Constellium Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellium Bundle

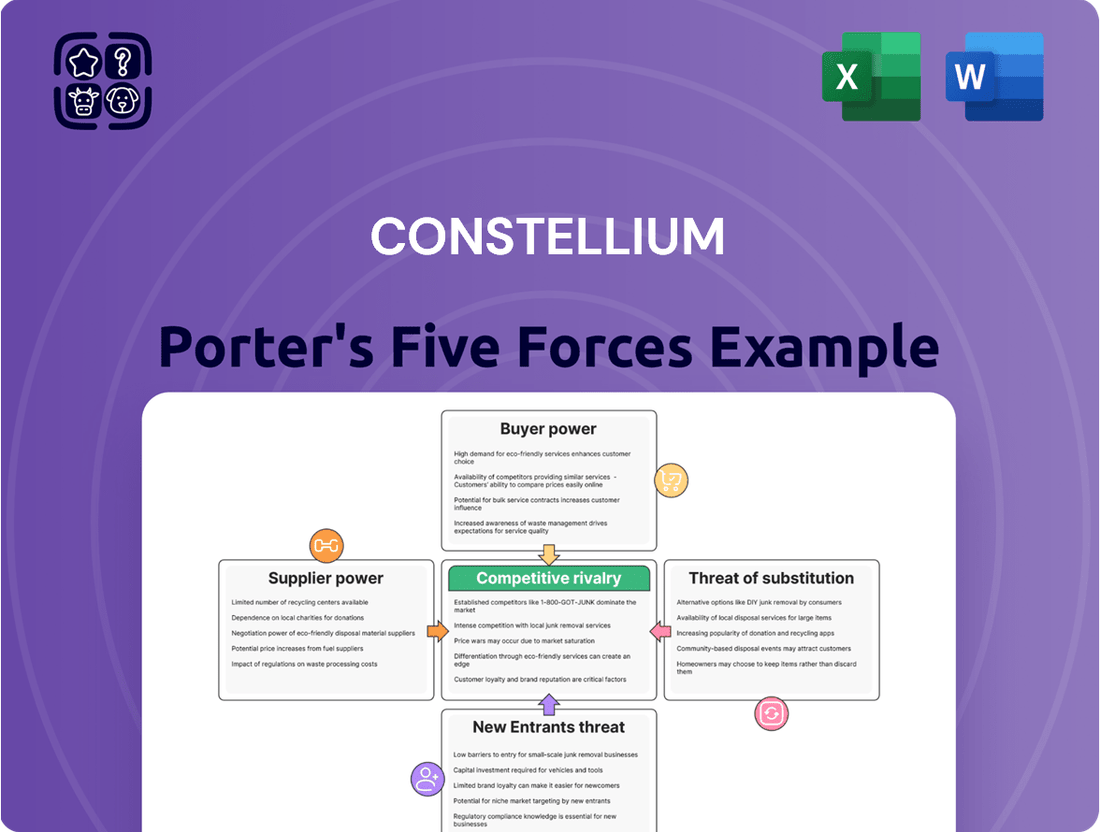

Constellium navigates a complex aluminum industry, facing significant pressure from powerful buyers and intense rivalry among established players. The threat of substitutes and new entrants also shapes its competitive landscape, demanding strategic agility.

The complete report reveals the real forces shaping Constellium’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

While the global primary aluminum market features many participants, supply chain vulnerabilities and regional concentrations can arise. For instance, in 2024, key bauxite-producing regions like Guinea and Australia continued to be critical for alumina feedstock, meaning disruptions in these areas could significantly impact Constellium's raw material access.

Geopolitical developments and evolving trade regulations in 2024 also played a role in the availability and pricing of essential inputs such as bauxite and alumina. These factors directly influence Constellium's operational costs and, consequently, its profitability.

Constellium's significant reliance on aluminum scrap as feedstock, with 42% recycled content in 2024, underscores the bargaining power of suppliers in this sector. The company's substantial investment in recycling capacity, exemplified by its €130 million French recycling center opened in September 2024, highlights the strategic importance of securing a stable and cost-effective supply of quality scrap.

