Corby PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corby Bundle

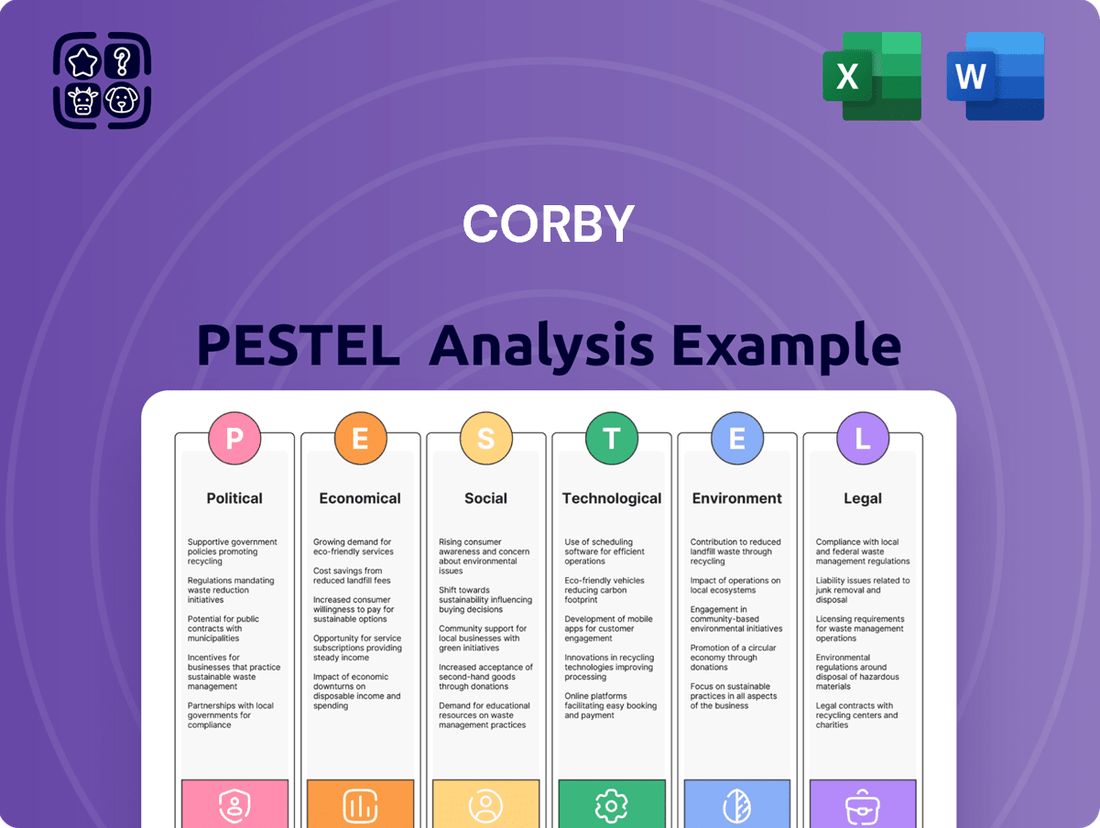

Uncover the critical external forces shaping Corby's trajectory with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors create both opportunities and threats for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full PESTLE analysis now for immediate insights.

Political factors

The Canadian federal government's decision to cap alcohol excise tax increases at 2% annually until April 1, 2026, offers significant breathing room for companies like Corby. This policy, a direct response to inflationary pressures, was set to allow a 4.7% increase on April 1, 2024, based on the Consumer Price Index, but the cap provides welcome stability.

Provincial liquor boards wield considerable influence over alcohol sales in Canada. For instance, Ontario's liberalization of alcohol sales, allowing convenience and grocery stores to sell beverages, began its phased rollout in 2024. This expansion is expected to introduce approximately 8,500 new retail points for alcohol, which could reshape distribution landscapes for companies like Corby.

Bill S-290, the Alcoholic Beverage Promotion Prohibition Act, was introduced in the Canadian Senate in November 2024. This proposed legislation aims to curb alcohol promotions, focusing on public health and reducing the appeal of alcohol to young people. If passed, it could force significant shifts in how companies like Corby market their products.

Key provisions include restrictions on linking alcohol consumption to social success and prohibitions on using imagery that might attract minors. Such changes could impact Corby's advertising campaigns, potentially requiring a complete overhaul of their promotional strategies to comply with the new rules.

