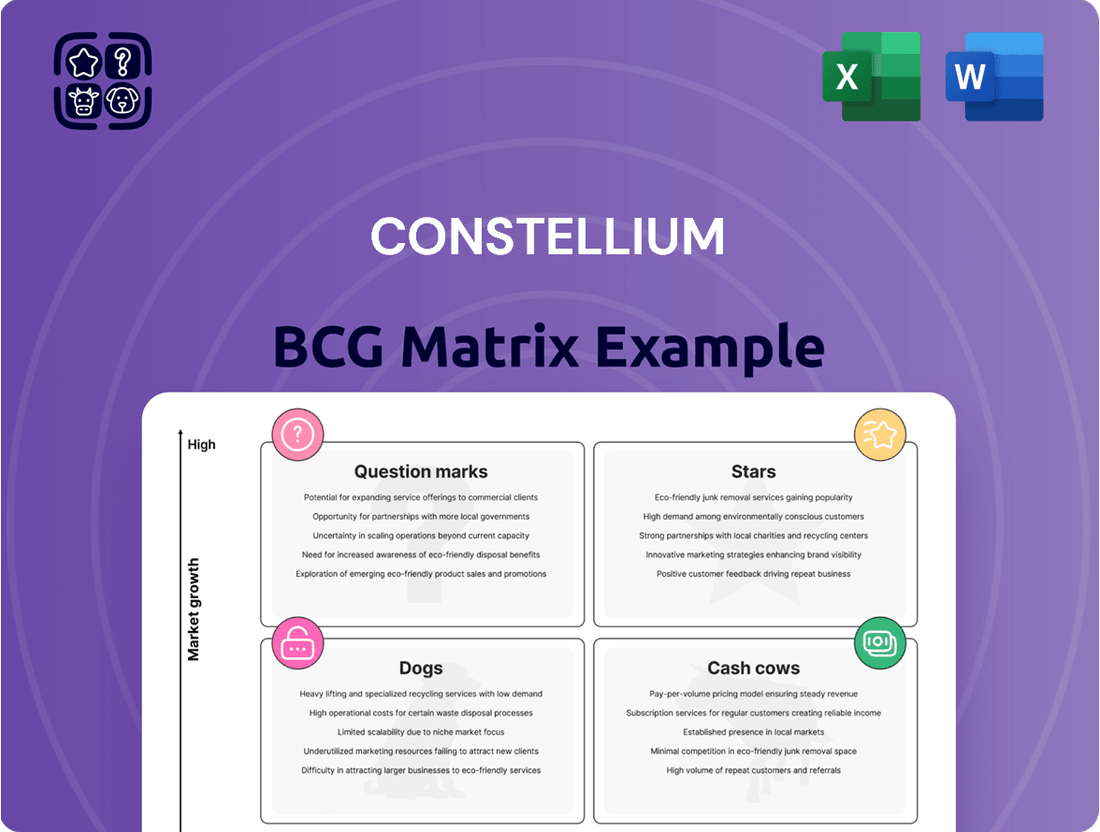

Constellium Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellium Bundle

Uncover the strategic positioning of Constellium's product portfolio with our insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, giving you a glimpse into their market performance.

This snapshot is just the beginning of understanding Constellium's competitive landscape. Purchase the full BCG Matrix to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing their product strategy and resource allocation.

Stars

Constellium's proprietary Airware® alloys are a prime example of a Star in the BCG matrix, boasting high growth and high market share within the aerospace sector. These advanced aluminum-lithium materials are crucial for next-generation aircraft due to their exceptional strength-to-weight ratio and lower density.

The aerospace industry's increasing focus on fuel efficiency and reduced emissions directly benefits Airware®, as lightweight materials are key to achieving these goals. This trend is expected to continue driving demand for these specialized alloys, solidifying their position as a market leader.

Constellium's automotive lightweighting solutions are a shining example of their position in the EV market. As EVs become more prevalent, the demand for lighter materials to extend range and boost performance is soaring. Constellium's advanced aluminum body sheets and extrusion-based components are directly meeting this need, contributing to significant growth in this segment.

The company's commitment to innovation is evident in projects like FlexCAR, which focuses on developing modular and sustainable automotive structures. This forward-thinking approach is crucial as the automotive industry evolves. In 2024, Constellium reported a strong performance in its Automotive and Transportation segment, driven by these lightweighting initiatives, with sales in this area showing a notable year-over-year increase.

Constellium's high-performance aluminum alloys are a star in the defense sector, boasting exceptional impact resistance vital for armored vehicles and military bridging. This specialized segment is characterized by high growth and a strong market position for Constellium, driven by the persistent demand for durable, lightweight materials in military applications.