The availability and pricing of this crucial recycled material directly impact Constellium's operational costs and its ability to meet ambitious sustainability goals. Fluctuations in the aluminum scrap market can therefore exert considerable influence on the company's financial performance and competitive positioning.

Switching primary aluminum or specialized alloy suppliers could incur substantial costs for Constellium. These costs might include the expense and time associated with re-qualifying new suppliers, adapting logistical networks, and the potential disruption to production efficiency and the precise specifications of their advanced alloy products.

Constellium's strategic emphasis on advanced alloys and highly customized solutions often necessitates deep, long-term partnerships with specific suppliers for critical inputs, thereby increasing supplier bargaining power.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers is influenced by their ability to forward integrate, meaning they could potentially move into their customers' businesses. For primary aluminum producers, directly integrating into the highly specialized downstream products that Constellium provides, such as those for aerospace and automotive sectors, is generally unlikely.

However, some larger, more diversified aluminum companies might explore expanding their value-added product lines. Constellium's significant investment in research and development and its focus on customized solutions create a substantial barrier, making it difficult for suppliers to replicate its specialized offerings and thus limiting their threat of forward integration.

In 2023, Constellium reported revenue of €7.3 billion, highlighting its position in complex, high-value aluminum markets.

- Supplier Integration Threat: While primary aluminum producers can't easily replicate Constellium's specialized downstream products, larger integrated players might attempt to move into value-added segments.

- Constellium's Defense: The company's deep expertise in customized solutions and continuous R&D investment serves as a strong deterrent against supplier forward integration.

- Market Dynamics: Constellium operates in sectors where technical know-how and specific product development are paramount, making direct substitution by suppliers challenging.

Impact of Energy Costs

The bargaining power of suppliers is significantly influenced by energy costs, a critical input for aluminum production. Fluctuations in energy prices directly impact the cost of raw materials Constellium procures, giving energy suppliers leverage. For instance, in 2024, global energy markets experienced considerable volatility, with natural gas prices in Europe seeing significant swings due to geopolitical factors and supply chain adjustments.

Constellium's strategic focus on decarbonization further underscores the impact of energy costs. The company's commitment to transitioning away from coal-fired power stations and adopting more sustainable energy sources means that the cost and availability of these cleaner alternatives become paramount. This shift can alter the supplier landscape, potentially increasing the bargaining power of providers of renewable energy or low-carbon electricity.

- Volatile Energy Prices: In 2024, European natural gas prices, a key indicator for industrial energy costs, saw a notable increase of approximately 15% in the first half of the year compared to the same period in 2023, affecting input costs for energy-intensive industries like aluminum.

- Decarbonization Drive: Constellium aims to reduce its carbon footprint by 20% by 2030, necessitating increased reliance on electricity, particularly from renewable sources, which can shift supplier leverage towards renewable energy providers.

- Supplier Dependence: The reliance on energy as a primary cost driver for aluminum smelting means that suppliers of electricity and natural gas hold considerable sway over the pricing of aluminum inputs for Constellium.

Constellium's reliance on specialized aluminum scrap, with 42% recycled content in 2024, gives scrap suppliers considerable bargaining power. The company's €130 million French recycling center, opened in September 2024, highlights its strategy to secure this vital feedstock. This focus on recycled materials means that the availability and pricing of scrap directly influence Constellium's costs and sustainability targets.

