Conn's Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conn's Bundle

Unlock the strategic blueprint behind Conn's's innovative business model. This comprehensive Business Model Canvas dissects how they connect with customers and deliver value. Understand their key resources, revenue streams, and cost structure to gain a competitive edge.

Dive deeper into Conn's’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Conn's relied heavily on its relationships with manufacturers and suppliers of durable goods. Key partners included major electronics and appliance brands such as Samsung, LG, and GE, alongside numerous furniture vendors. These collaborations were vital for maintaining a broad and competitive product selection in their stores.

These supplier relationships directly impacted Conn's ability to manage its inventory and offer a diverse range of products to customers. The company's operational success was intrinsically linked to the consistent supply of goods from these established brands.

The financial distress leading to Conn's bankruptcy filing underscored the strain on these partnerships, with significant outstanding debts owed to these crucial suppliers. This highlights the interconnectedness of retail operations and their supply chain dependencies.

Conn's strategically partnered with third-party financing and lease-to-own providers to expand its customer reach. These collaborations offered alternative payment solutions for individuals who didn't meet the criteria for Conn's in-house credit programs. This broadened accessibility significantly, allowing a wider demographic to purchase products.

In fiscal year 2024, approximately 23% of Conn's sales were facilitated through these external financing partnerships. This demonstrates the substantial role these third-party providers play in driving sales and capturing market share by catering to a more diverse customer base.

Conn's leverages key partnerships with third-party logistics providers and independent contractors to manage its product delivery and installation services. This outsourcing model is crucial for supporting both its brick-and-mortar retail sales and its growing e-commerce channel.

These partnerships are vital for ensuring timely and efficient product delivery, a core component of Conn's value proposition. In 2024, Conn's continued to focus on optimizing its supply chain and delivery network to meet customer expectations for speed and convenience.

By partnering for installation, Conn's ensures that customers receive their appliances and electronics set up correctly, directly contributing to a positive post-purchase experience. This allows Conn's to maintain a focus on sales and product merchandising while relying on expert partners for the in-home service aspect.

Financial Institutions for Capital

Conn's relies heavily on financial institutions to secure the capital necessary for its operations, particularly its extensive in-house financing programs. These partnerships are crucial for managing the substantial financial resources needed to support customer credit.

Key financial partnerships include securing revolving credit facilities and engaging in asset-backed security (ABS) transactions. These arrangements provide liquidity and allow Conn's to effectively manage its credit portfolio by securitizing its receivables.

For example, Conn's successfully executed an ABS transaction in January 2024. This demonstrates their ongoing strategy to leverage capital markets for funding.

- Asset-Backed Security (ABS) Transactions: Conn's utilizes these to transform future revenue streams from customer financing into immediate capital.

- Revolving Credit Facilities: These provide ongoing access to funds, essential for maintaining liquidity and supporting new customer financing.

- Capital Management: Partnerships with financial institutions are fundamental to managing the significant capital demands of Conn's credit-centric business model.

Repair Service Agreement Insurers

Conn's actively collaborates with third-party insurers to provide valuable repair service agreements (RSAs) to its customer base. This strategic partnership allows Conn's to offer extended protection on purchased products, enhancing customer satisfaction and loyalty.

These RSAs function as a crucial revenue stream, generating commission income for Conn's. Furthermore, the company often handles the actual repair services, integrating this into its post-sale support infrastructure. This dual benefit of commission revenue and enhanced customer service underpins the importance of these relationships.

For instance, in fiscal year 2024, Conn's reported continued success with its protection agreements, which are largely driven by these insurer partnerships. These agreements contribute significantly to the company's overall financial performance.

- Insurer Collaboration: Partnerships with third-party insurers for offering repair service agreements.

- Customer Benefit: Provides customers with coverage for product repairs, increasing value and peace of mind.

- Revenue Generation: Creates commission revenue for Conn's through the sale of these agreements.

- Operational Integration: Conn's often performs the actual repair services, bolstering its post-sale support capabilities.

Conn's cultivated strategic alliances with financial institutions to underwrite its expansive in-house credit programs, a cornerstone of its business model. These partnerships were indispensable for managing the substantial capital required to support customer financing. Key financial collaborations included securing revolving credit facilities and participating in asset-backed security (ABS) transactions, which provided essential liquidity by securitizing receivables.

In January 2024, Conn's executed an ABS transaction, highlighting its ongoing strategy to access capital markets for funding. These financial partnerships were critical for maintaining liquidity and effectively managing its extensive credit portfolio.

Conn's also formed vital partnerships with third-party insurers to offer repair service agreements (RSAs) to its customers, enhancing product value and driving commission revenue. These agreements, significantly supported by insurer collaborations, contributed positively to Conn's fiscal year 2024 financial performance.

| Key Partnership Type | Purpose | Impact on Conn's | Fiscal Year 2024 Relevance |

| Financing Institutions | Capital for in-house credit programs, liquidity | Enables broad customer financing, supports sales volume | ABS transaction executed January 2024 |

| Third-Party Insurers | Offer Repair Service Agreements (RSAs) | Generates commission revenue, enhances customer loyalty | Continued success with protection agreements |

