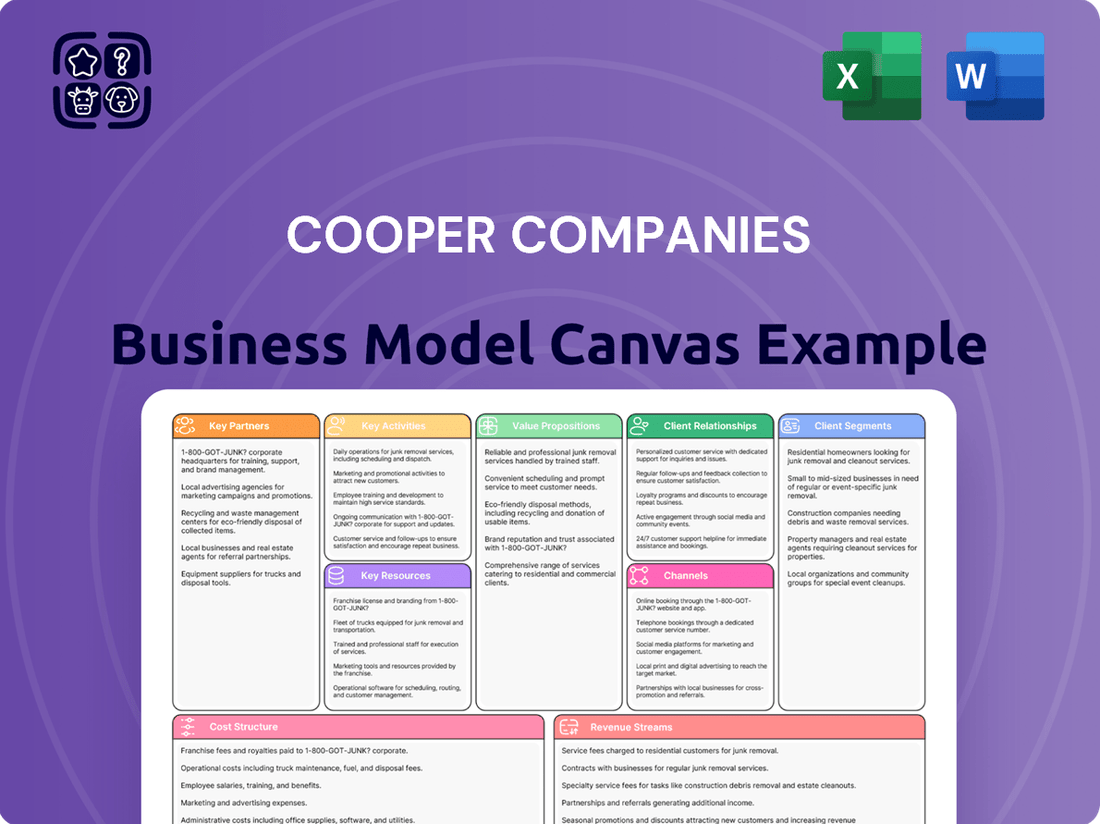

Cooper Companies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cooper Companies Bundle

Unlock the strategic blueprint behind Cooper Companies's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core value propositions, key customer segments, and innovative revenue streams. Discover how they leverage strategic partnerships and manage their cost structure to maintain market leadership.

Partnerships

Cooper Companies cultivates vital partnerships with healthcare professionals, including optometrists and ophthalmologists for its CooperVision segment. These eye care specialists are essential for product prescription and patient access, driving the distribution of contact lenses. In 2024, Cooper Companies continued to focus on strengthening these relationships through educational programs and product innovations designed to meet the evolving needs of practitioners and their patients.

For CooperSurgical, key alliances are formed with OB/GYNs, fertility clinics, and hospitals. These collaborations are critical for the widespread adoption and distribution of its women's health and fertility products. The company actively supports these clinicians and researchers, ensuring they are informed about the latest advancements in care, which is vital for patient outcomes and market penetration.

CooperCompanies relies heavily on a robust network of global and regional distributors and optical retailers to ensure its contact lens products reach a broad customer base. This extensive reach is critical for market penetration and accessibility.

For CooperSurgical, strategic alliances with medical device distributors are paramount. These partnerships guarantee efficient delivery of their specialized products to hospitals and clinics, underscoring the importance of a well-established supply chain for medical devices.

Cooper Companies actively engages with universities and research institutions to fuel innovation, a strategy that has proven particularly fruitful in areas like myopia management. For example, CooperVision supports PhD candidates and collaborates on cutting-edge myopia research, ensuring they remain at the vanguard of contact lens technology development.

These strategic alliances extend to other medical technology firms, fostering a collaborative environment for the creation of novel fertility solutions and women's health devices. Such partnerships are crucial for accelerating new product pipelines and maintaining a competitive edge in the rapidly evolving healthcare landscape.

Sustainability Partners

Cooper Companies actively collaborates with organizations dedicated to environmental and social progress. A prime example is their ongoing relationship with Plastic Bank, a partnership aimed at achieving plastic neutrality.

These collaborations are instrumental in Cooper Companies' pursuit of its sustainability objectives, enabling a reduction in its environmental impact and strengthening its commitment to corporate social responsibility. In a significant move, CooperVision has extended its partnership with Plastic Bank until 2026, reinforcing their joint efforts in collecting and recycling plastic waste that is destined for the ocean.

The company's engagement with sustainability partners is multifaceted:

- Environmental Impact Reduction: Partnerships like the one with Plastic Bank directly contribute to mitigating plastic pollution and promoting a circular economy.

