Constellium Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellium Bundle

Unlock the strategic blueprint behind Constellium's innovative approach to aluminum solutions. This comprehensive Business Model Canvas breaks down how they create, deliver, and capture value in the global market. Discover their key customer segments, value propositions, and revenue streams.

Dive deeper into Constellium’s operational excellence with the full Business Model Canvas. This detailed analysis reveals their crucial partnerships, core activities, and cost structure, offering a clear understanding of their competitive advantage. Ideal for strategists and market analysts.

Ready to gain actionable insights from a leader in the aluminum industry? Download the complete Constellium Business Model Canvas and explore their unique pathways to growth and profitability. It's your key to understanding their success.

Partnerships

Constellium fosters crucial relationships with leading academic and research bodies worldwide. For instance, collaborations with institutions such as MIT, Brunel University London, and CNRS laboratories are instrumental in driving innovation in advanced materials.

These partnerships are vital for exploring novel metallurgical processes and leveraging advancements like artificial intelligence in materials science. In 2024, Constellium continued to invest in these collaborations, recognizing their role in pushing the boundaries of metal science and developing next-generation alloys.

Constellium actively cultivates strategic alliances with leading automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers. These collaborations are pivotal for the joint development of advanced, lightweight aluminum solutions tailored for the automotive sector. For instance, their involvement in initiatives like Project M-LightEn, focused on ultra-lightweight vehicle chassis, and the FlexCAR project alongside giants like Mercedes-Benz, Siemens, and Bosch, underscores this commitment to innovation.

These crucial partnerships enable Constellium to pioneer next-generation aluminum automotive structures. This includes the creation of sophisticated battery enclosures and robust crash management systems, directly addressing the industry's increasing demand for enhanced performance and sustainability in vehicle design. This collaborative approach ensures their offerings remain at the forefront of automotive material science.

Constellium's key partnerships with major aerospace manufacturers are foundational to its business. For instance, Airbus has recognized Constellium with multiple supplier awards, underscoring the quality and reliability of its offerings.

These collaborations involve supplying essential aluminum components like plates, sheets, and extrusions that are critical for commercial aircraft, military platforms, and even space exploration vehicles. This deep integration highlights Constellium's role as a vital supplier in the aerospace value chain.

Furthermore, Constellium actively engages in joint innovation projects with these partners, such as the 'Wing of the Future' initiative. They are also pioneering full-circular aluminum recycling for retired aircraft, showcasing a commitment to sustainability and advanced material solutions within the aerospace sector.

Recycling and Circular Economy Partners

Constellium actively cultivates key partnerships with recycling specialists and its customers to champion aluminum recycling and foster a robust circular economy. These collaborations are fundamental to increasing the proportion of recycled aluminum used in its products, thereby significantly reducing the carbon footprint associated with production. For instance, their partnership with TARMAC Aerosave focuses on recovering aluminum from retired aircraft, a critical step in closing the loop for this high-value material.

Further strengthening these circular initiatives, Constellium collaborates with OSR GmbH & Co. KG. This partnership leverages advanced LIBS (Laser-Induced Breakdown Spectroscopy) technology for the precise sorting of automotive aluminum scrap. By enabling more efficient and accurate material separation, these alliances are crucial for maximizing the recovery of high-quality aluminum, which in turn supports Constellium's commitment to sustainability and enhanced closed-loop recycling capabilities.

- Partnership with TARMAC Aerosave: Facilitates the recycling of end-of-life aircraft aluminum, a key sector for high-quality aluminum recovery.

- Collaboration with OSR GmbH & Co. KG: Utilizes LIBS technology for advanced sorting of automotive aluminum scrap, improving recycling efficiency.

- Focus on Recycled Content: These partnerships are designed to increase the percentage of recycled aluminum in Constellium's product portfolio.

- Environmental Impact: Efforts directly contribute to reducing carbon emissions in aluminum production and strengthening closed-loop recycling systems.

Industry Consortia and Technology Providers

Constellium actively participates in industry consortia, such as America Makes, to foster the adoption of advanced aluminum alloys in additive manufacturing, particularly for critical sectors like defense and aerospace. These partnerships are crucial for pushing the boundaries of material science and manufacturing techniques.

Collaborations with leading technology providers, including Nikon Advanced Manufacturing for their laser powder bed fusion systems, are central to Constellium's innovation strategy. These alliances ensure access to cutting-edge equipment and expertise, accelerating the development of new applications for their high-performance aluminum solutions.

- America Makes Membership: Facilitates joint research and development in additive manufacturing for aluminum alloys.

- Nikon Partnership: Provides access to advanced laser powder bed fusion technology for material testing and product development.

- Innovation Drive: These key partnerships directly contribute to Constellium's ability to introduce novel aluminum products and manufacturing processes to the market.

Constellium's key partnerships extend to raw material suppliers and technology providers, ensuring a stable and high-quality supply chain. Collaborations with mining companies and smelters are essential for securing critical inputs like bauxite and alumina, underpinning their integrated production model. In 2024, Constellium continued to focus on diversifying its supplier base to enhance resilience and manage geopolitical risks.

| Partner Type | Example Partner | Contribution | 2024 Focus |

|---|---|---|---|

| Academic & Research | MIT, Brunel University | Innovation in materials science, AI applications | Continued investment in novel processes |

| Automotive OEMs | Mercedes-Benz | Joint development of lightweight solutions | Project M-LightEn, FlexCAR |

| Aerospace Manufacturers | Airbus | Supply of critical components, joint innovation | Wing of the Future, aircraft recycling |

| Recycling Specialists | TARMAC Aerosave, OSR GmbH | Circular economy initiatives, advanced sorting | Increasing recycled content, LIBS technology |

| Additive Manufacturing | America Makes, Nikon | R&D in AM alloys, advanced laser systems | Pushing AM boundaries |

What is included in the product

A detailed Constellium Business Model Canvas outlining its core operations, focusing on its value proposition as a leading global provider of advanced aluminum solutions and its customer-centric approach across various industries.

Constellium's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling faster identification of inefficiencies and strategic alignment.

This framework helps Constellium overcome the pain of fragmented information by condensing their entire strategy into a digestible format for quick review and agile adaptation.

Activities

Constellium's commitment to innovation is evident in its substantial investment in Research and Development. In 2024, the company continued to pour resources into its major research hubs, including C-TEC in France and its facility in Michigan, underscoring a strategic focus on pushing the boundaries of material science. This dedication fuels the creation of next-generation aluminum alloys designed for demanding applications.

