Conn's Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conn's Bundle

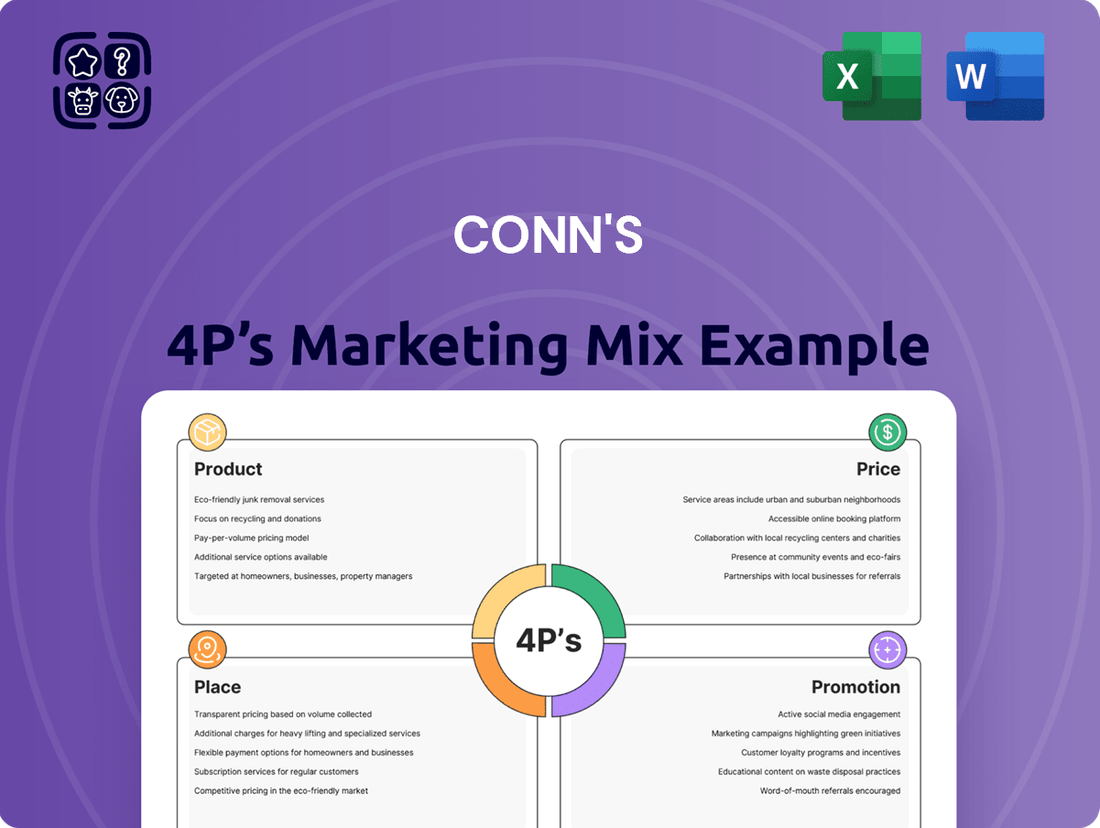

Conn's 4Ps Marketing Mix Analysis dives deep into how their product offerings, pricing strategies, distribution channels, and promotional activities create a cohesive market presence. Understanding these elements is crucial for anyone looking to grasp their competitive edge.

Explore the intricacies of Conn's product portfolio and how it's tailored to their target demographic. See how their pricing models, often featuring flexible financing, attract and retain customers.

Discover Conn's strategic approach to 'Place,' examining their retail footprint and online presence. Uncover the promotional tactics they employ to build brand awareness and drive sales.

Ready to gain a comprehensive understanding of Conn's marketing engine? Access the full, in-depth 4Ps analysis, complete with actionable insights and ready-to-use formatting.

Save valuable time on market research. Our pre-written Conn's 4Ps Marketing Mix report offers structured thinking and real-world examples, perfect for strategic planning or academic benchmarking.

