Corby SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corby Bundle

Corby's market position is shaped by a unique blend of established strengths and emerging opportunities. However, understanding the full picture requires a deeper dive into its potential weaknesses and the competitive threats it faces.

Want to truly grasp Corby's strategic landscape and unlock its future potential? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Corby Spirit and Wine Limited boasts a powerful collection of beloved Canadian liquor brands, complemented by its role as the Canadian distributor for prominent international alcohol labels. This comprehensive approach ensures they cater to a wide audience, offering a diverse selection spanning spirits, wines, and ready-to-drink (RTD) options.

The company's standing as the second-largest marketer and distributor of spirits and wines in Canada underscores its substantial market penetration and well-established distribution infrastructure. For instance, in fiscal year 2023, Corby reported net sales of $420.7 million, demonstrating the strength of its brand portfolio in driving revenue.

Corby has shown a steady upward trend in its financial health, with both revenue and earnings consistently growing. This resilience is a key strength, highlighting the company's ability to navigate market dynamics effectively.

The company reported a 4% increase in organic revenue and an 11% surge in total sales for the first half of fiscal year 2025, boosted by strategic acquisitions of ready-to-drink (RTD) brands. This growth trajectory, building on a 41% sales jump for the fiscal year ending June 30, 2024, underscores a robust business model and sound operational management.

Corby's strategic acquisitions have significantly bolstered its position in the Ready-to-Drink (RTD) market. The company secured a substantial 90% ownership of Ace Beverage Group (ABG) in June 2023 and completed the acquisition of Nude in April 2024, both key players in the RTD sector.

These moves have demonstrably enhanced Corby's revenue streams and cemented its status as a leading entity in the burgeoning RTD category. Notably, Corby's performance in this segment has outpaced overall market value growth, highlighting the success of its expansion strategy.

Affiliation with Pernod Ricard S.A.

Corby's affiliation with Pernod Ricard S.A., a global leader in the spirits and wine industry, offers substantial strategic advantages. This powerful partnership grants Corby access to a vast portfolio of internationally recognized premium brands, significantly enhancing its market presence and consumer appeal.

The integration with Pernod Ricard bolsters Corby's operational capabilities and purchasing power. This allows for more efficient supply chain management and cost optimization, directly impacting profitability and competitiveness in the Canadian market.

Leveraging Pernod Ricard's extensive international expertise and best practices provides Corby with a distinct edge. This includes access to advanced marketing strategies, product development insights, and global distribution networks, all of which contribute to sustained growth and innovation.

- Brand Portfolio Expansion: Access to Pernod Ricard's premium international brands like Absolut Vodka and Jameson Irish Whiskey strengthens Corby's product offering.

- Enhanced Buying Power: As part of a larger entity, Corby benefits from increased negotiation leverage with suppliers, leading to better cost efficiencies.

- Operational Synergies: Integration allows for the adoption of Pernod Ricard's proven operational models and best practices in distribution and sales.

- Global Market Insights: Corby can tap into Pernod Ricard's global market intelligence, informing strategic decisions and identifying emerging trends.

Effective Market Adaptation and Execution

Corby has demonstrated remarkable agility in navigating a volatile market, a testament to its strong execution capabilities and a well-diversified product offering.

The company's strategic focus has allowed it to consistently capture market share within the spirits sector.

Corby's performance has outpaced the broader Canadian spirits market in terms of value for over two consecutive years, highlighting its effective market adaptation.

- Market Share Gains: Corby's ability to gain market share indicates successful product positioning and sales strategies.

- Value Outperformance: Outperforming the Canadian spirits market in value for over two years (as of mid-2024) suggests Corby's premiumization efforts or pricing power are effective.

- Portfolio Diversity: A diverse portfolio allows Corby to mitigate risks associated with specific product categories or consumer trends.

Corby's robust brand portfolio, featuring both owned Canadian labels and distributed international premium brands, provides a significant competitive advantage. This diversification, particularly its strong presence in the rapidly growing Ready-to-Drink (RTD) segment, fuels consistent revenue growth. For example, the strategic acquisitions of Ace Beverage Group and Nude in 2023 and 2024, respectively, have significantly boosted its market share in RTDs, a category showing strong consumer demand.

