Conn's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conn's Bundle

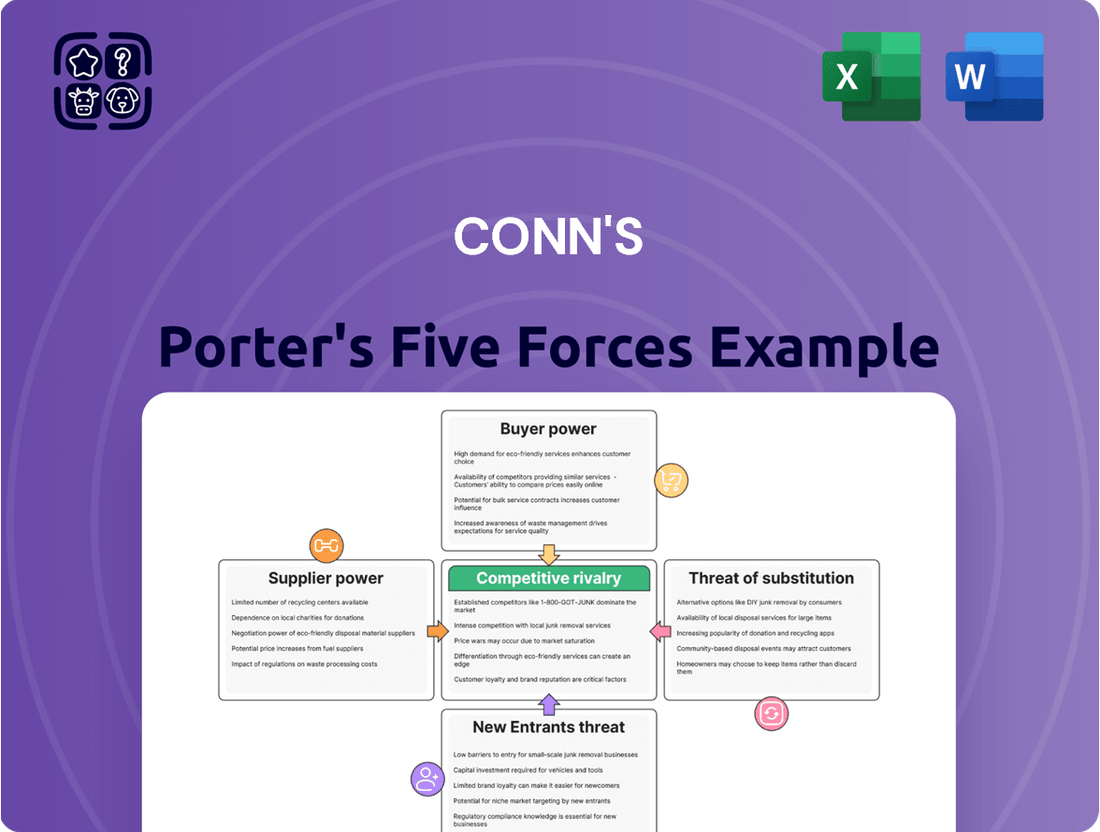

Conn's operates in a dynamic retail landscape shaped by powerful industry forces. Understanding the intensity of buyer power, the threat of new entrants, and the influence of suppliers is crucial for navigating this competitive arena. Analyzing the threat of substitute products and the intensity of rivalry among existing players provides a deeper look into Conn's's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Conn's’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly influences bargaining power. For Conn's, a limited number of key manufacturers for furniture, appliances, and electronics means these suppliers can dictate terms more effectively. For instance, if a major appliance brand like Samsung or LG, which are global leaders, were to face production constraints or decide to increase prices, Conn's would have fewer alternatives, potentially impacting its cost of goods sold.

Conn's faces potential leverage from its suppliers due to the costs and complexities involved in switching. These can include the effort required to renegotiate contracts, integrate new inventory management systems, or retrain staff on different product lines. For instance, if Conn's heavily relies on specific brands or proprietary technologies from a supplier, the transition to an alternative could disrupt operations and incur significant expenses.