What is included in the product

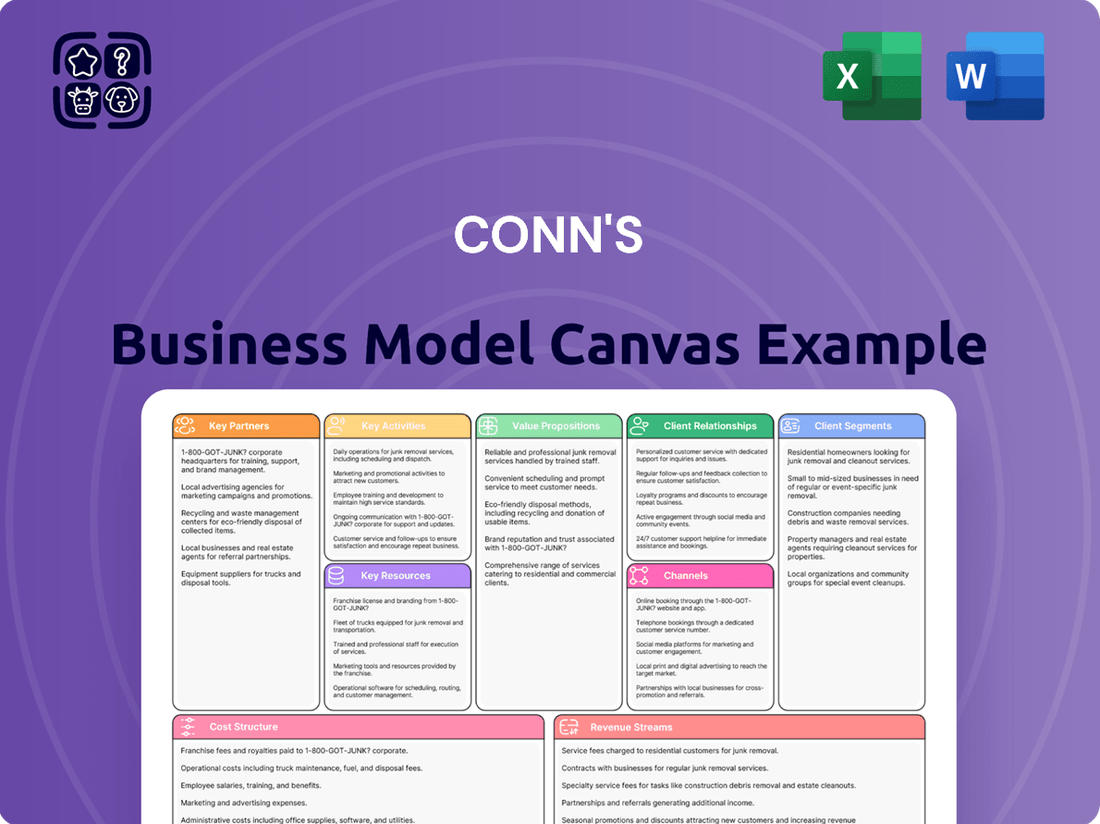

A detailed Business Model Canvas for Conn's, outlining its customer segments, channels, and value propositions, with a focus on its retail and credit operations.

This BMC reflects Conn's real-world operations, detailing key partners, activities, resources, cost structure, and revenue streams for informed decision-making.

Provides a structured framework to pinpoint and address inefficiencies in existing business operations.

Helps identify and solve strategic challenges by clearly outlining customer segments and value propositions.

Activities

Conn's primary activity centers on the sale of durable consumer goods like furniture, appliances, and electronics. This is executed through a significant retail footprint and growing e-commerce channels. For instance, in fiscal year 2024, Conn's reported approximately $1.1 billion in total revenue, with a substantial portion stemming from these retail sales operations.

Key to these operations is the effective management of their retail environments. This includes optimizing store layouts and merchandising to attract and engage customers, alongside training and motivating sales staff. The company actively uses its two main brands, Conn's HomePlus and Badcock Home Furniture & More, to reach diverse customer segments.

Conn's distinctive key activity revolved around its proprietary in-house financing programs, a crucial offering for customers with limited credit access. This involved the entire lifecycle of credit management, from rigorous underwriting and efficient loan origination to the ongoing servicing and diligent collection of customer accounts receivable.

This in-house financing was not a minor aspect of Conn's operations; it was a significant driver of sales. In fiscal year 2024, a substantial 61% of all customer purchases were facilitated through these very programs, underscoring their importance in enabling customer transactions and driving revenue.

Conn's actively engaged in product repair and service, extending its value proposition beyond initial sales. This key activity included offering repair services, frequently bundled with service agreements, which was crucial for fostering customer loyalty and generating recurring revenue streams. For instance, in fiscal year 2024, Conn's reported that its service agreements contributed to a more stable revenue base, complementing its core retail sales.

Maintaining a robust service infrastructure, complete with a network of skilled technicians and readily available parts, was fundamental to the success of these repair operations. This investment ensured that customers received timely and effective support for their purchases, enhancing overall satisfaction and encouraging repeat business. The company’s commitment to service excellence supported its brand reputation in a competitive market.

Inventory and Supply Chain Management

Conn's key activities in inventory and supply chain management are focused on efficiently moving products from suppliers to customers. This involves careful purchasing, strategic warehousing, and ensuring a smooth flow of goods to meet demand across their retail and online channels.

Maintaining optimal inventory levels is crucial for Conn's to balance product availability with the costs associated with holding stock. Their 2023 annual report highlighted efforts to improve supply chain efficiency, recognizing its direct impact on profitability and customer satisfaction.

- Purchasing and Procurement: Establishing strong relationships with vendors to secure favorable terms and ensure a consistent supply of appliances, electronics, and furniture.

- Warehousing and Distribution: Managing a network of distribution centers to store products and efficiently allocate them to individual stores and direct-to-customer delivery points.

- Logistics and Transportation: Overseeing the movement of goods, including inbound shipments from suppliers and outbound deliveries to customers, optimizing routes and carriers.

- Demand Forecasting: Utilizing data analytics to predict customer demand, enabling more accurate inventory planning and reducing the risk of stockouts or excess inventory.

Marketing and Customer Acquisition

Conn's actively pursues customer acquisition through diverse marketing channels, highlighting its extensive product range and appealing financing solutions. In 2024, the company continued to invest in advertising, both in-store and online, to draw consumers to its offerings.

A significant focus was placed on refining the credit application process to streamline the customer journey and encourage more credit applications, a key driver for sales. This strategic emphasis on accessibility aims to capture a broader customer base. For instance, in the first quarter of fiscal year 2025 (ending May 2024), Conn's reported a 7.5% increase in same-store sales, underscoring the effectiveness of its customer acquisition and marketing efforts.

