Corby Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corby Bundle

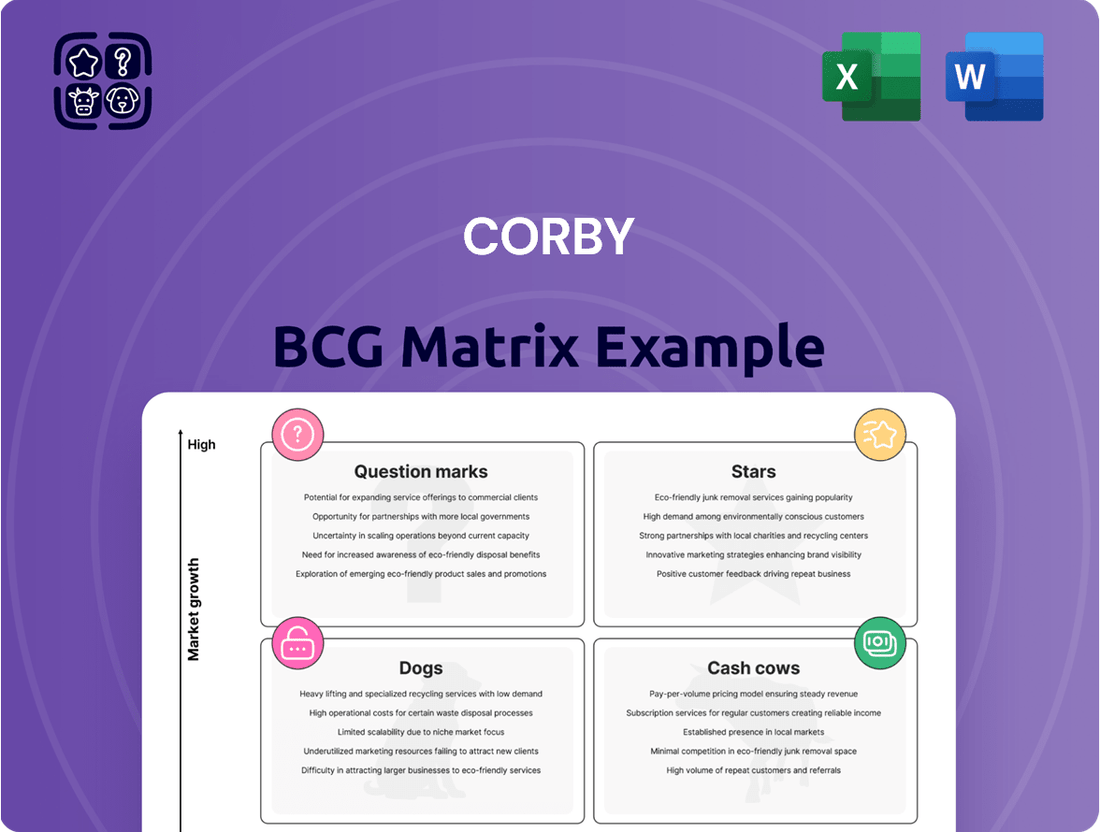

Understand how a company's product portfolio stacks up with the Corby BCG Matrix, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks. This powerful framework reveals growth potential and market share, offering a vital snapshot of strategic positioning. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your business strategy.

Stars

Corby's strategic acquisitions of Ace Beverage Group (ABG) and Nude Beverages have significantly bolstered its revenue, positioning its Ready-to-Drink (RTD) portfolio as a key growth driver. The RTD category is the fastest-growing segment in the Canadian beverage alcohol market.

The RTD segment experienced a substantial 6.3% value increase in the twelve months leading up to March 31, 2025. Corby's own RTD brands, excluding Nude, demonstrated even stronger performance, growing by 9.1% year-over-year, which outpaced the overall market growth.

This impressive growth within a rapidly expanding market, combined with Corby's increasing market share in RTDs, strongly suggests that these brands are positioned as Stars in the BCG Matrix. Their high growth rate and increasing dominance indicate significant potential for future expansion and market leadership.

Jameson Irish Whiskey stands out as a significant player in the Canadian spirits market, ranking among the top 10 brands by value. This strong market presence suggests a substantial market share and consumer demand.

The overall growth of the Irish whiskey category further bolsters Jameson's position. As the category expands, Jameson, backed by its affiliation with Pernod Ricard, is well-positioned to capitalize on this trend, making it a prime candidate for a Star in the BCG Matrix.