High switching costs empower suppliers by making Conn's more dependent on their ongoing relationship. This dependence can translate into suppliers having greater influence over pricing, terms, and product availability. In 2024, the retail sector, including appliance and furniture sellers like Conn's, continued to navigate supply chain challenges, potentially exacerbating the impact of switching costs.

The uniqueness of products supplied significantly impacts supplier bargaining power for Conn's. When suppliers offer highly differentiated or proprietary items, essential for Conn's' product mix and customer attraction, they can command higher prices and more favorable terms. For instance, if a key electronics manufacturer provides exclusive models or advanced technology not easily replicated, Conn's has fewer alternatives, thus strengthening that supplier's position.

Conversely, if the products Conn's sources are largely commoditized, meaning they are standard items available from numerous vendors, supplier power is considerably weaker. In such cases, Conn's can more easily switch suppliers to secure better pricing or terms. For example, basic home furnishings or widely available appliances, if not branded uniquely, offer Conn's greater flexibility.

In 2024, Conn's continued to navigate a retail landscape where brand partnerships and exclusive product lines can be critical differentiators. While specific supplier product exclusivity data for Conn's isn't publicly detailed, the general trend in the appliance and electronics sector suggests that suppliers of innovative or exclusive models do hold leverage. This is especially true as consumer demand shifts towards smart home technology and energy-efficient appliances, where supplier innovation plays a key role in market appeal.

Threat of Forward Integration by Suppliers

Suppliers possess a significant bargaining chip if they can credibly threaten to integrate forward into the retail space, effectively becoming direct competitors to companies like Conn's. This means a manufacturer of appliances or electronics could decide to open its own stores or significantly ramp up its direct-to-consumer online sales. This capability allows them to capture more of the value chain and potentially bypass the retailer entirely.

For Conn's, this threat is particularly relevant in categories where supplier brands are strong and have the resources to establish their own retail presence. If a major appliance manufacturer, for example, were to open its own showrooms or enhance its e-commerce platform, it would directly compete with Conn's for customer dollars. This leverage means suppliers can demand better terms or face the prospect of losing Conn's as a customer to a potentially more favorable retailer, or even facing direct competition from that supplier.

- Forward integration by suppliers bypasses traditional retail channels.

- This capability strengthens supplier bargaining power by offering alternative sales routes.

- A strong supplier brand can leverage its name to enter the retail market directly.

- The threat is more pronounced in product categories with high supplier brand recognition.

Importance of Conn's to Suppliers

The significance of Conn's business volume to its suppliers is a key factor in determining supplier bargaining power. When Conn's constitutes a large percentage of a supplier's total revenue, that supplier is likely to be more accommodating. For instance, if a supplier's sales to Conn's represent over 15% of their business, they might be hesitant to push for unfavorable terms, as the potential loss of Conn's as a customer could be detrimental to their own financial health.

This dependency can significantly dampen a supplier's ability to dictate terms. Suppliers understand that aggressive pricing demands or unfavorable contract adjustments could lead Conn's to seek alternatives. In 2023, Conn's reported net sales of approximately $1.5 billion, indicating a substantial purchasing volume that would make many suppliers reluctant to jeopardize the relationship.

- Conn's Sales Contribution: Suppliers with a high percentage of their sales derived from Conn's have less leverage.

- Supplier Dependence: A significant portion of a supplier's revenue tied to Conn's reduces their willingness to exert strong bargaining power.

- Risk of Losing Business: Suppliers are mindful that aggressive tactics could cause Conn's to switch to competitors, impacting their own sales.

- Conn's Purchasing Power: The sheer scale of Conn's annual sales, in the billions, gives it considerable weight in negotiations with suppliers.

