Cooper Companies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper Companies Bundle

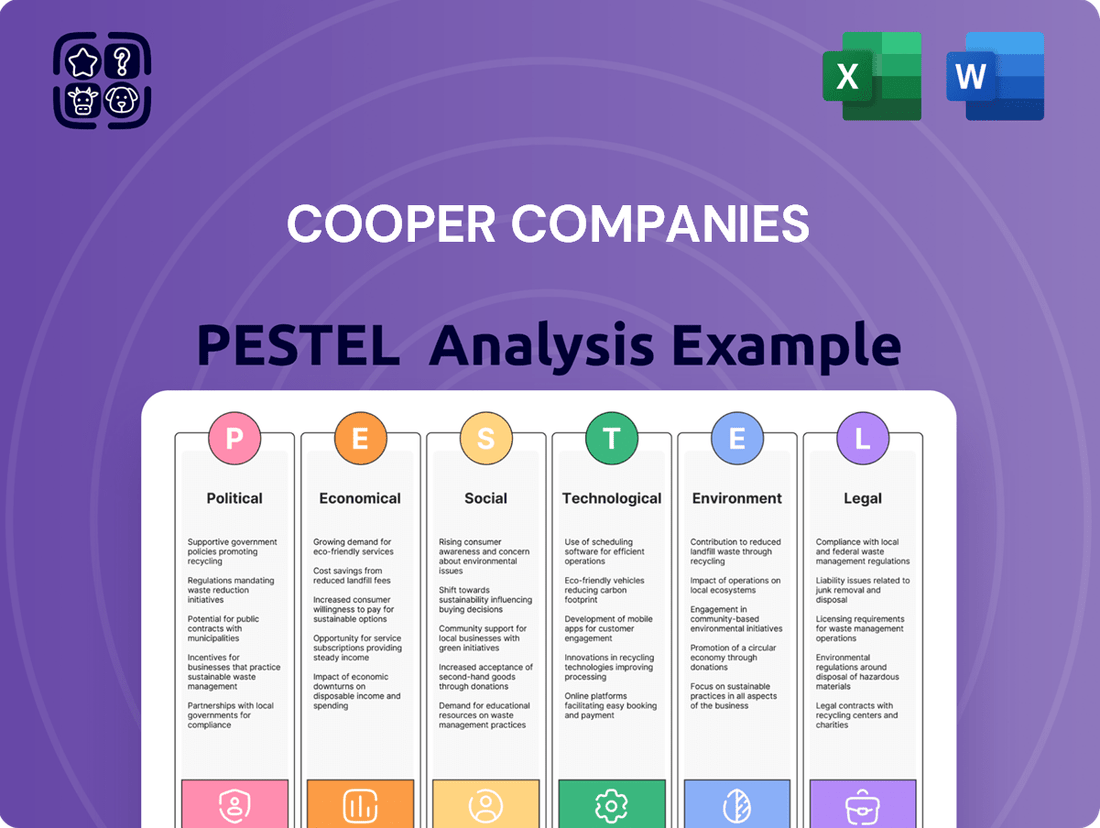

Navigate the complex external forces shaping Cooper Companies's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social demographics, environmental regulations, and legal frameworks are impacting their operations and future growth. Gain a critical edge by downloading the full analysis now to unlock actionable intelligence for your strategic planning.

Political factors

Government healthcare policies, particularly those concerning spending and reimbursement rates, are pivotal for Cooper Companies. For instance, in 2024, many developed nations continued to focus on cost containment within their healthcare systems, potentially impacting the pricing power of medical device manufacturers. Public health initiatives, such as those promoting early detection of diseases or expanding access to reproductive health services, directly shape the market landscape for Cooper's vision care and women's health products.

Changes in healthcare reform, like the potential for expanded insurance coverage in certain regions or a pivot towards value-based care models, could present significant opportunities for Cooper. Conversely, shifts in regulatory frameworks, such as stricter approval processes for medical devices in key markets like the EU or US, could introduce challenges to market entry and profitability for the company's offerings in 2024 and beyond.

Global trade relations significantly influence Cooper Companies' operations. For instance, the United States' trade deficit with China in goods was approximately $279.4 billion in 2023, impacting supply chain costs for many industries, including medical devices where Cooper operates. Changes in tariffs or the renegotiation of trade agreements, like those potentially affecting medical device components, directly alter the cost of goods sold and the competitiveness of Cooper's products internationally.

Geopolitical tensions can further complicate these trade dynamics. The ongoing conflict in Eastern Europe, for example, has led to increased energy prices and disruptions in shipping routes, affecting transportation costs for Cooper Companies' global distribution network. The company must navigate these shifting political landscapes, as protectionist policies in key markets could restrict market access or impose higher duties, impacting profitability and market share.

The political climate significantly influences the pace and rigor of regulatory approvals for medical devices. In the United States, the Food and Drug Administration (FDA) plays a crucial role, while Europe relies on the CE Mark. For instance, in 2024, the FDA continued to streamline certain pathways for innovative medical technologies, aiming to balance patient access with safety.