Interprovincial Trade Barriers

Interprovincial trade barriers continue to complicate the movement and sale of Corby's products across Canada, despite some provinces exploring direct-to-consumer alcohol sales through bilateral agreements. These existing hurdles can limit market access for Canadian producers like Corby.

The Ontario government's efforts to liberalize trade, including signing memoranda of understanding with several provinces for direct-to-consumer sales, signal a potential shift. Such initiatives, if expanded, could significantly broaden the market reach for Canadian beverage alcohol companies.

- Provincial Trade Agreements: Ontario has signed MOUs with provinces like British Columbia and Manitoba to facilitate direct-to-consumer alcohol sales, potentially easing some interprovincial barriers.

- Economic Impact: The Canadian Chamber of Commerce has highlighted that interprovincial trade barriers cost the Canadian economy billions annually, with the alcohol sector being particularly affected.

- Market Expansion: Liberalization of these barriers could allow Corby to more efficiently distribute its brands across all Canadian provinces, increasing sales volume and market share.

Trade Agreements and Tariffs

International trade agreements and potential tariffs significantly shape Corby's operational landscape. For instance, the U.S. imposition of tariffs on Canadian exports in recent years directly impacts the cost of importing international brands into Canada and Corby's ability to export its Canadian portfolio. Monitoring these trade relations is crucial for managing import expenses and identifying export growth avenues.

Geopolitical shifts and leadership changes introduce considerable uncertainty into global trade flows. These dynamics can alter consumer preferences, potentially favoring domestic products over imported ones, thereby affecting demand for Corby's diverse brand offerings. Staying attuned to these evolving international trade relations is paramount.

- Tariff Impact: In 2024, the average tariff rate on goods imported into Canada remained around 7.1%, a figure that can fluctuate based on specific trade agreements and geopolitical events impacting countries like the United States.

- Trade Volume: Canada's total trade in goods and services reached approximately CAD 1.5 trillion in 2024, highlighting the significant volume of international commerce that Corby navigates.

- Geopolitical Risk: Global trade disruptions, such as those experienced in 2023 due to supply chain issues and regional conflicts, can add an estimated 1-2% to the cost of imported goods for Canadian companies.

The Canadian federal government's decision to cap alcohol excise tax increases at 2% annually until April 1, 2026, provides stability, allowing a potential 4.7% increase in 2024 but capped, easing cost pressures. Provincial liquor boards, like Ontario's liberalization of alcohol sales in convenience and grocery stores starting in 2024, offer new distribution channels. Bill S-290, introduced in November 2024, proposes restrictions on alcohol promotions, potentially impacting Corby's marketing strategies if passed.

| Political Factor | Impact on Corby | Data/Observation (2024-2025) |

| Alcohol Tax Cap | Cost stability, predictable revenue | 2% annual cap on excise tax increases until April 1, 2026. Potential 4.7% CPI-linked increase in 2024 was capped. |

| Provincial Retail Liberalization | Expanded distribution channels | Ontario began phased rollout of alcohol sales in convenience/grocery stores in 2024, adding ~8,500 new retail points. |

| Alcohol Promotion Legislation (Bill S-290) | Potential marketing restrictions | Introduced November 2024, aims to curb promotions, particularly those appealing to minors. |

| Interprovincial Trade Barriers | Hindered market access, increased costs | Cost the Canadian economy billions annually; alcohol sector significantly affected. |

| International Trade Policy | Affects import costs and export potential | Average Canadian import tariff around 7.1% in 2024; global trade disruptions can add 1-2% to imported goods costs. |

What is included in the product

This Corby PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business, providing a comprehensive understanding of the external landscape.

Provides a clear, actionable framework that simplifies complex external factors, enabling teams to focus on strategic responses rather than getting bogged down in data.

Economic factors

Persistent inflation and the ongoing cost-of-living crisis are noticeably impacting how much Canadians can afford to spend on non-essential items like alcohol. This has led to a decrease in the actual volume of alcohol sold across the country. For instance, in early 2024, many Canadian households reported cutting back on discretionary spending due to rising prices for groceries and housing.

As household budgets become tighter, alcohol purchases are increasingly viewed as a discretionary expense, meaning consumers are more likely to reduce or eliminate them to cover essential needs. This shift is evident even though some provincial liquor boards have seen their revenues either stay the same or increase, often due to strategic price adjustments rather than higher sales volumes.

The Canadian food and beverage sector anticipates a somewhat muted performance in 2025. While modest overall sales growth is on the horizon, the industry is contending with significant economic headwinds and evolving consumer preferences. Manufacturers must strategically manage increasing operational expenses to safeguard their profit margins.