Conn's faces moderate supplier bargaining power, influenced by factors like supplier concentration, switching costs, and product differentiation. While some suppliers may hold leverage, Conn's substantial sales volume, exceeding $1.5 billion in 2023, helps mitigate excessive supplier demands.

| Factor | Impact on Conn's | 2024 Context |

| Supplier Concentration | Higher power for limited suppliers | Continued supply chain scrutiny |

| Switching Costs | Increased supplier leverage | Operational disruptions add to costs |

| Product Uniqueness | Stronger supplier position for differentiated products | Innovation in smart tech favors suppliers |

| Forward Integration Threat | Suppliers can bypass retailers | Direct-to-consumer models are growing |

| Conn's Sales Volume | Weakens supplier power | $1.5B+ annual sales provide negotiation weight |

What is included in the product

Analyzes the five competitive forces—threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and industry rivalry—to understand Conn's competitive intensity and profitability.

Gain immediate clarity on competitive pressures with a visually intuitive spider chart, highlighting key areas for strategic focus.

Customers Bargaining Power

The sheer number of places consumers can buy durable goods, from massive superstores to niche online shops, gives them considerable sway. In 2024, with inflation concerns lingering, consumers actively sought the best deals, making price comparison a primary driver in purchasing decisions. This abundance of choice means retailers must work harder to retain customers.

Conn's customers, particularly those buying durable goods like appliances and furniture, tend to be quite price-sensitive. This means that the cost of a product heavily influences their purchasing decisions, especially for significant expenditures. For instance, during the holiday season of 2023, many retailers observed increased consumer focus on discounts and promotional offers for home goods.

The ease with which consumers can now compare prices online and across different physical stores puts significant pressure on retailers like Conn's. If Conn's prices are not perceived as competitive, customers have readily available alternatives, directly impacting sales volume. In 2024, reports indicated that consumers were actively using price comparison tools before making purchases in the home furnishing sector.

Conn's in-house financing plays a crucial role in mitigating customer bargaining power. By offering financing to a segment of customers who might not qualify for traditional credit, Conn's essentially reduces their reliance on external financing options. This allows Conn's to differentiate itself beyond just product price, as the financing itself becomes a significant part of the value proposition for these customers.

For customers needing credit, Conn's financing can make them less sensitive to minor price differences, as securing the purchase is paramount. This unique selling proposition can lead to a more loyal customer base for those who value the accessibility of credit. In 2023, Conn's reported that approximately 70% of its sales were financed through its own program, highlighting the significant impact of this offering on customer purchasing decisions and reducing their immediate power to negotiate on price alone.

Customer Information and Transparency

Customers wield significant power, largely due to the internet and review platforms. This accessibility to product specifics, quality assessments, and competitor pricing empowers them to make smarter buying choices and push for superior value. For instance, in 2024, online review sites like Consumer Reports and Yelp continue to be critical resources, with a significant portion of consumers, often upwards of 80%, consulting reviews before making a purchase. This readily available information directly impacts Conn's ability to command premium pricing and reduces switching costs for consumers.

- Information Accessibility: The internet provides unparalleled access to product details and pricing.

- Informed Decisions: Customers leverage this data to compare options and negotiate effectively.

- Impact on Pricing: Increased transparency often leads to price sensitivity and pressure on margins.

- Brand Loyalty: While information empowers, it can also shift loyalty towards brands offering better perceived value.

Low Switching Costs for Customers

For most consumers purchasing durable goods, the effort and expense involved in switching from one retailer to another are minimal. This low barrier to entry means customers can easily explore different options and select the most appealing deal without facing significant penalties. For instance, in the competitive consumer electronics market, a customer can readily compare prices and promotions across multiple online and brick-and-mortar stores. In 2024, the widespread availability of price comparison websites and readily accessible online reviews further reduces the friction associated with switching, directly amplifying customer bargaining power.

This ease of switching directly translates into increased leverage for customers. They are not locked into any particular retailer, allowing them to demand better prices or terms. If Conn's, for example, does not offer competitive pricing or a satisfactory customer experience, a customer can simply shift their business to a rival without incurring substantial costs. This dynamic forces retailers to remain competitive on price, service, and product selection to retain their customer base.

