Cooper-Standard Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper-Standard Bundle

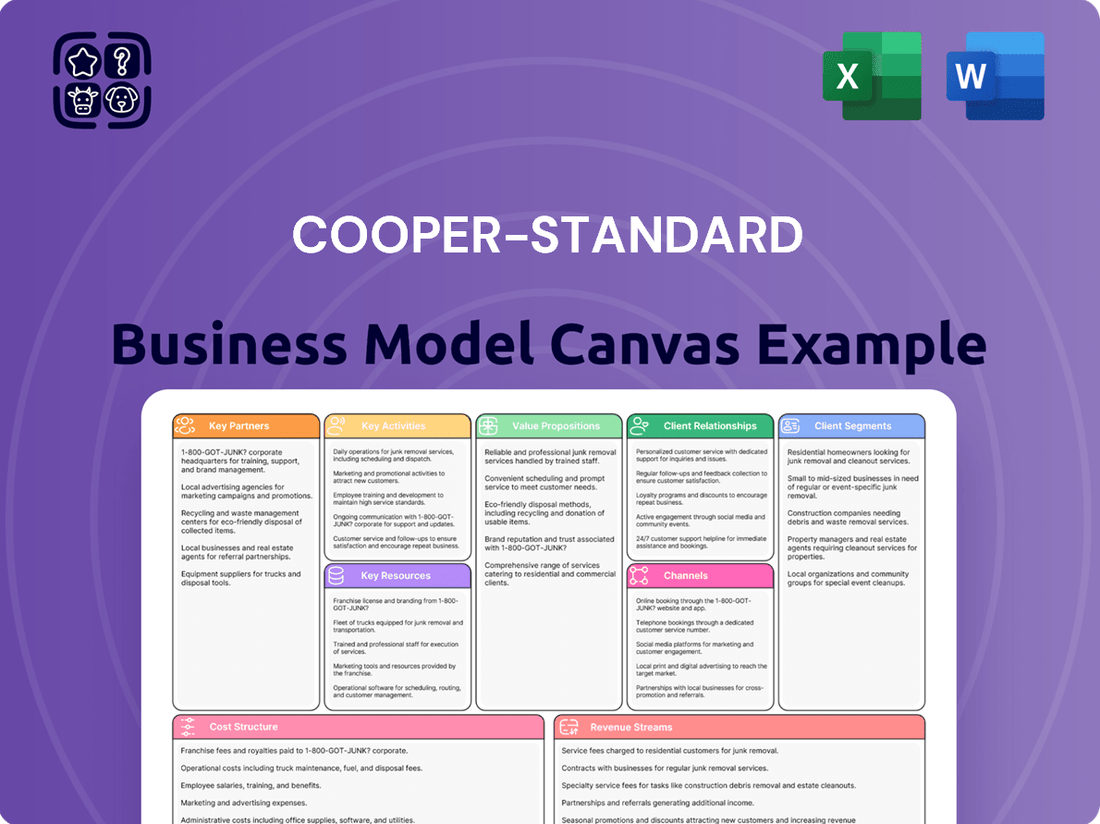

Discover the strategic core of Cooper-Standard's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their success.

Partnerships

Cooper-Standard's core partnerships are with major global automotive original equipment manufacturers (OEMs). These include giants like Ford, General Motors, Stellantis, Volkswagen Group, Mercedes-Benz, BMW, Jaguar/Land Rover, Hyundai, Toyota, and the emerging electric vehicle maker Rivian.

These deeply entrenched relationships are vital for Cooper-Standard, serving as the primary channel for securing new business awards. Maintaining its status as a preferred supplier within the automotive ecosystem hinges on these long-standing collaborations.

The company actively pursues new business with these OEM partners by highlighting its advanced engineering and manufacturing prowess. Innovation initiatives and a strong reputation for quality and reliable service are key differentiators in this competitive landscape.

Collaborations with technology partners are crucial for Cooper-Standard to develop cutting-edge solutions, particularly as the automotive industry shifts towards electric vehicles (EVs). These alliances allow the company to integrate novel technologies and enhance its product offerings.

A prime example is Cooper-Standard's partnership with Saleri Group, which resulted in the development of the eCoFlow™ Switch Pump technology. This innovative system combines an electric water pump with an electrically driven valve, significantly improving thermal management systems in EVs.

Through such strategic technology partnerships, Cooper-Standard reinforces its position at the vanguard of automotive innovation. This proactive approach ensures the company can effectively adapt to the dynamic and evolving demands of the global automotive market.

Cooper-Standard relies heavily on its raw material suppliers for consistent production of its automotive components. These partnerships are fundamental to ensuring the company has the necessary materials for its sealing, fuel and brake delivery, and fluid transfer systems.

To navigate economic challenges, Cooper-Standard actively collaborates with its suppliers to manage inflationary pressures and reduce exposure to material cost fluctuations. This proactive approach helps maintain cost stability in a volatile market.

The strength of these supplier relationships directly impacts the stability of Cooper-Standard's supply chain. For instance, in 2023, the automotive industry continued to grapple with supply chain disruptions, making robust supplier partnerships even more crucial for companies like Cooper-Standard to secure essential inputs.

Research and Development Institutions

Cooper-Standard's partnerships with research and development institutions are crucial for accelerating the creation of novel materials and advanced manufacturing techniques. These collaborations bolster the company's technological prowess and dedication to innovation, enabling the development of cutting-edge products and refinements to existing offerings.

These strategic alliances allow Cooper-Standard to tap into specialized knowledge and resources, driving forward its innovation pipeline. For instance, in 2024, the company continued to invest in collaborative research projects focused on lightweighting solutions and sustainable materials, aiming to reduce vehicle weight and environmental impact.

- Accelerated Material Innovation: Collaborations with universities and research centers help Cooper-Standard identify and develop next-generation materials, such as advanced composites and bio-based polymers, for automotive applications.

- Process Optimization: Partnerships enable the co-development of more efficient and sustainable manufacturing processes, potentially leading to reduced energy consumption and waste in production.