Specifically, the beverage segment is projected to experience a downturn, with an estimated sales decline of 2.5% and a volume decrease of 2.6% in 2025. This dip is largely attributed to a noticeable reduction in consumer demand for alcoholic beverages, a trend that Corby, like other players, will need to address through product innovation and market adjustments.

Despite caps on excise duty increases, these taxes remain a significant factor in the retail pricing of alcoholic beverages. For instance, in Canada, federal excise duty on spirits increased by 2.3% in April 2024, following a similar rise the previous year, directly impacting consumer costs.

This tax, levied at the point of production, creates a cascading effect through the supply chain. When combined with broader inflationary pressures, such as the 3.1% CPI increase in Canada for 2023, it reduces product affordability and contributes to declining consumption volumes, a trend observed across many developed markets.

Shifting Consumption Occasions

Economic pressures are significantly nudging consumers towards enjoying alcoholic beverages at home. This shift is driven by a desire for better value and more budget-friendly options compared to the higher costs associated with out-of-home venues. For companies like Corby, this means a strategic pivot is necessary, potentially focusing more on products and packaging that cater to at-home consumption and adapting marketing efforts to resonate with this evolving consumer behavior.

The trend toward in-home consumption is particularly beneficial for the ready-to-drink (RTD) alcoholic beverage category. These products are well-positioned to capitalize on this movement, offering convenience and a perceived value that aligns with consumers looking for cost-effective enjoyment. In 2023, the global RTD market was valued at approximately $32.6 billion, with projections indicating continued robust growth through 2030.

Corby's sales channels and marketing strategies must therefore be agile enough to respond to this evolving landscape. Increased demand for products suitable for home enjoyment may necessitate adjustments in distribution, perhaps emphasizing e-commerce and off-premise retail. Marketing campaigns could highlight the convenience and social aspects of enjoying Corby's portfolio within the comfort of one's home.

- Economic Headwinds: Consumers are increasingly prioritizing value, leading to a noticeable increase in at-home alcohol consumption.

- Channel Adaptation: Companies like Corby need to adjust their sales channels to better serve the growing at-home market, potentially boosting e-commerce and off-premise sales.

- RTD Growth: The ready-to-drink segment is a key beneficiary, with the global market expected to see continued expansion.

- Marketing Focus: Marketing efforts may shift to emphasize the at-home enjoyment experience and the value proposition of their products.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly influence Corby's operations, given its role in distributing international alcohol brands in Canada. For instance, a weaker Canadian dollar against major currencies like the Euro or US Dollar directly increases the cost of acquiring imported wines and spirits. This can squeeze profit margins if Corby cannot pass the full cost increase onto consumers through higher retail prices.

The Bank of Canada's policy rates and global economic sentiment heavily influence the Canadian dollar's value. For example, throughout 2024 and into early 2025, market analysts have observed volatility in the CAD/USD exchange rate, with periods where the dollar weakened against its US counterpart. This trend directly impacts Corby's cost of goods sold for imported products.

- Impact on Cost of Goods: A 5% depreciation of the Canadian dollar against the Euro could translate to a similar percentage increase in the cost of European wines and spirits for Corby.

- Pricing Strategy Challenges: Corby must carefully balance absorbing these increased costs, which reduces profitability, or passing them on, which could dampen sales volume in a competitive market.

- Hedging Strategies: To mitigate these risks, companies like Corby often employ financial instruments such as forward contracts or currency options to lock in exchange rates for future purchases.

Persistent inflation and the ongoing cost-of-living crisis are noticeably impacting how much Canadians can afford to spend on non-essential items like alcohol, leading to a decrease in actual sales volumes. For instance, in early 2024, many Canadian households reported cutting back on discretionary spending due to rising prices for groceries and housing.

The beverage segment is projected to experience a downturn, with an estimated sales decline of 2.5% and a volume decrease of 2.6% in 2025, largely attributed to reduced consumer demand for alcoholic beverages. This trend, coupled with a 2.3% increase in federal excise duty on spirits in April 2024, directly impacts affordability and contributes to declining consumption volumes.