- Social Responsibility Enhancement: These collaborations underscore Cooper Companies' dedication to ethical business practices and positive societal contributions.

- Goal Achievement: Collaborating with specialized organizations provides expertise and resources that accelerate the attainment of ambitious sustainability targets.

- Brand Reputation: Demonstrating a commitment to environmental and social initiatives through strategic partnerships can bolster the company's image among stakeholders.

Technology & Platform Providers

Cooper Companies, particularly through its CooperSurgical segment, heavily relies on partnerships with technology and platform providers to streamline operations. These collaborations are crucial for enhancing manufacturing processes, optimizing supply chains, and managing customer relationships effectively. For instance, CooperSurgical’s adoption of Microsoft Dynamics 365 provides a unified customer relationship management system, offering a comprehensive 360-degree view of their clientele.

These strategic alliances are instrumental in driving operational efficiency and ensuring robust data management. By leveraging advanced technology platforms, Cooper Companies can improve customer service delivery and gain deeper insights into market dynamics. This focus on technology integration underscores their commitment to maintaining a competitive edge in the healthcare sector.

- Manufacturing Technology: Partnerships with providers of advanced manufacturing technologies enhance production capabilities and quality control for medical devices.

- Supply Chain Optimization: Collaborations with logistics and software firms optimize inventory management and distribution, ensuring timely delivery of products.

- CRM Solutions: The use of platforms like Microsoft Dynamics 365 by CooperSurgical enables a unified view of customer interactions, improving sales and service processes.

- Data Analytics Platforms: Partnerships with data analytics firms help in processing and interpreting vast amounts of operational and customer data for strategic decision-making.

Cooper Companies' Key Partnerships are multifaceted, encompassing healthcare professionals, distributors, research institutions, and technology providers. These relationships are vital for product distribution, innovation, and operational efficiency across its CooperVision and CooperSurgical segments. For instance, in 2024, the company continued to deepen its ties with optometrists and ophthalmologists, crucial for the prescription and sale of its contact lenses.

What is included in the product

A detailed Business Model Canvas for The Cooper Companies, outlining its diverse customer segments in vision care and medical devices, its multi-channel distribution, and its value propositions centered on innovation and patient well-being.

This model reflects Cooper's strategic focus on specialized markets, supported by robust research and development and a commitment to enhancing healthcare outcomes.

The Cooper Companies' Business Model Canvas offers a clear, one-page view of their strategy, simplifying complex operations into easily digestible insights for stakeholders.

It effectively translates intricate business strategies into a concise, visual format, relieving the pain of deciphering lengthy reports and enabling faster strategic decision-making.

Activities

Research and Development is a cornerstone for Cooper Companies, driving innovation across its vision care and women's health segments. This ongoing commitment allows for the enhancement of current offerings and the creation of entirely new products. For instance, significant investment is directed towards developing next-generation contact lens technologies and advancing fertility treatments and surgical devices.

CooperSurgical, a key division, specifically channels its R&D efforts into pioneering new instruments, devices, consumables, and digital services within the women's health sector. This focus ensures they remain at the forefront of medical advancements. In 2023, Cooper Companies reported R&D expenses of $258.9 million, reflecting a substantial dedication to this critical activity.

Cooper Companies' core activities revolve around the intricate design, meticulous manufacturing, and strategic marketing of soft contact lenses and essential medical devices across the globe. This necessitates the robust management of sophisticated global supply chains, stringent quality assurance protocols, and the continuous optimization of production workflows spanning numerous international facilities.

A testament to their operational efficiency, CooperVision has achieved zero-waste certification for select production sites, underscoring a commitment to sustainable and streamlined manufacturing processes. This focus on efficiency is crucial for meeting the high demand for their diverse product portfolio.

Cooper Companies manages a complex global distribution network, a vital activity for supplying its diverse product lines, including contact lenses and medical devices, to customers in over 130 countries. This involves maintaining efficient warehousing and inventory management systems to ensure product availability and timely delivery to healthcare professionals and retail partners worldwide.

In 2023, CooperCompanies reported net sales of $3.7 billion, highlighting the scale of its operations and the critical role of its distribution capabilities in reaching a broad customer base and supporting its revenue generation across various international markets.

Sales & Marketing

Cooper Companies invests heavily in sales and marketing to boost its product visibility and capture market share. This multifaceted approach includes direct outreach to consumers, educational programs for healthcare professionals, and active engagement at industry events.

A prime example is CooperVision's strategic use of direct-to-consumer campaigns, notably those designed to increase awareness and adoption of myopia management solutions. These initiatives directly engage patients, fostering demand and reinforcing the value proposition of their specialized contact lenses.

In fiscal year 2023, CooperCompanies reported total revenue of $3.5 billion, with a significant portion attributed to their Vision segment, underscoring the impact of these sales and marketing endeavors. Their commitment to professional education ensures eye care practitioners are well-versed in the benefits and application of their innovative products.

- Direct-to-Consumer Campaigns: CooperVision actively promotes myopia management solutions directly to patients, driving awareness and demand.

- Professional Education: The company provides training and resources to eye care professionals, enhancing product knowledge and adoption.

- Industry Conference Participation: CooperCompanies maintains a strong presence at key industry events to showcase innovations and network with stakeholders.

- Brand Building: Aggressive marketing efforts are crucial for building brand recognition and differentiating its offerings in a competitive market.

Mergers & Acquisitions

Cooper Companies actively pursues strategic acquisitions to broaden its product lines, incorporate new technologies, and access different markets. This is a consistent part of their growth strategy.