- Technological Edge: By engaging with R&D institutions, Cooper-Standard stays at the forefront of technological advancements, ensuring its product portfolio remains competitive and meets evolving industry demands.

Logistics and Distribution Partners

Cooper-Standard relies heavily on its logistics and distribution partners to ensure its automotive components reach Original Equipment Manufacturers (OEMs) globally on time, a critical factor for supporting OEM production schedules. These partnerships are vital for maintaining the company's extensive supply chain operations, which span across 20 countries.

The effectiveness of these collaborations directly impacts Cooper-Standard's ability to deliver manufactured components efficiently. This global footprint, encompassing numerous manufacturing and logistics sites, underscores the importance of robust relationships with specialized logistics providers to manage the complex movement of goods.

- Global Reach: Cooper-Standard's operations in 20 countries necessitate partnerships with logistics providers capable of navigating international shipping regulations and diverse transportation modes.

- Timely Delivery: The automotive industry's just-in-time manufacturing model means that delays in component delivery can halt production lines, making reliable logistics partners indispensable.

- Cost Optimization: Strategic alliances with logistics firms can help Cooper-Standard optimize shipping routes, consolidate shipments, and reduce overall transportation costs, contributing to competitive pricing.

Cooper-Standard's key partnerships extend to technology providers and research institutions, crucial for innovation in areas like electric vehicles. Collaborations with Saleri Group, for example, led to the eCoFlow™ Switch Pump, enhancing EV thermal management.

These alliances allow Cooper-Standard to integrate novel technologies and stay ahead in the evolving automotive landscape. In 2024, the company continued to focus on collaborative research for lightweighting and sustainable materials.

Strong relationships with raw material suppliers are fundamental for consistent production and managing inflationary pressures. In 2023, navigating supply chain disruptions highlighted the critical nature of these supplier partnerships for securing essential inputs.

Logistics and distribution partners are vital for Cooper-Standard's global operations, ensuring timely delivery of components to OEMs across its 20-country footprint. These collaborations are essential for optimizing supply chains and maintaining competitive pricing.

| Partner Type | Key Collaborators | Strategic Importance | Example/Impact |

|---|---|---|---|

| OEMs | Ford, GM, Stellantis, VW Group, Rivian | Securing new business, preferred supplier status | Primary channel for sales and growth |

| Technology Providers | Saleri Group | Developing cutting-edge solutions, EV integration | eCoFlow™ Switch Pump for EV thermal management |

| Raw Material Suppliers | Various global suppliers | Ensuring production consistency, managing costs | Mitigating inflationary pressures and supply chain risks |

| R&D Institutions | Universities, research centers | Material innovation, process optimization | Focus on lightweighting and sustainable materials (2024) |

| Logistics & Distribution | Global logistics firms | Timely delivery, global reach, cost optimization | Supporting just-in-time manufacturing across 20 countries |

What is included in the product

A comprehensive, pre-written business model tailored to Cooper-Standard’s strategy, detailing customer segments, value propositions, and operational plans within the 9 classic BMC blocks.

Cooper-Standard's Business Model Canvas provides a structured framework to pinpoint and address inefficiencies, acting as a pain point reliever by clarifying operational bottlenecks and resource allocation.

Activities

Cooper-Standard's core activity revolves around the design and engineering of advanced solutions aimed at improving vehicle performance, reducing noise and vibration, and boosting fuel efficiency. This forward-looking approach encompasses the creation of novel products tailored for both conventional internal combustion engine vehicles and the rapidly expanding electric vehicle (EV) market. For instance, they are actively developing critical components like sophisticated battery cooling systems and innovative lightweighting solutions designed to enhance EV range and performance.

The company strategically utilizes its deep-rooted expertise in materials science to develop components that are not only environmentally responsible but also significantly improve vehicle performance. This commitment to material innovation is crucial in meeting the evolving demands of the automotive industry, particularly as it transitions towards greater sustainability and electrification. In 2024, the automotive industry continued its strong push towards electrification, with global EV sales projected to reach over 17 million units, underscoring the market relevance of Cooper-Standard's focus on EV platform solutions.

Manufacturing and production are central to Cooper Standard's operations, focusing on the creation of critical automotive components like sealing and trim, fuel and brake delivery systems, and fluid transfer systems. This core activity directly translates their designs into tangible products for the automotive industry.

The company's commitment to operational excellence is evident in its expansive global footprint, boasting 75 manufacturing locations. This widespread presence allows for localized production and efficient supply chain management.

Cooper Standard heavily emphasizes lean manufacturing principles and drives for operational efficiencies across its facilities. In 2023, for instance, the company continued to invest in process improvements to optimize production and reduce waste, a crucial strategy for maintaining competitiveness.

These manufacturing strategies are designed to control costs and bolster profitability, particularly important given the dynamic and often challenging nature of the automotive market. For example, by streamlining production lines and enhancing quality control, Cooper Standard aims to deliver value while managing the inherent cost pressures in the sector.

Cooper-Standard's commitment to Research and Development (R&D) is the engine driving its innovation in the automotive sector. This continuous investment is vital for creating next-generation products and refining current offerings to align with the ever-changing needs of the automotive industry, especially the burgeoning electric vehicle (EV) market. The company actively channels resources into R&D to bolster its technological capabilities and secure its competitive edge.

Recent advancements underscore this dedication, with innovations like the FlexiCore™ thermoplastic body seal and the eCoFlow™ Switch Pump showcasing Cooper-Standard's forward-thinking approach. These developments highlight the company's focus on delivering advanced material solutions and efficient fluid management systems that cater to the evolving demands of modern vehicle design and performance.

Supply Chain Management

Cooper-Standard's supply chain management is a critical function, focusing on the timely procurement of raw materials and the efficient delivery of finished goods across its global operations. This involves navigating complex logistics and supplier relationships to maintain production flow.

The company actively collaborates with its suppliers to identify and reduce potential risks, such as disruptions in material availability or price volatility. A key objective is to optimize costs throughout the supply chain, a particularly important endeavor in the face of ongoing inflationary pressures experienced in 2024.

