Corby Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corby Bundle

Curious about Corby's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain a strategic advantage.

Partnerships

Corby's strategic affiliation with Pernod Ricard S.A. is a critical element of its business model, granting it exclusive rights to manufacture, market, and distribute a vast portfolio of premium international spirits and wines across Canada. This powerful alliance allows Corby to leverage Pernod Ricard's renowned global brands, including popular names like Absolut vodka and Jameson Irish whiskey, significantly enhancing its product offering and market penetration within the Canadian landscape.

Corby's success hinges on robust partnerships with provincial liquor boards, which function as essential monopoly distributors and retailers across Canada. These relationships are vital for securing shelf space, negotiating pricing, and ensuring our brands reach consumers effectively in a highly regulated market.

In 2024, navigating these provincial monopolies remains a cornerstone of Corby's go-to-market strategy, enabling access to a significant portion of the Canadian beverage alcohol market. For instance, the Liquor Control Board of Ontario (LCBO) alone reported over $7.5 billion in sales for the fiscal year ending March 31, 2024, highlighting the immense scale of these distribution channels.

Corby Spirit and Wine Limited maintains a crucial partnership with Hiram Walker & Sons Ltd., a fellow affiliate under the Pernod Ricard umbrella. This collaboration is fundamental, as Hiram Walker's Windsor, Ontario facility handles the blending and bottling for the vast majority of Corby's proprietary brands. This arrangement is not just about production; it's a core element of Corby's operational efficiency and its ability to bring its Canadian-focused portfolio to market effectively.

Acquired Brands' Founders/Teams

Corby's strategy involves forging crucial partnerships with the founders and key teams of acquired brands, such as Ace Beverage Group (ABG) and Nude Beverages. This collaboration is vital for smoothly integrating these new entities into Corby's existing operations.

These partnerships are instrumental in leveraging the specialized knowledge and entrepreneurial spirit of the acquired companies' leadership. By retaining their expertise, Corby ensures that the unique value and innovation driving these brands continue to flourish post-acquisition, contributing to overall portfolio strength.

For instance, Corby's acquisition of Ace Beverage Group in 2023, a significant move in the ready-to-drink (RTD) segment, underscores the importance of retaining the founding team's vision and operational know-how. This approach aims to accelerate growth and market penetration for ABG's popular brands.

The retention of Nude Beverages' core team following Corby's investment further exemplifies this strategy. Their deep understanding of the functional beverage market and direct-to-consumer channels is essential for expanding Nude's reach and product development within Corby's broader distribution network.

- Founder/Team Retention: Essential for seamless integration and continuity of brand vision.

- Expertise Leverage: Capitalizing on specialized market knowledge and operational experience.

- Innovation Continuity: Ensuring ongoing product development and brand evolution.

- Growth Acceleration: Utilizing acquired teams' insights to speed up market expansion.

Retailers and On-Premise Establishments

Corby’s key partnerships extend beyond government liquor boards to include a diverse network of private liquor retailers and on-premise establishments like bars and restaurants. These partnerships are critical for ensuring broad product availability and consumer accessibility across different markets.

These collaborations are vital for Corby's sales strategy, driving product visibility and direct consumer engagement. For instance, in fiscal year 2024, Corby reported that its distribution agreements with key retail partners were instrumental in achieving its sales targets.

- Retailer Network: Access to private liquor stores in provinces where direct sales are permitted.

- On-Premise Partnerships: Collaborations with bars, restaurants, and hotels to feature Corby's brands.

- Promotional Alignment: Joint marketing campaigns and in-store activations to boost brand awareness and sales.

Corby's strategic alliances with Pernod Ricard S.A. and Hiram Walker & Sons Ltd. are foundational, providing access to global brands and essential production capabilities. Furthermore, retaining the expertise of founders and teams from acquired companies like Ace Beverage Group and Nude Beverages is key for innovation and growth.

These partnerships are critical for market access, with provincial liquor boards acting as essential distributors, as evidenced by the LCBO's $7.5 billion in sales for fiscal year 2024. Collaborations with private retailers and on-premise establishments also drive sales and brand visibility.

| Partner Type | Key Role | Impact/Example |

|---|---|---|

| Pernod Ricard S.A. | Brand Portfolio Access & Distribution Rights | Leverages global brands like Absolut and Jameson in Canada. |

| Hiram Walker & Sons Ltd. | Blending & Bottling Services | Handles production for the majority of Corby's proprietary brands. |

| Provincial Liquor Boards | Monopoly Distribution & Retail | Ensures market access; LCBO FY24 sales exceeded $7.5 billion. |

| Acquired Company Founders/Teams | Expertise & Brand Vision | Facilitates integration and drives innovation for brands like Nude Beverages. |

| Private Retailers & On-Premise | Sales Channels & Consumer Engagement | Boosts brand awareness through joint promotions and visibility. |

What is included in the product

A structured framework for visually mapping out a company's business strategy, detailing key components like customer segments, value propositions, and revenue streams.

It simplifies complex business strategies, making them actionable and understandable for all stakeholders.

It provides a clear roadmap for identifying and addressing strategic gaps, preventing costly oversights.

Activities

Corby's manufacturing and production activities are centered at its Hiram Walker facility, where the company crafts its portfolio of Canadian liquor brands. This encompasses the entire process from distillation and aging to the final bottling of whiskies, rums, vodkas, and liqueurs.

Maintaining stringent quality control throughout these production stages is a critical focus. For instance, in fiscal year 2024, Corby emphasized operational efficiency and product consistency to uphold the premium image of its brands like J.P. Wiser's and Lot No. 40 Rye, which are key drivers of its market presence.

Corby actively invests in robust marketing and brand management for its portfolio of Canadian and international brands. This involves crafting engaging campaigns and digital strategies to boost visibility and foster loyalty.

In 2024, Corby continued its focus on driving consumer demand through targeted promotional activities. The company's commitment to brand building is crucial for maintaining its competitive edge in the dynamic beverage alcohol market.