- Advertising Campaigns: Conn's utilizes a mix of digital and traditional advertising to promote its brand and product selection.

- Credit Application Enhancements: Simplifying and expediting the credit application process is a core strategy to convert interest into sales.

- Promotional Offers: Flexible payment options and special financing deals are consistently marketed to attract price-sensitive consumers.

- Online and In-Store Presence: Marketing efforts aim to drive traffic to both physical retail locations and the company's e-commerce platform.

Conn's key activities encompass the direct sale of durable goods, managing store operations, and offering proprietary in-house financing. These are supported by product repair services, inventory and supply chain management, and targeted customer acquisition strategies.

| Key Activity | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Retail Sales of Durable Goods | Selling furniture, appliances, and electronics through physical stores and online. | Contributed significantly to the reported $1.1 billion in total revenue. |

| In-House Financing | Managing the entire credit lifecycle from underwriting to collection. | Fueled 61% of customer purchases, demonstrating its critical role in sales enablement. |

| Product Repair and Service | Offering repair services and selling service agreements. | Contributed to a more stable revenue base and fostered customer loyalty. |

| Inventory & Supply Chain Management | Efficiently procuring, warehousing, and distributing products. | Crucial for balancing product availability with holding costs, impacting profitability. |

| Customer Acquisition | Driving traffic through marketing, promotions, and credit application enhancements. | Supported a 7.5% increase in same-store sales in Q1 FY2025 (ending May 2024). |

Full Version Awaits

Business Model Canvas

The Conn's Business Model Canvas preview you see is an authentic representation of the final document you will receive. This is not a sample or a mockup; it's a direct snapshot from the actual, comprehensive file. Upon completing your purchase, you will gain full access to this exact Business Model Canvas, ready for immediate use and customization.

Resources

Conn's extensive retail store network is a cornerstone of its business, acting as the primary avenue for sales and direct customer engagement. This physical footprint is crucial for reaching consumers and facilitating the purchase of their products.

The company strategically expanded this network, notably through the acquisition of W.S. Badcock. This move significantly boosted its presence, pushing the total number of stores to over 550 locations spread across 15 states, enhancing its market reach.

These stores are not uniform; they are designed with varying sizes and product assortments to effectively cater to the specific needs and preferences of local communities. This adaptability ensures relevance and maximizes sales potential in diverse markets.

The customer accounts receivable portfolio is a cornerstone of Conn's business model. It represents the company's own financing arm, allowing customers to purchase goods on credit. This creates a significant financial asset for Conn's.

This portfolio is crucial for Conn's dual business strategy. It not only facilitates sales but also generates a steady income stream through interest payments from these customer loans. This recurring revenue is vital for the company's financial health.

As of January 31, 2024, Conn's customer accounts receivable portfolio stood at an impressive figure, nearing $1 billion. This substantial balance underscores the scale and importance of its in-house financing operations.

Conn's built its business model on a strong brand reputation, cultivated over more than a century. This heritage positioned them as a trusted specialty retailer for durable goods, a key factor in attracting and retaining customers, especially those with limited credit access.

The acquisition of Badcock Home Furniture & More further broadened Conn's brand reach. In fiscal year 2024, Conn's reported total revenue of $1.18 billion, demonstrating the scale of operations supported by their established brand presence.

Human Capital (Sales and Credit Personnel)

Conn's recognized that its people were a critical asset, particularly in sales and credit. A well-trained sales force was key to driving product adoption and providing a positive customer experience. These individuals were responsible for understanding customer needs and effectively presenting Conn's offerings.

The company's specialized credit underwriting and servicing teams were equally vital. They managed the intricacies of Conn's in-house financing, a significant differentiator. This department ensured that credit was extended responsibly and that accounts were serviced efficiently, directly impacting the company's financial health and customer retention.

As of early 2024, Conn's employed a workforce of approximately 3,800 individuals. This substantial team underscored the operational scale required to support its retail and financing model.

- Sales Personnel: Trained to drive product sales and enhance customer engagement.

- Credit Teams: Specialized in underwriting, servicing, and collections for in-house financing.

- Workforce Size: Approximately 3,800 employees as of early 2024, highlighting the human capital investment.

E-commerce Platforms and Technology

Conn's leverages its e-commerce websites, conns.com and badcock.com, as vital extensions of its physical retail footprint. These digital platforms provide customers with convenient access to a wider product selection and facilitate seamless transactions, enhancing overall reach and sales potential.

Significant investments in technology underpin Conn's strategy to boost operational efficiency and customer experience. A key area of focus has been the integration of its various sales channels and the streamlining of critical processes, such as the credit application, which is crucial for its customer base.

- E-commerce Sales Growth: Conn's reported a significant increase in its e-commerce segment. For instance, in the first quarter of fiscal year 2024, e-commerce sales represented approximately 17% of total sales, showcasing its growing importance.

- Technology Investments for Credit: The company allocated capital towards enhancing its proprietary credit application system, aiming to improve approval rates and reduce friction for consumers seeking financing, a core component of their business model.

- Omnichannel Integration: Conn's technology efforts focus on creating a cohesive omnichannel experience, allowing customers to browse online, purchase in-store, or vice-versa, thereby maximizing customer touchpoints.

Conn's key resources include its extensive retail store network, a substantial customer accounts receivable portfolio, a strong brand reputation built over a century, and its dedicated workforce. The company also relies on its e-commerce platforms and ongoing technology investments to support its operations and customer financing.

| Key Resource | Description | Supporting Data/Facts |

|---|---|---|

| Retail Store Network | Primary sales and customer engagement channel. | Over 550 locations across 15 states following the Badcock acquisition. |

| Customer Accounts Receivable | In-house financing arm, generating revenue through interest. | Portfolio nearing $1 billion as of January 31, 2024. |

| Brand Reputation | Over a century of trust as a specialty retailer. | Supported $1.18 billion in total revenue for fiscal year 2024. |

| Human Capital | Sales and credit teams critical for the business model. | Approximately 3,800 employees as of early 2024. |

| Digital Platforms & Technology | E-commerce sites and investment in operational efficiency. | E-commerce sales comprised ~17% of total sales in Q1 FY24. |

Value Propositions

Conn's core offering was making essential home furnishings and appliances attainable for individuals with credit challenges. Their flexible, in-house financing programs opened doors for consumers often overlooked by conventional lenders. This approach was central to their business, allowing a wider customer base to furnish their homes.

