Cooper Companies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper Companies Bundle

The Cooper Companies demonstrates robust strengths in its diversified healthcare portfolio, particularly in contact lenses and medical devices, positioning it for continued growth. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for navigating future opportunities.

Want the full story behind Cooper Companies' market position, potential threats, and strategic advantages? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Cooper Companies boasts a robust business model anchored by two distinct yet complementary segments: CooperVision, a dominant force in the contact lens market, and CooperSurgical, a rapidly growing contributor in women's health and fertility. This strategic diversification shields the company from the volatility of any single industry, fostering a more resilient revenue stream.

The company’s extensive global footprint is a significant strength, with products available in over 130 countries. This wide reach not only diversifies revenue geographically but also positions Cooper Companies to capitalize on growth opportunities across various international markets. For example, CooperVision's commitment to innovation, including its silicone hydrogel lens technology, has solidified its market leadership.

CooperCompanies has showcased impressive financial strength, achieving record consolidated revenues in fiscal year 2024. The company is projecting continued positive growth for fiscal year 2025, underscoring a robust trajectory.

In the second quarter of fiscal year 2025, CooperCompanies reported a significant 6% year-over-year revenue increase, surpassing the $1 billion mark. This growth was largely fueled by double-digit expansion in its key product lines.

The company's strong financial performance extends to its profitability, with notable improvements in gross margins and non-GAAP diluted earnings per share. These results highlight effective operational management and a solid financial foundation.

Cooper Companies boasts market leadership in crucial segments, notably within the contact lens industry. CooperVision commands a substantial share, especially in the United States, and is at the forefront of daily silicone hydrogel lenses and myopia management with its innovative MiSight product.

Furthermore, CooperSurgical has secured a robust position in women's healthcare and fertility markets, including a significant presence in the IUD sector. This market dominance is a direct result of sustained innovation and a strategic emphasis on developing high-value, differentiated products.

Commitment to Innovation and Product Development

The Cooper Companies demonstrates a strong commitment to innovation, consistently channeling significant investment into research and development. This dedication is evident in their launch of advanced products, including cutting-edge silicone hydrogel contact lenses and specialized solutions for fertility treatments. For instance, in fiscal year 2023, CooperCompanies reported approximately $325 million in R&D expenses, a testament to their forward-looking strategy.

Their strategic focus on high-value, differentiated products is a key driver of market share expansion. A prime example is the FDA-approved MiSight contact lenses, designed to manage myopia progression in children, addressing a growing global health concern. This product alone contributed significantly to their contact lens division's growth in 2024.

Furthermore, CooperCompanies actively pursues strategic acquisitions to broaden its product offerings and technological capabilities. The acquisition of obp Surgical in early 2024, for example, integrated innovative medical devices into their portfolio, enhancing their presence in specialized surgical markets and reinforcing their commitment to innovation.

- R&D Investment: Approximately $325 million in fiscal year 2023.

- Key Innovations: Advanced silicone hydrogel lenses and fertility solutions.

- Market Focus: High-value products like MiSight for myopia management.

- Strategic Growth: Acquisitions such as obp Surgical to expand medical device portfolio.

Robust Supply Chain and Operational Efficiency

Cooper Companies demonstrates a robust supply chain and impressive operational efficiency. This is evident in their strong execution, leading to improved gross and operating margins through efficiency gains and strategic expense management. For instance, in fiscal year 2023, Cooper Companies reported a 9% increase in revenue, partly driven by strong product demand and operational improvements.

Further strengthening their operational capabilities, CooperVision is actively expanding production capacity for high-demand products. A key example is the increased output for their MyDay daily disposable lenses, a strategic move to meet escalating market demand and capitalize on growth opportunities. This proactive approach ensures they can reliably supply their customers and maintain market share.

- Strong Operational Execution: Efficiency gains and targeted expense leverage have bolstered gross and operating margins.

- Capacity Expansion: CooperVision is increasing production for popular items like MyDay lenses to meet demand.

- Market Responsiveness: Focus on operational excellence and capacity ensures they can effectively serve growing markets.