Corby manages its entire supply chain from production to market across Canada, a crucial activity for its business model. This encompasses efficient warehousing, transportation, and close coordination with provincial liquor boards and other distributors to ensure products reach consumers nationwide promptly and effectively.

In 2023, Corby's distribution network played a key role in its financial performance, contributing to its reported net sales of $230.3 million. This intricate network is essential for maintaining product availability and meeting consumer demand across diverse Canadian provinces.

Beyond domestic operations, Corby also actively manages export sales to international markets. This global reach diversifies revenue streams and expands the brand's presence, requiring sophisticated logistics to navigate international trade regulations and distribution channels.

Portfolio Management and Acquisitions

Corby continuously manages and strategically reshapes its brand portfolio through active brand investment and strategic acquisitions. This involves identifying high-growth categories, such as ready-to-drink (RTD) beverages and premium spirits, and integrating new brands to diversify offerings and capitalize on evolving consumer trends.

- Active Brand Investment: Corby's approach involves significant investment in its existing brands to drive growth and maintain market relevance.

- Strategic Acquisitions: The company actively seeks and integrates new brands, particularly in high-potential segments like RTD beverages and premium spirits, to expand its market reach and product diversity.

- Portfolio Reshaping: This dynamic management ensures Corby's portfolio remains aligned with changing consumer preferences and market opportunities, as seen in its focus on premiumization and convenience.

- Growth Category Focus: For instance, the RTD category has seen substantial growth, with global sales projected to reach over $60 billion by 2027, highlighting the strategic importance of such investments for Corby.

Sales and Customer Relationship Management

Corby's key activities in sales and customer relationship management are multifaceted, encompassing both direct engagement with liquor boards and indirect channels through retailers. This involves meticulous sales execution, ensuring efficient order management, and cultivating robust relationships with on-premise clients like bars and restaurants. The company's focus is on securing product listings, optimizing placement on shelves, and ultimately driving sales volume across all its brands.

In fiscal year 2024, Corby reported net sales of $309.2 million, highlighting the importance of these sales activities. Effective relationship management is crucial for navigating the complex regulatory landscape of liquor boards and for securing favorable positioning with key retail partners. Corby's strategy relies on consistent engagement to maintain and grow its market share.

- Direct Sales Engagement: Interacting with provincial liquor authorities to secure and maintain product listings.

- Retailer Partnerships: Collaborating with off-premise retailers to ensure product availability and visibility.

- On-Premise Client Management: Building relationships with bars, restaurants, and hotels to drive consumption and brand presence.

- Sales Execution and Order Fulfillment: Efficiently processing orders and ensuring timely delivery to maintain customer satisfaction.

Corby's core activities revolve around manufacturing its spirits at the Hiram Walker facility, ensuring quality control throughout distillation, aging, and bottling. The company also invests heavily in marketing and brand management to enhance visibility and consumer loyalty for its diverse portfolio.

Managing the entire supply chain, from production to distribution across Canada, is a critical function, ensuring timely product availability. Additionally, Corby actively manages its brand portfolio through strategic investments and acquisitions, focusing on growth areas like RTD beverages and premium spirits to adapt to evolving consumer trends.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Manufacturing & Production | Distillation, aging, bottling of Canadian spirits at Hiram Walker facility. | Emphasis on operational efficiency and product consistency. |

| Marketing & Brand Management | Developing campaigns and digital strategies to boost brand visibility and loyalty. | Driving consumer demand through targeted promotions for brands like J.P. Wiser's. |

| Supply Chain Management | Warehousing, transportation, and distribution coordination across Canada. | Ensuring product availability and meeting demand, contributing to net sales. |

| Brand Portfolio Management | Strategic investment in existing brands and acquisitions in growth categories (e.g., RTDs). | Aligning portfolio with consumer preferences and market opportunities. |

