Constellium PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellium Bundle

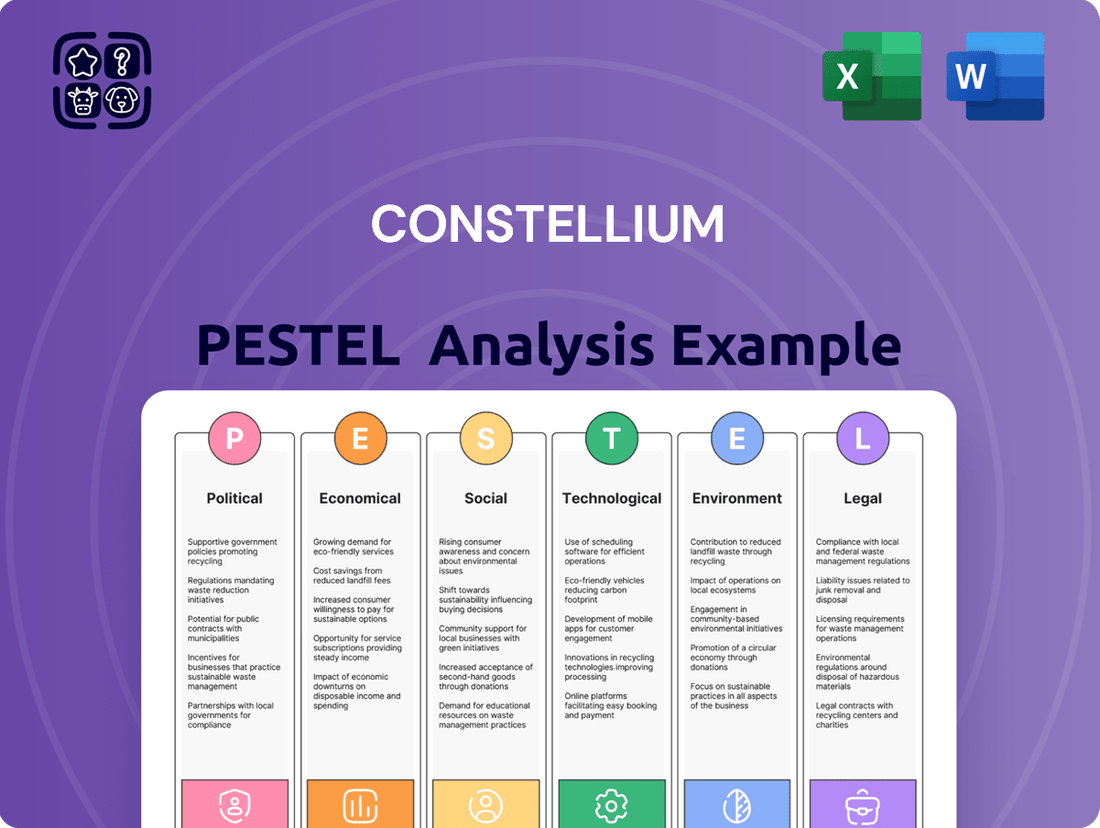

Navigate the complex external forces shaping Constellium's future with our comprehensive PESTEL Analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social trends are impacting the aluminum industry leader. Gain a strategic advantage by leveraging these critical insights to inform your own business planning and investment decisions. Download the full, ready-to-use analysis today to unlock actionable intelligence and stay ahead of the curve.

Political factors

Global trade policies, especially those concerning aluminum, are a significant factor for Constellium. Changes in tariffs and protectionist measures can directly affect the cost of raw materials and the competitiveness of its products in various markets.

For example, the US decision to impose a 50% Section 232 tariff on Canadian aluminum imports starting in June 2025 creates a volatile trade landscape. This move increases costs for US-based manufacturers and consumers, impacting Constellium's North American business and potentially shifting demand patterns for its aluminum products.

Government policies actively promoting lightweighting in the automotive and aerospace industries are a significant tailwind for Constellium. For instance, the European Union's CO2 emission standards for new passenger cars, which aim for an average of 95 g/km by 2025 and further reductions by 2030, directly encourage the use of lighter materials like aluminum alloys. These regulations, coupled with incentives for sustainable manufacturing and enhanced recycling infrastructure, create a more favorable market environment for Constellium's advanced aluminum solutions.