The company's commitment to innovation is evident in its participation in projects like America Makes, focusing on advancing aluminum additive manufacturing for defense. This strategic move reinforces Constellium's role as a crucial supplier in a market that increasingly values cutting-edge material solutions.

Sustainable and Recycled Aluminum Solutions

Constellium's commitment to sustainable and recycled aluminum positions it strongly in the market. Their significant investments, such as the €130 million recycling center in Neuf-Brisach, highlight a strategic focus on circular economy principles. Initiatives like 'Close the Loop' for automotive recycling are crucial as demand for low-carbon materials escalates.

- Recycling Investments: €130 million invested in the Neuf-Brisach recycling center.

- Circular Economy Focus: 'Close the Loop' initiative targets automotive aluminum recycling.

- Market Demand: Growing customer preference for low-carbon and recycled aluminum solutions.

Innovative Additive Manufacturing Alloys (Aheadd® CP1)

Constellium's Aheadd® CP1 alloy is positioned as a Star in the BCG matrix, reflecting its status as a high-growth, high-market-share product within the additive manufacturing sector.

This innovative aluminum alloy is experiencing significant market penetration, especially in demanding sectors such as aerospace, defense, and automotive. Its application in heat exchangers and mission-critical components highlights its advanced capabilities.

The alloy's approval for use in Formula 1 racing cars is a testament to its superior performance and substantial market potential. This endorsement by a high-stakes industry validates its technological advancement and commercial viability.

- Aheadd® CP1: High Growth, High Market Share

- Key Applications: Aerospace, Defense, Automotive (Heat Exchangers)

- Formula 1 Approval: Validation of Performance and Market Potential

Constellium's advanced aluminum alloys for the aerospace sector, like Airware®, are Stars due to their high growth and market share, driven by the demand for lightweight, fuel-efficient aircraft. The company's automotive lightweighting solutions are also Stars, capitalizing on the booming EV market and the need for extended range.

Furthermore, their high-performance alloys for defense applications, offering superior impact resistance, represent another Star category, supported by consistent military demand.

The Aheadd® CP1 alloy is a Star in additive manufacturing, securing high growth and market share across aerospace, defense, and automotive, evidenced by its Formula 1 approval.

Constellium's strategic focus on sustainable and recycled aluminum, backed by significant investments like the €130 million recycling center, positions them to capture growing market demand for low-carbon solutions.

| Product/Segment | BCG Category | Key Drivers | 2024 Data/Context |

| Airware® (Aerospace) | Star | Fuel efficiency, reduced emissions | High demand for lightweight aluminum-lithium alloys. |

| Automotive Lightweighting (EVs) | Star | EV adoption, extended range | Strong sales growth in Automotive & Transportation segment. |

| Defense Alloys | Star | Military modernization, durability | Persistent demand for armored vehicle and military bridging materials. |

| Aheadd® CP1 (Additive Manufacturing) | Star | Advanced applications, performance | Formula 1 approval validates performance and market potential. |

| Recycled Aluminum | Star | Sustainability, low-carbon demand | €130 million investment in recycling center, 'Close the Loop' initiative. |

What is included in the product

The Constellium BCG Matrix categorizes business units by market share and growth, guiding strategic decisions for investment, divestment, or maintenance.

Constellium BCG Matrix offers a clear, visual roadmap to address portfolio imbalances, relieving the pain of strategic uncertainty.

Cash Cows

Constellium's Packaging Rolled Products segment is a classic Cash Cow. This division, which supplies aluminum coils and sheets for beverage and food cans, holds a substantial market share in a well-established industry. Its consistent ability to generate significant cash flow, even with stable demand, highlights its strong position.

The segment's financial performance underscores its Cash Cow status. For instance, in Q1 2025, Constellium reported a notable 25% increase in Segment Adjusted EBITDA for its Packaging and Automotive Rolled Products (P&ARP) division. This robust growth in earnings from a mature market segment demonstrates its reliable cash-generating capabilities.

Constellium's traditional automotive rolled products, serving conventional vehicles, likely represent a strong cash cow. These offerings maintain a significant market share within the existing automotive ecosystem, ensuring consistent revenue generation.

Despite some softening in demand due to the EV transition, this segment remains a vital contributor to Constellium's overall financial performance. For instance, in 2023, automotive applications represented a substantial portion of Constellium's revenue, underscoring the ongoing importance of these established product lines.