Preview Before You Purchase

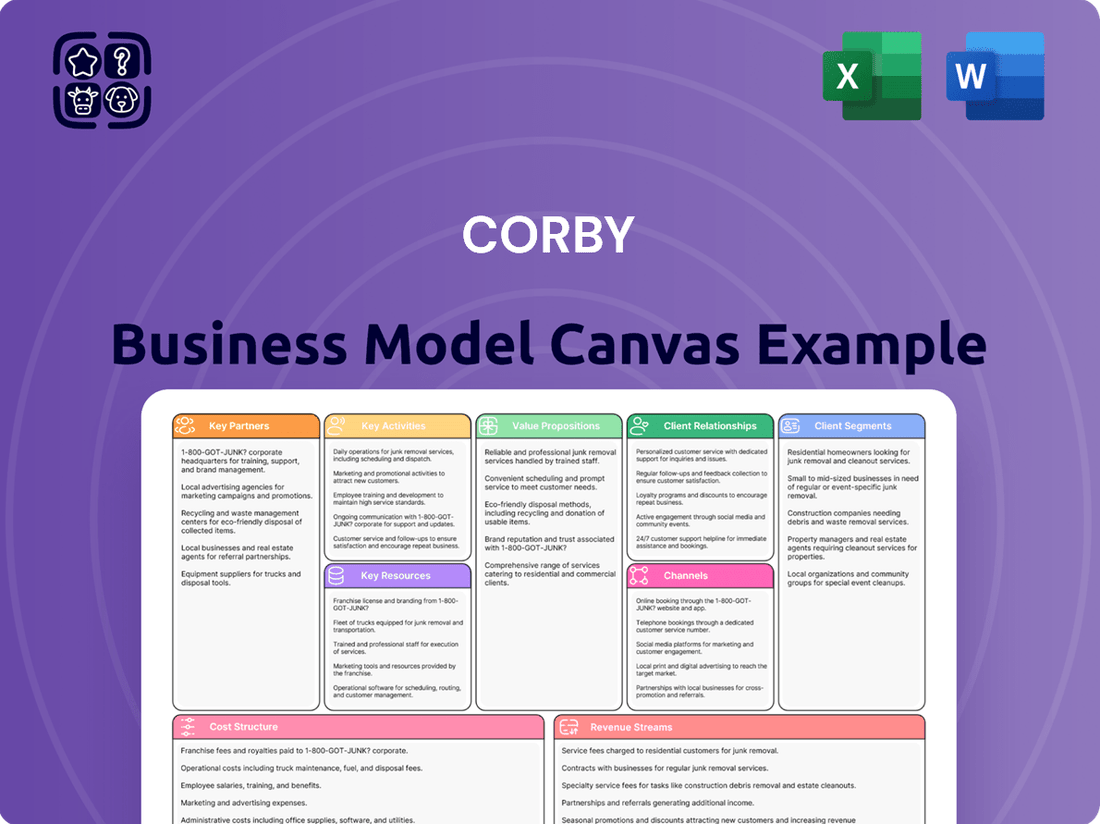

Business Model Canvas

The Corby Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You'll gain immediate access to this same professionally structured and formatted Business Model Canvas, allowing you to start strategizing without delay.

Resources

Corby's brand portfolio is a cornerstone of its business, featuring iconic Canadian spirits like J.P. Wiser's and Lamb's, alongside popular ready-to-drink (RTD) brands such as Cottage Springs, which saw significant growth in 2023. This diverse domestic offering is complemented by a powerful international lineup, including Absolut vodka and Jameson Irish whiskey, secured through Corby's affiliation with Pernod Ricard.

Corby's Hiram Walker facility in Windsor, Ontario, is a cornerstone of its operations, housing the essential blending and bottling infrastructure for the majority of its proprietary brands. This physical asset directly supports production capacity, ensuring Corby can meet market demand efficiently.

The Windsor site is critical for maintaining stringent quality control throughout the manufacturing process, safeguarding brand integrity. Its advanced bottling capabilities also contribute to operational efficiency, a key factor in cost management and profitability.

Corby's established distribution network across Canada is a critical resource. This network efficiently reaches provincial liquor boards, retailers, and various other sales channels, ensuring product availability nationwide.

Key to this network are Corby's robust logistics infrastructure, warehousing facilities, and transportation capabilities. These elements work in concert to manage inventory and deliver products effectively.

In fiscal year 2024, Corby reported that its distribution network played a significant role in its sales performance, contributing to its ability to maintain strong market presence and respond to consumer demand across diverse Canadian regions.

Human Capital and Expertise

Corby's human capital is a cornerstone of its business model, encompassing a diverse team of seasoned professionals across manufacturing, marketing, sales, finance, and supply chain management. This collective expertise is crucial for their success in the competitive Canadian alcohol industry.

The deep understanding of the Canadian market, coupled with proven brand-building capabilities and a commitment to operational excellence, makes Corby's workforce an invaluable asset. This human resource directly contributes to their ability to innovate and maintain market share.

- Skilled Workforce: Corby employs experienced professionals in key operational and strategic areas.

- Market Acumen: Their team possesses deep knowledge of the Canadian alcohol market dynamics.

- Brand Stewardship: Expertise in brand development and management is a critical human resource.

- Operational Efficiency: A focus on operational excellence ensures efficient production and distribution.

Financial Capital and Shareholder Base

Corby's financial capital is a cornerstone of its business model, enabling robust operations and strategic growth. As of its latest reporting period in 2024, the company maintained a healthy cash position and access to significant credit facilities, providing the liquidity needed for ongoing investments and potential acquisitions.

The company's ability to generate consistent cash flows from its core businesses is crucial. This financial strength not only supports day-to-day operations but also fuels its capacity for innovation and market expansion. For instance, in the fiscal year ending March 31, 2024, Corby reported strong operating cash flow generation, demonstrating its financial resilience.

Corby's status as a publicly traded entity is instrumental in accessing capital markets. Its shareholder base, comprising institutional and retail investors, provides a vital avenue for raising funds through equity issuances when necessary. This broad shareholder support underpins its ability to finance larger strategic initiatives.

- Financial Strength: Corby's substantial cash reserves and available credit lines in 2024 equip it to manage operational needs and pursue growth opportunities.

- Cash Flow Generation: Consistent positive cash flow from its operations, as evidenced by its performance in early 2024, provides financial stability and funding for investments.

- Access to Capital: Being a publicly traded company with a diverse shareholder base allows Corby to tap into equity markets for capital raising.

- Shareholder Base: A supportive shareholder structure enhances Corby's financial flexibility and its capacity to undertake significant corporate actions.

Corby's intellectual property, including its proprietary brand formulations and trademarks, represents a significant intangible asset. These brands, such as J.P. Wiser's and Forty Creek, are protected through rigorous trademark registration and enforcement, safeguarding their market value.

The company's exclusive distribution agreements, particularly its long-standing relationship with Pernod Ricard for international brands, are crucial. These agreements grant Corby access to a portfolio of globally recognized spirits, significantly enhancing its market offering and competitive position in Canada.

Corby's commitment to innovation, evidenced by the development of new product lines and packaging formats, is also a key intellectual resource. This focus on R&D ensures the company remains relevant and responsive to evolving consumer preferences.

| Intellectual Property | Description | Impact |

|---|---|---|

| Brand Portfolio | Proprietary formulations and trademarks for Canadian spirits (e.g., J.P. Wiser's) and RTDs (e.g., Cottage Springs). | Drives brand loyalty and market differentiation. |

| Distribution Agreements | Exclusive rights for Pernod Ricard brands (e.g., Absolut, Jameson) in Canada. | Expands product offering and market reach. |

| Innovation Pipeline | Ongoing development of new products and packaging. | Ensures market relevance and captures emerging trends. |

Value Propositions

Corby offers a wide selection of spirits, wines, and ready-to-drink beverages. This includes well-known Canadian brands and popular international ones, ensuring something for everyone.

Their portfolio is designed to meet diverse consumer tastes and suit various drinking occasions. Think classic whiskies and modern RTD cocktails, all part of Corby's extensive range.