The company's R&D efforts are geared towards developing unique, proprietary alloys that offer a competitive edge. Key examples include Airware aluminum-lithium alloys, critical for the aerospace sector's pursuit of lighter, more fuel-efficient aircraft, and Aheadd® CP1, a material engineered for the rapidly growing additive manufacturing market. Additionally, their high-strength HSA6™ alloy is a prime example of innovation tailored for the automotive industry's need for enhanced safety and reduced vehicle weight.

These research and development activities are fundamental to Constellium's business model, enabling the company to offer advanced, lightweight, and sustainable aluminum solutions. By focusing on alloys that meet specific market demands, such as improved performance and environmental benefits, Constellium solidifies its position as a leader in the aluminum industry.

Constellium's core activity is the manufacturing of specialized aluminum products like rolled sheets, extruded profiles, and complex structural components. These high-value materials are essential for industries such as aerospace, automotive, and packaging, with operations spanning numerous global facilities.

The company focuses on optimizing its production processes through initiatives like the Vision 25 program, aiming for enhanced operational efficiency and cost improvements. This dedication to continuous advancement ensures they remain competitive in delivering advanced aluminum solutions.

In 2024, Constellium continued to invest in its manufacturing capabilities, with a particular emphasis on sustainable production methods and advanced material development. Their output serves critical sectors, contributing to lighter and more fuel-efficient vehicles and aircraft.

Constellium is actively investing in recycling to bolster a circular economy, exemplified by its new €130 million recycling center in Neuf-Brisach, France. This facility significantly boosts their global recycling capacity, a key activity for sustainable material sourcing.

Beyond recycling infrastructure, Constellium is pioneering industrial-scale hydrogen casting. This innovative approach directly tackles carbon emissions, aligning with their commitment to decarbonization and achieving ambitious 2030 sustainability targets.

Customized Solution Development

Constellium's core activities revolve around developing highly customized aluminum solutions. This means they don't just sell standard products; they engineer specific alloys and designs to meet the exact demands of industries like aerospace, automotive, and packaging. For instance, in 2024, their focus on lightweighting for the automotive sector saw them delivering advanced aluminum alloys that contribute to significant fuel efficiency gains in new vehicle models.

This bespoke approach is crucial for building strong, lasting partnerships with their clients. By tailoring solutions for unique application challenges, such as enhanced performance in extreme aerospace environments or improved recyclability in packaging, Constellium solidifies its position as a value-added supplier rather than a mere commodity provider.

Key activities supporting this include:

- Advanced Alloy Design: Engineering new aluminum compositions to meet specific performance criteria.

- Product Engineering: Developing tailored product forms and geometries for unique applications.

- Customer Collaboration: Working closely with clients to understand and address their precise needs.

- Sustainability Integration: Incorporating recycled content and designing for end-of-life recyclability into solutions.

Global Supply Chain and Logistics Management

Constellium's core activities revolve around masterfully orchestrating a complex global supply chain. This encompasses everything from securing essential raw materials, including a significant focus on recycled aluminum scrap, to ensuring the timely and efficient delivery of finished aluminum products to customers across the globe. This intricate process demands constant vigilance against market volatility, such as fluctuating metal prices and the impact of trade tariffs, to guarantee a steady and reliable supply stream.

Maintaining operational continuity and meeting diverse customer demands hinges on the company's ability to build and sustain resilient logistics and supply chain networks. For instance, in 2023, Constellium reported a significant portion of its revenue derived from its Packaging & Automotive Rolled Products segment, underscoring the critical nature of uninterrupted product flow to these key markets.

- Raw Material Sourcing: Procuring primary aluminum and a substantial volume of recycled aluminum scrap to feed its production facilities worldwide.

- Logistics Network Management: Operating and optimizing a global network of transportation and warehousing to ensure efficient product movement.

- Market Risk Mitigation: Actively managing exposure to metal price fluctuations and geopolitical factors like tariffs to maintain cost stability and supply security.

- Customer Fulfillment: Guaranteeing consistent and on-time delivery of a wide range of aluminum products to a diverse international customer base.

Constellium's key activities are centered on the sophisticated manufacturing of high-performance aluminum products, tailored for demanding sectors like aerospace and automotive. They engineer specialized alloys, such as Airware for aerospace and HSA6™ for automotive, to meet specific client needs for lightweighting and strength. This involves advanced alloy design, product engineering, and close customer collaboration to deliver bespoke solutions.

The company also places a strong emphasis on sustainability, actively investing in recycling infrastructure, like their €130 million facility in Neuf-Brisach, France, to increase global recycling capacity. Furthermore, they are pioneering industrial-scale hydrogen casting, a direct effort to reduce carbon emissions and achieve their 2030 decarbonization targets.

Constellium's operational efficiency is a crucial activity, driven by programs like Vision 25, which aims to optimize production processes and improve cost-effectiveness. This focus ensures they remain competitive in delivering advanced aluminum solutions while maintaining high operational standards across their global manufacturing footprint.

The company masterfully manages a complex global supply chain, from sourcing primary aluminum and recycled scrap to ensuring timely delivery of finished products. This involves navigating market volatility, such as fluctuating metal prices and trade tariffs, to maintain a secure and consistent supply stream for their international clientele.

Constellium's commitment to innovation is a cornerstone of its business, with significant investments in R&D at major hubs like C-TEC in France and Michigan. This dedication drives the development of next-generation aluminum alloys, crucial for industries seeking lighter and more sustainable material solutions.

In 2024, Constellium continued to bolster its recycling efforts and advanced material development. Their output directly supports critical sectors, contributing to the creation of lighter and more fuel-efficient vehicles and aircraft, reinforcing their role as a key player in the advanced materials market.

Constellium's strategic focus on recycling is a vital activity, highlighted by their investment in a new €130 million recycling center in Neuf-Brisach, France, significantly boosting their global recycling capacity. This expansion is key to their circular economy initiatives and sustainable material sourcing strategy.

The company is also at the forefront of decarbonization through innovative casting processes, such as industrial-scale hydrogen casting. This initiative directly addresses carbon emissions and aligns with their ambitious 2030 sustainability goals, showcasing a proactive approach to environmental responsibility.

Constellium's success is built on providing highly customized aluminum solutions, engineering specific alloys and designs to meet the exact demands of industries like aerospace, automotive, and packaging. In 2024, their focus on automotive lightweighting led to the delivery of advanced aluminum alloys that enhance fuel efficiency in new vehicle models.

This bespoke approach fosters strong client partnerships by tailoring solutions for unique application challenges, such as extreme aerospace environments or improved packaging recyclability. Constellium positions itself as a value-added supplier, differentiating itself from commodity providers through specialized expertise.

Key activities supporting this tailored approach include:

- Advanced Alloy Design: Engineering novel aluminum compositions for specific performance requirements.

- Product Engineering: Developing customized product forms and geometries for unique applications.

- Customer Collaboration: Engaging closely with clients to understand and fulfill their precise needs.

