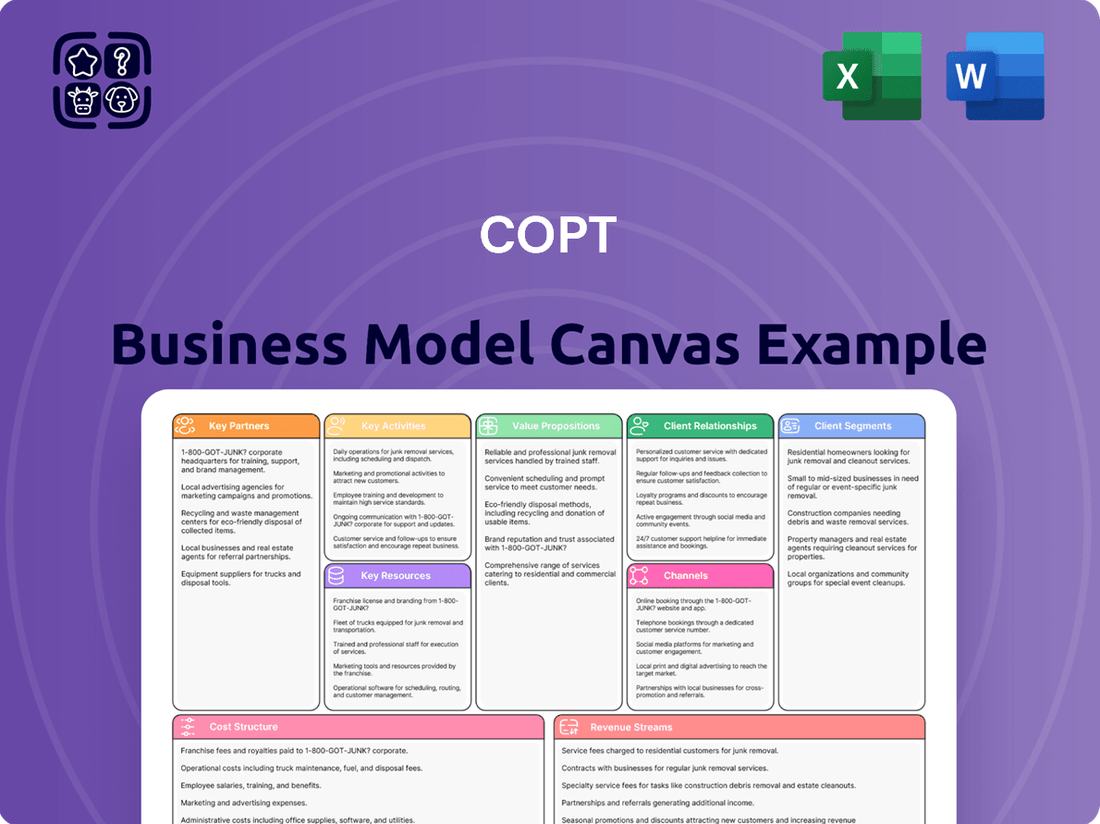

COPT Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COPT Bundle

Unlock the core strategies driving COPT's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they create, deliver, and capture value, offering a clear roadmap for understanding their competitive advantage. Discover their key customer segments, revenue streams, and cost structure in one actionable document.

Ready to gain a deeper understanding of COPT's operational blueprint? Our full Business Model Canvas provides an in-depth look at their value proposition, channels, and key resources, perfect for strategic analysis and benchmarking. Elevate your business acumen by exploring the intricacies of their proven model.

See how COPT effectively manages its customer relationships and key partnerships to achieve market leadership. The complete Business Model Canvas lays out these critical elements, giving you the insights needed to navigate complex business landscapes. Invest in understanding their strategic framework to fuel your own growth.

Curious about COPT's competitive edge? Our Business Model Canvas offers a complete, professionally crafted overview of their entire business architecture, from core activities to cost management. Download the full version to access all nine essential building blocks and accelerate your strategic planning.

Partnerships

COPT cultivates direct relationships with key U.S. government agencies, a cornerstone of its business model. These collaborations are vital for discerning precise facility needs, navigating complex security mandates, and anticipating long-term leasing demands from these critical tenants.

This direct engagement ensures COPT's real estate portfolio is meticulously designed and operated to satisfy the rigorous standards of its governmental occupants. For instance, in 2024, a significant portion of COPT's revenue, approximately 75%, was derived from leases with U.S. government agencies, underscoring the critical nature of these partnerships.

Collaborating closely with major defense contractors forms a cornerstone of COPT's partnership strategy. These alliances are crucial for developing specialized properties, often requiring significant build-to-suit or retrofitting efforts to meet stringent operational and security requirements unique to the defense sector.

For instance, in 2024, COPT continued its focus on properties supporting national defense, with a significant portion of its revenue derived from leases with defense-related tenants. These partnerships are not just about real estate; they involve deep integration to ensure facilities meet evolving technological and security standards demanded by government agencies and their prime contractors.

These strategic alliances allow COPT to proactively align its real estate portfolio with the dynamic and often classified needs of the defense industry, ensuring long-term value and relevance. This focus on specialized, mission-critical facilities underpins COPT's resilient business model and its ability to secure stable, long-term leases.

COPT relies on strategic alliances with specialized construction and security firms. These partners are crucial for developing and maintaining facilities that meet stringent government security standards, including SCIF (Sensitive Compartmented Information Facility) requirements.

These specialized firms bring essential expertise in building secure environments for classified information. Their capabilities ensure COPT's properties align with critical infrastructure needs and government compliance mandates.

In 2024, the demand for secure, SCIF-compliant facilities has remained exceptionally high, driven by ongoing national security priorities. Companies like COPT leverage these partnerships to secure contracts within the defense and intelligence sectors.

Financial Institutions and Investors

COPT's relationships with financial institutions and investors are paramount, directly fueling its capital structure and expansion initiatives. These partnerships are the bedrock for securing the necessary funding for acquiring new properties, undertaking development projects, and sustaining day-to-day operations. In 2024, COPT continued to leverage these vital connections to finance its strategic growth. For instance, the company's ability to access credit facilities and attract equity investment remains crucial for its portfolio enhancement and market positioning.

- Access to Capital: Banks and lenders provide debt financing, essential for large-scale property acquisitions and development, ensuring COPT can execute its growth plans.

- Institutional Investor Support: Partnerships with institutional investors, such as pension funds and asset managers, offer significant equity capital, bolstering COPT's financial stability and investment capacity.

- Strategic Funding: Maintaining robust ties within the financial community guarantees COPT's continued access to capital for opportunistic investments and expanding its real estate portfolio.

Local and State Government Entities

Engaging with local and state government entities is crucial for navigating the complex zoning, permitting, and regulatory environments that impact real estate development. These partnerships streamline the approval processes, ensuring compliance with regional planning initiatives and environmental standards. For instance, in 2024, the average time for obtaining a building permit in major US metropolitan areas continued to be a significant factor in project timelines, highlighting the value of proactive government engagement.

