Cooper-Standard PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper-Standard Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Cooper-Standard's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence to guide your strategic decisions. Gain a competitive edge by understanding the complete landscape. Download the full version now for immediate insights.

Political factors

Governments globally are tightening rules on vehicle emissions and fuel efficiency, with many nations targeting significant reductions in CO2 output by 2030 and beyond. For instance, the European Union's CO2 emission performance standards for new cars and vans mandate average fleet emissions of 95 g CO2/km for 2020, with further reductions planned. These evolving mandates necessitate advanced materials and designs in automotive components, directly influencing Cooper-Standard's product development and material sourcing strategies to ensure compliance and market access.

Safety regulations are also becoming more stringent, pushing for enhanced occupant protection and advanced driver-assistance systems (ADAS). This trend requires suppliers to develop components that integrate seamlessly with these new technologies, potentially demanding lighter yet stronger materials and more complex manufacturing processes. For Cooper-Standard, this means investing in research and development to create solutions that meet or exceed these safety benchmarks, a crucial factor given the automotive industry's focus on accident prevention and cybersecurity in connected vehicles.

Trade policies and tariffs are critical for Cooper-Standard. For instance, the imposition of tariffs on steel and aluminum, key inputs for automotive components, directly impacts production costs. In 2024, ongoing trade negotiations and potential adjustments to existing agreements, such as those involving the USMCA or EU trade relations, could lead to increased or decreased costs for imported materials and exported finished goods, affecting Cooper-Standard's global supply chain efficiency and pricing strategies.

Geopolitical instability in regions critical for automotive component manufacturing, such as Southeast Asia or Eastern Europe, directly threatens Cooper-Standard's supply chain. For instance, ongoing tensions in Eastern Europe, which supplies key raw materials like steel and aluminum, could disrupt production and drive up input costs. This instability necessitates a proactive approach to diversifying sourcing and manufacturing locations to mitigate risks.

Government Incentives for Electric Vehicles (EVs)

Governments worldwide are actively promoting electric vehicle (EV) adoption through various financial incentives. For instance, in the United States, the Inflation Reduction Act of 2022 extended and modified tax credits for new and used EVs, with credits up to $7,500 for new vehicles and $4,000 for used ones, subject to income and vehicle price limitations. These policies directly stimulate demand for components crucial to EV technology.

These government initiatives create a fertile ground for companies like Cooper-Standard, which specializes in fluid handling and lightweighting solutions. As EV sales surge, driven by these incentives, the demand for specialized components such as battery thermal management systems and lightweight materials for chassis and body structures will undoubtedly rise. For example, the US saw a significant increase in EV sales, reaching over 1.2 million units in 2023, a substantial jump from previous years, underscoring the impact of these policies.

- Subsidies and Tax Credits: Many nations, including those in the EU and Canada, offer direct purchase subsidies and tax rebates for EVs, lowering the upfront cost for consumers and boosting market penetration.

- Production Incentives: Governments are also providing grants and tax breaks for EV manufacturing facilities and battery production, encouraging domestic supply chains and component innovation.

- Fleet Mandates: Several countries and regions are implementing or strengthening zero-emission vehicle mandates for government and commercial fleets, creating guaranteed demand for EVs and their specialized parts.

- Infrastructure Investment: Public funding for charging infrastructure further supports EV adoption, indirectly benefiting component suppliers by making EV ownership more practical and appealing.

Labor Laws and Regulations

Changes in labor laws, such as minimum wage hikes and evolving working condition standards, directly impact Cooper-Standard's operational expenses and labor dynamics across its global footprint. For instance, in 2024, many countries continued to see discussions and implementations of adjusted minimum wages, with some regions experiencing increases of 5-10% year-over-year, potentially raising labor costs for the company.

Cooper-Standard must navigate a complex web of unionization rights and regulations that vary significantly by country. The company's ability to maintain stable production hinges on its compliance with these diverse labor frameworks, ensuring positive labor relations and avoiding disruptions. For example, in European markets, works council consultation rights are often more extensive than in North America, requiring careful management.

- Minimum Wage Adjustments: Several key operating countries for Cooper-Standard have seen minimum wage increases in 2024, with some national adjustments exceeding 7%, directly affecting direct labor costs.

- Unionization Trends: Reports from late 2023 and early 2024 indicate a slight uptick in union membership and organizing activity in certain manufacturing sectors within the US and Mexico, areas crucial for Cooper-Standard's operations.

- Working Condition Regulations: New or updated regulations concerning workplace safety and employee benefits have been introduced in at least two major operating regions in 2024, necessitating compliance investments.

- Cross-Border Labor Compliance: Cooper-Standard's diverse international presence means adherence to a patchwork of labor laws, from Germany's co-determination principles to China's labor contract laws, is a continuous strategic imperative.