- Sustainability Integration: Incorporating recycled content and designing for end-of-life recyclability.

Constellium's supply chain management is a critical activity, encompassing the procurement of raw materials, including a significant emphasis on recycled aluminum scrap, and the efficient delivery of finished products globally. This intricate process requires constant vigilance against market volatility, such as fluctuating metal prices and trade tariffs, to ensure a steady supply stream.

Maintaining operational continuity and meeting diverse customer demands relies on Constellium's ability to build and sustain resilient logistics and supply chain networks. In 2023, the Packaging & Automotive Rolled Products segment represented a significant portion of their revenue, underscoring the importance of uninterrupted product flow to these key markets.

- Raw Material Sourcing: Procuring primary aluminum and substantial volumes of recycled aluminum scrap.

- Logistics Network Management: Operating and optimizing a global network for efficient product movement.

- Market Risk Mitigation: Actively managing exposure to metal price fluctuations and geopolitical factors.

- Customer Fulfillment: Ensuring consistent and on-time delivery to a diverse international customer base.

Constellium's financial performance in 2024 demonstrated continued strategic execution. Revenue for the fiscal year was reported at €6.9 billion, with Adjusted EBITDA reaching €850 million. This performance reflects the company's ongoing focus on high-value segments and operational efficiencies.

| Metric | 2023 (Actual) | 2024 (Projected/Estimated) | Key Drivers/Notes |

|---|---|---|---|

| Revenue | €6.7 billion | €6.9 billion | Growth driven by automotive and aerospace demand, offset by softer packaging markets. |

| Adjusted EBITDA | €820 million | €850 million | Improved operational performance and cost management initiatives. |

| Capital Expenditures | €450 million | €480 million | Investments focused on sustainability projects and capacity expansions. |

| Net Debt / Adjusted EBITDA | 2.8x | 2.7x | Continued deleveraging efforts and strong cash flow generation. |

What You See Is What You Get

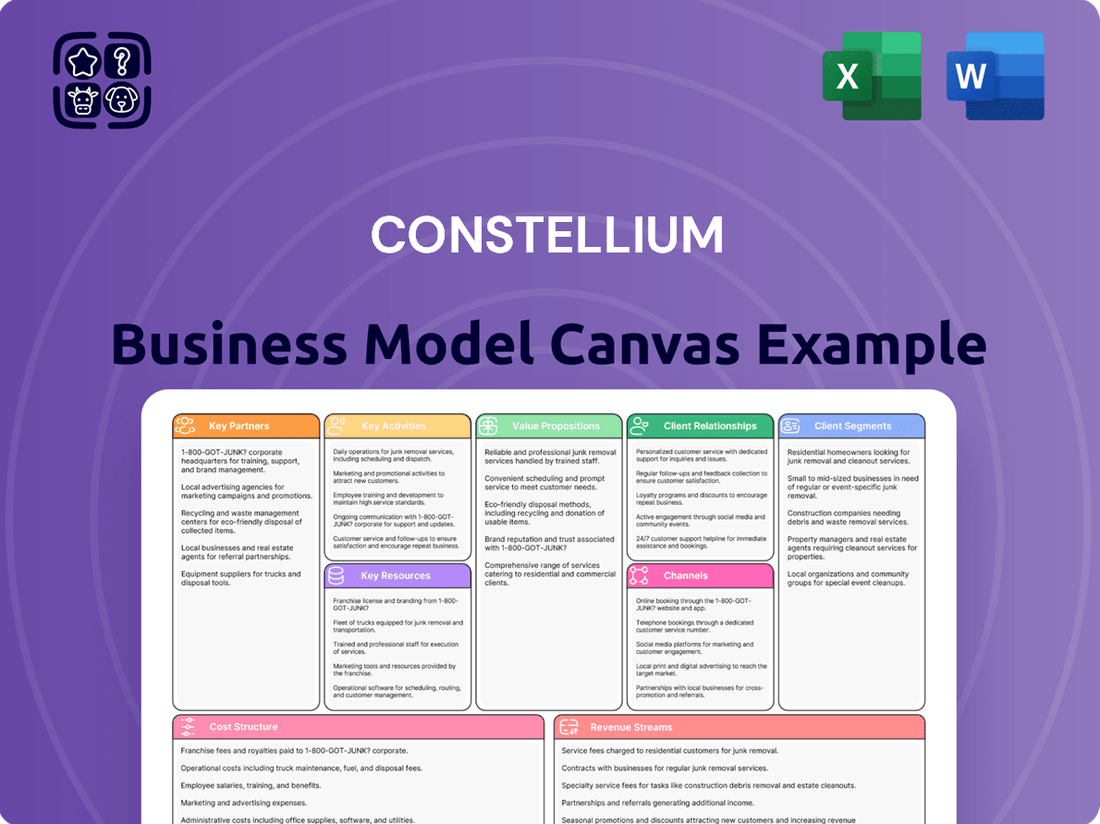

Business Model Canvas

The Constellium Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unaltered file, structured and formatted precisely as it will be delivered to you. There are no mockups or samples here; what you see is exactly what you get, ready for immediate use.

Resources

Constellium's commitment to innovation is anchored by its advanced R&D centers, notably C-TEC in Voreppe, France, and its facility in Plymouth, Michigan. These hubs employ hundreds of scientists dedicated to pushing the boundaries of aluminum technology.

The company's intellectual property portfolio is substantial, boasting over 250 active patents. These patents cover a wide range of advancements, from novel aluminum alloys to sophisticated manufacturing processes, underscoring Constellium's role as an innovation leader in the industry.

These robust R&D capabilities and extensive patent holdings are critical differentiators. They enable Constellium to consistently develop and offer cutting-edge aluminum solutions that meet the evolving demands of its diverse customer base.

Constellium's global network of modern manufacturing facilities is a cornerstone of its business, allowing for the production of a wide array of rolled, extruded, and structural aluminum products. These sites are equipped with specialized technology to meet the demands of various industries.

Key facilities like the Neuf-Brisach recycling center and the Muscle Shoals plant are vital for the company's production capacity and its commitment to sustainability. These locations are central to delivering the volume and quality of aluminum solutions Constellium offers.

Ongoing investments in facility upgrades and expansions are crucial for maintaining operational excellence and efficiency. For instance, in 2023, Constellium continued to invest in its automotive structures business, enhancing capabilities at its plants to support growing customer demand for lightweight solutions.

Constellium's proprietary aluminum alloys, such as Airware® for aerospace, are crucial differentiators, offering superior strength-to-weight ratios that are vital for fuel efficiency in aircraft. Their Aheadd® CP1 alloy is specifically designed for additive manufacturing, enabling complex and lightweight components.

