Corby Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corby Bundle

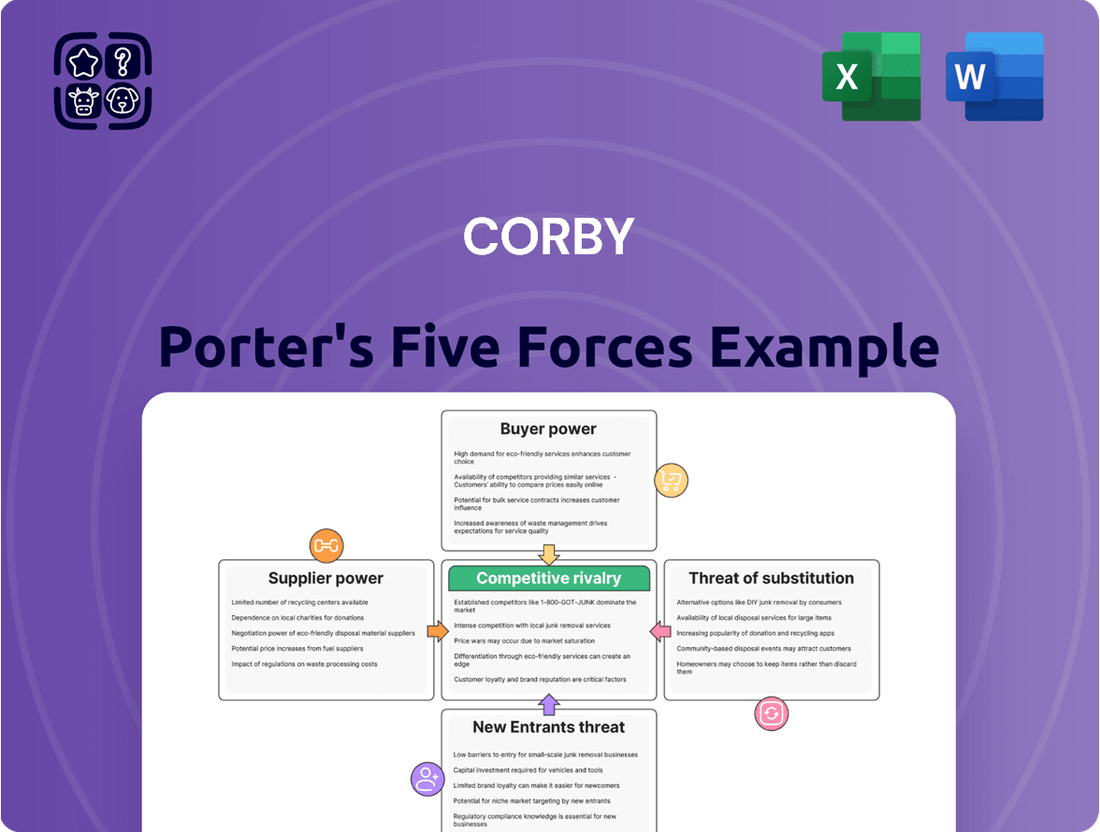

Corby's competitive landscape is shaped by the interplay of five key forces, revealing the industry's attractiveness and potential profitability. Understanding these dynamics is crucial for any strategic decision-making concerning Corby.

The full Porter's Five Forces Analysis delves into the nuances of Corby's market, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes. It also dissects the intensity of rivalry within the industry.

Ready to gain a comprehensive understanding of Corby's strategic position? Unlock the complete analysis to uncover actionable insights and identify opportunities for competitive advantage.

Suppliers Bargaining Power

Corby's reliance on agricultural inputs like barley, corn, rye, and grapes for its spirits and wines places it directly in the path of supplier bargaining power. These raw materials are foundational to its product line, meaning any significant shift in their availability or cost can directly affect Corby's profitability and operational stability.

The bargaining power of these agricultural suppliers is notably influenced by factors such as harvest yields, which can be unpredictable due to climate conditions. For instance, a poor harvest season in a key grain-producing region could lead to scarcity and price hikes. Global commodity prices also play a crucial role; in 2024, grain prices experienced volatility driven by geopolitical events and supply chain disruptions, directly impacting the input costs for distilleries.

