COPT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COPT Bundle

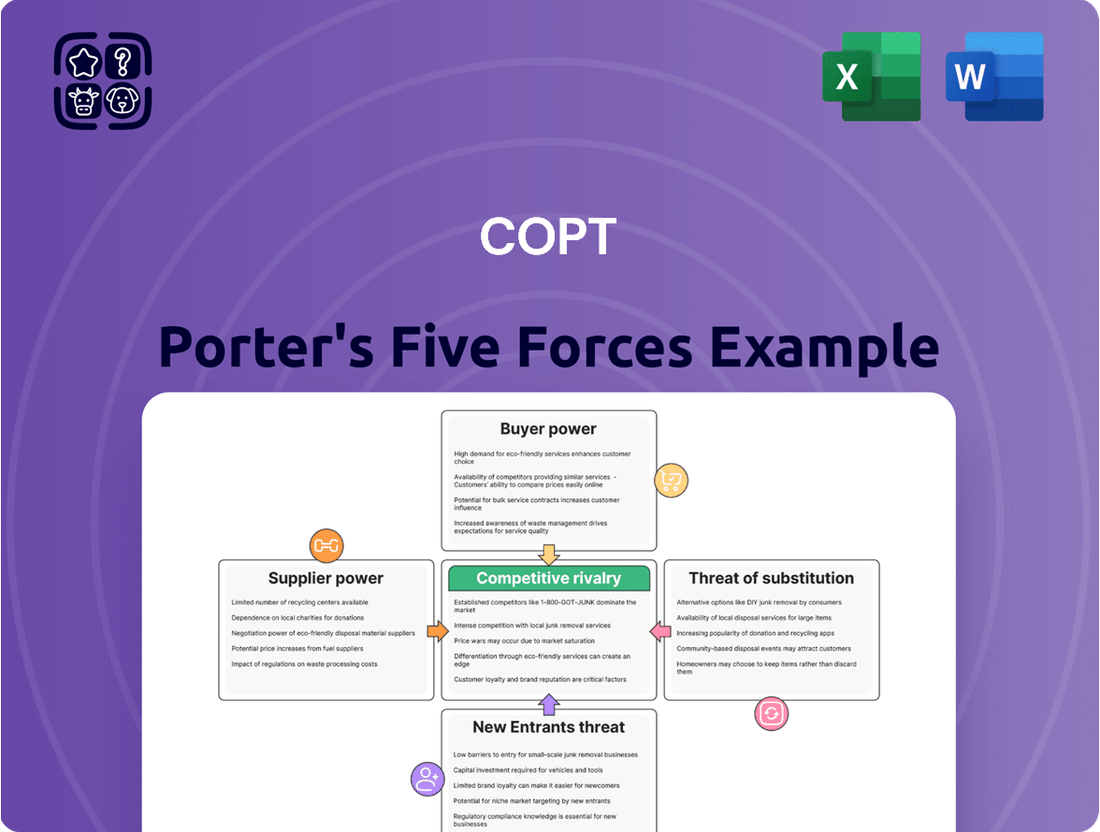

Understanding the competitive landscape is crucial for any business, and COPT's industry is no exception. Our Porter's Five Forces analysis delves into the intricate forces shaping this market, from the bargaining power of buyers and suppliers to the intensity of rivalry among existing competitors.

We've also examined the ever-present threat of new entrants and the potential disruption from substitute products. This initial glimpse offers a foundational understanding of COPT's market dynamics.

The complete report reveals the real forces shaping COPT’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

COPT's reliance on specialized construction and security providers for its government and defense sector clients is a key factor in understanding supplier bargaining power. These firms often possess unique security clearances and technical expertise that are not easily replicated, giving them a distinct advantage.

The limited pool of contractors capable of meeting stringent government security requirements, such as those mandated by agencies like the Department of Defense or intelligence community, can translate to moderate to high bargaining power for these suppliers. This is particularly true for highly customized projects requiring specific accreditations or specialized construction methods.