Delays or heightened complexity in securing these approvals can impede the market entry of new products from CooperCompanies' divisions like CooperVision and CooperSurgical. For example, a prolonged review period for a novel contact lens material could delay its global rollout.

Shifts in political priorities, whether advocating for quicker patient access to groundbreaking treatments or demanding more stringent safety protocols, can dynamically alter the regulatory environment. This responsiveness is critical for companies like CooperCompanies to adapt their product development and launch strategies effectively.

Political Stability in Key Markets

Political stability in key markets like the United States and Europe, where CooperCompanies generates significant revenue, is paramount. For instance, in 2023, the US accounted for a substantial portion of CooperCompanies' net sales, making its stable political climate vital for continued growth in both the Vision and Medical Device segments. Conversely, any political instability in major sourcing regions could impact the supply chain for raw materials used in contact lens manufacturing.

Shifts in government policy or unexpected unrest in these regions can directly affect business operations. For example, changes in healthcare regulations or trade policies could alter market access or increase operational costs. CooperCompanies' exposure to emerging markets also means monitoring political developments there, as these can influence consumer spending on elective medical products and fertility treatments.

The company's global footprint means it must navigate a diverse range of political landscapes. Political stability directly influences investor confidence and the willingness of consumers to invest in health and wellness products. In 2024, ongoing geopolitical tensions in certain regions could pose indirect risks, potentially affecting global economic sentiment and, by extension, demand for CooperCompanies' offerings.

- United States: As a primary market for CooperCompanies, political stability in the US is critical for consistent revenue generation.

- European Union: Political stability within the EU is important for CooperCompanies' Vision segment, particularly for contact lens sales.

- Supply Chain Risks: Political unrest in countries that supply raw materials for contact lens production could disrupt manufacturing.

- Emerging Markets: Political volatility in developing economies can impact consumer purchasing power for fertility solutions and vision care.

Government Funding for Health Research

Government funding for health research, especially in ophthalmology and reproductive health, directly impacts Cooper Companies' innovation pipeline. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $47.4 billion in fiscal year 2024, with a significant portion dedicated to biomedical research that could yield advancements relevant to Cooper's product development. Increased public investment fosters scientific breakthroughs, creating opportunities for Cooper to license new technologies or form strategic partnerships, thereby enhancing its competitive edge in these specialized markets.

Conversely, shifts in government budgetary priorities can pose challenges. A reduction in funding for key research areas could decelerate the pace of innovation, potentially limiting Cooper's access to cutting-edge discoveries. For example, if federal budgets tighten in 2025, research grants in areas like advanced lens materials or novel drug delivery systems for ocular conditions might decrease, indirectly slowing the development of next-generation products for Cooper.

- Increased NIH funding in FY2024: Approximately $47.4 billion, supporting a broad range of biomedical research.

- Ophthalmology and reproductive health focus: Government R&D spending in these areas can spur innovation directly beneficial to Cooper Companies.

- Leveraging breakthroughs: Publicly funded research can provide Cooper with new technologies for product development and partnerships.

- Funding reductions impact: Decreased government investment may slow scientific progress, potentially hindering Cooper's access to new advancements.

Government healthcare policies, particularly concerning spending and reimbursement, are crucial for Cooper Companies. In 2024, many nations focused on cost containment, potentially impacting medical device pricing. Public health initiatives, like disease detection programs, directly influence the markets for Cooper's vision care and women's health products.

Regulatory landscapes are also shaped by political decisions. For instance, in 2024, the FDA continued efforts to streamline approvals for innovative medical technologies, balancing patient access with safety. However, stricter approval processes in regions like the EU could present challenges for new product introductions.

Geopolitical stability in key markets like the US and Europe is vital, as these regions contribute significantly to Cooper's revenue. Political unrest or shifts in trade policies in sourcing regions can disrupt supply chains for essential materials, impacting manufacturing and costs.

| Political Factor | Impact on Cooper Companies | 2024/2025 Relevance |

| Healthcare Policy Changes | Affects reimbursement rates and market access for medical devices and vision care products. | Continued focus on cost containment in developed nations may pressure pricing. |

| Regulatory Approvals | Influences the speed and success of new product launches. | Streamlining efforts by agencies like the FDA aim to accelerate innovation, but stricter EU regulations could pose hurdles. |

| Geopolitical Stability | Impacts supply chain reliability and consumer spending in key markets. | Political stability in the US and EU is critical for revenue, while unrest in sourcing regions can disrupt operations. |

| Trade Relations & Tariffs | Affects the cost of goods sold and international competitiveness. | Changes in trade agreements or tariffs can alter supply chain costs for components. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting The Cooper Companies, covering political, economic, social, technological, environmental, and legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and potential challenges relevant to Cooper's global operations.

