Core Scientific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Core Scientific Bundle

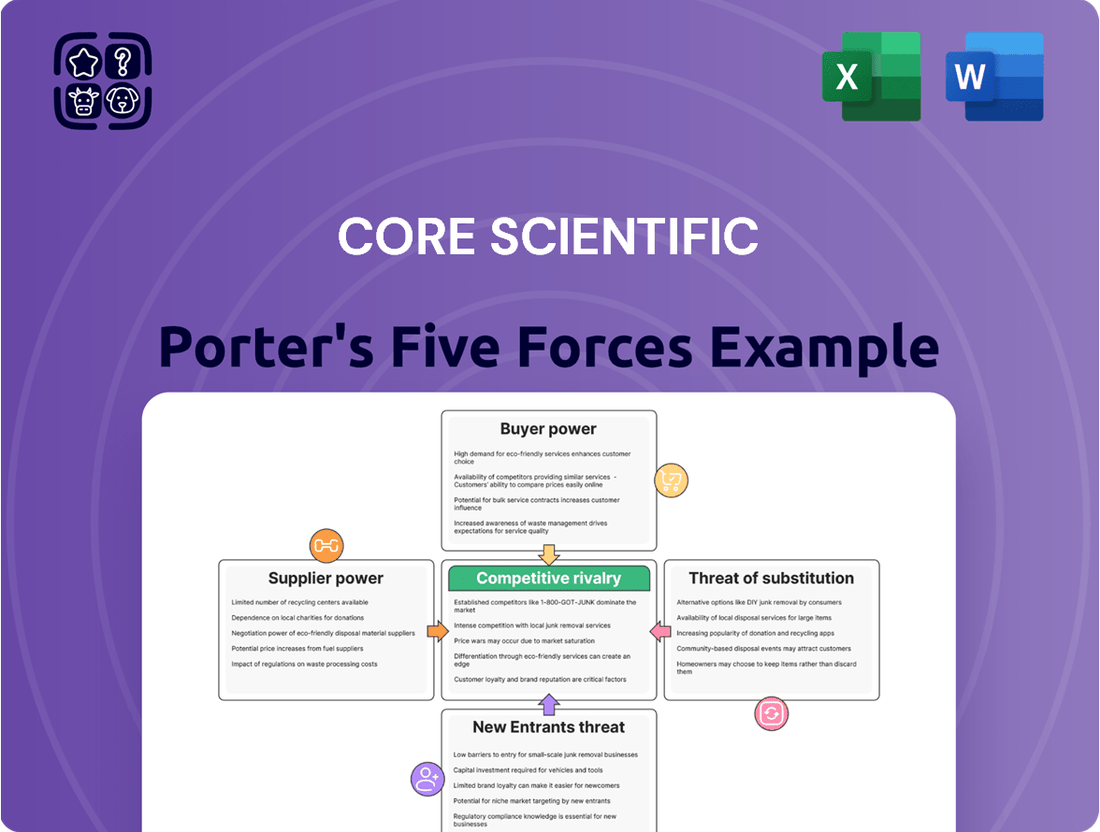

Porter's Five Forces Analysis provides a powerful lens to understand the competitive landscape Core Scientific operates within. It dissects the intricate interplay of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and industry rivalry, revealing the underlying forces that shape profitability and strategic decisions.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Core Scientific’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Core Scientific's reliance on low-cost energy, particularly electricity, is a critical factor in its operations. The company's Bitcoin mining and high-performance computing data centers are energy-intensive, making power costs a significant portion of their expenses. In 2023, electricity costs represented a substantial percentage of Core Scientific's operating expenses, directly influencing their ability to maintain profitability in a competitive market.

Core Scientific's reliance on a select group of specialized hardware manufacturers, particularly for high-efficiency ASIC miners and advanced GPUs from firms like NVIDIA, presents a significant bargaining power challenge. This concentration means fewer alternatives for acquiring critical mining and high-performance computing (HPC) equipment.

The limited number of suppliers for these advanced components grants them considerable leverage. This can translate into Core Scientific facing higher equipment costs or less favorable payment and support terms, directly impacting its operational expenses and profitability.