For instance, in 2024, the demand for secure, purpose-built facilities within the defense industrial base remained robust, driven by ongoing national security priorities. Companies possessing the necessary Top Secret facility clearances and a proven track record in delivering sensitive projects could command premium pricing and favorable contract terms.

This concentration of specialized expertise means COPT may face situations where the cost of switching suppliers is high, further bolstering the bargaining power of existing or potential providers of these critical construction and security services.

The scarcity of suitable land parcels near U.S. defense installations, a key focus for COPT, can significantly bolster the bargaining power of landowners. This limited availability means fewer options for COPT, potentially driving up acquisition costs for essential development sites. For instance, in 2024, the demand for strategically located real estate near military bases remained robust, reflecting ongoing defense spending and infrastructure needs.

When a company like a data center relies on highly specialized security systems or critical infrastructure components, switching to a new vendor becomes a significant undertaking. Consider the substantial investment in proprietary hardware and software integration; a 2024 estimate suggests that migrating such complex systems could easily run into millions of dollars in direct costs and lost operational time.

This deep integration means a company becomes heavily dependent on its current supplier for ongoing maintenance, essential upgrades, and the supply of compatible replacement parts. For example, a specialized cooling system integral to a data center's operation might only have a single, certified provider for replacement parts, giving that supplier considerable leverage in pricing and service availability.

Labor and Material Costs

The bargaining power of suppliers significantly impacts COPT's profitability, particularly concerning labor and material costs. Suppliers of specialized labor, such as skilled construction workers or cybersecurity experts, and critical materials, like advanced IT equipment, can wield considerable influence. This power is amplified when their availability is limited or when their costs experience substantial volatility.

Recent trends highlight this vulnerability. For instance, the construction sector in 2024 continued to grapple with labor shortages, with some regions reporting a deficit of up to 30% in skilled trades. This scarcity directly translates to higher wage demands from workers, increasing COPT's project development expenses. Similarly, disruptions in the supply chain for specialized building materials, exacerbated by geopolitical events in early 2024, led to an average price increase of 15% for key components used in commercial real estate development.

- Labor Shortages: Persistent lack of skilled trades in construction impacts project timelines and increases labor costs for COPT.

- Material Cost Volatility: Global supply chain disruptions in 2024 caused significant price hikes for essential building materials.

- Specialized Equipment: Access to and cost of advanced IT and construction equipment can be dictated by a limited number of suppliers.

- Impact on COPT: These supplier pressures directly affect COPT's operational expenses and ability to control development costs.

Technology Providers for Data Centers

COPT relies heavily on technology providers for essential data center components like servers, cooling systems, and networking equipment. The rapid pace of technological advancement means that access to cutting-edge solutions from specialized suppliers can significantly influence COPT's operational capabilities and costs. For instance, in 2024, the demand for advanced AI-specific hardware, such as high-performance GPUs, saw significant price increases and supply constraints, granting considerable power to the few manufacturers capable of meeting this demand.

When these technology providers offer proprietary or industry-standard solutions that are difficult to substitute, their bargaining power intensifies. This situation can arise if a particular server architecture or cooling technology becomes the de facto standard, making it costly and time-consuming for COPT to switch to alternatives. The market for specialized data center infrastructure, particularly for hyperscale and AI-focused facilities, often exhibits such concentration among key suppliers.

- Supplier Concentration: The data center technology market, especially for high-performance computing and AI infrastructure, is characterized by a limited number of dominant players in areas like advanced processors and specialized cooling solutions.

- Switching Costs: Integrating new hardware or software into existing data center infrastructure can involve substantial costs related to compatibility testing, reconfiguration, and potential downtime, increasing supplier leverage.

- Proprietary Technology: Suppliers offering unique, patented technologies for critical functions like power management or thermal control can command higher prices and exert greater influence.

- Market Demand: Surging demand for data center capacity, particularly driven by AI workloads in 2024, has amplified the bargaining power of key technology vendors who can meet these specialized needs.

The bargaining power of suppliers for COPT, particularly in specialized construction and data center technology, is a significant factor. This power stems from limited competition, high switching costs, and the proprietary nature of certain goods and services.