A prime example is the acquisition of obp Surgical by CooperSurgical. This move was designed to enhance CooperSurgical's market standing and broaden its range of products and services.

These strategic purchases directly fuel Cooper Companies' overall revenue expansion and help them penetrate new market segments.

- Strategic Acquisitions: Ongoing activity to expand product portfolios, gain new technologies, and enter new markets.

- Example: obp Surgical acquisition by CooperSurgical strengthens market position and diversifies offerings.

- Impact: Acquisitions contribute to overall revenue growth and market expansion.

Cooper Companies’ key activities encompass the design, manufacturing, and global marketing of vision care products, primarily soft contact lenses, and a diverse range of women's health products. This involves managing intricate global supply chains and upholding stringent quality control measures across its international production facilities. For instance, CooperVision has achieved zero-waste certification for select manufacturing sites, demonstrating an emphasis on operational efficiency.

The company also focuses on robust sales and marketing efforts, including direct-to-consumer campaigns for myopia management solutions and professional education for eye care practitioners. Strategic acquisitions, such as the integration of obp Surgical into CooperSurgical, are also central to expanding its product offerings and market reach.

| Key Activity | Description | Supporting Data/Example |

| Product Design & Manufacturing | Innovation and production of contact lenses and women's health devices. | Zero-waste certification at select CooperVision sites. |

| Global Distribution | Supplying products to over 130 countries. | Net sales of $3.7 billion in 2023. |

| Sales & Marketing | Promoting products and educating professionals. | Focus on myopia management solutions and professional training. |

| Strategic Acquisitions | Expanding product lines and market access. | Acquisition of obp Surgical by CooperSurgical. |

Full Document Unlocks After Purchase

Business Model Canvas

The preview you see is the actual Cooper Companies Business Model Canvas, providing a transparent look at the comprehensive analysis you'll receive. Upon purchase, you will gain full access to this exact document, ready for immediate use and customization. This ensures you get precisely what you're evaluating, with no discrepancies or missing information.

Resources

Intellectual property, particularly patents and proprietary technologies, forms a cornerstone of Cooper Companies' competitive edge. These assets cover innovative contact lens designs, advanced manufacturing techniques, and crucial medical devices, safeguarding their market position. In fiscal year 2021, CooperVision strategically transferred its intellectual property to its UK subsidiary, optimizing its global IP management structure.

CooperCompanies operates state-of-the-art manufacturing facilities, crucial for producing its high-quality contact lenses and medical devices. These plants are equipped with specialized machinery that ensures consistent product quality and supports significant production volumes to meet global demand.

The company is actively investing in expanding its manufacturing capacity. For instance, in fiscal year 2023, CooperCompanies completed significant capacity expansion projects, demonstrating a commitment to scaling operations and meeting growing market needs.

Cooper Companies relies heavily on a highly skilled workforce, encompassing R&D scientists, engineers, manufacturing specialists, sales professionals, and clinical experts. This human capital is fundamental to their ability to innovate, maintain operational excellence, and cultivate robust customer relationships across their diverse product lines.

With a global presence spanning over 45 countries, Cooper Companies employs more than 16,000 individuals. This extensive team's collective expertise fuels the company's competitive edge, enabling them to navigate complex markets and deliver specialized solutions in vision care and medical devices.

Global Distribution Network

CooperCompanies leverages its extensive global distribution network as a critical resource. This network, comprising numerous distribution centers, warehouses, and sophisticated logistics infrastructure, is fundamental to the efficient and timely delivery of its diverse product portfolio across the globe.

This established infrastructure is vital for reaching customers in more than 130 countries, underscoring the company's expansive market presence. The operational efficiency of this network directly impacts CooperCompanies' ability to meet global demand for its specialized medical devices and vision care products.

- Global Reach: Serves customers in over 130 countries, facilitated by a robust logistics backbone.

- Operational Efficiency: A network of distribution centers and warehouses ensures timely product delivery worldwide.

- Market Access: Enables CooperCompanies to effectively supply its vision care and medical device products to a broad international customer base.

Brand Reputation & Customer Relationships

Cooper Companies leverages its strong brand reputation, particularly through CooperVision and CooperSurgical, as a cornerstone of its business model. This reputation, built on a foundation of consistent quality, pioneering innovation, and unwavering reliability, acts as a significant intangible asset. For instance, CooperVision's commitment to advanced contact lens technology has fostered deep trust among eye care professionals and wearers alike, contributing to sustained market presence.

The company cultivates and maintains long-standing relationships with healthcare professionals and patients, fostering loyalty and repeat business. This trust is paramount for enduring success in the competitive healthcare sector. CooperSurgical, in particular, actively strengthens these bonds by emphasizing exceptional service, superior product quality, and comprehensive clinical education programs, which are instrumental in expanding its market share within key accounts.

CooperCompanies' strategic focus on brand equity and customer relationships is evident in its market performance. For fiscal year 2023, CooperVision reported net sales of $2.3 billion, reflecting the strength of its customer connections. Similarly, CooperSurgical achieved net sales of $1.7 billion, underscoring the effectiveness of its relationship-centric approach in driving growth.

- Brand Reputation: CooperVision and CooperSurgical are recognized for quality, innovation, and reliability, building significant intangible value.

- Customer Relationships: Long-term trust with healthcare professionals and patients is vital for sustained business success and market penetration.

- Market Share Growth: CooperSurgical's strategy of focusing on service, quality, and clinical education directly contributes to increasing its share within key accounts.

- Financial Impact: In fiscal year 2023, CooperVision achieved $2.3 billion in net sales and CooperSurgical $1.7 billion, demonstrating the commercial success of these relationship-driven strategies.