Core Scientific's need for specialized construction and engineering services for its expanding data center capacity and High-Performance Computing (HPC) upgrades grants significant bargaining power to these providers. This is especially true for bespoke solutions tailored to the unique demands of high-density computing facilities.

Limited Substitute Inputs

When suppliers control inputs that have few alternatives, their bargaining power significantly increases. This is particularly true for critical components like electricity or specialized hardware used in high-performance computing (HPC) and mining operations. For instance, in 2024, the global electricity market saw significant price volatility, with wholesale prices in some regions doubling compared to the previous year, directly impacting the cost structure for energy-intensive industries.

This scarcity of substitutes means businesses are often locked into existing supplier relationships, especially for essential resources. The lack of readily available alternatives for specialized mining hardware, for example, means that companies in that sector have limited recourse if suppliers decide to increase prices or alter terms.

- Limited Substitutes for Essential Inputs: Industries relying on electricity or specialized HPC/mining hardware often face a constrained choice of suppliers.

- Supplier Leverage: The absence of viable alternatives grants existing suppliers considerable leverage in price negotiations and contract terms.

- 2024 Electricity Price Hikes: In 2024, some regions experienced substantial increases in wholesale electricity prices, highlighting the critical nature of this input and the limited ability of consumers to switch providers quickly.

- Impact on Cost Structures: This dependency directly influences the operational costs and profitability of businesses dependent on these core inputs.

Technological Advancement Pace

The accelerating pace of technological innovation in mining hardware and AI chips significantly impacts Core Scientific's bargaining power with its suppliers. As new generations of more efficient and powerful equipment emerge, Core Scientific faces pressure to adopt these advancements to maintain its competitive edge in the rapidly evolving digital asset mining landscape.

This continuous need for upgrades creates a dependency on suppliers who lead these technological frontiers. Suppliers at the cutting edge of innovation can leverage this position to influence pricing and dictate the availability of critical, high-performance components. For instance, the demand for advanced AI chips, crucial for optimizing mining operations, has seen significant price fluctuations. In early 2024, the cost of high-end AI accelerators experienced substantial increases due to robust demand from various sectors, including data centers and advanced computing, directly affecting mining companies like Core Scientific.

- Supplier Leverage: Suppliers of next-generation mining ASICs and AI chips hold considerable power due to the specialized nature and high demand for their products.

- Upgrade Imperative: Core Scientific must invest in the latest hardware to improve hash rates and energy efficiency, making it reliant on suppliers for competitive viability.

- Cost Implications: The rapid obsolescence of older hardware and the premium pricing of new technology directly translate into higher capital expenditure for Core Scientific, impacting its operational costs.

- Market Dynamics: The limited number of leading manufacturers for advanced semiconductor technology further concentrates supplier power.

Core Scientific's bargaining power with its suppliers is significantly limited due to its reliance on specialized, high-demand inputs. The company depends heavily on a few key manufacturers for advanced ASIC miners and GPUs, granting these suppliers considerable leverage. This concentration means Core Scientific often faces higher prices and less favorable terms, directly impacting its operational costs and profitability.

The critical nature of electricity for Core Scientific's energy-intensive operations further amplifies supplier power, especially given the price volatility in the energy market. In 2024, wholesale electricity prices saw significant increases in many regions, a trend that directly affects Core Scientific's cost structure due to the limited availability of alternative energy sources for its facilities.