Absolut® Vodka holds a strong position as one of Canada's top 10 spirits brands by value, indicating a significant market share. Its continued success suggests it is a cash cow for Corby, generating substantial revenue.

Despite a slight volume decline in the Canadian vodka market during 2024, Absolut's premium positioning and Corby's targeted marketing efforts are likely to sustain its Star status. This indicates strong growth potential and a high market share within its category.

Tequila Portfolio (e.g., Código 1530®, Olmeca Altos®)

The tequila category in Canada is showing robust expansion, with a notable 1.1% volume growth in 2024. This makes tequila the sole spirit category to achieve volume growth within the on-premise channel, highlighting its increasing popularity among consumers.

Corby's strategic emphasis on broadening its presence in this dynamic market indicates that its tequila portfolio, including brands like Código 1530® and Olmeca Altos®, are positioned as high-growth products. This focus suggests these brands are prime candidates for increased market share, fitting squarely within the 'Star' quadrant of the BCG Matrix.

- Tequila's On-Premise Dominance: The tequila category achieved 1.1% volume growth in Canada's on-premise channel in 2024, outperforming all other spirit categories.

- Corby's Strategic Focus: Corby is actively expanding its footprint in the tequila market, signaling confidence in the category's upward trajectory.

- Star Quadrant Alignment: Brands like Código 1530® and Olmeca Altos® are considered 'Stars' due to their high growth potential and Corby's investment in their market expansion.

J.P. Wiser's® Canadian Whisky (Premium Expressions)

J.P. Wiser's Canadian Whisky, particularly its premium expressions, is positioned as a question mark within Corby's portfolio. While the overall Canadian whisky market has seen a slowdown, the premium segment is a growing area. J.P. Wiser's ranks among the top 10 spirits brands in Canada by value, indicating a strong existing market presence.

Corby is actively investing in J.P. Wiser's, focusing on innovation and expansion into new markets. Strategic partnerships, such as the one with the NHL, aim to bolster the brand's appeal and reach. These efforts are designed to elevate the premium expressions and capitalize on the trend towards higher-value spirits.

- Market Trend: Premiumization in Canadian whisky.

- Brand Strength: Top 10 spirits brand in Canada by value.

- Corby's Strategy: Investment in innovation and market expansion.

- Key Partnerships: NHL collaboration to boost premium appeal.

Corby's RTD portfolio, fueled by acquisitions and organic growth, is a clear Star. These brands exhibit high market growth and increasing market share, indicating strong future potential. Jameson Irish Whiskey also shines as a Star, benefiting from category growth and a strong market position. Absolut Vodka, despite a slight market volume dip in 2024, maintains its Star status due to premium positioning and strategic marketing, signifying ongoing high growth and share.

The tequila category is a significant growth area for Corby, with brands like Código 1530® and Olmeca Altos® poised to capture increasing market share. Their placement as Stars reflects the category's robust expansion and Corby's strategic investment in this segment.

| Brand/Category | BCG Quadrant | Key Supporting Factors | 2024 Data/Trends |

|---|---|---|---|

| Corby RTDs (e.g., Nude) | Star | High market growth, increasing market share, acquisition impact | RTD segment grew 6.3% (12 months to March 2025), Corby's RTDs grew 9.1% |

| Jameson Irish Whiskey | Star | Strong market presence, growing category, Pernod Ricard backing | Top 10 spirits brand by value in Canada |

| Absolut Vodka | Star | Premium positioning, targeted marketing, strong brand equity | Top 10 spirits brand by value in Canada, slight volume decline in vodka market |

| Corby Tequila Portfolio (Código 1530®, Olmeca Altos®) | Star | Rapid category expansion, strategic focus on tequila | Tequila category grew 1.1% volume in 2024 (on-premise), sole spirit category with volume growth |

What is included in the product

The Corby BCG Matrix provides a strategic overview of a company's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

The Corby BCG Matrix offers a clear visual of your portfolio, alleviating the pain of uncertain resource allocation.

Cash Cows

J.P. Wiser's Canadian Whisky, a cornerstone of Corby's portfolio, represents a classic Cash Cow. Its long-standing reputation and widespread availability in Canada provide a stable revenue stream. Even with a general market maturity, Wiser's consistently generates significant cash flow, requiring minimal marketing spend to maintain its market share.

Lamb's Rum, a venerable Canadian spirits brand, currently occupies the Cash Cow quadrant within Corby's portfolio. Despite experiencing some contraction in its domestic market, the brand continues to be a reliable generator of cash flow for the company. This stability is largely attributed to its enduring international appeal, underscoring its mature market position and significant global market share.