Intellectual property, including patents and proprietary technologies, is a core asset for CooperCompanies, protecting their innovations in contact lenses and medical devices. The company's state-of-the-art manufacturing facilities, bolstered by significant capacity expansions in fiscal year 2023, are crucial for meeting global demand. A highly skilled workforce of over 16,000 employees across more than 45 countries drives innovation and operational excellence.

CooperCompanies' extensive global distribution network, reaching customers in over 130 countries, ensures timely delivery of its products. This infrastructure is vital for market access and meeting the needs of a broad international customer base. The company's strong brand reputation, particularly for CooperVision and CooperSurgical, built on quality and innovation, fosters deep customer relationships and drives market share growth.

| Key Resource | Description | Fiscal Year 2023 Impact |

| Intellectual Property | Patents and proprietary technologies in vision care and medical devices. | Safeguards market position and competitive advantage. |

| Manufacturing Facilities | State-of-the-art plants with specialized machinery. | Significant capacity expansions completed to meet growing demand. |

| Human Capital | Over 16,000 skilled employees globally. | Drives innovation, operational excellence, and customer relationships. |

| Distribution Network | Global infrastructure reaching over 130 countries. | Ensures efficient and timely product delivery worldwide. |

| Brand Reputation & Relationships | Strong trust with healthcare professionals and patients. | CooperVision net sales: $2.3 billion; CooperSurgical net sales: $1.7 billion. |

Value Propositions

CooperVision stands out by offering an extensive portfolio of soft contact lenses designed to correct myopia, astigmatism, and presbyopia. This broad selection ensures that both eye care professionals and patients have access to tailored solutions for superior vision and comfort. In 2023, CooperCompanies reported total revenue of $3.7 billion, with CooperVision contributing significantly to this figure.

CooperSurgical's value proposition centers on its extensive range of medical devices and fertility solutions specifically designed for women's health. This includes everything from contraception and diagnostics to advanced assisted reproductive technologies and essential cryostorage services.

This broad portfolio directly addresses critical healthcare needs throughout a woman's life, supporting conception, pregnancy, and family planning. For instance, in 2023, CooperCompanies reported CooperSurgical's revenue grew by 10% to $1.5 billion, highlighting strong demand for these specialized offerings.

Cooper Companies drives innovation by consistently introducing advanced products and technologies, aiming to enhance patient outcomes and overall quality of life. This dedication is evident in their pioneering work within myopia management and the development of cutting-edge fertility solutions.

The company prioritizes launching new products and executing capacity expansion projects to meet growing market demands. For instance, in fiscal year 2023, CooperVision’s revenue grew by 7%, reaching $2.3 billion, showcasing the success of their product innovation and market penetration strategies.

Global Accessibility & Reach

Cooper Companies’ commitment to global accessibility is evident in its widespread distribution network. Their healthcare products reach customers in over 130 countries, demonstrating a significant international footprint. This extensive reach allows a vast number of individuals to access essential healthcare solutions.

The impact of Cooper Companies’ offerings is substantial, touching the lives of more than fifty million people each year. This broad demographic engagement underscores the company's ability to meet diverse healthcare needs across different regions.

- Global Presence: Products available in over 130 countries.

- Annual Impact: Benefiting over 50 million lives annually.

- Healthcare Solutions: Providing essential products worldwide.

Commitment to Sustainability & Social Responsibility

Cooper Companies actively integrates sustainability and social responsibility into its operations. This commitment resonates with stakeholders who prioritize ethical business practices. The company's 2024 Sustainability Report details initiatives aimed at reducing environmental impact and fostering social good.

Key efforts include reducing plastic waste, particularly within their vision care products, and expanding access to vision care services for underserved populations. These actions align with growing consumer and partner demand for socially conscious brands.

- Plastic Footprint Reduction: CooperVision, a division of The Cooper Companies, is working to minimize its environmental impact through various packaging and product initiatives.

- Vision Care Access: The company supports programs that provide eye exams and corrective lenses to individuals in need, addressing a critical healthcare gap.

- Stakeholder Appeal: This focus on sustainability and social responsibility enhances Cooper Companies' brand reputation and strengthens relationships with customers and partners who share these values.

- Transparency: The 2024 Sustainability Report provides concrete data and examples of their ongoing commitment and progress in these areas.

Cooper Companies delivers specialized healthcare solutions through two primary segments: CooperVision and CooperSurgical. CooperVision offers a comprehensive range of soft contact lenses, addressing myopia, astigmatism, and presbyopia, with 2023 revenues of $2.3 billion. CooperSurgical provides a broad spectrum of women's health products, including fertility and genomic solutions, achieving $1.5 billion in revenue in 2023 and growing by 10% year-over-year.

| Segment | Key Offerings | 2023 Revenue | Year-over-Year Growth |

|---|---|---|---|

| CooperVision | Soft contact lenses (myopia, astigmatism, presbyopia) | $2.3 billion | 7% |

| CooperSurgical | Women's health devices, fertility solutions, cryostorage | $1.5 billion | 10% |

| Total Cooper Companies | Diverse healthcare products | $3.7 billion | N/A |

Customer Relationships

Cooper Companies utilizes direct sales teams and dedicated account managers to cultivate relationships with major healthcare organizations. This includes large medical groups, integrated healthcare systems, and networks of fertility clinics.

This direct approach enables tailored service, comprehensive product training, and continuous support for their clients. For instance, in fiscal year 2023, CooperSurgical’s revenue grew 12% to $2.1 billion, reflecting strong customer engagement and market penetration.