Political instability in regions crucial for sourcing raw materials or manufacturing can significantly disrupt Constellium's operations, impacting its ability to secure essential inputs like bauxite and alumina. For instance, the ongoing geopolitical tensions in Eastern Europe and parts of Africa, where significant mining and processing activities occur, pose a persistent risk to global aluminum supply chains.

Governments worldwide are increasingly prioritizing the security of critical material supply chains, including aluminum, which is vital for sectors like aerospace and automotive. This focus can lead to policies that encourage domestic production and investment, potentially creating favorable conditions for companies like Constellium to forge strategic partnerships and expand their presence in stable, supportive markets. In 2024, several European nations announced initiatives to bolster their industrial base, which could include support for aluminum production and processing.

Regulatory Environment for Industrial Emissions

The regulatory landscape for industrial emissions, particularly in Europe, presents a significant factor for Constellium. The EU's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, directly impacts the cost of imported goods based on their embedded carbon emissions. This mechanism is designed to level the playing field for European industries that already adhere to stricter emissions standards.

For Constellium, this translates to potential adjustments in its operational costs and competitiveness, especially for its European manufacturing sites. As an aluminum producer, the energy-intensive nature of its processes means that carbon pricing, whether through CBAM or other regional initiatives, will be a key consideration in its financial planning and strategic decisions. The CBAM's phased implementation allows for a gradual adaptation, but its long-term implications for global trade in aluminum are substantial.

- CBAM Transitional Phase: Began October 2023, impacting imported goods based on carbon content.

- Impact on Aluminum: Directly affects energy-intensive industries like aluminum production.

- Competitiveness Factor: Aims to ensure fair competition between EU producers and imports.

- Operational Costs: Potential for increased costs for Constellium's European facilities depending on emissions intensity.

Government Investment in Infrastructure

Government investment in key sectors like aerospace, defense, and transportation infrastructure directly boosts demand for advanced aluminum products. For instance, the US Department of Transportation's Bipartisan Infrastructure Law, enacted in 2021, allocates over $1 trillion towards upgrading roads, bridges, public transit, and airports, creating significant opportunities for materials like those Constellium produces. This increased spending translates into a need for lightweight, durable aluminum components in new aircraft, modernizing vehicle fleets, and expanding public transportation networks.

These initiatives are crucial for Constellium as they represent a tangible increase in potential orders. Consider the aerospace sector, where governments are funding next-generation aircraft development and military procurement. For example, the US Air Force's continued investment in its bomber and fighter jet programs, coupled with global defense spending increases, as seen in NATO members raising defense budgets towards 2% of GDP, directly benefits suppliers of high-performance aluminum alloys. Similarly, the push for electric vehicles and improved public transit systems, supported by government incentives and infrastructure projects worldwide, further solidifies the demand for Constellium’s specialized aluminum solutions.

- Increased demand for aerospace aluminum: Governments worldwide are investing heavily in defense and commercial aviation modernization, driving orders for advanced aluminum alloys used in aircraft manufacturing.

- Transportation infrastructure projects: Significant government funding for new trains, light rail systems, and electric vehicle charging infrastructure creates a substantial market for aluminum components.

- Defense spending growth: Rising global defense budgets translate into increased demand for military vehicles and aircraft, all of which utilize high-strength aluminum alloys.

- Focus on sustainability: Government mandates and incentives promoting lightweight materials for fuel efficiency in transportation further support the use of aluminum.

Government policies promoting lightweight materials for fuel efficiency and emissions reduction, particularly in the automotive and aerospace sectors, are a significant driver for Constellium. For instance, the EU's stringent CO2 emission targets for new cars, aiming for an average of 95 g/km by 2025 and further reductions by 2030, directly encourage the adoption of aluminum alloys.

Trade policies and tariffs, such as the US Section 232 tariffs on Canadian aluminum imports implemented in June 2025, create market volatility and impact raw material costs and product competitiveness. These measures can alter supply chains and influence demand for Constellium's products in key regions.

Increased government investment in infrastructure, defense, and transportation, like the US Bipartisan Infrastructure Law allocating over $1 trillion, boosts demand for advanced aluminum components in aircraft, vehicles, and public transit systems. This directly translates into growth opportunities for Constellium.