Energy costs are a significant factor, with European natural gas prices increasing by approximately 15% in the first half of 2024 compared to the previous year. Constellium's goal to reduce its carbon footprint by 20% by 2030, by increasing reliance on renewable energy, further shifts leverage towards providers of cleaner energy sources.

| Factor | Impact on Constellium | 2024 Data/Trend |

|---|---|---|

| Aluminum Scrap Availability | High bargaining power for suppliers due to Constellium's 42% recycled content target. | Increased investment in recycling capacity (e.g., €130M French center opened Sept 2024). |

| Energy Costs | Significant influence on raw material pricing for aluminum production. | European natural gas prices up ~15% H1 2024 vs H1 2023; transition to renewables impacts supplier leverage. |

| Specialized Inputs | Supplier power is amplified by the need for customized alloys and long-term partnerships. | Constellium's R&D focus on advanced alloys creates high switching costs for suppliers. |

What is included in the product

Explores the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes on Constellium's aluminum business.

Effortlessly identify and quantify competitive pressures with a dynamic, interactive model that highlights key areas of risk and opportunity for Constellium.

Customers Bargaining Power

Constellium's customer base is heavily concentrated within key industries like aerospace and automotive. This means a few major original equipment manufacturers (OEMs) represent a significant portion of their sales. For example, in the automotive sector, large players like Mercedes-Benz are crucial customers.

These substantial customers wield considerable bargaining power. Their large order volumes and the critical role Constellium's advanced aluminum products play in their manufacturing processes give them leverage. This concentration means Constellium must carefully manage relationships with these dominant buyers to maintain favorable terms.

Customer switching costs are a significant factor influencing Constellium's bargaining power of customers. In high-value sectors like aerospace and automotive, customers often invest heavily in qualifying specific aluminum alloys and working through lengthy design integration processes with suppliers. This can create substantial switching costs, making it difficult and expensive for them to change providers, even if pricing is a consideration.

For instance, the aerospace industry's stringent safety and performance requirements mean that re-qualifying a new material supplier can take years and involve extensive testing. This inertia benefits Constellium by locking in customers for extended periods. Conversely, in more commoditized markets such as beverage packaging, where aluminum specifications are more standardized, customers generally face lower switching costs, allowing them to more readily shift to alternative suppliers based on price or availability.

Customers in key sectors such as automotive and packaging exhibit significant price sensitivity. This means that even small price increases can lead to substantial shifts in demand, directly enhancing their bargaining power. For instance, weakness observed in certain end markets during Constellium's Q2 2025 reporting period underscores how fluctuating demand can amplify this leverage.

Threat of Customer Backward Integration

The threat of customers backward integrating into Constellium's specialized, high-value aluminum production is typically low due to the significant capital investment and technical know-how needed. This barrier protects Constellium's market position.

However, major clients, especially in sectors with strong sustainability mandates, may seek to secure their aluminum supply chain. For example, some automotive manufacturers are investing in advanced recycling technologies, a form of backward integration, to ensure a consistent flow of recycled aluminum meeting their environmental targets.

- Capital Intensity: The advanced manufacturing processes for aerospace and automotive aluminum alloys require substantial upfront investment, deterring most customers from replicating Constellium's capabilities.

- Specialized Expertise: Developing and maintaining the technical expertise for producing high-performance aluminum products is a significant hurdle for potential customer integration.

- Customer Sustainability Goals: In 2024, the push for circular economy models is intensifying, leading some large customers to explore partnerships or direct investments in aluminum recycling facilities to secure sustainable material sources.

- Limited Scope of Integration: While full backward integration into Constellium's core production is unlikely, customers might focus on specific, less complex stages like initial material processing or recycling.

Customer Focus on Lightweighting and Sustainability

Customers, particularly in the automotive and aerospace sectors, are increasingly prioritizing lightweight materials and sustainable solutions. This trend is driven by stringent environmental regulations and growing consumer demand for eco-friendly products. For instance, the automotive industry is a major focus for Constellium, with a significant portion of its revenue derived from this sector. In 2023, Constellium reported that its automotive segment accounted for approximately 40% of its total sales.

This heightened customer focus on sustainability and lightweighting directly impacts their bargaining power. As customers actively seek materials that reduce vehicle weight for fuel efficiency or emissions reduction, they gain leverage. They can demand specific material properties and performance characteristics, putting pressure on suppliers like Constellium to innovate and adapt. Constellium's commitment to developing advanced alloys and robust recycling capabilities is a direct response to these customer demands.

