Cooper-Standard Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper-Standard Bundle

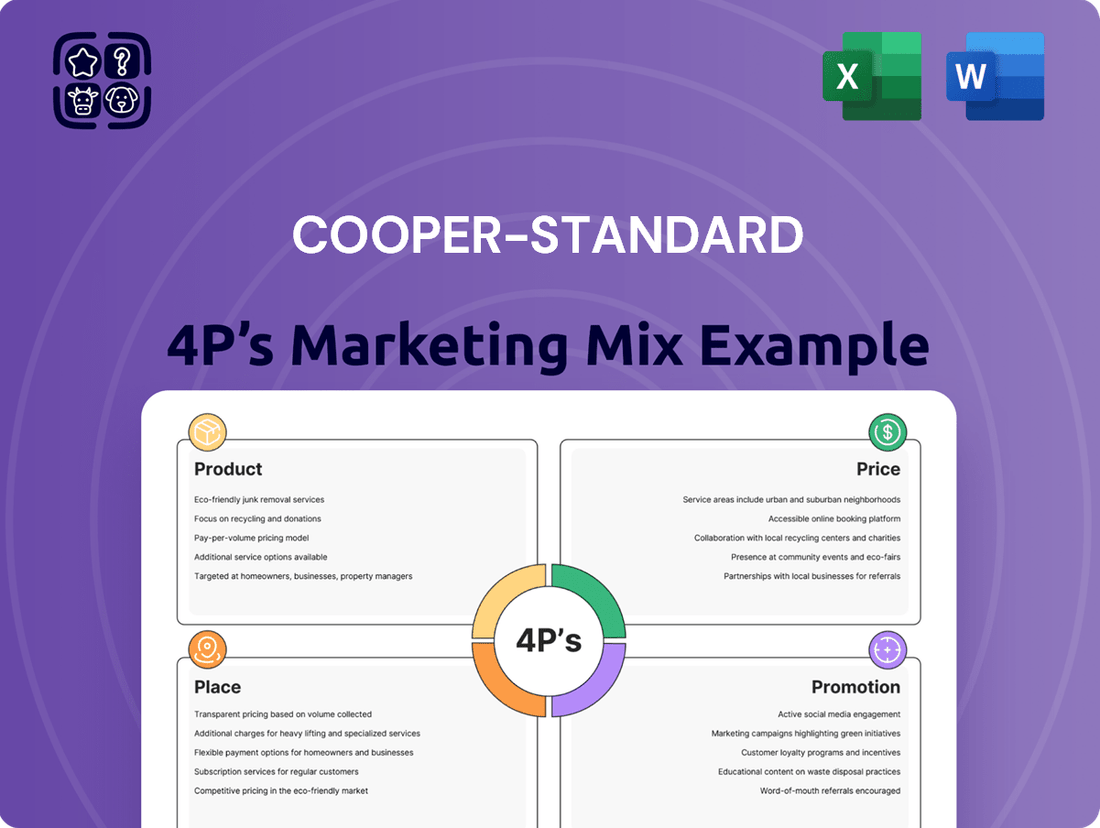

Discover how Cooper-Standard leverages its Product innovation, strategic Pricing, extensive Place in the automotive supply chain, and impactful Promotion to maintain its market leadership. This analysis offers a clear view of their integrated marketing efforts.

Ready to unlock the full strategic blueprint? Get immediate access to our comprehensive Cooper-Standard 4Ps Marketing Mix Analysis, presented in an editable, professional format perfect for business planning or academic study.

Product

Cooper-Standard's sealing and trim systems are a cornerstone of their product offering, directly impacting vehicle aesthetics, noise, vibration, and harshness (NVH), and overall environmental sealing. These systems, including dynamic and static seals, and encapsulated glass, are engineered to enhance vehicle performance and passenger comfort. For instance, the FlexiCore™ thermoplastic body seal exemplifies their commitment to lightweighting and sustainability, a key trend in the automotive industry as manufacturers strive to meet stricter emission standards and improve fuel efficiency.

Cooper Standard's fuel and brake delivery systems are vital components, guaranteeing vehicle safety and optimal performance. These systems are engineered for leak-free fuel transfer from the tank to the engine and reliable brake fluid management. For instance, the company's commitment to innovation is exemplified by its LoPerm 7500 multi-layer tubing, which significantly enhances polymer capabilities by providing exceptional low permeation and minimal oligomer washout, meeting stringent environmental and performance demands for both traditional and hybrid powertrains.