The EU's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, will affect the cost of imported goods based on their carbon emissions, potentially impacting Constellium's European operations and competitiveness in the global aluminum market.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Constellium, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for Constellium's operations and future growth.

A concise, actionable summary of Constellium's PESTLE factors, enabling swift identification of external threats and opportunities to inform strategic decision-making.

Economic factors

Global economic growth and industrial output are critical drivers for Constellium, directly impacting demand for its aluminum products across aerospace, automotive, and packaging sectors. A general economic slowdown or dip in industrial production, as observed in 2024 with notable demand weakness in most end markets except packaging, can significantly curb sales.

Constellium's profitability is closely tied to the volatile prices of raw materials, particularly aluminum. While the company operates with a pass-through business model for metal costs, significant fluctuations in aluminum ingot prices and the availability of scrap metal can still affect margins. For instance, LME aluminum prices saw considerable swings throughout 2024, impacting input costs.

Energy costs represent another substantial factor. Although forecasts suggest a moderate improvement in energy prices for 2025 compared to 2024, they are expected to remain elevated above historical norms. This sustained higher energy cost environment, especially in key operational regions for Constellium, puts pressure on operating expenses and can influence pricing strategies.

Inflationary pressures, especially concerning labor and raw material procurement, directly impact Constellium's operational costs. For instance, in 2024, global manufacturing input prices saw significant fluctuations, with energy and key commodity costs remaining elevated, potentially squeezing Constellium's profit margins if not passed on to customers.

Rising interest rates, a trend observed throughout 2024 and projected to continue into early 2025 in many major economies, increase Constellium's cost of capital for crucial investments in new facilities or technology. Furthermore, higher interest rates can dampen consumer spending power, particularly affecting demand in sectors like automotive and aerospace, which are key markets for Constellium's aluminum products.

Currency Exchange Rate Fluctuations

Constellium, as a global entity with significant operations and sales in both North America and Europe, faces considerable exposure to currency exchange rate fluctuations. These shifts directly impact its reported revenues, particularly when translating earnings from one currency to another, such as from Euros to U.S. Dollars. For instance, a stronger U.S. Dollar against the Euro could make Constellium's European-generated revenue appear lower when reported in its primary reporting currency.

Furthermore, these currency movements influence the cost of goods and services that Constellium imports or exports between its operational regions. A weaker Euro, for example, would increase the cost of raw materials or components purchased from the United States for its European manufacturing facilities, thereby affecting profit margins. Conversely, a stronger Euro could make its European-produced aluminum products more expensive for North American customers.

The volatility in exchange rates presents a key challenge for financial planning and risk management. For example, the Euro to U.S. Dollar exchange rate has seen significant movement in recent years; in early 2024, it hovered around 1.08 USD per EUR, a notable shift from periods where it was closer to 1.20 USD per EUR. This fluctuation directly impacts Constellium's financial statements and the competitiveness of its pricing strategies across different markets.

- Impact on Reported Revenue: Fluctuations in the EUR/USD exchange rate directly alter the reported value of Constellium's sales generated in Europe when translated into U.S. Dollars.

- Cost of Imports/Exports: Changes in currency values affect the cost of materials sourced from or sold to different currency zones, impacting Constellium's cost of goods sold.

- Competitive Pricing: Exchange rate shifts influence the price competitiveness of Constellium's products in international markets, affecting demand and market share.

- Financial Risk Management: Managing currency exposure through hedging strategies is crucial for Constellium to mitigate potential adverse impacts on profitability and financial stability.

Market Demand in Key Segments

Market demand within Constellium's key segments significantly shapes its financial performance. The aerospace sector, while showing signs of recovery, continues to grapple with post-pandemic supply chain disruptions, impacting order fulfillment and production schedules.

The automotive industry's demand is increasingly tied to the adoption rate of electric vehicles (EVs) and the ongoing push for lightweighting solutions to improve efficiency. For instance, the global EV market is projected to reach over 25 million units by 2025, a substantial increase from previous years, driving demand for advanced aluminum alloys.

- Aerospace: Navigating slow post-pandemic recovery and persistent supply chain issues.

- Automotive: Directly influenced by EV growth, with aluminum demand expected to rise as manufacturers prioritize lightweighting for battery-powered vehicles.