- Minimal Switching Costs: Customers face virtually no financial or logistical hurdles when moving between retailers for durable goods.

- Enhanced Bargaining Power: This ease of switching empowers customers to seek out and secure the best available offers.

- Competitive Pressure: Retailers like Conn's must continuously offer compelling value propositions to prevent customer attrition.

- Market Dynamics: In 2024, digital platforms continue to facilitate effortless customer comparisons, intensifying this effect.

Conn's customers have significant bargaining power, amplified by the widespread availability of information and the ease of switching between retailers. In 2024, consumers actively leverage online comparison tools and review sites, often consulting multiple sources before making purchases, with a substantial majority (over 80% in some sectors) relying on reviews. This transparency forces retailers like Conn's to focus on competitive pricing and value propositions to retain market share.

| Factor | Impact on Conn's Customer Bargaining Power | 2024 Context/Data |

|---|---|---|

| Information Accessibility | High | Consumers readily access competitor pricing and product reviews online, increasing price sensitivity. |

| Switching Costs | Low | Minimal effort or cost for customers to move between retailers, empowering them to seek better deals. |

| Conn's Financing | Mitigates Power | Approximately 70% of Conn's sales in 2023 were internally financed, reducing customer reliance on external credit and price comparisons for that segment. |

| Price Sensitivity | High | Customers, especially for durable goods, prioritize value and discounts, as evidenced by increased focus on promotions during holiday seasons in 2023. |

Preview Before You Purchase

Conn's Porter's Five Forces Analysis

This preview showcases the complete Conn's Porter's Five Forces analysis, detailing the competitive landscape within its industry. You're examining the actual, fully formatted document that will be delivered to you instantly upon purchase, providing actionable insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. No mockups or samples are used; what you see is precisely the professional analysis you'll receive. This ensures you get immediate access to the same comprehensive report ready for immediate application in your strategic planning.

Rivalry Among Competitors

Conn's operates in a highly fragmented durable consumer goods market. This fragmentation means they face a wide array of competitors, including national powerhouses like Best Buy and Lowe's, along with numerous regional furniture stores. The rise of discount retailers and e-commerce behemoths such as Amazon further intensifies this rivalry, making it a constant battle for market share and customer loyalty.

The industry growth rate for durable consumer goods, including appliances and furniture which Conn's heavily relies on, significantly impacts competitive rivalry. In 2024, the U.S. market for major appliances saw modest growth, with some categories experiencing slight declines due to economic headwinds and changing consumer spending patterns. This slower growth environment intensifies competition as companies like Conn's, alongside larger retailers and direct-to-consumer brands, vie for market share. When the overall pie isn't expanding rapidly, companies often resort to more aggressive pricing and promotional strategies to attract and retain customers, leading to increased pressure on profit margins.

The durable goods retail sector, including companies like Conn's, is characterized by substantial fixed costs. These costs stem from maintaining physical store locations, managing large inventories, and operating complex supply chains. For instance, in 2023, major appliance and electronics retailers often carried millions in inventory, with associated costs for warehousing and transport.

This high fixed-cost structure creates intense pressure to achieve and maintain high sales volumes. Companies must continuously operate at or near capacity to spread these fixed expenses over a larger revenue base. This necessity fuels aggressive pricing strategies and promotional activities as businesses vie to attract customers and move their stock.

The need to manage inventory effectively is paramount. Holding too much inventory ties up capital and incurs storage costs, while insufficient inventory can lead to lost sales opportunities. This delicate balancing act intensifies rivalry, as companies seek to optimize stock levels while simultaneously driving demand through competitive offers.

Conn's, for example, has historically managed significant inventory levels to offer a wide selection of furniture, mattresses, appliances, and electronics. In their fiscal year ending January 31, 2024, Conn's reported total inventory of approximately $607 million. This substantial investment highlights the financial commitment required to compete in this space.