This commitment to accessible credit translated into significant business volume. In 2024, approximately 61% of all Conn's sales were facilitated through these proprietary credit solutions. This figure underscores the critical role their financing played in driving customer acquisition and purchase completion.

Conn's provided a broad spectrum of high-quality, recognizable durable consumer goods. This selection encompassed essential household items like furniture, mattresses, and appliances, alongside consumer electronics, catering to diverse customer needs and tastes. For example, in fiscal year 2024, Conn's continued to focus on these core categories, with their credit segment supporting the sales of these durable goods.

Conn's offers a seamless shopping journey by merging product sales with essential services like delivery, installation, and repair. This integrated model simplifies the customer’s experience from purchase through the entire product life, fostering loyalty and trust. In 2024, Conn's continued to emphasize this customer-centric approach, aiming to differentiate itself in a competitive retail landscape.

The company’s commitment to a high level of customer service is a cornerstone of its value proposition. By providing support throughout the product lifecycle, Conn's builds lasting relationships, which is crucial for repeat business and positive word-of-mouth referrals. This focus aims to enhance customer satisfaction and retention.

Competitive Pricing and Payment Options

Conn's leverages competitive pricing and a variety of payment options to make durable goods accessible. This strategy is crucial for its core customer base, often seeking value and manageable payment plans. In 2024, Conn's continued to emphasize its in-house credit program as a key differentiator, alongside its flexible payment structures, aiming to capture market share by reducing financial barriers.

The company’s commitment to affordability is reflected in its approach to offering competitive prices on a wide range of appliances, electronics, and furniture. This allows customers to acquire necessary household items without undue financial strain. Conn's understands that for many, the ability to pay over time is as important as the product itself, driving its focus on payment flexibility.

- Competitive Pricing: Conn's aims to offer prices that are attractive compared to other retailers in the durable goods market.

- In-house Credit Program: A significant value proposition is its proprietary credit offering, which can be more accessible for customers with less-than-perfect credit histories.

- Flexible Payment Options: Beyond credit, Conn's provides various payment plans to suit different customer budgets and needs.

- Attainability of Durable Goods: The combination of pricing and payment terms makes larger purchases, like refrigerators or living room sets, more attainable for their target demographic.

Convenient Retail Presence

Conn's leverages its extensive retail footprint to offer unparalleled convenience. With numerous stores spanning multiple states, customers can easily visit, examine products firsthand, and receive in-person support. This physical accessibility is a cornerstone of their value proposition, allowing for immediate engagement and consultation.

The strategic acquisition of Badcock in 2023 significantly amplified Conn's retail presence, extending its reach into new territories. This expansion effectively merges urban convenience with rural accessibility, broadening the customer base and reinforcing the brand's commitment to widespread availability. By 2024, Conn's operated approximately 130 retail locations, underscoring this commitment to physical accessibility.

- Extensive Store Network: Approximately 130 retail locations across multiple states as of 2024.

- In-Person Experience: Facilitates product browsing, expert assistance, and financing applications.

- Geographic Expansion: Acquisition of Badcock broadened reach into new urban and rural markets.

- Customer Accessibility: Combines convenient shopping with accessible financing solutions.

Conn's provides a broad selection of quality home furnishings, appliances, and electronics, making essential durable goods accessible to a wider market. Their integrated approach combines product sales with crucial services like delivery and installation, simplifying the customer journey. This focus on providing value through both product and service differentiates them, particularly for their target demographic.

A key differentiator is Conn's proprietary credit program, which serves as a primary sales driver. This in-house financing is designed to be more accommodating for individuals who might struggle to qualify for traditional credit. In 2024, this strategy proved effective, with approximately 61% of Conn's sales being attributed to these in-house credit solutions, demonstrating its critical role in their business model.

The company’s commitment to customer service extends beyond the initial sale, offering support throughout the product lifecycle. This dedication to building lasting relationships fosters customer loyalty and encourages repeat business. Conn's aims to be a trusted partner for its customers, ensuring satisfaction and trust through ongoing engagement.

Conn's leverages competitive pricing and flexible payment options to enhance affordability. This strategy directly addresses the needs of their core customer base, who prioritize value and manageable payment plans. The company’s ability to offer these terms, especially through its in-house credit, is a significant competitive advantage.

| Value Proposition Component | Description | 2024 Impact/Data |

|---|---|---|

| Product Selection | Wide range of home furnishings, appliances, electronics | Core categories supported by credit sales |

| In-house Credit Program | Accessible financing for credit-challenged consumers | 61% of sales in 2024 |

| Integrated Services | Delivery, installation, and repair support | Enhances customer experience and loyalty |

| Customer Service | Lifecycle support to build lasting relationships | Aims to increase customer satisfaction and retention |

| Affordability | Competitive pricing and flexible payment options | Key differentiator for target demographic |

Customer Relationships

Conn's fostered strong customer relationships through its in-house credit support, a cornerstone of its business model. This personalized approach guided customers through the financing application process, making it smoother and more accessible. By directly managing customer accounts, Conn's built trust and loyalty, encouraging repeat business.

This direct involvement in customer financing was a key differentiator. In 2024, Conn's continued to leverage its credit expertise, with its credit segment playing a vital role in driving sales and customer retention. The company's ability to offer financing options directly to consumers, even those with less-than-perfect credit, solidified its market position.