- Supplier Collaboration: Cooper-Standard engages in strategic partnerships with key suppliers to ensure consistent material supply and manage cost fluctuations.

- Risk Mitigation: Proactive measures are implemented to address potential supply chain disruptions, including geopolitical events and economic instability.

- Cost Optimization: Efforts are concentrated on reducing procurement costs and improving logistics efficiency to counter inflationary impacts.

- Material Availability: Ensuring a steady flow of essential raw materials remains a top priority, especially given market uncertainties.

Customer Relationship Management and New Business Acquisition

Cooper-Standard's customer relationship management is centered on fostering deep connections with global original equipment manufacturers (OEMs). This is crucial for not only retaining existing business but also for winning new contracts, especially in the burgeoning electric vehicle (EV) sector. The company's commitment to quality and reliable service underpins its efforts to acquire new business, as evidenced by significant recent awards related to EV platforms.

- OEM Relationships: Maintaining strong, collaborative ties with major global OEMs is the cornerstone of Cooper-Standard's strategy for securing long-term business and new program wins.

- New Business Focus: The company is strategically targeting and winning new business, particularly within the rapidly expanding electric vehicle market, demonstrating adaptability and forward-thinking.

- Reputation Leverage: Cooper-Standard capitalizes on its established reputation for product quality, manufacturing excellence, and dependable customer service to differentiate itself and attract new OEM partners.

- EV Platform Wins: In 2024, Cooper-Standard announced securing several significant new business awards for global EV platforms, highlighting its success in this critical growth area.

Cooper-Standard's key activities are deeply rooted in innovation and manufacturing excellence within the automotive sector. The company designs and engineers advanced components, focusing on areas like sealing, fluid transfer, and fuel & brake delivery systems. A significant portion of their effort is directed towards developing solutions for the evolving electric vehicle (EV) market, including battery thermal management systems and lightweighting technologies. This dual focus on traditional and next-generation automotive needs drives their product development and manufacturing strategies.

Their manufacturing operations are geared towards producing these critical components efficiently and at scale, leveraging lean manufacturing principles. This operational focus is supported by a robust global supply chain designed for resilience and cost-effectiveness, especially crucial in the inflationary environment of 2024. The company also prioritizes strong relationships with Original Equipment Manufacturers (OEMs), securing new business, particularly for EV platforms, by highlighting their quality and technological capabilities.

| Key Activity | Description | 2024 Relevance/Data |

| Design & Engineering of Advanced Solutions | Creating innovative automotive components for performance, NVH reduction, and fuel efficiency, with a strong EV focus. | Development of battery cooling systems and lightweighting solutions for EVs. Global EV sales projected to exceed 17 million units in 2024. |

| Manufacturing & Production | Producing sealing, trim, fuel/brake delivery, and fluid transfer systems using lean principles. | Operates 75 global manufacturing locations. Focus on process improvements to optimize production and reduce waste. |

| Research & Development (R&D) | Investing in next-generation products and refining current offerings, especially for the EV market. | Innovations include FlexiCore™ thermoplastic body seal and eCoFlow™ Switch Pump. |

| Supply Chain Management | Ensuring timely procurement of materials and efficient delivery of finished goods, with risk mitigation and cost optimization. | Focus on managing material availability and logistics costs amidst 2024 inflationary pressures. |

| Customer Relationship Management | Fostering deep connections with global OEMs to retain business and win new contracts, especially in the EV sector. | Secured several significant new business awards for global EV platforms in 2024. |

Preview Before You Purchase

Business Model Canvas

The Cooper-Standard Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can be confident that the structure, content, and professional formatting are exactly what you'll be working with. Once your order is complete, you will gain full access to this identical, ready-to-use analysis, allowing you to immediately leverage its insights for your strategic planning.

Resources

Cooper Standard's manufacturing capabilities are anchored by a vast global network of 75 production facilities spread across 20 countries. These sites are outfitted with specialized machinery and advanced technology essential for manufacturing their core product lines: sealing, fuel and brake delivery, and fluid transfer systems.

The company demonstrably prioritizes the ongoing enhancement of these production assets. For instance, Cooper Standard reported capital expenditures of $170.5 million in 2023, a significant portion of which is directed towards modernizing and optimizing its manufacturing equipment and facilities to maintain a competitive edge and improve operational efficiency.

Cooper Standard's intellectual property, including proprietary technologies and materials science expertise, is a cornerstone of its business model. Innovations such as the FlexiCore™ and FlushSeal™ sealing systems, along with the eCoFlow™ Switch Pump, are key examples of this valuable intellectual property. These advancements are crucial for maintaining a competitive edge in the automotive supply industry.

The company's patent portfolio is a testament to its commitment to innovation. As of early 2024, Cooper Standard continues to invest in research and development, aiming to secure new patents that protect its cutting-edge solutions. This focus on intellectual property allows Cooper Standard to differentiate its offerings and command premium pricing for its specialized products.

A highly skilled workforce, encompassing engineers and manufacturing specialists, is fundamental to Cooper-Standard's ability to design, develop, and produce intricate automotive components. This talent pool is the engine behind their innovation and operational efficiency.

With approximately 22,000 team members worldwide, Cooper-Standard leverages this extensive expertise to maintain its competitive edge in the automotive supply chain.

Strong Customer Relationships and Brand Reputation

Cooper Standard's strong customer relationships, particularly with major global Original Equipment Manufacturers (OEMs), are a cornerstone of its business. These long-standing partnerships, built on a reputation for quality and reliable service, represent a significant competitive advantage. This deep integration with key players in the automotive industry ensures a stable revenue stream and facilitates access to future product development and business opportunities.

The company's brand reputation is further bolstered by consistent recognition from its OEM partners. For instance, Cooper Standard has been honored with prestigious awards such as Ford's World Excellence Award and GM's Supplier of the Year multiple times. These accolades underscore their commitment to exceeding customer expectations and maintaining high standards in product development and delivery.