In 2024, the demand for advanced AI hardware, like GPUs, surged, leading to price increases and supply constraints from dominant manufacturers, directly impacting data center infrastructure costs for companies like COPT. Similarly, skilled labor shortages in construction, with some regions facing deficits of up to 30% in 2024, drove up wages and project expenses.

| Supplier Factor | Impact on COPT | 2024 Data/Trend |

|---|---|---|

| Specialized Construction Labor | Increased project development costs and potential delays. | Skilled trades shortages up to 30% in some regions, driving wage increases. |

| Advanced Data Center Hardware (e.g., GPUs) | Higher capital expenditures for AI-focused infrastructure. | Significant price increases and supply constraints due to surging AI demand. |

| Proprietary Cooling Systems | High switching costs and dependence on single suppliers for maintenance/parts. | Limited providers for specialized, integrated systems amplify supplier leverage. |

What is included in the product

Uncovers the intensity of competition, buyer and supplier power, threat of new entrants, and substitutes specific to COPT's operating environment.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force on a dynamic, interactive dashboard.

Customers Bargaining Power

COPT's customer base, primarily U.S. government agencies and defense contractors, represents a concentrated group. This concentration grants these entities significant bargaining power. Their ability to influence lease terms is substantial, especially given their large leasing volumes and the critical nature of their mission requirements. These customers can effectively demand specific concessions, impacting COPT's pricing and contract conditions.

The mission-critical and high-security nature of COPT's properties significantly limits customer bargaining power. These facilities are essential for national security and critical infrastructure, meaning tenants face immense costs and risks if they were to relocate. Consider the extensive lead times and security clearances required to move sensitive operations, which can easily extend for months or even years, making immediate renegotiation leverage weak.

Government procurement processes often involve lengthy negotiation periods due to specific regulations and budgeting cycles. This can sometimes limit the bargaining power of individual suppliers, but it also offers stability once a contract is secured. For instance, in 2024, many government agencies are focused on optimizing real estate portfolios, which could impact long-term leasing demand and, consequently, the bargaining power of property owners.

Demand for Specialized Solutions

Customers often need highly specialized facilities, particularly in sectors like data centers and cybersecurity, which means their requirements are very specific. This demand for tailored solutions narrows down the number of providers who can adequately meet these unique needs, giving customers less leverage to switch providers easily. For instance, a government agency requiring top-tier, SCIF-compliant space cannot simply go to any commercial real estate provider; they need specialists.

COPT's proven ability to deliver these bespoke, secure facilities is a significant factor. Their expertise in constructing and managing properties that meet stringent government and defense contractor requirements means customers are often locked into relationships because finding comparable, ready-to-go alternatives is difficult and time-consuming. This specialized capability reduces the bargaining power of these particular customer segments.

This specialized demand can be seen in the leasing trends for properties designed for sensitive government operations. For example, in 2024, the demand for secure, SCIF-certified facilities remained robust, with vacancy rates for such specialized spaces staying exceptionally low, indicating that tenants seeking these capabilities have limited options and thus less power to negotiate unfavorable terms.

- Specialized Facility Needs: Customers increasingly require facilities with unique security, technological, and operational specifications.

- Limited Alternatives: The niche nature of these requirements restricts the number of providers capable of meeting them.

- COPT's Competitive Edge: COPT's expertise in developing and managing specialized, secure properties enhances customer retention.

- Reduced Customer Bargaining Power: The difficulty in finding comparable alternatives limits customers' ability to negotiate aggressively.

Budgetary Pressures and Return-to-Office Mandates

Government agencies, facing significant budgetary pressures, are actively seeking ways to optimize their real estate footprints. This trend, amplified by evolving work-from-home policies and legislative mandates for space efficiency, grants these entities greater bargaining power when negotiating lease terms. For instance, a 2024 government report highlighted a national initiative to consolidate agency offices, aiming to reduce leased square footage by 15% by 2028, directly impacting landlords’ negotiating positions.

The push for reduced operational costs and the potential for underutilized space in existing leases empower government entities as customers. This leverage is particularly evident during lease renewal periods or when entering new leasing agreements. The ability to walk away or demand more favorable terms, such as reduced rental rates or shorter lease durations, increases significantly.