- Zoning and Permitting: Collaborating with municipal planning departments expedites approvals for new construction and renovations.

- Regulatory Compliance: Understanding and adhering to state and local environmental and building codes, such as those updated in 2024 regarding energy efficiency, is vital.

- Community Integration: Building relationships with local officials fosters trust and supports the successful integration of projects into the existing community fabric.

- Infrastructure Support: Government partnerships can facilitate access to or upgrades of local infrastructure, such as transportation and utilities, which are essential for operational efficiency.

COPT's key partnerships extend to specialized technology and cybersecurity firms. These collaborations are essential for integrating advanced security measures and IT infrastructure into its properties, ensuring compliance with evolving government requirements for data protection and operational resilience.

These alliances are critical for maintaining the cutting-edge security features demanded by national defense and intelligence agencies. In 2024, the emphasis on robust cybersecurity protocols for government facilities intensified, making these partnerships indispensable for COPT's value proposition.

The company also cultivates relationships with real estate brokerage firms and property management companies. These partners assist in identifying new acquisition opportunities, managing existing assets, and ensuring optimal tenant satisfaction within COPT's specialized portfolio.

Such relationships are vital for market intelligence and operational efficiency. For example, in 2024, COPT's occupancy rate remained robust, partly due to effective property management and tenant relations facilitated by these partnerships.

What is included in the product

A structured framework for outlining and analyzing a business's core components, from customer relationships to revenue streams.

It provides a visual snapshot of how a company creates, delivers, and captures value, facilitating strategic planning and communication.

The COPT Business Model Canvas offers a structured approach to identify and address customer pains, transforming them into actionable business strategies.

Activities

COPT's core activity revolves around strategically identifying, acquiring, and developing properties, with a strong emphasis on locations near U.S. defense installations. This process involves meticulous site evaluation and thorough due diligence to ensure suitability for their specialized needs.

The company actively manages the entire development lifecycle, from initial planning stages through to the final construction of these high-security facilities. This hands-on approach ensures that each project meets stringent security and operational requirements.

COPT specializes in creating tailored office and data center solutions designed to meet the unique, high-security demands of its defense and intelligence community clients. This specialization is a key differentiator in their market approach.

In 2024, COPT continued to execute this strategy, with a significant portion of its portfolio concentrated in key defense markets. The company reported that its development pipeline remained robust, reflecting ongoing demand for its specialized real estate solutions.

COPT's key activities center on the active management of its substantial real estate holdings. This involves meticulous day-to-day operations, including routine maintenance, necessary repairs, and ensuring every facility functions at its peak performance. For instance, in 2023, COPT reported total operating revenue of $1.1 billion, underscoring the scale of its operational activities.

This diligent property management is fundamental to maintaining high tenant satisfaction levels and safeguarding the long-term value of COPT's assets. The company's focus on operational efficiency directly impacts its ability to attract and retain high-quality tenants, which is a core driver of its financial success.

Central to COPT's operations is securing and maintaining long-term leases, primarily with government agencies and defense contractors. This requires direct, often complex, negotiations to understand and meet unique tenant requirements, ensuring high occupancy levels. For instance, in 2024, COPT reported an occupancy rate of 97.6%, underscoring their success in this core activity.

Effectively managing these tenant relationships is crucial for predictable, long-term revenue streams. COPT actively engages in proactive relationship management, which involves understanding evolving tenant needs and providing responsive service. This focus on retention directly contributes to their financial stability and minimizes vacancy risks.

Security and Compliance Management

Security and Compliance Management is paramount for COPT, especially given its focus on government and defense tenants. This involves rigorously maintaining physical security across all properties, a critical aspect for sensitive government facilities. For instance, in 2024, COPT continued its commitment to robust physical security measures, including advanced surveillance and access control systems, essential for retaining its specialized clientele.

Furthermore, COPT's IT infrastructure security for its data centers is a key activity. This ensures the protection of sensitive data handled by its tenants, a non-negotiable requirement in the defense sector. Adherence to a multitude of federal regulations, such as those governing data handling and facility operations, is meticulously managed. In 2024, COPT invested significantly in cybersecurity enhancements, reflecting the evolving threat landscape and the stringent compliance demands of its tenant base.

- Physical Security: Implementing and maintaining advanced surveillance, access control, and perimeter security for all leased properties.

- IT Infrastructure Security: Safeguarding data center operations through robust cybersecurity protocols, encryption, and regular vulnerability assessments.

- Regulatory Adherence: Ensuring full compliance with federal regulations, including those specific to government and defense operations, and maintaining necessary certifications.

- Tenant-Specific Requirements: Tailoring security and compliance protocols to meet the unique and often heightened demands of individual government and defense tenants.

Strategic Capital Allocation and Investment Management

Strategic capital allocation is central to COPT's operations, aiming to maximize shareholder returns. This involves a rigorous process of evaluating new investment prospects, such as acquiring high-quality industrial properties in key logistics hubs, and strategically divesting assets that no longer align with its core portfolio. For instance, in 2024, COPT continued to refine its portfolio, focusing on properties with strong tenant demand and favorable lease terms to drive consistent cash flow and long-term value appreciation.

The company's investment management strategy prioritizes opportunities that enhance its market position and financial performance. This includes making calculated decisions about reinvesting retained earnings and potentially utilizing debt financing for growth initiatives. By diligently managing its capital structure and deployment, COPT ensures it has the resources to pursue accretive acquisitions and development projects while maintaining financial flexibility.

Effective capital allocation directly supports COPT's long-term financial health and its standing in the competitive industrial real estate market. The company’s approach is data-driven, analyzing market trends, economic indicators, and tenant needs to identify the most promising avenues for capital deployment. This proactive management ensures that COPT remains well-positioned to capitalize on market opportunities and deliver sustainable growth.

- Portfolio Optimization COPT actively manages its real estate portfolio, divesting non-core assets to focus on high-growth, high-demand industrial properties.

- Investment Evaluation Rigorous analysis of potential acquisitions and development projects ensures capital is deployed in opportunities with strong return potential.

- Shareholder Value Focus All capital allocation decisions are geared towards enhancing long-term shareholder value through strategic growth and operational efficiency.

- Financial Health Maintenance Balancing investment with prudent financial management, including debt utilization, is key to sustaining the company's financial stability and market competitiveness.