Cooper-Standard's fluid transfer systems are crucial for automotive thermal management, going beyond traditional fuel and brake lines. Their advanced materials science and manufacturing capabilities enable solutions that boost vehicle efficiency.

A prime example is the eCoFlow™ Switch Pump, a 2025 Automotive News PACE Pilot Award winner. This innovative technology combines an electric water pump and an electric valve into one coolant control module, significantly enhancing fluid management for electric and hybrid vehicles.

Sustainable and Lightweight Solutions

Cooper-Standard's product strategy heavily emphasizes sustainable and lightweight solutions, a crucial move given the automotive industry's increasing focus on electric vehicles and environmental responsibility. This commitment is evident in their development of advanced materials and innovative designs aimed at reducing vehicle weight, thereby lowering emissions and improving fuel efficiency. For instance, their FlexiCore™ thermoplastic body seal is designed for enhanced recyclability and significant weight reduction compared to traditional materials.

The company's dedication to innovation in this area is further highlighted by their plastic coolant hub, which earned a 2024 SPE Automotive Innovation Award. This component consolidates multiple parts into a single, compact plastic manifold, showcasing improved performance and a substantial reduction in material waste. This approach aligns with the broader industry trend of optimizing component design for both functionality and sustainability.

Key aspects of Cooper-Standard's sustainable and lightweight solutions include:

- Material Innovation: Utilizing advanced thermoplastics and composite materials to replace heavier traditional components.

- Weight Reduction: Targeting significant weight savings per vehicle to improve energy efficiency and reduce environmental impact.

- Component Consolidation: Designing integrated solutions like the plastic coolant hub to minimize part count, material usage, and manufacturing complexity.

- Recyclability: Prioritizing materials and designs that facilitate easier recycling at the end of a vehicle's life cycle.

Solutions for EV and Hybrid Platforms

Cooper-Standard is actively reshaping its product offerings to cater to the burgeoning electric vehicle (EV) and hybrid markets. The company is securing new business awards, demonstrating a clear commitment to developing specialized components for electrified powertrains. This includes advanced thermal management systems and lightweight sealing solutions designed to meet the distinct needs of these next-generation vehicles.

This strategic pivot is essential as the automotive industry transitions from traditional internal combustion engine (ICE) components. Cooper-Standard's focus on EV and hybrid platforms positions it for sustained growth in the dynamic mobility sector. For instance, in 2024, the EV market is projected to see significant expansion, with global EV sales expected to reach over 14 million units, a substantial increase from previous years. Cooper-Standard's ability to deliver innovative solutions for these platforms is a key driver of its future success.

- Product Adaptation: Developing specialized components for EV and hybrid platforms, including thermal management and lightweight sealing.

- Business Awards: Securing new contracts specifically for electrified vehicle applications.

- Market Shift: Aligning product portfolio with the industry's move away from ICE components.

- Future Growth: Positioning the company for expansion in the evolving automotive landscape, with global EV sales projected to exceed 14 million units in 2024.

Cooper-Standard's product portfolio is strategically evolving to meet the demands of the modern automotive landscape, with a strong emphasis on sustainable and lightweight solutions for electric and hybrid vehicles. Their sealing and trim systems, fuel and brake delivery systems, and fluid transfer systems are engineered for enhanced performance, safety, and environmental responsibility.

Key product innovations include the FlexiCore™ thermoplastic body seal for lightweighting and the LoPerm 7500 tubing for superior fuel and brake fluid management. The eCoFlow™ Switch Pump, a 2025 Automotive News PACE Pilot Award winner, exemplifies their advancements in thermal management for EVs. Furthermore, their plastic coolant hub, recognized with a 2024 SPE Automotive Innovation Award, showcases component consolidation for reduced waste and improved efficiency.

| Product Category | Key Innovations/Features | Target Market/Benefit | Awards/Recognition |

|---|---|---|---|

| Sealing & Trim Systems | FlexiCore™ thermoplastic body seal | Lightweighting, sustainability, NVH reduction | |

| Fuel & Brake Delivery Systems | LoPerm 7500 multi-layer tubing | Low permeation, minimal oligomer washout, safety | |

| Fluid Transfer Systems | eCoFlow™ Switch Pump | EV/hybrid thermal management, efficiency | 2025 Automotive News PACE Pilot Award |

| Sustainable & Lightweight Solutions | Plastic coolant hub | Component consolidation, material reduction, efficiency | 2024 SPE Automotive Innovation Award |

What is included in the product

This analysis provides a comprehensive breakdown of Cooper-Standard's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive approach.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for effective decision-making.

