Constellium SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellium Bundle

Constellium's position in the aluminum industry is marked by significant strengths in advanced materials and a broad product portfolio, but also faces challenges from intense competition and raw material price volatility. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex market.

Want the full story behind Constellium’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Constellium stands as a global frontrunner in specialized aluminum products, with a significant presence in high-growth sectors like aerospace and automotive. This broad market reach, encompassing everything from aircraft components to vehicle lightweighting solutions, provides substantial revenue diversification and resilience against sector-specific downturns. For instance, in 2023, the automotive segment represented a significant portion of their sales, showcasing their strong position in this evolving industry.

Constellium’s dedication to innovation is a core strength, evident in its continuous development of advanced aluminum alloys. These cutting-edge materials are designed to meet critical industry demands for lightweighting, superior performance, and enhanced sustainability. For instance, their specialized alloys are crucial for the automotive sector, particularly in electric vehicles where weight reduction directly impacts range and efficiency.

This focus on R&D translates into tangible market advantages. Constellium’s commitment to creating customized solutions allows them to cater to specific client requirements, fostering strong customer relationships. Their advanced product portfolio, including materials optimized for increased recyclability, positions them favorably in markets increasingly driven by environmental consciousness and regulatory pressures.

Constellium stands out as a frontrunner in sustainable aluminum, championing a circular economy with robust recycling infrastructure. Their commitment is evident in their 2024 Sustainability Report, detailing advancements like the closure of a coal-fired power station and the development of hydrogen casting technology. This focus not only bolsters their environmental credentials but also taps into the increasing market appetite for eco-friendly materials.

Solid Financial Performance and Future Guidance

Constellium has showcased robust financial health, reporting a notable increase in revenue and adjusted EBITDA for the first half of 2025. This strong performance allowed the company to revise its full-year 2025 guidance upwards, signaling confidence in its ongoing operations and market position.

Furthermore, Constellium maintains ambitious long-term financial targets set for 2028, underscoring a clear and positive trajectory for sustained growth and financial stability. This forward-looking perspective is a key strength, reassuring investors and stakeholders about the company's future prospects.

- Increased Revenue and Adjusted EBITDA: First half of 2025 saw significant financial gains.

- Raised Full-Year Guidance: Company improved its 2025 financial outlook.

- Confident Long-Term Targets: 2028 financial goals demonstrate a strong growth strategy.

Strategic Investments in Recycling Capacity

Constellium's strategic investments in recycling capacity are a significant strength. The inauguration of its €130 million facility in Neuf-Brisach in September 2024 is a prime example, boosting its annual global recycling capacity. This expansion is crucial for meeting growing demand for recycled aluminum.

This enhanced recycling capability directly supports Constellium's commitment to sustainability and circular economy principles. By increasing its capacity to process automotive and packaging scrap, the company is better positioned to offer products with higher recycled content, a key differentiator in today's market.

- Increased Recycling Capacity: The Neuf-Brisach facility alone adds substantial capacity, reinforcing Constellium's position as a leader in aluminum recycling.

- Reduced Carbon Footprint: Greater recycling directly translates to lower energy consumption and reduced greenhouse gas emissions compared to primary aluminum production.

- Closed-Loop Capabilities: These investments strengthen Constellium's ability to manage the entire recycling lifecycle, from collection to new product manufacturing.

Constellium's market leadership in specialized aluminum products, particularly for the aerospace and automotive sectors, provides significant revenue diversification. Their strong position in the automotive industry, a key growth area, was highlighted by its substantial sales contribution in 2023.

Innovation in advanced aluminum alloys is a core strength, enabling lightweighting and performance enhancements crucial for sectors like electric vehicles. This R&D focus allows for customized solutions, fostering strong client relationships and meeting the growing demand for sustainable materials.

The company's robust financial performance, with increased revenue and adjusted EBITDA in the first half of 2025, led to an upward revision of its full-year guidance. This financial strength is further underscored by ambitious 2028 targets, demonstrating a clear path for sustained growth.