Product Differentiation and Service Offerings

Competitive rivalry within the home goods and electronics retail sector is intense, with companies striving to stand out. While many products are similar, retailers differentiate through unique product selections, superior customer service, and added benefits like delivery, installation, and flexible financing options. Conn's notably leverages its in-house financing as a key differentiator, making it easier for customers to purchase big-ticket items.

In 2024, Conn's reported that its credit segment, which includes its proprietary financing, remained a significant component of its business. For the fiscal year ending January 31, 2024, Conn's reported net sales of $1.15 billion. The company's ability to offer credit directly to customers, particularly those with less-than-perfect credit, sets it apart from competitors who rely solely on third-party financing. This strategy directly addresses a segment of the market that values accessibility and convenience in payment options.

- Conn's In-House Financing: A cornerstone of their competitive strategy, offering accessible credit solutions.

- Product Assortment: While many products are commoditized, Conn's curates specific brands and models.

- Customer Service Focus: Emphasis on delivery, installation, and post-sale support to enhance the customer experience.

- Target Market Appeal: The financing option particularly attracts customers seeking flexible payment plans for larger purchases.

Exit Barriers for Competitors

Conn's faces intense competitive rivalry, partly due to high exit barriers that can trap struggling companies. For instance, specialized assets like large, dedicated retail footprints and long-term lease agreements represent significant sunk costs. These factors make it economically difficult for competitors to simply shut down operations, even when unprofitable.

This inability to exit easily means that even companies with declining market share or profitability may continue to operate, contributing to market overcapacity. For example, in the home appliance and electronics retail sector, the capital tied up in physical stores and inventory means that a competitor might continue to operate at a loss rather than incur further exit costs. This sustained presence of less efficient players can intensify price competition across the industry.

The consequence of these high exit barriers is often prolonged price wars and a general dampening of profitability for all participants, including Conn's. When competitors are unable to leave the market, they may resort to aggressive pricing strategies to maintain sales volume, further pressuring margins for everyone involved. This dynamic is a crucial element in understanding the competitive landscape for retailers like Conn's.

- High Exit Barriers: Specialized retail assets and long-term leases create substantial costs for competitors looking to leave the market.

- Market Overcapacity: Inability to exit easily results in more companies staying operational than market demand warrants.

- Sustained Price Competition: Overcapacity fuels aggressive pricing as struggling firms try to stay afloat, impacting all players' profitability.

- Impact on Conn's: These industry dynamics directly affect Conn's pricing strategies and overall financial performance.

Competitive rivalry is fierce in the durable consumer goods sector due to market fragmentation and slow growth. Conn's faces competition from national retailers like Best Buy, home improvement giants like Lowe's, and e-commerce players like Amazon. The U.S. major appliance market saw only modest growth in 2024, intensifying the battle for customers.

High fixed costs associated with inventory and physical stores, as seen with Conn's $607 million inventory in fiscal year 2024, push companies towards aggressive pricing. This is exacerbated by high exit barriers, such as specialized retail assets, which keep even underperforming competitors in the market, leading to prolonged price competition and impacting overall industry profitability.

Conn's differentiates itself through its in-house financing, a significant draw for customers, and a curated product assortment. This strategy, highlighted by its $1.15 billion in net sales for the fiscal year ending January 31, 2024, helps it compete against rivals who may not offer similar credit options.

| Competitor Type | Conn's Competitive Advantage | 2024 Market Factor |

|---|---|---|

| National Retailers (e.g., Best Buy) | In-house financing, curated product selection | Modest industry growth |

| Home Improvement Stores (e.g., Lowe's) | Targeted credit access for specific demographics | Intensified price competition |

| E-commerce Giants (e.g., Amazon) | Customer service focus (delivery, installation) | High fixed costs pressure sales volume |

SSubstitutes Threaten

Consumers increasingly choose to rent or lease items like furniture, appliances, and electronics, especially for temporary needs or to manage budgets. This option offers the use of a product without the commitment of ownership, directly competing with outright purchases. For instance, the rental furniture market is projected to grow, with some reports indicating a significant increase in adoption rates among younger demographics seeking flexibility. This trend diverts potential sales from outright ownership, representing a substantial substitute threat.