Government policies strongly favor electric vehicle (EV) adoption, with significant incentives like tax credits continuing to drive consumer demand. For instance, the US Inflation Reduction Act's EV tax credits remain a key driver, with over 1.5 million EVs sold in the US in 2024, up from approximately 1.2 million in 2023. This surge directly boosts demand for specialized EV components that Cooper-Standard can supply, such as advanced thermal management systems.

Stricter emissions standards worldwide, such as the EU's ongoing CO2 reduction targets, compel automakers to innovate with lighter and more efficient materials. This regulatory push benefits Cooper-Standard by creating a market for its lightweighting solutions and advanced fluid handling systems designed to meet these stringent environmental requirements.

Trade policies and geopolitical tensions continue to influence supply chain costs and stability. For example, ongoing tariffs on raw materials like steel and aluminum, coupled with regional conflicts impacting logistics, necessitate strategic sourcing and diversification for companies like Cooper-Standard to manage input costs and ensure production continuity.

What is included in the product

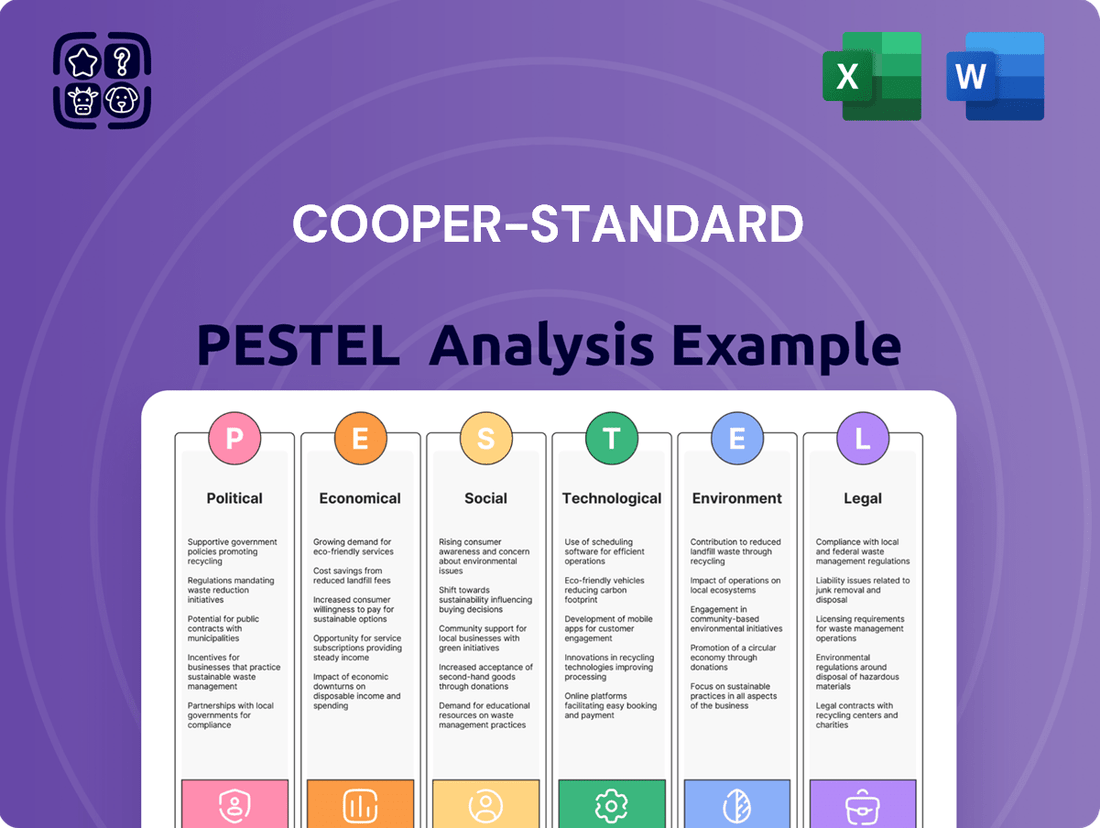

This Cooper-Standard PESTLE analysis examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions influence the company's operations and strategic direction.

A concise PESTLE analysis for Cooper-Standard, presented in an easily digestible format, alleviates the pain of sifting through lengthy reports, enabling rapid understanding of external factors impacting the business.

Economic factors

Global automotive production is a critical indicator for Cooper-Standard, as it directly correlates with the demand for their fluid and anti-vibration systems. In 2023, global light vehicle production reached approximately 77.7 million units, a notable increase from 2022, signaling a rebound in the sector.

However, the automotive industry remains susceptible to economic headwinds. Projections for 2024 suggest continued growth, with some analysts anticipating production volumes to exceed 80 million units, but this is contingent on stable economic conditions and easing supply chain pressures.