Constellium's strategic expansion of its recycling capacity, exemplified by the €130 million Neuf-Brisach facility opened in September 2024, significantly boosts its global recycling capabilities. This investment enhances its ability to process scrap, supporting its sustainability goals and offering products with higher recycled content.

| Metric | 2023 (Actual) | H1 2025 (Actual) | 2025 (Guidance) |

|---|---|---|---|

| Revenue | €6.5 billion | €3.3 billion | €6.6 - €6.8 billion |

| Adjusted EBITDA | €850 million | €480 million | €950 - €1,000 million |

| Recycling Capacity (Annual Global) | ~1.5 million tonnes | ~1.7 million tonnes (post-Neuf-Brisach) | N/A |

What is included in the product

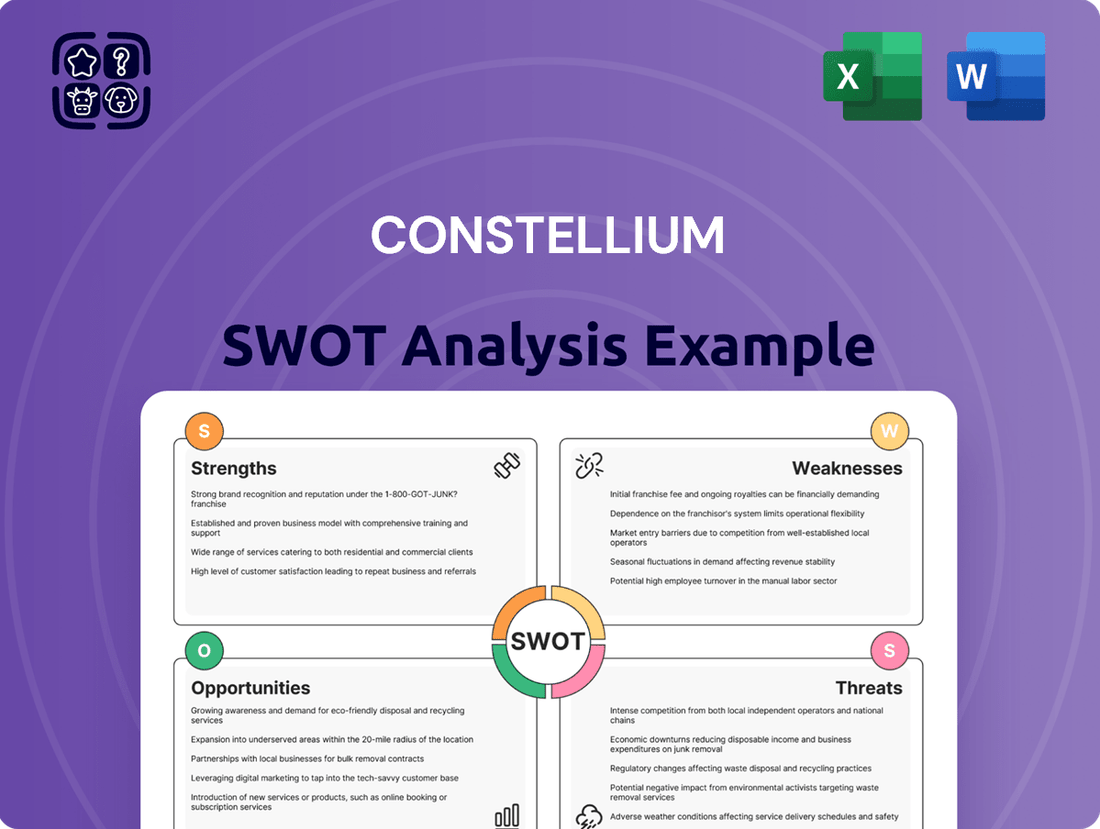

Delivers a strategic overview of Constellium’s internal strengths and weaknesses alongside external market opportunities and threats.

Identifies key market vulnerabilities and competitive advantages for targeted risk mitigation and opportunity maximization.

Weaknesses

Constellium's financial performance is vulnerable to fluctuations in metal prices, specifically the non-cash impact of metal price lag. This lag can directly impact Adjusted EBITDA, creating a degree of unpredictability in profitability that is not tied to the company's operational efficiency.

For example, in the second quarter of 2025, Constellium reported a negative non-cash metal price lag impact of $13 million. This figure underscores the potential for external market forces to significantly influence reported earnings, even when underlying business operations are stable.

Constellium's financial health is closely tied to the ups and downs of its key customer industries. While the packaging sector has shown resilience, other crucial areas like aerospace, transportation, and automotive components faced headwinds. For instance, in the second quarter of 2025, the company reported reduced shipments and a dip in EBITDA for its Aerospace & Transportation and Automotive Structures & Industry segments, highlighting a vulnerability to shifts in these specific end-market demands.

Constellium has experienced significant operational challenges due to external events. For instance, severe flooding in the Valais region of Switzerland during October 2024 directly impacted its Sierre and Chippis facilities. This disruption contributed to a notable decrease in EBITDA for both the A&T and AS&I segments in the first quarter of 2025, highlighting the vulnerability of its operations to unforeseen environmental circumstances.

