COPT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COPT Bundle

Navigate the complex external forces shaping COPT's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting the company's operations and future growth. This expert-crafted report provides actionable insights to inform your strategic decisions and competitive positioning. Don't be left in the dark; gain a critical understanding of COPT's operating environment. Download the full PESTLE analysis now to unlock a deeper level of market intelligence and secure your advantage.

Political factors

Government defense spending is a critical factor for COPT, as its business is deeply tied to U.S. government needs, particularly in defense and intelligence. The outlook for 2025 suggests robust defense outlays, which directly supports COPT's specialized real estate portfolio.

The U.S. Department of Defense's budget request for fiscal year 2025 was a substantial $849.8 billion. Projections indicate this figure could climb to approximately $866 billion by 2029, underscoring a consistent and elevated level of government investment in national security.

This sustained high level of defense spending acts as a significant demand driver for COPT's properties, which are often located in proximity to key defense installations and intelligence agencies. Such consistent government investment provides a stable foundation for COPT's revenue streams.

The predictability of federal budget cycles is crucial for COPT's strategic planning and investment decisions. Federal procurement activities saw a notable increase in early 2025, exceeding austerity forecasts, which suggests a degree of stability. However, the potential for continuing resolutions or sudden shifts in budgetary priorities can introduce an element of uncertainty for companies like COPT that rely on government contracts.

The current global geopolitical landscape is marked by heightened tensions, directly shaping U.S. national security priorities and, by extension, defense spending. This dynamic environment necessitates a strategic allocation of resources towards emerging threats and technological advancements.

The Fiscal Year 2025 Department of Defense budget request, for instance, reflects a significant emphasis on unmanned systems and securing strategic geographic areas. This focus underscores the growing demand for specialized, secure facilities capable of supporting these critical defense initiatives.

COPT's portfolio, which includes secure, specialized facilities, is therefore strategically positioned to benefit from these evolving national security requirements. The company's real estate assets align with the Pentagon's stated needs for supporting advanced defense technologies and operations.

For example, the FY2025 DoD budget proposes $13.5 billion for research, development, testing, and evaluation of advanced capabilities, including autonomous systems and cyber warfare. This indicates a substantial investment in areas where COPT's secure infrastructure can play a vital role.

Government Procurement Policy Changes

Changes to the Federal Acquisition Regulation (FAR), with key amendments anticipated around December 2024 and January 2025, will significantly alter the landscape of government contract awards and administration. These updates are crucial for COPT and its defense contractor tenants, demanding continuous adaptation to ensure compliance.

Specifically, revised regulations will likely introduce clearer guidelines for System for Award Management (SAM) registration, impacting the eligibility and administrative processes for contractors. Furthermore, expect renewed emphasis on small business participation goals, potentially reshaping subcontracting opportunities and reporting requirements for prime contractors.

- FAR Amendments (Effective Dec 2024/Jan 2025): Anticipated revisions will refine contract award procedures and oversight.

- SAM Registration Clarifications: Expect updated requirements for SAM registration, impacting contractor eligibility.

- Small Business Participation: New directives may strengthen mandates for small business inclusion in government contracts.

Policy Shifts by New Administrations

A significant political factor for COPT (Corporate Office Properties Trust) revolves around potential policy shifts following a change in presidential administration, such as the anticipated return of Donald Trump in 2025. Such a transition could lead to adjustments in fiscal stimulus measures and tax policies, which might offer new opportunities or challenges for real estate investors like COPT. For instance, changes in corporate tax rates could directly impact profitability for REITs and their tenants.

However, the economic landscape is also influenced by broader policy changes. Potential implementation of new import tariffs, for example, could create inflationary pressures or disrupt supply chains, indirectly affecting the demand for office space and the operational costs for COPT's tenants across various sectors, including technology and defense.

- Potential Impact of Tax Policy Changes: If a new administration enacts lower corporate tax rates, it could boost tenant profitability, potentially leading to increased demand for office space and higher rental income for COPT.

- Inflationary Effects of Tariffs: Increased tariffs could drive up the cost of goods and services, contributing to inflation and potentially impacting the cost of construction and maintenance for COPT's properties.

- Stimulus Measures and Economic Growth: Fiscal stimulus packages could stimulate overall economic activity, which generally benefits commercial real estate by increasing job growth and business expansion, thereby supporting COPT's leasing efforts.

Government defense spending remains a primary political driver for COPT, with the FY2025 budget request of $849.8 billion signaling continued robust investment in national security. This elevated spending directly supports COPT's specialized real estate portfolio, particularly properties near defense installations and intelligence agencies, ensuring stable demand and revenue.