The growing second-hand and refurbished goods market presents a significant threat of substitution for companies like Conn's. Consumers increasingly turn to online marketplaces, consignment shops, and specialized used retailers for durable goods, finding cost-effective alternatives to buying new. This trend is particularly pronounced among budget-conscious shoppers.

For instance, the global used car market alone is projected to reach $1.5 trillion by 2024, illustrating the scale of consumer acceptance for pre-owned items. Similarly, the refurbished electronics market is also experiencing robust growth. This accessibility to more affordable, pre-owned options directly competes with the demand for new appliances and electronics that Conn's offers, potentially impacting sales volume and pricing power.

The threat of consumers opting to repair existing products instead of buying new ones is a significant factor for retailers like Conn's. If the cost of repairing an older appliance or piece of furniture is substantially less than purchasing a brand-new item, consumers are likely to choose the repair option. This behavior directly impacts sales volume for new products.

While Conn's does offer repair services, which helps retain its own customer base and potentially mitigates this threat for its clientele, the broader market trend remains. For instance, in 2024, the average cost of appliance repair can range from $100 to $300, depending on the issue, while a new mid-range refrigerator might cost upwards of $1,000. This price differential encourages repair.

This dynamic means that Conn's must not only compete on product price and quality but also on the value proposition of its new offerings compared to the longevity and cost-effectiveness of repairs. The availability of affordable third-party repair services further intensifies this competitive pressure.

Delaying or Downgrading Purchases

During economic headwinds, consumers often postpone buying big-ticket items like furniture or electronics, or they might select less expensive alternatives. This behavior acts as a substitute for purchasing premium or brand-new goods, directly impacting sales of higher-priced durable goods.

For instance, in the latter half of 2023, discretionary spending on durable goods saw noticeable moderation. Data from the U.S. Bureau of Economic Analysis indicated a slowdown in personal consumption expenditures on goods, particularly those considered non-essential, as inflation persisted and interest rates remained elevated.

- Consumer behavior shifts Consumers may delay purchases of durable goods like appliances and furniture when economic uncertainty looms.

- Downgrading options A significant number of consumers opt for less expensive, lower-feature versions of products rather than premium models.

- Impact on sales This substitution effect directly reduces demand for higher-priced items, forcing companies to reconsider pricing and product offerings.

- Economic indicators In 2023, retail sales data for durable goods reflected this trend, with some sectors experiencing contractions or slower growth compared to previous periods.

Do-It-Yourself (DIY) Solutions

The threat of do-it-yourself (DIY) solutions presents a notable challenge for Conn's, particularly within its furniture segment. Consumers seeking to furnish their homes may increasingly turn to assembly-required furniture or even custom-built options as alternatives to purchasing pre-assembled items from retailers like Conn's. This trend taps into a desire for cost savings and personalization.

While not a perfect substitute for every product Conn's offers, DIY solutions can satisfy core consumer needs for functional and aesthetically pleasing home furnishings. For example, the growing availability of flat-pack furniture, which requires customer assembly, directly competes with Conn's ready-to-use offerings. This can impact sales volume for certain product categories.

The rise of online platforms and readily available tutorials further lowers the barrier to entry for DIY projects. Consumers can access extensive guides and purchase materials for custom furniture or assembly kits, bypassing traditional retail channels. This accessibility makes DIY a more viable and attractive option for a broader consumer base.

Consider the furniture market: According to 2024 industry reports, the global furniture market, which includes both assembled and flat-pack options, is projected to reach over $700 billion. Within this, the flat-pack furniture segment continues to grow, indicating a strong consumer preference for self-assembly solutions, which directly challenges retailers like Conn's that primarily offer assembled goods.