- Increased Scrutiny on Real Estate Spending: Government budgets are under constant review, leading to a demand for demonstrable value and cost savings in property leases.

- Remote Work Impact: A sustained shift towards hybrid and remote work models has reduced the need for physical office space, giving agencies more flexibility and leverage.

- Legislative Drivers: New laws and executive orders specifically target government real estate efficiency, compelling agencies to renegotiate or downsize leases.

- Market Data Utilization: Government negotiators increasingly use up-to-date market data to challenge asking rents and secure advantageous lease terms, a trend observed throughout 2024.

The bargaining power of COPT's customers is influenced by the highly specialized nature of their real estate needs, particularly within the defense and intelligence sectors. These government agencies and contractors often require facilities with stringent security protocols, such as SCIF (Sensitive Compartmented Information Facility) certifications, which are not readily available in the general market. This specialization limits the pool of suitable providers, thereby reducing the customers' ability to switch easily and negotiate aggressively.

Government entities, driven by efficiency mandates and budget scrutiny, are actively seeking to optimize their real estate portfolios. This trend, noted prominently in 2024, allows them to exert greater leverage during lease negotiations. For instance, a 2024 government directive encouraged agencies to reduce their leased office space by 15% by 2028, directly impacting landlords' negotiating positions.

While the concentration of COPT's customer base, primarily U.S. government agencies and defense contractors, grants these entities significant bargaining power due to their large leasing volumes and critical mission requirements, their ability to demand concessions is tempered by the unique, mission-critical nature of the properties. Tenants face substantial costs and operational risks associated with relocating sensitive operations, which can require extensive lead times and security clearances, thus weakening immediate renegotiation leverage.

| Customer Segment | Bargaining Power Factor | Impact on COPT |

|---|---|---|

| U.S. Government Agencies | Concentrated buyer base, large lease volumes, mission-critical needs | Strong leverage for specific concessions and pricing |

| Defense Contractors | Demand for specialized, secure facilities (e.g., SCIF) | Limited alternatives reduce ability to switch, but also drive demand for tailored solutions |

| Budget-Conscious Agencies | Focus on real estate optimization and cost reduction (e.g., 2024 initiatives) | Increased pressure for favorable lease terms, potentially lower rents or shorter durations |

What You See Is What You Get

COPT Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are viewing a comprehensive Porter's Five Forces analysis for COPT, detailing the competitive landscape and strategic implications for the organization. This includes in-depth examinations of the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. The insights provided will equip you with a thorough understanding of the market dynamics affecting COPT's profitability and competitive positioning.

Rivalry Among Competitors

COPT's focus on a niche market – government agencies and defense contractors near U.S. defense installations – significantly shapes its competitive rivalry. This specialization creates a unique dynamic where competition is less about broad office REITs and more about the handful of companies deeply entrenched in this high-barrier-to-entry sector.

While this niche insulates COPT from generalized competition, it intensifies rivalry among the specialized players. For instance, in 2023, the U.S. Department of Defense's budget was approximately $886 billion, highlighting the substantial, albeit concentrated, demand within this sector. Companies like COPT compete fiercely for these government contracts and leases, often leveraging long-standing relationships and deep understanding of regulatory requirements.

The competitive rivalry within the government and defense real estate sector, where companies like COPT operate, is notably constrained by a limited number of direct competitors. This is a direct consequence of the exceptionally high barriers to entry, stemming from stringent security protocols, the necessity for highly specialized infrastructure, and the cultivation of enduring, trust-based relationships with government and defense agencies. For instance, as of 2024, the number of publicly traded REITs with a primary focus on U.S. government and defense-related properties remains a small, concentrated group, preventing the widespread commoditization often seen in less specialized real estate markets.

Corporate Office Properties Trust (COPT) enjoys a significant advantage through its long-term lease structures and impressive tenant retention, especially within its Defense/IT portfolio. This stability is a key factor in managing competitive rivalry.