A clear, actionable PESTLE analysis for The Cooper Companies, presented in a digestible format, alleviates the pain of information overload and facilitates strategic decision-making.

Economic factors

Global economic growth trends significantly influence consumer spending on Cooper Companies' products. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady pace that supports disposable income. This directly affects demand for premium contact lenses and elective fertility treatments, as consumers with more financial flexibility are more likely to purchase non-essential healthcare items.

Conversely, economic slowdowns can lead consumers to prioritize essential vision correction and potentially postpone fertility procedures. For instance, if global growth falters in 2025, as some analysts predict a slight deceleration, discretionary spending on items like advanced contact lens designs might decrease, favoring more basic alternatives.

Robust economic expansion, however, presents a favorable environment for CooperCompanies. Stronger economies typically translate to higher consumer confidence and increased spending power, driving demand for both CooperVision's advanced contact lenses and CooperSurgical's fertility and genomic solutions. This was evident in Q1 2024, where CooperCompanies reported a 6% increase in revenue, partly attributed to resilient consumer spending in key markets.

Global healthcare spending is on an upward trajectory, with projections indicating a continued rise. For instance, the World Health Organization (WHO) reported that global health spending reached $8.3 trillion in 2021, a significant increase driven by pandemic-related expenditures but also by underlying demographic and technological trends. This sustained growth in national healthcare expenditures, encompassing both public and private outlays, directly influences the market size for medical devices.

Rising healthcare costs can indeed create pricing pressures for medical device manufacturers like Cooper Companies. However, this is often counterbalanced by increased investment in healthcare infrastructure and expanded access to care, which in turn broadens the market. In the United States, for example, healthcare spending as a percentage of GDP was around 17.3% in 2023, a figure that has remained relatively stable but represents a substantial market for medical products.

Cooper Companies is well-positioned to benefit from these trends, particularly within its specialized niches such as contact lenses and surgical products. The ongoing demand for vision correction and advancements in surgical technologies fuel consistent growth in these segments. For example, the global contact lens market alone was valued at approximately $10.8 billion in 2023 and is expected to grow substantially in the coming years, underscoring the positive impact of sustained healthcare spending on Cooper's core business.

High inflation in 2024 and projected into 2025 directly impacts Cooper Companies by escalating the costs of essential raw materials, manufacturing processes, and labor. This cost pressure can significantly squeeze profit margins if not effectively managed through pricing strategies or operational efficiencies. For instance, the US Consumer Price Index (CPI) saw a notable increase in late 2023 and early 2024, indicating persistent inflationary pressures across various sectors.

Furthermore, the anticipated trajectory of interest rates in 2024 and 2025 presents a challenge for Cooper Companies' growth initiatives. As central banks continue to manage inflation, borrowing costs for capital expenditures, such as new facility construction or technological upgrades, and strategic acquisitions are likely to remain elevated. Higher interest rates increase the expense of debt financing, potentially making expansion plans more costly and requiring a more rigorous return on investment analysis.

Currency Exchange Rate Fluctuations

Cooper Companies operates globally, making it susceptible to currency exchange rate shifts. A robust US dollar can diminish the value of earnings from overseas operations when converted back to dollars. Conversely, a weaker dollar can boost these reported revenues.

For instance, in fiscal year 2023, Cooper Companies reported that foreign currency translation had a negative impact on net sales growth. This highlights the ongoing challenge of managing currency volatility to ensure consistent financial results across its diverse international markets.

- Impact on Revenue: A stronger USD can reduce reported foreign earnings.

- Impact on Costs: Conversely, a weaker USD can increase the cost of imported goods or components.

- Hedging Strategies: Cooper Companies likely employs financial instruments to mitigate currency risks.

- FY23 Performance: Foreign currency translation negatively affected net sales growth in fiscal year 2023.

Competitive Landscape and Pricing Pressure

The economic climate, characterized by persistent inflation and potential shifts in consumer spending, directly impacts the medical device and contact lens sectors. This environment, combined with a highly competitive market, often translates into significant pricing pressure for companies like CooperCompanies.

Competitors frequently leverage lower price points or aggressive marketing tactics, which can quickly chip away at market share and affect profit margins. For instance, in the contact lens market, private label brands and direct-to-consumer (DTC) offerings have intensified competition, forcing established players to carefully manage their pricing strategies.

CooperCompanies' ability to navigate this landscape hinges on its commitment to innovation and clearly communicating the value proposition of its products. This includes investing in research and development to introduce differentiated offerings and focusing on customer retention through superior product performance and service.

Key competitive pressures observed in 2024 and projected into 2025 include:

- Intensified competition from private label and DTC contact lens brands.

- Economic sensitivity leading to increased consumer price consciousness.

- The need for continuous product innovation to justify premium pricing.

- Aggressive promotional activities by rivals impacting market share.

Global economic growth trends significantly influence consumer spending on Cooper Companies' products. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady pace that supports disposable income, directly affecting demand for premium contact lenses and elective fertility treatments.