Anticipated changes to the Federal Acquisition Regulation (FAR) in late 2024 and early 2025 will likely refine government contract processes, including SAM registration and small business participation mandates. These amendments are critical for COPT and its defense contractor tenants, requiring ongoing adaptation for compliance and to navigate evolving subcontracting opportunities.

The political climate, including potential shifts in presidential administrations and related fiscal policies in 2025, could influence tax rates and stimulus measures. Such changes may present both opportunities and challenges for COPT and its tenants, impacting profitability and demand for commercial real estate.

| Political Factor | 2024/2025 Data/Projection | Impact on COPT |

| U.S. Defense Spending | FY2025 Budget Request: $849.8 billion; Projected to ~$866 billion by 2029 | Directly supports demand for COPT's specialized real estate, ensuring stable revenue. |

| Federal Procurement Activities | Notable increase in early 2025, exceeding austerity forecasts. | Suggests stability in government contracting, benefiting COPT's leasing. |

| FAR Amendments | Anticipated effective Dec 2024/Jan 2025. | Requires adaptation for COPT and tenants due to changes in contract award and administration. |

| Potential Policy Shifts (e.g., Presidential Administration Change) | Anticipated for 2025. | Could alter tax policies and stimulus measures, impacting tenant profitability and real estate demand. |

What is included in the product

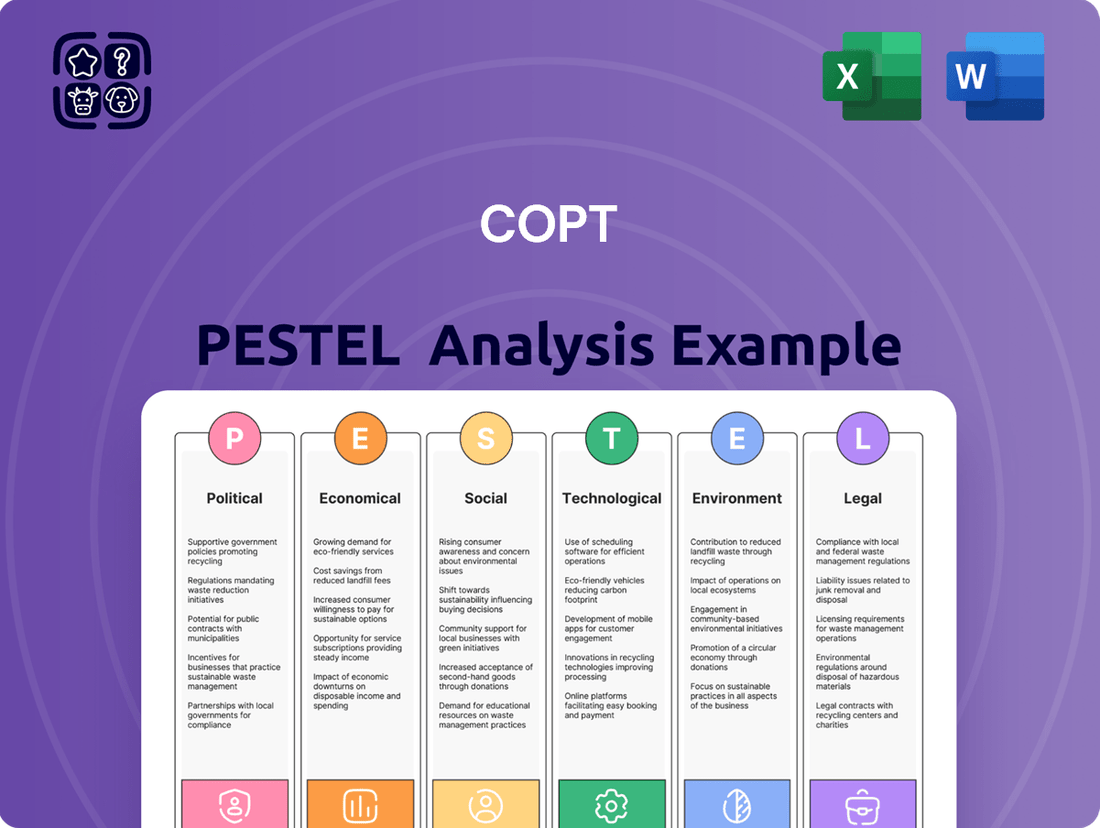

The COPT PESTLE Analysis systematically examines how Political, Economic, Social, Technological, Environmental, and Legal forces shape the business environment, providing a comprehensive understanding of external influences.

COPT's PESTLE analysis offers a streamlined, visually segmented breakdown of external factors, simplifying complex market dynamics to pinpoint actionable insights for strategic planning and risk mitigation.