Unlock the secrets behind Conn's marketing success. The complete report provides a detailed breakdown of each 'P,' offering a powerful tool for learning and application.

Product

Conn's features a broad assortment of durable consumer goods, encompassing furniture, mattresses, home appliances, and electronics. This extensive selection is designed to meet a wide array of household needs and tastes, establishing Conn's as a go-to destination for home furnishings. For the fiscal year ending January 31, 2024, Conn's reported net sales of approximately $1.07 billion, reflecting the demand for these product categories.

The company's product strategy focuses on offering both essential items for everyday living and aspirational products that enhance home comfort and style. This approach caters to the diverse financial and lifestyle needs of their target customer base, aiming to be a one-stop shop for home outfitting. Conn's aims to provide value across its entire product range, from major appliances to entertainment systems.

Conn's in-house financing is more than just a service; it's a vital component of their product strategy, making big-ticket items like furniture and appliances attainable for a wider customer base. This unique offering directly addresses a key barrier to purchase for many consumers. It’s a powerful differentiator that sets Conn's apart from competitors who rely solely on third-party financing.

This integrated financing solution is central to Conn's value proposition, directly enabling purchases that might otherwise be out of reach. For example, as of early 2024, Conn's reported that a significant portion of their sales are facilitated through their own financing programs, highlighting its importance to their business model. This accessibility broadens their market reach considerably.

By offering in-house financing, Conn's effectively transforms high-cost goods into manageable purchases, tapping into a demographic often underserved by traditional lenders. This strategy is particularly impactful in the current economic climate, where access to credit can be a deciding factor for consumers. Their commitment to this feature underscores its strategic importance in driving sales and customer loyalty.

Conn's enhances its product offering with repair and service agreements, extending the value beyond the initial purchase. These agreements, alongside credit insurance, aim to bolster the post-purchase customer experience. For instance, Conn's reported that its Protection Agreement segment contributed $309.3 million in revenue during the fiscal year ending January 31, 2024, demonstrating their significance. This focus on service builds customer loyalty by assuring them of ongoing support and commitment to product longevity.

Brand and Private Label Offerings

Conn's merchandising strategy is a dual-pronged approach, featuring both globally recognized brands and its own private label offerings. This allows them to cater to a broad spectrum of consumer needs and preferences across different price tiers, ensuring a comprehensive product selection for their core customer base.

The company stocks prominent brands like Samsung, LG, and General Electric for appliances, alongside tech giants such as HP, Apple, and Microsoft for home office products. This curated mix of established names provides consumers with trusted, high-quality options.

Complementing these major brands, Conn's private label products offer value-driven alternatives, enhancing the overall assortment and providing competitive price points. For example, during the 2024 fiscal year, Conn's reported that private label products contributed significantly to their overall sales mix, particularly in the appliance category.

- Brand Portfolio: Features leading global brands across major product categories like appliances and home office electronics.

- Private Label Strategy: Offers proprietary brands to provide value and competitive pricing, broadening appeal.

- Consumer Appeal: The combined strategy ensures a wide selection that resonates with the majority of Conn's core consumers.

- Market Presence: By offering both, Conn's aims to capture a larger market share and meet diverse consumer demands effectively.

E-commerce Capabilities and Accessibility

Conn's significantly enhances product accessibility by complementing its physical showrooms with strong e-commerce platforms, conns.com and badcock.com. This digital strategy ensures customers can explore and buy products from anywhere, anytime, broadening their reach beyond geographical limitations.

The company prioritizes a unified customer journey, aiming for a seamless experience whether shopping online or in-store. This omni-channel approach is crucial for meeting diverse customer preferences in the evolving retail landscape. For instance, Conn's reported that its e-commerce segment continued to grow, contributing to overall revenue streams, reflecting the increasing importance of digital channels for furniture and appliance retailers.