Conversely, economic slowdowns can lead consumers to prioritize essential vision correction and potentially postpone fertility procedures. For instance, if global growth falters in 2025, as some analysts predict a slight deceleration, discretionary spending on items like advanced contact lens designs might decrease, favoring more basic alternatives.

High inflation in 2024 and projected into 2025 directly impacts Cooper Companies by escalating the costs of essential raw materials, manufacturing processes, and labor, potentially squeezing profit margins. Furthermore, anticipated shifts in interest rates may increase borrowing costs for capital expenditures and strategic acquisitions, making expansion plans more costly.

Cooper Companies operates globally, making it susceptible to currency exchange rate shifts, with a robust US dollar potentially diminishing the value of overseas earnings. For instance, in fiscal year 2023, Cooper Companies reported that foreign currency translation had a negative impact on net sales growth, highlighting the ongoing challenge of managing currency volatility.

| Economic Factor | 2024/2025 Projection/Data | Impact on Cooper Companies |

|---|---|---|

| Global GDP Growth | IMF projected 3.2% for 2024; slight deceleration anticipated for 2025. | Supports disposable income for premium products; slowdown may reduce demand for non-essentials. |

| Inflation | Persistent high inflation in 2024, continuing into 2025. | Increases raw material, manufacturing, and labor costs; potential margin squeeze. |

| Interest Rates | Expected to remain elevated as central banks manage inflation. | Higher borrowing costs for expansion, new facilities, and acquisitions. |

| Currency Exchange Rates | Volatile, with a strong USD impacting reported foreign earnings. | Negative impact on net sales growth from foreign operations (e.g., FY23). |

What You See Is What You Get

Cooper Companies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Cooper Companies delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping The Cooper Companies' market landscape, enabling informed decision-making and risk mitigation.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a robust framework for analyzing the macro-environmental influences critical to The Cooper Companies' continued success and growth in the global healthcare sector.

Sociological factors

The increasing global aging population is a significant sociological trend. This demographic shift directly fuels demand for vision correction products, such as the multifocal and presbyopia-correcting contact lenses that CooperVision specializes in. By 2050, the United Nations projects that the number of people aged 65 and over will reach 1.6 billion, a substantial increase from approximately 703 million in 2019, highlighting a robust long-term growth driver for CooperCompanies.

Modern lifestyles, characterized by extended screen time and a resurgence in outdoor activities, directly impact vision health and, consequently, the demand for corrective solutions like contact lenses. For instance, a 2024 report indicated that over 60% of adults spend more than 6 hours daily looking at digital screens, a trend that has accelerated the need for specialized contact lens designs offering enhanced comfort and blue light filtration.

Heightened consumer awareness regarding vision care and reproductive health is a significant driver for Cooper Companies. By 2025, surveys suggest that over 75% of consumers are proactively seeking information about preventative eye care and advanced reproductive health solutions, creating a robust market for Cooper's specialized offerings in these areas.

Cooper Companies is well-positioned to leverage these evolving consumer needs. By developing and marketing products that address increased screen-related eye strain and promote proactive health management, such as innovative contact lens materials and advanced diagnostic tools for reproductive health, the company can effectively tap into this growing health-conscious market.

Societal attitudes toward family planning and fertility are undergoing significant shifts, with a growing emphasis on individual choice and well-being. This evolution is directly impacting the demand for reproductive health solutions. For instance, the global fertility services market was valued at approximately $14.5 billion in 2023 and is projected to reach over $30 billion by 2030, demonstrating a robust growth trajectory.

The increasing acceptance and accessibility of assisted reproductive technologies (ART) are key drivers for companies like CooperSurgical. As more individuals and couples explore options like IVF and egg freezing, the market for related diagnostic and therapeutic products expands. A 2024 report indicated that approximately 1% of all births in the United States in 2021 resulted from ART, highlighting its growing prevalence.

Furthermore, cultural shifts that destigmatize discussions around fertility challenges and women's health are crucial. This destigmatization encourages more people to seek professional help and utilize available technologies, thereby broadening the potential patient base for CooperSurgical's offerings. Public awareness campaigns and increased media coverage of these topics are contributing to this positive societal change.

Urbanization and Access to Healthcare

Global urbanization continues to reshape demographics, with the UN projecting that by 2050, 68% of the world's population will live in urban areas. This concentration of people in cities can significantly enhance Cooper Companies' market access for its vision and women's health products by creating denser customer bases and potentially improving the reach of eye care professionals and healthcare clinics. For instance, in 2024, major metropolitan areas are often hubs for specialized medical services, directly benefiting companies like Cooper.

However, this trend also highlights a critical challenge: the persistent disparity in healthcare access between urban centers and rural or underserved regions. While urbanization can boost distribution in cities, it can simultaneously create barriers to market penetration in areas left behind. This uneven development means Cooper Companies must strategize carefully to ensure its products reach all segments of the population, not just the most accessible urban dwellers.