Constellium's strategic investments in innovation and its ability to offer advanced, sustainable aluminum solutions can, however, mitigate this customer bargaining power. By providing differentiated products that meet these evolving needs, Constellium strengthens its value proposition. This can lead to greater customer loyalty and a reduced willingness to switch suppliers based solely on price. For example, Constellium's development of high-strength, low-density alloys for automotive structures helps customers achieve their lightweighting goals, making their offerings more indispensable.

- Customer Demand: Growing emphasis on lightweighting and sustainability in automotive and aerospace markets.

- Regulatory Influence: Environmental regulations are a key driver for material choices.

- Constellium's Response: Innovation in advanced alloys and recycling strengthens its market position.

- Impact on Bargaining Power: Differentiated, sustainable solutions can reduce customer leverage by offering unique value.

The bargaining power of Constellium's customers is significant, particularly within its core aerospace and automotive sectors. Large original equipment manufacturers (OEMs) represent a substantial portion of sales, giving them considerable leverage due to their order volumes and the critical nature of Constellium's advanced aluminum products. While customers face high switching costs in specialized applications, their price sensitivity, especially in more commoditized markets, can amplify their influence.

Customers' increasing focus on lightweighting and sustainability further enhances their bargaining power. They can dictate material specifications and performance characteristics, pushing suppliers like Constellium to innovate. For example, Constellium's automotive segment, which accounted for around 40% of its sales in 2023, is heavily influenced by these trends. Constellium mitigates this by offering differentiated, sustainable solutions.

| Customer Segment | Key Drivers of Bargaining Power | Constellium's Mitigation Strategies |

|---|---|---|

| Aerospace & Automotive OEMs | High order volumes, critical product integration, price sensitivity | Product differentiation, innovation in advanced alloys, strong customer relationships |

| Beverage Packaging | Lower switching costs, price sensitivity, standardized products | Cost efficiency, reliable supply chain, product quality |

| General Industry | Varying degrees of price sensitivity and switching costs | Diversified product portfolio, responsive service |

Full Version Awaits

Constellium Porter's Five Forces Analysis

This preview showcases the complete Constellium Porter's Five Forces Analysis you will receive immediately after purchase, providing a thorough examination of competitive forces within the aluminum industry. You're looking at the actual document, ensuring no surprises and full readiness for your strategic planning. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The aluminum product market, especially for rolled goods, is intensely competitive. Major global players like Novelis Inc., Alcoa, Arconic Corporation, Kaiser Aluminum, and Norsk Hydro are Constellium's main rivals. These companies actively compete for market share across Constellium's core business areas, significantly heightening the rivalry.

In 2024, the global aluminum market experienced dynamic shifts. For instance, Novelis, a key competitor, reported strong performance in its automotive segment, a crucial area for Constellium as well. This ongoing competition for high-value applications like automotive body panels and aerospace components means pricing pressure and innovation are constant factors.

The global aluminum market is expected to see robust growth, with projected compound annual growth rates (CAGRs) between 4.9% and 6.1% for the period of 2025-2035. This expansion is fueled by increasing demand across key sectors like transportation, construction, and packaging.

While this growth presents opportunities, the potential for overcapacity in specific aluminum segments or geographical areas could heighten competitive pressures. Such overcapacity often leads to more aggressive pricing strategies among industry players, impacting profitability.

Constellium actively differentiates itself by focusing on high-value-added products, including advanced alloys and bespoke customer solutions. The company's commitment to innovation is underscored by significant R&D investments, projected to reach around $50 million in 2024, allowing for the development of cutting-edge technologies. This focus on unique offerings creates a distinct market position.

Key innovations such as hydrogen casting and enhanced recycling capabilities provide Constellium with a tangible competitive advantage. These advancements not only improve product performance but also address growing market demands for sustainability. Such forward-thinking developments are crucial in a sector where technological leadership is paramount.

