COPT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COPT Bundle

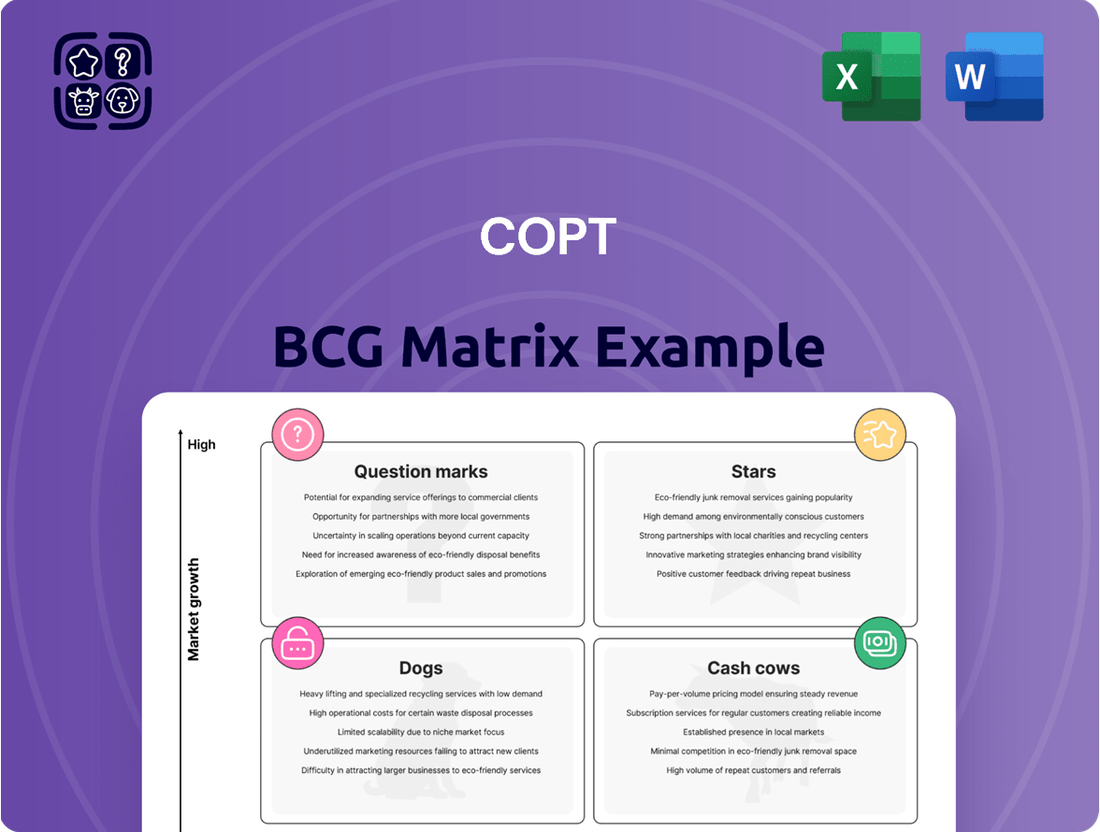

The BCG Matrix is a powerful tool for understanding product portfolio performance. It categorizes products into Stars, Cash Cows, Question Marks, and Dogs based on market growth and relative market share. This allows businesses to make informed decisions about resource allocation and strategic planning.

This preview offers a glimpse into the strategic positioning of a company's products. To truly unlock its potential and gain a comprehensive understanding, dive deeper into the full BCG Matrix. Purchase the complete version for a detailed breakdown of each product's quadrant placement and actionable insights.

The full BCG Matrix provides the critical data and strategic recommendations needed to optimize your product portfolio and drive growth. Don't miss out on the opportunity to gain a competitive edge by understanding where your company's resources are best utilized.

Stars

Corporate Office Properties Trust's (COPT) strategic acquisition of a substantial 365-acre land parcel near Des Moines, Iowa, is a significant indicator of its hyperscale data center ambitions. This site is designed to support an impressive 3.3 million square feet of data center development, backed by a robust 1 gigawatt of power capacity.