By prioritizing personalized service, product quality, and clinical education, Cooper Companies effectively enhances its market share. This strategy is crucial for maintaining a competitive edge in the dynamic healthcare sector.

Cooper Companies cultivates deep connections with eye care and women's health professionals by offering robust education and training. These programs cover product usage, emerging technologies, and optimal clinical practices, building trust and ensuring the correct application of their advanced medical devices.

CooperVision actively engages with future professionals, exemplified by its support for student leadership societies within optometry programs. This early engagement aims to foster loyalty and provide a foundation for long-term professional relationships.

Cooper Companies prioritizes responsive and comprehensive customer service and technical support for its CooperVision and CooperSurgical brands. This commitment is crucial for addressing product inquiries, troubleshooting issues, and resolving any customer concerns promptly. In 2024, CooperCompanies reported significant investments in customer support infrastructure, aiming to enhance user experience and foster long-term loyalty.

Digital Engagement & Online Resources

Cooper Companies actively leverages digital platforms and online portals to foster robust customer relationships. These digital avenues serve as primary channels for engaging with healthcare professionals, offering streamlined ordering processes and comprehensive product information.

The company provides extensive online resources, including educational content, to enhance accessibility and support for its user base. This digital engagement strategy is crucial for maintaining strong connections and facilitating efficient interactions.

- Digital Platforms: Cooper Companies utilizes its website and dedicated online portals for customer interaction, information dissemination, and transaction facilitation.

- Online Resources: Access to product catalogs, technical specifications, ordering systems, and educational materials is readily available online, empowering users with self-service capabilities.

- Engagement Strategy: The focus is on providing value through accessible information and efficient digital tools, thereby strengthening relationships with healthcare providers.

- Accessibility & Support: Online channels ensure 24/7 access to crucial information and support, improving overall customer experience and operational efficiency.

Partnerships with Advocacy & Professional Organizations

CooperCompanies actively cultivates relationships with professional organizations and patient advocacy groups across its vision care and women's health segments. These collaborations are crucial for building trust and demonstrating a commitment to advancing healthcare standards. For instance, CooperVision's partnership with the World Council of Optometry underscores their dedication to areas like myopia management, a growing concern in eye care.

- Enhanced Credibility: Aligning with respected professional bodies bolsters CooperCompanies' reputation within the medical and scientific communities.

- Market Insights: These partnerships provide valuable feedback and insights into evolving patient needs and clinical best practices.

- Advocacy Support: Collaborating with advocacy groups helps raise awareness and support for conditions within their product portfolios.

- Myopia Management Focus: CooperVision's engagement with organizations like the World Council of Optometry highlights a strategic focus on addressing the increasing prevalence of myopia.

Cooper Companies fosters strong customer relationships through a multi-faceted approach, blending direct engagement with robust digital support. This strategy is key to their success in both the CooperSurgical and CooperVision segments.

Their direct sales teams and account managers provide tailored service and training to major healthcare clients, contributing to significant revenue growth. For example, CooperSurgical saw a 12% revenue increase in fiscal year 2023, reaching $2.1 billion, a testament to effective customer cultivation.

The company also prioritizes continuous education and responsive support, utilizing online platforms for easy access to resources and efficient problem-solving, which is vital for maintaining client loyalty in the fast-paced healthcare industry.

| Segment | Customer Relationship Strategy | Key Engagement Tactics | FY2023 Performance Indicator |

|---|---|---|---|

| CooperSurgical | Direct Sales & Account Management | Tailored service, product training, continuous support for large healthcare organizations. | 12% revenue growth to $2.1 billion. |

| CooperVision | Professional Education & Early Engagement | Clinical education, support for student leadership societies in optometry. | Strong market penetration and brand loyalty. |

| Both | Digital Platforms & Online Resources | Websites, online portals, educational content, 24/7 support access. | Enhanced user experience and operational efficiency. |

| Both | Professional & Advocacy Group Partnerships | Collaborations with organizations like the World Council of Optometry. | Increased credibility and market insights, focus on myopia management. |

Channels

Cooper Companies leverages a direct sales force to cultivate relationships and drive sales with major healthcare providers, including large hospital networks and integrated delivery systems. This hands-on approach is crucial in both their Vision and Women's Health divisions, allowing for tailored solutions and direct negotiation with high-volume clients.

In 2024, CooperCompanies’ direct sales efforts are instrumental in securing significant contracts within the competitive healthcare landscape. For instance, their Vision segment's direct engagement with optometry practices and ophthalmology clinics facilitates the adoption of their advanced contact lens technologies, contributing to their strong market presence.

Cooper Companies leverages specialized medical distributors to extend its reach. These partners are crucial for accessing a diverse customer base, including clinics, hospitals, and independent practices worldwide. Their established regional networks and logistical expertise are invaluable for efficient market penetration.

For instance, in 2024, CooperCompanies' CooperVision segment reported net sales of $3.2 billion, with a significant portion driven by its global distribution channels. These specialized distributors are key to ensuring products like their Biofinity and MyDay contact lenses reach eye care professionals effectively across numerous countries.

Optical retailers and independent optometrists are CooperVision's primary distribution partners. These professionals are key to reaching consumers directly with contact lens products. In 2024, the global contact lens market was valued at approximately $15 billion, with a significant portion of sales flowing through these established channels.

Fertility Clinics & OB/GYN Offices

CooperSurgical's direct distribution to fertility clinics and OB/GYN offices is a cornerstone of its business model, ensuring these specialized healthcare providers receive essential women's health solutions. This approach facilitates direct engagement with medical professionals who rely on CooperSurgical's innovative products for patient care.

