuations, and enhances market perception |

Price

Core Scientific's pricing for colocation and HPC hosting is anchored in long-term contracts, frequently featuring take-or-pay clauses. This model guarantees revenue streams, offering substantial stability and predictability compared to their previous self-mining operations. For instance, significant deals with clients like CoreWeave are valued in the billions over extended 12-year periods.

Core Scientific positions its High-Performance Computing (HPC) and Artificial Intelligence (AI) hosting services as premium, value-driven compute solutions. This reflects the intricate and mission-critical nature of the workloads they support.

Pricing for these specialized services takes into account the significant investment in advanced infrastructure, guaranteed high power availability, and the essential expert operational support needed to ensure seamless performance.

This value-based approach allows Core Scientific to target potentially higher profit margins compared to its traditional Bitcoin mining operations, aligning pricing with the superior capabilities and reliability offered to HPC/AI clients.

For Core Scientific's self-mining, the 'price' is the Bitcoin it mines, directly tied to Bitcoin's market price and the increasing difficulty of mining. This means their revenue is inherently volatile, reflecting the broader cryptocurrency market.

The April 2024 Bitcoin halving, which cut block rewards from 6.25 BTC to 3.125 BTC, significantly impacted Core Scientific's revenue per block. This event necessitates strategic adjustments, like optimizing energy efficiency and expanding operations, to maintain profitability amidst reduced block subsidies.

To manage its financial obligations and operational costs, Core Scientific regularly sells a portion of its mined Bitcoin for U.S. dollars. For instance, in Q1 2024, the company sold 4,454 BTC, generating approximately $293 million, demonstrating their strategy of converting mined assets into fiat currency.

Cost Management and Efficiency

Core Scientific places a significant emphasis on cost management, particularly concerning power expenses and overall operational outlays. This focus is crucial for them to offer competitive pricing and boost their profitability.

Their data centers are engineered with energy efficiency as a core design principle. A key strategy involves actively managing power consumption, which includes a notable practice of returning megawatt hours to local electrical grids. This proactive approach to energy management directly translates into a reduced total cost of operations for their clientele.

- Energy Efficiency Focus: Core Scientific's data centers are built for optimal energy usage.

- Power Cost Management: They actively control and reduce power expenses.

- Grid Participation: The company returns megawatt hours to local grids, demonstrating efficient power utilization.

- Customer Cost Reduction: Operational efficiencies lead to lower overall costs for their customers.

Financial Structure and Capital Deployment

Core Scientific's financial strategy centers on securing capital through various instruments to fuel its growth, particularly in high-density colocation and High-Performance Computing (HPC). This includes the strategic pricing of financial products like convertible senior notes, which are crucial for funding significant infrastructure development and potential acquisitions.

The capital raised is directly deployed to enhance their data center capabilities and expand their service offerings. For instance, the company has been active in managing its debt and equity, with a focus on instruments that support long-term expansion. This approach allows them to invest in cutting-edge technology and maintain competitive pricing in a rapidly evolving digital infrastructure landscape.

- Capital Raises: Core Scientific has utilized convertible senior notes to fund its strategic initiatives.

- Debt Management: The company actively manages its capital structure to support expansion.

- Use of Proceeds: Funds are directed towards infrastructure development and HPC capabilities.

- Market Competitiveness: Financial strategy aims to enable advanced services and competitive pricing.

Core Scientific's pricing strategy for its HPC and colocation services is built on long-term contracts, often with take-or-pay clauses, ensuring stable revenue. This contrasts with the inherent volatility of its Bitcoin mining revenue, which is directly tied to market prices and mining difficulty. The April 2024 Bitcoin halving, reducing block rewards from 6.25 BTC to 3.125 BTC, underscores the need for operational efficiency to maintain profitability. For example, in Q1 2024, Core Scientific sold 4,454 BTC for approximately $293 million, a key part of its strategy to convert mined assets into fiat currency.

| Service Type | Pricing Basis | Key Revenue Driver | Example Contract Value | Contract Duration |

|---|---|---|---|---|

| HPC/Colocation | Long-term contracts, take-or-pay | Guaranteed revenue, premium compute solutions | Billions (e.g., CoreWeave deal) | 12 years |

| Self-Mining | Bitcoin market price, mining difficulty | Volatile revenue based on crypto market | N/A (revenue is mined BTC) | N/A |

4P's Marketing Mix Analysis Data Sources

Our Core Scientific 4P's Marketing Mix Analysis is built upon a robust foundation of primary and secondary data. We meticulously gather information from official company disclosures, including SEC filings and investor relations materials, alongside industry-specific market research and competitive intelligence reports.