Conn's PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conn's Bundle

Navigate the complex external environment affecting Conn's with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. This expertly crafted report provides a clear roadmap for strategic decision-making. Don't get left behind; download the full PESTLE analysis today and gain the competitive edge you need.

Political factors

Government regulations concerning consumer credit, particularly for those with less-than-perfect credit histories, have a substantial effect on Conn's in-house financing operations. Stricter oversight regarding interest rates, transparency in disclosures, and how debts are collected can lead to higher compliance expenses and potentially shrink the customer base that qualifies for their credit offerings.

For instance, the Consumer Financial Protection Bureau (CFPB) actively monitors lending practices. In 2024, continued scrutiny on fair lending and debt collection practices could necessitate further adjustments to Conn's credit underwriting and servicing protocols, directly impacting their ability to extend credit and thus sales.

Conn's business model is fundamentally built upon providing accessible and adaptable payment solutions to its customers. Therefore, any significant shifts in political sentiment or legislative changes that tighten consumer lending rules represent a critical political risk to the company's core strategy and revenue generation.

As of early 2025, legislative proposals or regulatory guidance that further restrict allowable interest rates or impose more rigorous affordability checks could directly constrain Conn's ability to serve a significant portion of its target market, potentially impacting its sales volume and profitability.

Changes in international trade policies and tariffs significantly impact Conn's cost of goods sold. For instance, the U.S. imposed tariffs on goods from China, affecting electronics and furniture, categories central to Conn's product mix. In 2023, the U.S. maintained tariffs on many Chinese goods, with ongoing discussions about potential adjustments.

As a global retailer, Conn's ability to source products worldwide means these tariffs directly influence pricing. Higher tariffs can force Conn to either absorb the increased costs, squeezing profit margins, or pass them onto consumers, potentially reducing sales volume and impacting the affordability of purchases made through Conn's in-house financing.

Political stability significantly impacts consumer confidence, which in turn drives discretionary spending on big-ticket items like those sold by Conn's. When the political environment feels uncertain, consumers tend to hold back on major purchases, directly affecting Conn's revenue from furniture and appliances.

In the United States, for instance, periods of political transition or heightened geopolitical tension have historically correlated with dips in consumer confidence indexes. For example, the University of Michigan Consumer Sentiment Index, a key indicator, often shows volatility during election years or times of significant policy shifts, directly influencing demand for durable goods.

Conversely, a stable political climate fosters a sense of security, encouraging consumers to spend and take on credit for larger purchases. This predictability is crucial for retailers like Conn's, as it supports the financing models common in their industry.

Fiscal and Monetary Policy

Government fiscal and monetary policies significantly influence Conn's sales environment. For instance, a tightening of monetary policy, such as interest rate hikes by the Federal Reserve, can reduce consumer liquidity and make financing purchases more expensive, potentially dampening demand for Conn's durable goods. In late 2023 and early 2024, the Federal Reserve maintained higher interest rates, impacting consumer borrowing costs.

Conversely, expansionary fiscal policies, like stimulus checks or tax cuts, can inject disposable income into the economy, potentially boosting consumer spending at retailers like Conn. While there haven't been broad federal stimulus packages in 2024 comparable to the COVID-19 era, localized or sector-specific government spending can still create pockets of increased consumer liquidity.

The accessibility of credit is a critical factor for Conn's customer base, many of whom rely on financing for larger purchases. Changes in credit availability, influenced by both monetary policy and lending regulations, directly affect Conn's sales performance. If credit becomes harder to obtain or more expensive, Conn's credit-constrained customers may postpone or forgo purchases.

- Interest Rate Environment: The Federal Reserve's federal funds rate, which influences borrowing costs across the economy, remained elevated through much of 2024, impacting consumer credit availability.

- Consumer Spending Trends: Retail sales figures, a key indicator of consumer liquidity, showed mixed performance in 2024, with durable goods often facing headwinds from higher interest rates.

- Inflationary Pressures: Persistent inflation in 2023 and early 2024 eroded some consumer purchasing power, further complicating the impact of fiscal and monetary policies on spending.

Bankruptcy Laws and Consumer Debt Relief

Changes to bankruptcy laws directly affect Conn's ability to recover funds from customers who default on their in-house financing. More lenient regulations, or government programs offering widespread consumer debt relief, could mean Conn's experiences higher credit losses. For instance, if new legislation makes it easier for consumers to discharge debts or restructure them with less recourse for lenders, Conn's receivables portfolio could see increased write-offs.

This impacts Conn's profitability by increasing the provision for bad debts and potentially affecting the valuation of its credit segment. In 2023, Conn's reported net credit losses of $220.5 million, highlighting the sensitivity of its financial performance to credit risk management. Any shifts towards more consumer-friendly debt resolution mechanisms could exacerbate these losses.

Key considerations include:

- Impact on Receivables: Stricter bankruptcy protections for consumers can reduce the collectibility of Conn's in-house financing receivables.

- Profitability Strain: Increased credit losses directly reduce net income and can put pressure on profit margins.