This development positions COPT's hyperscale data center segment firmly in the Star category of the BCG Matrix, reflecting its high growth potential. The company is actively capitalizing on the escalating demand for data center space, a trend fueled by the rapid expansion of cloud computing services and the transformative impact of artificial intelligence.

COPT anticipates that this strategic land acquisition will significantly bolster its development pipeline over the medium to long term. Management expects these hyperscale projects to deliver substantial, long-term accretion to Funds From Operations (FFO), underscoring the segment's financial promise.

COPT's strategic acquisition of an 80,000 square foot vacant building in San Antonio, Texas, exemplifies a Stars position in the BCG matrix. This property was promptly fully leased to the U.S. Government, with operations expected to begin in the second quarter of 2025. This rapid lease-up underscores COPT's proficiency in capitalizing on high-demand opportunities within the defense sector.

The swift monetization of this San Antonio asset, situated near critical defense installations, highlights the robust market appetite for COPT's specialized real estate offerings. This move not only solidifies COPT's position in a key market but also demonstrates effective execution of their acquisition and leasing strategy, contributing to their portfolio's growth and tenant diversification.

COPT's investments in high-demand defense installation expansions, like the 150,000 square foot development at Redstone Gateway in Huntsville, Alabama, directly address current and emerging needs. These projects are designed to capture immediate demand for secure, specialized facilities, reflecting the robust increase in defense budgets and specific agency requirements. This strategic focus allows COPT to solidify its market leadership in crucial defense-related real estate markets, ensuring strong occupancy and rental income.

Pre-Leased Development Pipeline

COPT's active development pipeline, featuring five properties totaling 756,000 square feet, was 62% leased as of April 2025. This pipeline, representing an estimated $308 million investment, is geared towards mission-critical tenants. The strong pre-leasing indicates robust demand and market confidence in these future assets.

These development projects are strategically positioned to deliver substantial cash flow once completed and fully occupied. The high level of pre-leasing, reaching 62% across the 756,000 square feet, underscores the market's positive reception and COPT's successful execution in securing future tenants.

- Pipeline Size: 756,000 square feet across five properties.

- Pre-Leasing Rate: 62% as of April 2025.

- Estimated Investment: $308 million.

- Tenant Focus: Mission-critical occupants.

Growth in Cybersecurity-Focused Regions

The Fort Meade/BW Corridor and Northern Virginia stand out as prime examples of Stars within the cybersecurity-focused real estate landscape. COPT's continued investment and robust leasing performance in these critical hubs underscore their strategic importance. These regions are experiencing sustained demand driven by government agencies focused on cybersecurity and intelligence, creating a consistent need for specialized, secure facilities.

COPT's leading market position in these Star segments is a testament to their ability to cater to the evolving requirements of these high-demand tenants. As of 2024, the demand for highly secure, mission-critical facilities in these areas remains exceptionally strong, reflecting the ongoing national security priorities. This sustained growth translates into reliable income streams and significant potential for further capital appreciation.

- Fort Meade/BW Corridor and Northern Virginia are identified as Star segments due to their concentration of cybersecurity and intelligence tenants.

- Sustained government demand and the need for specialized, secure facilities fuel growth in these regions.

- COPT's established market leadership in these areas provides a competitive advantage.

- The leasing performance in these segments demonstrates resilience and strong tenant retention.

COPT's hyperscale data center development in Des Moines, Iowa, representing 3.3 million square feet and 1 gigawatt of power, exemplifies a Star due to its high growth potential driven by cloud computing and AI. Similarly, the rapid lease-up of an 80,000 square foot building in San Antonio to the U.S. Government, with operations starting in Q2 2025, showcases a Star segment due to high demand in the defense sector. COPT's strategic investments in mission-critical facilities, like the 756,000 square foot pipeline with 62% pre-leasing as of April 2025, also fit the Star profile, promising substantial future cash flow and strong market reception.

