COPT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COPT Bundle

COPT's SWOT analysis reveals a company with significant strengths in its real estate portfolio and a clear growth strategy. However, understanding the nuances of its competitive landscape and potential market shifts is crucial for informed decision-making.

Want the full story behind COPT's market position, its key advantages, and the potential hurdles it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

COPT's specialized mission-critical portfolio, focusing on properties near U.S. defense installations and government demand centers, is a significant strength. This niche strategy attracts tenants with essential operational needs, fostering strong occupancy and sustained demand.

As of the first quarter of 2025, COPT's Defense/IT Portfolio reported an impressive 95.3% occupancy and 96.6% leased status. This high utilization underscores the stability and resilience inherent in its specialized real estate assets, providing a reliable revenue stream.

COPT's strength lies in its tenant base, predominantly U.S. government agencies and defense contractors. These tenants typically require specialized, high-security property features and commit to lengthy lease agreements, contributing to COPT's revenue stability.

This focus on a secure tenant profile shields COPT from the fluctuations often experienced in broader commercial real estate sectors. The Department of Defense's budget, for instance, saw an increase to approximately $886 billion for fiscal year 2024, underscoring the robust demand and financial underpinning for COPT's operations.

COPT's Defense/IT portfolio demonstrates remarkable stability, consistently achieving occupancy rates above 94% for the past nine quarters ending in Q1 2025. This sustained high occupancy underscores the demand for their specialized real estate assets.

Furthermore, the company exhibits exceptional tenant loyalty, with an average retention rate of 79% between 2020 and 2024. This figure significantly surpasses the typical retention rates seen in other office Real Estate Investment Trusts (REITs), highlighting strong tenant relationships and operational efficiency.

These robust occupancy and retention metrics translate into predictable revenue streams and significantly mitigate the financial risks associated with tenant turnover and vacancy, reinforcing COPT's market position.

Robust Development Pipeline and Growth Trajectory

COPT’s robust development pipeline is a significant strength, with $308 million in active developments encompassing 756,000 square feet as of April 2025. This pipeline is already showing strong traction, with 62% of the space currently leased.

Management anticipates a compound annual FFO per share growth of approximately 4% from 2023 through 2026. This projected growth is directly supported by the ongoing leasing demand and the company's strategic development initiatives.

- Significant Development Pipeline: $308 million in active developments (756,000 sq ft) as of April 2025.

- High Pre-Leasing: 62% of the active development pipeline is already leased.

- Projected FFO Growth: Management forecasts a 4% compound annual FFO per share growth from 2023-2026.

- Growth Drivers: Strong leasing demand and continued development activities fuel future growth.

Stable Financial Health and Dividend History

Corporate Office Properties Trust (COPT) demonstrates a notably stable financial foundation, underscored by its investment-grade credit rating. This strong profile is further bolstered by a conservative debt structure, with an impressive 98% of its debt carrying fixed interest rates as of March 31, 2025. This strategic approach minimizes exposure to rising interest rate volatility, providing a predictable cost of capital.

COPT's commitment to shareholder returns is evident in its long-standing dividend history. The company boasts a remarkable 34-year track record of consistent dividend payments. Reinforcing this commitment, in February 2025, COPT approved a 3.4% increase in its quarterly dividend, marking the third consecutive year of annual dividend growth.

- Stable Financial Health

- Investment-Grade Credit Rating

- 98% Fixed-Rate Debt (as of March 31, 2025)

- 34-Year Dividend Track Record

- 3.4% Quarterly Dividend Increase Approved (February 2025)

- Third Consecutive Annual Dividend Increase

COPT's core strength is its specialized focus on mission-critical real estate supporting U.S. defense and government tenants. This niche market ensures high occupancy, with its Defense/IT Portfolio at 95.3% occupied and 96.6% leased as of Q1 2025. The company benefits from stable, long-term leases with government agencies and defense contractors, who often require specialized, secure facilities, contributing to predictable revenue streams.

A robust development pipeline of $308 million (756,000 sq ft) as of April 2025, with 62% pre-leased, positions COPT for future growth. Management projects a compound annual FFO per share growth of approximately 4% from 2023 through 2026, driven by this development activity and sustained leasing demand.