Leverage Ratio Above Target Range

Constellium's leverage ratio is a concern, currently sitting at 3.6x as of June 30, 2025. This figure is notably above their stated target range of 1.5x to 2.5x. While management anticipates a downward trend, this elevated leverage can restrict the company's ability to maneuver financially and pursue new growth avenues.

The higher leverage ratio presents increased financial risk. It may limit Constellium's operating flexibility, potentially hindering its capacity to respond to market shifts or capitalize on emerging opportunities. This situation could also make it more challenging to secure favorable financing terms in the future.

- Leverage Ratio: 3.6x (as of June 30, 2025)

- Target Range: 1.5x to 2.5x

- Implication: Limited operating flexibility and increased financial risk

- Outlook: Expected to trend downwards, but current level poses challenges

Impact of Tariffs and Trade Tensions

Tariffs and ongoing trade tensions introduce significant uncertainty across Constellium's key markets, especially the automotive sector. These geopolitical dynamics can directly impact raw material costs, finished product pricing, and the stability of global supply chains, making consistent financial performance more challenging.

For instance, the automotive industry, a major consumer of Constellium's aluminum products, is particularly sensitive to trade disputes. Fluctuations in import/export duties can alter the cost-competitiveness of aluminum components, potentially leading to shifts in demand and affecting Constellium's order books and profitability.

- Automotive Sector Vulnerability: The automotive industry, a significant end-market for Constellium, faces heightened risk due to trade policy shifts.

- Supply Chain Disruptions: Tariffs can disrupt the flow of raw materials and finished goods, increasing logistical costs and lead times.

- Pricing Volatility: Geopolitical factors contribute to price volatility for aluminum, impacting Constellium's revenue and margins.

- Market Uncertainty: The unpredictable nature of trade negotiations creates a challenging environment for forecasting demand and managing inventory.

Constellium's reliance on specific customer industries like aerospace and automotive exposes it to cyclical downturns and shifts in demand. For example, a slowdown in aircraft production or automotive sales directly impacts Constellium's order volumes and revenue streams.

The company's high leverage ratio, standing at 3.6x as of June 30, 2025, exceeding its target range of 1.5x to 2.5x, limits financial flexibility. This elevated debt level increases financial risk and could hinder the company's ability to invest in growth or navigate economic uncertainties.

External factors such as tariffs and trade tensions create significant market uncertainty, particularly for the automotive sector. These geopolitical issues can disrupt supply chains, affect raw material costs, and introduce price volatility for aluminum products, impacting Constellium's profitability.

Operational disruptions, like the October 2024 flooding impacting its Swiss facilities, highlight Constellium's vulnerability to unforeseen environmental events. Such incidents can lead to reduced production and negatively affect segment EBITDA, as seen in Q1 2025 for its A&T and AS&I segments.

Full Version Awaits

Constellium SWOT Analysis

This is the actual Constellium SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It covers key internal strengths and weaknesses, alongside external opportunities and threats impacting the company. This comprehensive view will equip you with actionable insights.

Opportunities

The automotive industry's push for lighter vehicles to boost fuel efficiency and cut emissions is a major tailwind for Constellium. Aluminum's role in this lightweighting trend, especially with the surge in electric vehicles (EVs), is undeniable. For instance, by 2025, it's anticipated that the average EV will use significantly more aluminum than its internal combustion engine counterpart, driving substantial demand for Constellium's advanced alloys.

The aerospace sector is experiencing robust growth, fueled by an anticipated 4.3% compound annual growth rate (CAGR) in global air traffic through 2042. This surge in travel necessitates new, fuel-efficient aircraft, creating a significant demand for advanced materials like those Constellium provides.

Constellium is well-positioned to benefit from this expansion, leveraging its status as a key supplier of high-performance aluminum alloys to major aerospace manufacturers. The company's products are crucial for both commercial and military aircraft, as well as emerging space exploration initiatives, directly aligning with market needs for lighter, stronger, and more sustainable components.

The growing global demand for sustainable products and circular economy principles presents a significant opportunity for Constellium. As aluminum is highly recyclable, the company can leverage this by expanding its recycling infrastructure and increasing the percentage of recycled content in its offerings. This strategic move directly addresses customer sustainability objectives, enhancing Constellium's market appeal in an increasingly environmentally aware landscape.

Technological Advancements in Aluminum Production

Constellium stands to gain significantly from ongoing technological advancements in aluminum production. Investments in areas like Laser-Induced Breakdown Spectroscopy (LIBS) for precise automotive aluminum scrap sorting offer a pathway to enhanced material recovery and purity. Furthermore, the development of industrial-scale hydrogen casting technologies presents an opportunity to drastically reduce the carbon footprint associated with aluminum production, aligning with growing sustainability demands.