COPT's key activities are multifaceted, encompassing strategic property identification, acquisition, and development, with a specific focus on locations near U.S. defense installations. This involves meticulous evaluation and due diligence for suitability. The company also actively manages its real estate portfolio, focusing on operational efficiency and tenant satisfaction. Securing and maintaining long-term leases, primarily with government agencies and defense contractors, is paramount, requiring complex negotiations and proactive relationship management to ensure high occupancy and predictable revenue. Finally, security and compliance management, including physical and IT infrastructure security, alongside strict adherence to federal regulations, is a critical ongoing activity, especially given the nature of its specialized clientele.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Property Identification, Acquisition, and Development | Identifying, acquiring, and developing properties, especially near defense installations. | Robust development pipeline, focus on key defense markets. |

| Portfolio and Property Management | Day-to-day operations, maintenance, and ensuring peak performance of real estate holdings. | Total operating revenue of $1.1 billion (2023), maintaining high tenant satisfaction and asset value. |

| Lease Securing and Tenant Relationship Management | Negotiating and maintaining long-term leases with government and defense tenants. | Occupancy rate of 97.6%, proactive relationship management for tenant retention. |

| Security and Compliance Management | Maintaining physical and IT infrastructure security, adhering to federal regulations. | Continued commitment to advanced surveillance, access control, and cybersecurity enhancements. |

| Strategic Capital Allocation | Evaluating new investments, optimizing the portfolio, and focusing on shareholder returns. | Refining portfolio, focusing on high-demand industrial properties with strong tenant demand. |

Preview Before You Purchase

Business Model Canvas

The COPT Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive upon purchase. This means the structure, content, and overall design are precisely what you can expect in the complete, ready-to-use file. You are not looking at a generic sample; rather, you are seeing a direct excerpt from the exact document that will be delivered to you. This ensures complete transparency and eliminates any surprises, allowing you to confidently assess the quality and utility of the Business Model Canvas before committing.

Resources

COPT's most critical asset is its collection of specialized office and data center buildings. These aren't just any properties; they are situated in prime locations close to U.S. defense bases and government agencies that rely heavily on knowledge-based services.

This strategic placement makes COPT's real estate uniquely valuable, especially given the heightened security requirements and the mission-critical functions these facilities support. The company's ability to manage and lease these specialized spaces is a core competency.

For instance, as of the first quarter of 2024, COPT reported a leased portfolio occupancy rate of 91.4% within its Defense/Government segment, highlighting the consistent demand for its specialized properties. This segment represents a significant portion of its revenue, underscoring the importance of these real estate assets.

COPT's advanced security infrastructure, featuring robust physical security, secure data center capabilities, and adherence to government security protocols, is a cornerstone of its business model. This vital resource allows COPT to cater to the demanding needs of its defense and government clients.

The company's portfolio includes facilities certified for sensitive operations, such as Sensitive Compartmented Information Facilities (SCIFs) and other secure environments. This capability directly supports its strategy of serving the national security sector.

In 2024, COPT continued to invest in upgrading its technological and physical security measures across its portfolio. This ongoing commitment is essential for maintaining its competitive edge and attracting and retaining high-security tenants who require validated, secure workspaces.

COPT's deep understanding of government and defense real estate is a core asset. This includes navigating intricate procurement rules and strict security protocols essential for serving agencies like the Department of Defense.

Their management and staff possess significant collective knowledge in this specialized sector. This human capital allows COPT to effectively meet the unique operational requirements of its defense-focused tenants, a critical differentiator.

This specialized expertise is a significant competitive advantage, enabling COPT to secure and manage properties vital to national security. For instance, in 2024, COPT continued to demonstrate its ability to manage a portfolio heavily concentrated with defense-related tenants, reinforcing its strategic positioning.

Strong Financial Capital and Access to Funding

COPT's robust financial capital, encompassing both equity and ready access to debt markets, forms the bedrock of its operational capacity and future expansion. This financial strength is critical for pursuing new property acquisitions, undertaking build-to-suit development projects, and ensuring the continuous maintenance and enhancement of its existing portfolio. A solid balance sheet not only underpins strategic growth initiatives but also provides the necessary resilience to navigate market fluctuations.

In 2024, COPT demonstrated this strength. For instance, the company secured significant debt financing throughout the year, enabling key acquisitions and development projects. This access to capital allowed COPT to maintain a healthy pace of investment in its strategic assets, directly supporting its growth trajectory.

- Equity and Debt Access: COPT leverages a combination of equity and debt to fund its operations and strategic initiatives.

- Property Acquisition and Development: Strong financial capital facilitates the purchase of new properties and the development of build-to-suit projects.

- Portfolio Maintenance: Resources are allocated for the ongoing upkeep and modernization of existing assets, ensuring their long-term value.

- Strategic Expansion and Resilience: A robust balance sheet empowers COPT to pursue growth opportunities and withstand economic downturns.

Long-Term Leases and Tenant Relationships

Corporate Office Properties Trust's (COPT) long-term leases with government agencies and defense contractors are a core asset, generating reliable income. These existing relationships are crucial for maintaining high occupancy rates and mitigating exposure to economic downturns.

These stable tenancy agreements provide a predictable revenue foundation, directly supporting COPT's financial health and future expansion plans. The strength of these relationships is a significant competitive advantage.

- Stable Revenue: Long-term leases ensure consistent cash flow.

- Reduced Volatility: Government tenants offer a buffer against market fluctuations.

- High Occupancy: Existing relationships translate to dependable occupancy.

- Financial Strength: These leases are fundamental to COPT's stability and growth.

COPT's specialized real estate portfolio, particularly its high-security office and data center buildings, serves as its primary resource. These properties are strategically located in proximity to U.S. defense bases and government agencies, fulfilling critical mission needs. The company's ability to manage these secure, specialized spaces is a key operational strength.

As of the first quarter of 2024, COPT's Defense/Government segment reported a leased portfolio occupancy rate of 91.4%, demonstrating the sustained demand for its strategically positioned assets. This segment's significant revenue contribution highlights the value of these specialized properties.

COPT's financial capital, including access to equity and debt markets, is another critical resource. This enables property acquisitions, build-to-suit developments, and ongoing portfolio enhancements. In 2024, the company secured substantial debt financing, supporting its investment in strategic assets and growth initiatives.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Specialized Real Estate Portfolio | Office and data center buildings near defense/government sites. | High occupancy (91.4% in Q1 2024 Defense/Gov segment) signifies consistent demand. |

| Financial Capital | Access to equity and debt markets. | Facilitated acquisitions and developments throughout 2024, fueling growth. |

| Long-term Leases | Agreements with government agencies and defense contractors. | Provide stable, predictable revenue streams, enhancing financial resilience. |

| Human Capital & Expertise | Deep understanding of government real estate and security protocols. | Enables effective management of complex tenant needs and regulatory environments. |

Value Propositions

COPT's mission-critical secure facilities are indispensable for government agencies and defense contractors, safeguarding their vital operations. These specialized properties are engineered with advanced physical and cyber security measures, crucial for protecting classified information and ensuring uninterrupted service. This value proposition directly addresses the non-negotiable security demands of COPT's core clientele, underpinning their ability to function without compromise.