What is included in the product

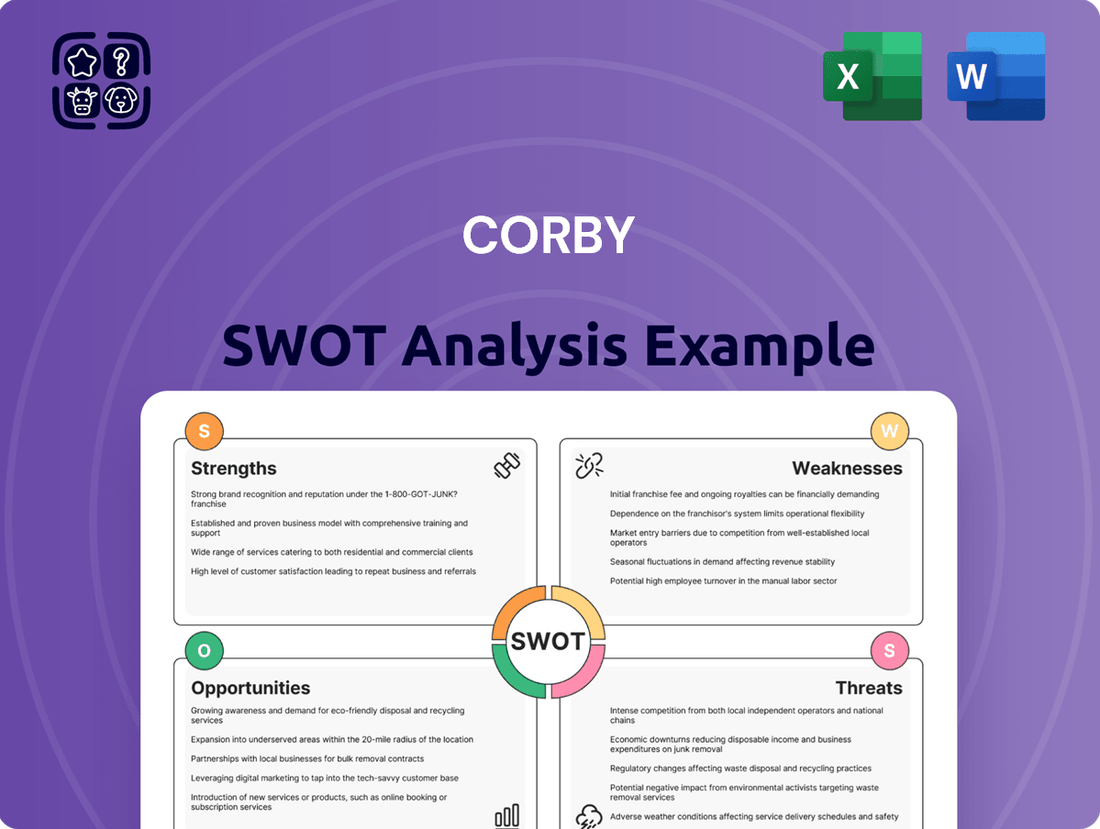

Analyzes Corby’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, reducing uncertainty and fostering proactive problem-solving.

Weaknesses

Corby's heavy reliance on government-controlled liquor boards, such as Ontario's LCBO, presents a significant weakness. While these relationships are strong, they create a dependency that can be disrupted by external factors.

For instance, the LCBO strike in July 2024 demonstrated this vulnerability, negatively impacting overall spirits sales and highlighting the potential for operational disruptions beyond Corby's direct control. This dependence limits Corby's agility in reaching consumers directly.

The Canadian wine market is facing headwinds, with a notable 6% drop in consumption volume during 2023. This decline is largely attributed to increasing health consciousness among consumers and the ongoing impact of cost-of-living pressures, which are making consumers more budget-conscious.

This broader market contraction presents a significant challenge for Corby's wine portfolio. The company will need to implement strategic adjustments to navigate this shrinking market and protect its share within the wine segment.

Corby's reliance on export revenue presents a significant weakness due to inherent volatility. For instance, the first half of fiscal 2025 saw a 9% decline in export revenue, underscoring the inconsistency of international sales. This fluctuation indicates that global market dynamics and external factors can heavily impact Corby's financial performance, creating an element of unpredictability.