Suppliers of essential packaging components like bottles, labels, and caps can exert considerable influence, particularly when Corby requires unique or environmentally friendly designs. For instance, in 2024, the average cost of glass bottles saw a notable increase, impacting beverage manufacturers across the board. Any disruption or price hike from these packaging providers directly translates to higher production expenses and potential delays in getting Corby's products to consumers.

International brand owners, or licensors, wield substantial bargaining power over distributors like Corby. Their global brand recognition and established market presence mean they can easily switch to alternative distribution partners if terms are not favorable, directly impacting Corby's access to sought-after products and, consequently, its revenue. For instance, the global spirits market saw significant growth in 2024, with premium brands commanding higher margins, further solidifying licensors' leverage.

Logistics and Distribution Services

Corby's reliance on third-party logistics (3PL) providers for certain distribution needs, especially across Canada's vast geography, grants these suppliers a degree of bargaining power. The cost and availability of freight, warehousing, and transportation services directly influence Corby's operational expenses. For instance, in 2024, the Canadian trucking industry faced ongoing challenges with driver shortages and rising fuel costs, which can translate into higher rates for logistics services. This situation allows logistics providers to negotiate terms, impacting Corby's overall cost structure and profitability.

The bargaining power of logistics and distribution service suppliers for Corby is influenced by several factors:

- Market Concentration: A limited number of large 3PL providers in specific regions can lead to less competition and greater supplier leverage.

- Service Specialization: If Corby requires highly specialized logistics, such as temperature-controlled transport for certain beverages, suppliers with this niche capability may command higher prices.

- Contractual Agreements: The terms and duration of existing contracts with logistics providers can either limit or enhance their bargaining power during renewal periods.

Specialized Equipment and Technology

Suppliers of specialized distillation equipment, bottling lines, and other advanced manufacturing technologies wield significant bargaining power over Corby. The substantial capital investment and specialized technical knowledge needed to produce and maintain these essential assets create a barrier to entry for potential alternative suppliers.

This reliance on a limited number of providers for critical machinery translates into high switching costs for Corby. If Corby were to seek new suppliers for its bottling lines, for instance, the expense and disruption associated with retooling and retraining could be prohibitive, reinforcing the suppliers' leverage.

- High Capital Investment: The cost of advanced distillation and bottling equipment can run into millions of dollars, limiting the pool of potential suppliers.

- Technical Expertise: Suppliers possess proprietary knowledge and engineering capabilities that are difficult for buyers to replicate internally.

- Switching Costs: Replacing specialized machinery involves significant expenses for deinstallation, new installation, calibration, and employee training, often exceeding 10-15% of the equipment's value.

- Limited Alternatives: In highly specialized sectors like beverage manufacturing, the number of suppliers offering cutting-edge, reliable technology can be very small.

Corby's dependence on agricultural products like barley and grapes means suppliers can influence pricing and availability, directly impacting production costs. For instance, in 2024, global grain prices saw fluctuations due to geopolitical tensions, which can increase input expenses for distilleries. Similarly, disruptions in packaging supply chains, such as increased glass bottle costs in 2024, further amplify supplier leverage.

The bargaining power of Corby's suppliers is heightened by market concentration and the specialized nature of their offerings. For example, limited providers of advanced bottling equipment or niche logistics services can command higher prices due to high switching costs for Corby, often exceeding 10-15% of the equipment's value.

| Supplier Type | Key Inputs/Services | Factors Influencing Bargaining Power | Impact on Corby |

|---|---|---|---|

| Agricultural Producers | Barley, Corn, Grapes | Harvest yields, Global commodity prices (e.g., 2024 grain price volatility) | Input cost fluctuations, Production stability |

| Packaging Suppliers | Bottles, Labels, Caps | Material costs (e.g., 2024 glass bottle price increases), Design complexity | Increased production expenses, Potential delays |

| International Brand Owners (Licensors) | Brand rights for spirits/wines | Global brand recognition, Market presence (e.g., premium brands commanding higher margins in 2024) | Access to key products, Revenue potential |

| Logistics & Distribution Providers (3PL) | Transportation, Warehousing | Market concentration, Service specialization, Contract terms (e.g., Canadian driver shortages and fuel costs in 2024) | Operational expenses, Cost structure |

| Equipment Manufacturers | Distillation, Bottling machinery | High capital investment, Technical expertise, Switching costs (10-15% of equipment value) | Capital expenditure, Operational efficiency |