- DIY furniture assembly kits offer a lower price point compared to pre-assembled units.

- Custom-built furniture allows for greater personalization, a feature often not available in mass-market retail.

- Online tutorials and readily available materials empower consumers to undertake furniture projects themselves.

- The flat-pack furniture segment's growth signifies a consumer willingness to engage in DIY assembly.

The threat of substitutes for Conn's offerings is multifaceted, encompassing rental services, the used goods market, product repair, economic downgrading, and DIY solutions.

Rental and used markets provide lower-cost alternatives to new purchases, while repair services extend product lifespans, directly impacting new sales volume. Economic pressures also drive consumers toward less expensive options or delayed purchases.

DIY furniture also presents a substitute by offering personalization and cost savings, challenging traditional retail models.

| Substitute Category | Example | Impact on Conn's | 2024 Relevance/Data |

|---|---|---|---|

| Rental Services | Furniture rental for temporary needs | Reduces demand for outright purchases | Projected growth in rental market adoption, especially by younger demographics. |

| Used Goods Market | Online marketplaces, consignment shops | Offers cost-effective alternatives to new items | Global used car market projected to reach $1.5 trillion by 2024; refurbished electronics market also growing. |

| Product Repair | Repairing existing appliances/furniture | Extends product life, delaying new purchases | Appliance repair costs ($100-$300) significantly lower than new appliance prices (e.g., $1,000+ for a refrigerator). |

| Economic Downgrading | Choosing lower-feature or less expensive alternatives | Decreases demand for premium or higher-priced goods | In late 2023, discretionary spending on durable goods moderated due to inflation and interest rates. |

| DIY Solutions | Flat-pack furniture, custom builds | Provides cost savings and personalization | Global furniture market over $700 billion in 2024, with a growing flat-pack segment. |

Entrants Threaten

Establishing a retail chain for durable goods, like those sold by Conn's, demands significant upfront capital. Think about the costs involved in securing prime retail locations, stocking a diverse inventory of appliances and electronics, building out warehousing facilities, and setting up efficient logistics and delivery networks. These substantial financial outlays create a formidable barrier, effectively deterring many aspiring competitors from entering the market and directly challenging established players.

Existing retailers like Conn's have cultivated strong brand recognition and deep customer loyalty over decades. This established trust makes it challenging for new entrants to attract customers who are already satisfied with familiar brands and service. For instance, Conn's has consistently invested in its brand, which is a significant barrier to entry for newcomers seeking to capture market share.

Newcomers face the daunting task of building credibility and overcoming ingrained customer preferences. Significant marketing expenditure is required to even begin to rival the brand equity Conn's and its competitors possess. This investment in customer acquisition and retention is a substantial hurdle, as evidenced by the high customer lifetime value typically associated with established retail relationships.

Conn's, like many retailers, faces significant hurdles for new entrants when it comes to accessing established distribution channels and supply chains. Building efficient logistics, securing reliable suppliers, and creating a robust distribution network requires substantial investment and time, often years of development.

Newcomers often find it difficult to replicate the economies of scale and operational efficiencies that Conn's has achieved through its long-standing presence. For instance, by the end of fiscal year 2024, Conn's had a vast network of stores and a mature e-commerce platform, giving it a distinct advantage in reaching customers across diverse markets.

The capital expenditure and expertise needed to establish comparable logistical infrastructure and supplier relationships present a formidable barrier. This includes investments in warehousing, transportation fleets, and sophisticated inventory management systems, all of which are critical for competitive delivery and product availability.

Regulatory Hurdles and Licensing

The threat of new entrants for Conn's is significantly shaped by regulatory hurdles and licensing requirements. Depending on the specific financial products and services Conn's offers, newcomers must contend with a complex web of regulations, licenses, and compliance standards. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending practices, requiring extensive documentation and adherence to rules that can be costly and time-consuming for new players to implement. Navigating these complexities, particularly for specialized financing operations like those Conn's engages in, presents a substantial barrier to entry.