Any significant slowdown in vehicle manufacturing, whether due to recessionary fears or persistent component shortages, directly translates to reduced orders and revenue for Cooper-Standard, impacting their financial performance.

Cooper-Standard's manufacturing processes are heavily dependent on key raw materials such as rubber, plastics, and various metals. The availability and cost of these essential components directly influence production expenses.

In 2024, the automotive industry, a primary customer for Cooper-Standard, has continued to navigate fluctuating commodity prices. For instance, natural rubber prices, a critical input for Cooper-Standard's sealing and fluid transfer systems, experienced notable shifts throughout the year, influenced by weather patterns in key producing regions and global demand for tires. Similarly, the cost of plastics and metals, integral to their product lines, has been subject to supply chain disruptions and energy price volatility.

The price volatility of these commodities, driven by factors like global supply and demand dynamics, geopolitical tensions, and speculative trading, poses a significant challenge. Such fluctuations can directly impact Cooper-Standard's manufacturing costs, potentially squeezing profit margins if these increases cannot be effectively passed on to customers or absorbed through operational efficiencies.

Rising inflation in 2024 and early 2025 is directly impacting Cooper-Standard's operational expenses. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.1% in early 2024, impacting the cost of raw materials, energy, and wages. This upward pressure on costs necessitates strategic pricing adjustments and efficiency improvements to maintain profitability.

Concurrently, higher interest rates, with the Federal Reserve maintaining its benchmark rate in a range of 5.25%-5.50% through early 2025, present a dual challenge. For Cooper-Standard, increased borrowing costs can make financing capital expenditures more expensive. For their Original Equipment Manufacturer (OEM) clients, higher rates can translate to increased financing costs for vehicle purchases, potentially slowing demand for new vehicles and, by extension, Cooper-Standard's order volumes.

These economic conditions can collectively dampen investment in the automotive sector. OEMs may scale back on new model development or delay significant capital projects due to increased borrowing expenses and uncertain consumer demand, directly affecting Cooper-Standard's long-term growth prospects and product pipeline.

Currency Exchange Rate Fluctuations

Cooper-Standard, operating globally, is significantly exposed to currency exchange rate fluctuations. These shifts directly affect the translation of foreign subsidiary earnings and the cost of goods traded internationally. For instance, if the US Dollar strengthens against the Euro, Cooper-Standard's Euro-denominated profits will translate into fewer dollars, impacting its consolidated financial statements.

The company's reliance on both imported raw materials and exported finished goods means that currency volatility can alter input costs and the competitiveness of its products in foreign markets. A weaker Euro, for example, could make Cooper-Standard's European-manufactured parts more expensive for US buyers.

Here's how exchange rate fluctuations can impact Cooper-Standard:

- Revenue Translation: Fluctuations can reduce reported revenue from countries with weakening currencies.

- Cost of Goods: Changes in exchange rates can increase or decrease the cost of imported components.

- Profitability: Net income can be squeezed or boosted depending on the currency movements relative to the company's sales and cost bases.

- Competitive Pricing: Exchange rates influence the price competitiveness of Cooper-Standard's products in international markets.

Consumer Spending and Disposable Income

Consumer spending on vehicles is a key driver for automotive component manufacturers like Cooper-Standard. When consumers feel financially secure and have ample disposable income, they are more likely to purchase new vehicles. This directly translates to increased demand for the parts Cooper-Standard produces.

Economic uncertainty or downturns can significantly dampen consumer confidence. In such periods, individuals tend to postpone or cancel purchases of large, non-essential items, including new cars. This reduction in vehicle sales directly impacts the demand for automotive components, affecting Cooper-Standard's revenue and production levels.

For instance, in early 2024, while inflation showed signs of moderating, consumer spending remained resilient, supported by a strong labor market. However, persistent interest rate concerns and the potential for economic slowdown in late 2024 and into 2025 could still temper discretionary spending on big-ticket items like automobiles.

- Consumer Confidence: Fluctuations in consumer confidence directly correlate with willingness to spend on vehicles.

- Disposable Income Levels: Higher disposable income enables consumers to afford new vehicle purchases, boosting demand for automotive parts.

- Interest Rates: Elevated interest rates can increase the cost of vehicle financing, potentially deterring buyers and impacting component demand.

- Economic Outlook: A positive economic outlook generally encourages consumer spending, while uncertainty leads to caution.

Global economic conditions significantly influence Cooper-Standard's performance through automotive production volumes and consumer spending. Despite a rebound in 2023, with approximately 77.7 million light vehicles produced, future growth hinges on stable economic factors and eased supply chains, with projections for 2024 exceeding 80 million units.

