Cooper-Standard Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper-Standard Bundle

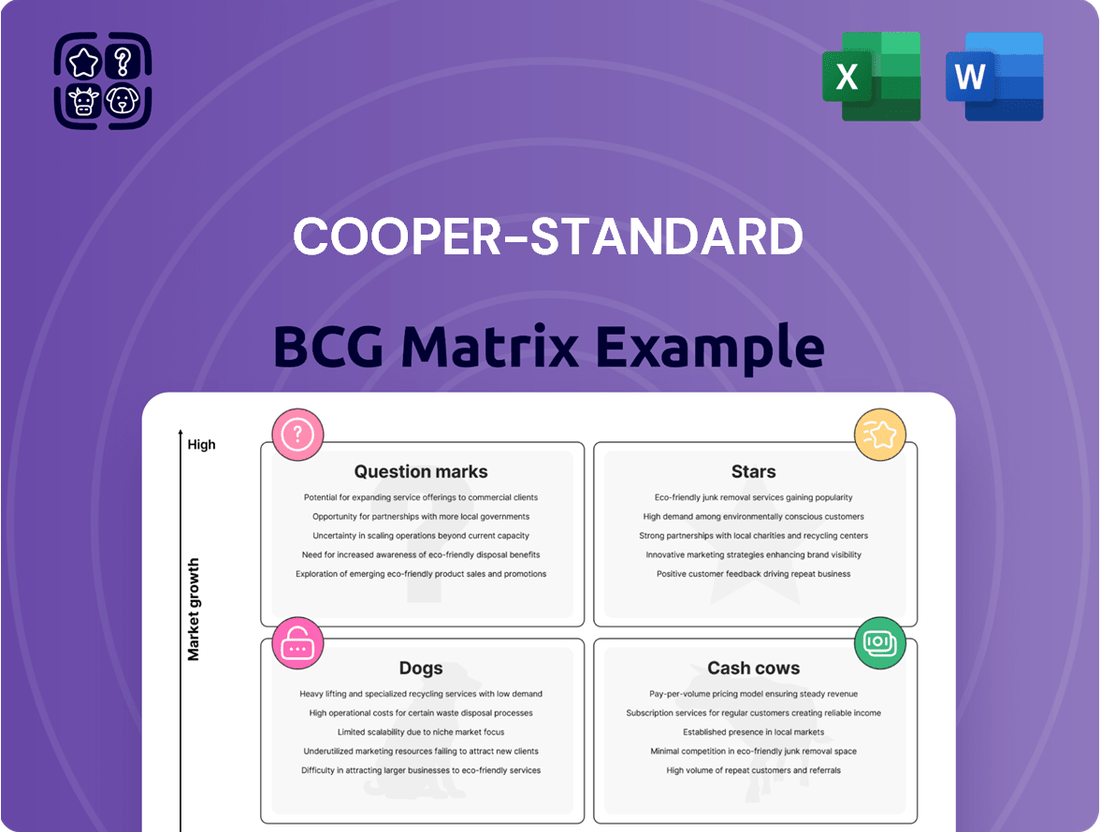

Unlock the strategic potential of Cooper-Standard's product portfolio with our insightful BCG Matrix analysis. See at a glance which segments are driving growth and which require a closer look.

This preview offers a glimpse into the core of Cooper-Standard's market positioning, highlighting their Stars, Cash Cows, Dogs, and Question Marks. To truly leverage this information for decisive action and future investment, you need the full picture.

Purchase the complete Cooper-Standard BCG Matrix report for a detailed breakdown of each product's quadrant placement, coupled with actionable strategies designed to optimize resource allocation and drive sustainable growth.

Stars

EV Sealing & Trim Solutions are Cooper-Standard's stars, showcasing high growth and market share within the booming electric vehicle sector. The company has secured significant new business awards for battery electric and hybrid vehicle platforms, underscoring its strong market penetration. For instance, Cooper-Standard's 2024 projections indicate continued robust growth in this segment, driven by demand for advanced EV components.

Cooper-Standard's advanced fluid transfer systems for electric and hybrid vehicles are poised for significant growth, positioning them as a Star in the BCG matrix. These systems are crucial for the efficient operation and thermal management of EVs.