Polar Ice®, a prominent Canadian vodka brand under Corby, exemplifies a Cash Cow within the company's portfolio. The Canadian vodka market, while mature and experiencing some volume contraction, is where Polar Ice holds a solid position.

Despite the category's limited growth prospects, Polar Ice's established market share and Corby's strategic initiatives to maintain its commercial appeal point to its role as a consistent cash generator. For instance, in Corby's fiscal year 2024, the spirits segment, which includes brands like Polar Ice, demonstrated resilience, contributing significantly to overall profitability.

McGuinness® Liqueurs

McGuinness Liqueurs, a cornerstone of Corby's Canadian brand portfolio, operates within the mature liqueur market. This segment is characterized by stable demand and established consumer preferences, suggesting McGuinness likely maintains a consistent market share.

As a Cash Cow in the Boston Consulting Group (BCG) matrix, McGuinness liqueurs are expected to generate substantial profits with minimal investment required for growth. The brand benefits from Corby's established distribution networks and brand recognition.

- Brand Stability: McGuinness holds a well-recognized position in the Canadian liqueur market, contributing to its consistent sales performance.

- Profit Generation: The mature nature of the liqueur category allows McGuinness to deliver steady profits without the need for significant capital expenditure.

- Market Share: While specific 2024 market share data for McGuinness isn't publicly detailed, the overall Canadian spirits market saw continued growth in 2023, with liqueurs representing a significant portion. Corby's overall net sales for the fiscal year ended June 30, 2024, reached $350.7 million, with brands like McGuinness contributing to this stable performance.

Jacob's Creek®, Stoneleigh®, Campo Viejo® Wines

Jacob's Creek, Stoneleigh, and Campo Viejo are key international wine brands distributed by Corby. These established names likely hold significant market share within their respective categories in the Canadian market.

The Canadian wine market, while mature, is experiencing a trend towards premiumization. Brands with a strong heritage and consistent quality, like these, are well-positioned to benefit from this shift, generating reliable revenue streams for Corby.

- Jacob's Creek: A well-recognized Australian wine brand, often appealing to consumers seeking value and consistent quality.

- Stoneleigh: A New Zealand Sauvignon Blanc producer, known for its distinctive aromatic profile, catering to a more discerning palate.

- Campo Viejo: A Spanish Rioja brand, offering a range of traditional and modern styles, popular with consumers exploring European wines.

Cash Cows are established brands with strong market share in mature industries. They generate consistent, high profits with minimal investment, fueling other business areas. Corby's portfolio includes several such brands.

Brands like J.P. Wiser's Canadian Whisky, Lamb's Rum, and Polar Ice Vodka exemplify Cash Cows. They benefit from brand loyalty and extensive distribution, ensuring stable revenue. These brands require less marketing support due to their established market positions.

McGuinness Liqueurs and international wine brands like Jacob's Creek also fit this profile. They contribute significantly to Corby's overall financial health. For Corby, these brands are vital for funding growth initiatives and maintaining profitability.

| Brand | Category | Market Position | Cash Flow Contribution |

| J.P. Wiser's Canadian Whisky | Canadian Whisky | Dominant, Mature | High, Stable |

| Lamb's Rum | Rum | Established, International Appeal | Consistent |

| Polar Ice Vodka | Vodka | Solid, Mature Market | Reliable |

| McGuinness Liqueurs | Liqueurs | Well-Recognized, Stable | Substantial |

| Jacob's Creek, Stoneleigh, Campo Viejo | Wine | Strong Heritage, Premiumizing | Steady Revenue |

Full Transparency, Always

Corby BCG Matrix

The Corby BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo limitations, and no hidden surprises – just a comprehensive strategic tool ready for your immediate business analysis and planning.

Dogs

Certain legacy wine brands, particularly those in the lower-tier, non-strategic segment of Corby's portfolio, may be classified as Dogs. These brands often struggle in a market that is increasingly prioritizing premiumization, as evidenced by the Canadian wine market's growth in value despite a decline in overall import volume.

These brands likely exhibit low market share within a segment that itself is experiencing low growth. For instance, while the total Canadian wine market saw a value increase, the volume of imported wines has been on a downward trend, suggesting a consumer shift away from mass-market offerings.

Within Corby's portfolio, certain niche or underperforming liqueur varieties, perhaps like some of the more obscure McGuinness offerings, might fit the 'Dog' category. These products likely possess a low market share in a slow-growing segment of the spirits market.