- Packaging: Demonstrating sustained healthy demand, providing a stable revenue stream.

Global economic conditions directly influence Constellium's sales volumes, with industrial output and consumer spending being key indicators. While 2024 saw some market weaknesses, particularly in automotive, the packaging sector remained robust. Projections for 2025 suggest a gradual improvement in global economic activity, which should benefit demand across Constellium's diverse end markets.

Preview Before You Purchase

Constellium PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Constellium delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. It provides actionable insights for informed decision-making.

Sociological factors

Consumers are increasingly prioritizing products that are good for the planet, leading to a greater demand for aluminum, especially in packaging and cars. This shift is fueled by growing awareness of environmental issues and a desire for recyclable materials. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products.

Constellium's commitment to using recycled aluminum and adopting eco-friendly manufacturing processes directly taps into these consumer preferences. By focusing on sustainability, the company not only meets market demand but also strengthens its brand image. Their efforts in increasing the use of recycled content, aiming for 50% by 2025, directly support this trend.

Constellium's operational efficiency is directly influenced by shifts in workforce demographics and the availability of skilled labor. As the global workforce ages and younger generations enter the job market, the company must adapt its recruitment and training strategies to meet evolving skill demands, particularly in specialized areas like aluminum processing.

Labor relations are a significant consideration, with a substantial portion of Constellium's workforce represented by unions or covered by collective bargaining agreements. In 2023, for instance, Constellium reported that its employee relations were generally stable, with ongoing dialogue with employee representatives across its various operating sites to ensure smooth operations and fair labor practices.

Societal expectations and regulatory requirements around workplace health and safety are paramount for Constellium, a global leader in aluminum solutions. These standards directly impact operational integrity and the company's reputation, as demonstrated by the increasing global focus on worker well-being. For instance, in 2024, the International Labour Organization reported a continued emphasis on robust safety protocols across manufacturing sectors, influencing how companies like Constellium invest in training and equipment.

Prioritizing employee health and safety is not just a regulatory obligation but a core component of Constellium's commitment to its workforce and its long-term sustainability. High safety standards contribute to reduced workplace incidents, which in turn can lower insurance costs and improve overall productivity. In 2023, Constellium reported a reduction in its Lost Time Injury Frequency Rate (LTIFR), underscoring the effectiveness of its ongoing safety initiatives.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with the UN projecting that 68% of the world's population will live in urban areas by 2050, up from 57% in 2023. This surge directly fuels demand for new infrastructure, from housing and commercial buildings to transportation networks like high-speed rail and airports. These developments create significant opportunities for aluminum producers like Constellium, whose lightweight and durable products are essential for modern construction and public transport solutions.

Constellium's advanced aluminum alloys are particularly well-suited for these expanding markets. For instance, their solutions are used in facade systems for skyscrapers, contributing to energy efficiency and aesthetic appeal. In transportation, aluminum’s strength-to-weight ratio makes it ideal for train bodies and components, supporting the growth of sustainable public transit systems. The company reported revenues of €6.5 billion in 2023, reflecting the broad demand across these sectors.

- Urban Population Growth: The urban population is expected to increase by 1.7 billion people by 2050, requiring substantial infrastructure investment.

- Infrastructure Spending: Global infrastructure spending is projected to reach $15 trillion by 2040, with significant portions allocated to urban development.

- Aluminum in Construction: Aluminum's use in building envelopes and facades offers energy savings and design flexibility, a growing trend in sustainable architecture.

- Aluminum in Transportation: The automotive and rail sectors are increasingly adopting aluminum to meet fuel efficiency and emission reduction targets.

Shifting Mobility Trends

The global automotive industry is undergoing a significant transformation, with a pronounced shift towards electric vehicles (EVs) and a persistent demand for lighter, more fuel-efficient conventional cars. This trend directly influences Constellium's automotive segment, as aluminum plays a crucial role in achieving these objectives.

While the anticipated growth rate for EVs in 2024 and 2025 might be moderating compared to earlier projections, the fundamental driver of lightweighting remains strong. This ongoing push for reduced vehicle weight is a key factor boosting the demand for aluminum solutions. For instance, by 2025, it's estimated that the average EV could use significantly more aluminum than a comparable internal combustion engine vehicle, with some estimates suggesting up to 20% more aluminum content per vehicle to offset battery weight and improve range.