Economic factors

The interest rate environment significantly impacts REITs, including COPT. After a challenging 2023, the economic outlook for REITs is brightening. We've seen the Federal Reserve implement rate cuts starting in September 2024, and further reductions are anticipated throughout 2025.

This shift in monetary policy is crucial. A peak in long-term real yields, coupled with these projected interest rate cuts, could substantially lower borrowing costs for REITs like COPT. This reduction in financing expenses can directly translate into improved profitability and a more attractive dividend yield for investors.

Inflation directly impacts COPT's operational expenses, with rising utility costs and maintenance contributing to higher outlays. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, indicating a sustained inflationary environment that affects these expenditures.

Construction costs for new developments are also sensitive to inflation, impacting COPT's ability to expand its portfolio efficiently. The Producer Price Index (PPI) for construction materials, a key indicator of input costs, has shown upward trends, potentially increasing the capital required for new projects.

While Real Estate Investment Trusts (REITs) like COPT can partially offset inflation through rent escalations and property value appreciation, persistent high inflation could squeeze profit margins. If rent increases cannot keep pace with the rising operating and construction costs, COPT's net operating income may be negatively affected.

Effective cost management and strategic lease structures are therefore crucial for COPT to mitigate the impact of inflationary pressures. The ability to pass on increased costs to tenants through well-structured lease agreements will be a key determinant of profitability in this economic climate.

Economic growth is a significant driver for COPT, as it directly impacts government revenue and, by extension, the budgets available for defense spending and related agencies. A robust economy in 2024, with the US GDP projected to grow by 2.3%, generally translates to more consistent demand for COPT's specialized real estate assets, supporting stable leasing activity and potential for expansion.

Conversely, any economic downturn or slowdown in 2025 could create budgetary pressures for government tenants. This might lead to reduced leasing activity or even delayed decisions on expansion plans, potentially impacting COPT's occupancy rates and rental income. For instance, if government agencies face austerity measures due to slower economic growth, their ability to commit to new leases or renewals could be curtailed.

Real Estate Market Dynamics (Office and Data Center)

COPT's real estate focus is on niche markets: office spaces catering to defense and intelligence agencies, and data centers. While the general office sector faces headwinds, COPT's specialized defense-related portfolio demonstrates resilience. As of December 31, 2024, this segment boasted a high occupancy rate of 96.8%, indicating robust demand from its target tenants.

The data center market, however, is a significant growth engine for COPT. Fueled by the escalating adoption of artificial intelligence and cloud computing, this sector is experiencing substantial expansion. COPT's data center properties are seeing strong pre-leasing activity, signaling excellent future revenue potential and a strategic alignment with key technological trends.

- Defense Office Portfolio Strength: COPT's office properties near defense installations maintained a 96.8% leased rate as of December 31, 2024, highlighting consistent demand and stability in this specialized segment.

- Data Center Market Growth Drivers: The burgeoning demand for AI and cloud services is propelling the data center market, creating significant expansion opportunities for COPT.

- High Data Center Pre-Leasing: COPT's data center assets are experiencing high pre-leasing rates, indicating strong forward demand and a positive outlook for future occupancy and revenue.

Capital Availability and Investment

Capital availability is a significant driver for COPT's growth, influencing its ability to pursue strategic investments and manage its asset portfolio effectively. REITs, including COPT, have historically maintained conservative leverage, which bolsters their access to diverse funding sources.

In 2024, the real estate investment trust sector saw robust activity in unsecured debt issuances, demonstrating continued investor confidence and a healthy capital market. This trend suggests that companies like COPT can readily tap into capital for their expansion and operational needs.

Looking ahead to 2025, projections indicate potential stability or even a decline in interest rates. This scenario would be highly beneficial for COPT, likely easing the cost of financing for new property acquisitions and development projects, thereby enhancing investment capacity.

The cost of capital directly impacts the profitability and viability of new ventures. A favorable interest rate environment in 2025 could unlock more attractive investment opportunities for COPT, allowing for greater strategic flexibility and potentially higher returns on invested capital.

- Capital access: REITs, including COPT, benefit from strong access to unsecured debt markets, evidenced by robust issuances in 2024.

- Leverage position: Historically low leverage ratios maintained by REITs enhance their borrowing capacity and financial stability.

- 2025 outlook: Projected stable or declining interest rates in 2025 are expected to lower financing costs for COPT's investments.

- Investment impact: Reduced capital costs can improve the feasibility and profitability of new acquisitions and development projects for COPT.