Currency exchange rate fluctuations significantly influence Corby's operations, as a weaker Canadian dollar against major currencies increases the cost of imported wines and spirits. Throughout 2024 and into early 2025, market analysts observed volatility in the CAD/USD exchange rate, impacting Corby's cost of goods sold for imported products.

| Economic Factor | Impact on Corby | Supporting Data/Trend (2024/2025) |

| Inflation & Cost of Living | Reduced discretionary spending on alcohol; increased at-home consumption | Canadian CPI increased 3.1% in 2023; households cutting back on non-essentials in early 2024 |

| Excise Duties | Increased retail pricing, further impacting affordability | Federal excise duty on spirits increased 2.3% in April 2024 |

| Currency Exchange Rates | Higher cost of imported goods; potential margin squeeze | Volatility in CAD/USD exchange rate observed throughout 2024; weaker CAD increases import costs |

| Sales Volume Projections | Projected downturn in the beverage segment | Estimated 2.5% sales decline and 2.6% volume decrease for the beverage segment in 2025 |

What You See Is What You Get

Corby PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Corby PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company. It's a complete, ready-to-deploy strategic tool.

Sociological factors

Canada is witnessing a significant decline in alcohol consumption by volume across all provinces. This societal shift is a critical factor for the beverage alcohol industry to consider in its strategic planning.

Younger demographics, specifically the 18-34 age group, are leading this trend, with a notable portion reporting abstaining from alcohol in the past month. For instance, Statistics Canada data from recent years indicates a growing segment of this age cohort identifying as non-drinkers.

This cultural pivot away from alcohol presents a substantial challenge, impacting sales volumes and necessitating adaptation in product offerings and marketing strategies for companies like Corby.

Growing public awareness of the health risks linked to alcohol consumption is significantly impacting consumer choices. This heightened health consciousness, coupled with a broader focus on personal wellness, is leading many Canadians to seek moderation and explore non-alcoholic beverages. Initiatives like Dry January have seen substantial participation, with a notable segment of the population actively looking for lower-calorie and lower-alcohol drink options.

Canada's demographic makeup is changing, with immigration playing a significant role. This influx of people from various backgrounds is influencing consumption patterns, including alcohol. For instance, in 2023, Canada welcomed over 470,000 new permanent residents, many of whom originate from countries with lower rates of alcohol consumption due to cultural or religious practices.

This increasing cultural diversity means that traditional assumptions about alcohol consumption may no longer hold true for all segments of the population. Corby, as a business, needs to be aware that a growing portion of its potential customer base might have different attitudes towards alcohol, impacting overall per capita consumption and requiring tailored marketing and product strategies.

Rise of Non-Alcoholic Alternatives

The growing popularity of non-alcoholic beverages is a significant sociological shift impacting the beverage industry. Consumers are increasingly seeking healthier lifestyle choices, leading to a decline in traditional alcohol consumption. This trend is particularly evident among younger demographics who are more health-conscious and open to exploring sophisticated non-alcoholic options.

This market evolution is not going unnoticed by regulatory bodies. For instance, some provincial liquor boards in Canada have begun to incorporate non-alcoholic products into their retail offerings, reflecting the changing consumer landscape. This strategic move by liquor boards acknowledges the demand and aims to capture a share of this expanding market segment.

The rise of non-alcoholic alternatives presents a dual challenge and opportunity for companies like Corby. While it may pose a threat to established alcoholic product sales, it simultaneously opens avenues for portfolio diversification. Corby can leverage this trend by investing in or developing its own range of premium non-alcoholic spirits, wines, or ready-to-drink options to cater to this burgeoning consumer demand.

Key data points illustrating this trend include:

- Market Growth: The global non-alcoholic beverage market was valued at approximately USD 26.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7.1% from 2024 to 2030.

- Consumer Preference: Surveys indicate that a significant percentage of consumers, particularly millennials and Gen Z, are actively reducing their alcohol intake or opting for non-alcoholic drinks at social gatherings.

- Product Innovation: Major beverage companies are responding with substantial investments in research and development for high-quality non-alcoholic products that mimic the taste and experience of their alcoholic counterparts.

- Retail Expansion: The inclusion of non-alcoholic options in traditional liquor stores signifies a broader acceptance and integration of these products into mainstream beverage retail channels.

Social Media Influence and Brand Perception

Social media is a powerful engine for beverage discovery, especially for Gen Z and Millennials, significantly shaping how alcohol brands are perceived. In 2024, over 4.9 billion people are active on social media, with platforms like TikTok and Instagram being key for trendsetting in the beverage industry. Corby's success hinges on its ability to craft engaging content that aligns with current social dialogues around responsible consumption and lifestyle choices, ensuring its brand image remains positive and relevant.