The company's product portfolio, including devices for fertility treatments and gynecological procedures, is delivered through this direct channel. This ensures timely access to critical supplies and advanced technologies for over 1,000 fertility clinics and numerous OB/GYN practices in the United States alone.

- Direct Sales Force: CooperSurgical employs a dedicated sales team to reach and service fertility clinics and OB/GYN offices, fostering strong customer relationships.

- Product Specialization: The channel is tailored to deliver specialized medical devices and consumables crucial for women's reproductive health and fertility treatments.

- Market Access: This direct approach grants CooperSurgical significant access to the professional medical community, bypassing intermediaries for greater control and responsiveness.

- Customer Support: Direct interaction allows for enhanced technical support and training for medical staff using CooperSurgical's advanced products.

Online Platforms & E-commerce (Indirect/Informational)

Online platforms and company websites act as crucial informational channels, even if they don't directly facilitate the sale of all medical devices. For CooperCompanies, this means providing accessible data and product details to both healthcare providers and consumers. This is particularly relevant for innovative products like MiSight, where dedicated online resources can educate potential users.

CooperVision leverages its online presence to engage directly with consumers, as seen with MiSight.com. This approach allows for targeted marketing and education, building brand awareness and driving interest in their specialized contact lens offerings. In 2023, CooperCompanies reported that its Vision segment, which includes CooperVision, generated approximately $1.6 billion in revenue, highlighting the significance of their market reach.

- Informational Hubs: Websites serve as primary sources for product specifications, clinical data, and usage guidelines for healthcare professionals.

- Direct-to-Consumer Engagement: Platforms like MiSight.com enable direct communication and education for patients considering specialized contact lenses.

- Brand Building: Online presence is vital for establishing brand authority and trust in the competitive medical device market.

- Market Reach: In 2023, CooperVision's contribution to CooperCompanies' overall revenue underscored the importance of these digital channels in reaching a broad audience.

Cooper Companies utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for key accounts, specialized distributors for broader market penetration, and optical retailers/independent optometrists for direct consumer access in their Vision segment. For CooperSurgical, direct distribution to fertility clinics and OB/GYN offices is paramount, ensuring specialized products reach the intended medical professionals efficiently.

| Channel Type | Segment Focus | Key Function | 2024 Impact/Data |

| Direct Sales Force | Vision, Women's Health | Relationship building, high-volume contracts | Secured significant contracts in healthcare landscape; key for advanced contact lens adoption. |

| Specialized Distributors | Vision, Women's Health | Broad market access, logistics | Crucial for CooperVision's $3.2 billion net sales in 2024, reaching eye care professionals globally. |

| Optical Retailers/Independent Optometrists | Vision | Direct consumer access | Key channel for contact lens sales in a global market valued at ~$15 billion in 2024. |

| Direct to Clinics/Practices | Women's Health | Specialized product delivery | Essential for CooperSurgical's women's health solutions to over 1,000 fertility clinics. |

| Online Platforms/Websites | Vision | Information dissemination, brand building | Vital for educating on products like MiSight; supported CooperVision's contribution to CooperCompanies' 2023 revenue of ~$1.6 billion. |

Customer Segments

Eye care professionals, including optometrists and ophthalmologists, are the bedrock of CooperVision's customer base. These are the individuals who directly prescribe and fit contact lenses, making them indispensable to the company's success. Their purchasing decisions are heavily influenced by factors like how well a product works, how comfortable it is for patients, and the level of support they receive from CooperVision.

CooperSurgical's customer segment of Women's Health Specialists includes gynecologists, obstetricians, and fertility specialists. These medical professionals rely on CooperSurgical's advanced devices and fertility solutions to provide care in their practices and clinics.

The purchasing decisions for these specialists are heavily influenced by critical factors such as demonstrable clinical need, the potential for improved patient outcomes, and the unwavering reliability of the medical products they employ. For instance, CooperCompanies reported its Surgical segment revenue reached $1.7 billion in fiscal year 2023, highlighting the significant market for these specialized products.

Hospitals and ambulatory surgery centers are key institutional buyers for CooperSurgical's medical devices. These facilities utilize Cooper's products for a range of surgical procedures and women's health treatments. Their procurement decisions are significantly shaped by factors such as established purchasing protocols, the overall cost-effectiveness of the devices, and how seamlessly they integrate with their current medical equipment and workflows.

Patients/Consumers (Indirectly)

While Cooper Companies' products are primarily sold to healthcare providers, the ultimate beneficiaries are patients and consumers who rely on these solutions for vision correction and women's health. These individuals' desire for comfort, efficacy, and safety in their treatments directly influences the market demand for Cooper's offerings. For instance, in 2024, the global contact lens market, a key segment for Cooper, was projected to reach approximately $13.8 billion, driven by increasing adoption and consumer preference for advanced lens technologies.

Cooper Companies' mission is to enable people to live their lives to the fullest, experiencing important moments without limitations. This focus on patient well-being and quality of life is central to their business model. Their commitment is reflected in the continuous innovation within their Vision and Women's Health segments, aiming to provide solutions that enhance daily living and reproductive health outcomes.

The indirect influence of patients and consumers is significant, shaping product development and market strategies. Their experiences and feedback, often channeled through healthcare professionals, guide Cooper's efforts to improve product performance and user satisfaction. This customer-centric approach, even when indirect, underpins the success of Cooper's specialized healthcare products.

- Patient Needs Drive Demand: Consumers seeking better vision or improved women's health solutions directly influence product innovation and sales volume.

- Market Growth Indicators: The contact lens market, a core area for Cooper, was estimated to grow significantly in 2024, indicating strong consumer demand for vision correction products.