While Constellium pushes the boundaries of innovation, it's important to note that its competitors are also making substantial investments in research and development, particularly in areas like sustainability. This means that the competitive landscape remains dynamic, with ongoing efforts from rivals to match or surpass Constellium's technological advancements and eco-friendly initiatives.

High Fixed Costs and Exit Barriers

The aluminum manufacturing sector, including companies like Constellium, is characterized by substantial fixed costs. This capital intensity means that companies must maintain high production levels to spread these costs, often leading to aggressive pricing during downturns to keep factories running. For instance, in 2024, the global aluminum market faced fluctuating demand, pressuring producers to optimize capacity utilization.

High exit barriers further exacerbate competitive rivalry. The specialized nature of aluminum production equipment and the significant capital invested make it difficult and costly for firms to leave the market. This immobility means that even struggling players tend to remain, intensifying competition and potentially leading to price wars as they fight for market share.

- High Capital Intensity: Aluminum production requires significant investment in plant, property, and equipment, creating a high barrier to entry and influencing operational strategies.

- Aggressive Pricing Tactics: To cover high fixed costs, companies may engage in price competition, especially when demand softens, impacting profitability across the industry.

- Specialized Assets: The need for highly specialized machinery and facilities contributes to substantial exit barriers, locking in existing players and sustaining rivalry.

- Impact on Constellium: For Constellium, these factors mean constant pressure to maintain efficient operations and competitive pricing in a market where exiting is not a simple option.

Market Dynamics and Geopolitical Factors

Market dynamics, including the lag effect of metal prices and weaknesses in demand from certain end markets, directly influence profitability and can escalate competitive rivalry. For instance, Constellium's Q2 2025 performance highlighted how these factors can pressure margins, forcing companies to compete more aggressively on price or efficiency.

Geopolitical events and evolving trade policies introduce another layer of complexity. Tariffs, such as those imposed by the US on aluminum imports, can significantly alter the competitive landscape. Companies with manufacturing bases in regions unaffected by such tariffs might gain a cost advantage, intensifying pressure on those with operations in tariff-affected areas.

- Metal Price Volatility: Fluctuations in aluminum prices can create a lag effect, impacting Constellium's cost of goods sold and revenue recognition, thereby influencing its competitive positioning.

- Regional Demand Shifts: Weakness in specific end markets, such as automotive or aerospace in certain geographies, can lead to overcapacity and heightened competition as players vie for remaining demand.

- Trade Policy Impact: US tariffs on aluminum, for example, can disadvantage Constellium if its primary sourcing or manufacturing is in regions subject to these tariffs, while potentially benefiting competitors with unhindered supply chains.

- Operational Efficiency as a Differentiator: In a dynamic market, companies that can maintain high operational efficiency and manage input costs effectively are better positioned to withstand competitive pressures.

Competitive rivalry within the aluminum products market is intense due to the presence of major global players like Novelis, Alcoa, and Arconic. These companies vie for market share in key segments such as automotive and aerospace, leading to constant pressure on pricing and innovation. Constellium's strategy of focusing on high-value, differentiated products, backed by significant R&D investments like its projected $50 million in 2024, aims to carve out a distinct market position amidst this fierce competition.

The high capital intensity of aluminum production, with substantial fixed costs, compels companies to maintain high operational levels, often resulting in aggressive pricing strategies, particularly when demand fluctuates as seen in 2024. Furthermore, significant exit barriers due to specialized assets mean that even less profitable firms remain in the market, sustaining rivalry and potentially leading to price wars.

Market dynamics, including metal price volatility and regional demand shifts, directly impact profitability and intensify competition. For instance, Constellium's Q2 2025 results indicated how these factors can squeeze margins, necessitating a focus on operational efficiency and cost management to remain competitive.