Brands need to be agile, adapting marketing to reflect shifting societal views on alcohol. This includes embracing digital channels to communicate messages of moderation and well-being. For instance, campaigns that highlight responsible drinking, perhaps through influencer partnerships or user-generated content showcasing balanced lifestyles, can build trust and brand loyalty. In 2025, we expect social media marketing spend to continue its upward trajectory, with a significant portion dedicated to influencer collaborations and short-form video content.

The visual-first nature of platforms like Instagram and Pinterest makes brand aesthetics paramount. Corby must ensure its visual identity and messaging consistently promote responsible enjoyment, not excessive consumption. A strong online presence that visually communicates sophistication and mindful indulgence can differentiate Corby in a crowded market. Data from 2024 indicates that visually appealing content drives higher engagement rates, with brands that prioritize aesthetic quality often seeing better recall and sentiment.

- Social Media Reach: Approximately 62.3% of the global population uses social media as of early 2024.

- Influencer Impact: Influencer marketing is projected to reach $21.1 billion in 2024, highlighting its importance in brand perception.

- Gen Z Preferences: Over 60% of Gen Z consumers discover new products through social media platforms.

- Responsible Drinking Messaging: Brands incorporating responsible drinking themes in their social media content often experience improved brand sentiment scores.

Societal attitudes towards alcohol are shifting, with a notable decline in consumption volume across Canada, particularly among younger demographics aged 18-34. This trend is driven by increasing health consciousness and a growing preference for non-alcoholic alternatives, a market segment projected to grow significantly. Corby must adapt by diversifying its portfolio and leveraging social media for responsible consumption messaging.

Technological factors

The food and beverage sector is heavily investing in digital transformation and automation. For instance, in 2024, global spending on industrial automation in manufacturing was projected to reach over $200 billion, with a significant portion directed towards the food and beverage industry's adoption of Industry 4.0 technologies. This shift aims to streamline processes, from ingredient sourcing to final delivery, enhancing both efficiency and product consistency for companies like Corby.

Corby can leverage these technological advancements by implementing automated systems in its production lines, packaging, and logistics. This includes adopting smart sensors for real-time quality monitoring and utilizing AI-powered analytics to optimize inventory management and predict demand. The global market for food automation is expected to grow substantially, reaching an estimated $30 billion by 2027, highlighting the significant opportunities for efficiency gains and competitive advantage.

Digital advancements are revolutionizing how companies like Corby manage their supply chains. Technologies such as real-time data analytics, the Internet of Things (IoT), and blockchain are key to enhancing efficiency and ensuring product traceability. These tools allow for better inventory management and more agile responses to market shifts.

By leveraging IoT sensors, Corby can gain unprecedented visibility into its operations, tracking everything from raw material sourcing to final product delivery. This granular data enables optimized energy consumption and more precise inventory control, crucial for a beverage company operating in a competitive landscape. For instance, in 2024, the global supply chain management software market was valued at approximately $25 billion, indicating significant investment in these technological solutions.

The surge in e-commerce is fundamentally reshaping the alcoholic beverage sector. Corby, like many in the industry, must adapt to consumers increasingly preferring online purchasing channels, a trend amplified by the convenience offered by digital platforms. This shift necessitates a strategic focus on enhancing customer engagement and loyalty through these online avenues.

Navigating the complexities of provincial regulations for online alcohol sales remains a critical challenge. For instance, as of early 2024, provinces like Ontario continue to refine their frameworks for direct-to-consumer alcohol sales online, impacting how companies like Corby can reach customers. Successfully leveraging these digital channels requires a deep understanding and compliance with these evolving legal landscapes.

Data Analytics for Consumer Insights

Advanced data analytics and artificial intelligence (AI) are increasingly vital for understanding evolving consumer preferences and crafting personalized marketing strategies. Corby can leverage these technologies to gain deeper insights into consumer behavior, enabling them to tailor product offerings and optimize promotional activities for a more data-driven market approach.

The ability to analyze vast datasets allows companies like Corby to identify emerging trends and predict future consumer demands. For instance, in 2024, the global big data and business analytics market was projected to reach over $300 billion, highlighting the significant investment in these capabilities across industries.

- Enhanced Consumer Understanding: AI-powered analytics can process social media sentiment, purchase history, and online behavior to build detailed consumer profiles.

- Personalized Marketing: Tailoring advertisements and promotions based on individual preferences, leading to higher engagement rates.

- Product Development: Identifying unmet needs or desired product features directly from consumer data, informing innovation pipelines.

- Optimized Promotions: Predicting the most effective channels and timing for marketing campaigns to maximize ROI.