The economic outlook for COPT is shaped by interest rate movements and inflation. Anticipated Federal Reserve rate cuts starting in late 2024 and continuing into 2025 should lower borrowing costs for REITs like COPT, potentially boosting profitability and dividend yields. However, persistent inflation, as seen with the 3.4% CPI in April 2024, increases operational and construction expenses, which COPT must manage through effective lease structures to maintain margins.

Full Version Awaits

COPT PESTLE Analysis

The preview you see here is the exact COPT PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

What you’re previewing here is the actual file—fully formatted and professionally structured for immediate application.

Sociological factors

Government agencies and defense contractors are navigating evolving operational models. While some civilian government functions might embrace hybrid work, impacting traditional office demand, the defense sector's inherent need for on-site, secure operations for mission-critical functions remains a significant factor. This duality suggests a nuanced impact on COPT's portfolio, with some properties potentially seeing reduced demand while others remain insulated.

The defense industry, in particular, is prioritizing enhanced cybersecurity and operational continuity. This often translates to a preference for highly secure, purpose-built facilities that can support classified work and ensure uninterrupted operations, a trend that aligns well with the specialized nature of some COPT properties. For instance, in 2023, the U.S. Department of Defense allocated billions to facility upgrades and modernization, underscoring the continued importance of physical infrastructure for national security operations.

The evolving landscape of national security, marked by increasingly sophisticated threats, fuels a continuous need for exceptionally secure and purpose-built facilities. This sociological driver is particularly acute for government agencies and defense contractors handling sensitive operations.

Cognitive Capital Partners (COPT) is well-positioned to meet this demand, leveraging its established capabilities in developing and managing highly specialized real estate solutions. Their focus on high-security enhancements, including advanced access controls and robust physical security measures, directly addresses this critical requirement.

In 2024, government spending on national defense and intelligence infrastructure is projected to remain robust, with significant allocations towards secure facilities. For example, the U.S. Department of Defense's fiscal year 2025 budget request emphasizes modernization and secure operational environments, underscoring the market's reliance on specialized real estate.

Demographic shifts significantly impact COPT's operational landscape. For instance, regions around major U.S. defense installations, a key focus for COPT, are experiencing varied population growth patterns. As of 2024, many of these areas, particularly in the Sun Belt, continue to attract a younger, working-age population, which bodes well for COPT's access to a skilled defense-related workforce.

However, some established defense hubs might face slower growth or even slight population declines, potentially affecting the immediate talent pool. COPT's strategy of concentrating on locations with a strong military presence directly taps into a demographic that often includes veterans and families with defense industry experience, ensuring a relevant talent pipeline through 2025.

Community Relations and Local Impact

COPT's extensive development and management of large office and data center properties inherently create a significant local community impact. These operations can affect traffic, infrastructure, and the overall character of the surrounding areas. Positive community relations are therefore crucial for COPT's ability to secure necessary permits and approvals for new projects, ensuring smoother development cycles.

Maintaining strong ties with local communities, particularly those adjacent to defense installations where many of its properties are located, is vital for COPT. This positive relationship fosters goodwill, which can translate into support for zoning changes or expansions. Furthermore, a welcoming community environment aids in attracting and retaining talent for the businesses that lease space in COPT's buildings, benefiting its tenants.

For instance, in 2024, COPT continued its focus on strategic developments that integrate with local needs. The company's commitment to being a good corporate citizen often involves local hiring initiatives and support for community programs, strengthening its social license to operate. This proactive approach helps mitigate potential opposition and builds a foundation of trust.

- Local Economic Contribution: COPT's projects create jobs during construction and ongoing operations, injecting capital into local economies.

- Infrastructure Strain and Improvement: Large-scale developments can strain local infrastructure, but COPT often contributes to necessary upgrades.

- Tenant Talent Pool: A community's quality of life directly impacts the ability of COPT's tenants to attract skilled workers.

- Regulatory Environment: Positive community sentiment can lead to a more favorable regulatory and permitting environment for COPT's real estate activities.

Talent Attraction and Retention for Tenants

The ability of government agencies and defense contractors to attract and retain skilled personnel is paramount to their operational success, directly influencing their demand for real estate. In 2023, the U.S. Department of Defense alone employed over 2.9 million personnel, highlighting the sheer scale of human capital these organizations manage. Effective talent strategies are therefore critical for mission fulfillment.

COPT's focus on developing high-quality, amenity-rich facilities in strategically advantageous locations plays a significant role in supporting its tenants' talent attraction and retention efforts. For instance, the availability of modern workspaces, convenient amenities, and proximity to talent pools can be a deciding factor for employees when choosing an employer, especially within competitive sectors like defense and government contracting.