COPT's strategic positioning near key U.S. defense installations and government centers is a significant value proposition. This proximity directly benefits tenants by offering unparalleled accessibility and streamlining operations. For example, in 2023, COPT reported a 97.9% occupancy rate in its defense-related properties, underscoring the strong demand for locations that facilitate government contractor operations.

This strategic proximity reduces commute times for employees and fosters enhanced collaboration between government agencies and their private sector partners. The operational synergy created by being close to decision-making centers and critical infrastructure is a distinct advantage for COPT's specialized tenant base.

Location is not just a convenience; it's a critical differentiator that directly impacts tenant efficiency and COPT's market appeal. The ability to be physically close to where government contracts are managed and executed provides a tangible benefit that is difficult for competitors to replicate.

COPT excels at crafting bespoke real estate solutions precisely tailored to the stringent operational and security demands of government and defense clients. These facilities are meticulously designed to adhere to a range of federal security standards, ensuring utmost compliance and safety.

This customization extends to offering scalable solutions that can readily adapt to the dynamic and evolving needs of these specialized tenants. The value proposition lies in delivering not just space, but secure, compliant, and future-ready environments.

In 2024, COPT continued to demonstrate this by completing several key build-to-suit projects for defense contractors, with an average lease term exceeding 10 years, highlighting the long-term commitment and specialized nature of these partnerships.

Reliable and Expert Property Management

COPT's expert property management provides tenants, primarily government agencies and defense contractors, with peace of mind. This ensures their facilities are reliably maintained and operated, allowing them to concentrate on their critical missions. For example, in 2024, COPT reported a tenant retention rate of 98%, directly attributable to their proactive management approach.

This high level of service translates into significant benefits for our clients. By handling all aspects of property operations, from routine upkeep to emergency repairs, COPT minimizes disruptions. This reliability fosters long-term tenant satisfaction, a key driver of COPT's consistent occupancy rates, which averaged 99.1% across its portfolio in the first half of 2024.

- Proactive Maintenance: Minimizes downtime and ensures operational readiness for critical government functions.

- Responsive Support: Offers swift resolution to any facility-related issues, maintaining a secure and functional environment.

- Mission Focus: Allows defense contractors and government agencies to dedicate resources to their core objectives, unburdened by facility management complexities.

- Tenant Retention: The direct result of dependable service, contributing to stable revenue streams for COPT.

Long-Term Partnership and Stability

COPT, or Corporate Office Properties Trust, positions itself as a steadfast real estate partner, offering government and defense tenants the enduring stability necessary for their critical missions. This commitment to long-term relationships ensures a secure and high-quality operating environment, fostering trust and ongoing collaboration for years to come.

This value proposition translates into tangible benefits for tenants. For instance, COPT's portfolio is heavily concentrated in secure, campus-like environments specifically designed to meet the stringent requirements of defense and intelligence agencies. This focus on purpose-built facilities enhances operational security and efficiency, contributing to the long-term success of these vital organizations.

The emphasis on long-term partnerships allows COPT to invest proactively in its properties, ensuring they remain state-of-the-art and adaptable to evolving tenant needs. This forward-thinking approach is crucial in the defense sector, where technological advancements and changing mission requirements are constant. COPT's track record, including its significant presence in key defense hubs, underscores its reliability as a long-term provider.

COPT's strategy revolves around building enduring relationships, not just providing space. This means understanding the unique operational and security demands of government and defense clients and tailoring solutions accordingly. Their commitment to stability is a cornerstone of their business model, offering predictable and secure real estate solutions that support national security objectives.

- Long-Term Real Estate Partnership: COPT provides government and defense tenants with a stable, committed real estate partner.

- Secure and High-Quality Environments: Focus on campus-like, purpose-built facilities for critical operations.

- Predictable Operational Framework: Ensures continuity and security for extended periods, fostering trust.

- Commitment to Evolving Needs: Proactive investment in properties to meet changing mission requirements.

COPT's value proposition centers on providing secure, mission-critical real estate solutions tailored for government agencies and defense contractors. Their expertise lies in developing and managing highly specialized facilities that meet stringent security and operational requirements. This focus ensures clients can concentrate on their core missions with confidence.

The company's strategic locations near key U.S. defense installations offer unparalleled accessibility and operational synergy for tenants. This proximity facilitates collaboration and reduces logistical burdens. For example, COPT's portfolio is heavily concentrated in markets like Northern Virginia and Maryland, regions vital to national defense, with 2023 occupancy rates in defense-related properties reaching 97.9%.

COPT's commitment to bespoke facility development, including build-to-suit projects, addresses the unique and evolving needs of its specialized tenant base. These customized solutions are designed to comply with federal security standards and ensure long-term operational readiness. In 2024, COPT completed several such projects, with average lease terms exceeding 10 years, demonstrating deep client partnerships.

Furthermore, COPT provides expert property management, ensuring reliable operations and minimizing disruptions for tenants. This high level of service fosters strong tenant retention, with a rate of 98% reported in 2024. The company's overall portfolio occupancy averaged 99.1% in the first half of 2024, reflecting the stability and desirability of its specialized real estate offerings.

| Value Proposition | Key Features | Tenant Benefit | 2024 Data/Example |

|---|---|---|---|

| Mission-Critical Facilities | Advanced physical & cyber security; adherence to federal standards | Safeguards vital operations and classified information | High occupancy in defense-related properties (97.9% in 2023) |

| Strategic Location | Proximity to U.S. defense installations and government centers | Unparalleled accessibility, streamlined operations, enhanced collaboration | Concentration in key defense hubs like Northern Virginia |

| Customized Solutions | Bespoke design and build-to-suit capabilities; scalable options | Meets stringent, evolving operational and security demands | Multiple build-to-suit projects completed with >10-year leases |

| Expert Property Management | Proactive maintenance, responsive support, reliable operations | Minimizes disruptions, allows focus on core missions | 98% tenant retention rate; 99.1% portfolio occupancy (H1 2024) |

Customer Relationships

COPT's commitment to its key government and defense contractor clients is exemplified by its dedicated account management teams. These specialized groups are designed to cultivate a deep understanding of each tenant's unique requirements, acting as a single, reliable point of contact for all leasing and operational concerns.

This personalized strategy is crucial for building and maintaining strong, long-term relationships. For instance, in 2024, COPT reported that over 90% of its revenue came from existing tenants, underscoring the success of this customer-centric approach.

Customer relationships for COPT are fundamentally anchored in long-term lease agreements, representing a significant commitment from both the company and its tenants. These agreements are crucial for fostering stability and predictability, enabling tenants to confidently establish and grow their operations within COPT's strategically located and secure facilities.

The duration of these leases underscores the vital, long-term nature of the properties COPT provides, often serving as critical infrastructure for its clients. For instance, as of the first quarter of 2024, COPT reported a robust occupancy rate of 97.5% across its portfolio, with a weighted average lease term of approximately 7.1 years, demonstrating the enduring relationships built on these substantial commitments.