Competitive Landscape in Spirits and RTDs

The Canadian spirits market is intensely competitive, featuring many established brands and emerging craft producers. Corby's efforts to increase market share face ongoing challenges from these diverse players, necessitating substantial marketing spend and a constant drive for product innovation to stay ahead. The growing consumer demand for unique, artisanal spirits, often from smaller, agile craft distilleries, presents a significant competitive hurdle.

Corby's ability to maintain its market position is directly tied to its capacity for continuous innovation and significant marketing investments. The rise of craft distilleries, offering niche products and strong local appeal, intensifies this competitive pressure.

- Intense Competition: The Canadian spirits market is crowded with both large corporations and numerous craft distilleries, increasing pressure on market share.

- Innovation Demands: Maintaining a competitive edge requires continuous product development and adaptation to evolving consumer tastes, particularly the growing preference for craft and premium spirits.

- Marketing Investment: Significant financial resources are needed for marketing and promotional activities to differentiate Corby's brands in a saturated marketplace.

- Consumer Preferences: The increasing demand for diverse and unique spirits, often driven by smaller, agile craft producers, poses a challenge to established players like Corby.

Potential Impact of Regulatory and Trade Changes

Corby's operations are sensitive to shifts in regulations and trade policies, particularly the ongoing monitoring of potential import tariffs between Canada and the United States. These changes can significantly reshape the business landscape, impacting everything from product pricing to the reliability of supply chains.

For example, the Canadian government's 2023 budget introduced measures that could affect the spirits industry, and Corby, as a major player, must adapt to any resulting competitive shifts or cost adjustments. Such policy changes can also alter the playing field for imported versus domestically produced goods, potentially influencing Corby's market share and profitability.

- Regulatory Scrutiny: Corby faces ongoing scrutiny from various regulatory bodies concerning product labeling, marketing, and distribution, which can lead to compliance costs and operational adjustments.

- Trade Policy Volatility: Fluctuations in trade agreements and tariffs, especially between Canada and the U.S., can directly impact the cost of goods sold and the competitiveness of Corby's product portfolio.

- Supply Chain Disruptions: Changes in cross-border trade regulations or unforeseen geopolitical events can disrupt established supply chains, affecting raw material availability and delivery timelines.

- Consumer Protection Laws: Evolving consumer protection laws, particularly around alcohol advertising and sales, may necessitate changes in marketing strategies and sales channels.

Corby's significant dependence on government-controlled liquor boards, such as Ontario's LCBO, represents a key vulnerability. This reliance, while currently strong, creates a dependency that can be disrupted by external factors, limiting direct consumer reach.

The Canadian wine market is experiencing a downturn, with consumption volume dropping by 6% in 2023 due to increased health consciousness and cost-of-living pressures. This contraction poses a challenge for Corby's wine portfolio, requiring strategic adjustments.

Export revenue for Corby showed a 9% decline in the first half of fiscal 2025, highlighting the inherent volatility and unpredictability of international sales, which can heavily impact financial performance.

The company faces intense competition within the Canadian spirits market from established brands and an increasing number of craft distilleries, necessitating substantial marketing investment and continuous product innovation to maintain market share.

Same Document Delivered

Corby SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Ontario's decision to permit alcohol sales in up to 8,500 new retail locations, including grocery, convenience, and big-box stores, beginning in late 2024, creates a significant avenue for growth. This deregulation of the alcohol market in Canada's most populous province directly benefits Corby by offering vastly expanded product distribution. Corby's domestic case goods revenue and commission earnings are poised for an uplift as its brands gain broader accessibility to consumers across Ontario.

The ready-to-drink (RTD) category is a significant growth engine within Canada's alcoholic beverage sector, demonstrating robust value expansion that outpaces many other segments. This trend presents a prime opportunity for Corby to leverage its strategic positioning.

Corby's proactive approach, including key acquisitions like Nude and Ace Beverage Group, directly addresses this burgeoning market. These moves are designed to enhance Corby's capacity to capture a larger share of the rapidly expanding RTD market, driving future revenue streams.

Canadian consumers are increasingly drawn to premium and craft spirits and wines, a trend that directly benefits Corby. This growing preference for quality and authenticity aligns perfectly with Corby's diverse portfolio, which includes both established Canadian brands and sought-after international premium labels.

This presents a significant opportunity for Corby to capitalize on higher-margin products. For instance, the Canadian premium spirits market saw a substantial increase in sales in 2023, with consumers willing to pay more for unique and high-quality offerings, indicating a strong market for Corby's premium brands.