- Talent Demand: Government and defense sectors require a continuous influx of specialized skills, making employee retention a key operational metric.

- Location Advantage: Proximity to skilled workforces and transportation hubs enhances tenant ability to attract talent.

- Facility Quality: Modern, well-equipped facilities can improve employee morale and productivity, aiding retention.

- Competitive Market: In 2024, the competition for top talent in technology and engineering roles remains intense across all sectors, including defense.

Sociological factors underscore the importance of community relations and talent attraction for Cognitive Capital Partners (COPT). Strong community ties can facilitate smoother project approvals, while desirable locations and high-quality facilities are crucial for tenant recruitment and employee retention, especially in the competitive defense sector.

Technological factors

The relentless advancement in data center technology, particularly with innovations like liquid cooling and specialized generative AI hardware, is reshaping facility requirements. COPT needs to ensure its properties can accommodate these evolving needs to attract and retain tenants in 2024 and beyond.

For instance, the increasing power density of AI servers, often exceeding 50 kW per rack, necessitates advanced cooling solutions that traditional air cooling cannot efficiently manage. This trend directly influences the structural and utility infrastructure that COPT must provide.

By 2025, the demand for data centers supporting high-performance computing, driven by AI and machine learning, is projected to significantly increase. Companies are investing heavily; NVIDIA alone reported a 42% revenue jump in Q4 2023, largely from its data center segment, highlighting the critical need for adaptable infrastructure.

COPT's strategic focus on developing shell properties capable of integrating these advanced cooling systems and power provisions ensures they remain competitive and meet the sophisticated demands of hyperscale and AI-focused tenants.

COPT's reliance on high-security properties for government and defense clients means that advancements in security technology are critically important. The company must continually integrate cutting-edge physical security measures, such as advanced access control systems and surveillance technology, to meet the rigorous demands of its tenants. For instance, the U.S. Department of Defense's ongoing investment in cybersecurity infrastructure, projected to exceed $10 billion annually in the coming years, directly influences the type of secure facilities COPT must provide.

Smart building technologies are significantly boosting operational efficiency for companies like COPT. These systems, by enabling better monitoring and management of HVAC, lighting, and security, are projected to reduce energy consumption by up to 30% in commercial real estate by 2025, according to recent industry reports. This translates directly to cost savings for COPT and improved tenant satisfaction through enhanced comfort and amenity management.

Investing in these advanced technologies is not just about current savings; it's a strategic move to increase property value. Buildings equipped with smart features are increasingly in demand, commanding higher rents and occupancy rates. For instance, a recent study showed that smart-enabled commercial properties saw a 5-7% increase in valuation compared to their non-smart counterparts in the 2024-2025 period.

Cybersecurity Threats to Data Infrastructure

The increasing sophistication and frequency of cyberattacks are driving a constant need for secure and resilient data infrastructure. This trend directly benefits companies like COPT, which specialize in providing secure data center solutions. Their ability to safeguard client data against evolving threats acts as a significant competitive advantage and a catalyst for growth in the current digital landscape.

The global cybersecurity market is projected to reach $345.4 billion by 2026, up from $217.9 billion in 2023, highlighting the escalating investment in data protection. For COPT, this translates into a growing demand for their secure data center services, as businesses prioritize safeguarding their critical information assets.

Key cybersecurity factors impacting COPT include:

- Ransomware Attacks: The financial services sector, a key COPT customer segment, experienced an average ransomware payment of $4.8 million in 2023, underscoring the critical need for data protection and business continuity solutions.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million globally, a figure that continues to rise, making robust data center security a paramount concern for all organizations.

- Regulatory Compliance: Evolving data privacy regulations, such as GDPR and CCPA, necessitate stringent security measures within data infrastructure, creating opportunities for providers like COPT that can ensure compliance.

- Supply Chain Vulnerabilities: Threats targeting the technology supply chain can compromise data infrastructure, increasing the demand for secure and vetted data center providers.

Impact of AI and Automation on Office Space

Artificial intelligence and automation are reshaping how businesses operate, potentially influencing the need for traditional office environments. While these technologies can boost efficiency, their ultimate effect on overall office space demand remains a dynamic area of observation. For instance, a 2024 report indicated that while some sectors are exploring hybrid models, the core need for collaborative physical spaces persists.

COPT's portfolio, which largely caters to government and defense agencies, may offer a degree of resilience. These tenants often have specific operational requirements that necessitate a physical, secure human presence, making them potentially less exposed to widespread downsizing of office footprints driven by automation compared to more generalized commercial office tenants.

The trend suggests a nuanced impact:

- Optimized Operations: AI and automation streamline workflows, potentially reducing the need for certain job functions.