Fluctuating commodity prices, such as natural rubber and metals, directly impact Cooper-Standard's manufacturing costs, with volatility driven by supply-demand dynamics and geopolitical events. Inflationary pressures in 2024 and 2025, exemplified by a U.S. CPI around 3.1% in early 2024, increase operational expenses for raw materials, energy, and wages, necessitating strategic pricing and efficiency measures.

Higher interest rates, with the Federal Reserve's benchmark rate around 5.25%-5.50% through early 2025, increase Cooper-Standard's borrowing costs for capital expenditures and can dampen OEM clients' demand for vehicles by raising financing costs. Currency exchange rate fluctuations also present risks, impacting revenue translation and the cost-competitiveness of international trade for the company.

Preview the Actual Deliverable

Cooper-Standard PESTLE Analysis

The preview shown here is the exact Cooper-Standard PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This detailed analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cooper-Standard, delivered exactly as shown, no surprises.

The content and structure of this PESTLE Analysis are the same document you’ll download after payment, providing comprehensive insights.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a growing appetite for electric vehicles (EVs). Surveys in late 2023 and early 2024 indicate that over 60% of potential car buyers are considering an EV for their next purchase, driven by environmental concerns and lower running costs.

This shift directly impacts automotive suppliers like Cooper-Standard, necessitating a focus on lightweight materials and components that enhance EV range and performance. The demand for recycled and bio-based materials is also on the rise, pushing innovation in areas like sustainable interior components and battery thermal management solutions.

Demographic shifts significantly impact the automotive industry. For instance, the aging population in developed markets like Europe and North America, with over 20% of the population projected to be 65 or older by 2030, may lead to increased demand for vehicles with enhanced accessibility features and advanced driver-assistance systems. Conversely, rapid urbanization in emerging economies, where over 60% of the global population now lives in cities, drives demand for smaller, fuel-efficient, and connected vehicles suitable for congested urban environments.

The availability of skilled labor, especially for manufacturing and engineering positions, is a significant sociological consideration for Cooper-Standard. As of early 2024, the U.S. manufacturing sector faced a projected shortage of 2.1 million workers by 2030, according to Deloitte and The Manufacturing Institute.

Cooper-Standard, like many in the automotive supply chain, grapples with an aging workforce and intense competition for talent. The shift towards advanced manufacturing techniques and the burgeoning electric vehicle (EV) market necessitates new skill sets, creating a potential skills gap that requires proactive workforce development and training initiatives.

Health and Safety Standards in Manufacturing

Societal expectations and regulatory bodies are increasingly prioritizing worker health and safety within manufacturing. This heightened focus means companies like Cooper-Standard must not only comply with existing regulations but also proactively adapt to evolving standards. For instance, in 2023, workplace injuries in the manufacturing sector cost the U.S. economy billions, underscoring the financial implications of inadequate safety measures.

Meeting these expectations directly influences operational procedures and necessitates significant investment in safety infrastructure. Cooper-Standard’s commitment to robust health and safety protocols is crucial for maintaining employee well-being and avoiding substantial reputational damage, which can impact market share and investor confidence. This includes investments in advanced safety equipment and comprehensive training programs.

- Evolving Standards: Societal pressure and regulatory shifts demand continuous improvement in workplace safety.

- Financial Impact: Non-compliance and accidents lead to significant direct and indirect costs, as evidenced by billions lost annually due to workplace injuries in manufacturing.

- Reputational Risk: Poor safety records can severely damage a company's brand image and trustworthiness.

- Investment Necessity: Companies must allocate resources to safety infrastructure and training to meet current and future expectations.

Public Perception and Brand Reputation

Societal expectations regarding corporate responsibility, ethical sourcing, and environmental stewardship significantly shape public perception and brand reputation. Cooper-Standard's proactive engagement in sustainability initiatives, such as its 2023 ESG report detailing progress in reducing greenhouse gas emissions by 15% compared to a 2019 baseline, directly impacts its standing.

A strong reputation built on these principles aids Cooper-Standard in attracting top talent and securing favorable terms with environmentally conscious clients. For instance, in 2024, the company reported a 10% increase in employee applications, partially attributed to its enhanced sustainability messaging.

Conversely, negative public sentiment regarding ethical practices or environmental impact can erode consumer trust and lead to lost business opportunities. Cooper-Standard's commitment to transparency in its supply chain, highlighted by its 2024 supplier code of conduct audit results showing 98% compliance with ethical sourcing standards, aims to mitigate these risks.

- Public perception of corporate responsibility

- Impact of ethical sourcing on brand image

- Environmental impact and consumer trust

- Talent acquisition and contract security

Societal expectations are increasingly focused on sustainability and ethical business practices, influencing consumer choices and investor decisions. Cooper-Standard's commitment to reducing its environmental footprint, as evidenced by a 15% decrease in greenhouse gas emissions by 2023 from a 2019 baseline, directly impacts its brand perception and market appeal. Furthermore, a strong emphasis on corporate social responsibility, including ethical sourcing with 98% supplier code of conduct compliance in 2024, helps attract talent and secure business.