- Urban Population Growth: The UN estimates that urban areas will house 68% of the global population by 2050, a significant increase from 56% in 2021.

- Healthcare Infrastructure Concentration: Major urban centers often boast a higher density of hospitals, clinics, and specialized practitioners, facilitating product adoption.

- Rural-Urban Disparities: Unequal distribution of healthcare resources remains a key hurdle, impacting market reach for companies like Cooper.

- Market Penetration Strategy: Cooper Companies needs targeted approaches to address access gaps in non-urbanized or less developed regions.

Socioeconomic Disparities

Socioeconomic disparities significantly impact the market for Cooper Companies' products, particularly in healthcare. Unequal income distribution can create a divide in access to advanced medical devices and treatments. For instance, in 2024, the World Bank reported that approximately 689 million people globally still lived on less than $2.15 a day, highlighting a substantial segment of the population with limited purchasing power for premium healthcare solutions.

Cooper Companies must navigate these disparities by considering strategies that enhance broader market accessibility. This involves developing product tiers or exploring innovative distribution models to reach lower-income demographics. In 2025, projections suggest that while the global medical device market is expected to reach over $600 billion, the penetration of high-cost technologies in emerging economies will remain a challenge due to affordability constraints.

- Income Inequality: Persistent income gaps limit the ability of a significant portion of the global population to afford advanced medical technologies.

- Healthcare Affordability: High costs associated with innovative medical devices and treatments can exclude lower and middle-income individuals.

- Market Segmentation: Cooper Companies needs to tailor product offerings and pricing strategies to address diverse socioeconomic segments effectively.

Societal shifts toward proactive health management and personalized medicine are increasingly influencing consumer choices in vision care and reproductive health. By 2025, over 75% of consumers are actively seeking information on preventative eye care and advanced reproductive solutions, directly benefiting Cooper Companies' specialized product lines.

The growing acceptance and destigmatization of fertility treatments, coupled with advancements in assisted reproductive technologies, are expanding the market for CooperSurgical. In 2023, the global fertility services market was valued at $14.5 billion, with projections indicating it will exceed $30 billion by 2030, underscoring significant growth potential.

Urbanization trends, with 68% of the global population expected to reside in urban areas by 2050, concentrate potential customer bases for Cooper Companies, enhancing market access in metropolitan hubs. However, disparities in healthcare access between urban and rural areas necessitate targeted strategies for equitable market penetration.

Socioeconomic disparities remain a critical factor, as persistent income inequality limits access to advanced medical technologies for a significant portion of the global population. In 2024, approximately 689 million people worldwide lived on less than $2.15 a day, highlighting the need for Cooper Companies to develop tiered product offerings and innovative distribution models for broader market accessibility.

| Sociological Factor | Trend Description | Impact on Cooper Companies | Relevant Data/Projection |

|---|---|---|---|

| Aging Population | Increasing number of older individuals globally. | Drives demand for vision correction products. | UN: 1.6 billion aged 65+ by 2050. |

| Lifestyle Changes | Increased screen time, focus on health. | Boosts demand for specialized contact lenses. | 60%+ adults spend 6+ hours daily on screens (2024). |

| Health Awareness | Heightened consumer focus on vision & reproductive health. | Creates robust market for specialized offerings. | 75%+ consumers seek preventative eye/reproductive health info (2025). |

| Family Planning Attitudes | Shifting societal views on fertility and choice. | Expands market for reproductive health solutions. | Fertility services market: $14.5B (2023) to $30B+ (2030). |

| ART Acceptance | Increased adoption of assisted reproductive technologies. | Broadens market for diagnostic/therapeutic products. | 1% of US births via ART (2021). |

| Urbanization | Concentration of populations in cities. | Enhances market access in urban centers. | UN: 68% global population in urban areas by 2050. |

| Socioeconomic Disparities | Unequal income distribution and healthcare access. | Challenges affordability and market penetration. | 689M people live on <$2.15/day (2024). |

Technological factors

CooperVision's success hinges on continuous innovation in materials science, lens design, and manufacturing. For instance, advancements in silicone hydrogel materials are key to improving oxygen permeability and wearer comfort, directly impacting product appeal. The market is seeing a strong shift towards daily disposable lenses, with global sales projected to reach over $10 billion by 2025, highlighting the importance of this segment for CooperCompanies.

Technological breakthroughs offer a significant competitive edge. Developing specialized lenses for conditions like astigmatism and presbyopia, areas where CooperVision is actively investing, can capture growing market segments. In 2023, CooperCompanies reported that its Vision segment, primarily driven by CooperVision, saw revenue growth, underscoring how technological leadership translates into market share gains and financial performance.