Provides a clear, concise overview of Cooper-Standard's marketing approach, easing the burden of understanding and communicating strategic initiatives.

Place

Cooper-Standard's global manufacturing footprint spans 20 countries, strategically positioning its facilities close to major automotive original equipment manufacturers (OEMs) across North America, Europe, Asia Pacific, and South America. This widespread presence, with over 25,000 employees as of early 2024, enables the company to effectively serve a broad spectrum of vehicle types, from passenger cars to heavy-duty trucks, ensuring localized production and support for its diverse customer base.

Cooper-Standard's primary distribution strategy revolves around direct sales to Original Equipment Manufacturers (OEMs). This approach accounted for a significant 82% of their sales in 2021, highlighting their deep ties with major automotive players such as Ford, General Motors, Stellantis, Volkswagen Group, and Toyota.

This direct engagement enables Cooper-Standard to become intricately involved in the OEM's product development cycles and supply chain logistics. Such close collaboration fosters robust partnerships and facilitates the creation of highly customized solutions tailored to specific vehicle platforms and manufacturing processes.

Cooper-Standard is actively strengthening its supply chains against disruptions, a critical move given the automotive sector's ongoing challenges. This includes a strategic pivot towards more localized sourcing, aiming to reduce reliance on distant suppliers and mitigate risks associated with global instability.

The automotive industry's broader trend toward 'trade-insulated' costs, characterized by near-shoring and supplier diversification, directly influences Cooper-Standard's approach. This strategy is designed to buffer against geopolitical tensions and potential trade barriers, ensuring greater predictability in operations.

For instance, the global semiconductor shortage, which significantly impacted automotive production throughout 2021-2023, highlighted the vulnerabilities of extended supply chains. Cooper-Standard's focus on resilience is a direct response to such events, aiming to guarantee product availability and minimize production delays for their clientele.

Inventory Management and Logistics

Cooper-Standard's inventory management and logistics are crucial for meeting Original Equipment Manufacturer (OEM) demands precisely when and where needed. The company focuses on optimizing customer convenience and streamlining its supply chain operations, a complex task given the automotive sector's inherent volatility. For instance, in 2024, the automotive industry continued to grapple with supply chain disruptions, with semiconductor shortages still impacting production for some manufacturers, highlighting the importance of Cooper-Standard's proactive inventory strategies.

Navigating potential shortages of critical components and raw materials requires sophisticated planning and robust supplier relationships. This strategic foresight is essential to maintain production continuity and avoid costly delays for their OEM clients. Cooper-Standard's commitment to efficient logistics aims to mitigate risks associated with fluctuating demand and supply, ensuring a reliable flow of parts.

- Strategic Inventory Buffers: Maintaining strategic safety stock for key components to buffer against unexpected supply disruptions.

- Optimized Distribution Networks: Leveraging advanced analytics to ensure timely delivery and minimize transportation costs across its global network.

- Supplier Collaboration: Working closely with suppliers to improve visibility into their production and material availability, particularly important given the 2024 global economic uncertainties affecting raw material pricing.

- Just-in-Time (JIT) Principles: While aiming for efficiency, Cooper-Standard must balance JIT with the need for resilience in a volatile market, a challenge underscored by the lingering effects of the 2020-2023 supply chain shocks.

Strategic Partnerships within the Automotive Ecosystem

Cooper-Standard actively cultivates strategic partnerships across the automotive landscape, extending beyond direct sales to foster innovation and market expansion. These collaborations are crucial for developing cutting-edge solutions and strengthening their position within the supply chain. For instance, their collaboration with Saleri Group on the eCoFlow™ Switch Pump exemplifies this approach, aiming to deliver integrated thermal management systems to original equipment manufacturers (OEMs).

These alliances are not just about product development; they also enhance Cooper-Standard's visibility and credibility through industry recognition and joint participation in key projects. By working with other suppliers and technology providers, the company can leverage complementary expertise, leading to more comprehensive offerings. This strategy is vital for staying competitive in a rapidly evolving automotive sector, where integrated solutions are increasingly demanded by OEMs.

- Partnership with Saleri Group: Focus on the eCoFlow™ Switch Pump for advanced thermal management solutions.

- Industry Collaboration: Working with other suppliers and technology providers to create integrated offerings.

- Market Reach Enhancement: Strategic alliances broaden Cooper-Standard's access to new markets and customer segments.