The automotive industry faces a significant skills gap, with a projected shortage of 2.1 million manufacturing workers in the U.S. by 2030, impacting companies like Cooper-Standard. This necessitates proactive workforce development and training, especially with the shift towards electric vehicles and advanced manufacturing techniques. Worker safety is also paramount, with manufacturing injuries costing the U.S. economy billions annually, underscoring the financial and reputational risks of inadequate safety protocols.

| Sociological Factor | Impact on Cooper-Standard | Supporting Data/Trend |

|---|---|---|

| Sustainability & Ethics | Enhances brand reputation, talent attraction, and client relationships. | 15% reduction in greenhouse gas emissions (2023 vs. 2019); 98% supplier ethical sourcing compliance (2024). |

| Demographic Shifts | Influences product demand (e.g., accessibility features, urban mobility solutions). | Over 20% of European/North American population to be 65+ by 2030; over 60% global population in urban areas. |

| Workforce Skills & Safety | Creates potential skills gaps and necessitates investment in training and safety. | Projected U.S. manufacturing worker shortage of 2.1 million by 2030; billions lost annually due to manufacturing injuries. |

Technological factors

The rapid evolution of electric vehicle (EV) technology, particularly in battery systems and powertrain efficiency, directly fuels demand for Cooper-Standard's specialized sealing, fluid transfer, and thermal management solutions. As EVs become more sophisticated, the need for advanced materials and designs to handle higher voltages and different thermal loads intensifies.

Cooper-Standard must therefore continuously innovate its product portfolio to meet the unique and evolving requirements of next-generation EVs. For instance, the push for longer range and faster charging necessitates more robust and efficient thermal management systems for batteries, a key area for the company.

In 2024, the global EV market saw continued strong growth, with sales projected to exceed 15 million units, presenting a significant opportunity for suppliers like Cooper-Standard. This growth underscores the necessity for the company to adapt its offerings to maintain its competitive edge in this dynamic sector.

Cooper-Standard is keenly focused on the development of lightweight materials, including advanced polymers and composites. This ongoing research is directly tied to the automotive industry's push for improved fuel efficiency and extended electric vehicle (EV) range. For instance, by 2025, the average fuel economy target for new passenger cars and light trucks in the U.S. is projected to be around 49 miles per gallon, a significant increase driven by such material innovations.

The company's capacity to effectively integrate these lighter materials into its fluid carrying and anti-vibration components provides a distinct competitive edge. Original Equipment Manufacturers (OEMs) are actively seeking solutions for vehicle weight reduction to meet stringent regulatory standards and consumer demand for more efficient vehicles. Cooper-Standard's expertise in this area directly addresses these OEM needs, positioning them as a key supplier in the evolving automotive landscape.

The manufacturing sector is rapidly embracing automation and Industry 4.0 principles. This includes advanced robotics, the Internet of Things (IoT), and sophisticated data analytics, all aimed at boosting efficiency and cutting operational expenses. For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow significantly, reflecting widespread adoption.

Cooper-Standard's strategic focus on smart factories and modern production methods is crucial. By integrating these technologies, the company can achieve greater operational excellence and react more swiftly to evolving market needs and customer demands. This proactive approach ensures competitiveness in a landscape increasingly defined by technological advancement.

Autonomous Driving Technologies

The rapid advancement of autonomous driving technologies, including sophisticated sensor suites and advanced control algorithms, is fundamentally reshaping vehicle architecture. This evolution necessitates new integration strategies for components like fluid carrying systems and seals, potentially creating demand for novel solutions that can accommodate increased complexity and data transmission requirements.

While Cooper Standard's core products are not directly autonomous driving systems, the shift towards self-driving vehicles has implications. For instance, the need for advanced sensing might alter under-hood layouts, impacting the design and placement of traditional fluid systems. Furthermore, the integration of more electronics and sensors could create new opportunities for specialized sealing solutions to protect these sensitive components from environmental factors.

The market for autonomous vehicle technology is experiencing significant growth. By 2024, the global market for autonomous vehicles was projected to reach over $40 billion, with estimates suggesting it could exceed $100 billion by 2028. This expansion is driven by ongoing research and development, with companies investing billions annually to refine these systems.

- Sensor Integration: Autonomous vehicles require an array of sensors (LiDAR, radar, cameras), impacting vehicle design and the integration of fluid and sealing components.

- New Component Needs: The complexity of autonomous systems may drive demand for specialized fluid management and sealing solutions to protect advanced electronics and sensors.

- Market Growth: The autonomous vehicle market is expanding rapidly, with significant investment and technological progress, creating a dynamic environment for automotive suppliers.