What is included in the product

Corby Porter's Five Forces Analysis provides a comprehensive framework to understand the competitive intensity and attractiveness of the industry in which Corby operates.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Provincial liquor boards in Canada, such as the LCBO in Ontario and the SAQ in Quebec, represent significant bargaining power for beverage alcohol producers like Corby. These boards often operate as monopolies or oligopolies, controlling the vast majority of retail sales within their respective provinces. In 2024, these provincial boards continue to be the gatekeepers for market access and pricing, wielding substantial influence over product listings and promotional activities.

The sheer volume of purchases made by these provincial entities grants them considerable leverage. Their ability to dictate terms, including pricing, payment schedules, and marketing support, can directly impact Corby's profitability and market strategy. For instance, a decision by a major provincial board to reduce shelf space for certain products or to impose stricter margin requirements can significantly affect Corby's revenue streams.

Bars, restaurants, and hotels are significant customers for beverage companies like Corby, often buying in large volumes. While a single bar might not wield much influence, the combined purchasing power of many establishments can significantly impact Corby's pricing and how its products are displayed. For instance, in 2024, the hospitality sector, which includes these on-premise establishments, continued to be a major driver of alcohol sales, with many venues actively seeking favorable terms from their suppliers to manage costs and maximize margins.

Consumer preferences are the ultimate drivers of demand, influencing what retailers stock and, consequently, what companies like Corby produce. For instance, a significant shift in consumer preference towards lower-sugar beverages, a trend observed globally, directly impacts demand for traditional soft drinks, granting consumers more leverage over product development and marketing strategies.

Private Label and Store Brands

The growing trend of private label and store brands significantly amplifies the bargaining power of customers, particularly large retailers and liquor boards. These entities can leverage their scale to develop or expand their own proprietary spirits and wine offerings, effectively bypassing traditional suppliers like Corby for specific market segments. This strategy directly challenges Corby’s pricing power and can erode its market share.

For instance, in 2024, major grocery chains and specialized liquor retailers continued to invest heavily in their private label programs, aiming to capture higher margins and customer loyalty. This is a direct response to consumer demand for value and unique offerings. For Corby, this means facing increased price pressure as these retailers can dictate terms or simply choose to source from alternative, lower-cost producers for their store brands.

- Retailer private label growth: Many large retailers are actively expanding their private label portfolios across various product categories, including alcoholic beverages.

- Margin control for retailers: Developing private labels allows retailers to control the entire value chain, from sourcing to pricing, thereby enhancing their profit margins.

- Consumer perception shifts: Consumers are increasingly open to private label brands, viewing them as offering comparable quality at a lower price point, especially in accessible segments.

- Competitive threat to established brands: The proliferation of private label options creates a direct competitive threat to established brands like those in Corby's portfolio, forcing them to compete on price or differentiate more aggressively.

Price Sensitivity and Product Availability

Customers, particularly in the mass market, often exhibit significant price sensitivity. This is exacerbated by the wide array of readily available alternatives. For instance, in the global beverage market, which Corby operates within, consumers have countless options from large multinational corporations to smaller craft producers.

The ease with which customers can switch suppliers directly amplifies their bargaining power. This forces companies like Corby to maintain competitive pricing strategies and ensure a consistent, reliable supply chain. In 2024, for example, many consumer goods companies reported increased pressure on margins due to heightened consumer demand for value, impacting their ability to pass on rising input costs.

- High Price Sensitivity: Consumers often prioritize cost when making purchasing decisions, especially for everyday items.

- Abundant Alternatives: The market typically offers a wide selection of similar products from various brands.

- Ease of Switching: Customers can readily change brands or suppliers with minimal inconvenience or cost.

- Impact on Corby: This necessitates competitive pricing and robust product availability to retain market share.

The bargaining power of customers is a critical factor in Corby's operating environment. Large provincial liquor boards in Canada, such as the LCBO and SAQ, act as significant buyers, dictating terms due to their market dominance. In 2024, these entities continue to wield substantial influence over pricing and product placement, directly impacting Corby's revenue. Furthermore, the hospitality sector, including bars and restaurants, also exerts considerable purchasing power, especially when acting collectively, pushing for favorable terms to manage their own costs.