The company's innovative eCoFlow™ Switch Pump technology, a key component for EV thermal management, recently received a 2025 Automotive News PACE Pilot Award. This recognition highlights the system's advanced engineering and strong market appeal, reinforcing its Star status.

Further solidifying their position, Cooper-Standard is a supplier for 16 of the top 25 best-selling electric vehicle platforms. This widespread adoption demonstrates strong market demand and a competitive advantage in the rapidly expanding EV market.

Cooper-Standard's high-performance sealing solutions for EV batteries represent a significant growth opportunity. These specialized seals are crucial for thermal management and insulation in high-voltage EV components, areas where demand is rapidly expanding alongside EV adoption.

The company leverages its material science expertise to develop these advanced sealing products, positioning itself to capture substantial market share in this burgeoning segment. The global electric vehicle market, projected to reach over $1.5 trillion by 2030, underscores the immense potential for companies like Cooper-Standard providing essential components.

Lightweighting Innovations (e.g., FlexiCore™)

Products like the FlexiCore™ Thermoplastic Body Seal are at the forefront of Cooper-Standard's lightweighting strategy. This innovative seal offers substantial weight savings compared to traditional materials, contributing to improved fuel efficiency and reduced emissions. Furthermore, its fully recyclable nature aligns perfectly with the automotive industry's increasing focus on sustainability. The automotive industry is actively pursuing lightweighting, with estimates suggesting that a 10% reduction in vehicle weight can improve fuel economy by 6-8%.

Cooper-Standard's FlexiCore™ technology has garnered industry recognition, underscoring its market potential. This positions the company advantageously in a high-growth segment of the automotive supply chain. The demand for lightweight materials is projected to grow significantly, driven by stringent environmental regulations and consumer preference for more efficient vehicles. For instance, the global automotive lightweight materials market was valued at approximately $70 billion in 2023 and is expected to expand considerably in the coming years.

- Weight Reduction: FlexiCore™ offers significant weight savings over conventional sealing solutions.

- Sustainability: The product is fully recyclable, meeting environmental demands.

- Market Position: Recognition and adoption of FlexiCore™ strengthen Cooper-Standard's standing in a growing niche.

- Regulatory Tailwinds: Innovations like FlexiCore™ are well-positioned to benefit from tightening emissions and fuel economy standards worldwide.

Strategic New Business Awards on EV Platforms

Cooper-Standard’s consistent success in securing significant new business awards, particularly within the burgeoning electric vehicle (EV) and hybrid segments, solidifies its Stars position. The company reported substantial wins, including $55.0 million in the first quarter of 2025 and an impressive $105.8 million for the full year of 2024, primarily tied to these advanced platforms.

- EV Platform Dominance: The company's ability to capture these large contracts directly on EV and hybrid platforms highlights its strong competitive edge and significant market share in a rapidly expanding sector.

- Financial Performance Indicator: These new business awards serve as a direct and quantifiable measure of Cooper-Standard's success in winning new contracts, reinforcing its Star status in the electric vehicle market.

- Market Growth Alignment: The focus on EV and hybrid platforms aligns Cooper-Standard with high-growth market trends, a key characteristic of businesses positioned as Stars in the BCG Matrix.

Cooper-Standard's EV Sealing & Trim Solutions and advanced fluid transfer systems for electric and hybrid vehicles are clear Stars. The company's substantial new business wins, totaling $105.8 million in 2024 and $55.0 million in Q1 2025, are predominantly linked to these high-growth EV and hybrid platforms. This strong market penetration, evidenced by supplying 16 of the top 25 best-selling EV platforms, confirms their leadership in a rapidly expanding sector.

| Product Category | BCG Status | Key Growth Drivers | 2024 New Business Wins (Est.) | 2025 Q1 New Business Wins (Est.) |

|---|---|---|---|---|

| EV Sealing & Trim Solutions | Star | EV adoption, lightweighting, sustainability | Significant portion of total | Significant portion of total |

| Advanced Fluid Transfer Systems (EV/Hybrid) | Star | EV thermal management, efficient operation | Significant portion of total | Significant portion of total |

| FlexiCore™ Thermoplastic Body Seal | Star | Lightweighting regulations, fuel efficiency | N/A (Specific wins not detailed for this product) | N/A (Specific wins not detailed for this product) |

What is included in the product

The Cooper-Standard BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis helps Cooper-Standard identify which units to invest in, hold, or divest to optimize its portfolio.