- Risk Assessment: Lenders and investors will closely monitor changes in bankruptcy laws as they influence the overall risk profile of Conn's credit operations.

- Consumer Behavior: The availability of debt relief programs can also influence consumer repayment behavior, potentially leading to higher delinquency rates.

Government regulations on consumer credit, including interest rate caps and transparency requirements, directly influence Conn's financing model. Stricter rules, like those enforced by the CFPB, can increase compliance costs and limit the pool of eligible customers, impacting sales. As of early 2025, proposed legislation to further restrict interest rates could significantly constrain Conn's ability to serve its core market.

Trade policies and tariffs on imported goods, especially electronics and furniture, affect Conn's cost of goods sold. The continuation of tariffs on goods from China in 2024 means Conn's must either absorb these costs, reducing margins, or pass them on, potentially impacting sales volume and affordability.

Political stability is crucial for consumer confidence and spending on big-ticket items. Uncertainty, as seen during political transitions or geopolitical tensions, often leads to reduced consumer sentiment, negatively affecting demand for durable goods. Stable political environments, conversely, encourage consumer spending and credit utilization.

Fiscal and monetary policies, such as Federal Reserve interest rate decisions, impact consumer liquidity and borrowing costs. Elevated interest rates through much of 2024 made financing more expensive, dampening demand. Conversely, expansionary policies can boost spending, though broad stimulus measures were less prevalent in 2024 compared to prior years.

Changes in bankruptcy laws can lead to higher credit losses for Conn's. More lenient consumer bankruptcy protections reduce the recoverability of receivables, directly impacting profitability. In 2023, Conn's reported net credit losses of $220.5 million, underscoring the sensitivity to credit risk.

What is included in the product

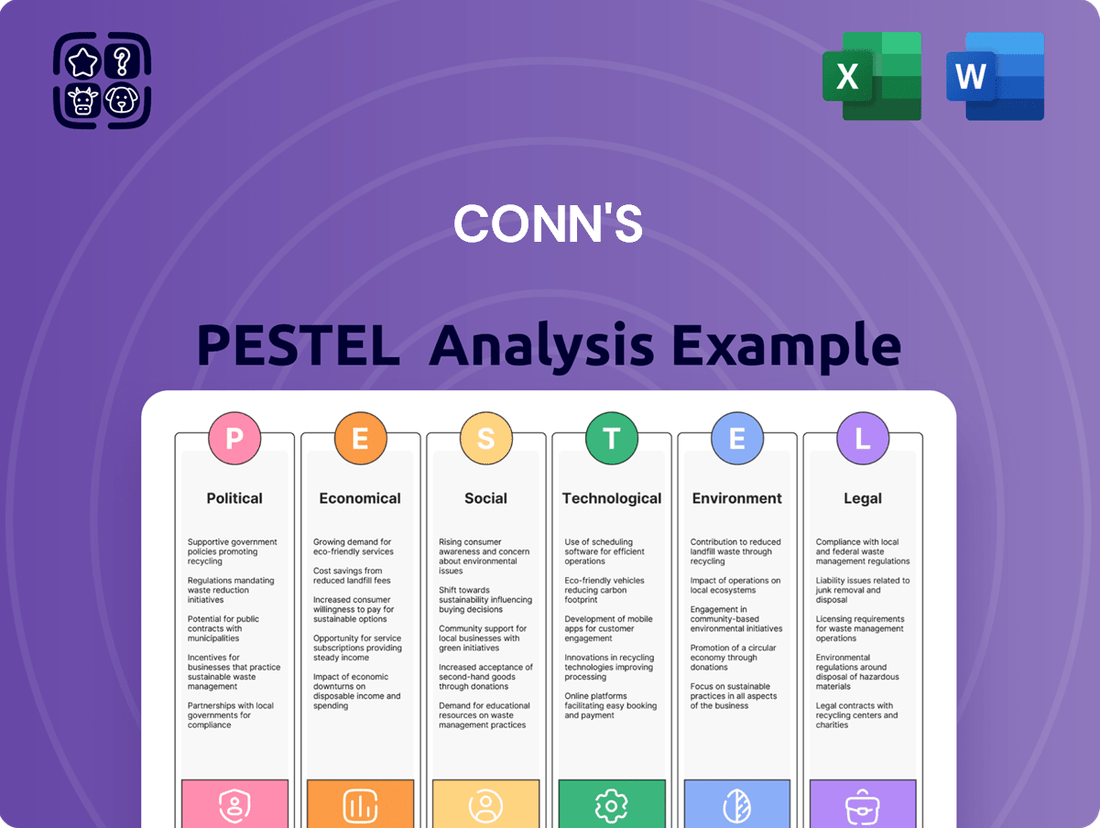

This Conn's PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides actionable insights into how these external forces create both challenges and advantageous opportunities for Conn's to leverage.

Provides a concise version of Conn's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify external opportunities and threats.

Economic factors

Interest rate fluctuations significantly impact Conn's business model, particularly its reliance on in-house financing. As of mid-2024, the Federal Reserve maintained a hawkish stance, with the federal funds rate hovering around 5.25%-5.50%, a level that has persisted for some time. This elevated rate environment directly increases Conn's cost of capital, making it more expensive to fund the credit extended to its customers for appliance and furniture purchases.