These regulatory challenges can deter potential competitors by increasing upfront investment and operational complexity. For a new company to enter the market, it would need to secure various state and federal licenses related to consumer credit, potentially including those for installment sales and financing. This process often involves rigorous background checks, capital reserve requirements, and ongoing audits. In 2023, several fintech companies faced scrutiny and delays in obtaining necessary licenses to operate nationwide, highlighting the persistent difficulties in this area. For example, the average time to obtain a lending license in multiple states can extend over a year and incur significant legal and compliance fees, estimated to be tens of thousands of dollars.

- Regulatory Compliance Costs: New entrants must invest heavily in legal counsel and compliance personnel to understand and adhere to varying state and federal regulations governing consumer credit and financing.

- Licensing Procedures: Obtaining the necessary licenses to operate in different jurisdictions is a lengthy and often expensive process, requiring detailed applications and proof of financial stability.

- Capital Requirements: Many regulatory frameworks mandate minimum capital reserves for financial service providers, which can be a significant barrier for smaller or less-funded new entrants.

- Evolving Regulatory Landscape: Changes in consumer protection laws and financial regulations, as seen with ongoing discussions around data privacy and predatory lending in 2024, require continuous adaptation and investment from all market participants.

Proprietary In-House Financing Capabilities

Conn's proprietary in-house financing capabilities act as a significant barrier to new entrants. This model allows Conn's to offer credit directly to customers, a crucial factor in its retail strategy, especially for big-ticket items. Developing comparable credit assessment tools and managing the inherent financial risks requires substantial capital and expertise, making it difficult for newcomers to replicate.

For instance, in fiscal year 2024, Conn's reported that its credit segment generated approximately 58% of its total revenue, highlighting the integral role of its financing operations. New competitors would not only need to establish a retail presence but also build a robust credit infrastructure from scratch, a considerable and costly endeavor.

- Barrier to Entry: Conn's in-house financing creates a high barrier due to the complexity and capital required to build similar credit assessment and risk management systems.

- Customer Access: This capability directly enables Conn's to serve a broader customer base, including those with less-than-perfect credit, a segment that new entrants might struggle to attract initially.

- Financial Risk Management: New entrants would need to develop sophisticated underwriting processes and manage potential loan defaults, a challenging and resource-intensive task.

- Competitive Advantage: The established financing platform provides Conn's with a distinct competitive edge that is difficult and expensive for potential new entrants to overcome.

The threat of new entrants for Conn's is relatively low due to substantial capital requirements for establishing a retail presence and inventory, alongside the significant investment needed for marketing and brand building. For example, establishing a new retail chain in 2024 would necessitate millions in upfront costs for real estate, inventory, and logistics, a considerable hurdle for most new businesses.

Conn's established brand reputation and customer loyalty, cultivated over years of operation, further deter new competitors. Acquiring customers and building trust in a market where brand recognition is key requires extensive resources, making it difficult for newcomers to gain traction against established players like Conn's.

Furthermore, Conn's proprietary in-house financing operations present a significant barrier. Developing comparable credit assessment tools, managing financial risks, and complying with lending regulations, as highlighted by the CFPB's focus in 2024, demand substantial capital and specialized expertise that new entrants often lack.

The complexity of regulatory compliance and licensing for financial services, a critical aspect for Conn's operations, also acts as a strong deterrent. Obtaining necessary licenses and adhering to consumer protection laws can be a lengthy and costly process, as evidenced by fintech companies' struggles in 2023, often requiring tens of thousands of dollars in legal and compliance fees.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Conn's leverages data from Conn's annual reports, SEC filings, and investor presentations to understand internal operations and strategic positioning. We also incorporate industry-specific market research reports and competitor financial data to gauge industry rivalry and buyer power.