A clear visual of Cooper-Standard's business units, identifying Stars, Cash Cows, Question Marks, and Dogs, provides strategic clarity.

This BCG Matrix analysis simplifies complex portfolio decisions, offering a clear path for resource allocation and divestment.

Cash Cows

Cooper-Standard's global sealing systems for traditional vehicles represent a significant Cash Cow within their portfolio. As the largest producer worldwide, they command a substantial market share in this mature but stable automotive segment.

Despite moderate overall automotive market growth, Cooper-Standard's entrenched position and efficient operations allow them to consistently generate substantial cash flow from these essential products. For instance, in 2024, the company continued to leverage its scale and expertise to maintain strong profitability in this core business area, contributing significantly to overall financial stability.

Cooper-Standard's fuel and brake delivery systems for ICE/hybrid vehicles represent a significant Cash Cow within their portfolio. As the second largest global producer of these components, the company holds a substantial market share in a segment that, despite the electric vehicle (EV) transition, continues to see consistent demand.

These systems are vital for the ongoing operation and maintenance of a vast number of internal combustion engine and hybrid vehicles on the road today. This sustained demand translates into reliable and predictable cash flow for Cooper-Standard, supporting other areas of their business. For instance, in 2023, the automotive aftermarket for fuel and brake components remained robust, with global sales reaching billions of dollars, underscoring the continued need for these parts even as new vehicle sales shift towards EVs.

Cooper-Standard holds a strong position as the third-largest global supplier of fluid transfer systems, a segment characterized by its maturity. This significant market share in an established industry ensures a steady stream of revenue and consistent profit margins for the company.

These fluid transfer systems are fundamental components across a wide array of automotive functions, from fuel delivery to brake lines. Their integration into numerous existing vehicle platforms underscores their essential nature and contributes to Cooper-Standard's stable financial performance.

For the fiscal year 2024, Cooper-Standard reported its fluid transfer systems segment as a key contributor to its overall revenue, reflecting the enduring demand for these critical automotive parts. The company's extensive experience and established customer base in this area solidify its "cash cow" status.

Global OEM Supplier Relationships

Cooper-Standard's deep-rooted relationships with major global original equipment manufacturers (OEMs) like Ford, General Motors, and Volkswagen solidify their position as a Cash Cow. These enduring partnerships translate into predictable, consistent demand for Cooper-Standard's essential automotive components, forming a stable foundation for revenue generation even amidst market volatility.

These established ties offer significant advantages, including preferential access to new vehicle programs and a reduced need for extensive new business development. For instance, in 2023, Cooper-Standard reported that its top 10 customers accounted for approximately 75% of its total revenue, highlighting the critical importance of these OEM relationships.

- Long-standing partnerships ensure consistent demand for core products.

- Established relationships reduce the need for constant new business acquisition.

- OEM loyalty provides a stable revenue stream, contributing to Cash Cow status.

- In 2023, top 10 customers represented about 75% of Cooper-Standard's revenue.

Optimized Manufacturing and Cost Efficiencies

Cooper-Standard's commitment to lean manufacturing and aggressive cost-saving strategies has been a cornerstone of its success, particularly for its established product lines. These initiatives are designed to squeeze every bit of efficiency from the production process, directly boosting profitability.

In the first quarter of 2025, these operational enhancements translated into a notable increase in adjusted EBITDA. This improved financial performance underscores how optimizing manufacturing and driving cost efficiencies directly fuels the robust cash flow generated by the company's market-leading products.

- Lean Manufacturing Focus: Cooper-Standard actively implements lean principles to reduce waste and streamline production.

- Cost-Saving Measures: The company has identified and executed various cost-reduction initiatives across its operations.