Financially, COPT maintains stability with an investment-grade credit rating and a conservative balance sheet, featuring 98% fixed-rate debt as of March 31, 2025. This mitigates interest rate risk. The company also demonstrates a strong commitment to shareholders, evidenced by a 34-year dividend payment history and a 3.4% increase in its quarterly dividend approved in February 2025.

| Key Strength Indicator | Metric | Data Point | Timeframe |

| Portfolio Occupancy | Defense/IT Portfolio Occupancy | 95.3% | Q1 2025 |

| Portfolio Leased | Defense/IT Portfolio Leased | 96.6% | Q1 2025 |

| Development Pipeline Value | Active Developments | $308 million | April 2025 |

| Development Pipeline Square Footage | Active Developments | 756,000 sq ft | April 2025 |

| Development Pipeline Pre-Leasing | Active Developments | 62% | April 2025 |

| FFO Per Share Growth Projection | Compound Annual Growth | ~4% | 2023-2026 |

| Debt Structure | Fixed-Rate Debt Percentage | 98% | March 31, 2025 |

| Dividend History | Consecutive Payments | 34 years | Ongoing |

| Dividend Growth | Quarterly Dividend Increase | 3.4% | Approved Feb 2025 |

What is included in the product

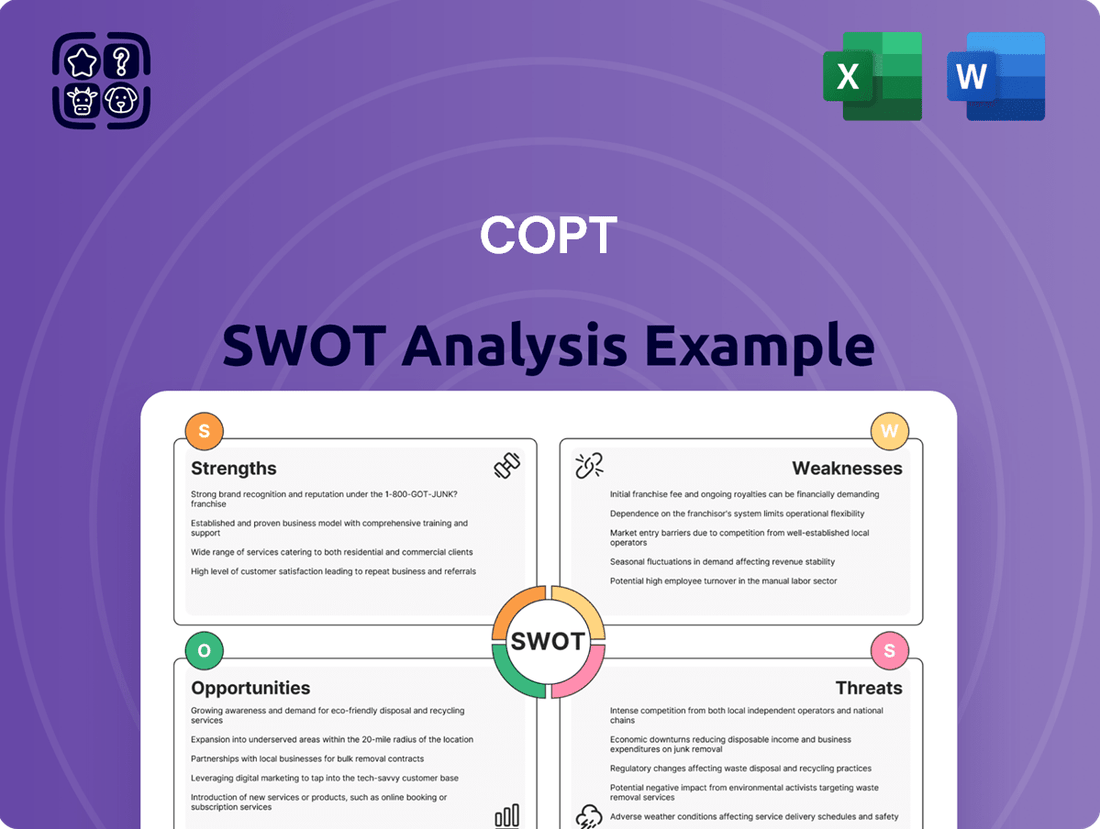

Delivers a strategic overview of COPT’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

The COPT SWOT Analysis offers a clear, organized framework to pinpoint and address strategic weaknesses, thereby relieving the pain of uncertainty and indecision.