The credit department's active monitoring of customer portfolios and proactive collection and mitigation efforts were crucial for managing risk and maintaining healthy customer accounts. This diligent management ensured the sustainability of their credit programs, further reinforcing customer confidence in Conn's commitment to providing accessible and reliable financing solutions.

Conn's customer relationships were significantly shaped by the direct assistance provided by their sales associates within physical stores. These trained professionals were crucial in guiding customers through product selections, offering detailed information, and simplifying the payment process, making in-person engagement a vital part of the overall experience.

The company placed a strong emphasis on ensuring their sales personnel were not only knowledgeable about the products but also adept at understanding customer needs. This focus on expertise aimed to build trust and facilitate informed purchasing decisions, directly impacting customer satisfaction and loyalty.

For instance, in fiscal year 2024, Conn's continued to leverage its retail footprint, with sales associates playing a key role in driving sales and fostering customer connections. While specific customer relationship metrics tied directly to sales associate interactions aren't always publicly itemized, the company's strategy consistently highlights the importance of this in-store human element.

Conn's offers post-sale service and repair through protection plans, fostering an ongoing relationship beyond the initial purchase. This commitment to customer satisfaction and loyalty is key to retaining clients. For instance, in fiscal year 2024, Conn's continued to leverage partners like Assurant to manage these service agreements, ensuring customers have a reliable point of contact for assistance with their protection plans.

Multi-Channel Support

Conn's provides customer support across multiple avenues to ensure accessibility and engagement. This includes in-store assistance for immediate needs, a robust online platform with FAQs and self-service options, and specialized customer service teams handling billing and repair inquiries. This commitment to a multi-channel strategy reflects their dedication to maintaining strong customer relationships.

In 2024, Conn's continued to refine its customer support infrastructure. By offering a blend of digital and in-person interactions, they aimed to cater to diverse customer preferences. This approach is crucial for managing customer loyalty and addressing service-related touchpoints effectively.

- In-Store Assistance: Direct interaction with sales associates and service personnel for product information and immediate issue resolution.

- Online Resources: A comprehensive website featuring product details, order tracking, payment portals, and troubleshooting guides.

- Dedicated Support Lines: Specialized phone and online support for billing inquiries, repair scheduling, and warranty claims.

- Customer Engagement: Proactive communication through email and app notifications regarding order status and service appointments.

Relationship-Driven Repeat Business

Conn's actively cultivates enduring customer connections, primarily through its in-house credit programs. This strategy aims to encourage repeat purchases by making financing accessible, thereby fostering loyalty and a continuous sales cycle. For instance, in fiscal year 2024, Conn's reported that a significant portion of its sales were generated from existing customers, underscoring the effectiveness of its relationship-driven approach.

The company views its flexible credit options not just as a sales tool, but as a cornerstone of customer retention. By offering tailored financing solutions, Conn's seeks to become a trusted partner for customers' ongoing needs, translating into higher lifetime value and sustained revenue. This focus on credit accessibility directly influences customer loyalty.

- Fostering Long-Term Relationships: Conn's emphasizes building lasting connections with its customer base.

- Credit Programs as a Loyalty Driver: In-house financing options are central to encouraging repeat business.

- Flexible Financing Fuels Repeat Purchases: Accessible and adaptable credit solutions are designed to enhance customer retention.

- Fiscal Year 2024 Impact: A substantial percentage of Conn's revenue in FY24 originated from repeat customers, validating the strategy.

Conn's cultivates customer loyalty through its integrated in-house credit offerings, making purchases accessible and encouraging repeat business. This direct financing approach, a key differentiator, underpins their customer retention strategy, as evidenced by a notable percentage of sales in fiscal year 2024 coming from existing customers.

The company's commitment extends to post-sale support via protection plans, managed in partnership with entities like Assurant in 2024, ensuring ongoing customer engagement and satisfaction.

Conn's customer relationships are actively managed through a multi-channel support system, including in-store assistance, online resources, and dedicated customer service lines, all designed to enhance accessibility and engagement.

| Key Customer Relationship Aspects | Description | 2024 Relevance |

| In-House Credit | Provides accessible financing, driving repeat purchases and loyalty. | Significant portion of FY24 sales from repeat customers. |

| Post-Sale Support | Protection plans and service agreements ensure ongoing customer engagement. | Partnerships like Assurant manage these plans in 2024. |

| Multi-Channel Support | In-store, online, and phone support cater to diverse customer needs. | Refined infrastructure to meet varied customer preferences. |

Channels

Conn's primary sales channel is its extensive network of physical retail stores, operating under the Conn's HomePlus and Badcock Home Furniture & More brands. These locations act as crucial touchpoints for customers, functioning as showrooms where they can see and interact with products, complete sales transactions, and apply for credit. As of January 31, 2024, Conn's maintained a significant physical presence with 552 retail stores.

Conn's leverages its e-commerce websites, conns.com and badcock.com, to significantly broaden its customer base, offering a convenient way to shop for furniture, appliances, and electronics beyond its brick-and-mortar stores.

This digital expansion proved highly successful, with e-commerce sales reaching an impressive $109.3 million in fiscal year 2024, marking a new record for the company and demonstrating a strong customer preference for online purchasing.

Conn's actively engaged potential customers through a multi-channel direct marketing and advertising approach. This strategy aimed to highlight product offerings, special promotions, and crucially, their accessible financing solutions, a key differentiator.

The company utilized a blend of traditional media, such as television and print, alongside robust digital advertising campaigns. These efforts were designed to drive both in-store foot traffic and online engagement, ensuring broad reach.

For instance, in fiscal year 2024, Conn's reported advertising expenses of $172.6 million, demonstrating a significant investment in reaching its target demographic. This spend directly supported their efforts to acquire new customers and inform them about their credit programs.

By focusing on direct communication about their value proposition, including flexible payment plans, Conn's sought to overcome potential price barriers and attract a customer base that might not qualify for traditional credit, thereby expanding their market reach.