The "stickiness" of COPT's customer base, meaning tenants find it difficult and costly to relocate, acts as a natural barrier against intense competition. When tenants are housed in mission-critical facilities, the disruption and expense associated with moving are substantial, thereby dampening the incentive to switch providers.

For instance, COPT's Defense/IT portfolio, which comprised approximately 88% of its total portfolio square footage as of the first quarter of 2024, demonstrates this resilience. High tenant retention in these specialized spaces means fewer vacancies and less pressure to lower rents to attract new occupants.

This long-term commitment from tenants, often spanning multiple years, reduces the frequency with which COPT must engage in aggressive pricing or service offerings to retain its market share, thereby softening the impact of competitive pressures.

Development and Acquisition Strategies

Competitive rivalry for COPT, particularly in the defense and government real estate sector, intensifies as other Real Estate Investment Trusts (REITs) and developers eye this specialized market. Their strategies often involve either developing new, purpose-built facilities or acquiring existing, strategically located properties. For instance, in 2024, the broader REIT market saw significant activity, with some players actively seeking niche sectors like those COPT occupies.

COPT's competitive edge hinges on its proficiency in identifying and securing prime locations, often near major defense installations, and its capability to develop specialized, mission-critical facilities. This expertise allows them to meet the unique demands of their tenant base. In 2023, COPT reported a portfolio of approximately 17.3 million square feet of gross leasable area, underscoring the scale of its operational footprint and the ongoing need for strategic development and acquisition to maintain market leadership.

- Focus on Prime Locations: COPT's strategy involves securing sites in proximity to key defense hubs, a critical differentiator in attracting and retaining defense-related tenants.

- Specialized Facility Development: The ability to construct and adapt properties to meet stringent government and defense requirements is a core competitive advantage.

- Acquisition Opportunities: Competitors may seek to grow by acquiring similar defense-oriented portfolios or by purchasing individual assets that align with COPT's target market.

- Market Entry by Other REITs: The defense real estate sector, while niche, can attract new entrants if perceived as offering stable, long-term returns, increasing competitive pressure.

Impact of Government Spending and Policy

Competitive rivalry within the commercial real estate sector, particularly for companies like COPT, is heavily shaped by U.S. defense spending and government real estate policies. For instance, a significant portion of COPT's portfolio is dedicated to the U.S. government, making it directly susceptible to changes in defense budgets. In fiscal year 2024, the U.S. defense budget was approximately $886 billion, a figure that directly impacts the demand for specialized real estate services and facilities.

Fluctuations in these budget allocations or shifts in strategic priorities can either open up new opportunities for providers or intensify competition for existing government contracts. Specialized providers who can adapt to changing government needs and demonstrate cost-effectiveness are better positioned to thrive in this environment. For example, if the government decides to consolidate certain operations or relocate facilities, it can create a surge in demand for specific types of properties, leading to heightened competition among REITs that serve these needs.

The intensity of rivalry is also influenced by how government entities approach leasing versus owning property. Policies that favor leasing can boost demand for companies like COPT, while those encouraging ownership might reduce opportunities. The government's real estate strategy, therefore, acts as a critical external factor influencing the competitive landscape.

- U.S. Defense Budget (FY2024): Approximately $886 billion.

- Portfolio Dependency: COPT's significant exposure to government tenants means its competitive position is directly tied to defense spending levels and government real estate policies.

- Policy Impact: Government decisions on leasing versus property ownership directly influence market opportunities and competitive intensity.

- Adaptability is Key: Providers who can align with evolving government strategic priorities and offer cost-efficient solutions gain a competitive edge.

Competitive rivalry for COPT is characterized by a limited number of highly specialized players, a direct result of high barriers to entry such as stringent security requirements and established government relationships. While this niche limits broad competition, it intensifies rivalry among those deeply entrenched in serving defense and government agencies. For instance, in 2024, the number of publicly traded REITs primarily focused on U.S. government and defense properties remains small and concentrated, preventing commoditization.

COPT's competitive advantage is further bolstered by its long-term lease structures and high tenant retention, particularly within its Defense/IT portfolio, which comprised roughly 88% of its total portfolio square footage as of Q1 2024. This tenant "stickiness," driven by the mission-critical nature of their facilities, significantly reduces the incentive for tenants to relocate, thus dampening direct competitive pressures on COPT.