Higher borrowing costs for Conn translate to potentially higher interest rates offered to customers. This can act as a deterrent, reducing the attractiveness of Conn's financing options and consequently dampening demand for its higher-ticket durable goods. For instance, a 1% increase in the annual percentage rate (APR) on a customer's financing could shift purchasing decisions for budget-conscious consumers.

Conversely, a future pivot by the Federal Reserve towards rate cuts, a possibility being discussed in late 2024 and early 2025, could provide a tailwind. Lower interest rates would reduce Conn's funding expenses and potentially allow for more competitive customer financing rates, thereby stimulating borrowing and boosting sales of its core product offerings.

Consumer spending and disposable income are critical drivers for companies like Conn's, which specialize in durable goods. When consumers have more money left over after essential expenses, they are more likely to purchase big-ticket items such as furniture, mattresses, and appliances. This discretionary income directly fuels demand for Conn's product offerings.

Conversely, economic slowdowns or periods of persistent inflation can significantly squeeze consumers' purchasing power. When inflation erodes the value of savings and wages, discretionary income shrinks, forcing households to cut back on non-essential purchases. This directly translates to lower sales volumes for retailers of durable goods.

Data from 2023 and early 2024 indicates a challenging environment for discretionary spending. For example, the U.S. personal saving rate, while fluctuating, remained below historical pre-pandemic averages, suggesting less buffer for consumers. Conn's itself has reported decreased same-store sales, a direct reflection of this reduced consumer appetite for its products amidst tighter household budgets.

The availability and terms of consumer credit significantly influence Conn's customer base, especially those with less-than-perfect credit. When credit markets tighten generally, Conn's in-house financing becomes a more vital lifeline for its customers. However, Conn's own capacity to offer credit is directly tied to broader economic conditions and the performance of its specific credit segment.

For instance, as of early 2024, the Federal Reserve's interest rate hikes have made borrowing more expensive across the board, impacting consumers' ability to qualify for and afford credit, including for large purchases like appliances and electronics that Conn's offers. This environment underscores the sensitivity of Conn's business model to the overall health of consumer lending.

Inflation and Cost of Goods

Inflation significantly impacts Conn's by increasing the cost of goods, which can force higher retail prices for consumers. For instance, the Consumer Price Index (CPI) in the U.S. saw a notable increase, with inflation reaching 3.3% year-over-year as of May 2024. This trend directly affects Conn's ability to maintain its pricing structure.

When consumer wages don't rise in tandem with inflation, their purchasing power erodes. This reduced spending capacity can lead to a slowdown in sales volume for Conn's, particularly for discretionary items like furniture and electronics. The personal consumption expenditures (PCE) price index, a key inflation gauge for the Federal Reserve, also reflects these pressures.

Managing these rising operational costs while remaining competitively priced presents a substantial hurdle for Conn's. The company must balance the need to pass on increased expenses to consumers with the risk of deterring sales. Navigating this economic landscape requires careful cost management and strategic pricing adjustments.

- Inflationary Impact: Higher costs for goods can translate to increased retail prices for Conn's customers.

- Purchasing Power: If wages lag inflation, consumer demand for Conn's products may decline.

- Operational Challenges: Conn's faces the dual challenge of managing its own rising costs and maintaining competitive pricing.

- Economic Data: U.S. CPI was 3.3% year-over-year in May 2024, illustrating the ongoing inflationary environment.

Unemployment Rates

Unemployment rates significantly influence Conn's ability to sell its products and manage its credit operations. When unemployment is high, fewer people have stable incomes, directly reducing consumer spending on big-ticket items like furniture and electronics that Conn's offers. This downturn in demand can be substantial, impacting sales volumes and overall revenue. For instance, if the U.S. unemployment rate were to climb to levels seen during economic downturns, say above 6% as it did in early 2021 due to pandemic effects, Conn's would likely experience a noticeable drop in sales.

Furthermore, elevated unemployment poses a greater risk to Conn's credit portfolio. As more individuals face job losses, their ability to make timely payments on credit extended by Conn's diminishes. This can lead to an increase in delinquencies and defaults, negatively affecting the company's profitability and potentially requiring higher provisions for bad debt. In May 2024, the U.S. unemployment rate stood at 4.0%, indicating a relatively stable labor market that generally supports consumer spending and credit performance.

- Decreased Consumer Income: High unemployment directly cuts into household budgets, limiting discretionary spending on durable goods.

- Reduced Consumer Confidence: Job insecurity often makes consumers hesitant to make large purchases, even if they have some income.

- Increased Credit Risk: A larger pool of unemployed individuals raises the probability of loan defaults for Conn's credit offerings.

- Impact on Sales Volume: Lower consumer spending translates to fewer unit sales for Conn's retail operations.

Economic growth, or its contraction, directly influences consumer confidence and spending on durable goods, Conn's core market. A robust economy typically leads to higher disposable incomes and a greater willingness to invest in home furnishings and appliances.