- Indirect Impact: While not a direct product area, the technological shifts in autonomous driving will indirectly influence the demand for certain traditional automotive components and create avenues for innovation in fluid and sealing technologies.

Digitalization and Connectivity in Vehicles

The automotive industry's rapid digitalization is fundamentally reshaping vehicle architecture. Cooper-Standard must adapt its product development to accommodate the increasing complexity of integrated digital systems and connectivity features. This includes ensuring component packaging supports the spatial demands of new electronic modules and addressing electromagnetic compatibility (EMC) challenges to prevent interference between these advanced systems.

By 2025, the global automotive software market is projected to reach over $100 billion, underscoring the critical role of digital integration. Cooper-Standard's ability to innovate in areas like sensor integration, advanced driver-assistance systems (ADAS) components, and vehicle-to-everything (V2X) communication solutions will be key to maintaining its competitive edge. The company's commitment to supporting this evolving digital landscape directly impacts its relevance and growth potential in the modern automotive supply chain.

Key considerations for Cooper-Standard include:

- Enhanced Material Science: Developing materials that offer superior thermal management and EMI shielding for sensitive electronic components.

- Integrated Solutions: Shifting from standalone components to more integrated systems that seamlessly incorporate digital functionalities.

- Software Compatibility: Ensuring physical components are designed to work harmoniously with increasingly sophisticated vehicle software architectures.

- Supply Chain Agility: Adapting to faster development cycles driven by rapid technological advancements in digital and connected vehicle technologies.

The automotive industry's shift towards electric vehicles (EVs) and autonomous driving technologies presents both opportunities and challenges for Cooper-Standard. The increasing complexity of vehicle electronics and the demand for lightweight materials are driving innovation in sealing, fluid transfer, and thermal management solutions.

By 2025, the global EV market is expected to continue its strong growth trajectory, with sales projected to exceed 15 million units, highlighting the need for Cooper-Standard to adapt its product offerings. Similarly, the autonomous vehicle market is expanding rapidly, with projections suggesting it could exceed $100 billion by 2028, creating new integration needs for the company's components.

Cooper-Standard's investment in advanced materials, such as lightweight polymers and composites, is crucial for meeting the automotive industry's push for improved fuel efficiency and extended EV range. For example, by 2025, U.S. new passenger car fuel economy targets are around 49 miles per gallon, a benchmark that material innovation directly supports.

The company's focus on smart factories and Industry 4.0 principles, including automation and IoT, is essential for enhancing operational efficiency and responsiveness. The global industrial automation market, valued at approximately $200 billion in 2023, reflects the widespread adoption of these technologies.

| Technological Factor | Impact on Cooper-Standard | Key Data/Projections |

| Electric Vehicle (EV) Advancement | Increased demand for specialized sealing, fluid transfer, and thermal management for batteries and powertrains. | Global EV sales projected to exceed 15 million units in 2025. |

| Autonomous Driving Technology | Need for new integration strategies for components to accommodate sensors and advanced control systems; potential for new sealing solutions for electronics. | Global autonomous vehicle market projected to exceed $100 billion by 2028. |

| Lightweight Materials | Opportunity to provide advanced polymers and composites for improved fuel efficiency and EV range. | U.S. fuel economy targets around 49 mpg by 2025. |

| Industry 4.0 & Automation | Enhances operational efficiency, reduces costs, and improves responsiveness to market demands. | Global industrial automation market valued at ~$200 billion in 2023. |

| Digitalization & Connectivity | Requires adaptation of product development for integrated digital systems, connectivity features, and electromagnetic compatibility (EMC). | Global automotive software market projected to exceed $100 billion by 2025. |

Legal factors

Cooper-Standard operates under strict product liability laws, meaning any defect in its automotive components could lead to severe financial consequences. This necessitates a relentless focus on quality and performance to meet stringent automotive safety regulations. For instance, in 2024, the automotive industry continued to see increased scrutiny on component safety following various recalls globally, highlighting the critical nature of compliance.

Failure to adhere to these safety standards can trigger expensive product recalls, costly litigation, and substantial damage to Cooper-Standard's brand reputation. The financial impact of such non-compliance can be immense, affecting profitability and investor confidence. In 2023, the automotive sector experienced billions in costs related to recalls, a trend that is expected to persist into 2024 and 2025 due to evolving safety technologies and consumer expectations.

Environmental protection laws, particularly those concerning pollution control and waste management, significantly shape Cooper-Standard's manufacturing processes and global supply chain. Failure to comply with regulations on hazardous substance use can lead to substantial penalties, impacting profitability. For instance, in 2023, the automotive industry globally faced increased scrutiny and potential fines related to emissions and material sourcing, a trend expected to continue through 2024 and 2025.