These innovations translate into tangible benefits for Constellium:

- Improved Efficiency: Advanced sorting and casting methods can streamline production processes, leading to higher yields and lower operational costs.

- Reduced Carbon Emissions: Technologies like hydrogen casting directly address environmental concerns, potentially lowering Constellium's Scope 1 and 2 emissions. For context, the aluminum industry's energy intensity is a significant factor, and innovations here are critical.

- Enhanced Product Development: The ability to produce higher-quality, more sustainably produced aluminum alloys can open doors to new markets and applications, particularly in the automotive and aerospace sectors where lightweighting and environmental performance are paramount.

Strategic Partnerships and Collaborations

Constellium can forge strategic partnerships with major automotive manufacturers to co-develop advanced aluminum solutions for next-generation vehicles, potentially increasing its share in the growing lightweighting market. For instance, in 2024, the automotive industry continued its push for lighter materials, with many OEMs setting ambitious targets for EV battery casing and body-in-white weight reduction. Collaborating with recycling specialists, such as those involved in closed-loop aluminum recycling programs, can bolster Constellium's sustainability credentials and secure a stable supply of high-quality recycled aluminum, a key factor for environmentally conscious customers.

Engaging with research institutions and universities in 2024 and 2025 will allow Constellium to tap into cutting-edge material science and accelerate the development of novel aluminum alloys and applications, such as advanced high-strength steels replacements. These collaborations can lead to enhanced product offerings, like specialized aluminum alloys for aerospace or demanding industrial applications, thereby expanding Constellium's market penetration into higher-value segments.

- Automotive Co-Development: Partnering with leading carmakers to integrate advanced aluminum alloys into new EV platforms, aiming to reduce vehicle weight by up to 20% in specific components.

- Recycling Infrastructure Investment: Collaborating on projects to enhance aluminum scrap sorting and reprocessing technologies, increasing the availability of high-purity recycled content for production.

- Research & Innovation Alliances: Joint research programs with universities focusing on additive manufacturing of aluminum and novel alloy compositions for improved performance characteristics.

- Market Access Expansion: Strategic alliances with distributors or end-users in emerging markets or specialized industrial sectors to broaden the reach of Constellium's product portfolio.

Constellium's strategic focus on lightweighting in the automotive sector, particularly for electric vehicles, presents a substantial growth avenue, with projections indicating increased aluminum usage per EV by 2025. The aerospace industry's expansion, driven by a projected 4.3% CAGR in global air traffic through 2042, creates sustained demand for Constellium's advanced alloys. Furthermore, the company's commitment to sustainability and the circular economy, leveraging aluminum's recyclability, aligns with growing market preferences and regulatory trends.

Technological advancements in production, such as hydrogen casting and improved scrap sorting, offer pathways to enhanced efficiency and reduced environmental impact. These innovations are critical for meeting the evolving demands of key industries and strengthening Constellium's competitive position. Strategic partnerships with automotive manufacturers and research institutions are also key to co-developing next-generation materials and expanding market reach into high-value segments.

| Opportunity Area | Key Drivers | Constellium's Role | Market Potential (Illustrative) |

|---|---|---|---|

| Automotive Lightweighting (EVs) | Fuel efficiency, emissions reduction, EV growth | Supplying advanced aluminum alloys for body structures, battery casings | Significant increase in aluminum content per EV by 2025 |

| Aerospace Sector Growth | Increased air travel demand, fuel efficiency mandates | Providing high-performance alloys for aircraft structures | 4.3% CAGR in global air traffic (by 2042) |

| Sustainability & Circular Economy | Environmental regulations, consumer demand for recycled content | Expanding recycling infrastructure, increasing recycled aluminum content | Growing preference for sustainable materials |

| Technological Innovation | Production efficiency, carbon footprint reduction | Investing in hydrogen casting, advanced scrap sorting (LIBS) | Lower operational costs, enhanced product quality |

| Strategic Partnerships | Co-development of advanced materials, market access | Collaborating with OEMs, research institutions, recycling specialists | Accelerated product development, expanded market penetration |

Threats

The aluminum industry, including Constellium, grapples with volatile raw material prices, particularly for alumina. For instance, LME alumina prices saw significant swings in late 2023 and early 2024, impacting production costs. These price fluctuations, coupled with potential supply chain disruptions, can directly affect Constellium's material expenses and necessitate adjustments to its production and pricing strategies to maintain profitability.

The global aluminum industry is marked by fierce competition, with a multitude of companies actively seeking to expand their market presence. This intense rivalry can exert downward pressure on aluminum prices and Constellium's profit margins, necessitating ongoing innovation and stringent cost control to maintain a competitive edge.