Despite these advantages, other REITs and developers are increasingly eyeing this specialized market, leading to rivalry through new development or strategic acquisitions of defense-oriented properties. The overall U.S. defense budget, approximately $886 billion in fiscal year 2024, directly influences demand, meaning shifts in government spending or policy can either create opportunities or sharpen competition for existing contracts.

| Metric | Value (as of 2024 or latest available) | Impact on Rivalry |

|---|---|---|

| U.S. Defense Budget (FY2024) | ~$886 billion | Directly impacts demand and potential for competition. |

| COPT Defense/IT Portfolio Share | ~88% (Q1 2024) | High concentration in a specialized, less competitive segment. |

| Number of Specialized REITs | Small, concentrated group | Limits broad competition but intensifies rivalry among existing players. |

| Tenant Retention Rate | High (especially Defense/IT) | Reduces churn, lessening the need for aggressive competitive tactics. |

SSubstitutes Threaten

Government-owned facilities represent a key substitute for COPT's leased properties, particularly for defense and intelligence agencies. These entities have the capacity to self-fund and develop their own specialized, secure buildings, bypassing the need for private sector leasing. While the upfront capital expenditure and extended development timelines for such bespoke facilities are substantial, it remains a viable long-term alternative for government entities seeking complete control and customization of their operational infrastructure.

For less critical government functions, general-purpose office spaces can be adapted, potentially serving as a substitute for highly specialized facilities. This flexibility allows agencies to reconfigure spaces as needed, potentially reducing costs associated with custom builds. However, for many of COPT's core tenants, the unique security and operational demands make these generic spaces a less attractive or even unworkable alternative.

The burgeoning adoption of remote work and cloud computing presents a significant threat of substitutes for physical office and data center real estate. As more businesses embrace flexible work arrangements, the need for traditional office footprints diminishes. This trend was notably accelerated in 2024, with many companies solidifying hybrid or fully remote policies.

Cloud computing services offer scalable and cost-effective alternatives to on-premise data centers, reducing the demand for dedicated physical infrastructure. Companies are increasingly migrating their data and applications to cloud providers, impacting the market for colocation and enterprise data center facilities. For instance, global cloud spending continued its upward trajectory throughout 2024, with major providers reporting substantial revenue growth.

While mission-critical defense operations necessitate secure, on-premise facilities, the broader commercial real estate market faces incremental pressure from these substitute technologies. This shift could lead to higher vacancy rates and downward pressure on rental prices for office buildings and data centers not specifically tailored for high-security government contracts.

Alternative Data Center Solutions

Customers needing data center solutions do have alternatives. They can opt for colocation services from other providers or even establish their own smaller, on-premises data centers. For instance, in 2024, the global colocation market was valued at approximately $60 billion, indicating a competitive landscape.

However, COPT's distinct advantage lies in its specialized, high-security data center solutions. These offerings are meticulously designed to meet stringent requirements that often exceed the capabilities of standard commercial data centers. This focus on specialized needs, particularly in critical infrastructure sectors, differentiates COPT from more generalized providers.

Consider these points regarding substitutes:

- Colocation Services: A readily available alternative, with numerous providers offering space and connectivity. The market is robust, with significant investment continuing in 2024.

- In-House Data Centers: Building and managing proprietary data centers provides control but incurs substantial capital expenditure and ongoing operational costs.

- COPT's Niche: COPT's strength is in providing solutions tailored for specific, often government or defense-related, clients who require enhanced security and compliance standards not typically met by standard colocation facilities.

- Cost vs. Specialization: While substitutes might appear cheaper initially, they may not fulfill the specialized security and compliance mandates that COPT's clients prioritize.

Internal Adaptation and Repurposing

Existing government facilities can be adapted or repurposed, potentially reducing the demand for new leased office space from entities like Corporate Office Properties Trust (COPT). For instance, in 2024, many agencies continued to explore options for optimizing their current footprints before committing to new leases. However, the significant costs and logistical challenges associated with retrofitting older buildings to meet current security and technological requirements can limit the effectiveness of these substitutes.