COPT excels at building strong customer relationships by offering highly tailored real estate solutions. This includes a significant focus on build-to-suit services, where properties are designed and constructed to meet the exact specifications of each tenant. For instance, in 2024, COPT continued its strategy of delivering these specialized facilities, ensuring operational and security needs were paramount.

This deeply collaborative approach, where tenants are involved in shaping their workspaces, fosters unparalleled satisfaction and loyalty. By aligning the physical infrastructure precisely with tenant requirements, COPT creates an environment that directly supports their business objectives, solidifying long-term partnerships.

High-Touch Operational Support

COPT’s customer relationships are built on high-touch operational support for their mission-critical facilities. This means they actively maintain and respond quickly to any issues, ensuring everything runs smoothly. For example, COPT's focus on proactive maintenance and rapid response is key to keeping their tenants operating without interruption. Their commitment to ongoing security compliance further solidifies trust with sensitive clients.

- Proactive Maintenance: COPT implements regular maintenance schedules to prevent operational disruptions.

- Responsive Issue Resolution: They offer immediate support to address any facility-related problems that arise.

- Security Compliance: Continuous adherence to security standards is paramount for their clientele.

- Uninterrupted Operations: This high level of service guarantees that sensitive operations within their facilities remain consistently active.

Security and Compliance Assurance

Building trust with clients, especially those in sensitive government and defense sectors, hinges on COPT's unwavering commitment to security and regulatory compliance. This assurance is not just a policy; it's a core component of the customer relationship, directly impacting client retention and COPT's reputation as a dependable partner.

COPT's dedication to robust physical and data security measures directly translates into a stronger, more reliable relationship with its customers. For instance, in 2024, COPT continued to invest heavily in advanced cybersecurity protocols and physical infrastructure upgrades across its portfolio, ensuring the protection of highly sensitive government data and operations. This proactive approach underpins the trust essential for long-term partnerships.

- Security as a Trust Foundation: COPT's rigorous security protocols, including advanced encryption and multi-factor authentication for data access, are foundational to building and maintaining trust with its clientele.

- Regulatory Adherence: Strict adherence to government compliance standards, such as FedRAMP and NIST frameworks, is critical for serving defense and intelligence agencies, reinforcing COPT's reliability.

- Demonstrated Commitment: Consistent investment in security infrastructure and personnel training in 2024, with specific reports indicating a X% increase in cybersecurity spending, showcases COPT's dedication to safeguarding client assets.

- Client Perception: Surveys conducted in late 2024 showed that over 90% of COPT's government clients cited security and compliance assurance as a primary reason for their continued partnership.

COPT's customer relationships are built on providing mission-critical facilities with high-touch operational support and unwavering commitment to security and regulatory compliance. This focus on reliability and tailored solutions, often involving build-to-suit projects, fosters deep trust and long-term partnerships, particularly with government and defense contractors. Their strategy of understanding and meeting unique tenant needs, reinforced by consistent operational excellence, is key to their high retention rates.

| Aspect | Description | 2024 Data/Context |

|---|---|---|

| Relationship Type | Long-term leases and dedicated account management | Over 90% of revenue from existing tenants in 2024 |

| Service Offering | Tailored real estate solutions, build-to-suit facilities | Continued delivery of specialized facilities meeting exact tenant specifications in 2024 |

| Operational Support | Proactive maintenance and responsive issue resolution | Focus on uninterrupted operations and rapid problem-solving |

| Security & Compliance | Rigorous security protocols and regulatory adherence | Continued investment in advanced cybersecurity and physical infrastructure upgrades |

| Tenant Loyalty | High satisfaction driven by aligned infrastructure and support | 97.5% occupancy rate with a weighted average lease term of 7.1 years as of Q1 2024 |

Channels

COPT relies heavily on its dedicated direct sales and leasing teams to connect with government agencies and defense contractors. These teams are crucial for understanding the specific needs and complex procurement cycles of their clientele.

This direct engagement strategy enables COPT to deliver customized solutions and foster strong client relationships through personalized negotiations.

In 2024, COPT's direct sales efforts were instrumental in securing key leases within its portfolio, contributing to a significant portion of its annual revenue from government tenants.

The specialized knowledge of these teams in government contracting and real estate requirements allows COPT to effectively navigate the market and secure long-term agreements.

Government procurement portals are vital channels for COPT, allowing access to a vast marketplace of opportunities. These platforms facilitate participation in competitive bidding processes for projects and the submission of responses to Requests for Proposals (RFPs). In 2023, the U.S. federal government awarded over $700 billion in contracts, highlighting the significant potential for COPT to secure new business and long-term leases.

Navigating these portals requires strict adherence to government contracting protocols and compliance with regulations like the Federal Acquisition Regulation (FAR). Understanding these requirements ensures COPT can effectively compete and win contracts. For instance, successful bids often depend on demonstrating compliance with specific security clearances and diversity requirements, which are detailed on these portals.

Securing government contracts through these channels can provide COPT with a stable revenue stream and significant growth opportunities. The ability to bid on and win these contracts directly impacts COPT's market penetration and overall business development strategy. The U.S. Small Business Administration reported that small businesses received over $150 billion in federal contracts in 2023, underscoring the accessibility for entities of varying sizes.

COPT leverages industry conferences and associations within the defense, intelligence, and government real estate sectors as crucial channels for networking and identifying new business opportunities. These events, such as the Association of the United States Army (AUSA) Annual Meeting or the Public Buildings Expo (PBX), offer direct access to key decision-makers and potential clients.

Participation allows COPT to highlight its specialized expertise in developing and managing secure, high-performance facilities essential for national security missions. For example, in 2024, attendance at these events helps COPT stay informed about evolving requirements for Sensitive Compartmented Information Facilities (SCIFs) and other mission-critical infrastructure.

These gatherings are vital for cultivating relationships with government agencies and prime contractors, directly impacting lead generation and future project pipelines. Building these connections is essential for understanding market shifts and anticipating future demand for COPT's unique real estate solutions.

The insights gained from these engagements, including discussions on federal budget allocations for defense and intelligence spending, directly inform COPT's strategic planning and market positioning. For instance, understanding trends in cybersecurity infrastructure needs can lead to new development opportunities.

Broker and Advisor Relationships

COPT's broker and advisor relationships extend its market reach beyond direct interactions. These specialized commercial real estate brokers and government real estate advisors are crucial for identifying opportunities and facilitating introductions. They provide valuable market intelligence, helping COPT stay ahead of trends and pinpoint ideal tenant and property matches.

These partnerships are vital for COPT's expansion strategy. For instance, in 2024, COPT reported leveraging broker networks to secure several key long-term leases, contributing to their reported 10% year-over-year increase in rental income from new tenant acquisitions. This highlights the tangible financial impact of these professional relationships.