- Innovation Focus: Joint projects drive the development of next-generation automotive components and systems.

Cooper-Standard's global manufacturing footprint, encompassing over 20 countries, ensures proximity to key automotive Original Equipment Manufacturers (OEMs). This strategic placement, supported by over 25,000 employees as of early 2024, facilitates localized production and responsive service across diverse vehicle segments. Their distribution primarily relies on direct sales to OEMs, a channel that represented 82% of sales in 2021, underscoring deep integration within the supply chains of major automakers.

| Metric | Value (as of early 2024/2021) | Significance |

| Global Footprint | 20+ Countries | Proximity to OEMs, localized support |

| Employee Count | 25,000+ | Operational capacity and global reach |

| Direct OEM Sales % | 82% (2021) | Primary distribution channel, deep customer ties |

Full Version Awaits

Cooper-Standard 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Cooper-Standard's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Cooper-Standard's promotion strategy centers on direct engagement with automotive original equipment manufacturers (OEMs). This B2B approach emphasizes their advanced engineering, manufacturing prowess, and commitment to world-class quality and service, directly communicating value to their clientele.

Securing new business awards, particularly for battery electric vehicle (BEV) and hybrid vehicle platforms, acts as a powerful promotional endorsement. For instance, in 2023, the company announced significant new business wins totaling $4.4 billion, with a notable portion attributed to these future-focused vehicle segments, underscoring their innovative capabilities.

Cooper-Standard actively promotes its standing as an innovation and technology leader. This is evident in their acquisition of prestigious industry accolades, such as the 2025 Automotive News PACE Pilot Award for their advanced eCoFlow™ Switch Pump. This recognition underscores their dedication to pioneering solutions for the automotive sector.

Further solidifying their technological prowess, Cooper-Standard also received the 2024 SPE Automotive Innovation Award for their novel plastic coolant hub. These awards are not merely symbolic; they represent tangible advancements in material science and engineering, directly addressing the industry's growing demand for lighter, more efficient components.

By consistently publicizing these achievements, Cooper-Standard effectively communicates its commitment to developing next-generation, sustainable products. This strategic promotion highlights their ability to anticipate and meet the evolving requirements of the automotive market, reinforcing their position as a forward-thinking industry partner.

Cooper-Standard actively promotes its commitment to corporate responsibility and sustainability through its annual Corporate Responsibility Report. This publication highlights their dedication to ethical operations, environmental care, and social impact, including ambitious targets like achieving carbon neutrality in Europe by 2040 and globally by 2050.

This strategic communication directly appeals to Original Equipment Manufacturers (OEMs) who are increasingly prioritizing sustainable sourcing and supply chain integrity. By showcasing these efforts, Cooper-Standard positions itself as a preferred partner in an evolving automotive industry landscape.

Industry Recognition and Awards

Cooper-Standard's commitment to excellence is consistently validated through prestigious industry recognition. Receiving the General Motors Supplier of the Year Award for eight consecutive years, and notably the 2024 Ford Supplier of the Year Award, underscores their consistent high performance and value proposition to key automotive partners.

These accolades serve as powerful third-party endorsements, reinforcing Cooper-Standard's reputation as a reliable and leading supplier in a competitive market. The company actively leverages these awards in its promotional efforts to build trust and highlight its capabilities.

- Industry Validation: Eight consecutive GM Supplier of the Year awards.

- Recent Achievement: 2024 Ford Supplier of the Year Award.

- Reputation Enhancement: Awards bolster standing as a trusted, high-performing supplier.

Participation in Industry Events and Publications

Cooper-Standard's engagement in industry events and publications is a key component of its marketing strategy, fostering visibility and thought leadership. By participating in major automotive trade shows and conferences, the company showcases its latest innovations and product advancements directly to industry professionals and potential clients. This direct interaction is crucial for highlighting their value proposition in a competitive market.

Their presence at events allows for the dissemination of technical information and product benefits, positioning Cooper-Standard as a knowledgeable partner in the automotive supply chain. Furthermore, contributions to industry publications reinforce their expertise and keep stakeholders informed about their strategic direction and technological progress. For instance, in 2024, their focus on lightweighting solutions and advanced materials would be a prime topic for such outreach.

Cooper-Standard's investor relations activities also fall under this umbrella, providing transparency and updates on financial performance and strategic initiatives. This communication is vital for building investor confidence and demonstrating the company's commitment to growth and innovation. Their reported revenues and strategic investments in areas like electric vehicle components in their 2024 and projected 2025 reports would be central to these communications.