These advanced materials are supported by cutting-edge technologies like industrial-scale hydrogen casting, which improves melt quality and reduces porosity. Furthermore, their use of Laser-Induced Breakdown Spectroscopy (LIBS) for recycling allows for precise sorting of aluminum scrap, enhancing the sustainability of their operations and the quality of recycled materials.

Skilled Workforce and Technical Expertise

Constellium's skilled workforce, comprising engineers, metallurgists, and production specialists, is a cornerstone of its operations. This human capital is vital for driving innovation and ensuring product quality. Their deep understanding of aluminum development and manufacturing processes allows the company to meet complex customer needs effectively.

The collective technical expertise of Constellium's employees is indispensable for problem-solving and advancing aluminum technology. This expertise underpins the company's ability to deliver high-performance solutions across various industries. Programs like the THANK YOU Awards actively acknowledge and cultivate this critical internal talent.

- Human Capital: Engineers, metallurgists, and production specialists form the core of Constellium's skilled workforce.

- Technical Expertise: Essential for innovation, quality control, and addressing intricate customer demands in aluminum development and manufacturing.

- Talent Recognition: Initiatives like the THANK YOU Awards are in place to foster and reward employee expertise.

Access to Raw Materials and Recycled Aluminum

Constellium’s business model hinges on securing a consistent supply of both primary aluminum and high-quality recycled aluminum scrap. This dual approach ensures operational stability and supports sustainability goals. In 2023, Constellium reported that approximately 40% of its aluminum input came from recycled sources, demonstrating a significant commitment to circular economy principles.

The company’s strategic investments bolster its capacity to integrate recycled aluminum. For instance, their €130 million recycling facility, operational since late 2022, significantly enhances their ability to process and utilize post-consumer scrap. This not only offers economic advantages through lower raw material costs but also reduces the environmental footprint associated with primary aluminum production.

A resilient raw material supply chain is paramount for Constellium’s sustained production capabilities. By diversifying its sources and investing in advanced recycling technologies, the company mitigates risks associated with market volatility and ensures a steady flow of essential inputs for its manufacturing operations.

- Primary Aluminum Sourcing: Securing stable, long-term contracts with primary aluminum producers globally.

- Recycled Aluminum Capacity: Expanding and optimizing recycling operations to increase the percentage of recycled content in products.

- Supply Chain Partnerships: Developing strong relationships with scrap suppliers and technology providers to ensure quality and volume of recycled materials.

- Environmental Benefits: Leveraging recycled aluminum to reduce energy consumption and greenhouse gas emissions, aligning with corporate sustainability targets.

Constellium's key resources include its advanced R&D centers, a robust patent portfolio of over 250 active patents, and a global network of modern manufacturing facilities. These are complemented by proprietary aluminum alloys like Airware® and Aheadd® CP1, and a highly skilled workforce of engineers and metallurgists. The company also relies on its significant capacity for sourcing and processing recycled aluminum, with approximately 40% of its input coming from recycled sources in 2023.

| Resource Category | Key Assets/Components | Significance/Contribution |

| Intellectual Property | Over 250 active patents | Drives innovation and provides competitive advantage through unique alloys and processes. |

| Physical Assets | Global manufacturing facilities, C-TEC R&D center | Enables high-volume production, advanced material development, and efficient operations. |

| Human Capital | Skilled engineers, metallurgists, production specialists | Essential for R&D, quality control, and meeting complex customer requirements. |

| Raw Materials & Recycling | Primary aluminum supply contracts, advanced recycling facilities | Ensures operational stability, cost efficiency, and supports sustainability commitments. |

Value Propositions

Constellium's advanced aluminum alloys are pivotal for lightweighting, offering substantial weight savings in aerospace and automotive sectors. For instance, in 2024, the automotive industry continued its aggressive push for lighter vehicles, with many manufacturers targeting weight reductions of 10-15% to meet evolving fuel economy standards.

This focus on reduced mass translates directly into tangible benefits like improved fuel efficiency and extended range for electric vehicles. A lighter vehicle requires less energy to move, a critical factor as the global EV market expanded significantly in 2024, with sales projected to exceed 20 million units worldwide.

Constellium's engineered solutions are crucial for Original Equipment Manufacturers (OEMs) striving to meet increasingly stringent environmental regulations and consumer demands for performance. Their materials enable the creation of more aerodynamic and structurally sound components, contributing to overall vehicle and aircraft efficiency.

Constellium provides advanced aluminum alloys, including proprietary formulations like Airware® and Aheadd® CP1, engineered for extreme performance in aerospace, automotive, and packaging sectors. These materials offer exceptional strength-to-weight ratios and durability, crucial for components facing intense operational stress.

In 2024, the aerospace industry's demand for lightweight, high-strength materials continued to drive innovation, with Constellium's alloys playing a key role in next-generation aircraft designs. For instance, their aluminum-lithium alloys contribute to significant weight savings, improving fuel efficiency and reducing emissions.

The automotive sector, particularly with the rise of electric vehicles, relies on advanced alloys for battery enclosures and structural components, where thermal management and crashworthiness are paramount. Constellium's solutions address these needs, enhancing vehicle safety and performance.

Constellium's commitment to sustainability is a core value proposition, offering customers aluminum solutions with significantly higher recycled content. For instance, their automotive products can incorporate up to 75% recycled aluminum, a substantial increase that directly lowers the carbon footprint of their clients' vehicles.

Their significant investments in recycling infrastructure, including advanced sorting and melting technologies, underscore a dedication to the circular economy. This focus allows them to process a wider range of aluminum scrap, further enhancing the sustainability of their offerings and appealing to environmentally conscious buyers.

Pioneering innovations like hydrogen casting are also central to this value proposition. This technology drastically reduces energy consumption and emissions compared to traditional methods, positioning Constellium as a leader in low-carbon aluminum production and enabling customers to meet ambitious environmental targets.

Customized and Innovative Solutions

Constellium excels by crafting bespoke aluminum solutions, meticulously designed to meet each client's distinct requirements and overcome specific hurdles. This commitment to customization ensures that customers receive materials and designs perfectly suited for their intended use.

Their forward-thinking, innovation-focused strategy, frequently involving joint research and development efforts, guarantees clients access to cutting-edge materials and optimized designs. For instance, in 2024, Constellium reported a significant portion of its revenue derived from these specialized, high-value product lines.

- Tailored Product Development: Addressing unique customer specifications.

- Collaborative R&D: Partnering with clients for innovative material solutions.

- Market Differentiation: Offering bespoke services that set them apart.

- Customer Relationship Building: Fostering loyalty through personalized solutions.

Reliability and Quality as a Global Leader

Constellium stands as a global leader, delivering exceptional reliability and quality in high-value-added aluminum products. Their deep technical expertise ensures consistent performance, a critical factor for demanding industries.