The financial implications of repurposing are considerable. Upgrading outdated infrastructure, such as HVAC systems or cybersecurity measures in older government buildings, can easily run into millions of dollars per facility. For example, a comprehensive modernization of a 50-year-old federal office building could potentially cost upwards of $50 million, making new construction or leasing more appealing in many scenarios.

- Limited Viability: Retrofitting costs can exceed the expense of new construction or leasing, diminishing the attractiveness of repurposed government facilities as direct substitutes for modern office spaces.

- Technological Gaps: Older facilities may struggle to meet the advanced technological and security demands required by government tenants, especially those in defense and intelligence sectors.

- Strategic Focus: Government agencies often prioritize mission readiness and efficiency, which can make the disruption and uncertainty of large-scale retrofits less desirable compared to securing purpose-built, modern facilities.

- Cost-Benefit Analysis: A thorough cost-benefit analysis typically favors newer, adaptable spaces when considering long-term operational efficiency and security requirements.

The threat of substitutes for COPT's specialized real estate offerings, particularly for government tenants, is multifaceted. While remote work and cloud computing have impacted general office and data center demand, COPT's focus on high-security, mission-critical facilities creates a unique competitive landscape. Existing government facilities can be repurposed, but the significant costs and logistical hurdles of retrofitting older buildings to meet modern security and technological standards often make this a less attractive substitute than new construction or leasing. For instance, upgrading outdated infrastructure in a 50-year-old federal building could cost upwards of $50 million, potentially exceeding the expense of securing purpose-built modern spaces.

| Substitute Type | Description | Impact on COPT | 2024 Relevance/Data |

|---|---|---|---|

| Remote Work & Cloud Computing | Reduced need for physical office space; migration of data to cloud providers. | Decreased demand for traditional office leases; potential impact on colocation if not highly specialized. | Global cloud spending continued strong growth in 2024; many companies solidified hybrid/remote policies. |

| Repurposed Government Facilities | Adapting existing government buildings for new uses. | Limited threat due to high retrofitting costs and technological gaps for specialized needs. | Agencies explored footprint optimization, but modernization costs for older buildings can exceed $50M per facility. |

| Standard Colocation Services | Off-the-shelf data center space and connectivity. | COPT's niche in high-security, compliant facilities differentiates it. | Global colocation market valued around $60 billion in 2024, with many providers. |

| In-House Data Centers | Building and managing proprietary data centers. | High capital expenditure and operational costs can be a deterrent compared to specialized leased solutions. | Ongoing trend for specialized entities to outsource infrastructure management to focus on core missions. |

Entrants Threaten

The specialized real estate market, particularly for government and defense properties, presents a formidable barrier to entry due to exceptionally high capital requirements. Acquiring land in strategic locations, coupled with the costs associated with specialized construction and compliance with stringent security and regulatory standards, demands significant upfront investment. For instance, developing a secure, purpose-built facility for a government agency in 2024 could easily run into tens or even hundreds of millions of dollars, depending on the scale and specifications.

New entrants face a substantial barrier in developing the specialized expertise required for government procurement, security protocols, and intricate facility design. This deep knowledge base is crucial for success in this sector, demanding significant investment in training and development.

Obtaining necessary security clearances is a lengthy and complex process, often taking years to complete. For instance, in 2024, the average processing time for top-secret clearances in the US continued to be a significant bottleneck, impacting the speed at which new companies can become operational.

Building trust with government agencies and prime defense contractors is another formidable challenge. This requires a proven track record and consistent performance, which new entrants, by definition, lack. The established relationships and reputation of incumbents are powerful deterrents.

These combined hurdles of specialized knowledge, security vetting, and trust-building create a high barrier to entry, protecting existing players like COPT Porter.

The development of properties, particularly those near defense installations, is often hampered by extended zoning, permitting, and construction timelines. These lengthy processes can take several years, presenting a significant hurdle for newcomers attempting to enter the market.

