Cooper Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper Companies Bundle

Curious about The Cooper Companies' product portfolio and market standing? Our BCG Matrix analysis reveals where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture – purchase the complete report for actionable insights and strategic guidance.

Stars

MyDay daily silicone hydrogel lenses are a significant growth engine for Cooper Companies, experiencing robust demand and enhanced distribution. The product line's sales continue to climb, bolstered by expanded production capacity that supports more aggressive promotional efforts.

The international rollout of MyDay's multifocal and extended toric variations highlights substantial market growth and Cooper Companies' dominant position within this specialized contact lens segment.

The MiSight myopia management portfolio is a standout performer within Cooper Companies' offerings, reflecting a strong market position in a rapidly expanding sector. Sales for MiSight have seen significant year-over-year increases, demonstrating robust demand for this innovative product.

This growth is fueled by the escalating global rates of myopia, a condition affecting a substantial portion of the world's population. CooperVision's leadership in this high-growth market is further solidified by their strategic expansion plans. For instance, the company is preparing to launch a silicone hydrogel version of MiSight in Europe, broadening its accessibility and appeal.

Further enhancing its market reach, Cooper Companies is also in the early stages of planning for the launch of MyDay MiSight lenses outside the United States. These strategic moves underscore the company's commitment to capitalizing on the burgeoning myopia management market and maintaining its competitive edge.

CooperVision's toric and multifocal lenses are performing exceptionally well, demonstrating robust growth that outpaces their spherical counterparts. These specialized lenses address significant vision needs such as astigmatism and presbyopia, which represent expanding niches within the global contact lens market.

The clariti 1 day multifocal, featuring the innovative Binocular Progressive System, is a prime example of CooperVision's commitment to product development. This advancement not only strengthens their market standing but also highlights their continuous drive for innovation in addressing complex vision correction requirements.

Daily Disposable Contact Lenses

Daily disposable contact lenses represent a significant growth area in the vision care market, driven by consumer demand for convenience and enhanced hygiene. CooperVision, a key player in this segment, benefits from this trend with its advanced silicone hydrogel offerings like MyDay and clariti.

This focus on daily disposables allows Cooper Companies to capture a larger share of a premium market segment. The higher price point associated with daily disposables can translate into improved profitability for the company.

- Market Growth: The global daily disposable contact lens market is projected to experience robust growth, with an anticipated compound annual growth rate (CAGR) of approximately 7-8% through 2028.

- CooperVision's Position: CooperVision's MyDay and clariti brands are leading the charge in this segment, contributing significantly to the company's revenue.

- Consumer Preference: A growing number of contact lens wearers are opting for daily disposables over reusable lenses due to perceived health benefits and ease of use.

- Profitability Impact: The premium pricing of daily disposable lenses supports higher profit margins compared to bi-weekly or monthly alternatives.

CooperSurgical's Fertility Products and Services

CooperSurgical's fertility products and services are positioned as a star in the BCG matrix for Cooper Companies. This segment operates within a high-growth market, fueled by increasing infertility rates globally and a greater acceptance of assisted reproductive technologies (ART). For instance, the global fertility services market was valued at approximately $38.4 billion in 2023 and is projected to reach $67.2 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 8.4%.

The company has strategically bolstered its presence in this sector through key acquisitions, notably Generate Life Sciences and ZyMōt Fertility. These moves have broadened CooperSurgical's portfolio, enabling it to offer a comprehensive suite of solutions across the entire in vitro fertilization (IVF) process. This integrated approach is crucial in capturing market share within the rapidly expanding fertility landscape.

Looking ahead, this segment is anticipated to maintain its strong growth trajectory, becoming an increasingly vital contributor to Cooper Companies' overall revenue. The ongoing demand for fertility treatments, coupled with CooperSurgical's expanding capabilities, solidifies its position as a leading player and a significant revenue generator for the parent company.

- High Market Growth: The fertility services market is experiencing robust expansion, driven by demographic shifts and technological advancements in ART.