| Segment | Key Characteristics | BCG Matrix Position | Supporting Data |

|---|---|---|---|

| Hyperscale Data Centers (Des Moines) | High growth potential, significant development pipeline | Star | 3.3M sq ft development, 1 GW power capacity |

| Defense-Focused Real Estate (San Antonio) | Rapid lease-up, strong demand from government | Star | 80,000 sq ft vacant building leased to U.S. Gov't (operations Q2 2025) |

| Mission-Critical Developments | High pre-leasing, strategic location, substantial investment | Star | 756,000 sq ft pipeline, 62% pre-leased (April 2025), $308M investment |

| Cybersecurity Hubs (Fort Meade/BW Corridor, NoVA) | Sustained government demand, specialized facilities | Star | Strong leasing performance, critical hubs for intelligence agencies |

What is included in the product

The COPT BCG Matrix analyzes products/units by market share and growth, guiding investment decisions.

One-page BCG matrix overview simplifying portfolio analysis for faster strategic decisions.

Cash Cows

COPT's Defense/IT portfolio, a cornerstone of its operations, functions as a classic Cash Cow. This extensive segment, featuring 198 properties and covering 22.6 million square feet, boasts a strong leased rate of 96.6% and an occupancy of 95.3% as of March 31, 2025. Such high utilization, driven by the mission-critical nature of these assets, ensures a predictable and substantial revenue stream.

The stability of this portfolio is further amplified by its tenant base, primarily consisting of government agencies and defense contractors. These entities typically engage in long-term lease agreements, providing COPT with consistent cash flow generation. This reliability makes the Defense/IT portfolio a dependable source of income, underpinning the company's overall financial health.

COPT's long-term government and contractor leases embody the characteristics of a Cash Cow within the BCG Matrix. The company's primary tenancy with the U.S. Government and its defense contractors generates highly predictable and stable income streams. These tenants often require specialized, high-security enhancements and typically sign long-term leases, ensuring consistent revenue with low tenant turnover.

COPT's consistent same-property cash Net Operating Income (NOI) growth highlights the strength of its established assets. This metric, showing a 7.1% increase in Q1 2025 and a robust 9.1% for the full year 2024, underscores the operational efficiency and profitability of its mature properties.

This impressive growth is largely attributable to built-in rent increases and superior property management practices within COPT's stable portfolio. These factors ensure reliable income streams and capitalize on the inherent value of their existing holdings.

High Tenant Retention Rates

COPT's exceptional tenant retention, reaching an impressive 86% in 2024, the highest in over twenty years, speaks volumes about the enduring value and specialized appeal of its properties. This high rate is a direct indicator of strong tenant relationships and the inherent "stickiness" of its portfolio, which caters to specific industry needs.

This elevated retention significantly bolsters COPT's financial performance by minimizing costly tenant turnover and reducing periods of vacancy. Such stability translates directly into a more consistent and predictable stream of rental income, a hallmark of a strong cash cow.

- 86% Tenant Retention in 2024: The highest rate in more than two decades.

- Reduced Re-leasing Costs: Lower expenses associated with finding and onboarding new tenants.

- Minimized Vacancy Periods: Ensuring continuous revenue generation from occupied spaces.

- Predictable Cash Flow Generation: Underpinning the stability and "cash cow" status of these assets.

Stable and Growing Dividend Payouts

COPT's (Corporate Office Properties Trust) consistent performance in delivering shareholder value solidifies its position as a Cash Cow. The company boasts an impressive 34-year track record of uninterrupted dividend payouts, demonstrating a stable and reliable income stream for investors.

This stability is further underscored by a tangible commitment to growth. In 2025, COPT increased its quarterly dividend by 3.4%, signaling confidence in its ongoing cash-generating ability.

The financial strength backing these payouts is evident in its Funds From Operations (FFO) per share. COPT projects a compound annual growth rate of 4% for FFO per share through 2026, reinforcing its status as a dependable Cash Cow.

- 34-year track record of uninterrupted dividend payouts.

- 3.4% increase in quarterly dividend in 2025.

- 4% compound annual growth projected for FFO per share through 2026.