- Long-standing OEM partnerships provide a stable customer base.

- Reputation for quality and service fosters trust and repeat business.

- Awards from major OEMs validate their strong industry standing.

- Access to new business opportunities through established relationships.

Financial Capital and Liquidity

Financial capital and liquidity are foundational to Cooper-Standard's ability to operate and grow. Access to readily available funds, whether through cash reserves or credit lines, is crucial for day-to-day activities and pursuing new opportunities. This financial bedrock allows the company to navigate market fluctuations and invest strategically.

As of March 31, 2025, Cooper-Standard demonstrated strong financial footing. The company reported $140.4 million in cash and cash equivalents. Furthermore, its total liquidity reached $300.1 million, highlighting a robust capacity to meet its financial obligations and fund its strategic objectives.

This financial strength directly supports Cooper-Standard's business model in several key ways:

- Operational Continuity: Sufficient cash ensures the smooth running of manufacturing processes, supply chain management, and employee compensation.

- Strategic Investments: The available capital enables investment in research and development, new technologies, and market expansion initiatives.

- Debt Management: Adequate liquidity provides the flexibility to manage existing debt obligations and potentially secure favorable financing for future growth.

- Resilience: A healthy liquidity position equips Cooper-Standard to weather economic downturns or unforeseen operational challenges.

Cooper Standard's key resources include its extensive global manufacturing footprint, advanced proprietary technologies, and a highly skilled workforce. These elements are critical for producing specialized automotive components and maintaining a competitive edge in the market.

The company's intellectual property, such as its innovative sealing and fluid transfer systems, along with its robust patent portfolio, forms a significant intangible asset. This focus on R&D and patent protection allows Cooper Standard to differentiate its product offerings.

Furthermore, strong, long-standing relationships with major automotive OEMs, backed by a reputation for quality and consistent supplier awards, represent a vital customer-centric resource. The company's substantial financial capital and liquidity, exemplified by its cash reserves and total liquidity, also underpin its operational stability and strategic investment capabilities.

| Key Resource | Description | Supporting Data/Examples |

| Manufacturing Capabilities | Global network of production facilities | 75 facilities in 20 countries; $170.5 million in capital expenditures in 2023 for modernization |

| Intellectual Property | Proprietary technologies and materials science expertise | FlexiCore™, FlushSeal™ sealing systems, eCoFlow™ Switch Pump; ongoing investment in R&D and patents |

| Human Capital | Skilled workforce of engineers and manufacturing specialists | Approximately 22,000 team members worldwide |

| Customer Relationships | Strong partnerships with major global OEMs | Ford World Excellence Award, GM Supplier of the Year awards |

| Financial Resources | Capital and liquidity for operations and growth | $140.4 million in cash and cash equivalents; $300.1 million in total liquidity as of March 31, 2025 |

Value Propositions

Cooper-Standard delivers cutting-edge solutions designed to boost vehicle performance and efficiency for Original Equipment Manufacturers (OEMs). Their innovations directly contribute to reducing noise and vibration, a key factor in driver comfort and perceived quality. Furthermore, these solutions are crucial for enhancing fuel economy in both traditional internal combustion engine (ICE) vehicles and the growing electric vehicle (EV) market.

These advanced components are integral to the overall functionality and quality of automobiles. For instance, in 2024, the automotive industry continued its strong push towards electrification, with EV sales projected to reach significant global market share, underscoring the demand for Cooper-Standard's efficiency-focused technologies.

Cooper Standard provides innovative solutions that directly support vehicle lightweighting and the critical goal of reducing CO2 emissions. This focus aligns perfectly with the automotive industry's strong push towards greater sustainability and environmental responsibility.

Their FlexiCore™ thermoplastic body seal is a prime example, contributing to lighter vehicle designs. Beyond its weight-saving benefits, this product is also fully recyclable, further enhancing its eco-friendly profile.

By offering these advanced materials and technologies, Cooper Standard empowers Original Equipment Manufacturers (OEMs) to not only meet increasingly stringent environmental regulations but also to cater to growing consumer demand for greener, more fuel-efficient vehicles.

Cooper Standard's commitment to advanced material science fuels the creation of eco-friendly components and solutions. Their innovative approach, exemplified by the Fortrex™ chemistry platform, enables the development of next-generation products with enhanced performance and greater design freedom.

Global Manufacturing and Supply Chain Capabilities

Cooper-Standard's extensive global manufacturing network, spanning 20 countries, provides Original Equipment Manufacturers (OEMs) with a significant advantage: consistent quality and dependable supply across the globe. This widespread footprint is crucial for meeting the diverse and often geographically dispersed production needs of automotive clients.

Their international presence allows for efficient product delivery directly to the various manufacturing sites of their customers. This proximity minimizes lead times and logistical complexities, ensuring that OEMs can maintain their own production schedules without interruption. As of 2024, Cooper-Standard's operational reach is a key differentiator in the competitive automotive supply chain landscape.

- Global Reach: Manufacturing operations in 20 countries.

- Consistent Quality: Standardized processes ensure uniform product quality worldwide.

- Reliable Supply: A robust network minimizes disruptions and ensures timely delivery.

- Customer Proximity: Facilitates efficient logistics to OEM assembly plants globally.

Problem-Solving and Custom Engineered Solutions

Cooper Standard excels at creating unique, engineered solutions that tackle specific problems for original equipment manufacturers (OEMs). This means they don't just offer standard parts; they develop custom components designed precisely for what each client needs, especially crucial in the fast-changing electric vehicle (EV) market. For instance, their work on the Renault Emblème demo car showcased this very capability.

Their expertise in problem-solving translates into significant value for their customers. This custom engineering approach is a key differentiator, allowing OEMs to integrate advanced technologies and meet demanding performance specifications. In 2024, the automotive industry's push for lighter, more efficient vehicles meant that specialized material science and design were paramount, areas where Cooper Standard's custom solutions shone.

- Custom-engineered components address specific OEM challenges.