The rise of private label brands, driven by consumer demand for value, significantly empowers retailers and liquor boards. These entities can leverage their scale to offer store-brand alternatives, creating direct price competition for established brands like Corby. This trend, prominent in 2024, forces Corby to focus on differentiation and cost management to maintain its market position.

| Customer Segment | Bargaining Power Drivers | Impact on Corby |

|---|---|---|

| Provincial Liquor Boards (e.g., LCBO, SAQ) | Monopoly/Oligopoly status, High Purchase Volume | Price control, Listing decisions, Margin pressure |

| Hospitality Sector (Bars, Restaurants, Hotels) | Bulk purchasing, Collective action | Negotiation on pricing, Promotional support demands |

| Retailers (with Private Labels) | Scale, Control over shelf space, Margin enhancement | Direct price competition, Potential for market share erosion |

| End Consumers | Price sensitivity, Abundant alternatives, Ease of switching | Need for competitive pricing, Consistent availability, Brand loyalty initiatives |

Full Version Awaits

Corby Porter's Five Forces Analysis

This preview showcases the complete Corby Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase. This ensures full transparency and immediate access to valuable strategic insights without any hidden elements or placeholders.

Rivalry Among Competitors

The Canadian alcohol market is a battleground with several strong domestic players, making it tough for companies like Corby to grab and keep market share.

Corby faces fierce competition from established Canadian brands that have deep roots and loyal customer bases, forcing continuous innovation to stand out.

For instance, in 2023, the Canadian spirits market saw significant growth, with companies like Corby needing to invest heavily in marketing and product development to compete against domestic rivals who also expanded their portfolios.

Corby competes fiercely with a broad spectrum of global spirits and wine brands, often distributed by rival companies. This international influx significantly heightens competitive pressure, particularly within the lucrative premium and niche market segments.

To navigate this intensified rivalry, Corby must invest heavily in robust marketing campaigns and sophisticated distribution networks. For instance, in 2024, the global alcoholic beverage market was valued at over $1.5 trillion, with a substantial portion driven by premium and imported brands, underscoring the critical need for differentiation and strong market presence.

The spirits and wine industry is seeing a significant influx of craft distilleries and micro-wineries. These smaller, nimble players are increasingly challenging established brands by focusing on unique flavor profiles and strong local connections. For instance, in 2023, the number of craft distilleries in the U.S. surpassed 2,000, a testament to their growing presence and ability to capture niche markets.

This proliferation of micro-producers intensifies competition by fragmenting consumer attention and preferences. While their individual market share might be small, collectively they exert considerable pressure, forcing larger companies to innovate and adapt to changing tastes. This dynamic particularly impacts market share in premium and specialty segments, where consumers often seek novelty and artisanal quality.

Marketing and Distribution Reach

Competitive rivalry is intense when it comes to marketing and distribution reach. Companies are constantly battling for prime shelf space, prominent promotional placement, and efficient delivery networks across Canada. This requires significant financial commitment to building strong brands, maintaining robust sales forces, and optimizing logistical operations.

In 2024, the Canadian beverage alcohol market, where Corby Porter operates, saw continued heavy investment in marketing. For instance, major players often allocate tens of millions of dollars annually to advertising and promotional activities to capture consumer attention. The efficiency of a company's distribution network is equally critical, impacting everything from product availability to delivery costs.

- Marketing Spend: Brands compete fiercely through advertising, sponsorships, and in-store promotions, often exceeding $20 million annually for leading players in Canada.

- Distribution Efficiency: Companies invest heavily in warehousing, transportation, and retail partnerships to ensure widespread product availability and timely delivery.

- Brand Visibility: Securing prominent placement on store shelves and online platforms is a key battleground, directly influencing consumer purchasing decisions.

- Sales Force Investment: Maintaining a skilled and motivated sales team is crucial for building relationships with retailers and driving sales volume.