For instance, in fiscal year 2023, Corby's net sales reached $373.4 million, showcasing the strong market reception of their broad product offering.

Corby's deep Canadian roots, stretching back to 1859, establish a significant value proposition centered on trusted heritage and unwavering quality. This long-standing presence has cultivated a strong reputation for craftsmanship across its portfolio of owned brands, deeply resonating with consumers who value authenticity and reliability.

This heritage translates into tangible consumer trust, a critical asset in the competitive spirits market. For instance, in 2024, brands with established Canadian heritage often command premium pricing and demonstrate greater resilience during economic fluctuations, reflecting consumer loyalty built over decades.

Corby's extensive distribution network, bolstered by strong relationships with provincial liquor boards, makes its diverse portfolio of spirits and wines readily available to Canadian consumers. This widespread accessibility, spanning from brick-and-mortar retail to on-premise licensed establishments, is a core component of its value proposition, ensuring consumers can easily find and purchase their preferred brands.

Innovation and Adapting to Trends

Corby's innovation is evident in its strategic focus on high-growth categories such as ready-to-drink (RTD) beverages and premium spirits. This proactive approach ensures the company remains competitive by aligning its portfolio with current consumer tastes and market trends.

By actively acquiring and developing new products, Corby effectively addresses evolving consumer demands. This strategy allows them to offer a dynamic range of choices that resonate with modern preferences, keeping their offerings fresh and appealing.

For instance, Corby's investment in brands like New Zealand Watson's, a popular RTD, highlights their commitment to capturing emerging market segments. In 2023, the Canadian spirits market saw significant growth in RTDs, with sales increasing by over 15%, a trend Corby is well-positioned to capitalize on.

- Focus on RTDs: Corby's expansion into the RTD market taps into a segment that experienced substantial growth in 2023, driven by convenience and evolving consumer preferences for mixed drinks.

- Premiumization Strategy: The company's emphasis on premium spirits aligns with a broader industry trend where consumers are increasingly willing to pay more for higher-quality, craft, or unique spirit offerings.

- Product Development: Corby's commitment to introducing new and innovative products, such as their recent expansions within the premium vodka and gin categories, directly addresses the demand for novelty and variety.

Responsible Enjoyment and Brand Experiences

Corby cultivates value by championing responsible enjoyment, integrating programs that promote mindful consumption across its brand portfolio. This commitment extends to crafting memorable and positive brand experiences, fostering deeper consumer engagement.

By prioritizing responsible drinking initiatives, Corby aims to build trust and enhance its brand reputation, recognizing that consumer well-being is integral to long-term success. This approach goes beyond mere product sales, focusing on the overall consumer journey and brand perception.

- Responsible Consumption: Corby actively supports and promotes responsible drinking practices through various campaigns and partnerships, aiming to educate consumers and mitigate potential harms associated with alcohol consumption.

- Enhanced Brand Experiences: The company focuses on creating engaging and memorable experiences for consumers at events and through its brands, fostering positive associations and emotional connections.

- Holistic Value Proposition: Corby's value proposition encompasses not only the quality of its beverages but also the commitment to consumer well-being and the creation of positive, lasting brand interactions.

- Market Differentiation: By emphasizing responsible enjoyment, Corby differentiates itself in a competitive market, appealing to a growing segment of consumers who value ethical brand practices and mindful consumption.

Corby's value proposition centers on its extensive and diverse product portfolio, encompassing well-loved Canadian and international spirits, wines, and ready-to-drink beverages. This breadth caters to a wide array of consumer preferences and occasions, ensuring broad market appeal.

The company leverages its deep Canadian heritage, established in 1859, to build trust and convey quality craftsmanship, a significant draw for consumers seeking authenticity. This long-standing reputation allows for premium pricing and market resilience.

Corby's strategic focus on innovation, particularly in high-growth segments like RTDs and premium spirits, keeps its offerings relevant and appealing to evolving consumer tastes. Their commitment to product development and market alignment fuels continued consumer engagement.

Furthermore, Corby champions responsible enjoyment, integrating programs that promote mindful consumption and create positive brand experiences. This focus on consumer well-being and ethical practices differentiates them in a competitive landscape.

Customer Relationships

Corby cultivates direct relationships with provincial liquor boards, acting as crucial wholesale distribution partners. These LBs are managed closely for order fulfillment and consistent product availability, a cornerstone of their sales strategy.

To stimulate demand at the consumer level, Corby also engages indirectly with retailers and on-premise establishments. This is achieved through dedicated sales teams and targeted marketing campaigns designed to create consumer pull for their brands.

Corby builds strong customer relationships through significant investment in brand building and consumer engagement. This includes widespread advertising campaigns across various media, targeted digital marketing efforts, and memorable experiential events designed to create lasting impressions.

The company aims to cultivate deep brand loyalty and forge emotional connections with its consumers. For instance, in the fiscal year ending March 31, 2024, Corby's marketing and advertising expenses amounted to approximately $15 million, reflecting a commitment to maintaining a strong brand presence and engaging directly with its customer base.

Corby actively supports its trade partners, such as retailers and bars, through dedicated trade marketing initiatives. This includes providing them with promotional materials and product education to ensure they can effectively showcase and sell Corby's diverse product range to consumers.

In 2024, Corby's investment in trade marketing programs aimed to bolster partner sales performance. For instance, their comprehensive support for the launch of a new premium spirit line saw participating retailers report an average sales uplift of 15% in the first quarter following the promotional period.

Innovation-Driven Relationship

Corby cultivates an innovation-driven relationship by consistently launching new products and adapting to evolving consumer preferences. This approach ensures their product portfolio remains fresh and appealing to both trade partners and end consumers, fostering loyalty through continuous relevance.

This strategy is crucial in a dynamic market. For instance, in 2024, the beverage industry saw significant growth in low-alcohol and non-alcoholic options, a trend Corby likely addressed to maintain its innovative edge and customer engagement.

- Innovation as a Relationship Driver: Corby's commitment to introducing novel products keeps customers engaged and anticipating what's next.