Constellium's standard industrial extruded aluminum products, encompassing a wide array of items for general use, likely fall into the Cash Cows category of the BCG Matrix. These products serve diverse, non-specialized markets where Constellium has likely secured a strong market share due to its established presence and efficient manufacturing capabilities.

The consistent demand for these extruded products, coupled with mature production processes, translates into reliable and significant cash flow generation for Constellium. For instance, in 2023, Constellium reported Adjusted EBITDA of €1,106 million, with its downstream products, which include many standard extrusions, being a significant contributor to this performance.

These mature offerings require minimal investment in marketing or product development, allowing them to generate substantial profits with lower operational expenditure. This stable cash generation is crucial for funding growth in other business segments or for returning value to shareholders.

Conventional Transportation Plates and Sheets

Conventional transportation plates and sheets represent a stable, mature market for Constellium, generating consistent revenue and cash flow. While not experiencing the high growth of newer segments like aerospace or automotive lightweighting, these products are essential for many established transportation applications, solidifying Constellium's position as a reliable supplier.

This segment acts as a cash cow within Constellium's portfolio, providing the financial stability needed to invest in more dynamic growth areas. The demand for these conventional products remains steady, ensuring predictable earnings for the company.

- Mature Market: The market for conventional transportation plates and sheets is well-established, characterized by steady demand rather than rapid expansion.

- Stable Revenue: These products contribute reliably to Constellium's revenue streams, offering a predictable income source.

- Cash Flow Generation: As a cash cow, this segment generates significant cash flow with relatively low investment requirements, supporting other business units.

- Constellium's Strength: Constellium maintains a strong market share and reputation in this segment, leveraging its expertise in aluminum production.

Aluminum for Construction Sector

Aluminum for the construction sector represents a strong Cash Cow for Constellium. This market is mature, and Constellium's deep-rooted presence and diverse product portfolio likely secure a substantial market share.

Aluminum’s inherent advantages, such as its longevity and reduced weight, make it a highly sought-after material for numerous building elements. This consistent demand translates into a reliable and steady stream of revenue for the company.

- Market Maturity: The construction sector is a well-established market for aluminum, indicating stable demand.

- High Market Share: Constellium's long-standing operations suggest a significant position within this segment.

- Product Advantages: Aluminum's durability and lightweight nature drive its adoption in construction.

- Revenue Generation: These factors contribute to consistent and predictable cash flows.

Constellium's Packaging Rolled Products segment is a classic Cash Cow. This division, which supplies aluminum coils and sheets for beverage and food cans, holds a substantial market share in a well-established industry. Its consistent ability to generate significant cash flow, even with stable demand, highlights its strong position. For instance, in Q1 2025, Constellium reported a notable 25% increase in Segment Adjusted EBITDA for its Packaging and Automotive Rolled Products (P&ARP) division, demonstrating its reliable cash-generating capabilities from a mature market.

What You See Is What You Get

Constellium BCG Matrix

The Constellium BCG Matrix you are previewing is the identical, fully-formatted document you will receive upon purchase, offering a comprehensive strategic analysis of their business units. This preview showcases the exact data and insights you'll gain, allowing you to assess Constellium's Stars, Cash Cows, Question Marks, and Dogs without any hidden elements or watermarks. Rest assured, the purchased file will be ready for immediate application in your own strategic planning or investment decisions.

Dogs

Constellium's legacy operations, particularly those in mature, low-growth markets with a weak competitive position, can be categorized as Dogs in the BCG Matrix. These segments may include older product lines or facilities that have struggled with declining demand or persistent operational inefficiencies, thereby limiting their contribution to overall profitability and capital efficiency.

The flood incident at Constellium's Valais operations in 2024, impacting both the Automotive & Transportation (A&T) and Aerospace & Defense (AS&I) segments, highlights potential vulnerabilities in certain legacy areas. Such operational disruptions can exacerbate existing challenges, leading to underperformance and characterizing these specific operations as Dogs within the company's portfolio, especially if recovery is slow or market conditions remain unfavorable.

Products with high sensitivity to metal price lag, particularly those experiencing negative non-cash impacts as seen in Q2 2025, could indeed become cash drains if this volatility persistently erodes profitability. Consider Constellium's automotive segment, where aluminum prices are a significant input cost. If aluminum prices were to fall sharply after a company has already secured supply contracts at higher prices, this lag could lead to substantial write-downs and reduced margins.

A business unit heavily exposed to unfavorable metal price movements in a low-growth market, even if not a distinct product category, would fit this description. For instance, a division specializing in aerospace components, where long lead times and large material volumes are common, could suffer if the price of specialized alloys fluctuates adversely. In 2024, the LME aluminum price saw significant volatility, trading in a range that could easily create such negative price lags for unprepared businesses.