Furthermore, the rapid technological advancements in mining hardware and AI chips necessitate continuous upgrades, making Core Scientific dependent on leading suppliers. The high demand for cutting-edge components, as seen with AI accelerators in early 2024, allows these suppliers to command premium pricing and dictate terms, further diminishing Core Scientific's negotiating position.

| Supplier Type | Key Inputs | Supplier Bargaining Power Factors | Impact on Core Scientific | 2024 Data/Trend |

|---|---|---|---|---|

| Hardware Manufacturers | ASIC Miners, GPUs | Limited number of specialized manufacturers, high R&D costs, proprietary technology | Higher equipment costs, limited negotiation on terms | Strong demand for advanced AI chips led to price increases for high-end accelerators |

| Energy Providers | Electricity | Regional monopolies, essential utility, price volatility | Significant portion of operating expenses, limited ability to switch providers | Wholesale electricity prices in some regions doubled compared to 2023 |

| Infrastructure Services | Data Center Construction, Engineering | Specialized expertise, bespoke solutions required for HPC facilities | Higher project costs for expansion and upgrades | Demand for high-density computing facilities drives up specialized service costs |

What is included in the product

This analysis dissects the competitive landscape for Core Scientific by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Instantly identify and quantify competitive threats with a dynamic, interactive dashboard that visualizes all five forces.

Customers Bargaining Power

Core Scientific's customer base includes both its own mining operations and colocation clients. This dual approach means that large clients, particularly those in high-performance computing (HPC) like CoreWeave, hold significant sway. For instance, CoreWeave's substantial commitment to Core Scientific's future revenue streams, estimated to be in the hundreds of millions of dollars over several years, directly translates into considerable bargaining power for them.

Core Scientific's colocation clients face significant hurdles when considering a move. The expense and effort involved in physically relocating servers, networking equipment, and ensuring uninterrupted operations can be prohibitive. This makes it difficult for customers to switch providers quickly, thereby limiting their immediate bargaining power.

In 2024, the trend of increasing data center density and specialized cooling solutions further elevates these switching costs. Clients who have invested in infrastructure tailored to Core Scientific's specific environment, such as advanced cooling systems or power configurations, will find it even more challenging and costly to migrate. This entrenchment can lead to more stable, long-term customer commitments.

The escalating global appetite for Artificial Intelligence (AI) and High-Performance Computing (HPC) infrastructure, fueled by advancements in machine learning and complex rendering tasks, significantly bolsters Core Scientific's market standing. This robust demand for specialized computing power translates directly into enhanced bargaining power for Core Scientific.

As a prominent provider of high-density computing solutions, Core Scientific is positioned to negotiate premium pricing and more advantageous contract terms with its clientele. Customers requiring cutting-edge, specialized infrastructure are often less price-sensitive and more focused on reliability and performance, giving Core Scientific leverage in these negotiations.

Price Sensitivity in Bitcoin Mining

Customers in the Bitcoin mining hosting sector, particularly after the April 2024 halving, are experiencing significantly reduced profitability. This financial pressure amplifies their sensitivity to pricing, giving them greater leverage when negotiating hosting contracts.

The reduced block rewards mean that every cost, including hosting fees, becomes a more critical factor in a miner's ability to remain profitable. This heightened price sensitivity directly translates to increased bargaining power for these customers.

- Increased Leverage: Miners facing tighter margins are more likely to seek out competitive hosting rates.

- Negotiation Focus: Discussions often center on reducing hosting costs per kilowatt-hour (kWh).

- Market Dynamics: A large number of hosting providers competing for business further empowers customers.

Diversification of Customer Base

Core Scientific is strategically moving to reduce its dependence on a few major clients. By cultivating relationships with a wider array of hyperscalers and enterprise businesses seeking AI infrastructure, the company aims to spread its customer base. This diversification is key to mitigating the significant bargaining power that any single large customer might otherwise wield.

The company's efforts in 2024 have focused on expanding its reach beyond its foundational Bitcoin mining operations and its significant HPC client, CoreWeave. Successfully onboarding new clients in the burgeoning AI sector is a primary objective. This expansion directly addresses the concentration risk inherent in having a limited number of large customers.

- Customer Diversification: Core Scientific is actively broadening its client portfolio, moving beyond its initial heavy reliance on Bitcoin mining and its primary HPC client, CoreWeave.

- AI Infrastructure Focus: The company is targeting a wider range of hyperscalers and enterprises for AI infrastructure services, aiming to reduce customer concentration.

- Reduced Customer Bargaining Power: By attracting a more diverse customer base, Core Scientific can gradually dilute the bargaining power of any single dominant client.