Technological advancements are crucial for CooperSurgical's growth, particularly in fertility treatments and diagnostic tools. Innovations in in-vitro fertilization (IVF) technologies, such as improved culture media and embryo selection techniques, are enhancing success rates. For instance, global IVF market is projected to reach USD 37.3 billion by 2028, growing at a CAGR of 6.8% from 2021, according to a recent report.

The development of more sophisticated genetic screening tools, like preimplantation genetic testing (PGT), allows for earlier detection of chromosomal abnormalities, improving patient outcomes and reducing the need for multiple IVF cycles. CooperCompanies invested heavily in R&D, with its fiscal year 2023 R&D expenses totaling $449 million, underscoring its commitment to these technological frontiers.

Furthermore, advancements in minimally invasive surgical instruments, such as robotic-assisted surgery and improved hysteroscopy devices, are making gynecological procedures safer and more efficient. These innovations not only benefit patients through quicker recovery times but also expand the range of treatable conditions, directly impacting CooperSurgical's product demand and market position.

The increasing adoption of digital health platforms and telemedicine presents significant opportunities for Cooper Companies. These technologies can be leveraged for enhanced diagnostics, remote patient monitoring, and efficient prescription management, particularly within Cooper's vision and reproductive health segments. For instance, the global telemedicine market was valued at approximately $175 billion in 2023 and is projected to grow substantially, offering Cooper a chance to expand its reach and improve patient engagement.

Automation and AI in Manufacturing and Diagnostics

Automation is significantly reshaping manufacturing for companies like CooperCompanies. By integrating automated systems into their production lines, CooperVision and CooperSurgical can expect enhanced efficiency and reduced operational costs. For instance, the global industrial automation market was valued at approximately $215 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards increased automation adoption.

Artificial Intelligence (AI) is proving to be a game-changer in diagnostic and data analysis. In ophthalmology, AI algorithms are increasingly used to detect eye conditions with remarkable accuracy, potentially leading to earlier and more effective treatments for patients served by CooperVision. Similarly, CooperSurgical can leverage AI to analyze complex fertility data, offering more personalized and successful treatment plans. The AI in healthcare market is expanding rapidly, with AI in medical diagnostics alone expected to reach tens of billions of dollars in the coming years.

- Efficiency Gains: Automation in manufacturing can boost output by up to 20% in certain processes, directly impacting cost reduction.

- Diagnostic Accuracy: AI in medical imaging has shown accuracy rates comparable to or exceeding human specialists in identifying specific conditions.

- Data-Driven Insights: AI's ability to process vast datasets can optimize supply chains, predicting demand and managing inventory more effectively.

- Personalized Treatment: AI analysis of patient data allows for tailored medical interventions, improving outcomes in areas like fertility.

Data Analytics and Personalized Medicine

Cooper Companies can harness big data analytics to gain deep insights into patient outcomes, evolving market trends, and the performance of its diverse product portfolio. This data-driven approach allows for the continuous refinement of its offerings, ensuring they remain competitive and aligned with healthcare needs. For instance, by analyzing aggregated patient data, Cooper can identify unmet needs in areas like contact lens wear or surgical procedures, guiding future product development.

The burgeoning field of personalized medicine presents a significant growth opportunity. This approach, which tailors treatments to individual patient genetic makeup and specific conditions, is heavily reliant on advanced technological capabilities. Cooper Companies can leverage its expertise in diagnostics and product development to create customized solutions, such as specialized contact lenses or surgical implants designed for specific patient profiles, thereby tapping into a high-value market segment.

Key technological advancements supporting these trends include:

- AI-powered diagnostic tools: Enhancing the accuracy and speed of identifying patient needs.

- Genomic sequencing technologies: Enabling the precise understanding of individual patient biology.

- Advanced manufacturing techniques (e.g., 3D printing): Facilitating the creation of bespoke medical devices.

- Cloud computing and secure data platforms: Essential for managing and analyzing vast amounts of patient and market data.

Technological advancements are pivotal for CooperCompanies, driving innovation in both its Vision and Surgical segments. The company's investment in R&D, totaling $449 million in fiscal year 2023, underscores its commitment to leveraging cutting-edge technologies for product development and market expansion.

The increasing adoption of AI in diagnostics, particularly in ophthalmology, promises to enhance early detection and treatment of eye conditions, benefiting CooperVision's market. Similarly, CooperSurgical is poised to capitalize on AI's ability to analyze complex fertility data, leading to more personalized and effective patient treatments.

Furthermore, advancements in minimally invasive surgical instruments and personalized medicine, supported by technologies like genomic sequencing and 3D printing, are creating new opportunities for CooperSurgical to offer tailored solutions and improve patient outcomes.

The global telemedicine market, valued at approximately $175 billion in 2023, and the industrial automation market, valued at around $215 billion in 2023, represent significant areas where CooperCompanies can enhance its reach, efficiency, and data-driven insights.

