Conn's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conn's Bundle

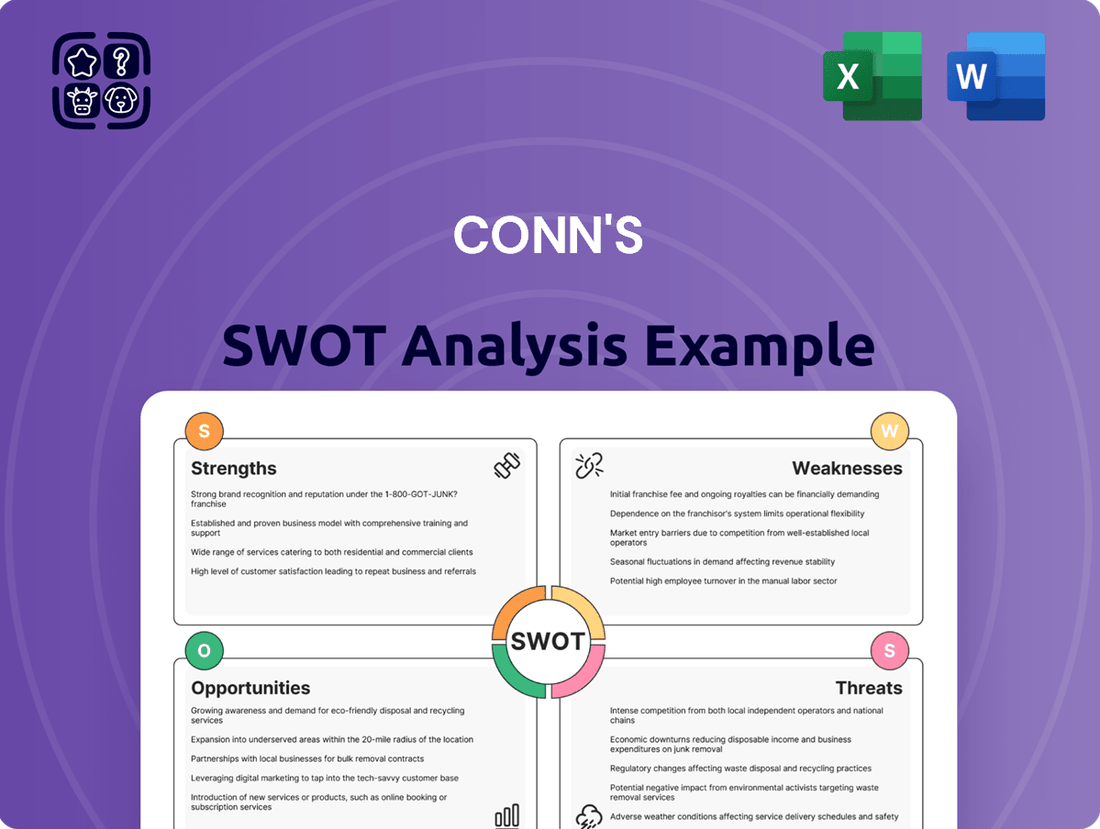

Conn's showcases notable strengths, including its established brand and customer loyalty, alongside significant growth opportunities in underserved markets. However, it also faces considerable challenges, such as intense competition and evolving consumer preferences, and potential threats from economic downturns and supply chain disruptions.

Want the full story behind Conn's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Conn's core strength is its specialized in-house financing model, which is a significant differentiator in the retail space. This model allows the company to serve customers who might not qualify for traditional credit, tapping into an underserved market segment.

This unique capability not only broadens Conn's customer base but also fosters strong customer loyalty by providing access to essential goods for those with credit limitations. It's a key element of their business strategy.

For instance, during fiscal year 2024, a substantial 61% of all purchases were financed through Conn's own credit program. This high penetration rate underscores the effectiveness and importance of their in-house financing to their overall sales volume.

Conn's boasts a diverse portfolio of durable goods, encompassing furniture, mattresses, home appliances, and consumer electronics from well-known brands. This breadth of offerings allows the company to cater to a wide array of customer needs, from essential household items to more aspirational purchases. For instance, in fiscal year 2024, Conn's continued to emphasize its home goods categories, which form a significant portion of its sales.