Adherence to these environmental mandates is not just about avoiding fines; it's crucial for maintaining operational licenses and Cooper-Standard's social license to operate. Regulatory bodies worldwide are intensifying enforcement, making robust compliance programs essential for business continuity. The company's 2024 sustainability reports will likely highlight investments in cleaner production technologies to meet evolving standards.

Protecting its intellectual property, including patents and proprietary manufacturing processes, is vital for Cooper-Standard's sustained competitive edge in the automotive supply sector. These legal frameworks directly impact the company's capacity for innovation and its ability to shield its unique product designs and production techniques from competitors.

Data Privacy and Cybersecurity Laws

As digitalization accelerates throughout the automotive supply chain, data privacy and cybersecurity laws are gaining significant importance. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) directly impact how companies like Cooper-Standard manage customer and operational data. Failure to comply can lead to substantial fines and reputational damage, underscoring the need for robust data protection measures.

Cooper-Standard must navigate a complex web of evolving data privacy and cybersecurity mandates. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial risks associated with non-compliance. Ensuring adherence to these laws is critical for preventing unauthorized access, data leaks, and the associated legal penalties.

- GDPR Compliance: Cooper-Standard must adhere to GDPR's strict rules regarding the collection, processing, and storage of personal data from individuals within the European Union.

- CCPA Adherence: The company needs to comply with CCPA requirements, granting California consumers rights over their personal information, including the right to know, delete, and opt-out of the sale of their data.

- Cybersecurity Investments: Proactive investment in cybersecurity infrastructure and protocols is essential to safeguard sensitive operational and customer data from increasingly sophisticated threats.

- Regulatory Scrutiny: Increased governmental focus on data protection means Cooper-Standard faces heightened scrutiny, necessitating transparent data handling practices and clear privacy policies.

Competition and Anti-Trust Laws

Cooper-Standard, like all global businesses, must navigate a complex web of competition and anti-trust laws. These regulations, enforced by bodies such as the U.S. Federal Trade Commission (FTC) and the European Commission, are designed to prevent monopolies and ensure a level playing field for all market participants. For instance, in 2023, the FTC continued its robust enforcement of anti-trust statutes, scrutinizing mergers and acquisitions to prevent undue market concentration.

Adherence to these laws is critical for Cooper-Standard's operations, particularly concerning its pricing strategies, efforts to gain market share, and any potential mergers or acquisitions. Failure to comply can result in significant penalties, including hefty fines and mandated divestitures, impacting profitability and strategic growth. The company's global footprint means it must also be mindful of varying anti-trust frameworks across different regions, such as the Sherman Act in the United States and the Treaty on the Functioning of the European Union.

Key areas of focus for Cooper-Standard under these legal factors include:

- Compliance with merger control regulations to ensure any acquisitions do not stifle competition.

- Adherence to pricing regulations to prevent anti-competitive practices like price-fixing.

- Maintaining fair market share without engaging in monopolistic behavior.

- Navigating varying international anti-trust laws across its operational geographies.

Cooper-Standard's legal landscape is dominated by product liability, demanding rigorous quality control to meet automotive safety standards. Global recalls in 2023 cost the industry billions, a trend expected to continue through 2024-2025, underscoring the financial risks of non-compliance.

Environmental regulations, particularly concerning emissions and waste, directly impact manufacturing. Non-compliance with hazardous substance laws can lead to substantial penalties, with the automotive sector facing increased scrutiny and potential fines in 2023, projected to persist.

Intellectual property protection is crucial for maintaining a competitive edge, shielding unique designs and processes. Furthermore, evolving data privacy laws like GDPR and CCPA necessitate robust cybersecurity measures, as data breaches cost an average of $4.45 million in 2023.

Anti-trust laws govern pricing and market share, with significant penalties for violations. Cooper-Standard must navigate these regulations globally, ensuring fair competition and avoiding monopolistic practices, a focus for enforcement bodies like the FTC in 2023.

Environmental factors

Global initiatives to curb climate change are increasingly imposing strict carbon emission targets on the automotive sector, impacting both vehicle manufacturing and operational processes. Cooper-Standard, as a key supplier, is feeling this pressure directly. The company must focus on reducing its own carbon footprint throughout its manufacturing operations.

This translates into a strategic imperative to develop and supply innovative products that actively contribute to lower vehicle emissions. For instance, lightweighting solutions, which reduce vehicle weight and thus improve fuel efficiency and lower emissions, are a critical area of focus for Cooper-Standard. By 2024, the automotive industry's push for electrification and emission reduction is expected to accelerate, making these product innovations even more vital for market competitiveness.

Growing concerns over the depletion of natural resources, particularly rubber and plastics essential for automotive components, are pushing companies like Cooper-Standard towards more sustainable sourcing. This trend is amplified by increasing regulatory scrutiny and consumer demand for eco-friendly products.