- Strategic Acquisitions: Investments in companies like Generate Life Sciences and ZyMōt Fertility have enhanced CooperSurgical's end-to-end IVF offerings.

- Significant Revenue Contribution: The fertility segment is expected to continue its strong performance, playing a key role in Cooper Companies' financial results.

- Market Value: The global fertility services market reached an estimated $38.4 billion in 2023, with projections indicating continued strong growth.

CooperSurgical's fertility business is a clear star in the BCG matrix. This segment thrives in a high-growth market, propelled by rising infertility rates and increased acceptance of assisted reproductive technologies. The global fertility services market was valued at roughly $38.4 billion in 2023 and is expected to reach $67.2 billion by 2030, showing a strong 8.4% CAGR.

Strategic acquisitions, such as Generate Life Sciences and ZyMōt Fertility, have significantly expanded CooperSurgical's capabilities, allowing for a comprehensive suite of IVF solutions. This integrated approach is vital for capturing market share in the expanding fertility landscape.

The fertility segment is poised for continued strong growth, making it an increasingly important contributor to Cooper Companies' overall revenue. Its robust performance and expanding offerings solidify its position as a key revenue generator.

| Segment | BCG Category | Market Growth | Cooper Companies' Position |

|---|---|---|---|

| CooperSurgical Fertility | Star | High (8.4% CAGR projected) | Leading player with end-to-end IVF solutions |

| CooperVision Contact Lenses | Star | High (7-8% CAGR for daily disposables) | Strong presence with MyDay and clariti brands |