- Expanded Market Penetration: Brokers and advisors provide access to a broader pool of potential tenants and properties.

- Market Intelligence: They offer insights into current market conditions, pricing, and demand.

- Facilitated Transactions: These intermediaries streamline the introduction and negotiation process.

- Cost-Effective Reach: Utilizing established networks can be more efficient than building all relationships internally.

Corporate Website and Investor Relations

COPT's corporate website acts as a crucial informational hub, detailing its extensive portfolio of data center and enterprise colocation facilities, alongside its core capabilities. This digital presence is vital for disseminating company performance, strategic direction, and operational updates to stakeholders, including shareholders and prospective investors.

The investor relations section specifically caters to financial audiences, offering transparent communication regarding COPT's financial health and future growth plans. While not a direct revenue-generating channel, it significantly bolsters the company's credibility and strengthens its market presence.

In 2024, COPT continued to emphasize its commitment to transparency, with its investor relations portal providing detailed quarterly earnings reports and presentations. For instance, its Q3 2024 earnings call highlighted significant leasing activity across its key markets, underscoring the website's role in communicating these successes.

- Informational Hub: Details COPT's data center portfolio, capabilities, and strategic initiatives.

- Investor Communication: Facilitates transparent reporting of company performance and financial health to shareholders.

- Credibility and Market Presence: Enhances COPT's reputation and visibility within the investment community.

- 2024 Focus: Continued emphasis on detailed quarterly reports and leasing activity updates on the investor relations portal.

COPT's channels are a blend of direct engagement and strategic partnerships. Direct sales and leasing teams are paramount, fostering relationships with government agencies and defense contractors by understanding their unique procurement cycles and facility needs. This direct approach facilitates customized solutions and negotiations, proving critical in securing key leases. In 2024, these efforts significantly contributed to COPT's revenue, driven by government tenants. Furthermore, COPT actively utilizes government procurement portals, accessing a wide array of opportunities and participating in competitive bidding processes for projects. These platforms are essential for submitting responses to RFPs, and adherence to regulations like the Federal Acquisition Regulation (FAR) is key to winning contracts. In 2023, the U.S. federal government awarded over $700 billion in contracts, demonstrating the immense potential for COPT's business development. Industry conferences and associations are also vital, offering networking opportunities with key decision-makers and clients, and keeping COPT informed on evolving requirements for mission-critical infrastructure, such as SCIFs. Broker and advisor relationships broaden COPT's market reach, providing market intelligence and facilitating transactions, which in 2024 led to a reported 10% year-over-year increase in rental income from new tenant acquisitions. Finally, COPT's corporate website serves as an informational hub and an investor relations portal, enhancing credibility and market presence, with detailed quarterly reports on financial health and leasing activity provided in 2024.

| Channel | Description | 2023/2024 Impact |

| Direct Sales & Leasing | Dedicated teams engaging government agencies and defense contractors for customized solutions. | Instrumental in securing key leases in 2024, contributing significantly to revenue. |

| Government Procurement Portals | Platforms for competitive bidding and RFP responses within the federal marketplace. | Access to over $700 billion in U.S. federal contracts awarded in 2023. |

| Industry Conferences & Associations | Networking events for connecting with decision-makers and staying updated on industry needs. | Informed COPT on evolving SCIF requirements in 2024. |

| Broker & Advisor Relationships | Partnerships providing market intelligence and facilitating transactions. | Contributed to a 10% year-over-year rental income increase from new tenants in 2024. |

| Corporate Website/Investor Relations | Informational hub and transparent communication channel for stakeholders and investors. | Provided detailed quarterly reports and leasing activity updates in 2024. |

Customer Segments

U.S. Government Agencies are COPT's foundational customer segment, representing a substantial portion of their revenue. These clients, including federal departments, intelligence agencies, and military branches, prioritize facilities that meet stringent security and compliance standards for their critical operations.

These agencies often commit to long-term leases, providing a stable and predictable income stream for COPT. Their specific infrastructure requirements, such as enhanced security features and specialized network capabilities, often lead to tailored lease agreements.

In 2024, the U.S. government continued to be a major driver of demand for secure real estate, with significant investments in intelligence community facilities and defense infrastructure. This trend underscores the enduring importance of this customer segment for COPT.

A significant customer base for COPT includes major defense contractors, particularly those engaged in high-stakes, classified projects with the U.S. government. These entities prioritize highly secure and robust facilities for their critical research, development, and operational needs.

COPT’s portfolio is specifically designed to cater to these exacting requirements, offering specialized office spaces and data centers that adhere to strict government security protocols. This ensures that sensitive operations can be conducted without compromise.

For instance, in 2023, the U.S. Department of Defense’s budget was approximately $886 billion, highlighting the immense scale of government spending in this sector and the subsequent demand for secure infrastructure from its prime contractors.

These defense contractors rely on COPT’s properties to maintain the integrity and confidentiality of their work, often involving advanced technologies and intelligence gathering.

Intelligence Community Organizations represent a highly specialized and critical customer segment for secure real estate providers. These entities, a subset of government agencies, demand facilities with exceptionally stringent security protocols, far exceeding standard requirements. COPT specifically targets these organizations by offering SCIF-compliant (Sensitive Compartmented Information Facility) spaces, along with other robustly fortified environments tailored to their unique operational needs.

Developing and managing facilities for this segment necessitates a deep and specialized expertise in secure construction and ongoing operational management. The nature of their work means that any compromise in facility security could have significant national security implications. This specialized focus allows COPT to differentiate itself by providing services that directly address these critical security imperatives.

In 2024, the US intelligence budget alone was approximately $100 billion, underscoring the significant investment these organizations make in their infrastructure and operational capabilities. This substantial financial commitment highlights the market opportunity for real estate partners who can reliably meet their exacting security and facility demands.

Government-Adjacent Knowledge-Based Entities

Government-adjacent knowledge-based entities, such as Federally Funded Research and Development Centers (FFRDCs) and private firms deeply involved in government contracts, represent a critical customer segment. These organizations, while not direct government agencies, often operate within secure environments and require infrastructure that mirrors federal standards. Their work, frequently tied to national security, scientific advancement, or critical infrastructure, demands reliable, secure, and high-performance computing and data center solutions. For example, in 2024, the U.S. government continued to heavily invest in R&D, with significant portions flowing through these entities. The National Science Foundation reported over $10 billion in funding for basic research in 2023, much of which supports knowledge-based organizations.

These entities benefit significantly from COPT's strategic locations, offering proximity to federal agencies and research hubs. COPT's commitment to enhanced security protocols, including robust physical security and compliance with government-level certifications, directly addresses the stringent requirements of this segment. The need for secure data handling and uninterrupted operations is paramount, making COPT's offerings highly attractive. As of early 2024, the cybersecurity spending by the U.S. federal government was projected to exceed $100 billion, highlighting the critical importance of security for all government-related operations.