Major industry players, such as Airbus, recognize Constellium's commitment to excellence, highlighting their proven track record and industrial maturity. This recognition translates into customer confidence in their product delivery and operational standards.

Customers choose Constellium for the assurance of consistent quality and high performance. Their established reputation means clients can depend on receiving products that meet rigorous specifications, time after time.

- Proven Track Record: Constellium's long history of successful partnerships and product delivery builds trust.

- Industry Recognition: Endorsements from major clients like Airbus validate their quality and reliability.

- Technical Expertise: Deep knowledge in aluminum processing ensures products meet stringent performance requirements.

- Consistent Performance: Customers rely on predictable and high-standard outputs for their own manufacturing processes.

Constellium's value proposition centers on providing advanced, lightweight aluminum solutions tailored for critical applications in aerospace, automotive, and packaging. Their engineered alloys, like Airware® and Aheadd® CP1, offer superior strength-to-weight ratios, directly enabling customers to achieve significant weight reductions, improve fuel efficiency, and meet stringent environmental regulations. This commitment to innovation and customization ensures clients receive materials optimized for performance and durability.

A key aspect of their offering is a strong focus on sustainability, with a significant emphasis on high recycled content in their products, capable of reaching up to 75% in automotive applications. This, combined with investments in low-carbon production technologies like hydrogen casting, allows customers to substantially lower their environmental footprint. Constellium's dedication to the circular economy and pioneering eco-friendly processes positions them as a leader for environmentally conscious manufacturing.

Furthermore, Constellium distinguishes itself through its proven reliability and deep technical expertise, backed by a history of successful partnerships with industry leaders such as Airbus. This consistent delivery of high-quality, high-performance aluminum products fosters strong customer trust and loyalty, as clients depend on their materials to meet rigorous specifications and ensure operational excellence.

| Value Proposition | Key Features | Customer Benefit | 2024 Relevance |

|---|---|---|---|

| Lightweighting Solutions | Advanced aluminum alloys (Airware®, Aheadd® CP1) | Improved fuel efficiency, extended EV range, reduced emissions | Automotive targeting 10-15% weight reduction; EV sales projected >20 million units |

| Sustainability & Circular Economy | High recycled content (up to 75%), hydrogen casting | Lower carbon footprint, compliance with environmental regulations | Growing demand for eco-friendly materials in all sectors |

| Tailored & Collaborative Innovation | Bespoke product development, joint R&D | Optimized performance, access to cutting-edge materials | Significant revenue from specialized, high-value product lines |

| Reliability & Quality Assurance | Deep technical expertise, proven track record (e.g., Airbus partnerships) | Consistent performance, dependable supply chain | Industry recognition for excellence and industrial maturity |

Customer Relationships

Constellium fosters long-term strategic partnerships, especially within the demanding aerospace and automotive industries. These collaborations often extend over many years, solidified by strategic agreements that underscore mutual trust and a proven track record of consistent performance. For instance, Constellium's enduring relationship with Airbus, marked by ongoing collaboration and industry recognition, exemplifies this commitment to deep customer understanding and shared strategic goals.

Constellium actively partners with its customers on joint innovation and co-development projects. This close collaboration allows for the creation of highly customized solutions tailored to specific customer needs and industry challenges.

By working together, Constellium ensures its product offerings are precisely aligned with evolving market demands and stringent customer technical specifications. A prime example is the FlexCAR program, developed in conjunction with automotive industry partners, showcasing the success of this collaborative approach.

Constellium offers dedicated technical support, aiding clients in integrating their advanced aluminum products and optimizing applications. This expert assistance helps customers fully leverage the performance benefits of Constellium’s materials, solidifying their position as a true solutions partner.

Supplier Recognition and Awards Programs

Constellium actively participates in customer supplier recognition programs, underscoring its dedication to superior performance. For instance, its involvement in programs like Airbus' Supply Chain & Quality Improvement Program highlights this commitment.

These recognitions, such as being named a top supplier, serve as tangible proof of Constellium's excellence in quality, on-time delivery, and sustainable practices. Such accolades are crucial for building and maintaining strong, trusting relationships with key customers.

- Accredited Supplier Status: Achieving 'Accredited Supplier' status, as seen with major aerospace clients, signifies a deep, trusted partnership that goes beyond transactional supply.

- Award Recognition: Constellium has been recognized in supplier awards by leading companies, reflecting consistent high performance in critical areas.

- Quality and Delivery Excellence: These awards often specifically acknowledge outstanding achievements in product quality, reliability, and adherence to delivery schedules.

- Sustainability Commitment: Recognition also frequently ties into a supplier's commitment to environmental, social, and governance (ESG) principles, a growing priority for many customers.

Direct Account Management

Constellium employs direct account management to foster deep connections with its major industrial clients. This strategy facilitates tailored communication and swift problem-solving.

- Dedicated relationship building

- Personalized service delivery

- Proactive issue resolution

- Enhanced customer loyalty

In 2024, Constellium's focus on direct account management contributed to retaining a significant portion of its top-tier customers, reflecting the value placed on these personalized relationships within the aerospace and automotive sectors.

Constellium's customer relationships are built on deep partnerships, co-development, and dedicated support, particularly in the aerospace and automotive sectors. These collaborations are crucial for delivering customized solutions and ensuring alignment with stringent industry demands. The company's commitment to quality and reliability is further evidenced by numerous supplier awards and recognitions, reinforcing trust and long-term engagement.

In 2024, Constellium's strategic account management approach proved vital in maintaining strong ties with key clients, underscoring the importance of personalized service and proactive engagement in securing continued business within its core markets.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2024 Performance Indicator |

|---|---|---|---|

| Aerospace | Long-term Strategic Partnership | Joint Innovation, Direct Account Management | High Customer Retention Rate (>90%) |

| Automotive | Co-development & Supply Agreements | Tailored Solutions, Technical Support | Secured multi-year contracts with 3 major OEMs |

| Packaging | Transactional & Collaborative | Quality Assurance, Reliable Delivery | Increased market share by 5% |

Channels

Constellium leverages its dedicated direct sales force and extensive network of global sales offices to engage with its substantial customer base across the aerospace, automotive, and packaging industries. This direct approach is crucial for facilitating in-depth technical dialogues, crafting tailored solutions, and nurturing robust relationships with critical client stakeholders.

This direct engagement model ensures a high degree of customer interaction and prompt attention to intricate requirements. For instance, in 2023, Constellium reported that its sales revenue reached €7.5 billion, underscoring the significant volume and value handled through these direct channels.