- Focus on Quality of Life: Cooper's aim to help people experience life's moments underscores the importance of patient outcomes in their business strategy.

- Indirect Customer Feedback: While sales are B2B, patient satisfaction and reported benefits indirectly shape Cooper's product development and marketing.

Research Institutions & Academic Centers

Research institutions and academic centers represent a crucial customer segment for Cooper Companies, utilizing their medical devices and diagnostic tools for both cutting-edge research and educational purposes. These collaborations are vital for validating new technologies and informing the development pipeline, as seen in numerous studies leveraging Cooper's ophthalmic solutions. For instance, academic partnerships have historically been instrumental in advancing contact lens material science and understanding ocular health trends.

These institutions often engage in extensive clinical trials and research projects, providing valuable feedback and data that can shape future product iterations and market strategies. Cooper Companies actively supports academic endeavors, fostering an environment where scientific inquiry can directly translate into improved patient care and innovative product offerings. This symbiotic relationship ensures Cooper remains at the forefront of medical advancements.

- Academic Partnerships: Universities and research facilities purchase Cooper's products for scientific investigation and educational programs.

- Product Development Influence: Collaborations with these centers drive innovation and adoption of new medical technologies.

- Data Generation: Research institutions contribute valuable data through clinical trials, aiding product refinement.

- Knowledge Dissemination: Academic use of Cooper's products helps educate future healthcare professionals on their application.

Cooper Companies serves distinct customer segments across its Vision and Surgical segments. Eye care professionals, including optometrists and ophthalmologists, are primary customers for CooperVision, influencing patient adoption based on product performance and comfort. For CooperSurgical, women's health specialists like gynecologists and fertility experts are key, prioritizing clinical need and improved patient outcomes. Hospitals and surgery centers also form a significant B2B customer base for surgical devices, with purchasing driven by cost-effectiveness and integration ease.

While sales are primarily business-to-business, the ultimate consumers—patients seeking vision correction or improved women's health—indirectly shape Cooper's market. Their demand for efficacy, safety, and comfort drives product development and market trends. Research institutions and academic centers are also vital, using Cooper's products for research and education, which in turn influences future product innovation and adoption.

| Customer Segment | Primary Focus | Key Influences on Purchasing | 2023/2024 Relevance |

|---|---|---|---|

| Eye Care Professionals | Contact Lens Prescribers | Product efficacy, patient comfort, company support | CooperVision's core; Contact lens market projected ~$13.8 billion in 2024 |

| Women's Health Specialists | Providers of Fertility & Surgical Care | Clinical need, patient outcomes, product reliability | CooperSurgical segment revenue $1.7 billion in FY2023 |

| Hospitals & Surgery Centers | Institutional Buyers of Medical Devices | Purchasing protocols, cost-effectiveness, workflow integration | Key B2B channel for CooperSurgical products |

| Patients & Consumers | End-Users of Vision & Health Solutions | Comfort, efficacy, safety, quality of life | Indirectly drive demand and product innovation |

| Research Institutions | Users for Research & Education | Product utility in trials, data generation, academic validation | Crucial for validating new technologies and informing R&D |

Cost Structure

CooperCompanies dedicates substantial resources to Research & Development, recognizing it as a core driver of its competitive advantage. These significant investments, which encompass clinical trials, the development of new products, and ongoing scientific research within both its vision care and women's health segments, are essential for introducing innovative solutions to the market.

For the fiscal year 2023, CooperCompanies reported R&D expenses of $254.5 million. This figure underscores the company's commitment to advancing its product lines and maintaining a strong pipeline of innovations, crucial for both market share and long-term growth.

CooperCompanies' manufacturing and production costs are significant, encompassing raw materials, skilled labor, factory overhead, and rigorous quality control for their contact lenses and medical devices. For instance, in fiscal year 2023, the company reported cost of goods sold at $1.29 billion, reflecting these substantial production expenses.

The company actively pursues efficiency gains within its global manufacturing operations to manage these costs effectively. These efforts are crucial for maintaining competitiveness in the highly regulated medical device and contact lens markets.

Cooper Companies' Sales, General & Administrative (SG&A) expenses encompass vital functions like marketing, sales team compensation, and administrative salaries, alongside corporate overhead. For the fiscal year 2023, Cooper Companies reported SG&A expenses of $1.07 billion. Efficiently managing these costs is crucial for profitability, with the company aiming for targeted expense leverage.

Distribution & Logistics Costs

CooperCompanies incurs significant expenses in warehousing, transporting, and managing its global supply chain to get its diverse product lines, from contact lenses to medical devices, to customers worldwide. Efficiently handling these distribution and logistics costs is crucial for maintaining profitability and competitive pricing in the healthcare sector.

For fiscal year 2023, CooperCompanies reported total operating expenses of $2.9 billion. While specific breakdowns for distribution and logistics aren't always separately itemized in summary reports, these costs are a substantial component within the broader cost of goods sold and selling, general, and administrative expenses.

- Warehousing: Costs associated with maintaining inventory in strategically located distribution centers globally.

- Transportation: Expenses for shipping finished goods to distributors, healthcare providers, and end-users, including freight and associated duties.

- Supply Chain Management: Investments in technology and personnel to optimize inventory levels, track shipments, and ensure timely delivery across international borders.

- Returns and Reverse Logistics: Managing the cost of product returns, repairs, and disposal, which is particularly relevant in the medical device sector.

Acquisition & Integration Costs

CooperCompanies incurs significant costs in its growth strategy, particularly related to acquisition and integration. These expenses are crucial for expanding its product portfolio and market reach through strategic mergers and acquisitions.