Weaknesses

COPT's significant concentration within the U.S. government and defense sector, while a source of stability, presents a notable weakness. This reliance makes the company susceptible to fluctuations in defense budgets, policy changes, and shifting government priorities. For instance, a slowdown in defense appropriations or increased administrative delays could directly affect COPT's ability to secure new leases or renew existing ones, impacting revenue streams.

COPT's reliance on U.S. government budgets makes it vulnerable to shifts in defense spending and national security priorities. For instance, while the FY 2025 defense budget supports current demand, future budget allocations might prioritize different areas, directly impacting COPT's specialized real estate needs.

A reduction in government spending or a change in strategic focus could lead to decreased demand for COPT's properties, affecting occupancy rates and rental income. This sensitivity to policy changes means COPT must carefully monitor evolving government fiscal plans and defense strategies to anticipate potential impacts on its portfolio.

As COPT operates within established defense industry hubs, the potential for substantial new development or expansion in these mature markets may be constrained. This could mean that future growth might hinge on redeveloping or intensifying existing properties rather than securing entirely new, large-scale sites.

For instance, while COPT's portfolio is heavily weighted towards well-established defense corridors, the availability of prime, undeveloped land for significant new projects is becoming scarcer. This dynamic could necessitate a strategic shift towards acquiring and modernizing older facilities or focusing on smaller, infill development opportunities within its existing markets.

This market maturity might require COPT to explore growth avenues in less familiar geographic areas or sectors, potentially introducing new competitive pressures. Alternatively, the company may need to rely more on strategic acquisitions or lease renewals and expansions within its current tenant base to drive top-line growth.

Exposure to Interest Rate Fluctuations for New Debt

While Corporate Office Properties Trust (COPT) has a significant portion of its debt at fixed rates, this doesn't eliminate its exposure to interest rate fluctuations, particularly for future financing needs. As of late 2024, with interest rates remaining elevated compared to previous years, any new debt taken on for development projects or potential acquisitions will be priced at current market rates. This means if borrowing costs continue to rise, COPT could face higher interest expenses on new borrowings.

This increased cost of capital could indeed impact the profitability of new ventures. For instance, a higher interest burden on a new development could reduce the net operating income generated, potentially affecting the overall feasibility and return on investment. Even with a robust balance sheet, rising rates present a headwind for growth initiatives requiring external financing.

- Future Debt Costs: New debt issuance will be subject to prevailing interest rates, which, as of the latest available data in mid-2025, have shown volatility.

- Impact on Profitability: Higher borrowing costs for new projects can directly reduce profit margins and alter the financial viability of development plans.

- Development Feasibility: Increased financing expenses may necessitate adjustments to project scope or timelines, potentially delaying or impacting the feasibility of new builds and acquisitions.

Competition from Other Real Estate Providers

While COPT focuses on a specific sector, it isn't immune to competition. Other real estate developers and landlords, including those in data center and office REITs, could expand into government-adjacent properties, intensifying rivalry.

Analysts have pointed to potential challenges in pricing power and competition within COPT's key markets, particularly when it comes to lease renewals and attracting new tenants to fill vacancies. For instance, the REIT sector generally saw occupancy rates fluctuate, with some office REITs reporting declines in the early part of 2024, which could pressure COPT’s leasing efforts.

- Increased Competition: Other REITs, even those in different sectors like data centers, may enter COPT's niche.

- Pricing Power Concerns: Analysts are watching how COPT can maintain favorable pricing during renewals and new leases.

- Market Vacancy Rates: Broader trends in commercial real estate, including office vacancy, can indirectly impact COPT's leasing environment.

COPT's concentrated tenant base, primarily U.S. government agencies, creates a significant dependency. This single-sector focus exposes the company to risks tied to federal appropriations and policy shifts, which can directly impact leasing and revenue. For example, changes in defense spending priorities could lead to reduced demand for specialized facilities, affecting occupancy and rental income.