- Hybrid Work Models: Many companies are adopting hybrid or remote work, affecting occupancy rates.

- COPT's Niche: Properties housing defense and government functions often require secure, physical infrastructure less easily replaced by remote solutions.

- Evolving Demand: The long-term demand for office space will likely depend on how effectively businesses integrate AI without compromising essential in-person collaboration or security needs.

Technological advancements are fundamentally altering the infrastructure requirements for data centers, especially with the rise of AI. COPT must adapt to accommodate higher power densities and advanced cooling systems, like liquid cooling, to attract tenants. The demand for high-performance computing facilities is growing, as evidenced by NVIDIA's significant revenue increases in its data center segment in late 2023.

Smart building technologies are also key, offering significant operational efficiencies and cost savings through better energy management. These smart features are projected to increase property valuations by 5-7% between 2024 and 2025, making them a strategic investment for COPT.

Cybersecurity is another critical technological factor. The escalating costs of data breaches, averaging $4.73 million globally in 2024, and the rising threat of ransomware, with average payments of $4.8 million in the financial sector in 2023, underscore the need for robust security. Evolving regulations like GDPR and CCPA further emphasize the demand for compliant and secure data infrastructure, playing to COPT's strengths.

AI and automation are impacting office environments, but COPT's focus on government and defense tenants provides a buffer, as these sectors often require secure, physical infrastructure that is less susceptible to displacement by remote work or automation.

| Technology Trend | Impact on COPT | Data/Projection (2024-2025) |

|---|---|---|

| AI Hardware & Liquid Cooling | Increased power density, need for advanced cooling infrastructure | AI servers exceeding 50 kW/rack; NVIDIA data center revenue up 42% (Q4 2023) |

| Smart Building Technologies | Enhanced operational efficiency, reduced energy consumption | Potential 30% energy reduction by 2025; 5-7% property valuation increase |

| Cybersecurity Advancements | Demand for secure facilities, compliance with regulations | Average data breach cost: $4.73M (2024); Global cybersecurity market to reach $345.4B by 2026 |

| AI & Automation in Workplaces | Potential impact on traditional office demand, but less so for secure government/defense tenants | Continued need for collaborative physical spaces persists |

Legal factors

COPT's operations are significantly shaped by the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS). These complex rules govern everything from how contracts are awarded to how costs are reported.

Recent updates, particularly those implemented in late 2024 and early 2025, demand constant vigilance. Key changes affecting COPT include stricter requirements for System for Award Management (SAM) registration, enhanced scrutiny of cost data submissions, and evolving mandates for small business subcontracting participation.

Failure to adapt to these evolving regulations can lead to penalties, contract termination, or exclusion from future bidding opportunities. For instance, non-compliance with small business subcontracting goals could result in financial penalties or a damaged reputation within the federal contracting ecosystem.

Staying ahead of these regulatory shifts is crucial for maintaining COPT's competitive edge and ensuring continued access to lucrative government contracts, which represent a substantial portion of its revenue stream.

Zoning and land use regulations significantly impact the development and expansion of Corporate Office Properties Trust (COPT) properties. These rules dictate what can be built, where, and how it can be used, directly influencing COPT's ability to acquire new sites or redevelop existing ones. Navigating these often complex and varied local frameworks, particularly for specialized facilities like those near defense installations, is a critical operational challenge. For instance, in 2024, COPT's success in securing permits for its data center development in Northern Virginia was directly tied to its understanding and adherence to stringent local zoning laws governing such facilities.

Environmental regulations are becoming more stringent globally, directly affecting real estate investment trusts like COPT. These rules focus on building performance, greenhouse gas emissions, and energy efficiency, requiring significant investment in upgrades and new construction methods. For instance, in 2025, Europe will see stricter reporting requirements, setting a precedent that may influence other regions and COPT's global operational standards.

Compliance with these evolving laws is paramount to avoid penalties and maintain a positive reputation. COPT must actively adapt its development and operational strategies to meet these increasing demands. This could involve investing in renewable energy sources for its properties or implementing advanced building management systems to reduce energy consumption and emissions.

REIT-Specific Tax Laws and Compliance

As a Real Estate Investment Trust (REIT), COPT is subject to stringent IRS regulations to preserve its favorable tax status. A key requirement is the distribution of at least 90% of its taxable income to shareholders annually as dividends. Failure to meet this threshold can jeopardize its REIT classification, leading to corporate income tax liabilities. For instance, in 2023, COPT reported a net income available for distribution of approximately $369 million, underscoring the significant dividend payout necessary to maintain its REIT status.