- Demonstrates strong and consistent cash-generating capabilities.

COPT's Defense/IT portfolio is a prime example of a Cash Cow within the BCG Matrix due to its stable, high-demand nature and consistent revenue generation. This segment, characterized by its mission-critical assets and long-term government leases, provides a predictable and substantial income stream that fuels other business initiatives.

The high occupancy rates, exceeding 95% for its 198 Defense/IT properties as of March 31, 2025, coupled with an impressive 86% tenant retention in 2024, underscore the low risk and high predictability of this portfolio. These factors minimize operational costs and maximize cash flow, solidifying its Cash Cow status.

COPT's commitment to shareholder returns further validates this classification, evidenced by 34 years of uninterrupted dividend payouts and a 3.4% dividend increase in 2025. The projected 4% compound annual growth in FFO per share through 2026 reinforces the robust and sustainable cash generation from these mature assets.

| Portfolio Segment | BCG Category | Key Performance Indicators (2024/Q1 2025) |

|---|---|---|

| Defense/IT | Cash Cow | - 198 Properties, 22.6M sq ft - 96.6% Leased Rate (Mar 31, 2025) - 95.3% Occupancy (Mar 31, 2025) - 7.1% Same-Property Cash NOI Growth (Q1 2025) - 9.1% Same-Property Cash NOI Growth (Full Year 2024) - 86% Tenant Retention (2024) |

| Shareholder Returns | Cash Cow Indicator | - 34 Years Uninterrupted Dividends - 3.4% Dividend Increase (2025) - 4% Projected FFO Growth (through 2026) |

Preview = Final Product

COPT BCG Matrix

The BCG Matrix analysis you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted by strategic planning experts, offers a clear and actionable framework for evaluating your business portfolio. You can confidently use this preview as an accurate representation of the professional-grade analysis that will be yours to download and implement directly into your strategic decision-making processes.

Dogs

Non-strategic or older office properties within Corporate Office Properties Trust (COPT) could be categorized here. These are assets that don't directly support the company's primary focus on defense and IT tenants. For example, COPT's portfolio might include some legacy office buildings acquired previously that no longer fit the strategic direction.

These older or non-core assets typically face higher vacancy rates and tenant turnover challenges compared to their specialized counterparts. In 2024, properties not catering to the specific needs of government contractors or technology firms might experience softer leasing demand, impacting their overall financial performance and requiring more active management.

Properties with Persistent Vacancy or High Turnover, within the COPT BCG Matrix, represent those assets that, despite favorable locations, are struggling to maintain stable occupancy. These properties may require substantial investment to become attractive to tenants again.

In 2024, for instance, certain office buildings in secondary markets within COPT's portfolio might exhibit this characteristic. A hypothetical example could be a property that saw its vacancy rate climb from 5% to 15% over 2023-2024 due to an aging infrastructure and lack of modern amenities, failing to compete with newer developments.

This persistent churn or emptiness signals a need for strategic intervention. It could involve significant capital expenditure for upgrades, a recalibration of rental pricing, or even a change in the property's intended use to better align with current market demand.

Assets with limited future development potential within Cousins Properties (COPT) portfolio, when viewed through the lens of a BCG Matrix, might include land parcels or existing properties that don't align with high-value, mission-critical development or expansion in COPT's core defense and IT sectors. These could represent a drag on capital, preventing reinvestment in more promising areas.

For instance, if COPT has a property in a declining industrial area with no clear path for conversion to a modern office or data center facility, it might fall into this category. Such an asset, perhaps acquired years ago, could tie up capital without generating significant returns or contributing to strategic growth objectives. As of the first quarter of 2024, COPT's focus remains on delivering high-quality, modern office and life science spaces, suggesting that assets not fitting this mold would be candidates for re-evaluation.

Properties Requiring Substantial Non-Accretive Capital Expenditure

Properties requiring substantial non-accretive capital expenditure are essentially the underperformers in the Boston Consulting Group (BCG) matrix, often categorized as Dogs. These are older assets that necessitate significant investment for upgrades, such as modernization or enhanced security, to align with current tenant expectations and regulatory requirements.