Conversely, a slowdown or recessionary environment can significantly dampen demand. Consumers tend to postpone large purchases when facing economic uncertainty, impacting Conn's sales volumes. For example, U.S. real GDP growth was projected to moderate in 2024 compared to prior years, indicating a less dynamic economic environment.

Conn's financial performance is closely tied to consumer sentiment and spending patterns, which are themselves highly sensitive to macroeconomic trends. For instance, the Conference Board Consumer Confidence Index, a key indicator of consumer outlook, saw fluctuations throughout 2023 and early 2024, reflecting broader economic concerns.

| Economic Indicator | Value | Date/Period | Implication for Conn's |

| U.S. Real GDP Growth (Annualized) | 2.0% (Q1 2024 estimate) | Q1 2024 | Moderate growth may support steady, but not robust, consumer spending. |

| Consumer Confidence Index | 102.0 (May 2024) | May 2024 | Slightly above 100 suggests cautious optimism, potentially limiting large discretionary purchases. |

| Personal Consumption Expenditures (PCE) Growth | 3.0% (Q1 2024 estimate) | Q1 2024 | Indicates continued consumer spending, but the pace may not fully offset inflationary pressures. |

Preview Before You Purchase

Conn's PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Conn's PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough overview of the external forces shaping Conn's business strategy and market position.

You will gain valuable insights into how these diverse elements influence Conn's operations, from regulatory compliance to consumer trends.

The detailed breakdown allows for a strategic understanding of both opportunities and threats facing Conn in the current business landscape.

Sociological factors

Societal attitudes toward debt significantly shape Conn's sales. In late 2024, a significant portion of U.S. households continued to manage substantial debt loads, with credit card debt alone exceeding $1.1 trillion. This environment makes consumers more discerning about taking on additional credit, potentially dampening demand for Conn's in-house financing.

A trend towards increased financial prudence, seen in rising savings rates among some demographics, could further limit the appeal of extended credit options. If consumers prioritize debt reduction over new purchases financed by credit, Conn's ability to leverage its financing arm to drive sales will be challenged.

Demographic shifts significantly influence Conn's business. For instance, the growing Gen Z population, born between 1997 and 2012, represents a key consumer segment entering adulthood and forming new households. In 2024, Gen Z is projected to comprise a substantial portion of the workforce and consumer base, with their purchasing power expected to rise. This generation often prioritizes digital experiences and flexible payment options, directly impacting how Conn's markets its home goods and electronics.

Changes in household formation patterns also play a crucial role. As more young adults establish independent living situations, there's an increased demand for furniture, appliances, and electronics. Data from 2023 indicated a steady, albeit varied, rate of new household formations across the US, with a notable trend towards smaller, more urban households. Conn's must therefore tailor its product assortments and credit offerings to meet the needs and financial capabilities of these emerging household structures.

Evolving lifestyle trends, particularly the sustained increase in remote work and a heightened emphasis on home comfort and improvement, directly impact consumer spending on home goods. Conn's can leverage this by ensuring its product offerings and marketing campaigns resonate with these home-centric behaviors. For instance, the home furnishings and appliances sector saw significant growth as people invested more in their living spaces. In 2024, a substantial portion of the workforce is expected to maintain hybrid or fully remote arrangements, fueling continued demand for comfortable and functional home environments. Conn's strategy can focus on showcasing products that enhance home office setups and living areas, directly addressing these shifts.

Online Shopping Adoption and Digital Literacy

The shift towards online shopping is profoundly impacting how Conn's engages with its customer base. As more consumers embrace digital platforms for their purchases, Conn's needs to ensure its online offerings are as robust and user-friendly as its physical stores. This includes streamlining the e-commerce experience and making digital credit applications seamless.

Digital literacy is a key enabler of this trend. According to recent surveys from 2024, a significant majority of consumers now possess basic digital skills, making online transactions more accessible than ever. For Conn's, this means investing in intuitive website design and mobile accessibility to capture this growing online market share.

The preference for e-commerce is not just a trend; it's a fundamental change in consumer behavior. By 2025, e-commerce sales are projected to continue their upward trajectory, with furniture and home goods being a significant category. Conn's must adapt by enhancing its digital infrastructure to meet these evolving customer expectations and remain competitive in the retail landscape.

- E-commerce Growth: Global e-commerce sales are expected to reach over $7 trillion by 2025, highlighting the importance of a strong online presence.

- Digital Literacy Rates: In developed nations, digital literacy rates are consistently above 85%, indicating a broad consumer base comfortable with online transactions.

- Online Furniture Sales: The online furniture market is a growing segment, with many consumers now comfortable purchasing large items sight unseen online.

- Customer Experience: A positive online user experience, including easy navigation and a straightforward checkout process, is crucial for customer retention.

Consumer Awareness and Financial Literacy

Increased consumer awareness about credit and financial products is a significant sociological factor influencing Conn's. As individuals become more savvy about interest rates, loan terms, and their overall financial health, they tend to be more selective in their purchasing decisions. This heightened financial literacy can pressure companies like Conn's, which relies heavily on its credit segment, to offer more straightforward and attractive financing options.