Evolving tax legislation presents a critical legal factor for COPT. Any modifications to the tax treatment of REITs, such as changes in depreciation rules or dividend taxation, could directly influence COPT's financial performance and the net returns received by its investors. For example, proposed changes to capital gains tax rates could indirectly affect the attractiveness of REIT investments for shareholders.

- Distribution Requirement: COPT must distribute at least 90% of its taxable income as dividends to maintain REIT status.

- Tax Law Impact: Changes in federal or state tax laws impacting real estate or dividend income can affect COPT's profitability and shareholder value.

- Compliance Costs: Adhering to complex REIT regulations incurs administrative and compliance costs.

- Interest Deductibility: Limitations on interest deductibility for REITs could impact taxable income and dividend capacity.

Data Privacy and Security Laws

COPT's data center operations are significantly impacted by evolving data privacy and security legislation. Compliance with regulations like GDPR, CCPA, and emerging state-level data protection mandates is paramount for attracting and retaining clients, particularly those handling sensitive information. Failure to adhere to these laws can result in substantial fines and reputational damage. For example, the potential fines under GDPR can reach up to 4% of global annual revenue or €20 million, whichever is higher.

These legal frameworks directly influence data center design and operational protocols. COPT must implement robust security measures, maintain detailed audit trails, and ensure data localization requirements are met where applicable. The increasing focus on data sovereignty means COPT may need to offer geographically specific data handling capabilities to meet tenant demands. By Q2 2024, the global data privacy software market was valued at an estimated $2.5 billion, reflecting the growing importance and complexity of these regulations.

- Regulatory Compliance: Adherence to GDPR, CCPA, and other global data protection laws is a non-negotiable requirement for COPT's data centers.

- Tenant Attraction: Demonstrating strong data security and privacy compliance is a key differentiator for attracting tenants with sensitive data needs.

- Operational Impact: Legal mandates dictate security infrastructure, data handling procedures, and potential data residency services offered by COPT.

- Financial Risk: Non-compliance carries significant financial penalties, potentially impacting COPT's profitability and market standing.

COPT's reliance on government contracts necessitates strict adherence to federal acquisition regulations like FAR and DFARS. Recent updates in late 2024 and early 2025 have introduced stricter SAM registration, enhanced cost data scrutiny, and evolving small business subcontracting mandates, all of which directly impact operational compliance and future bidding opportunities.

Zoning and land use laws critically affect COPT's property development and expansion, especially for specialized facilities near defense installations. Navigating these local frameworks is essential, as demonstrated by COPT's successful 2024 data center permitting in Northern Virginia, which hinged on strict adherence to local zoning. Environmental regulations are also tightening globally, impacting building performance and emissions, with new European reporting requirements in 2025 potentially influencing broader standards.

As a REIT, COPT must distribute at least 90% of its taxable income to shareholders annually to maintain its tax-advantaged status, a significant legal requirement. For instance, COPT distributed approximately $369 million in 2023 to meet this threshold. Evolving tax legislation, including potential changes to REITs, depreciation, or dividend taxation, could directly influence COPT's financial health and investor returns.

Data privacy and security legislation, such as GDPR and CCPA, are crucial for COPT's data center clients, with non-compliance carrying substantial financial risks, like potential fines up to 4% of global annual revenue. These laws influence data center design and operations, requiring robust security and audit trails, a market segment valued at $2.5 billion by Q2 2024.

Environmental factors

Corporate Office Properties Trust (COPT) demonstrates a strong commitment to sustainability, highlighted by its 11th annual Corporate Sustainability Report released in 2025. This dedication is further underscored by their consistent recognition through Green Star awards, reflecting ongoing efforts to minimize environmental impact.

Meeting evolving tenant demands and anticipating regulatory shifts necessitates strict adherence to green building certifications such as LEED. This focus on environmentally responsible construction and operation is crucial for maintaining property value and attracting a discerning tenant base in the current market landscape.

Climate change presents significant physical risks to COPT's property portfolio, with extreme weather events becoming more frequent and intense. For instance, in 2023, Australia experienced a notable increase in severe weather, including floods and storms, impacting various regions.

COPT's commitment to assessing and mitigating these climate-related risks is highlighted in their Task Force on Climate-related Financial Disclosures (TCFD) reports. These reports detail strategies for enhancing property resilience, which is vital for safeguarding long-term asset values against potential damage or disruption from climate events.

Energy efficiency is a major concern for data centers and office buildings. This is driven by a desire to be environmentally responsible, cut costs, and comply with regulations. For example, the U.S. Department of Energy's Energy Star program, which certifies energy-efficient products, has seen significant growth in commercial building participation, with over 27,000 buildings certified by early 2024.