Cooper Companies possesses a strong market position in both contact lenses and women's health. CooperVision is a leader, particularly in silicone hydrogel daily disposables and myopia management with MiSight. CooperSurgical has a significant presence in the IUD market and other women's health segments, demonstrating consistent innovation and strategic product development.

The company's financial performance is a key strength, with consistent revenue growth. For fiscal year 2024, consolidated revenues reached $3.2 billion, a 9% increase year-over-year. This upward trend is projected to continue into fiscal year 2025, with the company anticipating further revenue growth driven by strong product demand and market expansion.

Cooper Companies' commitment to research and development fuels its innovation pipeline. In fiscal year 2023, R&D expenses were approximately $325 million, supporting the development of advanced products like the MiSight lenses. This investment ensures a steady stream of high-value, differentiated offerings that cater to evolving market needs.

| Segment | Key Products | Fiscal Year 2024 Revenue (Approx.) | Growth Drivers |

|---|---|---|---|

| CooperVision | Daily Silicone Hydrogel Lenses, MiSight (Myopia Management) | $2.2 billion | Product innovation, market penetration |

| CooperSurgical | IUDs, Fertility Solutions, Surgical Devices | $1.0 billion | Market leadership, strategic acquisitions |

What is included in the product

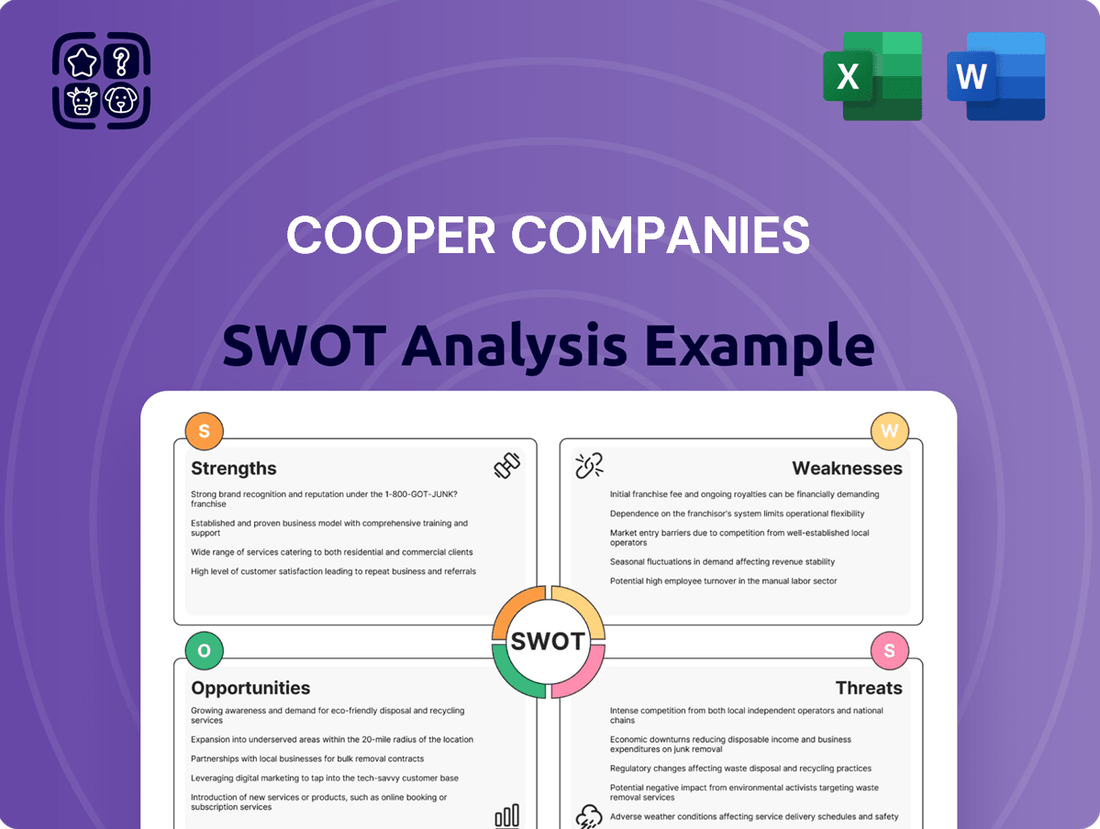

Delivers a strategic overview of Cooper Companies’s internal and external business factors, highlighting its strengths in specialized medical devices and opportunities in market expansion, while also addressing weaknesses in product diversification and threats from competition and regulatory changes.