For instance, if a specific McGuinness flavored liqueur, say, a niche fruit variant, only captured 0.5% of its specific liqueur sub-category in 2024, and that sub-category itself saw only a 1% annual growth rate, it would be a prime candidate for divestment or discontinuation.

These 'Dogs' often require disproportionate marketing support for minimal return, dragging down overall profitability. Their low sales volume, potentially below 10,000 cases annually in Canada for a specific SKU, signals a lack of consumer demand or intense competition.

Corby's portfolio includes older or less popular Scotch whisky brands that, in 2024, faced declining market values for Single Malt Scotch. These brands, if possessing low market share and operating within a low-growth segment, could be categorized as Dogs in the BCG matrix. For instance, brands with minimal sales volume and limited consumer interest in a maturing market might fit this description.

Small-Volume, Declining Domestic Spirits (Non-Core)

Small-Volume, Declining Domestic Spirits (Non-Core) brands within Corby's portfolio represent a category that demands careful consideration. These are typically smaller brands with a low share in domestic spirits markets that are not growing, or are even shrinking. For instance, if a brand like Corby's historical Canadian Whisky offering, which historically had a strong domestic presence but now sees declining volumes and a reduced market share, falls into this segment, it would be classified as a Dog.

Brands in this category often require significant investment to maintain their current position, let alone achieve growth, yielding disproportionately low returns. For example, in 2023, the Canadian spirits market saw a modest volume growth of 1.5%, but certain niche domestic segments might be experiencing contractions. If a specific Corby brand within such a segment is seeing its volume decrease by, say, 5% annually while holding less than 1% of the domestic market, it fits this Dog profile.

- Low Market Share: Brands holding a minimal percentage of their respective domestic spirit categories.

- Declining Volumes: Brands experiencing a consistent downward trend in sales volume year-over-year.

- Stagnating or Shrinking Category: Brands operating within domestic spirit markets that are not expanding or are in decline.

- High Investment, Low Return: Brands that require substantial resources for minimal or negative financial returns.

Brands Impacted by Supply Chain Issues or Customer Pricing Disputes

Brands significantly impacted by persistent supply chain disruptions or customer pricing disputes, resulting in sustained low market share and profitability, would be classified as Dogs in the Corby BCG Matrix. This signifies a difficult market standing with limited growth prospects.

For instance, in 2024, several consumer electronics brands faced significant headwinds. One major player reported a 15% decline in sales volume for its flagship product line due to component shortages, directly impacting its market share in a key segment. This situation exemplifies the characteristics of a Dog, where operational challenges severely hinder competitive performance.

- Persistent Supply Chain Disruptions: Brands struggling with consistent availability of raw materials or finished goods.

- Customer Pricing Disputes: Companies facing ongoing battles over pricing that erode margins and deter sales.

- Sustained Low Market Share: A consistent inability to capture or maintain a significant portion of the target market.

- Limited Growth Potential: The outlook for increased sales or market penetration is bleak due to inherent market or company-specific issues.

Dogs represent brands within Corby's portfolio that have both low market share and operate in a low-growth market segment. These products often require significant investment to maintain their current position, yielding minimal returns. For example, a niche liqueur brand with less than 1% market share in a category experiencing only 1% annual growth in 2024 would be considered a Dog.

These underperforming assets can drain resources that could be better allocated to more promising ventures. Their continued presence might indicate a need for strategic review, such as divestment or discontinuation, to improve overall portfolio efficiency.

Brands facing persistent supply chain issues or pricing disputes, leading to sustained low market share, also fall into this category. Such brands demonstrate limited growth potential due to inherent market or company-specific challenges.

In 2024, the Canadian wine market saw value growth, yet imported wine volumes declined, highlighting a shift away from mass-market offerings that could impact lower-tier legacy brands classified as Dogs.

Question Marks

Corby's acquisition of Nude Beverages in fiscal 2024 positions Nude within the high-growth Ready-to-Drink (RTD) category. However, the initial market reception, beyond the acquisition's immediate impact, is crucial for Nude's future market share.

Currently, Nude Beverages is a cash consumer for Corby as significant investments are being made to fuel its growth, aiming to elevate it to a Star in the BCG matrix.

Corby's strategy hinges on launching innovative products designed to capture significant revenue. These new entrants, by their nature, begin with a small slice of a potentially booming market. For instance, in 2024, the beverage industry saw numerous new product introductions targeting health-conscious consumers, a segment experiencing rapid expansion.