- Adaptability to Trends: By responding to shifting consumer tastes, Corby demonstrates a customer-centric approach, building trust and preference.

- Portfolio Refreshment: Regular updates to their offerings ensure Corby stays competitive and meets the diverse and changing demands of the market.

- Dual Customer Focus: The strategy benefits both trade customers, who receive new products to market, and consumers, who enjoy variety and novelty.

Corporate Communications and Investor Relations

Corby prioritizes clear and consistent communication with its shareholder and investor segments. This is achieved through detailed financial reporting, including quarterly earnings calls and dedicated investor relations outreach.

These efforts are designed to foster trust and provide stakeholders with a thorough understanding of Corby's financial performance and strategic direction.

- Financial Reporting: Corby releases comprehensive quarterly and annual financial statements, adhering to strict regulatory standards.

- Earnings Calls: Regular conference calls are held to discuss financial results, provide forward-looking guidance, and answer investor questions. In the first half of 2024, Corby held three such calls, with an average attendance of over 150 institutional investors and analysts.

- Investor Relations: A dedicated IR team manages relationships, responds to inquiries, and disseminates important company updates via press releases and the investor relations website.

Corby's customer relationships are multifaceted, encompassing direct engagement with provincial liquor boards for distribution, and indirect influence on retailers and consumers through marketing and sales efforts. The company invests heavily in brand building, utilizing advertising and experiential events to foster loyalty, as evidenced by their approximately $15 million marketing and advertising spend in fiscal 2024.

Trade partners receive dedicated support through marketing initiatives, including promotional materials and product education. Corby's innovation strategy, including new product launches and adaptation to trends like low-alcohol options, is key to maintaining relevance and customer engagement in the dynamic beverage market.

| Customer Segment | Relationship Type | Key Activities | 2024 Data/Insight |

|---|---|---|---|

| Provincial Liquor Boards | Wholesale Distribution Partners | Order fulfillment, Product availability management | Core to sales strategy |

| Retailers & On-Premise Establishments | Indirect Engagement | Sales team support, Targeted marketing, Trade marketing initiatives | Participating retailers saw a 15% average sales uplift for new premium spirit launches in Q1 2024. |

| Consumers | Brand Building & Engagement | Advertising, Digital marketing, Experiential events | ~$15 million invested in marketing & advertising (FY2024) |

| Shareholders & Investors | Communication & Transparency | Financial reporting, Earnings calls, Investor relations outreach | 3 earnings calls held in H1 2024 with >150 investor/analyst attendance per call. |

Channels

Provincial liquor boards are Corby's primary distribution channel across Canada, acting as government-controlled monopolies for both wholesale and often retail sales. Corby directly supplies these boards, which then manage the onward distribution to their extensive network of retail stores or to licensed private liquor retailers.

This centralized system means Corby's success is heavily reliant on maintaining strong relationships and favorable terms with these provincial entities. For instance, in fiscal year 2023, Corby's Canadian net sales reached $186.5 million, with the vast majority flowing through these liquor board channels.

In provinces where private liquor stores are permitted, Corby leverages these establishments as a key distribution channel. This strategy significantly broadens Corby's market reach, ensuring its diverse portfolio of spirits and wines is accessible to a wider consumer base. For instance, in markets like Alberta, private retailers play a crucial role in the beverage alcohol ecosystem, offering consumers a variety of purchasing options beyond government-run stores.

Corby's products are primarily distributed through on-premise channels like bars, restaurants, and hotels across Canada. This channel is vital for brand visibility and consumer trial in social environments.

In 2024, the Canadian hospitality sector continued to be a key focus for Corby, leveraging these establishments to drive sales and brand engagement. These venues are essential for consumers to experience Corby's brands in a social context, fostering trial and repeat purchase.

International Export Markets

Corby leverages international export markets to distribute its Canadian-owned brands, notably reaching consumers in the United States and across Europe. This strategy is crucial for diversifying revenue streams beyond domestic sales and significantly broadens the brand's global presence.

In 2024, Corby's international sales represented a substantial portion of its overall revenue, reflecting the growing demand for its portfolio in key overseas markets. For instance, the United States remains a primary export destination, with specific brands showing double-digit growth year-over-year.

- United States Market Penetration: Corby's brands have seen increasing traction in the US, contributing to a significant percentage of its export revenue.

- European Expansion: Efforts to grow market share in Europe are ongoing, with particular focus on premium spirit categories where Canadian whisky is gaining popularity.

- Revenue Diversification: International sales help mitigate risks associated with fluctuations in the Canadian market, providing a more stable financial outlook.

- Global Brand Footprint: Export activities are instrumental in building Corby's international brand recognition and establishing a stronger competitive position on the world stage.

E-commerce and Digital Platforms (Indirect)

While direct sales are restricted, Corby strategically utilizes e-commerce and digital platforms by partnering with provincial liquor board online stores and authorized third-party delivery services. This approach significantly boosts consumer convenience and product accessibility across Canada, a market where online alcohol sales are growing. For instance, in 2024, online alcohol sales in Canada continued their upward trajectory, with many consumers actively seeking the ease of digital purchasing.

These digital channels allow Corby to reach a broader customer base, overcoming geographical limitations inherent in traditional retail. By ensuring their products are listed on these platforms, Corby taps into a significant portion of the Canadian beverage alcohol market that is increasingly digital-first. This indirect e-commerce strategy is crucial for maintaining brand visibility and driving sales in a regulated environment.

- Digital Reach: Corby's presence on liquor board websites and third-party apps expands its market access beyond physical stores.

- Consumer Convenience: These platforms offer consumers the ease of browsing and purchasing Corby's portfolio from home.

- Sales Growth: The increasing adoption of online purchasing by Canadian consumers in 2024 directly benefits Corby's indirect digital sales strategy.

Corby's distribution hinges on provincial liquor boards as primary wholesale channels, with private retailers supplementing reach in specific markets. On-premise sales through bars and restaurants are crucial for brand visibility and consumer engagement.