Provides a clear, actionable framework for identifying and leveraging Cooper Companies' competitive advantages while mitigating weaknesses and threats.

Weaknesses

CooperCompanies' significant reliance on specific product categories, such as daily silicone hydrogel lenses and myopia management solutions through MiSight, presents a notable weakness. While these areas are driving growth, a concentrated focus means that any shifts in consumer preference or disruptive innovations from competitors could disproportionately impact overall performance. For example, the projected strong growth of MiSight, a key driver for CooperVision, highlights the potential vulnerability if market adoption falters.

Cooper Companies experiences geographic performance disparities, with notably slower sales growth observed in the EMEA and APAC regions. This is particularly evident in markets like China, where penetration and sales have not met expectations.

These regional weaknesses, potentially stemming from company-specific execution challenges or intense local competition, could impede Cooper's ability to fully capitalize on its global footprint. For instance, while the company aims for broad international expansion, these specific underperforming areas can drag down overall global revenue growth figures.

Cooper Companies has a history of growth through acquisitions, including recent deals like obp Surgical and Cook Medical's reproductive health assets. These integrations, while strategic, carry inherent risks. Successfully merging new operations, aligning company cultures, and managing unexpected expenses can be complex, potentially affecting immediate financial results.

Competitive Market Landscape

The medical device sector, particularly in vision care and women's health, is intensely competitive. CooperCompanies faces numerous established competitors and emerging players, which can lead to pricing pressures and a struggle for market share. For instance, the contact lens market, a key area for CooperVision, sees significant competition from giants like Johnson & Johnson Vision and Alcon, who consistently invest in R&D and marketing. In 2023, the global medical device market was valued at over $500 billion, highlighting the sheer scale of competition.

Competitors' rapid technological advancements and aggressive marketing campaigns pose a direct threat to CooperCompanies' market position. Companies that introduce innovative products or execute highly effective promotional strategies can quickly gain an advantage. This dynamic necessitates continuous investment in product development and marketing to maintain relevance and capture consumer attention. The pressure to innovate is constant, as seen with the ongoing advancements in multifocal and toric contact lens technology from various market participants.

- Intense Competition: The vision care and women's health markets are crowded with both large, established firms and agile new entrants.

- Pricing Pressure: High competition often forces companies to lower prices, potentially impacting profit margins for CooperCompanies.

- Market Share Erosion: Competitors' superior technology or more effective marketing can lead to a loss of market share.

- Innovation Race: The need to keep pace with competitors' product development and technological breakthroughs requires significant ongoing investment.

Currency Fluctuations and Macroeconomic Uncertainties

Cooper Companies operates globally, making it susceptible to currency exchange rate volatility. For instance, in Q1 2024, the company reported that foreign currency headwinds negatively impacted its revenue by approximately 1% compared to the prior year, highlighting a tangible effect on its financial performance.

Macroeconomic uncertainties also pose a risk, potentially dampening demand for Cooper's products. A slowdown in elective medical procedures or a shift in consumer spending towards less premium contact lens options could directly affect sales. Analysts in early 2024 projected a potential 0.5% to 1.5% contraction in the global elective medical procedures market due to rising inflation, which could impact Cooper's vision care segment.

- Currency Volatility: Foreign exchange rate fluctuations can directly reduce reported revenues and profits due to international sales.

- Macroeconomic Risks: Economic downturns or changes in consumer spending habits can decrease demand for non-essential medical products and premium contact lenses.

- Impact on Demand: Reduced consumer confidence or disposable income can lead to fewer elective procedures and a move towards less premium product offerings.