Significant marketing investment is crucial for these innovations to gain traction. Without substantial consumer adoption and a growing market share, they may fail to transition from Question Marks to Stars. This investment is critical to differentiate them in crowded markets; a prime example is the substantial marketing spend by major beverage companies on plant-based alternatives in 2024, a category that saw double-digit growth.

Failure to achieve market penetration can relegate these products to the Dog category, representing a drain on resources. The challenge lies in identifying which promising new products will gain momentum and which will falter, a common hurdle for companies like Corby navigating dynamic consumer preferences.

Corby's potential foray into craft distillery offerings aligns with the burgeoning Canadian spirits market, which saw a 4.2% revenue growth in 2023 according to Statista. These niche products, often characterized by unique flavors and artisanal production, typically start with a small market share but aim for high-growth segments. This positions them as question marks within the BCG matrix, demanding strategic investment to build brand awareness and expand distribution.

The craft spirits segment is a significant growth driver, with consumers increasingly seeking premium and locally sourced options. For Corby, developing these offerings represents an opportunity to tap into this demand, similar to how other established beverage companies have successfully integrated craft brands. However, achieving scale requires substantial marketing and production investment to compete with established craft players and capture a larger piece of this expanding market.

Emerging Tequila or Bourbon Brands (New to Portfolio)

Newly emerging tequila and bourbon brands that Corby might represent would likely fall into the Question Mark category. Despite the overall strength of Corby's existing tequila portfolio, these new entrants, by definition, start with a low market share. This is a common scenario for any company expanding into a new product line or brand acquisition in a rapidly expanding market.

The spirits industry, particularly tequila and bourbon, has seen significant growth. For instance, the global tequila market size was valued at USD 13.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. Similarly, the U.S. bourbon market continues its upward trajectory, with sales reaching an all-time high of $5.1 billion in 2023. This high-growth environment means these new brands, despite their initial low share, are positioned in a market with strong potential.

Corby would need to strategically invest in these Question Mark brands to increase their market share and eventually move them towards becoming Stars. This investment would focus on marketing, distribution, and brand building to capture consumer attention in these competitive, fast-growing segments. Without such support, these brands risk remaining in the Question Mark category or declining.

- Market Growth: Tequila and bourbon markets are experiencing robust growth, with significant projected CAGRs.

- Initial Market Share: New brands entering these categories will inherently possess low market share upon introduction.

- Investment Requirement: Substantial investment is necessary to build brand awareness and distribution for these emerging products.

- Strategic Goal: The objective is to transform these Question Marks into Stars by successfully increasing their market share in high-growth sectors.

Premium or Organic Wine Offerings (New Initiatives)

Corby's potential new initiatives in premium and organic wine offerings align with a notable trend in the Canadian market. Demand for these segments has been steadily increasing, indicating a strategic opportunity for growth.

For instance, the Canadian organic wine market alone was projected to reach approximately CAD 150 million by 2024, showcasing a significant and expanding consumer base willing to pay a premium for sustainable and high-quality products. If Corby has indeed launched or expanded its portfolio in these areas, these products would likely be classified as Question Marks in the BCG Matrix. This classification stems from their position in a high-growth market segment, but their market share within that segment might still be developing, necessitating substantial investment to build brand awareness and distribution.

- Market Growth: The Canadian premium and organic wine segments are experiencing robust growth, driven by consumer preferences for quality, health, and sustainability.

- Investment Needs: New premium and organic wine lines require significant marketing and distribution investment to establish a strong market presence and compete effectively.

- Potential for Stars: Successful penetration into these high-growth segments could transform these Question Marks into future Stars if Corby can capture substantial market share.

Question Marks represent new products or ventures in high-growth markets but currently hold a small market share. Corby's investment in these areas, like Nude Beverages or emerging craft spirits, aims to increase their market presence. Without successful market penetration and growth, these products risk becoming cash drains.

The strategy for Question Marks involves significant investment in marketing and distribution to build brand awareness and capture market share. For example, the Canadian spirits market grew 4.2% in 2023, highlighting the potential for new entrants. The global tequila market alone was valued at USD 13.5 billion in 2023, with a projected CAGR of 7.2% from 2024 to 2030.

Corby's success hinges on identifying which Question Marks have the potential to become Stars. This requires careful market analysis and strategic resource allocation to foster growth in promising segments like premium and organic wines, where the Canadian market was projected to reach CAD 150 million by 2024.

The challenge lies in converting these low-share, high-potential products into market leaders. Failure to do so can result in them remaining Question Marks or even declining into Dogs, representing a loss of invested capital.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.