- EV Adoption Impact: Despite potential downward revisions in near-term EV sales forecasts for 2024-2025, the long-term trajectory favors electrification, increasing aluminum's relevance in vehicle construction.

- Lightweighting Imperative: The continuous drive for fuel efficiency and extended EV range solidifies the need for lightweight materials like aluminum across all vehicle types.

- Aluminum Content Growth: Analysts project an increase in aluminum usage per vehicle, with estimates suggesting that by 2025, aluminum content in new cars could reach an average of 180-200 kg globally, up from around 150 kg in previous years.

Societal expectations regarding corporate responsibility and ethical business practices are increasingly influencing consumer and investor behavior. Constellium, like many global corporations, faces scrutiny over its supply chain, labor practices, and environmental impact. A 2024 survey revealed that 70% of investors consider ESG (Environmental, Social, and Governance) factors when making investment decisions.

The growing emphasis on diversity and inclusion within the workforce is another key sociological factor. Companies that foster inclusive environments often report higher employee engagement and better innovation. Constellium's reported efforts to promote diversity across its global operations, aiming for increased representation in leadership roles, align with this societal trend.

Public perception of aluminum production, particularly concerning energy consumption and emissions, can impact Constellium's brand reputation and social license to operate. However, the increasing demand for aluminum in sustainable applications, such as lightweight vehicles and recyclable packaging, presents a positive societal narrative that Constellium can leverage.

Technological factors

Constellium's commitment to advanced aluminum alloy development, particularly its Airware aluminum-lithium series, is a significant technological driver. These alloys offer a superior strength-to-weight ratio, crucial for the aerospace sector's demand for lighter, more fuel-efficient aircraft. For instance, the next generation of commercial aircraft, expected to see substantial order growth through 2025, will increasingly rely on such advanced materials to meet performance targets.

Advancements in aluminum recycling technologies are crucial for Constellium's sustainability. For instance, Laser-Induced Breakdown Spectroscopy (LIBS) is revolutionizing the sorting of automotive scrap, enabling higher purity aluminum recovery. This technology is vital for meeting the increasing demand for recycled content in the automotive sector, a key market for Constellium.

Constellium is making significant investments to bolster its recycling capabilities. By expanding its recycling capacity and implementing more closed-loop systems, the company aims to reduce its reliance on primary aluminum and lower its carbon footprint. This strategic focus on circularity is expected to enhance operational efficiency and provide a competitive edge in a market increasingly prioritizing sustainable materials.

Constellium's commitment to manufacturing process innovation is a key technological driver. Improvements like industrial-scale hydrogen casting are directly contributing to a reduction in carbon emissions and a boost in production efficiency. This focus on cleaner, more effective manufacturing methods is crucial for staying competitive in the evolving materials industry.

A significant milestone in this area was Constellium's successful completion of its first industrial-scale hydrogen casting. This achievement underscores the company's dedication to decarbonization efforts within its operational framework. Such advancements are not just environmentally responsible but also position Constellium at the forefront of sustainable manufacturing technologies.

Digitalization and Automation in Production

Constellium is actively integrating digitalization and automation to boost efficiency and product quality. This strategic move aims to streamline operations and cut expenses throughout its manufacturing network. For instance, the company is implementing advanced systems for real-time quality monitoring of molten aluminum, a critical step in ensuring the integrity of its high-performance alloys.

The impact of these technological advancements is significant. By automating processes, Constellium can achieve higher throughput and more consistent product specifications. This focus on technological upgrading is crucial for maintaining a competitive edge in the demanding aerospace and automotive sectors, where precision and reliability are paramount.

Key areas of technological adoption include:

- Smart Factory Initiatives: Implementing IoT sensors and data analytics for predictive maintenance and optimized production scheduling.

- Advanced Quality Control: Utilizing AI-powered visual inspection and spectral analysis for molten metal quality assurance.

- Robotic Process Automation (RPA): Automating repetitive administrative tasks to free up human resources for more strategic functions.