Conn's e-commerce capabilities are designed for ease of use, allowing for convenient browsing, detailed product information, and secure transactions. This focus on user experience is vital for converting online interest into sales. Data from 2024 suggests a continued upward trend in online furniture and appliance sales, underscoring the strategic importance of Conn's investment in its digital storefronts.

- Expanded Reach: Websites like conns.com and badcock.com make products available to a wider customer base.

- Convenience: Customers can shop 24/7, fitting purchases into their schedules.

- Omni-Channel Integration: Efforts are made to ensure a consistent and positive experience across online and offline channels.

- Digital Growth: E-commerce performance is a key driver for Conn's overall sales strategy, aligning with market trends showing increased online purchasing behavior.

Conn's product assortment is comprehensive, covering furniture, mattresses, home appliances, and electronics, aiming to be a one-stop shop for home outfitting. This wide range caters to diverse household needs and preferences, supported by net sales of approximately $1.07 billion for the fiscal year ending January 31, 2024. The company strategically balances essential items with aspirational products to appeal to a broad customer base, enhancing home comfort and style.

A key product strategy element is Conn's in-house financing, which makes higher-priced items accessible to a larger market, particularly those underserved by traditional lenders. This financial offering is a significant differentiator, directly enabling purchases that might otherwise be impossible. As of early 2024, a substantial portion of Conn's sales were attributed to these proprietary financing programs, underscoring their critical role in driving business.

Conn's also bolsters its product value through service and repair agreements, aiming to improve the post-purchase experience and build loyalty. The Protection Agreement segment alone generated $309.3 million in revenue during fiscal year 2024, highlighting the importance of these offerings. This commitment to ongoing support reinforces the longevity and value of their products.

The company employs a dual merchandising strategy, featuring both globally recognized brands and its own private label products. This approach allows Conn's to meet a wide spectrum of consumer needs and price points, from trusted names like Samsung and LG to value-oriented private label options. For instance, private label products played a notable role in their sales mix during fiscal year 2024, especially within the appliance category.

What is included in the product

This analysis offers a comprehensive breakdown of Conn's 4Ps marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities. It's designed for professionals seeking a data-driven understanding of Conn's market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic paralysis.

Streamlines understanding of Conn's marketing approach, reducing the burden of deciphering intricate details.

Place

Conn's boasts an extensive retail store network, a cornerstone of its marketing strategy. As of July 2024, the company operates over 550 locations, a figure significantly bolstered by the December 2023 acquisition of Badcock Home Furniture & More. This strategic move expanded Conn's presence into 15 new states, predominantly in the southern and southeastern United States, enhancing its market reach and customer accessibility. This widespread physical footprint is crucial for engaging its target demographic directly.

Conn's boasts a significant multi-state geographic footprint, operating stores across 15 states, including Alabama, Arizona, Colorado, Florida, Georgia, Louisiana, Mississippi, Nevada, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, and Virginia. This wide reach enables the company to tap into varied consumer bases and regional economic conditions. As of February 2024, Texas stood out as the state with the highest concentration of Conn's locations, indicating a strategic focus on this key market.

Conn's typically outfits its retail spaces in the 25,000 to 50,000 square foot range, a size designed to showcase a broad selection of home appliances and electronics. These stores are strategically placed in densely populated regions, specifically targeting areas with a high concentration of their core customer demographic. This approach in 2024 and 2025 continues to focus on accessibility for urban and suburban shoppers.

In contrast, Badcock Home Furnishings, acquired by Conn's, operates with a different store footprint, generally smaller and more prevalent in rural communities. This strategic divergence in store sizing and location allows Conn's to effectively serve a wider spectrum of customers, from those in bustling metropolitan areas to residents in more spread-out locales. The company also maintains a network of distribution and service centers, ensuring efficient delivery and support for its product offerings across its operating regions.

Integrated Online and In-Store Channels

Conn's has embraced an integrated online and in-store approach, often called an omnichannel strategy. This means customers can shop for furniture, mattresses, electronics, and appliances either by visiting a physical Conn's or Badcock store or by browsing and buying online through conns.com and badcock.com. This dual presence caters to a wide range of customer preferences, offering flexibility in how they discover and purchase products.