Legal factors

Cooper Companies navigates a complex web of medical device regulations worldwide. Key among these are the U.S. Food and Drug Administration (FDA) requirements and the European Union's Medical Device Regulation (MDR). For example, the MDR, fully implemented in May 2021, introduced significantly stricter pre-market review and post-market surveillance for medical devices, impacting companies like Cooper Companies by demanding more extensive clinical data and robust quality management systems.

Failure to adhere to these evolving legal frameworks carries substantial financial and operational risks. In 2024, regulatory bodies continued to emphasize product safety and efficacy, with enforcement actions often resulting in substantial penalties. For instance, a significant product recall due to non-compliance could lead to millions in lost revenue and severe damage to Cooper Companies' brand reputation, underscoring the critical need for ongoing investment in regulatory affairs and quality assurance.

Protecting its intellectual property, particularly through patents for innovative contact lens designs, advanced materials, and medical devices, is crucial for Cooper Companies to sustain its competitive advantage. In 2023, the company continued to invest in its patent portfolio, a key driver for its specialized medical device and vision care segments.

Legal disputes concerning patent infringement can represent significant financial and operational burdens, potentially impacting Cooper Companies' profitability and its standing in the market. The cost of litigating such cases can be substantial, diverting resources from research and development.

A strong framework for intellectual property protection not only acts as a deterrent to competitors but also fosters an environment conducive to ongoing innovation. This safeguards Cooper Companies' market share and encourages further investment in developing next-generation products.

The Cooper Companies operates under stringent product liability laws across all its global markets. This means any flaw in product design, manufacturing, or even the provided warnings can trigger costly lawsuits, mandatory product recalls, and substantial financial penalties. For instance, in 2023, the medical device industry saw a significant increase in litigation, with some companies facing multi-million dollar settlements due to product defects.

Data Privacy and Security Regulations

As a healthcare company, Cooper Companies must navigate a complex web of data privacy and security regulations. In the United States, the Health Insurance Portability and Accountability Act (HIPAA) mandates stringent protections for Protected Health Information (PHI). Similarly, the General Data Protection Regulation (GDPR) in Europe sets high standards for the processing and safeguarding of personal data. Failure to comply can lead to significant financial penalties and reputational damage.

Cooper Companies' commitment to data security is not just a best practice; it's a legal imperative. Breaches of sensitive patient data can result in substantial fines. For instance, under GDPR, penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. HIPAA violations can also incur significant fines, with penalties for violations ranging from $100 to $50,000 per violation, capped at $1.5 million per year for identical violations. Beyond financial repercussions, such breaches erode patient trust and can severely harm the company's brand image.

- HIPAA Compliance: Cooper Companies must adhere to HIPAA's Privacy and Security Rules to protect patient health information.

- GDPR Adherence: For operations within the European Union, compliance with GDPR's data protection principles is mandatory.

- Data Breach Penalties: Significant fines are levied for non-compliance, impacting financial performance and market standing.

- Reputational Risk: Maintaining robust data security is crucial for preserving customer trust and brand reputation in the healthcare sector.

Antitrust and Competition Laws

Cooper Companies operates within a strict framework of antitrust and competition laws globally, aimed at preventing monopolistic practices and fostering a competitive marketplace. Regulatory bodies, such as the U.S. Federal Trade Commission (FTC) and the European Commission, actively scrutinize mergers, acquisitions, and business strategies to ensure they do not unduly restrict competition. For instance, in 2023, the FTC continued its robust enforcement actions against healthcare mergers, highlighting the increased regulatory attention on consolidation within the medical device and healthcare sectors where Cooper Companies is active.

Failure to comply with these regulations can result in significant financial penalties, lengthy investigations, and even mandated divestitures of business units. These outcomes can severely disrupt Cooper Companies' strategic growth plans, impacting its ability to expand through acquisitions or engage in certain market practices. The company's adherence to these laws is therefore critical for maintaining operational freedom and achieving its long-term business objectives.

- Regulatory Scrutiny: Cooper Companies must navigate antitrust regulations in all operating regions, facing potential reviews of its market share and competitive conduct.

- Merger & Acquisition Oversight: Any significant M&A activity by Cooper Companies is subject to antitrust clearance, with regulators assessing potential impacts on market competition.

- Compliance Costs: Maintaining compliance involves ongoing legal counsel, risk assessments, and potential adjustments to business practices, incurring considerable operational expenses.

- Market Practice Review: Business strategies, including pricing, distribution, and product bundling, are monitored to ensure they do not create anti-competitive effects.

Cooper Companies faces significant legal challenges related to product safety and compliance, particularly with evolving regulations like the EU's MDR. In 2024, regulatory bodies intensified scrutiny on medical device efficacy and patient safety, leading to potential fines and recalls for non-compliance. The company's ability to secure and defend its intellectual property, especially patents for its contact lens and vision care innovations, remains a critical legal factor for maintaining market advantage and fostering future R&D investment.

Environmental factors

Growing environmental awareness is compelling medical device companies like CooperCompanies to prioritize sustainable manufacturing. This involves actively reducing energy and water consumption, alongside minimizing waste throughout their production processes for products like contact lenses and surgical instruments.