Furthermore, securing government and defense contracts, a crucial avenue for companies like Corporate Office Properties Trust (COPT), necessitates the cultivation of long-term relationships and a strong reputation within the industry. This relationship-building phase is inherently time-consuming, creating a substantial disadvantage for new entrants who lack established trust and a proven track record.

Limited Niche Market Opportunities

The market for highly specialized defense and government-adjacent properties presents a significant barrier to new entrants due to its inherently niche nature. These opportunities are often geographically concentrated, typically near key military installations or federal agencies, which restricts the pool of potential development sites. For instance, as of 2024, the demand for facilities supporting critical defense infrastructure remains high, but the available land parcels meeting strict security, zoning, and proximity requirements are scarce.

Identifying and securing suitable development sites that meet these stringent security and proximity requirements is a complex and challenging process, inherently limiting widespread entry. Newcomers must navigate a landscape where existing players often have established relationships and a deep understanding of the specific regulatory and operational demands. This complexity, coupled with the need for substantial capital investment to meet specialized building standards, effectively curtails the threat of new entrants.

- Niche Market Focus: The defense and government real estate sector is not a broad market but a specialized segment with limited opportunities.

- Geographic Concentration: Prime locations are tied to the presence of specific military bases or federal agencies, reducing the number of viable markets.

- Site Acquisition Challenges: Finding land that meets rigorous security, zoning, and proximity mandates is difficult and time-consuming for new developers.

- High Capital Requirements: Specialized construction and security features necessitate significant upfront investment, deterring smaller or less capitalized entrants.

Regulatory and Compliance Burdens

The defense sector is heavily regulated, presenting a significant barrier to new entrants. Companies must adhere to a complex web of government regulations, compliance standards, and evolving defense appropriations, which can be costly and time-consuming to navigate. For instance, in 2024, defense contractors faced increased scrutiny on supply chain security and cybersecurity protocols, adding layers of compliance overhead.

Ensuring adherence to these stringent requirements necessitates substantial investment in legal expertise, specialized personnel, and robust internal control systems. This steep learning curve and the associated overheads can deter potential new players, effectively limiting the threat of new entrants.

Key compliance areas impacting new entrants include:

- Export Controls: Navigating international arms trade regulations like ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations).

- Quality Assurance Standards: Meeting defense-specific quality certifications such as AS9100.

- Security Clearances: Obtaining and maintaining necessary security clearances for personnel and facilities.

- Contracting Requirements: Understanding and complying with complex government contracting processes and reporting mandates.

The threat of new entrants in the specialized real estate market, particularly for government and defense properties, is significantly low. High capital requirements, lengthy security clearance processes, and the need for specialized expertise create substantial barriers. For instance, acquiring land near critical military installations in 2024 often involved complex negotiations and significant upfront costs, easily reaching tens of millions of dollars for suitable parcels.

Established players like COPT benefit from decades of experience in navigating intricate government procurement, stringent security protocols, and specialized construction demands. Building the necessary trust and reputation with government agencies and prime defense contractors is a time-consuming endeavor, typically taking years to cultivate, which new entrants inherently lack.

Furthermore, the niche nature of the market, often concentrated around specific military bases or federal agencies, limits the availability of suitable development sites. Finding and securing these locations requires deep market knowledge and established relationships, further deterring potential new competitors.

| Barrier to Entry | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | Extremely high costs for land acquisition and specialized construction. | Developing a secure facility could exceed $100 million. |

| Specialized Expertise | Deep knowledge of government procurement and security standards is essential. | Significant investment needed in training for compliance and design. |

| Security Clearances | Lengthy and complex vetting processes for personnel and facilities. | Top-secret clearance processing times remained a significant bottleneck. |

| Brand Reputation & Trust | Proven track record and established relationships are critical for securing contracts. | New entrants lack the incumbent advantage of trust and performance history. |

| Regulatory Compliance | Navigating a complex web of defense regulations and appropriations. | Increased scrutiny on supply chain security added compliance overhead. |

Porter's Five Forces Analysis Data Sources

Our COPT Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available financial statements, industry-specific market research reports, and expert analyst commentary to capture the full spectrum of competitive dynamics.