- Tailored solutions are critical for the evolving EV market.

- Collaboration, like with the Renault Emblème, demonstrates this value.

- Problem-solving enhances vehicle performance and innovation.

Cooper Standard's value proposition centers on delivering advanced material science and engineered solutions that enhance vehicle performance, efficiency, and sustainability for OEMs. Their commitment to innovation, exemplified by platforms like Fortrex™, allows for the creation of lightweight, recyclable components crucial for meeting environmental regulations and consumer demand for greener vehicles. This focus is particularly relevant as the automotive industry, including significant EV market growth projected for 2024 and beyond, prioritizes CO2 reduction and fuel economy.

Customer Relationships

Cooper-Standard fosters deep partnerships with global automotive OEMs, exemplified by their dedicated account management teams. These teams work hand-in-hand with clients, ensuring a thorough understanding of evolving vehicle requirements and production schedules, a critical element in maintaining their strong market position.

The company provides extensive technical support, a cornerstone of their customer relationships. This support extends from initial design collaboration to ongoing product development, helping manufacturers integrate Cooper-Standard's innovative solutions seamlessly into their vehicle platforms.

Cooper Standard cultivates enduring strategic alliances with Original Equipment Manufacturers (OEMs), transcending mere transactional exchanges to establish itself as an indispensable partner.

This commitment is demonstrably reflected in the consistent stream of new business awards the company secures. For instance, in 2023, Cooper Standard was recognized by General Motors as a top supplier, underscoring the depth of their collaborative relationship and the value they deliver.

Further solidifying this, Ford also acknowledged Cooper Standard as a preferred supplier, highlighting their reliability and innovation in meeting automotive industry demands. These accolades are a testament to the company's focus on building trust and mutual growth with its key OEM clients.

Cooper Standard actively partners with its automotive clients on collaborative innovation and co-development initiatives. This approach is particularly vital for new vehicle platforms, especially those incorporating hybrid and electric vehicle (EV) technologies, where bespoke solutions are often required. For instance, in 2023, the company highlighted its work with major OEMs on advanced sealing solutions for next-generation EVs, a testament to this co-development strategy.

Quality and Service Excellence

Cooper-Standard's customer relationships are built on a foundation of world-class quality and service excellence. This dedication fosters strong customer satisfaction and loyalty, making them a trusted partner in the automotive supply chain.

Their commitment to superior product quality and responsive customer support has historically translated into long-term contracts and repeat business. For instance, in 2023, Cooper-Standard reported a significant portion of its revenue derived from established customer relationships, underscoring the success of their customer-centric approach.

- Focus on Zero Defects: Cooper-Standard emphasizes rigorous quality control processes throughout manufacturing to minimize defects and ensure product reliability, a key driver of customer trust.

- Customer Support and Responsiveness: They provide dedicated account management and technical support, ensuring prompt resolution of issues and a seamless experience for their clients.

- Long-Term Partnerships: The company actively cultivates enduring relationships with automotive OEMs, often securing multi-year supply agreements based on proven performance and reliability.

- Supplier Awards and Recognition: Cooper-Standard frequently receives accolades from major automotive manufacturers for quality and service, validating their commitment to excellence.

Regular Communication and Feedback Mechanisms

Cooper-Standard prioritizes consistent dialogue and structured feedback channels to swiftly address client requirements and evolving market dynamics. This proactive strategy enables agile adjustments to their product portfolio and operational plans, ensuring alignment with customer expectations.

- Open Communication: Maintaining direct and frequent communication with clients ensures their evolving needs are understood and met promptly.

- Feedback Loops: Formal mechanisms for gathering customer feedback allow Cooper-Standard to identify areas for improvement and innovation.

- Market Responsiveness: This approach facilitates a rapid response to market shifts, ensuring product offerings remain competitive and relevant.

- Customer Satisfaction: By actively listening and adapting, Cooper-Standard aims to foster strong, long-term customer relationships built on trust and mutual understanding.

Cooper-Standard's customer relationships are characterized by deep, collaborative partnerships with global automotive OEMs, underscored by dedicated account management and extensive technical support. This focus on co-development, particularly for new vehicle platforms and EV technologies, ensures tailored solutions and seamless integration, fostering long-term loyalty and repeat business.

| Customer Relationship Aspect | Description | Supporting Data/Examples |

|---|---|---|

| Partnership Depth | Cultivating strategic alliances beyond transactional exchanges. | Securing multi-year supply agreements with major OEMs. |

| Technical Collaboration | Providing comprehensive support from design to development. | Working with OEMs on advanced sealing solutions for next-gen EVs (2023). |

| Quality & Service Excellence | Commitment to world-class quality and responsive support. | Consistent customer satisfaction and loyalty leading to repeat business. |

| Supplier Recognition | Receiving accolades from automotive manufacturers. | Named a top supplier by General Motors and a preferred supplier by Ford (2023). |

Channels

Cooper-Standard primarily utilizes direct sales channels to reach its Original Equipment Manufacturer (OEM) customers worldwide. This approach involves dedicated sales teams engaging directly with automotive manufacturers to secure new business and manage existing supply agreements.

This direct engagement fosters close collaboration on product design, development, and seamless integration into new vehicle platforms. For instance, in 2024, Cooper-Standard continued to strengthen these relationships, which are crucial for understanding evolving OEM needs and technological advancements in the automotive sector.

Cooper-Standard leverages its expansive global manufacturing and logistics network as a vital channel to reach customers worldwide. This network is instrumental in ensuring the timely and efficient delivery of their automotive components.

With a significant presence, Cooper-Standard operates manufacturing facilities across 20 countries. This widespread footprint allows them to effectively serve their international clientele, providing essential parts to automotive manufacturers globally.

Technical Sales and Engineering Teams are crucial for Cooper-Standard's customer relationships. These specialized groups engage directly with Original Equipment Manufacturer (OEM) engineering departments, offering expert advice and support to ensure seamless product integration. For instance, in 2024, Cooper-Standard's commitment to technical collaboration was evident in their ongoing development of advanced sealing solutions for the automotive industry, directly addressing OEM needs for improved fuel efficiency and reduced noise, vibration, and harshness (NVH).