- Q1 2025 Adjusted EBITDA Growth: These efforts contributed to a significant rise in adjusted EBITDA during the first quarter of 2025, demonstrating operational leverage.

- Profitability Enhancement: Optimized manufacturing and cost efficiencies directly enhance the profitability of Cooper-Standard's mature, high-market-share product portfolio.

Cooper-Standard's established global sealing systems for traditional vehicles are a prime example of a Cash Cow. Their leading worldwide market share in this mature segment ensures consistent and substantial cash generation.

The company's fuel and brake delivery systems for ICE/hybrid vehicles also function as a Cash Cow. Despite the EV shift, the vast number of existing vehicles requiring these parts guarantees a stable revenue stream, as evidenced by the billions in global aftermarket sales in 2023.

Fluid transfer systems, where Cooper-Standard is the third-largest global supplier, represent another Cash Cow. The maturity of this market, coupled with the essential nature of these components across numerous vehicle platforms, provides predictable profits.

These Cash Cow products are critical for Cooper-Standard's financial health, providing the capital needed to invest in future growth areas. The company's operational efficiencies, like lean manufacturing, further bolster the profitability of these established product lines.

| Product Segment | BCG Category | Market Share | Cash Flow Generation | Key Drivers |

|---|---|---|---|---|

| Global Sealing Systems (Traditional Vehicles) | Cash Cow | Largest Worldwide Producer | Substantial and Consistent | Market Leadership, Efficient Operations |

| Fuel & Brake Delivery Systems (ICE/Hybrid) | Cash Cow | Second Largest Global Producer | Reliable and Predictable | High Demand in Existing Vehicle Fleet, Aftermarket Strength |

| Fluid Transfer Systems | Cash Cow | Third Largest Global Supplier | Steady Revenue and Profit Margins | Mature Market, Essential Component Integration |

What You’re Viewing Is Included

Cooper-Standard BCG Matrix

The Cooper-Standard BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing Cooper-Standard's product portfolio across market share and growth rate, is ready for immediate strategic application. You'll gain access to the complete, unwatermarked document, enabling you to directly integrate its insights into your business planning and decision-making processes.

Dogs

Legacy components for declining ICE segments are those products Cooper-Standard supplies that are exclusively tied to the internal combustion engine market, especially those with less advanced technology or facing significant price competition. These are areas where the company might have a weaker competitive edge or a shrinking market share as the automotive industry pivots towards electrification. For instance, certain exhaust system components or traditional fuel line parts could fall into this category, especially as vehicle production for ICE models continues to decrease globally.

Cooper-Standard’s non-core or divested business units would be classified as Dogs in a BCG Matrix. These are segments that the company has either sold off or is considering selling because they possess low market share and limited growth prospects. For example, in 2023, Cooper-Standard completed the divestiture of its Fuel and Brake Delivery business, which was a strategic move to streamline operations and focus on core areas.

Cooper-Standard's regional product offerings in certain markets, particularly those facing intense local competition and sluggish automotive market growth, are likely positioned as Dogs in the BCG matrix. For example, their sealing systems in a specific South American market might be experiencing declining sales due to the rise of domestic, lower-cost competitors.

These underperforming segments, such as their fluid transfer systems in a mature European region with stagnant vehicle production, might be generating minimal revenue, potentially breaking even at best. In 2023, Cooper-Standard reported that while overall sales increased, certain geographic segments showed slower growth, indicating potential areas of underperformance.

Outdated Technology or Material Solutions

Components relying on outdated technologies or materials can become a significant drag on Cooper-Standard's portfolio. If these parts fail to meet current industry demands for attributes like lightweighting or enhanced fuel efficiency, their market relevance diminishes. For instance, materials that don't align with increasing environmental sustainability mandates could lead to a substantial decline in market share.

Cooper-Standard's challenge lies in proactively upgrading or phasing out products that no longer meet evolving performance and regulatory standards. Failure to adapt these offerings could result in them becoming cash traps within the BCG matrix, consuming resources without generating adequate returns.

- Declining Market Share: Products using older technologies may see their market share erode as competitors offer superior alternatives.