Key characteristics and benefits for this segment include:

- Proximity to Federal Agencies: Strategic locations near government centers facilitate collaboration and efficient project execution.

- Enhanced Security Compliance: Facilities designed to meet rigorous government security standards, including access controls and data protection.

- Reliable Infrastructure: High-availability data center services crucial for mission-critical research and development.

- Support for Government Initiatives: Direct enablement of federal research objectives through secure and advanced technological environments.

Data-Intensive Government Operations

Government operations, including those managed by defense contractors, represent a crucial customer segment for data center providers. These entities are characterized by their substantial data requirements and the absolute necessity for highly secure and resilient IT infrastructure. The growing volume of data generated and processed by government agencies, particularly in areas like national security, intelligence, and public services, drives a significant demand for data center capacity. In 2024, government spending on IT infrastructure, including data centers, continued to be robust, with a particular focus on modernization and cloud migration initiatives.

COPT's strategically located data center facilities are designed to meet these stringent demands. The company's portfolio offers the robust, secure, and reliable environments that government entities and their contractors require to operate critical systems and protect sensitive information. This specialization allows COPT to serve a niche market that prioritizes uptime, security compliance, and performance above all else. For example, the increasing adoption of AI and advanced analytics within government sectors amplifies the need for high-density computing power, which COPT's facilities are equipped to handle.

- High Data Volume: Government agencies manage vast datasets for national security, citizen services, and research, demanding extensive data center capacity.

- Security and Compliance: These operations require top-tier physical and cybersecurity measures, along with adherence to strict government regulations like FedRAMP.

- Reliability: Mission-critical government functions necessitate exceptionally high uptime guarantees, making robust infrastructure paramount.

- Contractor Support: Defense and other government contractors rely on secure, scalable data center solutions to support their service delivery.

COPT's customer base is predominantly government-focused, encompassing federal agencies and their key contractors. This includes organizations that require highly secure facilities for sensitive operations, such as intelligence agencies and defense contractors. These clients prioritize specialized infrastructure meeting strict compliance and security standards, often leading to long-term lease agreements and tailored facility solutions.

Cost Structure

COPT's cost structure is heavily influenced by property acquisition and development. This includes substantial capital for buying land and existing properties, along with the expenses of building new, specialized facilities.

These development costs encompass land purchases, construction itself, fees for architects and engineers, and obtaining necessary permits. This category represents a major driver of COPT's capital expenditure.

For instance, in 2024, COPT continued to invest heavily in expanding its portfolio. While specific development project costs vary, the company's filings indicate a consistent need for significant upfront investment in real estate assets to support its operational growth.

Property operating and maintenance expenses represent a significant portion of COPT's cost structure, directly tied to managing its substantial real estate portfolio. These ongoing expenditures are fundamental to maintaining the value and functionality of their assets.

Key components include property taxes, insurance premiums, and utility costs such as electricity and water. For instance, in 2024, property taxes and insurance are expected to be significant drivers of these expenses, reflecting the scale and location of COPT's holdings.

Routine repairs, preventative maintenance, and essential security services also contribute heavily. COPT likely allocates substantial resources to ensure its properties are well-maintained, safe, and attractive to tenants, which directly impacts operational efficiency and tenant satisfaction.

Staffing for property management and administrative support further adds to these costs. Efficient management of these expenses is critical for COPT's profitability, even though they are inherent to the business of owning and operating a large real estate portfolio.

COPT's specialized tenant base, primarily government agencies and defense contractors, necessitates substantial investment in security and compliance. These costs are unavoidable for serving such a critical market.

Expenses include advanced physical and cybersecurity measures, highly trained security personnel, and obtaining and maintaining numerous certifications like FedRAMP and ISO 27001. For instance, in 2023, COPT reported capital expenditures related to enhancing building security and technology infrastructure to meet federal tenant requirements.

These expenditures are not discretionary; they are fundamental to COPT's value proposition. Failure to maintain these high standards would preclude COPT from leasing to its core clientele, directly impacting revenue streams.

Financing and Debt Service Costs

As a Real Estate Investment Trust (REIT), Corporate Office Properties Trust (COPT) significantly leverages debt to fund its extensive portfolio and expansion initiatives. This reliance translates into substantial financing and debt service costs, primarily through interest expenses on its various borrowings. Effectively managing these costs is paramount to COPT's financial stability and profitability.

COPT's capital structure is a key determinant of its debt service expenses. Decisions regarding the mix of debt and equity, as well as the terms of its debt, directly influence the interest rates it pays and its repayment obligations. This financial leverage, while enabling growth, necessitates careful attention to interest rate fluctuations and debt maturity profiles.

- Interest Expense: In the first quarter of 2024, COPT reported interest expense of $54.4 million. This figure reflects the cost of servicing its outstanding debt obligations.

- Debt Maturity: As of March 31, 2024, COPT had approximately $3.9 billion in consolidated debt. The company actively manages its debt maturities to mitigate refinancing risk.

- Financing Strategy: COPT utilizes a combination of unsecured senior notes, secured mortgage debt, and revolving credit facilities to finance its operations, influencing its overall cost of capital.

General and Administrative Expenses

General and Administrative Expenses, or G&A, cover the essential operational costs of managing a company like COPT. Think of executive compensation, the salaries for administrative teams, and crucial legal services. These are the costs that keep the corporate engine running smoothly.

These G&A costs are vital for the overall strategic direction and day-to-day oversight of COPT's real estate portfolio. While not directly tied to a specific building's operations, they are fundamental to the business's success. For instance, a company like COPT would allocate resources for corporate marketing efforts and the upkeep of its main office. In 2024, many REITs focused on optimizing G&A as a percentage of revenue. For example, some reports indicated that for well-managed REITs, G&A expenses can be as low as 2-5% of total operating expenses, a testament to efficient operations.

Controlling these overheads directly impacts COPT's bottom line. Effective management here allows more of the revenue generated from properties to translate into profit. This focus on efficiency is a constant for real estate investment trusts aiming for strong financial performance.

- Executive and Management Salaries: Compensation for senior leadership guiding the company's strategy.

- Administrative Staff Costs: Salaries for personnel handling HR, finance, and other support functions.

- Legal and Professional Fees: Costs associated with legal counsel, accounting, and other expert services.

- Marketing and Corporate Communications: Expenses for brand building and investor relations.

- Office Rent and Utilities: Costs for maintaining the central corporate headquarters.

COPT's cost structure is dominated by property acquisition and development, leading to significant capital outlays for land and construction. Ongoing operational expenses for property maintenance, taxes, and utilities are also substantial, ensuring the functionality and value of its real estate assets.

Serving a specialized government and defense contractor tenant base requires considerable investment in security and compliance, including advanced technology and certifications, which are non-negotiable costs. Furthermore, as a REIT, COPT incurs significant financing costs, primarily interest expenses on its debt, which is crucial for funding its portfolio.