Conn's maintained a robust retail footprint, boasting a substantial number of stores across various states prior to its Chapter 11 filing. This extensive physical network served as a key asset, facilitating customer engagement and service delivery across a wide geographic area.

The acquisition of W.S. Badcock in December 2023 further amplified Conn's market reach, adding to its established retail presence. This strategic move aimed to consolidate and expand its operational footprint, enhancing its competitive positioning in the retail landscape.

Integrated Repair Services

Conn's offers integrated repair services for the products it sells, creating a significant post-purchase advantage for its customers. This capability not only drives incremental revenue streams but also plays a crucial role in boosting customer satisfaction and loyalty, encouraging repeat purchases.

The repair services contribute to Conn's overall value proposition, differentiating it from competitors who may not offer similar in-house support. In fiscal year 2024, Conn's reported that its Service Contract Agreements, which often include repair services, represented a notable portion of its total revenue, demonstrating the financial impact of this strength.

- Enhanced Customer Loyalty: Integrated repair services foster stronger customer relationships by providing reliable post-purchase support.

- Additional Revenue Generation: Service contracts and repair fees contribute directly to the company's top line.

- Competitive Differentiation: Offering in-house repair services sets Conn's apart in the competitive retail landscape.

- Improved Customer Retention: Satisfied customers who utilize repair services are more likely to return for future purchases.

Growing E-commerce Capabilities

Conn's has shown impressive progress in its e-commerce operations, a key strength amidst broader financial headwinds. The company achieved record annual e-commerce sales totaling $109.3 million for fiscal year 2024. This represents a substantial 38% surge compared to the prior fiscal year, underscoring a robust and expanding digital footprint.

This significant online sales growth highlights Conn's ability to effectively leverage its digital platforms. The company's e-commerce capabilities are clearly a strong point, demonstrating adaptability and potential for future revenue generation through online channels.

- Record E-commerce Sales: $109.3 million in fiscal year 2024.

- Year-over-Year Growth: A 38% increase in online sales.

- Digital Presence: Strong and expanding online sales channels.

Conn's proprietary credit program is a cornerstone of its business, enabling it to serve a broader customer base, particularly those with less-than-perfect credit histories. This in-house financing model is not just a service but a significant competitive advantage, as evidenced by the fact that 61% of all purchases in fiscal year 2024 were financed through Conn's own credit operations. This deep integration of financing into the sales process fosters strong customer loyalty and drives substantial sales volume.

The company's strategic expansion through acquisitions, such as W.S. Badcock in December 2023, bolstered its retail footprint and market reach. Conn's also offers integrated repair services, which enhance customer satisfaction and create recurring revenue streams through service contracts. This commitment to post-purchase support differentiates them in the market and encourages repeat business.

Furthermore, Conn's has demonstrated a strong pivot to e-commerce, achieving record online sales of $109.3 million in fiscal year 2024, a remarkable 38% increase year-over-year. This digital growth highlights their adaptability and effective utilization of online channels to reach and serve customers.

| Strength | Description | Fiscal Year 2024 Impact |

| In-house Financing | Proprietary credit program serving underserved customers. | 61% of sales financed internally. |

| Product Diversification | Wide range of durable goods including furniture, appliances, and electronics. | Continued focus on home goods categories. |

| Retail Footprint & Expansion | Substantial store network, augmented by W.S. Badcock acquisition (Dec 2023). | Expanded market reach and operational presence. |

| Integrated Repair Services | In-house repair and service contracts. | Contributes to customer loyalty and revenue; notable portion of total revenue. |

| E-commerce Growth | Strong online sales performance. | Record $109.3 million in online sales, up 38% YoY. |

What is included in the product

Delivers a strategic overview of Conn's’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Provides a structured framework to identify and leverage Conn's competitive advantages, mitigating weaknesses and capitalizing on opportunities for improved performance.