The maturity of COPT's core markets, often established defense hubs, limits opportunities for large-scale greenfield development. This necessitates a strategy focused on redevelopment or intensification of existing properties, potentially restricting expansive growth avenues. Consequently, future expansion may rely more on strategic acquisitions or maximizing lease renewals within its current portfolio.

Elevated interest rates in 2024 and 2025 mean that any new debt COPT takes on for development or acquisitions will incur higher financing costs. This increased cost of capital can directly reduce the profitability of new projects and impact the overall financial viability of growth initiatives. For instance, a 1% increase in borrowing costs on a substantial new development could significantly increase annual interest expenses.

COPT faces competitive pressures from other real estate entities, including data center and office REITs, which could pivot into government-adjacent properties. This intensified rivalry may affect COPT's pricing power during lease renewals and its ability to fill vacancies, particularly as broader office market vacancy rates saw fluctuations throughout 2024.

Preview the Actual Deliverable

COPT SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the complete report, ensuring you know exactly what you're getting. The structure and depth you see here are representative of the full, actionable insights contained within. Purchase unlocks the entire in-depth version, ready for your strategic planning.

Opportunities

The U.S. defense sector's ongoing commitment to enhancing national security, especially in cybersecurity and intelligence, creates a fertile ground for companies like COPT. This trend is underpinned by significant budgetary allocations, with the Department of Defense's budget showing consistent upward movement.

For fiscal year 2024, the U.S. defense budget request was approximately $886 billion, a figure that underscores the government's priority on these critical areas. This sustained investment translates directly into increased demand for specialized, secure real estate solutions that COPT is well-positioned to provide.

Future investments are expected to heavily favor advanced technologies and resilient infrastructure, directly benefiting COPT's portfolio of secure, mission-critical facilities. The growing reliance on digital defense necessitates secure data centers and specialized office spaces, aligning perfectly with COPT's strategic focus.

The burgeoning demand for data center space, especially driven by AI and the cloud, presents a significant opportunity for COPT. We see this as a prime area for growth.

COPT's established strength in secure, government-grade facilities means we are uniquely positioned to serve the increasing needs of federal agencies and defense contractors for robust data storage and processing capabilities.

In 2024, the U.S. government's digital transformation initiatives, coupled with the rapid adoption of AI by defense entities, underscore the critical need for specialized data center solutions, a market COPT is well-equipped to address.

COPT can capitalize on its investment-grade balance sheet to actively pursue strategic acquisitions. These acquisitions would focus on properties that complement its existing defense and IT-centric portfolio, a strategy evidenced by its first property acquisitions since 2015 in 2024. This move signals a clear intent to grow through inorganic expansion.

Joint ventures present another significant opportunity for COPT to broaden its reach. By partnering with other entities, COPT can gain entry into new, high-demand defense-related markets or acquire specialized asset types that might be difficult to obtain independently. This collaborative approach can accelerate market penetration and diversify revenue streams.

Development of Build-to-Suit Properties

COPT's capacity to construct build-to-suit properties that precisely match tenant needs, especially for government entities requiring stringent security, is a significant strength. This capability enables the company to attract and retain long-term leases with creditworthy tenants, thereby ensuring stable and substantial rental income streams.

This specialized development approach allows COPT to capture premium rents, as these bespoke facilities often command higher rates due to their unique specifications and the critical nature of the tenants' operations. For instance, securing a 15-year lease for a secure data center, a typical build-to-suit project, can provide predictable cash flow for an extended period.

- Tailored Development: COPT can design and build properties to exact tenant specifications, ensuring a perfect fit for specialized operations.

- Long-Term Leases: This approach facilitates securing lengthy lease agreements, often 10-20 years, with high-quality, credit-backed tenants.

- Premium Rental Income: Build-to-suit properties typically yield higher rental income compared to standard commercial spaces due to their custom nature and tenant commitment.

- Competitive Advantage: The ability to deliver these specialized facilities differentiates COPT in the market, particularly within the government and defense sectors.