International markets, particularly the United States and Europe, represent a significant growth avenue, diversifying revenue and expanding global brand presence. Corby also leverages e-commerce via provincial online stores and third-party delivery services to enhance consumer convenience and accessibility.

| Channel | Description | Key Role | 2023/2024 Relevance |

|---|---|---|---|

| Provincial Liquor Boards | Government-controlled monopolies | Primary wholesale and retail distribution | Dominated Canadian sales, with $186.5M net sales in FY23 |

| Private Retailers | Licensed private liquor stores | Broadens market reach in specific provinces | Crucial in markets like Alberta |

| On-Premise (Bars, Restaurants, Hotels) | Hospitality venues | Brand visibility, consumer trial, social context | Key focus for sales and brand engagement in 2024 |

| International Exports | Markets like the US and Europe | Revenue diversification, global brand footprint | Substantial revenue portion in 2024, US showing double-digit growth |

| E-commerce/Digital Platforms | Partnerships with liquor board online stores, third-party delivery | Consumer convenience, accessibility, broader reach | Taps into growing online alcohol sales trend in Canada |

Customer Segments

Corby's broadest customer base is the general adult population in Canada, legally permitted to consume alcohol. This segment spans a vast demographic range, encompassing individuals with diverse tastes in spirits, wines, and ready-to-drink (RTD) beverages for their personal enjoyment.

In 2024, the Canadian beverage alcohol market continued to show resilience, with consumers actively seeking variety and convenience. Corby's portfolio, catering to a wide array of preferences from premium spirits to accessible RTDs, positions it well to capture a significant share of this broad market.

Premium Spirit Enthusiasts are a core customer segment for Corby, actively seeking out high-quality, aged spirits like whiskies, artisanal gins, and premium tequilas. Corby directly addresses this demand through its portfolio, which includes established brands such as J.P. Wiser's and Lot 40, alongside innovative offerings like Ungava gin.

This segment also appreciates the inclusion of internationally recognized premium spirits, which Corby represents, further solidifying its position as a provider of discerning taste. In 2024, the global premium spirits market continued its robust growth, with consumers increasingly willing to pay more for perceived quality and unique brand stories.

The Ready-to-Drink (RTD) beverage segment is a significant and expanding area of focus, attracting consumers, especially younger ones, who value the convenience of pre-mixed alcoholic drinks. This preference for grab-and-go options is a key driver for Corby's strategic direction.

Corby's proactive approach to this market is evident in its strategic acquisitions. The company's purchases of Ace Beverage Group and Nude brands are direct investments into this burgeoning trend, bolstering Corby's portfolio with a variety of RTD offerings designed to meet consumer demand for accessible and appealing alcoholic beverages.

Wine Connoisseurs and Casual Wine Drinkers

Corby caters to a broad spectrum of wine enthusiasts. For the discerning palate, Corby offers premium selections through its owned Foreign Affair Winery, appealing to connoisseurs who seek unique terroir and craftsmanship. This segment values depth of flavor and origin stories.

The company also serves the more casual wine drinker with widely recognized international brands such as Jacob's Creek and Campo Viejo. These consumers appreciate accessibility, consistent quality, and a variety of approachable wine styles for everyday enjoyment. In 2024, the Canadian wine market saw continued growth, with premium and imported wines showing particular strength, reflecting the diverse preferences within this customer segment.

- Connoisseurs: Appreciate premium, single-vineyard, or limited-edition wines from Foreign Affair Winery.

- Casual Drinkers: Prefer accessible, well-known brands like Jacob's Creek and Campo Viejo for everyday consumption.

- Market Preference: The 2024 Canadian market data indicates a growing demand for both imported and premium domestic wines, aligning with Corby's dual-brand strategy.

- Brand Loyalty: Corby aims to foster loyalty across both segments by offering consistent quality and diverse product portfolios.

Licensed Establishments and Hospitality Sector

Corby’s licensed establishments and hospitality sector segment encompasses bars, restaurants, hotels, and event venues. These businesses are key partners, purchasing Corby’s diverse portfolio for on-premise consumption and to enhance their customer offerings. In 2024, the Canadian hospitality sector saw continued recovery, with total revenue projected to reach approximately $100 billion, highlighting the significant volume these establishments represent for Corby’s sales.

This segment is vital for driving brand visibility and trial. For instance, the on-premise channel is often where consumers first experience new spirits, influencing future off-premise purchases. Reports from early 2024 indicated that while consumer spending in bars and restaurants was robust, operational costs remained a challenge, making reliable supply and strong brand partnerships like those with Corby even more critical for these establishments.

- On-Premise Sales Driver: These venues are primary points for direct consumer sales of Corby’s spirits.

- Brand Exposure: Hospitality partners offer significant opportunities for brand building and consumer engagement.

- Market Insight: Performance in this segment provides real-time feedback on consumer preferences and market trends.

- Economic Sensitivity: The sector's revenue, which reached over $95 billion in Canada by the end of 2023, directly impacts Corby's sales volume.

Corby’s customer segments are diverse, ranging from the general adult population in Canada to specialized groups like premium spirit enthusiasts and RTD consumers. The company also serves wine connoisseurs and casual drinkers, alongside the crucial hospitality sector.

In 2024, Corby's strategy focused on capturing growth across these varied segments. The company's portfolio, featuring both owned brands and international representations, is designed to meet the evolving preferences of Canadian consumers.

Key customer groups include those seeking premium spirits, a market that saw continued global growth in 2024, and the rapidly expanding RTD segment, bolstered by Corby's strategic acquisitions. Wine drinkers, from aficionados to casual consumers, also represent a significant base, with the Canadian wine market showing strength in both premium and imported categories.