- Market Expansion: This strategy is crucial for Core Scientific's long-term stability and its ability to negotiate more favorable terms as its client roster grows.

Core Scientific's bargaining power with customers is influenced by client concentration and the specific needs of its user base. While high switching costs generally limit customer power, the profitability pressures on Bitcoin miners, especially after the April 2024 halving, have amplified their negotiation leverage on hosting fees. Core Scientific's strategy to diversify its client base, particularly by attracting more AI and HPC clients, aims to mitigate the influence of any single large customer.

| Customer Segment | Key Influence Factor | Impact on Bargaining Power |

|---|---|---|

| Large HPC Clients (e.g., CoreWeave) | Significant revenue commitment, specialized infrastructure needs | Moderate to High |

| Bitcoin Miners | Profitability post-halving, price sensitivity | High |

| New AI/Enterprise Clients | Demand for specialized infrastructure, less price sensitivity | Low to Moderate |

Preview the Actual Deliverable

Core Scientific Porter's Five Forces Analysis

The preview you see is the exact, professionally crafted Porter's Five Forces Analysis for Core Scientific that you will receive immediately after purchase. This comprehensive document is fully formatted and ready for your immediate use, providing a thorough examination of the competitive landscape. You're looking at the actual document, ensuring no surprises or placeholders, just the complete analysis you need.

Rivalry Among Competitors

The Bitcoin mining landscape is fiercely competitive, with a multitude of large-scale operators battling for block rewards. This intense rivalry was amplified in 2024 by the halving event, which cut mining rewards in half. Consequently, miners are compelled to enhance operational efficiency and pursue consolidation to remain viable.

Core Scientific's strategic shift into high-performance computing (HPC) and AI data centers intensifies its competitive rivalry. This move directly pits it against established players like Equinix and Digital Realty, who already command significant market share and infrastructure in these lucrative spaces. The landscape is further populated by cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud, which offer their own comprehensive HPC solutions.

Competitive rivalry in the high-density computing sector is intensely shaped by operational efficiency, particularly access to affordable, reliable power. Companies that secure favorable energy contracts, like those seen with major cloud providers in 2024, can significantly lower their operating costs. For instance, Microsoft's Azure and Amazon's AWS have been actively investing in renewable energy sources to stabilize power costs and improve sustainability, directly impacting their ability to compete on price and scale.

Strategic Partnerships and Contracts

Core Scientific's competitive landscape is increasingly shaped by strategic partnerships and exclusive contracts. These agreements are crucial for locking in long-term revenue and creating a competitive moat. For instance, Core Scientific's significant hosting agreement with CoreWeave, a major AI infrastructure provider, highlights this trend. Such multi-year deals provide revenue visibility and operational stability, acting as a significant differentiator in a rapidly evolving market.

The ability to secure and maintain these large-scale contracts is a direct measure of competitive strength. These partnerships often involve substantial capital commitments and long-term service level agreements, making them difficult for smaller or less established competitors to replicate. This focus on securing exclusive or preferential access to significant clients is a key battleground for market share.

- Core Scientific's partnership with CoreWeave is a prime example of strategic alliance formation.

- These long-term contracts are vital for securing predictable revenue streams.

- The capacity to win and fulfill large hosting deals is a critical competitive advantage.

- Such agreements differentiate players by ensuring access to significant demand.

Capital Investment and Technology Race

The intense competition in the data center and high-performance computing sector is significantly fueled by the substantial capital investment required for cutting-edge hardware and ongoing facility upgrades. Companies must continuously invest to maintain a competitive edge.

The rapid evolution of technology means that yesterday's state-of-the-art equipment quickly becomes obsolete, forcing continuous reinvestment cycles. For instance, the demand for more powerful GPUs, like NVIDIA's H100 and the anticipated Blackwell architecture, necessitates massive capital outlays for hardware acquisition and integration. In 2024, major cloud providers and AI infrastructure companies are projected to spend tens of billions on AI-specific hardware alone.

- Capital Expenditure: Companies like Core Scientific require significant capital to build and maintain their facilities, purchase advanced computing hardware, and ensure efficient cooling and power infrastructure.