Technological Advancements in Secure Facilities

COPT has a significant opportunity to leverage technological advancements in secure facilities. By investing in cutting-edge security measures, COPT can solidify its position as a premier provider of highly secure real estate. This includes enhancing physical security systems, bolstering network resilience, and integrating sustainable building practices, all of which are increasingly critical for government tenants. For instance, the demand for facilities compliant with stringent government security standards, such as those requiring advanced cybersecurity infrastructure and controlled access, is growing. In 2024, the global physical security market was valued at approximately $115 billion, with cybersecurity for infrastructure also seeing substantial investment as agencies prioritize data protection and operational continuity.

The implementation of advanced technologies can directly translate into enhanced property value and tenant retention. COPT can differentiate itself by offering facilities equipped with state-of-the-art surveillance, biometric access controls, and robust data center infrastructure. This focus on innovation aligns with the evolving needs of defense and intelligence agencies, who often require facilities that can withstand sophisticated threats and ensure uninterrupted operations. The U.S. federal government alone is projected to spend over $100 billion on cybersecurity in fiscal year 2025, highlighting the market's focus on secure environments.

- Enhanced Security Features: Implementing advanced physical and digital security measures to meet stringent government requirements.

- Network Resilience: Investing in infrastructure that ensures reliable and secure data transmission and communication for tenants.

- Sustainable Building Practices: Incorporating eco-friendly technologies and design to reduce operational costs and meet environmental mandates, which are increasingly important for government contracts.

- Tenant Appeal: Attracting and retaining high-value government tenants by offering unparalleled security and operational continuity.

COPT is well-positioned to benefit from the increasing demand for secure, specialized real estate driven by government spending on defense and technology. The company's expertise in developing build-to-suit facilities and its investment-grade balance sheet provide opportunities for strategic growth through acquisitions and joint ventures.

Leveraging technological advancements in facility security and incorporating sustainable practices will further enhance COPT's competitive advantage and tenant appeal, particularly within the government and defense sectors.

| Opportunity Area | Key Driver | COPT's Advantage | 2024/2025 Data/Trend |

|---|---|---|---|

| Defense Sector Growth | Increased national security spending | Expertise in secure, mission-critical facilities | DoD budget request ~ $886 billion (FY24) |

| Data Center Demand | AI and cloud adoption | Existing secure government-grade facilities | Significant investment in secure data centers |

| Strategic Acquisitions | Portfolio expansion and diversification | Investment-grade balance sheet | First property acquisitions since 2015 in 2024 |

| Build-to-Suit Development | Tenant-specific security needs | Ability to deliver bespoke, premium rental properties | Long-term leases (10-20 years) common |

| Technology Integration | Enhanced security and operational efficiency | Focus on cutting-edge security measures | Global physical security market ~$115 billion (2024) |

Threats

While COPT benefits from current defense spending, future government budget sequestration or significant cuts to defense budgets pose a considerable threat. These fiscal adjustments could directly reduce demand for COPT's specialized real estate portfolio, potentially leading to lease non-renewals or downward pressure on rental rates.

Changes in government procurement and leasing policies pose a significant threat. For instance, a shift towards more flexible or shorter-term government leases could impact COPT’s long-term revenue stability. We've already seen administrative delays in government lease renewals, which directly affect occupancy and income streams.

While COPT currently benefits from fixed-rate debt, a prolonged high-interest rate environment, which saw the Federal Reserve maintain its target range at 5.25%-5.50% through early 2024, could significantly increase the expense of securing new financing and refinancing upcoming debt maturities. This escalation in borrowing costs has the potential to narrow profit margins and negatively influence the perceived value of COPT's properties.

Furthermore, the inherent choppiness in capital markets, exemplified by fluctuations in major indices like the S&P 500 throughout 2023 and into 2024, presents a considerable hurdle for COPT in its efforts to raise capital for future development and expansion initiatives.

Intensified Competition in Data Center Market

The data center market is incredibly crowded, featuring major global players like Equinix and Digital Realty, which can make it challenging for any company to stand out. While Corporate Office Properties Trust (COPT) carves out a specific niche, the intensifying competition for government and defense data center contracts presents a tangible threat. This heightened rivalry could potentially erode COPT's pricing leverage and chip away at its market share in these critical sectors.