The licensed establishments and hospitality sector remain vital for Corby, acting as key channels for on-premise sales and brand visibility. This sector, projected to generate substantial revenue in Canada in 2024, relies on strong brand partnerships to navigate its operational landscape.

| Customer Segment | Key Characteristics | Corby's Offerings | 2024 Market Relevance |

|---|---|---|---|

| General Adult Population | Legal drinking age, diverse tastes | Broad portfolio of spirits, wines, RTDs | Resilient market seeking variety and convenience |

| Premium Spirit Enthusiasts | Seek high-quality, aged, artisanal spirits | J.P. Wiser's, Lot 40, Ungava Gin, international premium brands | Continued robust growth in global premium spirits |

| RTD Consumers | Value convenience, pre-mixed drinks | Nude, Ace Beverage Group brands | Significant and expanding market, especially among younger consumers |

| Wine Enthusiasts | Connoisseurs and casual drinkers | Foreign Affair Winery (premium), Jacob's Creek, Campo Viejo (accessible) | Growing demand for both premium domestic and imported wines |

| Hospitality Sector | Bars, restaurants, hotels, event venues | Diverse portfolio for on-premise consumption | Key channel for brand visibility and trial; sector revenue projected over $95 billion (2023) |

Cost Structure

The manufacturing process for Corby's diverse portfolio, encompassing spirits and wines, represents a significant portion of its cost structure. Key expenditures include the procurement of raw materials such as grains for whiskey, grapes for wine, and botanicals for gin. These inputs are fundamental to product quality and volume, directly influencing overall production expenses.

Beyond raw materials, the operational costs of distillation, blending, and bottling are substantial. These stages require specialized equipment, energy, and skilled labor. For instance, the energy-intensive nature of distillation contributes to these overheads. In 2023, the spirits industry saw raw material costs, particularly for grains like corn and barley, fluctuate due to global supply chain dynamics and agricultural yields, impacting companies like Corby.

Packaging and labeling also add to the production cost, reflecting brand presentation and consumer appeal. The choice of bottles, closures, and secondary packaging is carefully considered to align with brand image and market positioning. These elements, combined with the direct manufacturing processes, are intrinsically linked to the volume and variety of products Corby brings to market, making efficient management crucial for profitability.

Corby's cost structure heavily features marketing, sales, and distribution. In fiscal year 2023, Corby reported marketing and promotion expenses of $59.3 million, a significant portion of which supports its diverse brand portfolio through advertising, digital efforts, and sponsorships.

The company's sales force and the intricate logistics of distributing its products across Canada represent further substantial costs. These operational necessities are critical for maintaining market presence and ensuring product availability to consumers.

Corby's acquisition strategy, exemplified by the recent purchases of Ace Beverage Group and Nude, necessitates substantial upfront capital for purchase prices. These deals also incur considerable integration expenses, including legal and due diligence fees, estimated to be in the millions for transactions of this scale.

The process of merging operations and supply chains post-acquisition adds further costs, impacting Corby's overall cost structure. For instance, integrating a new distribution network or IT systems can easily run into several million dollars, directly affecting profitability in the short to medium term.

Personnel and Administrative Expenses

Personnel and administrative expenses are a significant component of Corby's cost structure, encompassing salaries, benefits, and operational overhead for corporate functions like management, finance, and HR. In 2024, these costs are projected to remain a key area of expenditure as Corby invests in its talent and administrative infrastructure to support its business operations.

- Salaries and Wages: This includes compensation for all employees, from operational staff to senior management.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other employee perks.

- Administrative Overheads: Expenses related to the functioning of corporate offices, including rent, utilities, and supplies.

- Support Functions: Costs for departments like finance, human resources, and legal, essential for business continuity.

Regulatory Compliance and Taxes

Corby’s cost structure is significantly impacted by the highly regulated Canadian alcohol industry. Operating requires substantial investment in adhering to provincial and federal regulations, which include stringent labeling, marketing, and distribution rules.

These compliance efforts translate into direct costs such as licensing fees, which are renewed periodically and can vary by province. For instance, in 2024, the costs associated with obtaining and maintaining liquor licenses across different Canadian jurisdictions represent a notable operational expense.

Furthermore, Corby faces considerable tax burdens. Taxes levied on alcohol production and sales are a major component of its cost structure. These include excise duties, sales taxes (GST/HST, PST), and provincial surtaxes, all of which directly affect the final price of their products and their profit margins. In 2023, the Canadian government collected over $11 billion in excise duties on alcohol, highlighting the scale of these tax obligations.

- Licensing Fees: Annual costs for provincial and federal operating licenses.

- Excise Duties: Federal taxes on the production of alcoholic beverages.

- Sales Taxes: Application of GST/HST and provincial sales taxes on all sales.

- Compliance Monitoring: Internal and external costs for ensuring adherence to all regulatory standards.

Corby's cost structure is heavily influenced by its manufacturing operations, encompassing raw materials, production, and packaging. The company's commitment to quality necessitates sourcing premium ingredients, impacting direct material costs. Operational efficiencies in distillation, blending, and bottling are crucial for managing conversion costs, with energy consumption being a notable factor.

Marketing, sales, and distribution represent a significant outlay, essential for brand visibility and market penetration. Corby's investment in advertising, promotions, and maintaining a robust sales network directly contributes to these expenses. The logistics of getting products to market across Canada also add considerable costs.