Cooper Companies faces significant challenges due to its concentrated product portfolio, particularly its reliance on daily silicone hydrogel lenses and myopia management solutions like MiSight. This focus, while currently a growth driver, leaves the company vulnerable to shifts in consumer preferences or competitive innovations. For example, the substantial projected growth of MiSight underscores the potential impact if market adoption does not meet expectations.

Geographic performance variations present another weakness, with slower sales growth observed in the EMEA and APAC regions, notably in markets like China where penetration has lagged. These regional underperformances, potentially due to execution issues or strong local competition, can hinder Cooper's ability to leverage its global presence effectively and dampen overall revenue growth.

The company's strategy of growth through acquisitions, while beneficial, introduces inherent integration risks. Successfully merging new operations, aligning corporate cultures, and managing unforeseen costs associated with deals like obp Surgical and Cook Medical's reproductive health assets can be complex and impact short-term financial results.

Cooper Companies operates in highly competitive markets, facing pressure from established players and agile newcomers in vision care and women's health. This intense competition, exemplified by the contact lens market where giants like Johnson & Johnson Vision and Alcon invest heavily in R&D and marketing, can lead to pricing pressures and potential market share erosion. The global medical device market, valued at over $500 billion in 2023, underscores the competitive landscape.

| Weakness | Description | Impact |

| Product Concentration | Heavy reliance on daily silicone hydrogel lenses and MiSight. | Vulnerability to market shifts and competitive threats. |

| Geographic Disparities | Slower growth in EMEA and APAC, particularly China. | Hinders global revenue growth and market penetration. |

| Acquisition Integration Risks | Challenges in merging acquired companies and cultures. | Potential for unexpected costs and short-term financial impact. |

| Intense Market Competition | Crowded vision care and women's health sectors. | Pricing pressures, market share erosion, and need for continuous R&D investment. |

Preview the Actual Deliverable

Cooper Companies SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global surge in myopia presents a substantial opportunity, with projections indicating that half the world's population could be myopic by 2050. CooperVision's MiSight, uniquely recognized by the FDA for its ability to manage myopia progression in children, is perfectly positioned to benefit from this expanding market.

The company anticipates robust growth, targeting a 40% increase in MiSight sales for fiscal year 2025, bolstered by enhanced sales resources and strategic market adjustments.

The global market for daily disposable contact lenses is experiencing robust growth, fueled by consumer demand for enhanced convenience and superior hygiene. This trend is a significant opportunity for CooperCompanies.

CooperVision's leading brands, including MyDay and clariti, are silicone hydrogel daily disposables, perfectly aligning with this market shift. In 2023, CooperVision reported a strong performance in its Vision Care segment, with net sales increasing by 7% to $2.2 billion, partly driven by the continued success of its daily disposable lens portfolio.

This ongoing trade-up to daily disposables presents a clear path for CooperCompanies to capture increased revenue and expand its market share within the lucrative contact lens industry.

The global women's health market is experiencing robust growth, with the fertility solutions segment showing particularly strong momentum. Factors like later age at first childbirth and heightened awareness of reproductive health are fueling this demand. For instance, the global fertility services market was valued at approximately $12.5 billion in 2023 and is projected to reach over $20 billion by 2030, indicating substantial room for expansion.

CooperSurgical is well-positioned to capitalize on these trends with its diverse offerings, which include fertility products, advanced medical devices, and genetic testing services. This comprehensive portfolio allows CooperCompanies to address multiple facets of women's reproductive well-being. Strategic initiatives, such as introducing innovative new products and pursuing targeted acquisitions within this dynamic market, represent key avenues for further growth and market share enhancement.

Strategic Acquisitions and Partnerships

Cooper Companies has a strong track record of growth through strategic acquisitions. For instance, their acquisition of Safefit in 2022 significantly bolstered their contact lens portfolio. This historical success highlights an opportunity to continue identifying and integrating complementary businesses, especially in burgeoning segments of vision care and women's health, to further accelerate expansion and solidify market leadership.

Further leveraging partnerships is key. Collaborations with clinicians, practitioners, and researchers can drive innovation and ensure Cooper Companies remains relevant in evolving healthcare landscapes. For example, ongoing research initiatives in myopia management, a growing area in vision care, demonstrate the value of such relationships. These alliances can lead to the development of next-generation products and services, enhancing the company's competitive edge.