Weaknesses

Conn's core business model involves extending credit to customers with lower credit scores, a segment inherently more susceptible to economic downturns and changes in their ability to repay. This reliance on subprime borrowers creates significant vulnerability. For example, in fiscal year 2024, Conn's reported a net loss of $126.5 million, partly due to higher credit losses compared to the previous year.

This elevated exposure to subprime credit risk has directly translated into increased provisions for bad debts. In the first quarter of fiscal year 2025, Conn's provision for credit losses rose to $63.9 million, a substantial increase from $51.9 million in the same period of fiscal year 2024. Such provisions directly erode the company's profitability.

Conn's has been grappling with persistent financial difficulties, evidenced by significant net losses reported for multiple consecutive fiscal years. For instance, the company incurred nearly $77 million in net losses in fiscal year 2023 and a similar $76.9 million in fiscal year 2024. This ongoing financial strain highlights a major weakness in its operational stability.

Compounding these losses, Conn's has experienced a notable downturn in its revenue streams. In fiscal year 2024, total consolidated revenue saw a decline of 7.8%. This shrinking revenue, coupled with substantial losses, points to an unsustainable financial trajectory that predates its eventual bankruptcy filing.

Conn's has seen its interest expense balloon, jumping from around $26 million in fiscal year 2021 to nearly $83 million by fiscal year 2024. This substantial increase in the cost of servicing its debt significantly impacts its financial health. The growing debt burden, especially in a rising interest rate environment, diverts crucial cash flow away from other operational needs.

Challenges with Acquisition Integration and Redundancies

Conn's faced significant hurdles integrating its December 2023 acquisition of W.S. Badcock. This process introduced operational complexities and financial strain, partly due to overlapping store footprints that led to redundancies. The company reported that the integration efforts, coupled with these redundancies, exacerbated existing financial pressures, directly impacting overall performance and contributing to a challenging fiscal year.

- Integration Costs: The W.S. Badcock acquisition, completed in December 2023, incurred substantial integration costs that strained Conn's finances.

- Redundant Store Locations: The combination of the two businesses resulted in an overlap of store locations, creating operational inefficiencies and the need to manage redundancies.

- Hindered Performance: These integration challenges and operational complexities negatively impacted Conn's ability to perform effectively, contributing to financial stress.

Securities Fraud Investigations and Loss of Investor Confidence

Conn's has faced significant headwinds due to ongoing securities fraud investigations. These probes center on allegations that the company made misleading statements and failed to adequately disclose the risks associated with its subprime lending practices. Such scrutiny has understandably eroded investor confidence.

The impact on investor sentiment has been substantial, directly contributing to a sharp downturn in Conn's stock price. For example, during periods of heightened investigation activity in late 2023 and early 2024, the stock experienced significant volatility and downward pressure, reflecting market concerns about governance and financial reporting integrity.

- Ongoing Investigations: Allegations of misleading statements and inadequate risk disclosure in subprime lending practices.

- Investor Confidence Erosion: Negative impact on market perception and trust in the company's management and financial health.

- Stock Price Decline: Direct correlation between investigative periods and significant drops in Conn's share value throughout 2023-2024.

- Reputational Damage: Long-term harm to the brand's image, potentially affecting customer acquisition and retention.

Conn's core weakness lies in its heavy reliance on subprime lending, a strategy that exposes it to significant credit risk and makes it highly vulnerable during economic downturns. This vulnerability was starkly evident in fiscal year 2024, where the company reported a net loss of $126.5 million, partly driven by increased credit losses. The company's provisions for credit losses in Q1 fiscal year 2025 rose to $63.9 million, up from $51.9 million in the prior year, directly impacting profitability.

Persistent financial instability is another major weakness, marked by multiple consecutive years of substantial net losses, including nearly $77 million in fiscal years 2023 and 2024. This ongoing financial strain, coupled with a 7.8% decline in total consolidated revenue in fiscal year 2024, paints a picture of an unsustainable operational trajectory. Furthermore, interest expenses nearly quadrupled from fiscal year 2021 to fiscal year 2024, reaching almost $83 million, which severely strains cash flow and financial health.