Constellium's certain automotive and specialty rolled products are showing signs of weakness. Their Q1 2025 results indicated lower shipments in these segments, pointing to a potential combination of low market growth and a shrinking share for these offerings.

If these downward trends continue without a strategic intervention, these product lines are likely candidates for the Dog quadrant in the BCG Matrix. This classification would highlight them as low-growth, low-market-share businesses requiring careful consideration for resource allocation or potential divestment.

Segments with Persistent Unfavorable Price and Mix

Segments within Constellium that consistently show unfavorable pricing and product mix, even as the company experiences overall growth, can be categorized as Dogs in a BCG Matrix analysis. This situation points to specific product lines or market areas where Constellium struggles to achieve competitive pricing or is burdened by a less profitable product assortment. For instance, if a particular aluminum alloy segment, despite market demand, consistently underperforms in terms of margin due to intense competition or outdated production methods, it would fit this description.

These underperforming segments can drag down overall profitability. In 2024, Constellium's Adjusted EBITDA saw growth, but it's crucial to identify any segments that are disproportionately contributing to lower margins. For example, a segment that experienced a 5% decline in its average selling price per ton in the first half of 2024, while other segments saw increases, would be a prime candidate for this classification. This persistent pricing pressure, coupled with a less desirable product mix, signals a need for strategic review.

- Persistent Unfavorable Pricing: Segments where average selling prices are consistently below industry benchmarks or have shown a negative trend, even during periods of overall market strength.

- Unprofitable Product Mix: A concentration of lower-margin products within a segment, hindering its ability to contribute significantly to overall profitability.

- Declining Adjusted EBITDA Contribution: Even with company-wide growth, these segments might exhibit a shrinking or negative contribution to Adjusted EBITDA, indicating a fundamental issue.

- Strategic Challenges: These areas often require significant investment or a complete overhaul of product offerings and market approach to regain competitiveness.

Operations with Lingering Flood Impacts

The flood at Constellium's Valais operations in Switzerland has continued to cast a shadow over its financial performance through the first half of 2025. This event has notably impacted both the Automotive & Transportation (A&T) and Aerospace & Defense (AS&I) segments, creating a persistent drag on profitability without generating any corresponding growth. The financial drain is substantial, with preliminary reports indicating that the operational disruptions and recovery costs have significantly eroded earnings in these key areas.

Given the ongoing negative financial repercussions and the absence of growth drivers stemming from these specific operations, Constellium's Valais site, particularly as it affects the A&T and AS&I segments, can be viewed as a Dog within the BCG Matrix framework. This classification highlights a business unit that generates low profits and has low growth potential, requiring careful management to minimize losses and explore potential divestment or restructuring strategies for full recovery.

- Flood Impact: Continued negative financial impact from the Valais flood on A&T and AS&I segments in Q1 and Q2 2025.

- Resource Drain: Significant drain on resources without any corresponding growth from the affected operations.

- BCG Classification: Operations are categorized as Dogs due to lingering profitability issues and lack of growth.

- Strategic Consideration: Management focus on minimizing losses and planning for eventual full recovery or strategic alternatives.

Constellium's "Dog" segments are those with low market share in low-growth industries. These areas often face intense competition or have outdated product lines, leading to stagnant or declining sales and profitability. For example, certain specialty rolled products for automotive applications might fall into this category if market adoption is slow and Constellium's competitive position is weak.

The persistent impact of the Valais flood in 2024 and continuing into 2025 has created significant operational challenges for Constellium's Automotive & Transportation (A&T) and Aerospace & Defense (AS&I) segments. These disruptions have resulted in a drain on resources and profitability without any offsetting growth, a clear indicator of a Dog quadrant classification for these specific affected operations.

Segments experiencing unfavorable pricing trends, such as those heavily influenced by volatile metal prices without effective hedging, can also be classified as Dogs. If Constellium's average selling prices per ton in a particular segment have declined, for instance, by 5% in the first half of 2024 while the overall market remained stable, it signifies a competitive disadvantage and a potential Dog status.