Product Differentiation and Innovation

Competitive rivalry in the beverage industry, particularly for companies like Coca-Cola and PepsiCo, is intense and fueled by a constant push for product differentiation and innovation. Companies are locked in a perpetual race to introduce new flavor profiles, create exciting brand extensions, and develop innovative packaging to capture and retain consumer attention. This dynamic means that staying ahead requires not just a strong existing brand, but also the agility to adapt to rapidly changing consumer preferences and emerging market trends. For example, in 2024, major beverage players continued to invest heavily in R&D, with reports indicating a significant portion of their marketing budgets allocated to new product development and flavor innovation to combat market saturation and attract younger demographics.

Brand strength and perceived quality are paramount in this competitive landscape. Consumers often rely on these factors when making purchasing decisions, creating a barrier to entry for new players and a significant advantage for established brands. The ability to consistently deliver on quality expectations while also introducing novel offerings is a key differentiator. In 2023, Coca-Cola's global brand value was estimated at over $97 billion, underscoring the power of brand equity in driving sales and market share, even amidst fierce competition from rivals who also boast strong brand recognition and loyalty.

The drive for differentiation extends beyond taste and brand to encompass broader consumer trends and sustainability initiatives. Companies are increasingly competing on their ability to respond to demands for healthier options, plant-based ingredients, and environmentally conscious packaging. This strategic focus on aligning with evolving societal values is becoming as crucial as traditional product attributes. For instance, many beverage companies in 2024 announced ambitious targets for recycled content in their packaging and expanded their portfolios of low-sugar or zero-sugar alternatives, reflecting a direct response to consumer demand for healthier and more sustainable choices.

- Product Innovation: Companies like Coca-Cola and PepsiCo continuously launch new flavors and product lines to capture market share.

- Brand Strength: Established brands leverage their reputation for quality and consumer trust to maintain a competitive edge.

- Adaptability: The ability to quickly respond to changing consumer tastes and trends, such as the demand for healthier options, is crucial.

- Market Investment: Significant marketing and R&D investments are made to support new product launches and brand visibility.

Competitive rivalry in the Canadian alcohol market is intense, with Corby facing strong domestic and global competitors. This necessitates significant investment in marketing and product innovation to maintain market share, especially as the market saw substantial growth in 2023.

The proliferation of craft distilleries and micro-wineries further intensifies competition by fragmenting consumer preferences, forcing established players to adapt. For example, the U.S. craft distillery sector surpassed 2,000 operations in 2023, highlighting this trend.

Companies like Corby must invest heavily in marketing and distribution, with major players in Canada often spending over $20 million annually on promotions. Securing prime shelf space and efficient logistics are critical battlegrounds.

| Factor | Description | 2023/2024 Relevance |

|---|---|---|

| Domestic Competition | Established Canadian brands with loyal customer bases. | Drives need for continuous innovation and market presence. |

| Global Brands | Influx of international spirits and wines. | Heightens pressure, particularly in premium segments. |

| Craft Producers | Small, nimble players focusing on unique offerings. | Fragment consumer attention and necessitate agility. |

| Marketing & Distribution | Battles for shelf space, promotions, and efficient networks. | Requires substantial financial commitment and optimization. |

SSubstitutes Threaten

The threat of substitutes for Corby's spirits and wines is significant, stemming from a broad spectrum of other alcoholic beverage categories. Consumers can readily choose beer, cider, and a rapidly growing segment of ready-to-drink (RTD) cocktails. For instance, the global RTD market was valued at approximately USD 23.4 billion in 2023 and is projected to grow substantially, indicating a strong alternative for consumers seeking convenience and variety.

These alternative categories can directly siphon demand away from Corby's core offerings. A notable shift in consumer preferences, perhaps driven by evolving tastes, health consciousness favoring lower alcohol content options, or more accessible price points in beer or cider, can directly impact sales volumes for spirits and wines. For example, the craft beer market has seen consistent growth, offering consumers diverse flavor profiles that compete with traditional spirits.

The burgeoning health and wellness movement is significantly boosting the appeal of non-alcoholic beverages, including spirits, wines, and mocktails. This trend presents a direct substitute for traditional alcoholic drinks, offering consumers a similar social and sensory experience without the alcohol content. For instance, the global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially, indicating a clear shift in consumer preferences that could impact Corby's core business.