Favorable Tax Reductions for Local Production in Ontario

Starting August 1, 2025, Ontario is introducing a 50% reduction in the spirits basic tax for beverages manufactured locally and sold directly from distillery retail stores. This favorable tax environment directly benefits companies like Corby, which have a strong presence in Canadian spirit production.

These tax incentives are designed to boost the competitiveness of Ontario-made spirits. For Corby, this could translate into more attractive pricing for consumers, potentially stimulating demand for their Canadian whisky and other locally produced brands.

- 50% spirits basic tax reduction for eligible Ontario-produced spirits sold at distillery retail stores from August 1, 2025.

- Enhanced competitiveness for Corby's Canadian spirit portfolio.

- Potential for lower consumer prices, driving increased sales volume.

- Support for local manufacturing and economic growth within Ontario.

Leveraging Digital Transformation and E-commerce

Corby's ongoing digital transformation offers a significant advantage, allowing the company to proactively adapt to market shifts and capitalize on emerging trends. This digital foundation is crucial for navigating the evolving landscape of the spirits industry.

The spirits market is increasingly reliant on e-commerce, presenting a prime opportunity for Corby to bolster its online presence and direct-to-consumer (DTC) sales channels, provided provincial regulations permit. This expansion can unlock new revenue streams and enhance customer engagement.

- Digital Investment: Corby's commitment to digital transformation, evidenced by investments in online platforms and data analytics, positions it to better understand consumer behavior and personalize marketing efforts.

- E-commerce Growth: The global e-commerce market for alcoholic beverages experienced substantial growth, with projections indicating continued expansion through 2025, driven by convenience and evolving consumer preferences. For instance, in 2023, online sales of spirits in key markets saw double-digit percentage increases.

- DTC Potential: Expanding direct-to-consumer capabilities allows Corby to build stronger brand loyalty and capture higher margins, bypassing traditional retail intermediaries where feasible.

The deregulation of alcohol sales in Ontario, effective late 2024, opens up 8,500 new retail locations, significantly boosting Corby's distribution reach. This expansion directly supports Corby's domestic case goods revenue and commission earnings by making its brands more accessible to a wider consumer base.

The rapidly growing ready-to-drink (RTD) category presents a substantial opportunity for Corby, especially with its strategic acquisitions like Nude and Ace Beverage Group, which are designed to capture a larger market share in this expanding segment.

Consumer preference for premium and craft spirits, a trend evident in the 2023 Canadian market where premium spirits sales saw significant increases, aligns perfectly with Corby's diverse portfolio, enabling it to capitalize on higher-margin products.

The 50% spirits basic tax reduction for eligible Ontario-produced spirits sold directly from distillery retail stores, starting August 1, 2025, will enhance the competitiveness of Corby's Canadian spirit brands, potentially leading to lower consumer prices and increased sales volume.

Corby's investment in digital transformation and e-commerce capabilities positions it to leverage the growing online sales channel for alcoholic beverages, which saw double-digit percentage increases in key markets in 2023, allowing for enhanced customer engagement and potential DTC growth.

| Opportunity Area | Description | Impact on Corby | Supporting Data/Fact |

|---|---|---|---|

| Ontario Retail Expansion | Deregulation allowing alcohol sales in ~8,500 new retail locations (grocery, convenience, big-box) starting late 2024. | Expanded distribution, increased domestic case goods revenue, and commission earnings. | Ontario is Canada's most populous province. |

| RTD Market Growth | Continued robust value expansion in the ready-to-drink (RTD) category. | Leveraging acquisitions (Nude, Ace Beverage Group) to capture a larger share of this growing segment. | RTD category outpaces many other alcoholic beverage segments in value expansion. |

| Premiumization Trend | Increasing consumer demand for premium and craft spirits and wines. | Capitalizing on higher-margin products within Corby's diverse portfolio. | Canadian premium spirits market saw substantial sales increases in 2023. |

| Tax Incentives | 50% spirits basic tax reduction for eligible Ontario-produced spirits sold at distillery retail stores from August 1, 2025. | Enhanced competitiveness of Canadian spirit portfolio, potential for lower consumer prices, and increased sales volume. | Designed to boost the competitiveness of Ontario-made spirits. |

| Digital & E-commerce | Growing reliance on e-commerce and direct-to-consumer (DTC) sales channels. | Bolstering online presence, expanding DTC capabilities for stronger brand loyalty and higher margins. | Global alcoholic beverage e-commerce market projected for continued expansion through 2025; online spirit sales in key markets saw double-digit increases in 2023. |

Threats

A significant threat for Corby is the growing consumer shift towards non-alcoholic and low-alcohol-by-volume (ABV) beverages. This trend is particularly pronounced among younger Canadian demographics who are increasingly health-conscious and mindful of their alcohol intake.