Lightweighting Technologies for End Markets

Constellium's focus on lightweighting technologies is directly driven by evolving market demands, particularly in aerospace and automotive sectors. Ongoing research and development efforts are concentrated on creating advanced aluminum alloys and innovative manufacturing processes. These advancements are crucial for producing components that improve fuel efficiency and reduce emissions. For instance, the automotive industry is increasingly prioritizing lightweight materials for electric vehicles (EVs) to extend battery range and enhance performance. Constellium's work on battery enclosures and structural components directly addresses this trend, aiming to deliver solutions that are both lighter and stronger.

The push for sustainability and regulatory compliance further fuels the need for lightweighting. In 2024, global automotive manufacturers are investing heavily in EV technology, with projections indicating a significant increase in EV production. This creates a substantial market opportunity for Constellium's lightweight aluminum solutions. The company is actively developing products like:

- Crash management systems designed to absorb impact energy more effectively while reducing weight.

- Structural sills that contribute to vehicle rigidity and safety without adding significant mass.

- Battery enclosures for EVs, a critical component for thermal management and structural integrity, where weight reduction is paramount.

Constellium's technological edge is amplified by its investment in advanced alloys like aluminum-lithium, crucial for aerospace's demand for lighter, fuel-efficient aircraft, with next-gen commercial planes expected to boost demand through 2025. Its commitment to cutting-edge recycling technologies, such as LIBS for automotive scrap sorting, enhances aluminum purity recovery, vital for meeting the automotive sector's growing recycled content requirements.

The company's strategic expansion of recycling capacity and closed-loop systems aims to boost efficiency and reduce its carbon footprint, positioning it favorably in a market prioritizing sustainability. Furthermore, innovations in manufacturing, including industrial-scale hydrogen casting, directly contribute to emission reductions and improved production efficiency, keeping Constellium competitive in the evolving materials landscape.

Constellium is actively integrating digitalization and automation to enhance operational efficiency and product quality, implementing advanced real-time molten aluminum quality monitoring systems to ensure the integrity of its high-performance alloys.

Technological adoption includes smart factory initiatives leveraging IoT for predictive maintenance, advanced AI-powered quality control, and RPA for administrative tasks, all contributing to higher throughput and more consistent product specifications critical for the aerospace and automotive sectors.

Legal factors

Constellium operates under increasingly stringent environmental regulations, particularly concerning greenhouse gas emissions, waste disposal, and water usage. These rules necessitate significant investment in compliance measures and can impact operational costs. For example, the EU's Emissions Trading System (ETS) directly affects energy-intensive industries like aluminum production.

The company's commitment to sustainability is evident in its progress towards decarbonization and recycling goals. In its 2023 sustainability report, Constellium highlighted a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2021 baseline, aiming for a 30% reduction by 2030. Furthermore, their recycling rate for aluminum scrap reached 85% in 2023, a key factor in reducing energy consumption.

International trade laws and measures like anti-dumping duties directly influence Constellium's market access and pricing strategies for its aluminum products. These regulations can create cost disadvantages for imports, potentially benefiting domestic producers, but also risk retaliatory measures from other nations.

For instance, the United States' imposition of Section 232 tariffs on steel and aluminum imports, including those from Europe, has significantly altered global trade dynamics. In 2023, these tariffs continued to affect the cost of raw materials and finished aluminum goods, impacting Constellium's supply chain and the competitiveness of its products in the US market.

Countervailing duties, imposed when foreign governments unfairly subsidize their industries, can further complicate international trade. Such duties, if applied to aluminum exports from countries where Constellium sources materials or sells products, could necessitate price adjustments or sourcing strategy changes to maintain profitability and market share.

Constellium must adhere to rigorous product liability regulations, particularly for its high-performance aluminum alloys used in aerospace and automotive sectors. Failure in these critical applications, such as in aircraft structural components or vehicle safety systems, carries significant legal and reputational risks. For instance, the automotive industry's increasing focus on crashworthiness and pedestrian safety standards, like those outlined by the European New Car Assessment Programme (Euro NCAP), directly impacts material specifications and demands.

Intellectual Property Rights

Intellectual property rights are paramount for Constellium, safeguarding its significant investments in research and development. The company's competitive advantage hinges on its proprietary technologies, particularly in advanced aluminum alloys and sophisticated manufacturing techniques. For instance, Constellium holds numerous patents covering its high-performance alloys, such as those used in the aerospace and automotive sectors, which are critical for maintaining market leadership and ensuring profitability from its innovation pipeline. This robust IP portfolio allows Constellium to command premium pricing and prevent competitors from easily replicating its cutting-edge products.