What is included in the product

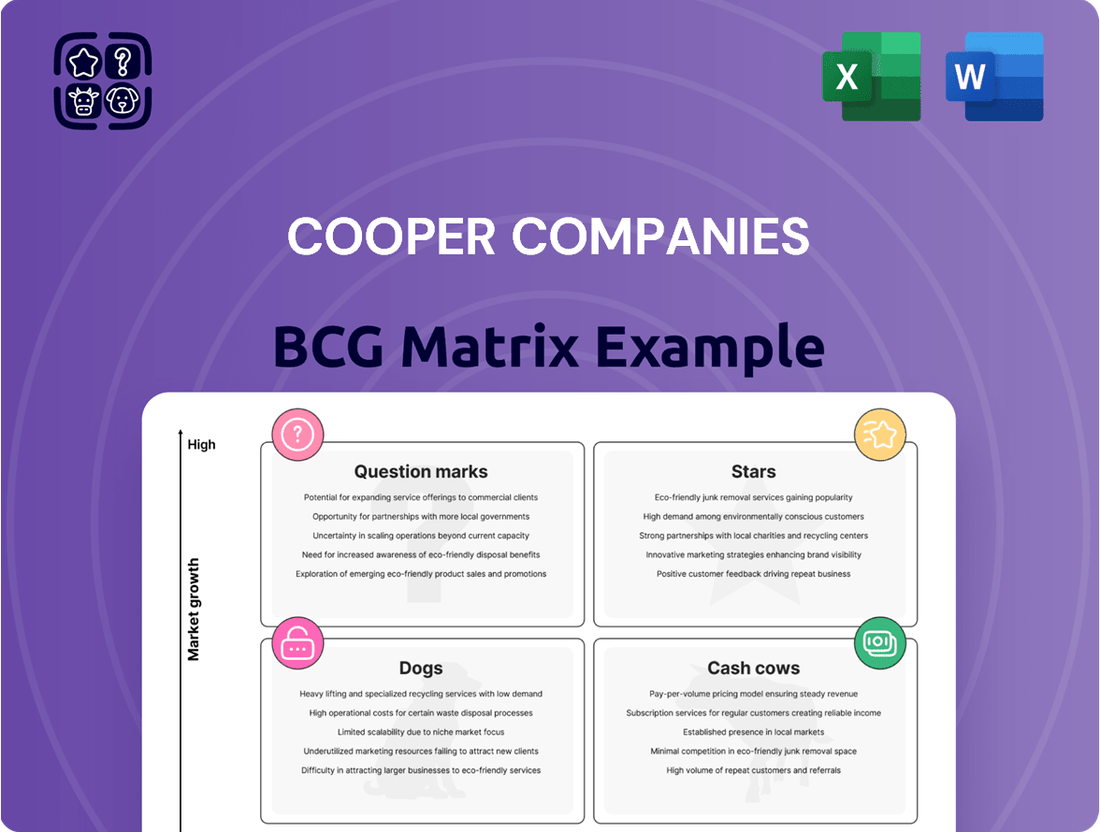

The Cooper Companies BCG Matrix provides a strategic overview of its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

The Cooper Companies BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

CooperVision's established silicone hydrogel frequent replacement (FRP) lenses, like Biofinity and Avaira, are definite cash cows for Cooper Companies. These lenses hold a substantial market share in the mature but consistent contact lens market, generating significant and stable revenue streams. Their widespread acceptance and the recurring nature of purchases ensure a dependable cash flow for the company.

CooperVision's comprehensive contact lens portfolio positions it as a significant player in the global market, consistently generating substantial revenue. This broad market leadership, spanning various lens types, underpins strong brand recognition and a stable income stream.

The company's ability to maintain high gross margins, often exceeding 60% in recent reporting periods, highlights its operational efficiency within the mature but competitive contact lens sector.

Paragard, CooperSurgical's hormone-free IUD, is a significant player in the U.S. market, known for its consistent revenue generation. Its position is bolstered by regulatory advantages and high customer loyalty due to substantial switching costs.

While facing some temporary inventory adjustments, Paragard's long-standing market presence and the growing acceptance of IUDs as a contraceptive method solidify its role as a dependable cash cow for Cooper Companies. In 2023, the U.S. IUD market continued to see steady growth, with hormone-free options like Paragard appealing to a specific segment of consumers.

CooperSurgical's Office and Surgical Products

CooperSurgical's office and surgical products represent a significant cash cow for Cooper Companies. This segment consistently generates substantial revenue by addressing essential women's health needs and supporting surgical procedures. The demand for these products remains steady, reflecting a mature market.

The company's strategic acquisitions, such as obp Surgical in 2023, bolster this cash cow. These moves integrate innovative technologies, expanding CooperSurgical's product portfolio and ensuring continued market competitiveness. For instance, obp Surgical's focus on surgical access devices complements CooperSurgical's existing offerings.

- Revenue Contribution: In fiscal year 2023, CooperSurgical's revenue reached approximately $1.4 billion, with office and surgical products forming the core of this figure.

- Market Stability: The women's health market, served by these products, is characterized by consistent, albeit slower, growth, providing a predictable revenue stream.

- Acquisition Impact: The integration of obp Surgical is expected to contribute positively to the segment's growth trajectory, enhancing CooperSurgical's position in the surgical device market.

Mature Reproductive Health Solutions

Within Cooper Companies, certain mature reproductive health solutions, particularly those within the CooperSurgical segment that are not focused on high-growth fertility markets, likely function as cash cows. These offerings often represent established diagnostic tools or medical devices for women's health that have achieved significant market penetration and enjoy sustained demand.

Their consistent usage and mature market position generate predictable and stable cash flows for the company. For instance, while CooperSurgical's fertility business is a star, its more established product lines in areas like surgical instruments or diagnostic tests for routine gynecological care are likely the bedrock cash generators.

- Established Diagnostic Tools: Products with long track records and widespread adoption in women's health screenings.

- Mature Medical Devices: Instruments and devices that are consistently utilized in gynecological procedures and care.

- Predictable Cash Flows: These segments benefit from stable demand, contributing reliably to overall company revenue.

- Sustained Market Penetration: High adoption rates ensure continued sales and profitability, even without rapid growth.