Geopolitical factors and trade policies, such as US tariffs, can also significantly alter the competitive landscape by creating cost advantages for some players while disadvantaging others, further fueling the rivalry.

| Key Competitors | 2024 R&D Investment (Est.) | Competitive Focus Areas | Market Growth Projection (2025-2035 CAGR) |

| Novelis Inc. | N/A (Private) | Automotive, Aerospace, High-Value Applications | 4.9% - 6.1% |

| Alcoa Corporation | N/A (Public) | Primary Aluminum, Bauxite, Alumina | 4.9% - 6.1% |

| Arconic Corporation | N/A (Public) | Engineered Structures, Rolled Products | 4.9% - 6.1% |

| Constellium SE | ~$50 Million | Advanced Alloys, Sustainable Solutions, Customer-Specific Products | 4.9% - 6.1% |

SSubstitutes Threaten

The primary threat of substitutes for Constellium's products comes from alternative lightweight materials, most notably carbon fiber composites. These materials boast superior weight savings and exceptional strength-to-weight ratios, coupled with excellent resistance to fatigue and corrosion, making them highly attractive, particularly in the demanding aerospace sector. The market for advanced materials, including various composites and high-performance polymers, is projected for continued expansion.

While substitutes like carbon fiber can offer enhanced performance, particularly in weight reduction for aerospace applications, their significantly higher cost remains a key barrier. For instance, carbon fiber composite prices can range from $20 to $100 per pound, whereas aluminum alloys typically fall between $1 to $5 per pound, making aluminum a more accessible option for many industries.

Constellium strategically addresses this by developing advanced aluminum alloys that deliver competitive performance characteristics at a more attractive price point. Their expertise in creating tailored solutions, such as high-strength aluminum for automotive structures, allows them to meet specific customer needs without the premium associated with materials like carbon fiber, thereby limiting the threat of substitution.

Ongoing advancements in materials science are making substitutes for aluminum increasingly competitive. Innovations in composites, for example, are enhancing their strength-to-weight ratios and durability, directly challenging aluminum's traditional dominance in sectors like automotive and aerospace. The global advanced composites market was valued at over $90 billion in 2023 and is projected to grow significantly, indicating a rising threat.

Additive manufacturing, or 3D printing, also presents a growing substitute threat, particularly for complex, low-volume parts. This technology allows for the creation of intricate designs with reduced material waste, often at a competitive cost compared to traditional aluminum forming methods. The aerospace industry, a key market for Constellium, is increasingly adopting 3D printed metal components, which can offer weight savings and performance improvements, thereby reducing reliance on conventionally manufactured aluminum parts.

Customer Willingness to Switch

Customer willingness to switch from aluminum solutions to substitute materials is influenced by a mix of performance needs, cost considerations, and supply chain dependability. In sectors like aerospace and high-performance automotive, where stringent requirements are paramount, customers might embrace alternatives if the advantages clearly surpass the expenses associated with changing suppliers or processes. For instance, while aluminum offers lightweighting benefits, advancements in composite materials or high-strength steel could present compelling alternatives in specific, demanding applications.

The cost-effectiveness of substitutes plays a crucial role. If alternative materials become significantly cheaper or offer a better total cost of ownership, customers are more likely to explore switching. This includes not just the raw material price but also processing costs and end-of-life management. Constellium's focus on innovation and value-added solutions aims to mitigate this by demonstrating superior performance and lifecycle benefits that justify the continued use of aluminum.

Sustainability goals are increasingly driving customer decisions. If substitute materials can demonstrably meet or exceed environmental targets, such as lower carbon footprints or higher recyclability rates, this can accelerate adoption. For example, the push for circular economy principles in manufacturing could favor materials with well-established and efficient recycling loops, a factor Constellium actively addresses with its recycling initiatives.

- Performance Requirements: Specialized applications in aerospace and automotive may see higher switching willingness if substitutes offer superior strength-to-weight ratios or thermal properties.

- Cost-Effectiveness: Fluctuations in aluminum prices compared to emerging materials like advanced composites or specialized steels can shift the economic balance for customers.