Constellium's commitment to innovation is evident in its ongoing patent filings and the protection of its technological know-how. The company's proprietary alloys are a testament to this, offering unique properties that meet stringent industry demands. In 2023, Constellium continued to invest heavily in R&D, with expenditures supporting the development of next-generation materials. The strategic protection of these innovations through patents is essential for recouping these development costs and fostering continued advancements in sustainable and high-performance aluminum solutions.

The legal framework surrounding intellectual property directly impacts Constellium's ability to monetize its innovations and maintain its technological edge. Key aspects include:

- Patent Protection: Securing patents for novel alloys and advanced manufacturing processes is vital for exclusive rights and market differentiation.

- Trade Secrets: Maintaining confidentiality around specific manufacturing techniques and formulations further protects Constellium's competitive advantages.

- Licensing Opportunities: A strong IP portfolio can open avenues for licensing agreements, generating additional revenue streams.

- Enforcement: Vigilant monitoring and enforcement of IP rights are necessary to prevent infringement and protect market share.

Labor Laws and Employment Regulations

Constellium must navigate a complex web of labor laws and employment regulations across its international operations. Compliance with these statutes, which govern everything from minimum wages and working hours to workplace safety and collective bargaining rights, directly impacts its human resource strategies and overall operational expenditures.

The company's adherence to these legal frameworks is crucial for maintaining stable labor relations and avoiding costly disputes or penalties. For instance, in 2023, the average hourly wage for manufacturing workers in the European Union, where Constellium has significant operations, was approximately €17.30, a figure subject to national variations and union agreements that Constellium must factor into its budgeting.

- Wage and Hour Laws: Ensuring compliance with minimum wage, overtime, and fair pay regulations in each operating country.

- Workplace Safety Standards: Adhering to stringent health and safety requirements to protect employees and prevent accidents.

- Collective Bargaining Agreements: Managing relationships and negotiations with labor unions, which can influence wage structures and working conditions.

- Employment Discrimination: Upholding laws that prohibit discrimination based on age, gender, race, or other protected characteristics in hiring and employment practices.

Constellium must navigate complex international trade regulations, including tariffs and anti-dumping duties, which directly impact its global market access and pricing. For example, in 2023, the ongoing Section 232 tariffs on aluminum imports into the United States continued to influence raw material costs and product competitiveness for the company.

The company is subject to stringent product liability laws, especially for its high-performance alloys used in critical aerospace and automotive applications. Adherence to evolving safety standards, such as those from Euro NCAP, necessitates continuous material development and rigorous quality control, posing significant legal and reputational risks if not met.

Intellectual property rights are crucial for Constellium, protecting its R&D investments in advanced alloys and manufacturing processes. The company actively safeguards its innovations through patents, as demonstrated by its robust portfolio in 2023, which is essential for maintaining market leadership and profitability from its technological advancements.

Constellium operates under a variety of labor laws and employment regulations across its international sites, impacting costs and HR strategies. In 2023, the average hourly wage for manufacturing workers in the EU, around €17.30, highlights the need for careful budgeting and compliance with diverse national labor agreements.

Environmental factors

Global efforts to address climate change are intensifying, creating a significant demand for aluminum produced with a lower carbon footprint. This shift is directly influencing the market for sustainable aluminum solutions.

Constellium is responding to these pressures by making substantial investments in decarbonization initiatives. A key part of this strategy involves phasing out coal-fired power plants at its facilities, a move that significantly reduces its operational emissions.

Furthermore, Constellium is at the forefront of innovation, actively developing and piloting new technologies like hydrogen casting. This pioneering approach aims to further lower the carbon intensity of aluminum production, aligning with ambitious climate targets and enhancing its competitive edge in the evolving market.

The increasing recognition of finite primary resources is driving a significant shift towards a circular economy, making aluminum recycling a critical factor for companies like Constellium. This transition emphasizes the need to maximize recycled content, a core strategy for Constellium, which is actively investing in and expanding its closed-loop recycling operations to reduce reliance on virgin materials.