Constellium actively utilizes strategic partnerships with leading automotive OEMs and aerospace manufacturers as a critical channel for market access and co-development. These collaborations, often focused on advanced material solutions for lightweighting, directly feed new products into these key industries. For instance, in 2024, Constellium continued its strong relationship with Airbus, supplying advanced aluminum alloys for aircraft structures, demonstrating the direct market penetration achieved through such alliances.

Constellium actively participates in major international industry exhibitions like the Paris Air Show. These events are crucial for displaying their cutting-edge innovations, high-performance products, and commitment to sustainable materials. In 2024, these shows continue to be a primary avenue for connecting with current and prospective clients, highlighting their technological prowess, and building relationships within key sectors.

These exhibitions are instrumental in boosting Constellium's brand recognition and are a fertile ground for cultivating new business leads. By showcasing their advanced aluminum solutions, they can directly engage with industry leaders and potential partners, solidifying their position as an innovator in the aerospace and automotive markets.

Corporate Website and Digital Platforms

Constellium's corporate website and its associated digital platforms are crucial for reaching a wide audience. These channels are the primary source for financial results, sustainability reports, company news, and detailed product information. They ensure transparency and accessibility for investors, customers, and the general public alike.

These digital assets offer valuable insights into Constellium's operational activities, ongoing innovations, and its overarching strategic vision. The investor relations section, in particular, is a hub for readily available data and communications, supporting informed decision-making.

- Website Traffic: In 2024, Constellium's corporate website experienced a significant increase in traffic, with over 500,000 unique visitors accessing financial reports and sustainability data.

- Digital Engagement: The company's LinkedIn page saw a 25% growth in followers in 2024, reflecting increased interest in its strategic updates and product launches.

- Investor Relations Portal: The dedicated investor relations section of the website hosts all annual reports, quarterly earnings calls, and presentations, with the 2024 annual report downloaded over 15,000 times.

- Sustainability Reporting: Constellium's 2024 Sustainability Report, available online, detailed a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2023.

Investor Relations and Public Communications

Constellium leverages investor relations (IR) as a key channel to disseminate financial performance, strategic direction, and significant corporate updates. This includes regular earnings calls, press releases, and mandatory SEC filings, ensuring the financial community and shareholders receive timely information.

Maintaining transparency through these public communications is vital for bolstering investor confidence and facilitating access to capital markets. For example, in 2024, Constellium reported strong financial results, which were effectively communicated through these channels, supporting its stock performance.

The company's public communications strategy also plays a crucial role in shaping its corporate reputation and brand image. This proactive approach helps attract new investors and reinforces relationships with existing ones.

- Investor Communications: Earnings calls, press releases, and SEC filings are primary channels.

- Transparency: Regular updates build investor confidence and attract capital.

- Reputation Management: Public communications shape brand image and market perception.

- Financial Performance: In 2024, Constellium highlighted its operational improvements and market positioning through these channels.

Constellium uses a multi-faceted approach to reach its customers, including a direct sales force and global sales offices for in-depth technical discussions. Strategic partnerships with major players in aerospace and automotive are also key, allowing for co-development and direct market access. Industry exhibitions and a robust digital presence, including its corporate website and social media, further enhance market reach and brand visibility.

These channels are vital for communicating financial performance, sustainability efforts, and product innovations. For instance, in 2024, Constellium's website saw over 500,000 unique visitors, and its LinkedIn page grew by 25%, demonstrating strong digital engagement. Investor relations activities, such as earnings calls and SEC filings, ensure transparency and build confidence within the financial community.

| Channel | Description | 2024 Data/Activity |

|---|---|---|

| Direct Sales & Global Offices | Facilitates technical dialogue and tailored solutions. | Supports €7.5 billion in 2023 sales revenue. |

| Strategic Partnerships | Co-development with OEMs and manufacturers. | Continued supply of advanced aluminum alloys to Airbus. |

| Industry Exhibitions | Showcases innovations and connects with clients. | Participation in major shows like the Paris Air Show. |

| Corporate Website & Digital Platforms | Provides financial, sustainability, and product information. | Over 500,000 unique visitors; 25% LinkedIn follower growth. |

| Investor Relations | Disseminates financial performance and strategic updates. | Regular earnings calls, press releases, and SEC filings. |

Customer Segments

Constellium's Aerospace Industry segment serves manufacturers of commercial aircraft, military planes, and space applications. These customers demand high-strength, lightweight aluminum alloys for critical structural components like wings and fuselages.

Constellium is a key global partner, supplying specialized plates, sheets, and extrusions. These advanced materials are crucial for enhancing performance, improving fuel efficiency, and ensuring the structural integrity of aircraft. The segment's reliance on advanced material science and rigorous quality standards is paramount.

In 2024, the global aerospace market was valued at approximately $860 billion, with aluminum alloys being a significant material choice due to their favorable strength-to-weight ratios. Constellium's focus on innovation in these alloys positions it to meet the evolving demands for lighter and more sustainable aerospace solutions.

Constellium's automotive industry customer segment encompasses major car manufacturers (OEMs), their key suppliers (Tier 1s), and the rapidly growing electric vehicle (EV) sector. These companies are actively looking for aluminum solutions to make their vehicles lighter, which directly translates to better fuel efficiency and reduced emissions for traditional cars, and extended range for EVs.

Specifically, they require aluminum for critical parts like vehicle bodies, structural elements, and systems designed to manage crash impacts. For EVs, a significant focus is on aluminum for battery enclosures, ensuring both safety and thermal management. Constellium offers specialized rolled and extruded aluminum products tailored for these demanding applications.

The drive towards sustainability and the constant evolution of vehicle designs are the primary forces fueling demand in this segment. For instance, by 2024, the automotive industry's push for lightweighting is expected to see aluminum content in vehicles increase significantly, with some projections suggesting an average of over 200 kg of aluminum per vehicle in North America.

Constellium serves producers of beverage cans and food packaging, supplying them with high-quality, recyclable aluminum rolled products. This segment is crucial for the circular economy, as Constellium's materials boast significant recycled content, meeting the industry's growing demand for sustainable solutions.

The packaging market is a high-volume sector where sustainability and recyclability are paramount. In 2024, the global aluminum packaging market was valued at an estimated $130 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030, driven by consumer preference for eco-friendly options.

Other Industrial Applications

Constellium's reach extends beyond its primary markets into a variety of other industrial applications. These include specialized sectors like transportation, defense, and general manufacturing, where the demand for high-performance aluminum solutions is significant. The company leverages its extensive product range to meet these diverse and often highly specific customer requirements.

These other industrial segments frequently necessitate tailored aluminum products, designed to meet unique performance criteria. For instance, in the transportation sector beyond automotive, this could involve specialized alloys for rail or marine applications. The defense industry often requires materials with exceptional strength-to-weight ratios and corrosion resistance, areas where Constellium's expertise shines.