These teams are instrumental in showcasing the tangible benefits and technical superiority of Cooper-Standard's innovative offerings. They act as the frontline for demonstrating how the company's materials science and product design translate into real-world performance improvements for their clients. This direct engagement helps solidify partnerships and drives the adoption of Cooper-Standard's cutting-edge technologies, contributing to their market position.

Industry Trade Shows and Conferences

Industry trade shows and conferences are crucial for Cooper-Standard to present its cutting-edge solutions and engage with automotive manufacturers. These events serve as vital touchpoints for showcasing advancements in areas like fluid transfer systems and sealing solutions, fostering direct interaction with key decision-makers.

Participation in major automotive industry events, such as the Automotive Engineering Show or the IAA Mobility, enables Cooper-Standard to highlight its innovative products and technologies. For instance, in 2024, the company likely emphasized its contributions to lightweighting and emissions reduction, critical trends for OEMs. These gatherings are essential for building and strengthening relationships with both current and prospective Original Equipment Manufacturer (OEM) clients, providing a tangible platform to demonstrate new technologies and secure future business.

- Showcasing Innovation: Demonstrating new technologies in fluid transfer, sealing, and anti-vibration systems to automotive OEMs.

- Customer Engagement: Direct interaction with potential and existing clients to understand evolving needs and present tailored solutions.

- Market Intelligence: Gathering insights into industry trends, competitor activities, and emerging technologies.

- Brand Visibility: Enhancing Cooper-Standard's brand presence and reputation as a leading automotive supplier.

Online Presence and Investor Relations Portal

Cooper-Standard utilizes its online presence, including a dedicated investor relations portal, to bridge communication with a diverse stakeholder base. This digital hub is crucial for disseminating information about the company's product portfolio, technological advancements, and financial health, even though its primary operations are business-to-business.

This online channel acts as a vital conduit for transparency and accessibility, offering insights into Cooper-Standard's strategic direction and market positioning. For instance, as of the first quarter of 2024, the company reported revenue of $565.1 million, demonstrating tangible performance metrics readily available to investors and interested parties.

- Investor Relations Website: Provides access to financial reports, SEC filings, and investor presentations.

- Product Information: Showcases the company's innovative sealing, fuel and fluid delivery, and anti-vibration systems for automotive and commercial vehicles.

- Corporate Communications: Facilitates the sharing of press releases, sustainability reports, and corporate governance information.

- Financial Performance Data: Offers key financial highlights, such as revenue figures and profitability metrics, enabling informed analysis.

Cooper-Standard's channels are predominantly direct, focusing on building strong relationships with Original Equipment Manufacturers (OEMs). This direct approach is supported by a global manufacturing and logistics network ensuring efficient delivery. Specialized technical sales and engineering teams are critical for demonstrating product value and fostering collaboration.

Customer Segments

Cooper-Standard's primary customer base consists of major global automotive Original Equipment Manufacturers (OEMs). This includes industry giants like Ford, General Motors, Stellantis, Volkswagen Group, Mercedes-Benz, BMW, Hyundai, Toyota, Jaguar/Land Rover, and Rivian.

These OEMs rely on Cooper-Standard for a consistent supply of high-quality, innovative components essential for their vehicle manufacturing processes. The demand from these core customers directly influences Cooper-Standard's production volumes and revenue streams.

In 2024, the automotive industry continued to navigate supply chain complexities and evolving consumer preferences, making the reliability and innovation offered by suppliers like Cooper-Standard crucial for OEM success. For instance, the global light vehicle production forecast for 2024 indicated a significant recovery, with projections suggesting a substantial increase in output compared to previous years, directly benefiting suppliers to these major players.

Passenger car manufacturers represent a core customer segment for Cooper-Standard, with the company supplying a wide array of critical components. These include fluid carrying systems, anti-vibration systems, and sealing systems essential for the assembly of numerous passenger vehicle models globally.

These automotive giants, such as General Motors and Ford, rely on Cooper-Standard for innovative solutions that directly impact vehicle performance, occupant comfort, and overall safety. For instance, advanced sealing technologies contribute to reduced cabin noise and improved aerodynamics, while sophisticated fluid carrying systems ensure efficient operation of critical vehicle functions.

In 2024, the global passenger car market saw continued demand, with manufacturers prioritizing lightweight materials and advanced technologies to meet evolving consumer expectations and regulatory standards. Cooper-Standard's ability to deliver high-quality, cost-effective components that support these trends is paramount to maintaining strong relationships with these key clients.

Cooper Standard serves light truck and SUV manufacturers, a dynamic and expanding sector of the automotive market. These vehicles frequently demand specialized, durable sealing solutions and efficient fluid management components to meet performance and longevity expectations.

In 2024, the light truck and SUV market continued its strong performance, with sales in the US alone projected to remain robust, representing a significant portion of overall vehicle sales. This sustained demand underscores the critical need for suppliers like Cooper Standard to provide advanced, reliable components tailored to the unique structural and operational needs of these popular vehicle types.

Commercial Vehicle Manufacturers

Cooper Standard supplies critical sealing, fuel and brake delivery, and fluid transfer systems to commercial vehicle manufacturers, including those producing heavy-duty trucks and vans. These components must withstand extreme temperatures, vibrations, and constant use, demanding exceptional durability and reliability. For instance, in 2024, the global commercial vehicle market saw continued demand for robust solutions, with the heavy-duty truck segment alone accounting for a significant portion of global vehicle production.

- High Durability Requirements: Components must endure rigorous operating conditions, including heavy loads and extended mileage.

- Reliability is Paramount: Downtime in commercial fleets is costly, making component failure unacceptable.

- Regulatory Compliance: Products must meet stringent emissions and safety standards relevant to commercial transport.

- Customization Needs: Manufacturers often require tailored solutions for specific vehicle platforms and applications.