CooperVision's Biofinity and Avaira contact lenses are prime examples of cash cows, benefiting from a large market share in the stable contact lens sector. These products deliver consistent revenue, supported by recurring purchases and high customer loyalty, contributing significantly to Cooper Companies' overall financial health.

Paragard, CooperSurgical's hormone-free IUD, also functions as a cash cow, demonstrating consistent revenue generation in the U.S. market. Its established presence and the growing demand for IUDs ensure its continued role as a reliable income source, despite minor inventory fluctuations.

CooperSurgical's office and surgical products, bolstered by strategic acquisitions like obp Surgical in 2023, represent another key cash cow segment. These offerings cater to essential women's health needs, providing stable demand and predictable revenue streams within a mature market.

| Product/Segment | Category | Role | Key Financial Indicator (FY23 Est.) | Market Characteristic |

|---|---|---|---|---|

| Biofinity & Avaira (CooperVision) | Contact Lenses | Cash Cow | Significant, stable revenue contribution | Mature, consistent demand |

| Paragard (CooperSurgical) | Contraception (IUD) | Cash Cow | Consistent revenue generation | Growing market segment, high loyalty |

| Office & Surgical Products (CooperSurgical) | Women's Health Devices | Cash Cow | Core contributor to $1.4B CooperSurgical revenue | Stable demand, mature market |

Delivered as Shown

Cooper Companies BCG Matrix

The Cooper Companies BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professional, analysis-ready report designed for strategic decision-making.

Dogs

Older, less differentiated spherical hydrogel contact lens lines within CooperVision are likely categorized as dogs in the BCG Matrix. These products contend with fierce price wars and are experiencing a shrinking market share as the industry gravitates towards more advanced materials like silicone hydrogel and the convenience of daily disposables.

The financial performance of these legacy lenses is probably characterized by low profitability, demanding significant resources to simply hold their ground against newer, more innovative offerings. CooperCompanies' strategic direction clearly favors investment in higher-margin, technologically superior products, indicating a deliberate move away from these mature and commoditized segments.

Products facing significant headwinds from supply chain issues or inventory recalibrations, especially in key markets, can temporarily fall into the dog category. CooperSurgical's medical devices, for example, saw a downturn impacted by shipping delays and inventory management adjustments within the U.S. distribution network.

These segments, while potentially salvageable, drain resources without yielding the anticipated profits during these challenging phases. For instance, in the first quarter of 2024, CooperCompanies reported that supply chain disruptions continued to affect certain product lines, leading to extended lead times and increased costs for some of their surgical and fertility offerings.

Acquired assets that don't integrate smoothly into Cooper Companies' operations or fail to meet revenue expectations could be classified as dogs. These underperforming acquisitions might necessitate continued financial support without yielding significant market share or growth, potentially diverting valuable resources.

While specific underperforming acquired assets are not publicly detailed, Cooper Companies' overall acquisition strategy aims for accretive contributions. For instance, the acquisition of Cook Medical's reproductive and gastrointestinal health businesses in 2023, valued at $570 million, is anticipated to bolster CooperSurgical's market position and contribute positively to earnings per share.

Products in Stagnant or Declining Niche Markets

Products within CooperSurgical targeting niche segments of women's health that are experiencing minimal innovation or shrinking demand could be classified as dogs. These offerings likely possess a low market share and limited future growth potential, yielding negligible returns. For instance, if CooperSurgical offers a specific diagnostic tool for a rare condition with a decreasing patient population, it would fit this category.

The company's strategy for such products would focus on capital preservation, minimizing further investment. This often involves milking existing revenue streams without significant R&D or marketing spend. For example, if a particular line of surgical instruments for an outdated procedure is seeing declining usage, Cooper Companies would likely avoid introducing new versions or expanding its reach.

- Low Market Share: Products in stagnant or declining niche markets often struggle to capture significant market share due to limited demand or competition from more innovative alternatives.