This integrated channel strategy is proving effective for Conn's. In fiscal year 2024, the company reported significant momentum in its digital sales. Specifically, Conn's achieved record annual e-commerce sales, reaching an impressive $109.3 million. This highlights the growing importance of their online platforms in driving overall revenue and customer engagement.

- Omnichannel Strategy: Conn's operates both physical stores and robust e-commerce platforms (conns.com, badcock.com).

- Customer Convenience: The integrated approach allows shoppers to choose their preferred method of interaction and purchase.

- E-commerce Growth: Fiscal year 2024 saw record annual e-commerce sales for Conn's, totaling $109.3 million.

Last-Mile Delivery and Logistics

Conn's prioritizes rapid last-mile delivery and installation, aiming to reach over 92% of the population in its operating states. This focus on swift and convenient delivery is a cornerstone of its service offering, particularly for bulky durable goods where the customer experience hinges on timely fulfillment. By investing in efficient logistics, Conn's directly addresses the convenience factor of the 'Place' in its marketing mix.

The company's commitment to last-mile efficiency is evident in its operational strategies, which are designed to minimize delivery times and ensure product availability. For instance, in the first quarter of fiscal year 2025, Conn's reported a 6.5% increase in same-store sales, partly attributed to its improved supply chain and delivery capabilities. This operational strength translates into enhanced customer satisfaction, a critical differentiator in the competitive home goods market.

- Coverage: Targets last-mile delivery to over 92% of the population in its key states.

- Speed: Emphasizes fast delivery and installation services to enhance customer convenience.

- Impact: Efficient logistics are crucial for customer satisfaction in the durable goods sector.

- Recent Performance: Q1 FY2025 saw a 6.5% rise in same-store sales, supported by supply chain improvements.

Conn's retail strategy centers on a vast network of physical stores, significantly expanded by the December 2023 acquisition of Badcock Home Furniture & More, which added locations in 15 new states. This diverse footprint, spanning over 550 locations by July 2024, allows Conn's to directly engage with its target demographic across various regions, from urban centers to more rural communities.

The company strategically sizes its stores, typically between 25,000 and 50,000 square feet, to effectively display a wide array of home furnishings and electronics. These locations are situated in populated areas, ensuring accessibility for their core customer base. Conn's commitment to an omnichannel approach, integrating online sales with its physical presence, is further evidenced by record e-commerce sales of $109.3 million in fiscal year 2024, demonstrating a strong customer preference for flexible shopping options.

Conn's excels in its "Place" strategy through efficient last-mile delivery and installation, aiming to serve over 92% of the population in its operating states. This focus on rapid fulfillment, which contributed to a 6.5% increase in same-store sales in Q1 FY2025, is vital for customer satisfaction in the durable goods market. The company's integrated distribution and service centers further support this commitment to convenient and timely product delivery across its expanding geographic reach.

| Metric | Value | As Of | Significance |

|---|---|---|---|

| Total Store Locations | Over 550 | July 2024 | Broad market reach and accessibility |

| New States Added (Badcock Acquisition) | 15 | December 2023 | Expanded geographic footprint |

| Average Store Size | 25,000 - 50,000 sq ft | Ongoing | Showcasing diverse product selection |

| E-commerce Sales | $109.3 million | Fiscal Year 2024 | Record growth in digital channels |

| Last-Mile Delivery Coverage | Over 92% of population | Ongoing | Enhancing customer convenience |

| Same-Store Sales Growth | 6.5% | Q1 FY2025 | Impact of improved logistics and supply chain |

What You See Is What You Get

Conn's 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive Conn's 4P's Marketing Mix Analysis document is meticulously crafted to provide actionable insights into their strategy. You'll gain a clear understanding of their Product, Price, Place, and Promotion tactics. This is the exact same ready-made analysis you'll download immediately after checkout, ensuring no surprises and full value for your investment.