Delivery and Installation Services

Delivery and installation services are a core component of Conn's customer value proposition, acting as a crucial channel to bring purchased goods directly into customers' homes. This direct interaction not only facilitates convenience but also ensures products are set up correctly, significantly improving the post-purchase experience and reducing potential returns. Conn's commitment to efficient service is evident in its widespread offering of fast delivery and installation across most of its operating markets.

These services are more than just an add-on; they are integrated into the overall customer journey, reinforcing the brand's reliability and customer-centric approach. By managing the final mile of the product lifecycle, Conn's solidifies customer satisfaction and differentiates itself in a competitive retail landscape. For instance, in 2024, Conn's continued to emphasize its robust delivery network as a key differentiator, aiming to enhance customer loyalty through dependable and timely service.

- Channel Functionality: Delivery and installation directly connect the product to the customer's living space, making the purchase tangible and immediately usable.

- Customer Experience Enhancement: Proper setup and timely delivery are critical touchpoints that build trust and satisfaction, directly impacting repeat business.

- Market Reach: Offering these services broadly ensures a consistent customer experience regardless of geographic location within their service areas.

- Operational Efficiency: In 2024, Conn's focused on optimizing its logistics to ensure that delivery and installation remained a strong, reliable channel, with many customers receiving their new appliances or electronics within days of purchase.

Credit Application Process

Conn's credit application process, a vital channel for reaching credit-constrained consumers, facilitated both in-store and online engagement. This process was instrumental in converting customer interest into financed sales, a core element of their business model.

In 2024, Conn's continued to refine its credit application to boost both the volume of applications and the overall rate of financed sales. These enhancements were designed to streamline the customer experience and maximize conversion rates.

- In-Store Applications: Customers could initiate credit applications directly at any Conn's HomePlus retail location, providing immediate assistance and a tangible point of contact.

- Online Applications: A user-friendly online portal allowed customers to apply for credit from the convenience of their homes, expanding accessibility.

- Conversion Focus: The entire credit application workflow was optimized to encourage more customers to complete applications and secure financing, directly impacting sales volume.

- 2024 Data Insight: While specific 2024 application numbers are not yet fully reported, Conn's historically leveraged its credit segment to drive a significant portion of its revenue, with the credit segment consistently contributing to a substantial percentage of total sales. For instance, in fiscal year 2023, their credit portfolio generated significant interest income, underscoring the channel's financial importance.

Conn's utilizes its extensive physical retail footprint as a primary channel, allowing customers to experience products firsthand and complete purchases, including credit applications, on-site. This strategy is supported by a robust e-commerce presence, which generated $109.3 million in fiscal year 2024, showcasing a significant shift towards digital engagement.

Direct marketing and advertising, backed by a $172.6 million spend in fiscal year 2024, serve as a crucial channel to inform customers about product offerings and, importantly, Conn's accessible financing options, driving both online and in-store traffic.

Delivery and installation are integral channels that directly bridge the gap between purchase and customer satisfaction, ensuring product usability and reinforcing brand reliability. The credit application process, both online and in-store, is a vital channel for enabling sales, particularly for credit-constrained consumers.

| Channel | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Physical Stores | Showrooms for product interaction and sales completion. | 552 store locations nationwide. |

| E-commerce | Online platform for broad customer reach and purchasing convenience. | Generated $109.3 million in sales. |

| Direct Marketing/Advertising | Communicates value proposition and financing options. | $172.6 million in advertising expenses. |

| Delivery & Installation | Ensures product usability and enhances customer experience. | Core component of customer value proposition. |

| Credit Application | Facilitates sales by enabling financing for consumers. | Key driver for sales volume, especially for credit-constrained customers. |

Customer Segments

Conn's strategically focused on credit-constrained consumers, a segment often overlooked by traditional lenders. This demographic, characterized by limited access to conventional financing, represented a significant market opportunity. By offering in-house credit solutions, Conn's directly addressed the needs of these individuals, making essential goods accessible.

This customer segment was crucial to Conn's success, forming the bedrock of their business model. The company's approach was built around serving this specific group, providing a vital service where others did not. In 2024, a significant portion of Conn's revenue continued to be driven by these financing arrangements, demonstrating the enduring relevance of this customer base.

Conn's has historically focused on middle-to-lower income households, understanding their need for accessible financing for major purchases. The company's core strategy revolves around offering durable home goods like appliances, electronics, and furniture, often with in-house credit options that cater to consumers who might not qualify for traditional financing. This approach directly addresses the financial realities of this segment, where discretionary income for large purchases is limited, and flexible payment plans are a significant draw.

In 2024, Conn's continued to leverage its unique credit capabilities to serve this demographic. The company reported that a substantial portion of its sales were driven by its proprietary financing, indicating the continued reliance of its customer base on these flexible payment solutions. This emphasis on affordability and accessible credit remains a cornerstone of Conn's customer acquisition strategy for this income bracket.

Conn's targets homeowners and renters who are in the market for durable goods to furnish and equip their living spaces. This customer base actively seeks to acquire items like furniture, mattresses, major appliances, and consumer electronics, covering both basic necessities and upgrades for comfort and lifestyle. For example, in fiscal year 2024, Conn's reported that over 60% of its revenue was generated from sales of furniture and mattresses, highlighting the importance of this segment.

Customers Valuing Full-Service Retail

A significant portion of Conn's customer base prioritizes a complete, end-to-end retail experience. These individuals value more than just the product itself; they seek assurance and convenience throughout the entire purchasing journey, from initial sales interaction to post-purchase support.

This customer segment is willing to pay a premium for the bundled services that Conn's offers. This includes personalized sales assistance to help them make informed decisions, reliable delivery and professional installation, and accessible repair services should any issues arise. This comprehensive approach simplifies the buying process for them.

- Convenience Seekers: Customers who value having all aspects of their purchase managed by a single provider.

- Service-Oriented Buyers: Those who see delivery, installation, and repair as integral parts of the product's value proposition.