Constellium's commitment to circularity is demonstrated by its ambitious targets; for instance, the company aims to increase the use of recycled aluminum in its automotive products, targeting over 75% recycled content in some applications by 2030. This focus not only addresses resource scarcity but also enhances cost-efficiency and reduces the carbon footprint associated with primary aluminum production, which can be up to 95% more energy-intensive than recycling.

The aluminum industry's significant energy demands place energy efficiency at the forefront of environmental considerations for companies like Constellium. In 2023, Constellium reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity by 12% compared to 2021, demonstrating a commitment to improving energy usage.

Constellium is actively pursuing strategies to lessen its environmental footprint, with a strong emphasis on enhancing energy efficiency across its operations. The company is also investigating the potential of alternative energy sources, such as green hydrogen, to power its production processes and further reduce carbon emissions.

Waste Management and Pollution Control

Effective waste management, encompassing the reduction of air emissions and water consumption, stands as a critical environmental focus for Constellium's manufacturing processes. The company's commitment to sustainability is evident in its operational strategies.

Constellium's recent investments in a new recycling center highlight its dedication to minimizing environmental impact through the adoption of advanced technologies. This facility is designed to process a significant volume of aluminum scrap, contributing to a circular economy model.

- Aluminum Recycling Rate: Constellium aims to increase its recycled aluminum content, with targets often exceeding 70% for certain product lines.

- Water Consumption Reduction: The company has implemented water-saving technologies across its sites, targeting a reduction in water withdrawal per tonne of product.

- Emissions Control: Investments in advanced filtration systems are in place to manage and reduce air emissions from melting and casting operations.

Biodiversity and Land Use

The environmental impact of industrial activities on biodiversity and land use is a significant consideration for companies like Constellium. As global awareness of ecological preservation grows, so does the scrutiny of industrial operations. Constellium's commitment to sustainability is evident in its approach to new projects.

For instance, the development of its new recycling center in Finale Emilia, Italy, included comprehensive biodiversity studies. This initiative aims to understand and mitigate the potential ecological footprint of the facility. By integrating these studies early in the planning phase, Constellium seeks to minimize disruption to local ecosystems and promote responsible land use.

Constellium's efforts align with broader industry trends and regulatory pressures to enhance environmental stewardship. The company's focus on these aspects reflects a strategic understanding of the long-term value of maintaining healthy ecosystems and managing land resources effectively.

- Biodiversity Impact Assessment: Constellium conducts detailed biodiversity studies for new projects to understand and minimize ecological disruption.

- Land Use Optimization: The company focuses on efficient and responsible land use in its operational planning, particularly for new facilities like recycling centers.

- Sustainability Integration: Environmental considerations, including biodiversity and land use, are increasingly integrated into Constellium's strategic decision-making processes.

Constellium is actively addressing environmental pressures by investing in decarbonization, such as phasing out coal power and piloting hydrogen casting to lower its carbon footprint. The company is also prioritizing aluminum recycling, aiming for over 75% recycled content in automotive products by 2030, which is significantly more energy-efficient than using virgin materials.

Energy efficiency is a key focus, with Constellium reducing its Scope 1 and 2 greenhouse gas emissions intensity by 12% between 2021 and 2023. They are also exploring alternative energy sources like green hydrogen.

Effective waste management, including reducing air emissions and water consumption, is critical. Constellium's new recycling center in Italy exemplifies this, incorporating biodiversity studies to minimize ecological impact and promote responsible land use.

| Environmental Focus | Constellium's Action/Target | Supporting Data/Context |

|---|---|---|

| Decarbonization | Phasing out coal power, piloting hydrogen casting | Aims to lower carbon footprint of aluminum production. |

| Circular Economy | Targeting >75% recycled content in automotive by 2030 | Recycling aluminum uses up to 95% less energy than primary production. |

| Emissions Reduction | 12% reduction in Scope 1 & 2 GHG emissions intensity (2021-2023) | Focus on energy efficiency and exploring green hydrogen. |

| Biodiversity & Land Use | Conducting biodiversity studies for new projects | Example: Finale Emilia recycling center project included ecological impact assessments. |

PESTLE Analysis Data Sources

Our Constellium PESTLE Analysis is built on a robust foundation of data from leading financial institutions, government agencies, and reputable industry associations. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the aluminum industry.