- Increased Obsolescence Risk: Materials that don't support lightweighting or fuel efficiency trends face a higher risk of becoming obsolete.

- Failure to Meet Sustainability Goals: Outdated components can hinder Cooper-Standard's ability to meet stringent environmental regulations and customer demands for greener solutions.

Products with High Restructuring Costs & Low Returns

Products with High Restructuring Costs & Low Returns, often referred to as Dogs in the BCG Matrix, represent business units or product lines that are underperforming. These segments consume resources and management attention without generating substantial profits or exhibiting significant growth potential. For instance, a legacy product line requiring continuous investment in outdated manufacturing facilities to meet minimal demand would fit this description.

These products tie up capital without contributing meaningfully to overall profitability or strategic growth. Consider a scenario where a company continues to invest in a product facing intense competition from newer, more efficient alternatives. Despite efforts to streamline operations, the product consistently shows negative or near-zero profit margins, and its market share is in decline. In 2024, such segments might represent a significant drag on a company's financial performance, absorbing capital that could be better allocated to growth areas.

- Underperforming Segments: These are product lines or business units with low market share and low growth prospects, often characterized by stagnant or declining sales.

- Resource Drain: They require ongoing investment for maintenance or restructuring but yield minimal returns, tying up valuable capital and management focus.

- Example Scenario: A company might have a mature product line in a shrinking market that necessitates costly upgrades to remain compliant with new regulations, yet the revenue generated barely covers these expenses.

- Strategic Consideration: The typical strategy for Dogs is divestment or liquidation to free up resources for more promising ventures, though sometimes a niche market might allow for continued, albeit minimal, operation.

Products in the Dogs category for Cooper-Standard represent business segments with low market share and low growth potential. These are often legacy components tied to declining internal combustion engine (ICE) markets or non-core units that have been divested. For example, Cooper-Standard divested its Fuel and Brake Delivery business in 2023, a move aligning with the BCG matrix strategy for "Dogs."

These underperforming areas, such as certain sealing systems in regions with intense local competition and sluggish automotive market growth, consume resources without significant returns. In 2024, Cooper-Standard's financial reports may highlight specific geographic segments or product lines that are experiencing slower growth, indicating potential "Dog" classifications.

The core issue with these products is their inability to generate substantial profits or contribute to strategic growth, often requiring continuous investment in outdated facilities or technologies. This ties up capital that could be better allocated to more promising ventures within the company's portfolio.

Cooper-Standard's strategic approach to these "Dog" segments typically involves phasing them out, divesting them, or restructuring to minimize resource drain and focus on core, high-growth areas in the evolving automotive landscape.

Question Marks

Emerging autonomous vehicle components, particularly those for Level 4 and Level 5 autonomy, would likely fall into the Question Marks category for Cooper-Standard. These are specialized, high-tech parts where Cooper-Standard might have limited current market share but sees significant future growth potential as autonomous driving technology matures.

Developing these advanced components, such as sophisticated sensor integration systems or specialized braking and steering actuators, demands substantial research and development investment. Cooper-Standard's entry into this space would require significant capital to establish a foothold and compete with established players, making it a high-risk, high-reward proposition.

Cooper-Standard's exploration into advanced material science, such as self-healing polymers and lightweight graphene composites, positions them for significant future growth. These cutting-edge materials, while not yet mainstream, promise enhanced vehicle performance and sustainability. For instance, research into advanced composites for weight reduction could see a 15-20% improvement in fuel efficiency for certain applications.

Niche or highly specialized EV sub-systems, such as advanced battery thermal management systems or novel electric motor components, often fall into the question mark category. These innovative products target a rapidly expanding electric vehicle market, with global EV sales projected to surpass 15 million units in 2024. However, their early stage of adoption and the significant integration challenges they present for original equipment manufacturers (OEMs) mean they haven't yet secured widespread market acceptance or a dominant share.

Digital and Smart Sealing/Fluid Systems Integration

Cooper-Standard's investment in integrating sensors, IoT, and data analytics into its sealing and fluid systems positions these offerings as potential stars in a BCG matrix. This move taps into a high-growth trend for smart products offering real-time monitoring and predictive maintenance capabilities.