- Technology Obsolescence: The rapid pace of innovation, particularly in AI and machine learning, means that hardware investments can become outdated quickly, demanding frequent upgrades and further capital expenditure.

- Competitive Advantage: Firms that can secure financing and effectively deploy new technologies faster than rivals gain a significant competitive advantage in attracting clients and offering superior performance.

Core Scientific faces intense rivalry not only in Bitcoin mining but also in the burgeoning high-performance computing (HPC) and AI data center markets. This dual competitive front means battling established giants and agile newcomers alike, all vying for market share and lucrative contracts. The need for continuous, substantial capital investment in cutting-edge hardware, particularly GPUs, further intensifies this rivalry, as companies race to offer the most advanced solutions.

The strategic importance of securing long-term, high-value hosting agreements, like Core Scientific's deal with CoreWeave, is paramount. These partnerships are a direct measure of a company's ability to compete effectively, providing revenue stability and a significant differentiator in a crowded marketplace. Companies that can consistently win and fulfill these large-scale contracts gain a distinct advantage, as the barriers to entry for such deals are substantial.

In 2024, the demand for AI infrastructure has driven significant capital allocation towards hardware. For instance, the market for AI accelerators alone saw billions invested by major players. This highlights the critical role of financial capacity in maintaining competitiveness, as companies must constantly upgrade their infrastructure to meet the evolving demands of AI workloads and stay ahead of technological obsolescence.

| Metric | Core Scientific (2024 Estimate) | Industry Average (AI Data Centers) |

|---|---|---|

| GPU Deployment Capacity | Significant, growing with HPC expansion | Rapidly expanding, driven by AI demand |

| Power Costs per kWh | Targeting competitive rates through efficiency | Varies significantly by location and contracts |

| Client Acquisition Cost | High due to competitive bidding for large contracts | High, with emphasis on long-term partnerships |

SSubstitutes Threaten

For those wanting Bitcoin, buying it directly on exchanges or through new spot Bitcoin ETFs offers a clear alternative to mining. These methods bypass the need for specialized hardware and energy consumption, making them more accessible. As of early 2024, the approval and subsequent trading of spot Bitcoin ETFs in the U.S. have significantly broadened direct acquisition channels.

While Core Scientific focuses on specialized, high-density computing, the threat of substitutes from general cloud computing services remains a consideration. Major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offer a vast array of flexible and scalable computing resources that could be utilized for certain blockchain or computational tasks, especially those not requiring Core Scientific's specialized infrastructure.

These generalized cloud platforms provide readily available alternatives for less demanding or more varied workloads. For instance, in 2024, the global public cloud market was projected to reach over $600 billion, indicating the sheer scale and accessibility of these substitute services, which can be a viable option for clients with less specialized computational needs.

The rise of Decentralized Physical Infrastructure Networks (DePIN) introduces a significant threat of substitutes for traditional colocation services, impacting companies like Core Scientific. These networks offer a distributed model for computing power, potentially drawing demand away from centralized data centers. By 2024, the DePIN sector is seeing substantial growth, with projects focusing on areas like storage and bandwidth, indicating a growing viable alternative for businesses seeking infrastructure solutions.

In-house Data Center Development

Large enterprises or well-funded blockchain projects may opt to build their own data centers for mining or high-performance computing. This approach offers enhanced control and customization, allowing them to bypass reliance on external colocation and hosting providers. For instance, in 2024, major tech companies continued to invest heavily in their own infrastructure to support AI and blockchain initiatives, with some allocating billions to data center expansion.

The threat of in-house data center development can impact Core Scientific by reducing demand for its colocation services. When significant players bring their operations in-house, it directly shrinks the potential customer base for third-party providers. This is particularly relevant as the cost of specialized hardware and energy continues to be a major factor in large-scale computing operations.

Key considerations for this threat include:

- Capital Expenditure: Building and maintaining a data center requires substantial upfront investment, which may not be feasible for all potential customers.

- Operational Expertise: Running a data center demands specialized knowledge in power management, cooling, security, and network infrastructure.