Electric Vehicle (EV) and Hybrid Vehicle Manufacturers

Electric Vehicle (EV) and Hybrid Vehicle Manufacturers represent a crucial and growing customer segment for Cooper-Standard. These companies have distinct needs, particularly for advanced thermal management solutions such as battery cooling systems, and components that contribute to vehicle lightweighting. Cooper-Standard is strategically investing in and developing these specialized product lines to meet the evolving demands of the electrified automotive market.

The global EV market is experiencing substantial growth. For instance, in 2023, global EV sales surpassed 13.6 million units, a significant increase from the previous year. This surge directly translates to an increased demand for the types of innovative components Cooper-Standard is developing, such as advanced battery thermal management solutions crucial for EV performance and longevity.

- Growing EV Market: Global EV sales reached approximately 13.6 million units in 2023, indicating a strong and expanding customer base for specialized automotive components.

- Demand for Lightweighting: To improve EV range and efficiency, manufacturers are prioritizing lightweight materials and designs, creating opportunities for Cooper-Standard's innovative material solutions.

- Battery Thermal Management: The critical need for effective battery cooling systems in EVs drives demand for Cooper-Standard's specialized product development in this area.

Cooper-Standard's customer base is primarily composed of major global automotive Original Equipment Manufacturers (OEMs), including giants like Ford, General Motors, and Stellantis. These OEMs depend on Cooper-Standard for essential, high-quality components that are critical to their vehicle production lines.

The company also serves the growing segments of electric vehicle (EV) and hybrid vehicle manufacturers, who require specialized solutions like advanced thermal management systems and lightweighting components. This diversification caters to the evolving demands of the automotive industry, as evidenced by the significant global EV sales growth, with over 13.6 million units sold in 2023.

Furthermore, Cooper-Standard supplies components to light truck, SUV, and commercial vehicle manufacturers. These sectors have specific needs for durable sealing, efficient fluid management, and reliable systems, especially given the robust performance of the light truck and SUV market and the demanding operational environment of commercial fleets.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Major OEMs (Ford, GM, Stellantis) | Consistent supply, high-quality, innovative components | Navigating supply chain complexities; strong demand for reliable suppliers. Global light vehicle production forecast for 2024 indicated a significant recovery. |

| EV & Hybrid Manufacturers | Advanced thermal management, lightweighting solutions | Substantial EV market growth; 2023 global EV sales surpassed 13.6 million units. |

| Light Truck & SUV Manufacturers | Durable sealing, efficient fluid management | Strong market performance; US sales projected to remain robust in 2024. |

| Commercial Vehicle Manufacturers | High durability, reliability, regulatory compliance | Continued demand for robust solutions; heavy-duty truck segment significant in global production. |

Cost Structure

Raw material expenses represent a substantial component of Cooper-Standard's cost structure. These costs are primarily driven by the procurement of essential polymers, rubbers, and metals, which are fundamental to the manufacturing of their sealing and fluid transfer systems.

In 2024, Cooper-Standard has been actively implementing strategies to counteract the effects of ongoing inflationary pressures on these critical raw material inputs, aiming to maintain cost competitiveness.

The cost structure for Cooper-Standard is heavily influenced by its extensive global footprint, encompassing 75 manufacturing facilities. Key expenses include labor, energy consumption across these sites, and general overhead, all contributing significantly to operational expenditure.

To counter these substantial manufacturing and production costs, Cooper-Standard actively pursues operational efficiencies. The company has strategically implemented lean manufacturing principles and ongoing cost optimization programs aimed at driving savings and improving overall financial performance.

Cooper-Standard's investment in research and development is a significant component of its cost structure. These expenditures are strategically allocated towards developing innovative solutions and advancing technologies, with a particular focus on the evolving electric vehicle (EV) market. This commitment to R&D is vital for the company to stay ahead in a competitive landscape and drive future growth.

For instance, in 2023, Cooper-Standard reported R&D expenses of $75.9 million. This investment underscores their dedication to creating next-generation products and enhancing their technological capabilities, directly impacting their operational costs.

Selling, General, Administrative, and Engineering (SGA&E) Expenses

Cooper-Standard's Selling, General, Administrative, and Engineering (SGA&E) expenses encompass a broad range of operational costs crucial for business function and growth. These include the compensation for administrative personnel, investment in sales and marketing initiatives to reach customers, and the significant overhead associated with engineering and product development.

The company has actively pursued strategies to optimize these costs, aiming to enhance overall profitability. This focus on streamlining processes and achieving greater efficiency within SGA&E is a key element of their business strategy.

- Salaries and Benefits: Compensation for administrative, sales, marketing, and engineering teams.

- Marketing and Sales: Costs related to advertising, promotions, and sales force operations.

- Engineering Overhead: Expenses for research, development, and technical support functions.

- General & Administrative: Costs for legal, finance, human resources, and other corporate services.

Debt Service and Restructuring Costs

Cooper-Standard's significant debt load means that interest expenses are a substantial component of its cost structure. For instance, in the first quarter of 2024, the company reported interest expense of $30.3 million. This ongoing financial obligation directly impacts profitability.

The company also incurs costs related to restructuring efforts aimed at improving efficiency and reducing long-term expenses. These initiatives, while carrying upfront costs, are designed to streamline operations and ultimately lower the overall cost base. For example, restructuring charges can include expenses for facility consolidations or workforce adjustments.

- Interest Expense: In Q1 2024, Cooper-Standard's interest expense was $30.3 million, reflecting the cost of servicing its debt.

- Restructuring Costs: Costs associated with operational restructuring are incurred to achieve future cost savings and enhance efficiency.

- Impact on Profitability: Both debt service and restructuring expenses directly affect the company's net income and overall financial performance.

Cooper-Standard's cost structure is significantly shaped by its global manufacturing presence, with key expenses including labor, energy, and overhead across its 75 facilities. The company actively pursues operational efficiencies through lean manufacturing and cost optimization programs to mitigate these substantial production costs.