- Industry Events: Participation in key automotive trade shows like the Automotive Engineering Show allows direct engagement with over 15,000 industry professionals annually, providing a platform to showcase advanced material solutions.

- Publications: Contributions to journals such as Automotive News and SAE publications reach a targeted audience of engineers and decision-makers, highlighting Cooper-Standard's technical capabilities.

- Investor Relations: Regular investor calls and reports, including updates on their 2024 performance and 2025 outlook, communicate strategic progress and financial health to the investment community.

- Market Trends: By actively participating and publishing, Cooper-Standard stays ahead of market trends, such as the growing demand for sustainable automotive components, which was a significant driver in their 2024 product development.

Cooper-Standard's promotional efforts focus on showcasing innovation and reliability. Their B2B strategy highlights engineering expertise and quality to automotive OEMs, with recent new business awards totaling $4.4 billion in 2023, particularly for EV and hybrid platforms, underscoring their forward-thinking capabilities.

Industry accolades, such as the 2025 Automotive News PACE Pilot Award for their eCoFlow™ Switch Pump and the 2024 SPE Automotive Innovation Award for a plastic coolant hub, serve as powerful endorsements of their technological leadership and commitment to advanced, sustainable solutions.

Consistent recognition, including eight consecutive GM Supplier of the Year awards and the 2024 Ford Supplier of the Year Award, reinforces Cooper-Standard's reputation as a dependable, high-value supplier, actively leveraged in their communication strategies to build market trust.

Participation in industry events and publications, coupled with transparent investor relations, further amplifies their message. For instance, their 2024 focus on lightweighting and advanced materials, along with updates on 2025 outlooks, ensures continuous engagement with stakeholders and highlights their strategic market positioning.

| Promotional Focus | Key Initiatives/Data | Impact |

|---|---|---|

| Innovation & Technology | 2025 Automotive News PACE Pilot Award (eCoFlow™ Switch Pump), 2024 SPE Automotive Innovation Award (Plastic Coolant Hub) | Demonstrates leadership in advanced automotive components and material science. |

| New Business Wins | $4.4 billion in new business awards (2023), significant portion for BEV/hybrid platforms | Validates engineering capabilities and market relevance for future vehicle technologies. |

| Supplier Excellence | 8 consecutive GM Supplier of the Year awards, 2024 Ford Supplier of the Year Award | Establishes a strong reputation for consistent performance and reliability with major OEMs. |

| Industry Engagement | Participation in automotive trade shows, publications in SAE journals, investor updates | Enhances visibility, thought leadership, and builds investor confidence by communicating strategic progress and market trends. |

Price

Cooper-Standard's pricing strategy for OEM solutions is rooted in a value-based approach. This means their pricing reflects the significant benefits and engineered precision their automotive components deliver to original equipment manufacturers. For instance, in 2023, Cooper Standard secured new business wins valued at approximately $1.5 billion, indicating that their pricing is competitive and aligned with the perceived value of their advanced technologies.

The company's commitment to innovation, such as developing solutions that enhance fuel efficiency and reduce noise, vibration, and harshness (NVH), directly translates into higher perceived value for OEMs. This allows Cooper-Standard to command prices that reflect the substantial performance improvements and competitive differentiation their products offer to vehicle manufacturers in the evolving automotive landscape.

Cooper-Standard's reliance on indexed contracts with Original Equipment Manufacturers (OEMs) is a significant cost management strategy. In 2022, approximately 70% of their contracts were indexed, meaning pricing automatically adjusts with raw material costs. This protects their margins against inflationary pressures.

This contractual feature allows Cooper-Standard to pass on increased material expenses directly to customers, maintaining profitability even when input costs rise. It provides a degree of predictability in their financial performance, particularly during periods of economic volatility.

Beyond indexed contracts, the company actively pursues ongoing cost reduction programs and operational improvements. These initiatives further enhance their ability to manage expenses, which in turn supports their pricing flexibility and overall market competitiveness.

Cooper-Standard's pricing strategy is heavily shaped by the intensely competitive automotive supplier landscape and fluctuating vehicle demand. In 2024, the automotive sector continues to navigate supply chain snags and workforce constraints, impacting production costs and, consequently, pricing.

Despite these headwinds, the accelerating shift towards electric and hybrid vehicles offers Cooper-Standard a chance to boost its content per vehicle (CPV). For instance, advanced sealing systems for EVs can command higher prices due to their critical role in battery thermal management and cabin acoustics. This necessitates a pricing approach that balances market competitiveness with the value derived from technological innovation in these growth areas.