The threat of substitutes for traditional alcoholic beverages, like those produced by Corby, is growing, particularly with the increasing legalization of cannabis in Canada. Cannabis-infused beverages and other cannabis products offer consumers an alternative recreational choice, directly competing for discretionary spending and leisure time. For instance, in 2023, the Canadian cannabis market saw significant growth, with edibles and beverages becoming increasingly popular, indicating a tangible shift in consumer preferences that could impact the alcohol sector.

Leisure Activities and Entertainment

Beyond direct beverage substitutes, other forms of leisure and entertainment can compete for consumer spending. If economic conditions or lifestyle changes lead consumers to prioritize other activities, overall alcohol consumption may decline, indirectly affecting Corby's sales.

For instance, the global entertainment and leisure market is substantial. In 2024, projections indicate continued growth, with consumer spending on experiences like travel, dining out, and digital entertainment vying for disposable income that might otherwise be allocated to alcoholic beverages. This means Corby faces indirect competition from a wide array of activities that fulfill consumers' desires for relaxation and enjoyment.

- Competition from Experiential Spending: Consumers increasingly allocate budgets to experiences over material goods, impacting discretionary spending on items like alcohol.

- Digital Entertainment Growth: The expansion of streaming services, gaming, and other digital content offers readily available and often lower-cost entertainment alternatives.

- Economic Sensitivity: During economic downturns, consumers often cut back on discretionary spending, with leisure activities and premium beverages being among the first to be reduced.

Home Brewing and DIY Culture

The growing popularity of home brewing, winemaking, and DIY spirit distillation, where legally permitted, presents a subtle yet tangible substitute for commercially produced beverages. This trend, fueled by both passionate hobbyists and consumers seeking cost savings, carves out a niche market. For instance, the American Homebrewers Association reported a steady increase in membership, indicating a persistent interest in crafting beverages at home.

While not a direct threat to large-scale commercial producers, this DIY culture can siphon off a segment of the market, particularly among younger, experimental consumers. The perceived freshness and customization options available through home production appeal to a specific demographic. Data from 2024 suggests that the home brewing equipment market continues to see modest growth, reflecting ongoing consumer engagement.

- DIY Beverage Production: Home brewing, winemaking, and spirit distillation (where legal) offer alternative consumption options.

- Consumer Drivers: This trend is propelled by hobbyists and cost-conscious individuals.

- Market Impact: While niche, it represents a present, albeit minor, substitute for commercial products.

- Growth Indicators: The home brewing equipment market has shown consistent, albeit modest, growth in recent years, including in 2024.

The threat of substitutes for Corby's spirits and wines is substantial, encompassing a wide array of alcoholic and non-alcoholic alternatives. Consumers can easily opt for beer, cider, or the rapidly expanding ready-to-drink (RTD) cocktail market, which was valued at approximately USD 23.4 billion in 2023. Furthermore, the growing non-alcoholic beverage sector, estimated at $1.1 trillion in 2023, offers a significant alternative for health-conscious consumers.

| Substitute Category | 2023 Market Value (Approx.) | Key Drivers |

|---|---|---|

| Ready-to-Drink (RTD) Cocktails | USD 23.4 billion | Convenience, Variety, Flavor Innovation |

| Non-Alcoholic Beverages | USD 1.1 trillion | Health & Wellness Trends, Social Acceptance |

| Beer & Cider | Significant Global Market | Accessibility, Price Point, Craft Movement |

| Cannabis-Infused Beverages (Canada) | Growing Market Segment | Legalization, Alternative Recreation |

Entrants Threaten

The spirits and wine industry demands considerable upfront capital. Establishing production facilities, managing aging inventory, and building widespread distribution networks are all major cost centers. For instance, setting up a modern distillery can easily run into tens of millions of dollars.

Newcomers struggle to match the economies of scale enjoyed by established companies like Corby. These incumbents benefit from lower per-unit production costs due to high-volume operations, giving them a significant pricing advantage. In 2024, major beverage alcohol companies reported billions in revenue, a testament to their scale.

The Canadian alcohol market presents a formidable barrier to entry due to its intricate web of federal and provincial regulations. Companies must contend with stringent licensing requirements, complex taxation structures, and restrictive marketing rules across various jurisdictions, making it challenging for newcomers to establish a foothold.