In 2023, CooperCompanies reported a 10% reduction in waste sent to landfills across its global operations, a testament to its focus on sustainability. This commitment is crucial for maintaining corporate responsibility and meeting evolving regulatory expectations.

Cooper Companies faces increasing pressure to address the environmental footprint of its global supply chain. This includes scrutinizing emissions from transportation, ensuring ethical sourcing of raw materials, and verifying that suppliers meet environmental regulations. For instance, the logistics sector, a significant part of any global supply chain, accounted for approximately 24% of direct CO2 emissions from fuel combustion globally in 2022, according to the International Energy Agency.

Stakeholders, including investors and consumers, are demanding greater transparency and sustainability from companies like Cooper. This expectation drives the need for robust environmental management systems throughout the supply chain, from manufacturing partners to final product delivery. Companies are increasingly reporting on their Scope 3 emissions, which encompass indirect emissions from their value chain, a figure that can be substantial for manufacturers of medical devices and contact lenses.

CooperCompanies' reliance on specific materials for its contact lenses and medical devices, such as polymers and specialty plastics, presents a significant challenge in the face of growing resource scarcity. The extraction and processing of these materials can have substantial environmental footprints, impacting ecosystems and contributing to carbon emissions. For instance, the global plastics market, a key component in many medical devices, is projected to grow, increasing demand on petrochemical feedstocks.

To address this, CooperCompanies must actively seek and integrate sustainable alternatives, potentially including bio-based or recycled polymers. Responsible sourcing is paramount, requiring robust supply chain management to ensure materials are obtained ethically and with minimal environmental damage. This proactive approach can not only mitigate risks related to material availability and price volatility, which are increasingly influenced by climate change and geopolitical factors, but also enhance the company's brand reputation among environmentally conscious consumers and investors.

Climate Change and Extreme Weather Events

Climate change is increasingly manifesting as more frequent and intense extreme weather events. These can significantly disrupt operations for companies like Cooper Companies, impacting manufacturing facilities, supply chains, and distribution networks. For instance, a severe hurricane in 2024 could halt production or damage inventory, leading to delays and increased costs.

The potential for operational continuity risks and challenges in timely product delivery is a direct consequence. Cooper Companies must proactively assess these climate-related vulnerabilities and invest in building resilience. This might involve diversifying manufacturing locations or strengthening logistics to mitigate the impact of unforeseen weather disruptions.

- Supply Chain Vulnerability: Increased frequency of extreme weather events, such as floods or heatwaves, can disrupt the sourcing of raw materials and the delivery of finished goods, impacting Cooper Companies' global supply chain.

- Operational Disruption: Manufacturing facilities, particularly those in coastal or flood-prone areas, face heightened risks of damage or forced shutdowns due to severe weather, as seen with the widespread impact of storms in late 2024.

- Increased Insurance Costs: The rising incidence of climate-related disasters can lead to higher insurance premiums for physical assets and business interruption coverage, directly affecting Cooper Companies' operating expenses.

- Logistical Challenges: Extreme weather can impede transportation networks, including shipping routes and road access, delaying the timely delivery of medical devices and other products to healthcare providers and patients.

Corporate Social Responsibility (CSR) and ESG Reporting

Investor and consumer focus on environmental, social, and governance (ESG) performance is intensifying, pushing companies like Cooper Companies to strengthen their corporate social responsibility (CSR) efforts and reporting. This trend is driven by a desire for sustainable and ethical business practices.

Cooper Companies is under pressure to showcase its dedication to environmental care. This includes setting quantifiable goals, obtaining relevant certifications, and making public disclosures. For instance, by the end of 2024, many companies in the healthcare sector, where Cooper operates, are aiming to reduce their Scope 1 and Scope 2 greenhouse gas emissions by an average of 20% compared to 2022 levels, according to industry reports.

- Growing ESG Demand: Investors increasingly favor companies with strong ESG profiles, impacting capital allocation.

- Environmental Stewardship: Cooper must demonstrate measurable progress in reducing its environmental footprint.

- Transparency in Reporting: Publicly disclosing CSR initiatives and performance data is crucial for maintaining trust.

- Brand Reputation: Proactive CSR engagement enhances brand image and consumer loyalty.

CooperCompanies faces increasing scrutiny regarding its environmental impact, particularly concerning waste management and resource consumption in its manufacturing processes for products like contact lenses. The company reported a 10% reduction in waste sent to landfills globally in 2023, reflecting a commitment to sustainability. This focus is driven by growing stakeholder expectations for environmental stewardship and the need to comply with evolving environmental regulations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Cooper Companies draws from a comprehensive mix of data, including reports from the World Health Organization and other health regulatory bodies, economic forecasts from the IMF and World Bank, and technological advancements tracked by industry analysts. We also incorporate legislative updates from key markets and environmental impact assessments.