Research and development is a notable expense, with a 2023 R&D spend of $75.9 million, reflecting investment in new technologies, particularly for the electric vehicle market. Selling, General, Administrative, and Engineering (SGA&E) costs, covering personnel, marketing, and technical support, are also managed through optimization strategies.

Financial obligations, such as the $30.3 million in interest expense reported in Q1 2024, represent a significant cost. Additionally, restructuring charges are incurred to streamline operations and reduce long-term expenses, impacting immediate profitability but aiming for future savings.

| Cost Category | Description | 2023/2024 Data Point |

|---|---|---|

| Raw Materials | Polymers, rubbers, metals for sealing and fluid transfer systems | Ongoing inflationary pressures in 2024 |

| Manufacturing & Operations | Labor, energy, overhead across 75 facilities | Lean manufacturing and cost optimization programs active |

| Research & Development | Innovation and EV market technology advancement | $75.9 million in 2023 |

| SGA&E | Salaries, marketing, engineering overhead, G&A | Focus on cost optimization and efficiency |

| Financial Costs | Interest on debt, restructuring charges | $30.3 million interest expense in Q1 2024 |

Revenue Streams

Cooper-Standard generates significant revenue from selling sealing and trim systems. This core business involves providing dynamic and static seals, encapsulated glass solutions, and a variety of trim components crucial for vehicle assembly.

In 2024, the automotive industry saw continued demand for these essential components. Cooper-Standard's sales in this segment reflect the ongoing need for advanced sealing technology to enhance vehicle performance, comfort, and aesthetics, contributing substantially to their overall financial performance.

Cooper-Standard generates substantial revenue from selling fuel and brake delivery systems and their components to automakers. These systems are critical for a vehicle's performance and safety, making them a consistent demand driver.

In 2024, the automotive industry saw a strong rebound in production, with global light vehicle production expected to reach around 92 million units. This increased output directly translates to higher demand for Cooper-Standard's essential components, bolstering this revenue stream.

Cooper Standard generates significant revenue from its fluid transfer systems, a vital component in modern vehicles. These systems are engineered to efficiently manage a variety of fluids, including fuel, coolant, and brake fluid, ensuring optimal vehicle performance and safety.

In 2024, the automotive industry saw continued demand for advanced fluid management solutions. Cooper Standard’s fluid transfer systems, known for their durability and innovative design, contributed substantially to the company's overall sales, reflecting the critical role these products play in vehicle manufacturing.

New Business Awards and Program Launches

Revenue expansion at Cooper Standard is significantly fueled by winning new business contracts and initiating new product programs. This growth is particularly robust with both established and new Original Equipment Manufacturer (OEM) clients, especially those focusing on electric and hybrid vehicle technology.

The company's performance in 2024 highlights this trend. Cooper Standard secured a substantial $181.4 million in net new business awards for the full year. A significant portion of this, $105.8 million, was directly attributable to electric vehicle (EV) platforms, underscoring the strategic importance of this market segment.

- New Business Awards: Securing new contracts with OEMs is a primary revenue driver.

- Program Launches: Introducing new programs, especially for EV and hybrid platforms, boosts revenue.

- 2024 Performance: The company achieved $181.4 million in net new business awards in 2024.

- EV Focus: A notable $105.8 million of these awards came from electric vehicle platforms.

Aftermarket Sales and Industrial & Specialty Group (ISG)

Cooper-Standard, while a major supplier to original equipment manufacturers (OEMs), diversifies its income through aftermarket sales. This segment caters to the need for replacement parts in vehicles already in use, providing a steady revenue stream independent of new vehicle production cycles.

Furthermore, the company's Industrial & Specialty Group (ISG) is a key revenue generator. ISG applies Cooper-Standard's core competencies in material science and manufacturing to a wide array of industrial and specialty markets, extending beyond the automotive sector. This strategic move broadens the company's market reach and revenue base, mitigating risks associated with over-reliance on a single industry.

- Aftermarket Sales: Cooper-Standard's aftermarket business provides replacement parts for vehicles, contributing to revenue stability.

- Industrial & Specialty Group (ISG): This segment leverages core expertise in non-automotive sectors, diversifying revenue.

- Diversification Strategy: The combination of aftermarket and ISG sales broadens Cooper-Standard's revenue streams, enhancing financial resilience.

Cooper-Standard's revenue streams are robust, encompassing core automotive components like sealing and trim systems, as well as fuel and brake delivery systems. The company also generates income from fluid transfer systems, crucial for vehicle operation.

A significant driver of revenue growth is the acquisition of new business awards and the launch of new product programs, particularly those targeting electric and hybrid vehicles. In 2024, Cooper-Standard secured $181.4 million in net new business, with a substantial $105.8 million specifically from EV platforms.

Diversification plays a key role, with aftermarket sales providing a stable income independent of new vehicle production. Additionally, the Industrial & Specialty Group (ISG) extends Cooper-Standard's expertise into non-automotive sectors, broadening its revenue base.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Sealing and Trim Systems | Essential components for vehicle assembly, enhancing performance, comfort, and aesthetics. | Continued demand in a recovering automotive market. |

| Fuel and Brake Delivery Systems | Critical systems for vehicle performance and safety. | Bolstered by increased global light vehicle production, projected around 92 million units in 2024. |

| Fluid Transfer Systems | Advanced solutions for managing vehicle fluids efficiently. | Demand driven by the need for durable and innovative fluid management in vehicles. |

| New Business Awards & Program Launches | Contracts with OEMs, especially for EV/hybrid platforms. | $181.4 million in net new business awards in 2024, with $105.8 million from EV platforms. |

| Aftermarket Sales | Replacement parts for vehicles in use. | Provides revenue stability independent of new vehicle production cycles. |

| Industrial & Specialty Group (ISG) | Application of core competencies to non-automotive markets. | Broadens market reach and diversifies revenue base. |

Business Model Canvas Data Sources

The Cooper-Standard Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and competitive landscape analyses. These diverse data sources ensure a comprehensive understanding of our operations and market position.