The demand for secure, high-performance data centers, particularly from government and defense entities, is robust. However, this also attracts significant investment and operational expansion from established competitors. For instance, in 2024, major data center REITs continued aggressive capital deployment, with companies like Equinix announcing substantial expansion plans, signaling a more competitive landscape for securing long-term leases and favorable contract terms.

- Increased Competition: Major players like Equinix and Digital Realty are expanding their footprints, intensifying rivalry for government and defense contracts.

- Pricing Pressure: A crowded market can lead to reduced pricing power for COPT as clients have more alternatives.

- Market Share Erosion: Fiercer competition could impact COPT's ability to maintain or grow its market share in its specialized data center segments.

- Capital Deployment: Competitors are investing heavily in data center infrastructure, increasing the overall supply and the need for differentiation.

Cybersecurity Risks and Physical Security Breaches

Cybersecurity risks are a significant concern for COPT, especially given its portfolio of mission-critical facilities. A breach could expose sensitive government tenant data, leading to severe reputational damage and potential loss of contracts. For instance, the US government alone spent an estimated $22.4 billion on cybersecurity in fiscal year 2024, highlighting the scale of this threat across all sectors.

Physical security breaches at COPT's properties pose another substantial threat. Compromising the physical integrity of these high-security locations could disrupt operations for critical government agencies and their contractors. The FBI reported a 60% increase in reported ransomware attacks against critical infrastructure organizations between 2022 and 2023, underscoring the escalating physical and digital threats.

- Cybersecurity threats: Potential for sensitive data breaches affecting government tenants.

- Physical security vulnerabilities: Risks of unauthorized access impacting critical operations.

- Reputational damage: Negative impact from security incidents, affecting trust and future business.

- Financial losses: Costs associated with remediation, legal liabilities, and lost revenue from contract disruptions.

Government budget sequestration or significant cuts to defense spending represent a substantial threat, potentially reducing demand for COPT's real estate and impacting rental rates. Changes in government leasing policies, such as a move towards shorter-term leases, could also destabilize COPT's revenue streams, as evidenced by recent administrative delays in lease renewals affecting occupancy.

The ongoing high-interest rate environment, with the Federal Reserve maintaining its target range at 5.25%-5.50% through early 2024, increases the cost of new financing and refinancing, squeezing profit margins. Furthermore, the volatility in capital markets, seen in S&P 500 fluctuations during 2023-2024, hinders COPT's ability to raise capital for expansion.

Intensifying competition in the data center market, with giants like Equinix and Digital Realty aggressively expanding, threatens COPT's market share and pricing power for government contracts. Cybersecurity and physical security breaches at COPT's mission-critical facilities pose severe risks, potentially leading to data exposure, reputational damage, contract loss, and significant financial liabilities, especially given the US government's $22.4 billion cybersecurity spending in FY2024.

| Threat Category | Specific Risk | Potential Impact | Supporting Data/Trend |

|---|---|---|---|

| Fiscal Policy | Government Budget Cuts/Sequestration | Reduced demand, lower rental rates, lease non-renewals | Defense spending priorities can shift based on economic conditions. |

| Leasing Policy | Shorter Lease Terms | Revenue instability, reduced predictability | Administrative delays in renewals have impacted occupancy. |

| Interest Rates | Increased Borrowing Costs | Narrowed profit margins, reduced property valuation | Federal Reserve target range: 5.25%-5.50% (early 2024) |

| Capital Markets | Market Volatility | Difficulty raising capital for expansion | S&P 500 fluctuations (2023-2024) |

| Competition | Aggressive Competitor Expansion | Pricing pressure, market share erosion | Equinix, Digital Realty expanding footprints. |

| Security | Cybersecurity Breaches | Reputational damage, contract loss, financial penalties | US Gov cybersecurity spending: $22.4 billion (FY2024) |

| Security | Physical Security Breaches | Operational disruption, reputational damage | Ransomware attacks up 60% (2022-2023) against critical infrastructure. |

SWOT Analysis Data Sources

The data sources for this COPT SWOT analysis include a comprehensive review of the company's financial reports, detailed market research, and expert opinions within the energy sector to provide a robust and actionable assessment.