The trend towards greater consumer financial literacy means Conn's must ensure its credit offerings are not only competitive but also transparent. A recent survey indicated that over 70% of consumers in the U.S. are actively seeking out information on credit terms before making a purchase. If Conn's credit segment primarily caters to a customer base with limited credit access, a rise in informed consumers could lead to increased scrutiny of its financing terms, potentially impacting the profitability of that segment.

- Consumer Scrutiny: A growing number of consumers are comparing financing options across different retailers, demanding clearer disclosures.

- Financial Literacy Initiatives: Government and non-profit organizations are expanding programs to improve financial education, creating a more informed consumer base.

- Impact on Profitability: If Conn's credit terms are perceived as less favorable than competitors due to increased awareness, it could lead to a decline in credit segment revenue.

- Data from 2024: Reports suggest a noticeable uptick in credit score monitoring among younger demographics, indicating a proactive approach to financial management.

Consumer attitudes towards debt remain a critical factor for Conn's, especially given that U.S. credit card debt surpassed $1.1 trillion in late 2024. This high debt burden encourages financial prudence, potentially reducing demand for credit-based purchases and impacting Conn's financing business.

The growing Gen Z demographic, entering adulthood and forming households in 2024, represents a key market. This generation's preference for digital experiences and flexible payments necessitates that Conn's adapts its marketing and credit offerings.

Evolving lifestyle trends, such as increased remote work and a focus on home improvement, continue to drive demand for home goods. Conn's can capitalize on this by aligning its product selection and marketing with these home-centric behaviors, especially as hybrid work arrangements persist in 2024.

Technological factors

Conn's ongoing investment in its e-commerce platform is a key technological driver. By continuously enhancing its online capabilities, Conn's aims to directly compete with pure-play online retailers and cater to increasingly digital-savvy consumers. This focus on a user-friendly interface and a smooth checkout experience is vital for broadening its customer base beyond its physical footprint.

Conn's can leverage advanced data analytics and AI to refine its in-house credit underwriting. This technology allows for a more nuanced assessment of credit risk, moving beyond traditional metrics. For instance, by analyzing a broader spectrum of data points, Conn's could potentially identify creditworthy customers who might be overlooked by more conventional methods.

The implementation of these tools is projected to enhance lending decisions, directly impacting bad debt expenses. In 2023, Conn's reported net write-offs of $164.8 million related to its credit portfolio. By improving the accuracy of risk assessment, Conn's aims to reduce this figure, thereby boosting profitability.

Furthermore, sophisticated data analytics can help optimize the credit approval process, making it faster and more efficient. This can lead to a better customer experience and potentially increase sales conversion rates for customers utilizing Conn's financing options.

The rise of digital payment solutions and mobile wallets significantly impacts Conn's operations by offering more convenient and secure transaction methods. For instance, by the end of 2024, it's projected that over 70% of all retail transactions globally will involve some form of digital payment, a trend Conn's can leverage to improve customer experience and reduce checkout friction.

Adopting a variety of these payment options, such as Apple Pay or Google Pay, can directly address evolving consumer preferences, making it easier for customers to complete purchases both online and in-store. This is crucial as mobile wallet usage is expected to see a compound annual growth rate of 18% through 2028, indicating a strong and sustained shift in consumer behavior.

Supply Chain Technology and Logistics

Technological advancements are revolutionizing supply chain management for retailers like Conn's. Innovations in areas such as artificial intelligence (AI) for demand forecasting, blockchain for enhanced transparency and traceability, and advanced robotics in warehouses are key drivers. For instance, AI-powered analytics can help Conn's better predict product demand, minimizing stockouts and overstock situations, which directly impacts profitability and customer satisfaction. The adoption of these technologies is crucial for maintaining a competitive edge in the fast-paced retail environment.

Optimizing logistics through technology directly translates to improved operational efficiency and cost reduction. Real-time tracking systems, route optimization software, and automated warehouse operations can significantly speed up delivery times and reduce transportation expenses. Conn's can leverage these tools to ensure products are available when and where customers want them, enhancing their overall service offering. For example, a 2024 report indicated that companies investing in supply chain technology saw an average reduction in logistics costs by 15-20%.

These technological upgrades enable Conn's to enhance customer experience through faster and more reliable delivery. Advanced inventory management systems, integrated with e-commerce platforms, provide accurate stock information to customers, managing expectations and reducing order fulfillment errors.

- AI-driven inventory management can reduce stockouts by up to 30% for electronics retailers.

- Blockchain implementation in supply chains offers a 99.9% reduction in counterfeit goods detection.

- Robotic process automation (RPA) in warehouses can increase order picking efficiency by 50%.

- Real-time shipment tracking improves customer satisfaction scores by an average of 25%.

In-store Technology and Experiential Retail

Conn's is increasingly integrating technology into its physical stores to create more engaging customer experiences. This includes interactive displays and augmented reality features that allow customers to visualize products, like furniture in their own homes. For instance, in 2024, retailers across various sectors reported a significant uptick in customer engagement metrics when employing in-store digital technologies. Self-service kiosks are also being implemented to streamline the purchasing process, catering to shoppers who prefer efficiency.