- Low Growth Prospects: The inherent nature of these markets means that the products within them have very little opportunity for expansion or increased sales.

- Minimal Investment: Companies typically reduce or eliminate investment in 'dog' products, focusing resources on areas with higher growth potential to avoid further losses.

- Potential Divestment: In some cases, companies may consider divesting or discontinuing 'dog' products if they become a drain on resources or offer no strategic advantage.

Certain Regional Market Segments with Declining Sales

Certain regional market segments for Cooper Companies might be classified as 'dogs' in the BCG Matrix if they exhibit consistent year-on-year sales declines. For instance, a reported slowdown in China for CooperVision's core product lines, as observed in recent financial reporting, could signal such a trend. These specific geographic areas may be grappling with intensified local competition or broader economic headwinds that stifle growth opportunities.

These 'dog' segments require careful evaluation. They typically possess low market share within a slow-growing industry. Cooper Companies might consider divesting from these underperforming regions or implementing targeted strategies to revitalize sales, rather than continuing to invest resources with little prospect of significant returns.

- Declining Sales in Specific Regions: Year-on-year sales decreases in markets like China for CooperVision's main product portfolio are indicative of 'dog' status.

- Local Competitive Pressures: These segments often face intense competition from local players, hindering market share growth.

- Economic Slowdowns: Broader economic challenges within a region can also contribute to declining sales and a 'dog' classification.

- Strategic Re-evaluation: Cooper Companies may need to consider divestment or specialized turnaround strategies for these underperforming areas.

Products in the 'dog' category for Cooper Companies are those with low market share in industries experiencing minimal growth or decline. These typically include older contact lens technologies, like some spherical hydrogel lines, which face intense price competition and are being superseded by newer materials. CooperSurgical might also have niche medical devices for shrinking patient populations that fall into this quadrant.

Financially, these dog products are characterized by low profitability and often require significant resources just to maintain their position, rather than generating substantial returns. For example, while CooperCompanies' overall revenue grew, specific legacy product lines might see stagnant or declining sales, as indicated by the company's focus on high-growth areas like myopia management and fertility solutions.

CooperCompanies' strategy for 'dogs' usually involves minimizing investment, potentially divesting underperforming assets, or focusing on capital preservation. This approach ensures that resources are channeled towards their 'stars' and 'question marks' which have higher growth potential. The company's acquisitions, like the Cook Medical deal, are geared towards strengthening their 'star' segments, implicitly suggesting a de-emphasis on 'dog' products.

In 2023, CooperCompanies reported a net sales increase of 7%, reaching $3.1 billion. However, within this growth, older product lines within CooperVision might be contributing minimally or even negatively, fitting the 'dog' profile. Strategic decisions are made to prune these less productive areas to optimize overall portfolio performance.

Question Marks

Newer daily silicone hydrogel product extensions, like MyDay Energys and the global expansion of clariti 1 day multifocal, likely fall into the question mark category for CooperCompanies within the BCG Matrix. These products operate in a rapidly expanding market for daily disposable contact lenses, a segment that saw significant growth in 2023 and is projected to continue its upward trajectory through 2024 and beyond, driven by consumer demand for convenience and ocular health. For instance, the global contact lens market was valued at approximately $13.5 billion in 2023 and is expected to reach over $17 billion by 2028, with daily disposables being a key growth driver.

Despite this favorable market environment, their market share outside of initial launch territories may still be relatively modest. Significant investment in marketing, sales, and distribution infrastructure is crucial to build brand awareness and capture a larger portion of these high-growth markets. This strategic investment is necessary to nurture these products and potentially transition them into star performers in the future.

CooperSurgical's advanced AI-driven genetic testing for embryo variations falls into the question mark category. This sector is experiencing rapid growth and holds immense promise for the future of reproductive health.

While the market share for these innovative technologies is likely still small, significant investment in R&D and market penetration efforts are essential. CooperSurgical's commitment to these areas will determine if these advancements can transition from question marks to stars in the coming years.