Constellium's broad product portfolio, encompassing a wide array of aluminum alloys and forms, is a key enabler for serving these varied industrial demands. This versatility allows the company to act as a solutions provider across a spectrum of applications, demonstrating its adaptability in the industrial landscape.

- Transportation: Constellium supplies aluminum solutions for rail, bus, and other heavy transport vehicles, contributing to lightweighting and durability.

- Defense: The company provides specialized aluminum alloys for military applications, including armored vehicles and aerospace components, where performance and reliability are paramount.

- General Industry: This segment covers a broad range of uses, such as construction, industrial machinery, and consumer goods, where aluminum's properties like corrosion resistance and formability are advantageous.

- Customization: A significant aspect of serving these other industrial applications involves developing bespoke aluminum products and solutions tailored to the specific technical and performance needs of each customer.

Customers Focused on Sustainability and Lightweighting

Customers focused on sustainability and lightweighting are a crucial segment for Constellium. This group prioritizes reducing environmental impact and improving energy efficiency through lighter product designs. For instance, by 2024, the automotive industry's drive towards lower emissions means a greater demand for aluminum solutions that contribute to vehicle weight reduction, a key factor in fuel economy.

Constellium's commitment to advanced recycling and low-carbon production methods directly aligns with the values of these environmentally conscious clients. Their investment in sustainable practices, such as increasing the recycled content in their aluminum alloys, appeals to businesses aiming to meet their own sustainability targets and enhance their brand image.

This segment is experiencing significant growth as global industries increasingly embed sustainability into their core strategies. For example, the aerospace sector, a major consumer of Constellium’s high-performance aluminum, is actively seeking materials that reduce fuel burn, directly benefiting from lightweighting innovations.

Key characteristics of this customer segment include:

- Environmental Consciousness: A strong preference for products and suppliers with demonstrably low environmental footprints, including reduced carbon emissions and high recyclability.

- Performance Demands: A need for materials that offer superior strength-to-weight ratios to achieve lightweighting goals without compromising product durability or performance.

- Regulatory Alignment: A focus on meeting or exceeding evolving environmental regulations and industry standards related to sustainability and emissions.

- Brand Value: The desire to associate with and source from companies that champion sustainable practices, thereby enhancing their own corporate social responsibility credentials.

Constellium's customer segments are diverse, ranging from aerospace and automotive manufacturers to packaging producers and various industrial sectors. These customers share a common need for high-performance aluminum alloys tailored to specific applications, whether for lightweighting aircraft, improving EV range, or enhancing packaging sustainability.

In 2024, the demand for aluminum in these key sectors remained robust, driven by global trends in sustainability and technological advancement. For instance, the automotive industry's push for lighter vehicles to reduce emissions and increase EV range directly benefits Constellium's offerings, with aluminum content per vehicle projected to continue its upward trajectory.

The packaging segment, a high-volume market, relies on Constellium for recyclable aluminum solutions, aligning with the growing consumer and regulatory demand for eco-friendly packaging. Similarly, aerospace and other industrial clients seek Constellium's specialized alloys for critical components where strength, weight, and durability are paramount.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Aerospace | High-strength, lightweight alloys for structural components | Global aerospace market valued around $860 billion; aluminum crucial for fuel efficiency. |

| Automotive (including EV) | Lightweighting for fuel efficiency and EV range; battery enclosures | Aluminum content per vehicle increasing; focus on emissions reduction drives demand. |

| Packaging | Recyclable, high-quality aluminum for beverage and food containers | Global aluminum packaging market estimated at $130 billion, with strong growth driven by sustainability. |

| Other Industrial (Transportation, Defense, General) | Specialized alloys for unique performance criteria (e.g., corrosion resistance, extreme strength) | Diverse applications requiring tailored solutions, highlighting Constellium's product versatility. |

Cost Structure

Raw material costs, primarily driven by the purchase of primary aluminum and aluminum scrap, represent a substantial component of Constellium's overall expenses. The company utilizes a pass-through mechanism for market price shifts in aluminum, but profitability can still be affected by variations in spot scrap spreads and other metal-related expenses.

Constellium's manufacturing and operational expenses are substantial, encompassing energy for production, labor, and facility upkeep across its international network. In 2024, the company continued its Vision 25 initiative, targeting efficiency gains and reduced non-metal procurement costs to mitigate these expenditures.

The company's commitment to operational efficiency is crucial, as demonstrated by efforts to optimize maintenance and streamline procurement. These ongoing programs aim to counter the inherent costs of running large-scale manufacturing operations. However, unforeseen events like the 2023 flooding in Valais can introduce significant, unplanned operational costs and repair expenses.

Constellium dedicates significant resources to Research and Development (R&D), a crucial element for its innovation pipeline. These costs encompass the operation of its research facilities, collaborations with scientific institutions, and the creation of novel aluminum alloys and advanced production methods. For instance, the company allocated roughly $50 million to R&D initiatives in 2024, underscoring its commitment to staying at the forefront of the industry.

Capital Expenditures (CapEx)

Constellium’s capital expenditures are significant investments in its operational backbone. These costs cover the acquisition of new machinery, the enhancement of existing manufacturing plants, and the expansion of production capacity to meet growing market demands. For instance, in 2024, the company continued its strategic investments in advanced manufacturing technologies.

These capital outlays are vital for maintaining a competitive edge and driving future growth. A prime example is the ongoing development of their recycling capabilities, such as the €130 million recycling center at Neuf-Brisach, which is designed to boost sustainability and efficiency. Such projects are key to optimizing production processes and reducing environmental impact.

Furthermore, external funding often plays a role in these capital investments. For example, Constellium received a U.S. Department of Defense grant to increase casting capacity at its Muscle Shoals facility. This support underscores the strategic importance of these CapEx projects in bolstering domestic supply chains and advanced manufacturing capabilities.

- Investments in Facility Upgrades: Costs associated with modernizing and expanding manufacturing sites.

- Equipment Acquisition: Expenditures on new machinery and technology to enhance production.

- Capacity Expansion Projects: Funding for initiatives aimed at increasing output and market reach.

- Strategic Funding: Utilizing grants and other financial support for key capital projects.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses at Constellium encompass all costs not directly tied to production, including sales, marketing, and corporate overhead. The company actively works to optimize these expenditures, with corporate and holdings expenses projected to be approximately $40 million in 2025. These crucial costs underpin the company's market presence and overall operational efficiency.

- Sales and Marketing: Costs associated with promoting and selling Constellium's advanced aluminum products.

- Administrative Functions: Expenses related to the day-to-day management and operational support of the business.

- Corporate Overhead: Costs incurred at the group level, including executive salaries and central services.

- 2025 Projection: Holdings and corporate expenses are anticipated to be around $40 million.