- Time-Constrained Individuals: People who prefer not to manage separate logistics or repair arrangements.

- Brand Trust Advocates: Customers who rely on the retailer's reputation for service and support.

For Conn's, this segment represents a core group that drives sales for higher-ticket items where installation and ongoing service are particularly important. In 2024, retailers offering robust service packages continued to see strong customer loyalty, as consumers increasingly look for hassle-free transactions.

Geographically Focused Consumers

Conn's initially concentrated its efforts on consumers located primarily in the southern United States, leveraging a physical store network that spanned 15 states. This geographical focus allowed for tailored marketing and product offerings to resonate with regional preferences.

The strategic acquisition of Badcock in 2021 significantly bolstered Conn's presence in specific regional markets, particularly in Florida and the Carolinas, reinforcing its ability to cater to localized consumer demands and preferences. This expansion aimed to deepen market penetration and enhance brand loyalty within these established territories.

This targeted geographic strategy is crucial for managing operational costs and marketing expenditures efficiently. By concentrating resources, Conn's can better understand and serve the distinct needs of its customer base in these key regions, leading to more effective sales and customer relationship management.

- Geographic Concentration: Primarily served customers across 15 states in the southern U.S.

- Market Penetration: Acquisition of Badcock strengthened reach in specific regional markets.

- Local Adaptation: Strategy allows for catering to distinct local consumer demands.

Conn's primary customer base consists of credit-constrained consumers, often with lower-to-middle incomes, who seek accessible financing for durable home goods. These individuals may not qualify for traditional credit, making Conn's in-house financing a critical enabler for purchases like furniture, appliances, and electronics. In fiscal year 2024, Conn's reported that a substantial portion of its sales, over 60% from furniture and mattresses alone, were driven by this demographic's reliance on flexible payment plans.

Another key segment values a comprehensive retail experience, prioritizing convenience and service beyond the product itself. This group appreciates having all aspects of their purchase, including delivery, installation, and repair, managed by a single provider. For these customers, the assurance of reliable support is a significant factor in their purchasing decisions, driving loyalty for higher-ticket items.

| Customer Segment | Key Characteristics | Conn's Value Proposition | 2024 Relevance |

| Credit-Constrained Consumers | Lower-to-middle income, limited access to traditional credit | In-house financing, accessible credit for essential purchases | Drives significant revenue through proprietary financing; over 60% of revenue from furniture/mattresses |

| Convenience & Service Seekers | Value end-to-end retail experience, reliable support | Bundled services (delivery, installation, repair), hassle-free transactions | Fosters customer loyalty for higher-ticket items and repeat purchases |

| Geographically Focused Buyers | Primarily located in the southern U.S. | Tailored marketing and offerings based on regional preferences | Strengthened presence in Florida and Carolinas post-Badcock acquisition |

Cost Structure

Conn's significant cost of goods sold (COGS) is primarily driven by the acquisition of inventory like furniture, mattresses, appliances, and electronics. This cost directly fluctuates with sales volume and the specific products customers choose. For instance, in fiscal year 2024, Conn's reported a COGS of $1.05 billion, highlighting the substantial investment in their product assortment.

Conn's significant expenses stem from its extensive retail store network. These operational and occupancy costs include rent for numerous locations, utility bills, ongoing maintenance, and the wages for store staff. For instance, in the fiscal year 2024, Conn's reported total operating expenses of $1.35 billion, a substantial portion of which is directly attributable to maintaining its physical footprint.

The company's recent merger with Badcock Home Furniture has also introduced complexities to its cost structure. This integration led to some overlap in store locations, creating a need to manage redundant sites. Addressing these overlaps is crucial for optimizing efficiency and mitigating associated costs.

Conn's credit segment incurs significant costs, primarily related to its in-house financing. These include the crucial provision for bad debts, which reflects potential loan losses. For fiscal year 2024, this provision saw an increase, highlighting a growing concern over credit quality.

Further expenses stem from the interest paid on debt used to finance the substantial credit portfolio. Additionally, the company bears costs associated with credit underwriting, ensuring new loans are sound, and collections efforts to recover outstanding balances.

Marketing and Advertising Expenses

Conn's significant investment in marketing and advertising campaigns was a key component of its cost structure, designed to draw in customers and highlight its product offerings and financing solutions. These expenditures were crucial for driving both foot traffic to stores and online engagement, ultimately aiming to increase credit applications and sales.

For fiscal year 2024, Conn's reported advertising expenses, a substantial part of its marketing efforts, amounted to $138.1 million. This figure underscores the company's commitment to brand visibility and customer acquisition through various promotional channels.

- Advertising Investment: Conn's allocated $138.1 million to advertising in FY2024, a clear indicator of its strategy to attract and engage a broad customer base.

- Promotional Focus: These marketing dollars were directed towards promoting not only the diverse range of appliances, electronics, and furniture but also the accessibility of their in-house credit program, a major differentiator.

- Customer Acquisition: The primary goal of these marketing and advertising expenses was to fuel customer acquisition, encouraging both in-store visits and online applications for their credit services.

- Competitive Landscape: In a competitive retail environment, these marketing outlays were essential for maintaining brand awareness and driving sales volume, especially for big-ticket items.

Logistics, Delivery, and Service Costs

Conn's significant expenses are tied to its integrated service model, encompassing logistics, delivery, and repair services. These costs are fundamental to supporting the customer experience and maintaining the company's value proposition.

The company incurs substantial outlays for transporting products to customers' homes and for the installation of appliances and electronics. Furthermore, the operational costs of its repair services, which include skilled technician labor and vehicle maintenance, represent a considerable portion of the overall cost structure.

- Delivery and Installation: Expenses associated with getting products to customers and setting them up.

- Repair Services: Costs for maintaining and operating the company's in-house repair teams, including technician wages and parts.

- Transportation: Fuel, vehicle maintenance, and driver compensation for the logistics network.