- Acquisition of Safefit in 2022: Expanded contact lens offerings, demonstrating a pattern of successful integration.

- Focus on Emerging Areas: Opportunities exist in high-growth segments like myopia management within vision care and advancements in women's health technologies.

- Clinical and Research Partnerships: Foster innovation and market relevance by collaborating with healthcare professionals and research institutions.

Leveraging Sustainability Initiatives for Brand Enhancement

CooperCompanies' dedication to sustainability offers a significant chance to bolster its brand image. The company's 2024 Sustainability Report details efforts that resonate with consumers and investors increasingly focused on environmental, social, and governance (ESG) factors. This commitment can translate into a stronger market position.

By highlighting specific initiatives, CooperCompanies can attract a wider audience. These include concrete actions like reducing plastic waste, a key concern for many consumers, and increasing the use of renewable energy sources. Such visible efforts can set the company apart from competitors.

The focus on employee development also contributes to brand enhancement. A company that invests in its people often demonstrates a more robust and ethical operational framework. This can lead to improved employee morale and retention, indirectly benefiting the brand's reputation.

- Brand Reputation: CooperCompanies' sustainability efforts, as outlined in its 2024 report, provide a clear avenue for enhancing its brand's appeal to environmentally and socially conscious stakeholders.

- Market Differentiation: Initiatives such as reducing plastic usage and increasing renewable energy adoption can distinguish CooperCompanies in a competitive marketplace.

- Investor Appeal: A strong ESG profile, supported by tangible sustainability progress, is increasingly attractive to investors seeking responsible and forward-thinking companies.

- Consumer Trust: Demonstrating a commitment to environmental stewardship and employee well-being can foster greater trust and loyalty among consumers.

The escalating global prevalence of myopia, with projections suggesting half the world's population could be affected by 2050, presents a significant growth avenue for CooperVision's myopia management solutions like MiSight.

The company's strategic focus on expanding its daily disposable contact lens portfolio, including brands like MyDay and clariti, aligns perfectly with the increasing consumer preference for convenience and hygiene in this rapidly growing market segment.

CooperCompanies is strategically positioned to capitalize on the expanding women's health market, particularly within the burgeoning fertility solutions sector, driven by demographic shifts and increased health awareness.

Continued growth through strategic acquisitions, mirroring past successes like the 2022 Safefit acquisition, offers a clear path to integrate complementary businesses and bolster market leadership in key vision care and women's health areas.

Strengthening partnerships with healthcare professionals and researchers will be crucial for driving innovation, ensuring market relevance, and developing next-generation products in areas like myopia management.

CooperCompanies' commitment to sustainability, as detailed in its 2024 report, offers a valuable opportunity to enhance brand reputation and appeal to an increasingly ESG-conscious consumer and investor base.

Threats

The medical device sector faces increasing regulatory oversight globally, with bodies like the FDA imposing strict rules. For CooperCompanies, this means adapting to evolving compliance landscapes, which can directly affect product development timelines and market entry strategies.

Changes in regulations, such as potential shifts in how Laboratory Developed Tests (LDTs) are managed or new approval pathways for medical products, present a significant challenge. These adjustments can lead to higher operational expenses and potentially delay the introduction of innovative solutions, impacting revenue streams.

The financial implications of non-compliance or regulatory delays are substantial. For instance, a recall due to unmet regulatory standards, as seen with other companies in the industry, can result in significant financial penalties and damage brand reputation, directly affecting CooperCompanies' market position.

Competitors are pushing the boundaries with new contact lens materials and vision correction alternatives like LASIK, directly challenging Cooper Companies' established market. For instance, advancements in refractive surgery continue to offer non-lens solutions. If Cooper Companies doesn't actively invest in and adapt to these emerging technologies, their market position could weaken.