The critical issue is that these capital outlays, while potentially necessary for basic maintenance or to avoid obsolescence, do not offer a clear pathway to proportionally higher rental income or improved occupancy rates. For instance, a property might need a $5 million renovation to meet new energy efficiency standards, but the projected increase in rent or tenant demand might only justify a $1 million return, making the net investment non-accretive.

These expenditures are often driven by a need to maintain a baseline operational status rather than to achieve growth or gain a competitive edge in the market. Such situations can tie up valuable capital that could otherwise be deployed in more promising areas of the portfolio.

- Definition: Older properties needing significant, non-return-generating capital for modernization or security upgrades.

- Challenge: Investments are necessary for maintenance but do not drive growth or competitive advantage.

- Example: A $5 million renovation yielding only a $1 million increase in projected rental income or tenant demand.

- Strategic Implication: Capital is tied up without a clear path to increased returns, potentially hindering portfolio growth.

Absence of Planned Asset Sales

For the year 2025, COPT has explicitly stated no plans for asset sales. This suggests a portfolio where underperforming assets, often categorized as 'Dogs' in the BCG matrix, are either minimal or the company believes current market conditions aren't favorable for divestiture. This focus implies a strategic decision to retain assets, perhaps anticipating future performance improvements or a more opportune selling environment.

The absence of planned asset sales for 2025 can be interpreted in a few ways. It might mean COPT has a lean portfolio with few assets fitting the 'Dog' profile, or it's a deliberate choice to hold onto any such assets instead of selling them off now. This approach could signal confidence in the long-term value of its entire asset base.

COPT's strategy regarding asset sales directly impacts its portfolio composition. By not planning to sell assets in 2025, the company signals a commitment to its current holdings, suggesting a belief in their ongoing or future contributions. This could also reflect a conservative approach to capital allocation, prioritizing internal reinvestment or debt reduction over immediate asset disposals.

- Minimal 'Dog' Assets: COPT's stated lack of planned 2025 asset sales suggests a limited number of underperforming assets requiring divestiture.

- Strategic Holding: Alternatively, the company may be choosing to hold onto any underperforming assets, waiting for more favorable market conditions for divestment.

- Portfolio Focus: This indicates a highly curated portfolio with few assets actively being shed, emphasizing stability and long-term value.

- No Divestiture Plans: For 2025, COPT has no stated intentions to sell off any part of its asset base, a key indicator for portfolio management strategy.

Assets classified as Dogs within COPT's portfolio represent older, non-strategic properties requiring significant capital for modernization without a clear return on investment. These properties may face persistent vacancies or high tenant turnover, impacting overall financial performance.

In 2024, COPT's focus on modern, mission-critical facilities for defense and IT tenants means older assets not aligning with this strategy are likely candidates for the Dog category. For example, a building needing substantial upgrades to meet energy efficiency standards but with limited projected rent increases would fall here.

The company's lack of planned asset sales for 2025 suggests either a minimal number of such 'Dog' assets or a strategic decision to retain them, anticipating future value or better divestment conditions. This reflects a commitment to portfolio stability and long-term asset value.

Question Marks

COPT's acquisition of a 365-acre site near Des Moines, Iowa, exemplifies a Question Mark in the BCG matrix. This large land parcel is earmarked for future data center shell development, tapping into the robust growth of the data center industry.

While the market outlook for data centers is exceptionally strong, with demand driven by cloud computing and AI, this specific asset currently represents an investment with no immediate return. The substantial capital required for development and infrastructure build-out means it will be some time before it contributes to COPT's Funds From Operations (FFO).

For instance, the data center market saw significant expansion in 2024, with hyperscale data center construction continuing at a rapid pace. However, realizing value from raw land requires extensive planning, zoning, and construction phases, often taking several years.

This strategic land acquisition positions COPT for long-term growth, but it necessitates significant upfront investment without immediate cash flow generation, a hallmark of Question Mark investments.