In 2024, the World Bureau of Metal Statistics reported a global primary aluminum production of approximately 69.5 million metric tons, underscoring the sheer volume and the number of participants in this market. Constellium must therefore focus on differentiating its product offerings and optimizing its operational efficiencies to navigate this challenging landscape.

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, alongside trade disputes, pose significant risks to Constellium. These issues can lead to the imposition of tariffs and other trade barriers, directly impacting the cost of raw materials and the accessibility of key markets.

For instance, the imposition of tariffs on aluminum or related components could increase Constellium's production costs, potentially squeezing profit margins. Furthermore, disruptions in global supply chains due to these tensions can create uncertainty, affecting sales volumes and the company's ability to meet demand in its diverse end markets, including automotive and aerospace.

Economic Downturns and Reduced Industrial Activity

Economic downturns pose a significant threat to Constellium. A general slowdown in the global economy, particularly impacting key sectors like automotive and aerospace, can directly translate to decreased demand for aluminum products. This reduction in demand can lead to lower shipment volumes, which, in turn, negatively affects Constellium's revenue and overall profitability.

For instance, a projected slowdown in global GDP growth for 2024, estimated by the IMF to be around 3.1%, could dampen industrial activity. Similarly, if the automotive sector, a major consumer of Constellium's offerings, experiences a contraction in production, this directly impacts Constellium's sales pipeline. The aerospace industry, while often more resilient, is also not immune to broader economic pressures that could affect aircraft orders and, consequently, demand for specialized aluminum alloys.

- Reduced Demand: Economic slowdowns directly decrease the need for aluminum in manufacturing, particularly in the automotive and aerospace sectors.

- Lower Shipments: A drop in demand leads to fewer products being shipped, impacting Constellium's top-line revenue.

- Profitability Squeeze: Reduced sales volumes coupled with potential price pressures during economic contractions can significantly erode profit margins.

High Energy Costs for Production

High energy costs present a significant challenge for Constellium's production processes. Electricity availability and pricing are particularly critical for aluminum production, even for companies like Constellium that emphasize recycling. For instance, in early 2024, European electricity prices remained volatile, with some industrial consumers facing rates significantly above historical averages, impacting the cost of smelting and remelting aluminum. This could directly affect Constellium's overall cost structure and its ability to compete effectively in the global market.

The impact of elevated energy expenses can be felt across Constellium's diverse operations. While recycling is a core focus, the energy required for melting, casting, and further processing still represents a substantial portion of operational expenditure. Constellium's 2023 financial reports indicated that energy costs were a key factor influencing their cost of goods sold. Fluctuations in natural gas and electricity prices, influenced by geopolitical events and supply chain disruptions, directly translate into higher production costs, potentially squeezing profit margins.

These elevated energy costs can act as a considerable headwind, impacting Constellium's competitiveness. For primary aluminum production, energy can account for as much as 30-40% of total production costs. While Constellium's recycling efforts mitigate some of this, the energy intensity of the aluminum value chain means that sustained high energy prices can erode competitive advantages, especially when compared to regions with lower energy costs. This necessitates continuous efforts to improve energy efficiency and explore alternative, more stable energy sources.

Constellium faces significant threats from increasing regulatory scrutiny and the potential for stricter environmental standards, especially concerning carbon emissions and waste management. For example, the European Union's ongoing efforts to implement more rigorous climate policies, such as the Carbon Border Adjustment Mechanism (CBAM), could increase costs for imported materials or necessitate further investment in decarbonization technologies. Non-compliance or the need for rapid adaptation to new regulations can lead to substantial financial penalties and operational disruptions.

The company is also vulnerable to technological obsolescence and the need for continuous innovation. Failure to keep pace with advancements in aluminum processing, alloy development, or sustainable manufacturing practices could lead to a loss of market share to more agile competitors. For instance, the rapid development of lighter, stronger materials in the automotive sector, such as advanced composites, presents an alternative that could displace aluminum in certain applications if Constellium does not innovate its product portfolio effectively.

Cybersecurity risks are an ever-present threat, with potential for data breaches or disruptions to operational technology systems. A successful cyberattack could compromise sensitive customer data, intellectual property, or disrupt production lines, leading to significant financial losses and reputational damage. The increasing reliance on digital systems across manufacturing and supply chain management amplifies this vulnerability.

SWOT Analysis Data Sources

This Constellium SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial filings, detailed market research reports, and insights from industry experts. We also incorporate information from reputable trade publications and economic forecasts to ensure a well-rounded and accurate assessment.