Corporate Office Properties Trust (COPT) can address these demands by investing in technologies that reduce energy consumption. This includes upgrading to high-efficiency heating and cooling systems. In 2023, COPT reported that its energy efficiency initiatives, including HVAC upgrades, contributed to a reduction in its overall energy usage intensity across its portfolio.

Furthermore, COPT could explore onsite renewable energy projects, such as solar installations on its properties. This not only enhances energy efficiency but also provides a hedge against rising energy costs and supports sustainability goals. Many companies are setting ambitious renewable energy targets; for instance, the Renewable Energy Buyers Alliance (REBA) reported a record 10.7 GW of new corporate renewable energy procurement in 2023 alone.

Carbon Footprint Reduction Goals

Government agencies and defense contractors are placing a growing emphasis on reducing their carbon footprints, a factor that significantly influences their real estate decisions. This trend is driving demand for properties that meet stringent environmental standards.

COPT's proactive approach to lowering greenhouse gas emissions and improving energy efficiency across its portfolio directly addresses these tenant objectives. For instance, COPT reported a 21% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity from its owned and operated portfolio between 2019 and 2023, demonstrating tangible progress towards sustainability.

This alignment with tenant sustainability goals supports COPT's ability to secure and maintain long-term leases. By investing in energy-efficient upgrades and sustainable building practices, COPT positions itself as an attractive partner for organizations committed to environmental responsibility.

Key aspects of COPT's environmental strategy include:

- Energy Efficiency Upgrades: Implementing technologies to reduce energy consumption in its buildings.

- Renewable Energy Integration: Exploring and adopting renewable energy sources where feasible.

- Waste Reduction Programs: Implementing initiatives to minimize waste generation and improve recycling rates.

- Water Conservation Efforts: Focusing on reducing water usage across its property portfolio.

Waste Management and Resource Conservation

Effective waste management and resource conservation are central to COPT's environmental sustainability. These practices are crucial for minimizing their ecological footprint.

COPT is actively working on enhancing the quality of its waste data, which is a vital step towards more informed decision-making and targeted reduction strategies. This focus on data accuracy underpins their commitment to responsible resource use.

Initiatives like the 'Grounds to Grow Program' highlight COPT's dedication to sustainability. This program specifically aims to reduce environmental impact through responsible consumption and waste minimization.

- Data Quality Improvement: COPT is investing in better waste data collection and analysis to track progress and identify areas for improvement.

- Grounds to Grow Program: This program exemplifies COPT's proactive approach to resource conservation and reducing waste generation.

- Environmental Impact Reduction: The company's efforts in waste management and resource conservation directly contribute to minimizing its overall environmental impact.

COPT's environmental strategy focuses on energy efficiency, waste reduction, and water conservation, aligning with increasing tenant demand for sustainable properties. The company reported a 21% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity between 2019 and 2023, showcasing tangible progress.

The company's commitment is further evidenced by its 11th annual Corporate Sustainability Report in 2025 and recognition through Green Star awards, underscoring its dedication to minimizing environmental impact and adhering to standards like LEED.

Rising awareness and regulations around climate change necessitate investments in resilient infrastructure and energy-efficient technologies, such as HVAC upgrades, to mitigate physical risks and operational costs. For example, over 27,000 commercial buildings were certified by the U.S. Department of Energy's Energy Star program by early 2024.

COPT's proactive stance on sustainability, including exploring onsite renewable energy projects, addresses the growing imperative for government agencies and defense contractors to reduce their carbon footprints, influencing their real estate choices.

| Environmental Initiative | COPT's Action/Goal | Supporting Data/Example |

|---|---|---|

| Green Building Certifications | Adherence to LEED standards | Crucial for attracting tenants and maintaining property value |

| Energy Efficiency | HVAC upgrades, technology investment | U.S. Energy Star program: 27,000+ buildings certified by early 2024 |

| Greenhouse Gas Emissions Reduction | Reducing Scope 1 & 2 emissions intensity | 21% reduction reported between 2019-2023 |

| Renewable Energy | Exploring onsite projects (e.g., solar) | Corporate renewable energy procurement reached record 10.7 GW in 2023 (REBA) |

| Waste Management | Implementing waste reduction and recycling programs | 'Grounds to Grow Program' focused on responsible consumption |

PESTLE Analysis Data Sources

Our COPT PESTLE Analysis is constructed using a blend of official government publications, reputable economic databases, and leading industry research reports. This comprehensive approach ensures that all insights are grounded in factual data, covering political stability, economic forecasts, technological advancements, and social trends.