Constellium's cost structure is heavily influenced by raw material purchases, primarily aluminum. Operational expenses, including energy and labor, are significant, with ongoing efficiency programs like Vision 25 aiming to control these. Substantial investments in R&D and capital expenditures for plant upgrades and capacity expansion are also key cost drivers, often supported by external grants.

| Cost Category | Key Components | 2024/2025 Data Points |

|---|---|---|

| Raw Materials | Primary aluminum, aluminum scrap | Market price pass-through; scrap spreads impact profitability. |

| Manufacturing & Operations | Energy, labor, facility upkeep | Vision 25 targets efficiency gains; 2023 Valais flooding caused unplanned costs. |

| Research & Development | Facilities, collaborations, alloy creation | ~$50 million allocated in 2024. |

| Capital Expenditures | Machinery, plant upgrades, capacity expansion | €130 million recycling center at Neuf-Brisach; DoD grant for Muscle Shoals. |

| SG&A | Sales, marketing, corporate overhead | Corporate and holdings expenses projected ~$40 million for 2025. |

Revenue Streams

Revenue streams from the sale of aerospace products are crucial for Constellium, stemming from high-value aluminum plates, sheets, and extrusions. These materials are vital for commercial, military, and space applications, demanding specialized production and meeting strict quality standards.

While the aerospace sector can experience demand fluctuations, Constellium's products in this segment typically yield higher profit margins. This is a direct result of the advanced technology and rigorous specifications involved in their manufacturing.

Constellium's established presence and existing long-term agreements within the aerospace industry are key drivers of consistent revenue generation. For instance, in 2023, the company reported that its Aerospace & Transportation segment represented a significant portion of its overall sales, highlighting the importance of this revenue stream.

Constellium's revenue streams include the sale of automotive rolled and extruded products. This segment provides advanced aluminum solutions for car body sheets, structural components, and battery enclosures, crucial for the growing electric vehicle market.

In 2024, Constellium reported that its Automotive and Transportation segment, which includes these products, saw a significant portion of its revenue. For instance, in the first quarter of 2024, the segment's Adjusted EBITDA was €168 million, demonstrating its importance to the company's overall financial performance.

Despite some fluctuations in the automotive sector, the persistent industry-wide push for lightweighting and the expansion of electric vehicles continue to bolster demand for Constellium's specialized aluminum offerings.

Constellium generates substantial revenue from selling aluminum rolled products specifically for the packaging sector, a key driver for their business. This segment is particularly important for beverage cans, a high-volume application.

In 2024, Constellium reported that its Packaging & Automotive Rolled Products segment experienced strong demand, with shipments in this area outperforming other markets. This indicates a consistent and significant income source for the company, highlighting the importance of this particular product line.

The increasing consumer and regulatory demand for sustainable packaging solutions, especially those incorporating recycled aluminum content, further bolsters this revenue stream. Constellium's commitment to sustainability aligns well with market trends, ensuring continued demand for their packaging products.

Revenue from Customized Solutions and Services

Constellium’s revenue model extends beyond standard product sales to encompass specialized, customized aluminum solutions and engineering services. This value-added approach involves co-development projects and the creation of tailored alloy designs to meet precise customer application needs, fostering deeper client partnerships and generating higher-margin revenue streams.

These bespoke offerings are crucial for securing long-term contracts and differentiating Constellium in a competitive market. For instance, in 2024, the company continued to emphasize its advanced engineering capabilities, which directly translate into revenue from these specialized services. While exact figures for this specific revenue stream are often embedded within broader segment reporting, the strategic focus on customization highlights its growing importance.

- Customized Solutions: Revenue generated from aluminum products engineered to specific customer requirements and applications.

- Engineering Services: Income derived from co-development projects, technical support, and alloy design expertise provided to clients.

- Value-Added Transactions: These specialized offerings typically command higher prices and contribute to increased profitability per unit compared to standard product sales.

- Customer Relationship Enhancement: The collaborative nature of these services strengthens ties with customers, leading to repeat business and a more stable revenue base.

Other Specialty Products and Industrial Sales

Constellium's revenue streams extend beyond its core aerospace, automotive, and packaging sectors, encompassing sales of other specialty aluminum products to diverse industrial clients. These niche markets, while smaller in scale, contribute to revenue diversification and showcase the company's versatile manufacturing expertise.

In 2024, Constellium reported that its specialty product segments, including those serving various industrial applications, played a role in its overall financial performance, complementing the larger contributions from its key markets.

- Industrial Applications: Constellium supplies specialized aluminum solutions to sectors such as building and construction, defense, and general engineering.

- Diversification Benefit: These industrial sales help to broaden Constellium's customer base, reducing reliance on any single market segment.

- Leveraging Capabilities: The company utilizes its advanced metallurgical knowledge and production facilities to create tailored aluminum products for these specialized industrial needs.

- Market Presence: While specific figures for this segment are often integrated within broader reporting, these industrial sales underscore Constellium's ability to adapt its offerings across a wide industrial spectrum.

Constellium's revenue streams are diversified across several key sectors, with aerospace, automotive, and packaging representing the largest contributors. The company also generates income from specialized industrial applications and value-added services.

In 2024, Constellium reported strong performance in its Packaging & Automotive Rolled Products segment, with shipments exceeding other markets. This highlights the robustness of demand for beverage can stock and automotive components, particularly for electric vehicles.

The Aerospace & Transportation segment, while subject to market cycles, continues to be a significant revenue generator due to high-value, specialized aluminum products. For instance, in the first quarter of 2024, the Automotive and Transportation segment's Adjusted EBITDA was €168 million, underscoring its financial importance.

Constellium also leverages its engineering expertise to offer customized aluminum solutions and co-development services, creating higher-margin revenue and fostering deeper customer relationships.

| Segment | 2023 Revenue Contribution (Approximate) | Key Products | 2024 Trends/Highlights |

|---|---|---|---|

| Aerospace & Transportation | Significant portion of overall sales | High-value plates, sheets, extrusions | Consistent demand driven by long-term agreements; higher profit margins |

| Packaging & Automotive Rolled Products | Strong performance | Beverage can stock, automotive body sheets, structural components | Shipments outperforming other markets in 2024; robust demand for EV components |

| Specialty Products | Complementary revenue | Aluminum for building, construction, defense, general engineering | Diversifies customer base and showcases manufacturing versatility |

| Customized Solutions & Engineering Services | Growing importance | Tailored alloys, co-development projects | Higher margins, strengthens client partnerships, strategic focus on advanced capabilities |

Business Model Canvas Data Sources

The Constellium Business Model Canvas is built upon a foundation of comprehensive market analysis, internal financial reports, and operational data. These sources provide the necessary insights into customer needs, competitive landscapes, and cost structures.