These technological enhancements aim to differentiate Conn's from competitors, particularly in an era where online shopping is prevalent. By offering an interactive and modern in-store environment, Conn's can attract customers seeking more than just a transaction. Data from late 2024 indicated that stores with advanced in-store technology saw an average 15% increase in dwell time and a 10% rise in conversion rates compared to those without.

- Interactive Displays: Enhancing product exploration and information access.

- Augmented Reality (AR): Allowing customers to visualize products in their own spaces, reducing purchase uncertainty.

- Self-Service Kiosks: Improving checkout efficiency and customer convenience.

- Data Integration: Leveraging in-store tech to gather customer behavior insights for personalized experiences.

Conn's commitment to enhancing its e-commerce platform is a significant technological factor, aiming to compete directly with online-only retailers and serve increasingly digital consumers. Advanced data analytics and AI are being leveraged for more nuanced credit underwriting, potentially improving lending decisions and reducing bad debt, which stood at $164.8 million in net write-offs for Conn's credit portfolio in 2023. The company is also embracing digital payment solutions and mobile wallets, aligning with a global trend where over 70% of retail transactions are projected to involve digital payments by the end of 2024, and mobile wallet usage is expected to grow at an 18% CAGR through 2028.

Technological advancements are also revolutionizing Conn's supply chain management, with AI for demand forecasting and route optimization software expected to reduce logistics costs by 15-20%, as seen in similar investments by other companies in 2024. In-store, Conn's is integrating interactive displays and augmented reality, which, according to late 2024 data, can increase customer dwell time by 15% and conversion rates by 10%.

| Technology Focus | Impact Area | Key Metric/Statistic |

|---|---|---|

| E-commerce Enhancement | Customer Reach & Sales | Competing with pure-play online retailers |

| AI/Data Analytics in Credit | Risk Management & Profitability | Reduced bad debt ($164.8M net write-offs in 2023) |

| Digital Payments/Mobile Wallets | Transaction Convenience & Efficiency | >70% of global retail transactions digital by end of 2024 |

| Supply Chain Optimization | Operational Efficiency & Cost Reduction | Potential 15-20% reduction in logistics costs |

| In-Store Digital Technologies | Customer Engagement & Conversion | 15% increase in dwell time, 10% rise in conversion rates (late 2024 data) |

Legal factors

Conn's retail operations are significantly shaped by stringent consumer protection laws. These regulations, covering everything from sales tactics to product warranties and return policies, are critical for compliance. Failure to adhere can result in substantial legal penalties, hefty fines, and severe damage to the company's reputation.

These consumer protection statutes often establish baseline requirements for product quality and the level of customer service expected. For instance, in 2024, the Federal Trade Commission (FTC) continued its enforcement of deceptive advertising practices, a key area impacting retailers like Conn's. Ensuring transparency in pricing and clear warranty terms is paramount to avoid regulatory scrutiny.

Conn's operates a significant in-house financing segment, making it particularly sensitive to lending and usury laws. These regulations, which cap interest rates and dictate fair lending practices, directly impact Conn's ability to extend credit to customers and manage its loan portfolio. For instance, changes to usury laws in key states where Conn's operates could limit the interest rates it can charge, potentially reducing profitability on its financing services.

Fair lending practices, enforced by bodies like the Consumer Financial Protection Bureau (CFPB), require transparency and prohibit discriminatory lending. Increased regulatory scrutiny or new enforcement actions in these areas could necessitate costly adjustments to Conn's credit underwriting and customer communication processes. In 2023, the CFPB continued its focus on oversight of non-bank mortgage servicers and installment lenders, signaling an ongoing trend of heightened attention to consumer credit providers.

Debt collection regulations, such as the Fair Debt Collection Practices Act (FDCPA), also impose strict rules on how Conn's can pursue delinquent accounts. Non-compliance can lead to significant fines and reputational damage. The ongoing evolution of these laws, coupled with potential state-level variations, demands continuous monitoring and adaptation from Conn's to ensure lawful and ethical debt recovery practices.

Conn's must rigorously adhere to data privacy and cybersecurity regulations, including evolving state-level acts and potential federal mandates, given its extensive collection of customer financial and personal information. Failure to comply, such as through data breaches, can result in substantial financial penalties; for instance, the California Consumer Privacy Act (CCPA) can impose penalties of up to $7,500 per violation. This also poses a significant risk to customer trust and brand reputation, impacting future sales and customer loyalty.

Bankruptcy and Insolvency Laws

Bankruptcy and insolvency laws significantly influence Conn's ability to manage and recover customer debt. When customers declare bankruptcy, these legal frameworks dictate the priority and feasibility of Conn recovering outstanding payments. The recent Chapter 11 filing by Conn itself and its subsequent delisting from NASDAQ in late 2023 underscore the profound impact these laws have on a company's financial health and operational continuity.