- Scalability Challenges: While in-house development offers control, scaling up or down can be less flexible compared to using a colocation provider.

Alternative Blockchain Solutions

The rise of alternative blockchain solutions presents a significant threat of substitutes for Core Scientific's core services. Technologies like Proof-of-Stake (PoS) networks, which are more energy-efficient and don't rely on intensive mining, could reduce the demand for traditional Bitcoin mining infrastructure.

For instance, Ethereum's transition to PoS in September 2022, known as The Merge, drastically reduced its energy consumption by over 99%. This shift highlights a potential pathway for other blockchain ecosystems to scale without the high energy demands that drive Core Scientific's business.

The development and adoption of Layer 2 scaling solutions on various blockchains also aim to increase transaction speeds and reduce costs, potentially lessening the reliance on the underlying blockchain's mining power. This could divert demand away from specialized mining hardware and services.

These evolving blockchain infrastructures pose a long-term threat by offering more sustainable and potentially more cost-effective alternatives, which could impact the overall market for Bitcoin mining services.

The threat of substitutes for Core Scientific's specialized Bitcoin mining operations is multifaceted. Direct purchase of Bitcoin via spot ETFs, as seen in early 2024, bypasses mining entirely. Furthermore, general cloud computing services, projected to exceed $600 billion globally in 2024, offer flexible alternatives for less demanding computational tasks, diverting potential clients. The growing Decentralized Physical Infrastructure Networks (DePIN) sector also presents a distributed alternative to traditional colocation.

Large enterprises increasingly opt for in-house data centers, a trend continuing in 2024 with billions invested by tech giants in infrastructure for AI and blockchain. This reduces the market for third-party colocation providers like Core Scientific. Alternative blockchain technologies, such as Proof-of-Stake (PoS) networks, exemplified by Ethereum's 99% energy reduction post-Merge, offer more energy-efficient solutions, diminishing the need for intensive mining infrastructure.

| Substitute Type | Description | Market Data/Trend (2024) | Impact on Core Scientific |

|---|---|---|---|

| Direct Bitcoin Acquisition | Buying Bitcoin via exchanges or ETFs | Spot Bitcoin ETFs approved and trading in early 2024 | Reduces demand for mining-derived Bitcoin |

| General Cloud Computing | Scalable computing resources from major providers | Global public cloud market projected over $600 billion | Offers alternative for less specialized computational needs |

| DePIN | Distributed computing power networks | Significant growth in the DePIN sector | Potential diversion of demand from centralized data centers |

| In-house Data Centers | Companies building their own infrastructure | Billions invested by tech companies in infrastructure | Shrinks potential customer base for colocation services |

| Alternative Blockchain Tech (PoS) | Energy-efficient consensus mechanisms | Ethereum's PoS reduced energy consumption by >99% | Decreases demand for energy-intensive mining |

Entrants Threaten

The significant capital investment needed to establish large-scale data centers, acquire specialized high-density computing hardware like ASICs and GPUs, and secure essential land and power infrastructure presents a substantial barrier for newcomers. For instance, building a state-of-the-art bitcoin mining facility in 2024 can easily cost tens of millions of dollars, if not hundreds of millions, for the initial setup and equipment procurement.

Securing reliable, low-cost, and large-scale power infrastructure is absolutely critical for operations like digital asset mining and high-performance computing (HPC). Without consistent and affordable electricity, these businesses simply can't function effectively or competitively.

The availability of suitable sites with the necessary power grid connections is quite limited. For instance, in 2024, many regions are experiencing increased demand for power, making it harder for new players to secure the substantial capacity needed. This scarcity, coupled with the intricate and often lengthy negotiations required with utility providers, creates a significant hurdle for any new company looking to enter the market.

The threat of new entrants is significantly lowered by the immense technical expertise and operational scale required to compete in the high-density computing sector. Operating and maintaining these facilities demands specialized knowledge in areas like power management, cooling systems, and network infrastructure, along with substantial operational experience.