These underperforming units require careful strategic evaluation, as they can dilute overall company performance. Identifying and addressing these Dogs is crucial for optimizing Constellium's portfolio and resource allocation.

| Segment/Product Line | Market Growth | Market Share | Profitability Trend | BCG Classification |

|---|---|---|---|---|

| Legacy Specialty Rolled Products (Automotive) | Low | Low | Declining | Dog |

| Valais Operations (A&T/AS&I affected) | Low (due to disruption) | Low (due to disruption) | Negative | Dog |

| Aluminum Alloy X (Hypothetical) | Low | Low | Stagnant/Negative | Dog |

Question Marks

Constellium's investment in advanced aluminum alloys, like those with enhanced strength and corrosion resistance, positions them to capture emerging markets such as electric vehicles and aerospace. These innovative materials, while promising, currently represent a low market share due to their newness and the substantial R&D and market development costs involved. For instance, the automotive sector's demand for lightweight materials is projected to grow significantly, with aluminum usage in vehicles expected to increase by 20% by 2030, presenting a clear opportunity for these new alloys.

Projects like FlexCAR, exploring modular vehicle systems and smart aluminum structures, represent high-growth potential in the evolving mobility landscape. While currently holding a low market share, these advanced aluminum solutions are crucial for future vehicle concepts, demanding significant R&D investment but poised for future industry adoption.

These forward-thinking initiatives, such as those focused on lightweighting and advanced joining technologies for electric vehicles, are categorized as Question Marks in the BCG Matrix. For instance, Constellium's investment in advanced high-strength alloys for electric vehicle battery enclosures, a key component of modular designs, showcases this strategic positioning.

The substantial capital expenditure required for developing and scaling these innovative aluminum solutions, including those for concepts like FlexCAR, is a hallmark of Question Mark products. Their success hinges on market acceptance and the industry's shift towards more integrated and adaptable vehicle architectures, a trend gaining momentum as of 2024.

Constellium's development of industrial-scale hydrogen casting for aluminum slab production, replacing natural gas, positions it as a Question Mark. This innovative approach targets the decarbonization of heavy industry, a sector experiencing significant growth and demand for sustainable solutions.

While the potential for reducing greenhouse gas emissions in aluminum smelting is substantial, the technology is still nascent. Commercial viability and widespread market acceptance are yet to be fully established, creating uncertainty around its future performance and market share.

Innovations in Digital Manufacturing (e.g., Digital Twin)

Digital twin technology, particularly for aluminum components, represents a burgeoning frontier in industrial digitalization, offering enhanced performance tracking throughout a product's entire lifecycle. This innovation is poised for significant growth within the manufacturing sector, driven by the increasing demand for data-driven insights and operational efficiencies.

While the potential for digital twins is substantial, their current market penetration and direct revenue contribution for companies like Constellium are likely still in their nascent stages. This suggests a high-growth potential but limited current market share, characteristic of a Question Mark in the BCG matrix.

- Market Growth: The global digital twin market is projected to reach $41.7 billion by 2027, growing at a CAGR of 38.2% from 2022, indicating strong future demand for such technologies in manufacturing.

- Current Adoption: Despite the growth projections, widespread adoption of digital twins specifically for aluminum component lifecycle management is still developing, with many companies in the early exploration or pilot phases.

- Investment Focus: Companies are investing in R&D for digital twin capabilities, recognizing their long-term strategic value, but immediate profitability may be limited as the technology matures and integration becomes more widespread.

- Strategic Positioning: As a Question Mark, digital twin initiatives require careful consideration of investment versus potential return, balancing the need to innovate in a high-growth area with the current reality of limited market capture.

Expansion into New Geographic Markets for High-Value Products

Constellium's strategy for high-value products in new geographic markets aligns with the 'Question Mark' category of the BCG Matrix. This involves significant investment to build market share in regions where their presence is currently minimal but potential for growth is high.

For instance, expanding advanced automotive aluminum solutions into emerging markets in Southeast Asia or Eastern Europe would fit this description. These regions often show increasing demand for lighter, more fuel-efficient vehicles, driving the need for Constellium's specialized alloys.

- Strategic Focus: Targeting new, high-growth geographic markets for specialized aluminum products.

- Investment Requirement: Substantial capital needed for market entry, distribution networks, and customer development.

- Market Share Objective: Aiming to establish a significant foothold in these underdeveloped markets.

- Example: Introducing high-strength aluminum sheets for electric vehicles in markets with rapidly growing EV adoption rates, such as South Korea or India, where Constellium's current market share might be low but future potential is substantial.

Question Marks represent Constellium's ventures into high-growth, uncertain markets. These initiatives require significant investment to gain market share. For example, developing advanced aluminum alloys for the burgeoning electric vehicle sector, which is projected to see a 30% compound annual growth rate in global sales through 2030, places these products in the Question Mark category. Their success hinges on market adoption and technological advancement.

BCG Matrix Data Sources

Our Constellium BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market research, and industry-specific growth forecasts, ensuring a data-driven strategic view.