Global supply chain vulnerabilities, exacerbated by geopolitical tensions and unexpected manufacturing issues, pose a significant threat to Cooper Companies' operations. These disruptions can impede the production and timely distribution of their diverse product portfolio, impacting revenue streams. For instance, the semiconductor shortage experienced in 2021-2022 affected various industries, and similar broad-reaching supply chain snags could arise again.

Despite ongoing capacity expansions, Cooper Companies has previously encountered limitations in meeting demand for high-growth products. This suggests that even with investments, future surges in demand or unforeseen production bottlenecks could constrain sales and hinder the company's ability to capitalize on market opportunities, potentially delaying new product rollouts or expansion plans.

Product Recalls and Litigation Risks

The medical device sector, including CooperCompanies, faces inherent risks from product recalls, often triggered by manufacturing flaws or safety issues. Such events can incur substantial financial penalties, erode brand trust, and potentially lead to costly legal battles, directly impacting revenue streams and shareholder sentiment.

For instance, in the broader medical device industry, recalls can be a significant drain. While specific CooperCompanies recall data for the most recent period isn't publicly detailed in a way that allows for precise financial impact calculation for this specific threat, the general trend shows that recalls can cost millions. In 2023, the FDA reported thousands of medical device recalls, underscoring the pervasive nature of this risk across the industry.

- Manufacturing Defects: Potential for flaws in production processes impacting product safety and efficacy.

- Safety Concerns: Adverse patient outcomes or unexpected side effects leading to regulatory scrutiny.

- Litigation Costs: Expenses associated with defending against lawsuits arising from product-related issues.

- Reputational Damage: Negative publicity impacting consumer and healthcare provider confidence.

Economic Downturn and Healthcare Spending Constraints

An economic downturn presents a significant threat by potentially curbing consumer spending on discretionary healthcare items, such as advanced contact lenses and fertility services, which are key revenue drivers for CooperCompanies. For instance, a slowdown in global GDP growth, which saw a projected 2.6% in 2024 according to the IMF, could directly impact the affordability of these products for a broader consumer base.

Furthermore, shifts in healthcare reimbursement policies or heightened pressure on providers to manage costs could negatively affect demand and pricing power for CooperCompanies' offerings. This is particularly relevant as many of their products are integrated into healthcare systems where cost-containment measures are increasingly prevalent.

- Economic Slowdown Impact: Reduced consumer disposable income can decrease demand for premium contact lens brands and elective fertility treatments.

- Healthcare Policy Changes: Alterations in insurance coverage or government healthcare spending could limit patient access or reimbursement for CooperCompanies' medical devices and services.

- Provider Cost Pressures: Hospitals and clinics facing budget constraints may seek lower-cost alternatives or delay purchasing new equipment, impacting sales cycles.

Intensifying competition, particularly from advancements in refractive surgery like LASIK, presents a direct challenge to CooperCompanies' contact lens market share. Furthermore, the company must navigate increasing global regulatory oversight, which can delay product launches and increase compliance costs.

Supply chain disruptions, a persistent risk highlighted by recent global events, could hinder production and distribution, impacting revenue. Economic downturns also pose a threat by reducing consumer spending on discretionary healthcare products and services offered by CooperCompanies.

The risk of product recalls due to manufacturing defects or safety concerns remains a significant concern, potentially leading to substantial financial penalties and reputational damage.

A table summarizing key threats and their potential impact:

| Threat Category | Specific Risk | Potential Impact |

|---|---|---|

| Competition | Advancements in refractive surgery (e.g., LASIK) | Loss of market share in contact lens segment |

| Regulatory Environment | Increased global oversight and evolving compliance rules | Delayed product launches, higher operational expenses |

| Supply Chain | Geopolitical tensions, manufacturing issues | Production delays, distribution disruptions, revenue impact |

| Economic Conditions | Consumer spending reduction on discretionary healthcare | Decreased demand for premium lenses and fertility services |

| Product Quality | Manufacturing defects, safety concerns | Recalls, litigation costs, reputational damage |

SWOT Analysis Data Sources

This SWOT analysis draws from a robust combination of financial statements, investor relations reports, and comprehensive market research. These sources provide a solid foundation for understanding Cooper Companies' operational performance and competitive landscape.