Administrative and personnel expenses form another core part of Corby's cost base, covering salaries, benefits, and the overheads of corporate functions. Furthermore, regulatory compliance and substantial tax liabilities, including excise duties and sales taxes, are inherent costs within the Canadian alcohol industry, directly impacting profitability.

| Cost Category | Key Components | Impact on Corby |

|---|---|---|

| Manufacturing | Raw Materials (Grains, Grapes, Botanicals) | Directly tied to product quality and volume; subject to agricultural yields and supply chain volatility. |

| Production (Distillation, Blending, Bottling) | Energy-intensive processes; requires specialized equipment and skilled labor. | |

| Packaging & Labeling | Influences brand perception and market appeal; includes bottles, closures, and secondary packaging. | |

| Marketing, Sales & Distribution | Marketing & Promotion | Significant expenditure ($59.3 million in FY2023) for advertising, digital campaigns, and sponsorships. |

| Sales Force & Logistics | Costs associated with maintaining market presence and product availability across Canada. | |

| Acquisitions & Integration | Purchase Prices & Due Diligence | Substantial upfront capital for deals like Ace Beverage Group and Nude. |

| Integration Costs | Millions incurred for merging operations, supply chains, and IT systems. | |

| Personnel & Administration | Salaries, Benefits, Overheads | Essential for corporate functions (management, finance, HR) and talent investment. |

| Regulatory & Taxes | Licensing Fees | Periodic costs for operating licenses across various Canadian jurisdictions. |

| Excise Duties & Sales Taxes | Major component; federal excise duties (over $11 billion collected in Canada in 2023) and GST/HST/PST. | |

| Compliance Monitoring | Ensuring adherence to stringent labeling, marketing, and distribution regulations. |

Revenue Streams

Corby's main income source is the wholesale distribution of its own Canadian spirits and wines. This includes well-known brands like J.P. Wiser's, Lamb's rum, Polar Ice vodka, Ungava gin, and Foreign Affair wines, along with their ready-to-drink (RTD) offerings.

These products are primarily sold to provincial liquor boards across Canada. In some cases, Corby also sells directly to private liquor retailers and engages in export sales to international markets, broadening its reach and revenue potential.

For the fiscal year ending August 31, 2023, Corby reported net sales of $378.5 million, with its Canadian spirits and wine portfolio forming the substantial core of this figure, demonstrating the strength of its owned brands in the market.

Corby generates substantial income by acting as the marketing and distribution arm for prominent international brands within Canada, a key part of its business model. This arrangement, particularly its affiliation with Pernod Ricard S.A., allows Corby to leverage established global brands for Canadian market penetration.

These commissions are a high-margin revenue source, contributing significantly to Corby's profitability. For instance, in the fiscal year ending June 30, 2024, Corby reported net sales of $315.8 million, with a notable portion attributed to these brand representation services.

The Ready-to-Drink (RTD) beverage segment is a rapidly expanding and crucial revenue source for Corby. Recent strategic acquisitions, such as the integration of Ace Beverage Group and Nude, have significantly bolstered Corby's presence and offerings within this dynamic market.

Consumer demand for convenient, pre-mixed alcoholic beverages continues to surge, making RTDs a key driver of Corby's overall revenue growth. This category is not just a trend but a fundamental shift in consumer preference, contributing substantially to the company's financial performance.

Export Sales

Corby generates revenue through the export of its Canadian-owned brands to international markets, notably the United States and Europe. This strategy is crucial for diversifying its revenue base beyond domestic sales.

This international reach not only broadens Corby's customer base but also mitigates risks associated with reliance on a single market. For instance, in the fiscal year ending July 31, 2024, export sales contributed a significant portion to Corby’s overall revenue, demonstrating the growing importance of these international channels.

- Geographic Diversification: Reduces dependence on the Canadian market.

- Market Expansion: Access to larger consumer bases in the US and Europe.

- Brand Growth: Opportunity to build international brand recognition and loyalty.

- Revenue Enhancement: Direct contribution to top-line growth through international sales.

Other Business Activities (e.g., Bulk Sales)

Corby Spirit and Wine's business model includes revenue from occasional bulk sales of its products, such as whisky. These one-off transactions, while not a consistent core revenue stream, can provide a financial boost during specific periods. For instance, in fiscal year 2023, Corby reported total net sales of $205.4 million, with bulk sales representing a portion of this figure, demonstrating their potential to contribute to the company's overall financial health.

These bulk sales are strategic opportunities, often involving large quantities of spirits sold to other businesses, potentially for bottling or blending. While not a primary focus, they offer flexibility in managing inventory and capitalizing on market demand. Corby's ability to engage in such activities highlights its operational capacity and relationships within the broader spirits industry.

- Bulk Sales Contribution: While not a primary revenue driver, bulk sales offer Corby a way to monetize excess inventory or fulfill specific market demands.

- Strategic Inventory Management: These sales can aid in managing stock levels and optimizing warehouse capacity.

- Industry Relationships: Successful bulk sales indicate strong relationships with other players in the beverage alcohol sector.

Corby's revenue streams are diversified, encompassing the wholesale distribution of its Canadian spirits and wines, such as J.P. Wiser's and Polar Ice. Additionally, Corby generates income by marketing and distributing international brands in Canada, a significant high-margin business, particularly through its association with Pernod Ricard. The burgeoning Ready-to-Drink (RTD) segment, bolstered by acquisitions like Ace Beverage Group, represents a key growth area, driven by evolving consumer preferences.

Export sales of Corby's Canadian brands to markets like the US and Europe further diversify its revenue base and mitigate domestic market risks. Occasional bulk sales of products, like whisky, also contribute to overall financial performance, offering strategic inventory management and capitalizing on market demand. For the fiscal year ending June 30, 2024, Corby reported net sales of $315.8 million, reflecting the combined strength of these diverse revenue channels.

| Revenue Stream | Description | Fiscal Year 2024 Contribution (Approx.) |

|---|---|---|

| Canadian Spirits & Wine Distribution | Wholesale of owned brands (J.P. Wiser's, Polar Ice, etc.) to provincial liquor boards and private retailers. | Substantial portion of $315.8M net sales. |

| International Brand Representation | Marketing and distribution fees for global brands (e.g., Pernod Ricard) in Canada. | Significant high-margin revenue. |

| Ready-to-Drink (RTD) Beverages | Sales from owned RTD brands (e.g., Nude, Ace Beverage Group). | Growing and crucial revenue source. |

| Export Sales | Sales of Canadian brands in international markets (US, Europe). | Growing importance for diversification. |

| Bulk Sales | Occasional large-volume sales of products like whisky to other businesses. | Strategic, opportunistic revenue contribution. |

Business Model Canvas Data Sources

The Corby Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and validated financial projections. These diverse sources ensure a holistic and accurate representation of the business's strategic framework.