- Service Infrastructure: Costs for maintaining repair facilities and necessary equipment.

For example, in fiscal year 2024, Conn's reported selling, general and administrative expenses, which include many of these operational costs, totaled $1.1 billion. This figure highlights the scale of investment required to manage its extensive delivery, installation, and service operations effectively, directly supporting its customer-centric approach.

Conn's cost structure is heavily influenced by its product sourcing, with a significant portion dedicated to the cost of goods sold for furniture, appliances, and electronics. This is complemented by substantial operating expenses stemming from its vast retail store network, encompassing rent, utilities, and staff wages. The company's in-house credit segment also adds considerable costs, notably through provisions for bad debts and interest on financing.

Marketing and advertising are key cost drivers, with $138.1 million spent in FY2024 to attract customers to both products and credit services. Furthermore, the integrated service model, including delivery, installation, and repair, incurs significant expenses, contributing to the $1.1 billion in selling, general, and administrative costs reported in FY2024.

| Cost Category | FY2024 Expense (in billions) | Key Components |

|---|---|---|

| Cost of Goods Sold (COGS) | $1.05 | Inventory (furniture, appliances, electronics) |

| Operating Expenses | $1.35 | Store rent, utilities, staff wages |

| Selling, General & Administrative (SG&A) | $1.10 | Delivery, installation, repair services, marketing |

| Advertising Expenses | $0.1381 | Promotional campaigns for products and credit |

| Credit Segment Costs | (Not explicitly detailed as a single figure, but includes bad debt provisions and interest) | Bad debt provisions, interest on debt, underwriting, collections |

Revenue Streams

Conn's primarily generates revenue through the direct sale of a wide array of durable consumer goods. This includes essential household items such as furniture, mattresses, major home appliances, and consumer electronics. These sales occur through their physical retail store network and their growing e-commerce channels, offering customers multiple avenues to purchase.

For the three-month period concluding January 31, 2024, Conn's reported retail revenues totaling $296.9 million. This figure highlights the significant contribution of product sales to the company's overall financial performance, reflecting customer demand for their product categories.

Conn's generates a significant portion of its revenue from finance charges and interest income derived from its customer accounts receivable. This income stream is a direct result of its proprietary in-house credit programs, which cater to a customer base that might otherwise struggle to obtain financing.

This segment offers a recurring income source, contributing to the stability of Conn's overall financial performance. For the three months ending January 31, 2024, these credit revenues amounted to $70.8 million, highlighting the importance of this revenue stream.

Conn's generates revenue through the sale of Repair Service Agreements (RSAs), offering customers extended coverage for product repairs beyond the manufacturer's warranty. These agreements provide a recurring revenue stream and enhance customer loyalty.

The company earns commissions from the sale of these RSAs, which are often bundled with product purchases. In the fiscal year ending January 31, 2024, Conn's reported that its protection agreement segment, which includes RSAs, contributed approximately $205.4 million in revenue, representing a significant portion of its overall income.

Credit Insurance Commissions

Conn's leverages credit insurance commissions as a significant revenue stream, diversifying its financial services income. This strategy allows the company to offer protection to its customers, simultaneously generating additional income for Conn's. In fiscal year 2024, Conn's reported substantial earnings from these ancillary financial products, underscoring their importance to the overall business model. This commission-based income is crucial for enhancing profitability beyond traditional product sales.

The company’s approach to credit insurance commissions is a key component of its financial services segment. This revenue source directly contributes to the bottom line by providing a steady stream of income tied to customer financing agreements.

- Diversified Revenue: Credit insurance commissions add a layer of financial services revenue distinct from appliance and electronics sales.

- Customer Value Proposition: Offering credit insurance provides customers with a sense of security on their purchases.

- Profitability Enhancement: These commissions directly boost the profitability of Conn's financing operations.

Late Fees and Other Finance-Related Income

Conn's also generates income through late fees on customer accounts that have fallen behind on payments. This is a common practice in retail financing, where interest and fees are applied to outstanding balances.

Beyond late fees, Conn's captures other finance-related income streams. These can include things like administrative fees or other charges associated with managing customer financing, adding to the overall revenue generated by their credit segment.

While these finance-related income sources, including late fees, are generally smaller components of Conn's total revenue, they still play a role in bolstering the profitability of their credit operations. In 2024, for example, Conn's reported that its financial services segment, which encompasses these fees, contributed a notable portion to its overall financial performance, demonstrating their consistent, albeit secondary, impact.

- Late Fees: Revenue generated from customers failing to meet payment deadlines.

- Other Finance-Related Income: Includes miscellaneous charges and administrative fees within the credit segment.

- Contribution to Credit Segment: These smaller income streams collectively support the profitability of Conn's financing operations.

Conn's revenue streams are diversified, encompassing not only the sale of durable goods but also significant income from its financial services offerings.

The company's credit operations are a cornerstone, generating substantial revenue through finance charges and interest on customer accounts, a testament to its in-house credit programs.

Furthermore, Conn's effectively monetizes its customer relationships through the sale of Repair Service Agreements and commissions from credit insurance, adding layers of recurring income and profitability.

| Revenue Stream | Q4 FY2024 (Ended Jan 31, 2024) | FY2024 (Ended Jan 31, 2024) |

|---|---|---|

| Retail Sales | $296.9 million | $1,068.4 million |

| Credit Revenues (Finance Charges & Interest) | $70.8 million | $297.1 million |

| Protection Agreements (RSAs) | Not specified | $205.4 million |

| Credit Insurance Commissions | Not specified | Significant portion of Financial Services |

| Late Fees & Other Finance Income | Included in Credit Revenues | Contributed to Financial Services profitability |

Business Model Canvas Data Sources

Conn's Business Model Canvas is built using a blend of internal financial disclosures, extensive market research on consumer electronics and home appliances, and strategic insights derived from their operational performance. These diverse data sources ensure each block of the canvas is grounded in Conn's specific business realities and market positioning.