Innovation in Product Development and Packaging

Technological progress is a significant driver for Corby's innovation in product development. The beverage industry is seeing a surge in new categories, particularly ready-to-drink (RTD) options and a growing market for no- and low-alcohol beverages, directly catering to evolving consumer preferences. For instance, the global RTD tea market was valued at approximately $120 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards convenient, on-the-go beverage solutions.

Furthermore, technology is instrumental in creating more sustainable packaging. Innovations like advanced flexible packaging and the development of bioplastics are becoming increasingly important. These solutions not only help companies meet environmental targets but also resonate with a consumer base that is more conscious of its ecological footprint. By 2025, the global bioplastics market is expected to reach over $10 billion, highlighting the increasing adoption of eco-friendly materials.

- RTD Growth: The global RTD beverage market is expanding rapidly, driven by convenience and changing lifestyles.

- No/Low Alcohol Trend: Consumer demand for reduced-alcohol options is creating new product development opportunities.

- Sustainable Packaging: Innovations in flexible packaging and bioplastics are crucial for meeting environmental goals and consumer expectations.

- Market Data: The bioplastics market is projected to exceed $10 billion by 2025, underscoring the shift towards sustainable materials.

Technological advancements are revolutionizing Corby's operational efficiency through automation and digital integration. The food and beverage sector's embrace of Industry 4.0, with global industrial automation spending projected over $200 billion in 2024, offers significant opportunities for streamlining production and logistics. Corby can enhance quality control and optimize inventory through smart sensors and AI-driven analytics, tapping into a food automation market expected to reach $30 billion by 2027.

The company must also navigate the growing importance of e-commerce in the alcoholic beverage sector, adapting to consumer preferences for online purchasing while addressing evolving provincial regulations for digital alcohol sales, as seen in ongoing refinements in Ontario's framework as of early 2024. Furthermore, leveraging advanced data analytics and AI, with the global big data market exceeding $300 billion in 2024 projections, will be crucial for understanding consumer trends and personalizing marketing efforts.

Technological innovation is also key to Corby's product development, particularly in the booming ready-to-drink (RTD) segment, with the global RTD tea market alone valued at approximately $120 billion in 2023, and the growing demand for no- and low-alcohol options. Innovations in sustainable packaging, such as bioplastics projected to reach over $10 billion by 2025, are also vital for meeting environmental goals and consumer expectations.

| Technological Trend | Impact on Corby | Market Data/Projections |

| Industry 4.0 & Automation | Streamlined production, enhanced quality control, optimized logistics | Global industrial automation spending > $200 billion (2024); Food automation market ~$30 billion (by 2027) |

| E-commerce & Digital Channels | Adapting to online sales, enhanced customer engagement, navigating regulatory landscapes | Ongoing refinement of provincial online alcohol sales regulations (e.g., Ontario, early 2024) |

| Data Analytics & AI | Deeper consumer insights, personalized marketing, predictive demand | Global big data & analytics market > $300 billion (2024 projection) |

| Product Innovation (RTD, Low/No Alcohol) | New product development opportunities catering to evolving tastes | Global RTD tea market ~$120 billion (2023) |

| Sustainable Packaging | Meeting environmental targets, appealing to eco-conscious consumers | Global bioplastics market > $10 billion (by 2025) |

Legal factors

Federal and provincial laws in Canada place significant restrictions on alcohol advertising. These regulations specifically forbid linking alcohol consumption to social achievements or sexual success, and also prohibit associating it with activities requiring skill, such as driving. For instance, in 2023, the Canadian government continued to review and enforce these advertising standards across various media platforms.

Corby must meticulously adhere to these rules, ensuring all promotional content is directed solely at individuals of legal drinking age and avoids any appeal to minors. This includes careful consideration of the platforms used, as regulations often restrict advertising in media predominantly consumed by younger demographics.

Alcoholic beverages in Canada face stringent product labelling requirements, mandating declarations of alcohol by volume, common names in both English and French, and crucial allergen information. These rules ensure consumers are well-informed about the products they purchase.

Specific regulations also dictate the appropriate use of descriptive terms, such as 'light,' and specify the minimum font size and placement for all mandatory information on packaging. For instance, the Alcohol and Gaming Commission of Ontario (AGCO) enforces detailed labelling standards for products sold within the province.

These comprehensive regulations are primarily overseen by federal bodies like the Canadian Food Inspection Agency (CFIA) and provincial liquor boards, ensuring compliance across the diverse Canadian market. In 2023, the CFIA reported over 5,000 inspections related to food and beverage labelling, highlighting the ongoing regulatory focus.