Full Version Awaits

Conn's SWOT Analysis

You are viewing a live preview of the actual Conn's SWOT analysis file. The complete version becomes available after checkout. This ensures you know exactly what you're getting—a professionally prepared and insightful document. It's designed to provide a comprehensive understanding of Conn's strategic position. Unlock the full, detailed report by completing your purchase.

Opportunities

Conn's, operating under Chapter 11 bankruptcy protection since May 2024, has a significant opportunity to divest non-core assets. This strategic asset sales process can unlock value for creditors by liquidating remaining store leases and inventory. For instance, as of their latest filings, Conn's operated a substantial physical footprint, and the efficient sale of these locations and associated product stock is crucial for maximizing creditor recoveries.

Conn's Chapter 11 filing offered a structured pathway to address its significant debt, which stood at over $1.1 billion when the petition was filed. This legal process, while ultimately leading to liquidation for Conn's, typically allows companies to renegotiate terms with creditors and streamline liability settlements under judicial oversight.

Conn's demonstrated e-commerce growth, with online sales representing a significant portion of its revenue, positions its digital infrastructure and customer data as valuable assets for asset disposal. In fiscal year 2024, Conn's reported strong digital penetration, and this robust online platform could be sold as a standalone entity or its technology could be utilized to efficiently liquidate remaining inventory.

Focus on Core Product Segments for Liquidation

Conn's can strategically concentrate its liquidation efforts on historically strong product categories such as furniture and mattresses. These segments have consistently represented a substantial portion of the company's net sales, indicating existing customer demand and perceived value. By prioritizing the sale of these higher-margin, more desirable items first, Conn's can potentially achieve better sell-through rates and realize more capital during its going-out-of-business phase. This focused approach aims to maximize returns on inventory.

- Prioritize Furniture and Mattresses: These categories have historically driven a significant portion of Conn's revenue.

- Optimize Liquidation Value: Focusing on higher-value items can lead to better financial outcomes during the wind-down process.

- Leverage Existing Demand: Concentrating on popular product lines taps into established consumer interest.

Cost Synergy Realization from Integration Efforts

Conn's identified substantial cost synergies from its Badcock acquisition, aiming to remove approximately $50 million in combined expenses during Q4 FY2024. An additional $50 million in cost savings was projected for the period following this initial integration phase. These efforts, though undertaken before bankruptcy, offer valuable insights for optimizing asset liquidation and mitigating further financial decline.

The realization of these synergies, even in the context of bankruptcy proceedings, underscores Conn's prior strategic focus on operational efficiency. The experience gained in streamlining operations could inform a more effective wind-down strategy, potentially minimizing losses for stakeholders by identifying and eliminating redundant costs.

Conn's can leverage its established e-commerce infrastructure and customer data, which represented a significant portion of its revenue in fiscal year 2024, to facilitate efficient liquidation. The company’s focus on historically strong categories like furniture and mattresses, which consistently drove substantial net sales, offers an opportunity to maximize returns by targeting these in-demand products first. Furthermore, the identification of substantial cost synergies, such as the projected $50 million in savings from the Badcock acquisition during Q4 FY2024, highlights potential efficiencies that could be applied to the asset disposition process.

| Opportunity Area | Description | Fiscal Year 2024 Data/Projections |

|---|---|---|

| E-commerce Infrastructure | Leveraging digital platform and customer data for efficient liquidation. | Significant portion of FY2024 revenue |

| Product Category Focus | Prioritizing sales of historically strong categories like furniture and mattresses. | Consistently substantial portion of net sales |

| Cost Synergies | Applying learnings from operational efficiency efforts for asset disposition. | Projected $50 million in savings from Badcock acquisition (Q4 FY2024) |

Threats

Conn's faces significant headwinds from larger, established retailers. Giants like Walmart and Target leverage immense purchasing power, allowing them to negotiate better prices and offer more aggressive promotions. For instance, Walmart's 2023 revenue exceeded $648 billion, dwarfing Conn's ability to match scale and pricing strategies.