Corby's strong brand loyalty, built on decades of consumer trust in its Canadian spirits like Canadian Club and Wiser's, presents a significant barrier. This loyalty makes it difficult for new players to capture market share, as consumers often gravitate towards familiar and trusted names.

Furthermore, Corby benefits from deeply entrenched relationships with provincial liquor boards and a vast network of retail partners across Canada. Gaining access to these crucial distribution channels is a major hurdle for any new entrant, often requiring substantial investment and time to replicate.

In 2024, the Canadian spirits market continued to be dominated by established players, with brands like Corby's portfolio maintaining a strong presence. New entrants face the challenge of not only creating a compelling product but also navigating the complex and regulated landscape of alcohol distribution in Canada, where shelf space and consumer visibility are hard-won.

Access to Raw Materials and Expertise

Newcomers often struggle to secure consistent access to high-quality raw materials like specific grains or botanicals, a hurdle compounded by the specialized knowledge required for distillation, blending, and aging processes. Established companies, such as Diageo, benefit from decades of accumulated expertise and deeply entrenched supplier relationships, creating a significant barrier.

For instance, the premium Scotch whisky market, a sector requiring extensive aging, saw global exports reach an estimated £5.5 billion in 2023, highlighting the long-term capital investment and patience new entrants must possess. This reliance on time and established networks makes it difficult for new players to quickly match the quality and brand recognition of incumbents.

- Securing consistent access to high-quality raw materials is a significant challenge for new entrants.

- Specialized knowledge in distillation, blending, and aging is a key barrier.

- Existing players leverage long-standing supplier relationships and accumulated expertise.

- The long maturation periods in sectors like premium spirits demand substantial upfront capital and patience.

Intense Competition and Marketing Costs

The threat of new entrants is significantly amplified by the already saturated market landscape. Established players, both domestic and international, have built strong brand recognition and customer loyalty, necessitating considerable investment in marketing and advertising for any newcomer to even be noticed. For instance, in the fast-moving consumer goods sector, which often includes companies like Corby, marketing expenditure can represent a substantial portion of revenue, sometimes exceeding 10-15% annually.

This intense competition means that new entrants face a steep uphill battle to gain traction. They must not only match the product quality and pricing of incumbents but also overcome their established marketing reach. This often translates to needing a much larger initial capital outlay to fund aggressive promotional campaigns, potentially leading to prolonged periods of unprofitability as they strive to capture even a small market share.

- High Marketing Spend: Companies in competitive consumer goods markets often allocate over 10% of their revenue to marketing and advertising.

- Brand Loyalty Barriers: Existing brands benefit from years of customer engagement, making it costly for new entrants to build comparable trust.

- Economies of Scale: Established firms often leverage economies of scale in production and distribution, allowing them to offer more competitive pricing that new entrants struggle to match.

- Distribution Channel Access: Securing shelf space and favorable terms with distributors can be challenging and expensive for new players.

The threat of new entrants in the spirits and wine industry is significantly mitigated by substantial capital requirements for production and distribution, alongside the need for specialized knowledge in crafting and aging products. Established players benefit from economies of scale and deeply entrenched distribution networks, creating formidable barriers for newcomers. Furthermore, strong brand loyalty and complex regulatory environments in markets like Canada further deter new competition.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment needed for facilities, inventory, and distribution. | Distillery setup can cost tens of millions of dollars. |

| Economies of Scale | Established firms have lower per-unit costs due to high-volume operations. | Major beverage alcohol companies reported billions in revenue in 2024. |

| Brand Loyalty | Consumers prefer trusted, established brands. | Corby's brands like Canadian Club have decades of consumer trust. |

| Distribution Access | Difficulty in securing shelf space and relationships with retailers/boards. | Corby benefits from established relationships with provincial liquor boards. |

| Regulatory Hurdles | Complex licensing, taxation, and marketing rules. | Canadian alcohol market has intricate federal and provincial regulations. |

| Technical Expertise | Specialized knowledge in distillation, blending, and aging. | Premium Scotch whisky market requires extensive aging and expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of data from company annual reports, industry-specific market research, and government economic indicators. This ensures a comprehensive understanding of competitive dynamics.