Federal legislation imposes excise duties on spirits, wine, and beer, a crucial element in Corby's cost structure. Recent amendments have capped annual increases for these duties at 2% through 2026, offering some predictability. These duties are levied at the point of production, directly influencing the final price consumers pay.

Corby must remain attuned to these tax regulations, as they are subject to parliamentary review and can significantly affect profit margins. Understanding and adapting to these excise duty frameworks is paramount for financial planning and maintaining competitive pricing in the market.

Intellectual Property Protection

Corby's extensive portfolio of Canadian liquor brands, including iconic names like Canadian Club and Wiser's, along with its international representations, relies heavily on strong intellectual property protection. This involves safeguarding trademarks, patents, and geographical indications to combat counterfeiting and unauthorized use, which is vital for maintaining market share and brand equity.

Legal frameworks governing intellectual property are paramount for Corby's sustained market position and brand value. For instance, in 2023, Canada's Intellectual Property Office reported a significant increase in trademark applications, highlighting the active legal landscape businesses like Corby navigate to protect their assets.

- Trademark Enforcement: Corby actively monitors and enforces its trademarks to prevent dilution and protect consumer trust in its established brands.

- Patent Protection: While less common for established liquor brands, any proprietary distillation or aging processes would be protected by patents, ensuring a competitive edge.

- Geographical Indications: For brands with specific regional origins, like certain Canadian whiskies, protecting geographical indications is crucial for authenticity and market differentiation.

- Anti-Counterfeiting Measures: Corby invests in legal strategies and technologies to identify and prosecute counterfeiters, safeguarding its revenue and brand reputation.

Distribution and Sales Channel Legislation

The legal landscape for distributing and selling alcoholic beverages in Canada is a patchwork of provincial regulations, directly impacting Corby's market access. For instance, Ontario's 2024 decision to permit alcohol sales in convenience and grocery stores significantly altered that province's retail environment, creating new avenues but also requiring careful navigation of updated licensing and sales conditions.

Corby must diligently adhere to each province's specific liquor control acts and licensing mandates. Failure to comply can result in penalties, impacting sales and brand reputation. For example, in Quebec, private retailers operate alongside the provincial Société des alcools du Québec (SAQ), each with distinct operational rules that Corby must respect.

- Provincial Variation: Liquor sales regulations differ significantly across Canada's provinces and territories.

- Ontario's Liberalization: Recent 2024 changes in Ontario expanded sales channels to include convenience and grocery stores.

- Compliance Necessity: Corby must ensure strict adherence to all provincial liquor control acts and licensing requirements.

- Market Access Impact: Legal frameworks directly influence how and where Corby can bring its products to consumers.

Corby operates within a complex legal framework in Canada, encompassing advertising restrictions, stringent product labelling mandates, and federal excise duties. Recent federal legislation capped annual increases for excise duties on spirits at 2% through 2026, providing some cost predictability. The Canadian Food Inspection Agency (CFIA) plays a key role, with over 5,000 inspections related to food and beverage labelling conducted in 2023, underscoring the regulatory focus on consumer information.

Intellectual property protection is crucial for Corby's brands like Canadian Club, with Canada's Intellectual Property Office reporting a significant rise in trademark applications in 2023. Furthermore, provincial regulations for alcohol distribution vary significantly; for example, Ontario's 2024 decision to allow alcohol sales in convenience and grocery stores reshaped the retail landscape, requiring Corby to adapt its distribution strategies and ensure compliance with new licensing conditions.

Environmental factors

Climate change is a significant environmental factor impacting Canada's viticulture, including regions relevant to Corby. Rising average temperatures are altering growing seasons, while shifts in precipitation, characterized by more intense rainfall events and prolonged droughts, create unpredictable conditions for grape cultivation.

These climatic shifts, coupled with an increased frequency of extreme weather events, present both opportunities and challenges. While warmer temperatures might allow for the introduction of new grape varietals, they also pose substantial risks to the quality and yield of existing crops. Furthermore, these changing environmental conditions are likely to exacerbate pest and disease pressures, demanding adaptive strategies for Corby's wine production.

Spirits and wine production, core to Corby's operations, are inherently water-intensive. This makes efficient water usage and responsible wastewater management crucial environmental considerations for the company.