New players often struggle to match the established talent pool and economies of scale that incumbents like Core Scientific have cultivated. For instance, Core Scientific's extensive experience in managing large-scale data center operations, evidenced by their significant operational uptime and efficiency metrics, provides a substantial barrier.

Furthermore, the ability to manage complex supply chains for hardware acquisition, maintenance, and upgrades is critical. New entrants may find it difficult to secure favorable terms or reliable supply lines compared to established operators who have built strong relationships with vendors over time.

Regulatory and Permitting Hurdles

The digital asset and data center sectors face an increasingly intricate regulatory environment. New entrants must contend with evolving rules governing digital assets, alongside stringent environmental regulations and complex local permitting processes for infrastructure development. Successfully navigating these multifaceted and often lengthy bureaucratic pathways is a substantial barrier to entry.

For instance, in 2024, the European Union continued to refine its MiCA (Markets in Crypto-Assets) regulation, impacting how new digital asset service providers can operate. Similarly, data center construction is frequently subject to local zoning laws and environmental impact assessments, which can add months or even years to project timelines and significantly increase upfront costs for new players.

- Evolving Regulatory Landscape: Digital asset and data center industries are subject to dynamic regulations, including those addressing environmental impact and operational compliance.

- Permitting Complexity: Obtaining necessary permits for data center construction and digital asset operations can be a time-consuming and resource-intensive process for new companies.

- Increased Compliance Costs: New entrants face higher initial investment due to the need to understand and adhere to a growing number of legal and environmental requirements.

- Market Entry Delays: Regulatory and permitting hurdles can significantly delay the launch and scaling of new businesses in these sectors.

Established Player Advantage and Contracts

Established players like Core Scientific hold a significant advantage due to their existing relationships with key suppliers, including hardware manufacturers and energy providers. These deep-rooted connections are crucial in an industry where access to critical resources can be a bottleneck for newcomers. For instance, Core Scientific has secured substantial agreements with major clients such as CoreWeave, demonstrating their ability to attract and retain large-scale customers.

Furthermore, the presence of long-term contracts and a proven operational history act as formidable barriers to entry. New entrants struggle to replicate the trust and reliability that established firms have cultivated over time. These existing agreements not only ensure a steady revenue stream for incumbents but also make it challenging for new companies to secure comparable deals, thereby limiting their ability to quickly gain market traction.

The difficulty for new entrants is further amplified by the capital-intensive nature of the industry and the need for specialized expertise. Core Scientific, having navigated these complexities, benefits from economies of scale and operational efficiencies that are hard for nascent competitors to match in the short term.

- Established Supplier Relationships: Core Scientific benefits from existing partnerships with hardware and energy providers.

- Key Client Contracts: Agreements with major clients like CoreWeave provide a stable revenue base.

- Contractual Barriers: Long-term contracts and a proven track record deter new entrants.

- Market Entry Difficulty: New players face challenges in securing similar deals and gaining market share quickly.

The threat of new entrants into the high-density computing and digital asset mining sectors is significantly mitigated by substantial capital requirements, the critical need for reliable, low-cost power, and the scarcity of suitable locations with adequate grid connections. These factors, combined with the complex regulatory environment and the difficulty in replicating established operational expertise and supplier relationships, create formidable barriers.

For instance, in 2024, securing the necessary power capacity for a large-scale data center can involve multi-year negotiation processes and significant upfront infrastructure investment. Furthermore, evolving regulations like the EU's MiCA framework add compliance layers that new entrants must navigate, potentially delaying market entry and increasing initial costs.

Established firms like Core Scientific benefit from existing long-term contracts with major clients, such as their agreement with CoreWeave, which provides a stable revenue stream and deters new competition. These existing relationships and proven track records are difficult for newcomers to quickly replicate.

The industry also demands specialized technical knowledge in areas like power management and cooling, alongside experience in navigating complex supply chains for hardware. New entrants often struggle to match the economies of scale and operational efficiencies that incumbents have built over time, making it challenging to compete effectively from the outset.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data, including company annual reports, industry-specific market research from firms like Gartner, and government economic data to provide a robust assessment of competitive forces.