New geographic market explorations for COPT, identified as having high growth potential due to shifts in government priorities or emerging technological needs, are essentially question marks in the BCG matrix. These nascent ventures, not yet established defense or IT hubs, demand substantial initial investment and dedicated market penetration strategies. For instance, COPT might be eyeing Southeast Asian nations like Vietnam or the Philippines, where increasing digital transformation initiatives and defense modernization are creating new opportunities.

Speculative development projects, often seen in the question mark category of the COPT BCG Matrix, are ventures initiated with limited pre-leasing commitments. These projects bank on the expectation of future demand, particularly in rapidly expanding but inherently risky sectors. Their viability is directly tied to attracting tenants during or after the construction phase.

For instance, in 2024, the demand for specialized logistics and cold storage facilities, driven by e-commerce growth, has seen developers undertake speculative builds. While some projects may secure anchor tenants early, many rely on market absorption post-completion, a strategy that carries higher risk but also the potential for greater rewards if demand materializes as anticipated.

Properties Acquired Vacant for Future Lease-up

Properties acquired vacant for future lease-up, like the initial phase of certain industrial real estate investments, are classic Question Marks in a BCG matrix context. These assets require significant capital outlay for acquisition and initial operating expenses before any rental income is generated. Their future success hinges entirely on the ability to attract and secure creditworthy tenants in a competitive market.

For instance, in 2024, the industrial sector continued to see strong demand, with vacancy rates for industrial properties averaging around 4.0% nationally, according to various real estate market reports. However, properties in specific submarkets or those requiring specialized build-outs can face longer lease-up periods. This uncertainty, coupled with the cash drain during the vacant period, places these acquisitions firmly in the Question Mark category.

- Cash Intensive: Properties acquired vacant require upfront capital for purchase and initial operating costs before generating revenue.

- Tenant Dependency: Success is heavily reliant on securing suitable tenants, which is subject to market conditions and property appeal.

- Market Sensitivity: Lease-up speed and rental rates are directly influenced by local economic factors and the supply/demand balance for industrial space.

- Potential for Growth: If successfully leased, these properties can become Stars, generating substantial cash flow and capital appreciation.

Investments in Evolving Mission-Critical Technologies

Investments in evolving mission-critical technologies, particularly within the context of a BCG matrix, represent the question marks. These are areas where growth potential is high, but market share is uncertain or still being established. Think about highly specialized facilities needed for cutting-edge defense applications. For instance, the demand for advanced AI and machine learning computing infrastructure within the defense sector is rapidly expanding, with projected growth rates indicating significant future investment opportunities.

These specialized facilities, designed for emerging defense technologies like AI/ML computing or secure cyber warfare capabilities, present a unique investment profile. While the market is still developing and tenant requirements are in flux, the potential for high returns is substantial. As of early 2024, the global defense technology market is experiencing robust growth, driven by geopolitical tensions and the increasing integration of advanced technologies.

The inherent risk in these mission-critical technology investments stems from the nascent stage of market development and the evolving nature of the technologies themselves. Establishing clear market standards and securing stable tenant commitments can be challenging. However, successful navigation of these uncertainties can lead to a dominant market position.

- High Growth Potential: Sectors like AI in defense are projected for significant expansion, with some forecasts suggesting a compound annual growth rate exceeding 15% in the coming years.

- Market Uncertainty: Tenant needs for advanced computing or cyber warfare facilities are still being defined, creating variability in demand and lease structures.

- Specialized Infrastructure: Investment often requires tailored, high-security facilities that are costly to build and adapt.

- Risk vs. Reward: While initial investments carry higher risk due to unproven markets, early movers can capture substantial market share and premium pricing.

Question Marks in COPT's portfolio represent ventures with high growth potential but uncertain market share, demanding significant investment without immediate returns. These include undeveloped land for future data centers, new geographic market entries, and speculative development projects. The success of these investments hinges on future market demand and the ability to secure tenants or develop the assets effectively.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive data, including financial statements, market share reports, industry growth rates, and customer feedback to provide a clear strategic overview.