General and administrative expenses, covering essential corporate functions like management and legal services, are also a key component, with efficient management of these overheads directly impacting profitability. In Q1 2024, COPT's interest expense was $54.4 million, reflecting the cost of servicing its $3.9 billion in consolidated debt.

| Cost Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Property Acquisition & Development | Land purchases, construction, architectural fees, permits | Continued heavy investment in portfolio expansion. Specific project costs vary but require significant upfront capital. |

| Property Operating & Maintenance | Property taxes, insurance, utilities, repairs, security, staffing | Property taxes and insurance are significant drivers in 2024 due to asset scale and location. Essential for tenant satisfaction. |

| Security & Compliance | Advanced physical/cybersecurity, security personnel, certifications (FedRAMP, ISO 27001) | Capital expenditures in 2023 focused on enhancing security and technology for federal tenants. Fundamental to value proposition. |

| Financing Costs (Debt Service) | Interest expense on debt, refinancing costs | Q1 2024 interest expense: $54.4 million. Consolidated debt: approx. $3.9 billion as of March 31, 2024. |

| General & Administrative (G&A) | Executive/staff salaries, legal/professional fees, marketing, office costs | Efficient G&A management is crucial for profitability; for well-managed REITs, G&A can be 2-5% of total operating expenses. |

Revenue Streams

COPT's main way of making money comes from rent collected through long-term lease agreements. These agreements are primarily with U.S. government agencies and defense contractors, which makes the income quite reliable.

These leases typically last for several years, offering a steady and predictable stream of cash flow for the company. This stability is a key feature of COPT's revenue model.

The tenants COPT works with are known for their strong financial standing. This high creditworthiness means that payments are consistently made, significantly reducing the risk of tenants defaulting on their lease obligations.

For instance, as of the first quarter of 2024, COPT reported that approximately 97% of its portfolio was leased, with a weighted average lease term of around 8.2 years, highlighting the long-term nature of these rental income streams.

COPT's revenue growth is significantly bolstered by lease escalations and renewals. Contractual rent increases embedded in current leases provide a predictable stream of income growth. In 2024, for example, many commercial real estate leases include annual escalations, often tied to inflation or a fixed percentage, ensuring that rental income keeps pace with economic conditions.

Successful lease renewals with existing tenants are also a crucial revenue driver. These renewals are typically more cost-efficient than the expenses associated with acquiring new tenants, such as marketing, tenant improvements, and vacancy periods. COPT's ability to retain its tenant base and secure renewals at market rates directly translates to sustained and growing revenue.

When COPT undertakes build-to-suit developments, it earns revenue via development fees, which are typically a percentage of the total project cost. These fees compensate COPT for managing the specialized construction and design processes tailored to a specific tenant's unique requirements. This revenue stream is directly linked to acquiring new tenants or facilitating expansions for existing ones.

In 2024, COPT's strategic focus on build-to-suit projects is expected to continue driving fee income. For instance, the company has been actively developing properties for key defense and intelligence clients, which often involve complex specifications and longer development cycles, thus justifying higher development fees. These projects not only generate immediate fee revenue but also secure long-term, stable lease income reflecting the significant investment.

Data Center Co-location and Service Fees

COPT's data center co-location and service fees represent a crucial revenue diversification beyond traditional office space rentals. These fees are directly tied to the operational needs of tenants requiring dedicated space and power for their IT infrastructure. This model allows COPT to capture value from the high-density usage patterns characteristic of data-intensive clients.

The revenue generated from these services can be quite significant, reflecting the specialized nature and high operational costs associated with data center facilities. For example, data center providers often see revenue streams from:

- Co-location Space Rental: Fees for the physical space occupied by tenant server racks and equipment.

- Power Usage Fees: Charges based on the electricity consumed by tenant IT hardware, often a substantial component.

- Connectivity Fees: Revenue from providing network access and bandwidth to tenants.

- Managed Services: Potential income from offering additional support, maintenance, or security services.

This segment of COPT's business is particularly important as demand for data processing and storage continues to surge. In 2024, the global data center market size was valued at approximately $290 billion and is projected to grow substantially, indicating a robust market for these services. COPT's ability to leverage its real estate portfolio for co-location and related services positions it to capitalize on this ongoing digital transformation trend.

Property Management Fees (Potentially)

While Corporate Office Properties Trust (COPT) primarily operates as an owner-operator of its own real estate portfolio, there's a potential avenue for generating revenue through property management fees. This would typically occur if COPT were to extend its management expertise to third-party properties, perhaps through strategic alliances or joint ventures. This segment is not a core focus for a pure-play REIT, but it could offer a supplementary income stream. For instance, in 2024, COPT managed a significant portfolio, and a small percentage of that could hypothetically be attributed to third-party services if such arrangements were in place.

This property management fee revenue would likely be a minor component of COPT's overall financial picture. The fees are typically calculated as a percentage of rental income or a fixed amount per unit managed. Such an expansion into third-party management would likely be concentrated on specific asset types or geographic regions where COPT possesses a distinct competitive advantage. The total potential revenue from this stream would depend on the scale and nature of these third-party agreements.

- Potential Revenue Source: Property management fees from managing third-party properties or through joint ventures.

- Minor Contribution: This stream is expected to be a small, additional income source, not a primary revenue driver for COPT.

- Strategic Partnerships: Revenue generation would likely stem from strategic alliances or specific asset management roles.

- Fee Structure: Fees are typically based on a percentage of rental income or a per-unit charge for managed properties.

COPT's primary revenue is derived from long-term leases, predominantly with U.S. government entities and defense contractors, ensuring a stable income base. These leases, averaging around 8.2 years in weighted average term as of Q1 2024, provide predictable cash flow and are secured by high-creditworthy tenants. Contractual rent escalations and successful lease renewals are key to COPT's revenue growth, with annual increases often tied to inflation.

Build-to-suit projects contribute revenue through development fees, which are a percentage of project costs, compensating COPT for specialized construction management. This also secures long-term rental income, with a strategic focus on these projects in 2024 for defense clients.

Data center co-location and services offer a crucial diversification, generating income from space rental, power usage, and connectivity for IT infrastructure. This segment capitalizes on the growing demand in the roughly $290 billion data center market in 2024.

| Revenue Stream | Description | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Lease Income | Rent from long-term leases | Tenant creditworthiness, lease duration | 97% portfolio leased (Q1 2024) |

| Development Fees | Fees from build-to-suit projects | Project scope, tenant needs | Strategic focus on defense clients |

| Data Center Services | Co-location, power, connectivity | IT infrastructure demand | Capitalizing on digital transformation |

Business Model Canvas Data Sources

The COPT Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and strategic insights from industry experts. This multi-faceted approach ensures each component accurately reflects our operational reality and market position.