Global Economic Conditions and Tariffs

Global economic conditions, including persistent inflation and fluctuating interest rates, directly affect Cooper-Standard's ability to set competitive prices. For instance, the International Monetary Fund projected global growth to be 3.2% in 2024, a slight slowdown from 2023, highlighting a cautious economic outlook that can pressure pricing power.

Trade policies, particularly tariffs, introduce significant uncertainty and can inflate the cost of raw materials and components. The ongoing trade disputes and the push for reshoring or nearshoring in the automotive sector, as evidenced by increased discussions around supply chain resilience in 2024, could lead to higher input costs for U.S. suppliers like Cooper-Standard, necessitating price adjustments to maintain margins.

- Impact of Tariffs: Tariffs on steel and aluminum, for example, directly increase manufacturing costs for automotive parts suppliers.

- Inflationary Pressures: Elevated inflation rates in 2024 continued to drive up costs for labor, energy, and materials, forcing pricing reviews.

- Geopolitical Risk: Shifting geopolitical landscapes can disrupt global supply chains, leading to component shortages and price volatility.

- Localized Sourcing Trends: The move towards localized sourcing can reduce transportation costs but may also increase per-unit production costs if economies of scale are not achieved.

Long-Term Customer Relationships and Contractual Agreements

Cooper-Standard's pricing strategy is intrinsically linked to long-term customer relationships and contractual agreements, a critical aspect given its role as a global supplier to Original Equipment Manufacturers (OEMs). These agreements are not static; they involve extensive negotiation covering pricing policies, volume-based discounts, and flexible payment terms, reflecting the complex nature of automotive supply chains. The company's consistent ability to secure repeat business, a testament to its strong reputation for quality and reliable service, underscores the success of these enduring pricing strategies.

The financial performance of Cooper-Standard in 2024 and projections for 2025 highlight the impact of these customer relationships. For instance, the company reported that approximately 80% of its revenue in the first half of 2024 was derived from existing customer contracts, demonstrating the stability these agreements provide. This reliance on long-term contracts allows for more predictable revenue streams and a reduced need for aggressive, short-term pricing adjustments.

- Contractual Stability: Over 80% of Cooper-Standard's revenue in H1 2024 came from existing customer contracts.

- Negotiated Pricing: Pricing is determined through ongoing negotiations on policies, discounts, and payment terms with major OEMs.

- Quality and Service Impact: A strong reputation for quality and service directly influences the company's ability to win and retain long-term business.

- Customer Retention: Successful long-term pricing strategies are key drivers for Cooper-Standard's high customer retention rates.

Cooper-Standard's pricing strategy is fundamentally value-based, reflecting the advanced engineering and performance benefits of their automotive components. This approach is validated by securing substantial new business wins, such as approximately $1.5 billion in 2023, indicating their pricing aligns with the perceived value of their innovative solutions.

The company leverages indexed contracts, with about 70% of agreements indexed in 2022, to automatically adjust pricing with raw material costs. This protects their profit margins against inflation, ensuring profitability even when input costs rise.

Market dynamics, including competition and fluctuating demand, alongside global economic factors like inflation and interest rates, significantly influence Cooper-Standard's pricing. For instance, the IMF projected a 3.2% global growth for 2024, suggesting a cautious economic environment that can impact pricing power.

Long-term customer relationships and negotiated contracts are central to their pricing, with over 80% of H1 2024 revenue stemming from existing contracts. This stability allows for predictable revenue and reduces the need for aggressive short-term pricing adjustments.

| Pricing Factor | Impact | 2023/2024 Data Point |

|---|---|---|

| Value-Based Pricing | Reflects engineered precision and performance benefits | $1.5 billion in new business wins (2023) |

| Indexed Contracts | Passes on raw material cost fluctuations | ~70% of contracts indexed (2022) |

| Market & Economic Conditions | Influences pricing power due to competition and inflation | Projected 3.2% global growth (2024) |

| Customer Relationships | Provides stability through long-term agreements | >80% revenue from existing contracts (H1 2024) |

4P's Marketing Mix Analysis Data Sources

Our Cooper-Standard 4P's Marketing Mix Analysis is built on a foundation of verified data, including official company reports, investor relations materials, and industry-specific market research. We also leverage insights from public pricing data, distribution channel information, and promotional campaign analyses to ensure accuracy.