Corby must prioritize water conservation strategies and adhere to stringent wastewater regulations to minimize its ecological impact. For instance, in 2024, the South African Department of Water and Sanitation reported that industrial water use accounts for a significant portion of national consumption, highlighting the regulatory pressure companies like Corby face.

Furthermore, a deep understanding of hydrological processes is vital, particularly for grapevines used in wine production, as water availability and quality directly influence crop yields and product consistency.

The beverage industry, including companies like Corby, is under significant pressure to adopt more sustainable packaging. This means less plastic waste, better recyclability, and exploring new materials such as bioplastics. For example, by the end of 2024, many major beverage companies aimed to increase their use of recycled PET (rPET) in bottles, with some targets reaching 50% or more.

Corby's proactive approach to eco-friendly packaging can significantly boost its brand image and appeal to a growing consumer base that prioritizes sustainability. This aligns with market trends; a 2024 survey indicated that over 60% of consumers are willing to pay more for products with sustainable packaging.

Furthermore, the implementation of Extended Producer Responsibility (EPR) policies is becoming more prevalent. These policies place the onus on producers for the end-of-life management of their packaging, encouraging more circular economy approaches and potentially impacting operational costs and strategies for companies like Corby throughout 2025.

Carbon Footprint Reduction

Corby, like many in the beverage industry, is increasingly focused on reducing its carbon footprint across its entire supply chain. This involves minimizing emissions from production facilities to the final delivery of products. For instance, in 2024, the spirits industry saw a push towards electrifying delivery fleets, with some major players aiming for 100% zero-emission vehicle fleets by 2030.

To achieve this, Corby can implement strategies such as optimizing energy consumption in its manufacturing plants, potentially through the adoption of renewable energy sources. Investing in more efficient transportation logistics, like route optimization software and exploring lower-emission shipping methods, also plays a crucial role. These initiatives not only contribute to global environmental targets but can also lead to significant operational cost savings.

The company's commitment to carbon footprint reduction can be demonstrated through tangible actions:

- Investing in energy-efficient technologies for bottling and distilling processes.

- Optimizing transportation routes and exploring alternative fuel vehicles for distribution.

- Partnering with suppliers who also prioritize emission reductions in their operations.

- Setting clear, measurable targets for greenhouse gas emission reductions, aligning with science-based targets.

Waste Management and Circular Economy

Corby's commitment to waste management is crucial for its environmental standing. Implementing robust waste reduction strategies, such as minimizing food and product waste and actively promoting recycling, is essential for demonstrating environmental responsibility. For instance, the UK's overall recycling rate for municipal waste reached 44.3% in 2022-23, with ongoing efforts to improve this figure across local authorities.

Embracing circular economy principles offers significant advantages. By minimizing waste and keeping resources in continuous use, Corby can unlock substantial cost efficiencies and bolster its sustainability credentials. This approach aligns with national targets, such as the UK government's goal to eliminate residual waste to landfill by 2050, encouraging innovative business models focused on resource longevity.

- Waste Reduction: Focus on minimizing waste generation at source, particularly in sectors like retail and manufacturing prevalent in Corby.

- Recycling Initiatives: Enhance local recycling infrastructure and public awareness campaigns to increase participation and diversion rates.

- Circular Economy Adoption: Explore business models that prioritize product longevity, repair, refurbishment, and material reuse to reduce reliance on virgin resources.

- Resource Efficiency: Track and report on key metrics like waste generated per unit of production or revenue to identify areas for improvement and cost savings.

Environmental factors significantly shape Corby's operational landscape. Climate change impacts viticulture through altered growing seasons and unpredictable precipitation, affecting grape quality and yield. Water scarcity and quality are critical for beverage production, necessitating efficient management to meet regulatory demands, as industrial water use remains a significant concern in many regions.

The push for sustainable packaging, with targets for increased recycled content like rPET in bottles by 2024, directly influences Corby's material choices and costs. Growing consumer preference for eco-friendly options, with over 60% willing to pay more, makes this a strategic imperative. Furthermore, Extended Producer Responsibility policies are increasingly common, shifting end-of-life packaging management responsibilities to producers.

Corby's carbon footprint reduction efforts are vital, with industry trends favoring fleet electrification and renewable energy adoption in manufacturing. Optimizing logistics and energy consumption can yield operational cost savings. Waste management and circular economy principles are also key, with national targets aiming to eliminate landfill waste, driving innovation in resource longevity and efficiency.

PESTLE Analysis Data Sources

Our Corby PESTLE analysis is meticulously constructed using a blend of official government statistics, reputable economic forecasts, and leading industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting Corby.