Cooper Companies' myopia management portfolio, beyond its leading MiSight contact lenses, presents a classic question mark scenario within the BCG Matrix. While MiSight is a clear star, other promising avenues like orthokeratology (Ortho-K) and strategic collaborations such as the one with SightGlass Vision in China are still in their growth phases.

The broader myopia management market is experiencing robust expansion, with projections indicating continued strong growth through 2030. However, the specific market penetration and profitability of Cooper's Ortho-K offerings and its SightGlass Vision partnership are still emerging. This necessitates ongoing investment and careful strategic evaluation to determine their future potential and ensure they don't become dogs.

Recently Acquired Products with Untapped Market Potential

Recently acquired products, like those from obp Surgical, often begin as question marks in the BCG matrix. For instance, obp Surgical's revenue was relatively modest in the trailing twelve months leading up to its acquisition by CooperCompanies. This positions them as potential high-growth assets, but their future trajectory is still uncertain.

These acquired products represent opportunities for CooperSurgical to broaden its offerings and penetrate previously untapped market segments. The key challenge lies in effectively integrating these products and investing strategically to unlock their full market potential and secure significant market share.

- Acquisition Rationale: Products like those from obp Surgical are acquired for their potential to disrupt existing markets or create new ones, even if initial revenue is low.

- Market Uncertainty: The market share and ultimate success of these recently acquired products are not yet established, placing them in the question mark category.

- Strategic Imperative: Successful integration and targeted investment are crucial for transforming these question marks into stars, driving future growth for CooperCompanies.

- Example Data: While specific 2024 revenue figures for all acquired products are not publicly detailed, the strategic intent behind such acquisitions highlights their potential to become significant revenue drivers.

Future Innovations in Women's Health Medical Devices

Future innovations in women's health medical devices, particularly those in CooperSurgical's pipeline that are in early market introduction or scaling phases, represent potential question marks within the Cooper Companies' BCG Matrix. These emerging technologies are designed to address evolving healthcare needs and tap into expanding market segments, but their ultimate success in gaining widespread market acceptance and achieving substantial market share remains uncertain.

CooperSurgical is actively investing in research and development for novel devices that could transform diagnostics and treatment in areas like fertility, minimally invasive surgery, and prenatal care. For instance, advancements in AI-driven diagnostic tools for early detection of gynecological cancers or more sophisticated minimally invasive surgical instruments could fall into this category. These innovations require significant R&D investment and robust market penetration strategies to prove their value and capture market share.

The success of these question mark products hinges on several factors:

- Demonstrated Clinical Efficacy: Robust clinical trial data proving improved patient outcomes and cost-effectiveness compared to existing solutions.

- Reimbursement Landscape: Securing favorable reimbursement codes and policies from payers is crucial for widespread adoption.

- Physician Adoption: Training and education programs to ensure healthcare providers are comfortable and proficient in using new devices.

- Market Education: Effectively communicating the benefits of these innovations to both healthcare professionals and patients.

Question Marks in Cooper Companies' BCG Matrix represent products or business units with low market share in high-growth industries. These require significant investment to increase their market share and potentially become future stars.

CooperCompanies’ newer silicone hydrogel contact lens extensions and advanced AI-driven genetic testing for embryo variations exemplify this category. While operating in expanding markets, their current market penetration is still developing, necessitating strategic investment to capture greater market share.

The myopia management portfolio, excluding MiSight, and recently acquired surgical products also fit this profile. These ventures are in growth phases or early integration, requiring careful management and investment to ascertain their future market position.

Future innovations in women's health medical devices, particularly those in early market scaling, are also potential question marks, dependent on clinical efficacy, reimbursement, and physician adoption for success.

BCG Matrix Data Sources

Our Cooper Companies BCG Matrix leverages comprehensive data from financial filings, market research reports, and industry growth forecasts to accurately assess product portfolio performance.