These larger players also benefit from broader customer reach and more sophisticated marketing capabilities. Best Buy, a direct competitor in the electronics and appliance space, consistently invests heavily in omnichannel experiences and customer loyalty programs. This makes it challenging for Conn's to capture market share when consumers have readily available, often cheaper, alternatives from these national brands.

Furthermore, competitors such as Home Depot and Lowe's, while not direct appliance competitors, demonstrate the power of category dominance and extensive store footprints, which can influence consumer spending habits across the retail landscape. Rent-A-Center, a direct competitor in the rent-to-own segment, also presents a formidable challenge with its established network and financing options.

Economic headwinds, such as persistent inflation and rising interest rates, directly dampen consumer confidence and discretionary spending. This is particularly challenging for retailers like Conn's, whose sales are heavily reliant on big-ticket items and consumers who often utilize credit. For instance, in the first quarter of 2024, Conn's reported a net sales decrease of 15.1% compared to the prior year, reflecting these macroeconomic pressures on purchasing power.

Higher interest rates not only make financing more expensive for consumers but also increase the cost of capital for businesses, impacting profitability and investment. The sensitivity of Conn's customer base, often credit-constrained, means that economic downturns can lead to a sharper decline in sales and a higher risk of loan defaults, further pressuring the company's financial performance.

Rising interest rates have significantly increased Conn's cost of capital, making it more expensive to finance operations and manage existing debt. For instance, in the first quarter of 2024, Conn's reported interest expense on its floor plan financing receivables and credit facilities rose, directly reflecting these higher borrowing costs. This escalation directly impacts their ability to secure new financing and manage their debt obligations, creating a significant hurdle for financial stability and liquidity.

Regulatory Scrutiny and Legal Liabilities

Conn's faces substantial threats from ongoing regulatory scrutiny and potential legal liabilities. Investigations into alleged securities fraud and violations of securities laws, particularly surrounding its subprime lending operations, represent a significant financial and reputational risk.

These legal challenges could translate into substantial fines and increased legal expenses. For instance, the company has previously settled with the SEC for misleading investors about its financial performance, highlighting the persistent nature of these risks. Such ongoing issues can further diminish investor confidence, impacting its stock valuation and access to capital markets.

- Securities Fraud Investigations: Ongoing probes into past disclosures and lending practices create uncertainty.

- Potential Fines and Legal Costs: Past settlements and ongoing litigation indicate significant financial exposure.

- Erosion of Investor Trust: Legal battles can damage reputation and negatively affect market perception.

- Increased Compliance Burdens: Regulatory attention often leads to stricter operational requirements and costs.

Inability to Secure Sufficient Liquidity

Conn's faced a severe threat from its inability to secure sufficient liquidity, a critical issue that preceded its bankruptcy filing. The company struggled to complete necessary disclosures for refinancing its revolving credit facility, a key source of operational funding.

This financial strain was exacerbated by Conn's failure to file timely financial reports, further eroding investor confidence and hindering access to capital markets. The inability to address these liquidity challenges directly contributed to the company's Chapter 11 bankruptcy filing in 2024, leading to a subsequent wind-down of its operations.

For instance, as of early 2024, the company had significant outstanding debt, and its covenant breaches indicated a precarious financial standing. The lack of transparency due to delayed filings made it exceptionally difficult to attract new lenders or renegotiate existing terms, effectively cutting off vital lifelines.

- Liquidity Crisis: Difficulty in refinancing revolving credit facilities due to disclosure issues.

- Reporting Failures: Inability to file timely financial reports, impacting market trust.

- Bankruptcy Trigger: Insufficient liquidity was a primary factor leading to Chapter 11 bankruptcy in 2024.

- Operational Shutdown: The liquidity shortfall ultimately resulted in the company's wind-down.

Conn's faces intense competition from larger retailers with greater financial muscle and broader market reach. Giants like Walmart and Best Buy can offer more aggressive pricing and customer incentives due to their scale and sophisticated marketing, making it difficult for Conn's to compete effectively. This disparity in resources and customer engagement presents a significant threat to Conn's market share and profitability.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Conn's official financial statements, comprehensive market research reports, and insights from industry experts and analysts to ensure a thorough and objective assessment.