- Supply Chain Reliability: A stable and predictable supply of substitute materials is critical for customers to consider a switch, especially for high-volume production.

- Sustainability Goals: Growing emphasis on environmental impact and circular economy principles can make alternative materials with lower carbon footprints or enhanced recyclability more attractive.

Sustainability and Lifecycle Impact

While carbon fiber offers lightweighting benefits, aluminum's infinite recyclability presents a strong sustainability advantage. This is increasingly important as industries embrace circular economy models and aim to reduce their carbon footprint. Aluminum's recyclability directly counters the threat posed by substitutes that are not as easily or infinitely recycled.

For instance, the European Aluminium industry reported that in 2023, 95% of end-of-life aluminum products were collected for recycling, with the recycled aluminum content in new products averaging 45%. This high recycling rate and the significant energy savings – up to 95% compared to primary aluminum production – make aluminum a compelling choice for environmentally conscious applications.

This inherent sustainability positions aluminum favorably against alternatives like advanced high-strength steels or composites, which may have more complex or energy-intensive recycling processes. Constellium's focus on developing innovative aluminum alloys for sectors like automotive and aerospace, which increasingly demand sustainable material solutions, directly addresses this threat.

Key advantages of aluminum as a substitute countermeasure include:

- Infinite Recyclability: Aluminum can be recycled repeatedly without losing its quality, unlike many other materials.

- Lower Carbon Footprint: Recycling aluminum uses significantly less energy than producing primary aluminum, contributing to lower greenhouse gas emissions.

- Circular Economy Alignment: Aluminum's recyclability strongly supports the principles of a circular economy, reducing waste and resource depletion.

- Growing Industry Demand: Many sectors are actively seeking materials with strong sustainability credentials, boosting aluminum's appeal.

The threat of substitutes for Constellium's aluminum products primarily stems from advanced materials like carbon fiber composites and increasingly, 3D printed metal components. These alternatives offer superior weight savings and strength-to-weight ratios, particularly appealing in aerospace and high-performance automotive sectors.

While carbon fiber composites can command prices of $20-$100 per pound compared to aluminum's $1-$5 per pound, their performance benefits are driving adoption. The global advanced composites market exceeded $90 billion in 2023, highlighting a growing competitive landscape. Additive manufacturing also presents a challenge, especially for complex parts, with the aerospace industry increasingly utilizing 3D printed metal.

Constellium counters this by developing advanced aluminum alloys that offer competitive performance at a lower cost. Their focus on tailored solutions, like high-strength aluminum for automotive structures, helps retain customers by meeting specific needs without the premium of substitutes. Aluminum's infinite recyclability, with 95% of end-of-life products collected for recycling in Europe in 2023, also provides a significant sustainability advantage.

| Substitute Material | Key Advantages | Typical Cost per Pound (USD) | Constellium's Counter |

| Carbon Fiber Composites | Superior strength-to-weight, fatigue resistance | $20 - $100 | Advanced aluminum alloys, cost-effectiveness |

| 3D Printed Metals | Complex geometries, reduced waste | Variable (depends on metal) | Optimized aluminum alloys for traditional manufacturing |

| Advanced High-Strength Steels | High tensile strength | $1 - $3 | Lightweighting, infinite recyclability, lower carbon footprint |

Entrants Threaten

Entering the primary aluminum production and high-value-added rolling and extrusion sectors demands immense capital. For instance, establishing a new aluminum smelter can cost billions of dollars, a figure that immediately deters most new players. This significant financial hurdle makes it incredibly difficult for new companies to even consider entering the market.

Established players like Constellium leverage significant economies of scale in production, procurement, and distribution. This cost advantage makes it challenging for newcomers to match pricing. For instance, Constellium's substantial production volumes in 2024 allow for more efficient raw material purchasing compared to a smaller, emerging competitor.

Years of accumulated operational experience also create a formidable barrier. This experience translates into optimized manufacturing processes, superior product quality, and a deeper understanding of customer needs, all of which are difficult for new entrants to replicate swiftly.