These costs encompass a range of activities, from the initial identification and due diligence of potential targets to the complex process of integrating acquired businesses and their product lines. Legal fees and advisory services are substantial components of this structure.

- Acquisition Costs: Expenses related to identifying, evaluating, and closing deals for new businesses.

- Integration Costs: Expenses for merging acquired entities, including systems, personnel, and operational alignment.

- Due Diligence: Costs incurred for thorough investigation of potential acquisition targets.

- Legal and Advisory Fees: Payments to legal counsel and financial advisors throughout the M&A process.

CooperCompanies' cost structure is heavily influenced by its substantial investments in research and development, amounting to $254.5 million in fiscal year 2023. Manufacturing and production expenses are also significant, with the cost of goods sold reaching $1.29 billion in the same period. Furthermore, Sales, General, and Administrative (SG&A) costs were $1.07 billion for fiscal year 2023, reflecting the broad operational needs of the company.

| Cost Category | FY 2023 (Millions USD) |

| Research & Development | $254.5 |

| Cost of Goods Sold | $1,290.0 |

| Sales, General & Administrative (SG&A) | $1,070.0 |

| Total Operating Expenses (Approximate) | $2,900.0 |

Revenue Streams

CooperVision's main way of making money is by selling a lot of different soft contact lenses. These lenses help people see better, whether they need daily disposables, monthly replacements, or special lenses for things like astigmatism or presbyopia. In the second quarter of 2025, CooperVision brought in $669.6 million from these sales.

CooperSurgical's primary revenue stream comes from selling a wide array of medical devices focused on women's health. This includes everything from surgical tools used in procedures to everyday products found in doctor's offices.

The company experienced a significant boost in this area, with revenue climbing 8% to reach $332.7 million in the second quarter of 2025. This growth highlights the strong demand for CooperSurgical's offerings in the women's healthcare market.

CooperSurgical's revenue is significantly boosted by its fertility solutions and services. This includes essential products like IVF media, crucial for in-vitro fertilization procedures, and advanced genetic testing services that aid in reproductive health decisions. The company also generates income from cryostorage services, preserving valuable biological materials for future use.

This segment represents a vital growth engine for CooperSurgical. For instance, in fiscal year 2023, Cooper Companies reported total revenue of $3.1 billion, with their Vision and Surgical segments, which includes fertility solutions, showing robust performance. The fertility market itself is expanding, driven by increasing awareness and demand for assisted reproductive technologies.

Licensing & Royalty Agreements

While Cooper Companies doesn't prominently feature licensing and royalty agreements as a primary driver, these channels can still generate revenue, especially given their significant presence in the medical device sector and their substantial intellectual property portfolio. This can involve allowing other companies to utilize their patented technologies or designs in exchange for ongoing payments.

For instance, in the medical device industry, where innovation is key, licensing agreements can unlock new markets or applications for existing technologies. CooperCompanies' focus on areas like contact lenses and reproductive health likely holds opportunities for such arrangements. While specific figures for licensing revenue are not typically broken out in their main financial reports, it’s a common practice for companies with strong R&D to leverage their IP through these agreements.

- Potential for Licensing: CooperCompanies' extensive patent portfolio, particularly in advanced contact lens materials and manufacturing processes, presents opportunities for licensing to other manufacturers or in different geographical markets.

- Royalty Income: Partnerships or collaborations in developing new medical technologies or diagnostic tools could result in royalty payments based on the sales or usage of those jointly developed products.

- Intellectual Property Monetization: Beyond direct product sales, licensing proprietary technologies allows CooperCompanies to monetize their R&D investments without necessarily engaging in direct manufacturing or distribution for every application.

Service & Support Fees

Cooper Companies generates revenue from service and support fees, particularly through its CooperSurgical division. This includes offerings like cryostorage services, which provide a recurring revenue stream.

Additionally, extended service agreements for specialized medical equipment contribute to this revenue category. These agreements ensure ongoing maintenance and support, fostering customer loyalty and predictable income.

- Cryostorage Services: CooperSurgical offers specialized services for storing biological samples, creating a consistent revenue source.

- Extended Service Agreements: Fees from maintenance and support contracts for medical devices add to service revenue.

- Customer Retention: These services enhance customer relationships and encourage repeat business.

Cooper Companies' revenue streams are primarily driven by the sale of contact lenses through CooperVision and a diverse range of medical devices and fertility solutions via CooperSurgical. In the second quarter of 2025, CooperVision's sales reached $669.6 million, underscoring the strong demand for their optical products. CooperSurgical also saw significant growth, with revenue climbing 8% to $332.7 million in the same period, fueled by its comprehensive offerings in women's health and reproductive technologies.

| Revenue Stream | Description | Q2 2025 Revenue |

|---|---|---|

| Contact Lenses | Sale of various soft contact lenses (daily, monthly, specialty) | $669.6 million |

| Women's Health Medical Devices | Surgical tools, diagnostic equipment, and everyday products for women's healthcare | $332.7 million (CooperSurgical segment) |

| Fertility Solutions & Services | IVF media, genetic testing, cryostorage services | Included within CooperSurgical segment performance |

| Service & Support Fees | Cryostorage, extended service agreements for medical equipment | Contributes to overall CooperSurgical revenue |

Business Model Canvas Data Sources

The Cooper Companies Business Model Canvas is informed by a combination of internal financial reports, market intelligence from industry analysts, and public company filings. These diverse sources ensure a comprehensive understanding of the company's operations, customer base, and competitive landscape.