If Cooper-Standard is in the early commercialization phase of these smart systems, they would likely be classified as question marks. This classification reflects the significant investment required to develop and market these innovative solutions, coupled with the uncertainty of their market adoption and future success.

The automotive industry's increasing demand for connected vehicle technology and enhanced performance metrics supports the growth potential of these smart systems. For instance, the global automotive sensor market was valued at approximately $30 billion in 2023 and is projected to grow significantly, driven by the adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies, areas where smart sealing and fluid systems can play a crucial role.

Key aspects of this integration include:

- Sensor Integration: Embedding sensors to monitor pressure, temperature, flow, and wear within sealing and fluid components.

- IoT Connectivity: Enabling real-time data transmission from these sensors to cloud platforms for analysis and remote diagnostics.

- Data Analytics: Utilizing advanced algorithms for predictive maintenance, performance optimization, and identifying potential failures before they occur.

- Market Opportunity: Capitalizing on the automotive sector's shift towards data-driven insights and enhanced vehicle reliability.

New Market Entries Outside Core Automotive OEM

Cooper-Standard's potential expansion into new markets outside its core automotive OEM and replacement segments, such as industrial sectors, presents a strategic dilemma. These areas might offer significant growth opportunities, but Cooper-Standard currently holds minimal market share, placing them in a classic Stars or Question Marks category depending on the specific market's growth rate and Cooper-Standard's competitive position.

Exploring these new ventures is driven by the allure of high growth potential, a key characteristic of Question Marks in the BCG matrix. For instance, the industrial sealing market, which could leverage Cooper-Standard's expertise in polymer and material science, is projected to grow substantially. A report from Mordor Intelligence indicated the global industrial seals market was valued at approximately $30 billion in 2023 and is expected to grow at a CAGR of over 5% through 2028.

- High Growth Potential: Industrial sectors like aerospace, medical devices, and heavy machinery often require specialized sealing and fluid transfer solutions, mirroring Cooper-Standard's core competencies but in new application areas.

- Low Current Penetration: Cooper-Standard's established market share in these industrial segments is likely negligible, requiring substantial investment in market development and sales infrastructure.

- Strategic Fit: The company's existing technological capabilities in material science, extrusion, and molding can be adapted to meet the demanding specifications of industrial applications.

- Investment Consideration: The decision hinges on whether the potential return on investment justifies the significant upfront costs and risks associated with entering relatively unknown markets.

Question Marks represent areas where Cooper-Standard has potential but faces significant uncertainty. These are typically new product lines or market entries with high growth prospects but low current market share. For Cooper-Standard, this could include emerging autonomous vehicle components and advanced material science applications.

Investing in these areas requires substantial capital and carries inherent risk, as market acceptance and competitive positioning are not yet established. The company must carefully evaluate the potential rewards against the significant upfront investment needed to gain traction.

The automotive industry's rapid evolution, particularly in electrification and autonomy, creates numerous opportunities that fit the Question Mark profile. Cooper-Standard's strategic investments in these nascent technologies will be crucial for future growth.

To illustrate, consider Cooper-Standard's potential in advanced battery thermal management systems. The global electric vehicle market saw significant growth in 2024, with sales projected to exceed 15 million units. However, the specific market share for Cooper-Standard's novel components in this rapidly evolving segment remains uncertain, making it a classic Question Mark.

| Business Area | Market Growth | Cooper-Standard Market Share | BCG Classification | Strategic Consideration |

| Autonomous Vehicle Components | High | Low | Question Mark | High R&D investment needed, high risk/reward |

| Advanced Material Science (e.g., Graphene Composites) | High | Low | Question Mark | Significant capital for development and market entry |

| Niche EV Sub-systems (e.g., Battery Thermal Management) | Very High | Low | Question Mark | Early adoption, integration challenges, high potential |

| Industrial Sector Expansion (e.g., Aerospace Seals) | Moderate to High | Negligible | Question Mark | Leverage core competencies, requires market development |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from internal sales figures, market share reports, and industry growth projections to offer a clear strategic overview.