This evolving preference directly impacts Corby's traditional spirits and wine portfolio, potentially leading to reduced sales volumes for its core products. For instance, reports from 2024 indicate a sustained year-over-year increase in the non-alcoholic beverage market, with projections suggesting continued growth throughout 2025.

Failure to adapt by diversifying its product offerings to include more non-alcoholic or low-ABV options could result in Corby losing market share to competitors who are more agile in responding to these changing consumer tastes.

Persistent economic pressures, including elevated inflation rates throughout 2024 and into early 2025, are significantly impacting consumer spending habits. This often leads to consumers scrutinizing discretionary purchases more closely, potentially favoring at-home consumption over on-premise dining and drinking experiences, which directly affects Corby's sales volumes, particularly in the on-trade channel.

The Canadian spirits and wine market is a crowded space, with many companies competing for consumer attention. Corby, despite its established presence, faces this intense competition from both large, established domestic and international brands, as well as a growing number of craft distilleries. This saturation makes it difficult to consistently gain market share and maintain dominance.

Regulatory and Excise Duty Changes

Changes in alcohol excise duties and other regulations pose a significant threat to Corby. While temporary caps on excise duty increases have been extended, these duties are inherently indexed to inflation, meaning costs can rise automatically, impacting Corby's profitability.

Corby must remain agile to adapt to these evolving regulatory landscapes. For instance, in 2024, continued inflation could push up excise duties even with the 2% cap, directly affecting the cost of goods sold.

- Inflationary Indexation: Alcohol excise duties are linked to inflation, potentially increasing Corby's production costs without explicit government action.

- Regulatory Uncertainty: Ongoing shifts in excise duty policies and broader alcohol regulations require Corby to continuously adjust its financial planning and operational strategies.

- Profitability Impact: Increased duties and compliance costs can directly squeeze profit margins, especially if these are passed on to consumers.

Supply Chain Disruptions and Trade Uncertainties

Global trade dynamics, particularly the ongoing trade discussions between the United States and Canada, present a significant threat to Corby's import and export activities. Potential tariffs or changes in trade agreements could directly impact the cost of goods and market access.

Supply chain disruptions remain a persistent challenge, exacerbated by geopolitical events and logistical bottlenecks. Corby's reliance on a diversified supply chain, while a strategy to mitigate risk, could also lead to increased operational costs and potential impacts on product availability throughout 2024 and into 2025.

- Trade Policy Shifts: Uncertainty surrounding US-Canada trade relations could lead to unexpected cost increases for imported materials or finished goods.

- Supply Chain Volatility: Global shipping and logistics challenges, as seen in recent years, continue to pose a risk of delays and higher transportation expenses for Corby.

- Diversification Costs: Efforts to diversify supply chains, while necessary, may involve higher sourcing costs or require investment in new supplier relationships, impacting margins.

Corby faces a significant threat from the growing preference for non-alcoholic beverages, particularly among younger consumers in Canada. This trend, which saw continued growth in 2024 with projections for 2025, directly challenges Corby's traditional spirits and wine sales.

Economic headwinds, including persistent inflation in 2024 and early 2025, are also a concern, potentially reducing consumer spending on discretionary items like premium beverages and impacting on-premise sales.

Intense competition from both established domestic and international brands, alongside a rising number of craft producers, makes it challenging for Corby to maintain and grow its market share.

Furthermore, changes in alcohol excise duties, even with caps, can increase Corby's cost of goods sold due to inflation indexing. For example, continued inflation in 2024 could push duties up despite the 2% cap, squeezing profit margins.

Global trade dynamics and supply chain disruptions, influenced by geopolitical events and logistics issues, also pose risks, potentially increasing operational costs and affecting product availability.

SWOT Analysis Data Sources

This Corby SWOT analysis is built on a foundation of robust data, incorporating official company financial filings, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate strategic overview.