Constellium's significant investment in research and development, evidenced by over 250 active patents, acts as a formidable barrier to new entrants. This deep well of proprietary technology and advanced manufacturing processes requires substantial capital and time for competitors to replicate, effectively deterring newcomers.

Regulatory Hurdles and Environmental Compliance

The aluminum industry faces significant regulatory hurdles, especially concerning environmental compliance. New entrants must navigate complex permitting processes and adhere to strict standards for energy consumption and emissions, which are intensifying with the global focus on decarbonization. For instance, the European Union's Emissions Trading System (ETS) places a cost on carbon emissions, impacting energy-intensive industries like aluminum smelting.

These regulatory requirements translate into substantial upfront investments and ongoing operational costs for any new player. Compliance with evolving environmental laws, such as those related to waste management and water usage, adds another layer of complexity and expense.

- Stringent Environmental Regulations: The aluminum sector is heavily regulated regarding emissions, energy use, and waste disposal.

- Decarbonization Push: Global efforts to reduce carbon footprints increase compliance costs and necessitate investment in greener technologies.

- Permitting and Compliance Costs: New entrants face significant financial outlays and administrative burdens to obtain necessary permits and meet regulatory standards.

- Evolving Standards: Continuous updates to environmental laws require ongoing adaptation and investment to maintain compliance.

Established Customer Relationships and Brand Loyalty

Constellium benefits from deep-rooted relationships with key clients in demanding sectors like aerospace and automotive. These partnerships, cultivated over years, are founded on a reputation for superior quality and tailored product development, making it difficult for newcomers to penetrate.

Building equivalent brand recognition and fostering the same level of customer loyalty presents a formidable hurdle for any new entrant attempting to challenge Constellium’s market position.

- Established Aerospace Partnerships: Constellium supplies advanced aluminum alloys to major aircraft manufacturers, a segment requiring extensive qualification processes and long lead times for new supplier integration.

- Automotive Sector Trust: The company's long-standing supply agreements with leading automotive OEMs, particularly for lightweighting solutions, are built on consistent performance and reliability.

- Brand Equity in Packaging: In the packaging industry, Constellium's brand is associated with premium quality and sustainability, creating a barrier to entry for less recognized competitors.

The threat of new entrants in the aluminum industry, particularly for high-value segments where Constellium operates, is significantly mitigated by immense capital requirements for new facilities, estimated in the billions for smelters. Furthermore, established players benefit from economies of scale, making it difficult for newcomers to compete on cost. Decades of accumulated operational expertise, coupled with substantial investments in R&D and a portfolio of over 250 active patents, create substantial technological and process barriers.

Stringent environmental regulations, including carbon emission costs and complex permitting, add further layers of difficulty and expense for potential new entrants. These factors, combined with deeply entrenched customer relationships in sectors like aerospace and automotive, built on trust and proven quality, create a formidable landscape for any new company seeking to enter Constellium's market space.

| Barrier Type | Description | Impact on New Entrants | Constellium's Advantage |

|---|---|---|---|

| Capital Requirements | Establishing new aluminum production facilities requires billions of dollars. | Extremely High Barrier | Significant existing asset base and financial capacity. |

| Economies of Scale | Larger production volumes lead to lower per-unit costs. | High Barrier | Optimized procurement and production efficiency in 2024. |

| Technology & R&D | Proprietary processes and advanced product development. | High Barrier | Over 250 active patents and continuous innovation investment. |

| Customer Relationships | Long-standing partnerships in demanding sectors. | High Barrier | Established trust and qualification with aerospace and automotive OEMs. |

| Regulatory Compliance | Navigating environmental and permitting standards. | Moderate to High Barrier | Established compliance infrastructure and experience. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Constellium leverages data from Constellium's annual reports, investor presentations, and SEC filings. We also incorporate industry-specific market research reports from firms like CRU Group and Metal Bulletin, alongside macroeconomic data from sources such as the World Bank and IHS Markit.