Conn's own financial restructuring through bankruptcy proceedings illustrates the direct consequences of these legal structures. The process impacts its ability to secure new financing, manage existing liabilities, and ultimately, its market valuation. These legal factors are critical considerations for Conn's strategic planning and risk management, especially concerning its credit policies and customer financing operations.

- Impact on Debt Recovery: Bankruptcy laws determine the extent to which Conn can recover funds from customers who default and file for bankruptcy protection.

- Operational Continuity: Conn's own Chapter 11 filing demonstrates how insolvency laws can force significant operational and financial restructuring.

- Access to Capital: Delisting from NASDAQ due to financial distress, a common outcome for companies undergoing bankruptcy, severely limits access to public capital markets.

- Legal Compliance Costs: Navigating bankruptcy and insolvency proceedings incurs substantial legal and administrative costs for the company involved.

Advertising and Marketing Regulations

Conn's must navigate a complex landscape of advertising and marketing regulations, particularly concerning credit offers and product claims. These rules mandate truthfulness and transparency in all customer communications. Failure to comply, such as through misleading advertisements, can lead to significant regulatory penalties, including fines, and expose the company to costly consumer lawsuits. For instance, the Federal Trade Commission (FTC) actively enforces truth-in-advertising laws, with penalties for violations often reaching substantial amounts, potentially impacting Conn's financial performance and brand reputation.

The company's marketing strategies are subject to scrutiny under various consumer protection laws, including the Truth in Lending Act (TILA) and the FTC Act. These regulations aim to prevent deceptive practices and ensure consumers receive accurate information about products and financing terms. In 2023, the FTC continued its focus on unfair or deceptive advertising, issuing guidance and taking enforcement actions against companies engaging in misleading marketing, a trend expected to persist through 2024 and 2025. Conn's financial reporting also requires careful adherence to disclosure requirements, ensuring all credit-related advertising is clear and not misleading.

- Truthfulness and Transparency: Regulations require Conn's to ensure all advertising, especially for credit offers, is truthful and transparent.

- Regulatory Penalties: Misleading advertisements can result in significant fines and enforcement actions from bodies like the FTC.

- Consumer Lawsuits: Non-compliance can lead to class-action lawsuits from consumers, impacting financial stability and brand image.

- Brand Reputation: Maintaining a reputation for honest marketing is crucial for customer trust and long-term financial success.

Conn's faces significant legal hurdles related to consumer protection, fair lending, and debt collection, demanding strict compliance. The company's own 2023 Chapter 11 bankruptcy filing and subsequent NASDAQ delisting highlight the profound impact of insolvency laws on its operations and access to capital.

Navigating these legal frameworks, including adherence to data privacy laws like CCPA with potential penalties up to $7,500 per violation, is crucial for maintaining customer trust and avoiding substantial financial penalties. Ongoing enforcement by agencies like the FTC and CFPB on deceptive advertising and lending practices means Conn's must prioritize transparency in all its dealings.

| Legal Area | Relevant Regulations/Concerns | Potential Impact on Conn's (2024-2025) |

|---|---|---|

| Consumer Protection | FTC Act, State Consumer Protection Laws | Fines for deceptive advertising; class-action lawsuits for product quality/warranty issues. |

| Lending & Credit | Truth in Lending Act (TILA), CFPB Regulations | Increased scrutiny on credit underwriting, potential limits on interest rates, compliance costs for fair lending. |

| Debt Collection | Fair Debt Collection Practices Act (FDCPA) | Penalties for non-compliance in recovery efforts; reputational damage from aggressive tactics. |

| Data Privacy | CCPA, potential federal mandates | Substantial fines for data breaches; loss of customer trust impacting sales. |

| Insolvency | Bankruptcy Code | Continued impact on access to capital and operational flexibility following 2023 restructuring. |

Environmental factors

Conn's faces growing pressure from both consumers and regulators to ensure its product sourcing is sustainable. This means carefully examining the environmental impact of the furniture, appliances, and electronics it sells, pushing the company to prioritize suppliers who demonstrate a commitment to ethical and eco-friendly manufacturing processes.

In 2023, a significant portion of consumers, estimated at over 60% according to some market studies, indicated they would pay more for products from companies with demonstrable sustainability efforts. This trend puts a spotlight on supply chain transparency for retailers like Conn's.

For Conn's, this translates to a need to verify supplier practices, potentially including material sourcing, manufacturing energy use, and waste management. Failure to adapt could impact brand reputation and market share as consumer preferences continue to shift toward environmentally conscious businesses.

Conn's faces increasing scrutiny and regulatory pressure regarding electronic waste (e-waste) and the disposal of durable goods. These regulations directly affect their repair services and how they manage products at the end of their lifecycle, potentially increasing operational costs for disposal and recycling.

Compliance with recycling mandates and responsible waste disposal is no longer optional for retailers like Conn's. As of 2024, many states have implemented or are strengthening e-waste recycling laws, aiming to divert millions of tons of electronics from landfills annually.

For instance, states like California have advanced producer responsibility laws that can hold retailers accountable for the collection and recycling of certain electronics. Conn's must invest in infrastructure and partnerships to meet these evolving environmental standards, impacting their supply chain and customer service models.