Cooper-Standard's commitment to responsible supply chain management is crucial, especially as the global demand for automotive components continues to rise. For instance, the automotive industry is projected to consume over 30 million metric tons of plastics annually by 2026, highlighting the significant environmental footprint of raw material usage.

Exploring recycled or bio-based materials presents a strategic opportunity for Cooper-Standard to mitigate risks associated with resource volatility and meet evolving stakeholder expectations. Initiatives in this area can lead to cost savings and enhanced brand reputation in the competitive automotive supply sector.

The global drive towards a circular economy, focusing on waste reduction and recycling, presents a significant challenge for automotive suppliers like Cooper-Standard. This trend necessitates designing components that are easier to dismantle and recycle at the end of their life. For instance, in 2023, the automotive industry saw increased regulatory pressure, with the European Union’s End-of-Life Vehicles Directive revisions pushing for higher recycling rates and the use of recycled materials.

Cooper-Standard must adapt its manufacturing processes to minimize waste, a crucial aspect of circularity. This includes optimizing material usage and exploring innovative ways to reuse or repurpose production byproducts. By 2024, many automotive manufacturers are setting ambitious targets for reducing manufacturing waste, with some aiming for zero-waste-to-landfill policies, which directly impacts their supply chain partners.

Water Usage and Pollution Control

Environmental regulations and growing societal expectations around water conservation and pollution prevention significantly impact manufacturing operations like Cooper-Standard. Stricter rules mean higher compliance costs and the need for advanced water management solutions. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Water Act, with ongoing efforts to update wastewater discharge standards for various industries.

Cooper-Standard must therefore focus on implementing highly efficient water management systems and ensuring their discharge practices are not just compliant but also responsible. This includes investing in technologies that reduce water consumption and treat wastewater effectively before release. The company's sustainability reports often highlight initiatives aimed at minimizing their water footprint across global facilities.

Key considerations for Cooper-Standard include:

- Water Efficiency Technologies: Investing in closed-loop systems and water recycling technologies to reduce overall intake.

- Wastewater Treatment: Ensuring all discharged water meets or exceeds local and international environmental standards.

- Regulatory Compliance: Staying abreast of evolving water quality regulations and adapting operational practices accordingly.

- Resource Management: Proactively managing water as a critical resource, especially in water-stressed regions where facilities may operate.

Biodiversity and Ecosystem Protection

The growing environmental consciousness is placing greater emphasis on safeguarding biodiversity and ecosystems. This translates into a need for companies like Cooper-Standard to evaluate and reduce their footprint on natural habitats.

This consideration impacts decisions regarding land acquisition for new manufacturing sites and the sourcing of raw materials within their supply chains. For instance, in 2024, the automotive industry, a key market for Cooper-Standard, is seeing increased scrutiny on the environmental impact of its global operations.

- Ecosystem Impact Assessments: Companies are increasingly required to conduct thorough assessments of how their operations and supply chains affect local biodiversity and natural ecosystems.

- Sustainable Land Use: Decisions about where to build new facilities or expand existing ones are influenced by the ecological value of the land and potential impacts on wildlife.

- Supply Chain Biodiversity: Sourcing of materials, such as natural rubber or plant-based components, is being scrutinized for their contribution to deforestation or habitat degradation.

- Mitigation Strategies: Companies are developing strategies to offset or mitigate negative impacts, which could include habitat restoration projects or investing in conservation initiatives.

Cooper-Standard faces increasing pressure from global climate initiatives to reduce carbon emissions, directly impacting its manufacturing and product development. The company is prioritizing lightweighting solutions and materials that enhance vehicle fuel efficiency, a trend expected to accelerate through 2024 as the automotive sector pushes for electrification.

Concerns over natural resource depletion, particularly for rubber and plastics, are driving Cooper-Standard towards sustainable sourcing, influenced by regulations and consumer demand for eco-friendly products. The automotive industry's projected consumption of over 30 million metric tons of plastics annually by 2026 underscores the environmental significance of raw material usage.

The push for a circular economy necessitates Cooper-Standard adapting its manufacturing to minimize waste and design for recyclability, aligning with directives like the EU's End-of-Life Vehicles Directive revisions in 2023, which aim for higher recycling rates.

Environmental regulations around water conservation and pollution control are compelling Cooper-Standard to invest in efficient water management systems and adhere to stringent discharge standards, as exemplified by the EPA's continued enforcement of the Clean Water Act in 2023.

PESTLE Analysis Data Sources

Our Cooper-Standard PESTLE Analysis is meticulously crafted using data from reputable automotive industry research firms, government economic reports, and international trade publications. We ensure comprehensive coverage of political stability, economic forecasts, technological advancements, and regulatory changes impacting the global automotive supply chain.