The financial implications of non-compliance can be significant, ranging from hefty fines to reputational damage. In 2023, estimates suggested that global e-waste generation reached 62 million metric tons, a figure projected to grow, highlighting the scale of the challenge and the growing regulatory focus on this sector.

Government-mandated energy efficiency standards for home appliances and electronics, such as those set by the U.S. Department of Energy (DOE) under the Energy Policy and Conservation Act (EPCA), directly impact Conn's product offerings. These standards, periodically updated, dictate the minimum energy performance levels for products sold in the United States. For instance, the DOE's ENERGY STAR program, a voluntary labeling program, signifies products that meet specific energy efficiency criteria, with new requirements often introduced for categories like refrigerators and washing machines, influencing Conn's inventory selection for 2024 and beyond.

Conn's must ensure its inventory aligns with these evolving energy efficiency regulations to remain compliant and competitive. Failure to stock compliant products can lead to significant penalties and lost sales opportunities. Furthermore, these standards can sway consumer choices, as buyers increasingly consider long-term energy cost savings when purchasing appliances, making energy efficiency a key selling point for Conn's sales team.

Carbon Footprint and Logistics Emissions

Conn's, like many retailers, faces increasing scrutiny regarding its carbon footprint, particularly from logistics and transportation. Growing global concerns about climate change mean that consumers and regulators are paying closer attention to the environmental impact of supply chains. This directly affects how Conn's manages its delivery operations and inbound logistics.

The company is likely to encounter pressure to implement more sustainable practices, such as investing in fuel-efficient delivery vehicles or exploring alternative fuels. Optimizing delivery routes to minimize mileage and fuel consumption is also a key strategy. For instance, in 2023, the transportation sector accounted for approximately 28% of total U.S. greenhouse gas emissions, highlighting the significant role logistics plays in a company's overall environmental impact.

- Logistics Emissions Impact: Transportation and delivery are significant contributors to Conn's carbon footprint.

- Regulatory and Consumer Pressure: Expect increased demand for emission reductions from stakeholders.

- Operational Adjustments: Investing in greener fleets and route optimization are key strategies for Conn's.

- Cost Implications: Implementing these changes could lead to upfront investment costs, but potentially long-term savings through efficiency.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products is a significant environmental factor impacting Conn's. This trend offers a chance to differentiate and attract a growing market segment. For instance, in 2024, sales of sustainable home goods saw a notable uptick, with many consumers actively seeking out energy-efficient appliances and furniture made from recycled materials.

Conn's can leverage this by expanding its product catalog to include more environmentally responsible options. This strategic move not only addresses consumer preferences but also bolsters the company's brand image as a forward-thinking and socially conscious retailer. By 2025, it's projected that over 60% of consumers will prioritize sustainability when making purchasing decisions for major home items.

- Growing Market Share: The market for green consumer goods is expanding rapidly, presenting a significant opportunity for Conn's to capture new customers.

- Brand Enhancement: Offering eco-friendly choices can improve Conn's reputation and appeal to environmentally conscious demographics.

- Product Diversification: This demand necessitates a broader selection of sustainable appliances, furniture, and electronics.

- Regulatory Alignment: Proactive adoption of eco-friendly offerings can preemptively address potential future environmental regulations.

Conn's must navigate evolving consumer expectations and regulatory landscapes concerning environmental impact. This includes addressing the growing demand for sustainable products, with over 60% of consumers in 2023 indicating a willingness to pay more for such items.

The company also faces increasing pressure regarding e-waste and product disposal, with many states strengthening recycling laws as of 2024 to divert millions of tons of electronics from landfills.

Furthermore, government-mandated energy efficiency standards, such as those from the U.S. Department of Energy, directly influence Conn's product selection, with ENERGY STAR criteria continually updated for appliances and electronics.

Conn's carbon footprint, particularly from logistics, is also under scrutiny, driven by climate change concerns and the fact that transportation accounted for approximately 28% of total U.S. greenhouse gas emissions in 2023.

| Environmental Factor | 2023/2024 Data/Trend | Implication for Conn's |

|---|---|---|

| Consumer Demand for Sustainability | Over 60% of consumers willing to pay more for sustainable products (2023). | Opportunity to expand eco-friendly product lines and enhance brand image. |

| E-waste & Disposal Regulations | Strengthening state laws for e-waste recycling (as of 2024). | Requires investment in compliant disposal and recycling infrastructure. |

| Energy Efficiency Standards | Periodic updates to ENERGY STAR requirements by DOE. | Necessitates careful inventory management to ensure compliance and appeal to cost-conscious buyers. |

| Logistics & Carbon Footprint | Transportation sector ~28% of U.S. GHG emissions (2023). | Pressure to adopt fuel-efficient fleets and optimize delivery routes. |

PESTLE Analysis Data Sources

Our Conn's PESTLE Analysis is built upon a robust foundation of data sourced from reputable market research firms, government economic reports, and industry-specific publications. This ensures that each political, economic, social, technological, legal, and environmental insight is grounded in current and reliable information.