Promotion

Conn's heavily promotes its flexible payment options, especially its own credit programs, as a major selling point. This strategy directly targets consumers facing credit challenges, making financing more accessible and encouraging purchases. In Q1 2024, Conn's reported that approximately 70% of its sales were financed through its credit offerings, highlighting the critical role of this promotion.

Conn's effectively uses a multi-channel strategy to connect with customers. This includes traditional methods like press releases for company updates, alongside a robust digital presence. For instance, in their fiscal year 2024, Conn's continued to leverage digital platforms for customer engagement and sales, reflecting a broader industry trend where online channels are crucial for reaching a wide audience.

The company's digital footprint is extensive, with active profiles across major social media networks such as Twitter, Instagram, Facebook, Pinterest, YouTube, and LinkedIn. This broad social media engagement allows Conn's to disseminate brand messaging consistently and interact directly with its target demographic, fostering brand loyalty and driving traffic to their platforms.

Conn's actively utilizes sales and discounts as a key element of its marketing strategy, particularly during significant events such as store closing sales. These promotions are designed to stimulate immediate customer purchases and efficiently manage inventory. For instance, observed initial discounts during these periods have ranged from 30-50%, demonstrating a strong incentive for buyers.

By offering competitive pricing through these sales, Conn's aims to attract a broad customer base and drive traffic, both online and in-store. This tactic is crucial for clearing out excess stock and generating revenue, especially when facing strategic shifts like store closures. The effectiveness of these discount strategies is often tied to the perceived value and urgency created by limited-time offers.

Brand Awareness and Customer Loyalty Initiatives

Conn's actively cultivates brand awareness and customer loyalty, drawing on its deep roots dating back to 1890. This long history is a key differentiator, underpinning a customer-centric philosophy. The company emphasizes its competitive edge, particularly in customer service and product repair, to build lasting relationships and encourage repeat purchases.

Recent data from 2024 indicates Conn's continues to invest in marketing efforts designed to reinforce its brand image. While specific figures for loyalty program engagement weren't widely publicized for early 2025, the strategy centers on highlighting value and reliability. This approach aims to resonate with consumers seeking dependable home goods and electronics, fostering a sense of trust and encouraging continued patronage.

- Brand Heritage: Founded in 1890, Conn's leverages its extensive history to build trust and recognition.

- Customer-Centricity: Initiatives focus on superior customer service and reliable product repair to foster loyalty.

- Competitive Advantages: Marketing highlights strengths like personalized service and post-purchase support.

- Repeat Business: The goal is to create a memorable customer experience that drives sustained engagement and future sales.

Integration of Acquired Brand

Conn's has actively worked to integrate its acquired brand, Badcock, into its marketing mix. A key aspect of this integration involves promoting Conn's established credit program within Badcock retail locations. This initiative is designed to tap into Badcock's existing customer base, offering them Conn's financing options and thereby expanding the reach of both brands.

The strategic goal behind this integration is to unlock revenue synergies by cross-selling Conn's credit solutions to Badcock shoppers. For example, Conn's reported that its credit segment continued to be a significant contributor, with its credit portfolio balance reaching approximately $1.5 billion as of early 2024, highlighting the importance of its financing programs in driving sales across its brands.

- Brand Synergy: Leveraging Badcock's established presence to introduce Conn's credit program.

- Revenue Generation: Aiming for increased sales through enhanced financing accessibility.

- Customer Reach: Expanding the customer base by offering integrated services.

- Credit Program Focus: Highlighting Conn's financial solutions as a key differentiator.

Conn's marketing strategy heavily emphasizes its proprietary credit program, making financing a primary draw, especially for credit-conscious consumers. This focus is evident in the significant portion of sales financed through their own credit offerings, as reported in their Q1 2024 earnings.

The company employs a comprehensive promotional approach, utilizing both traditional channels like press releases and a strong digital presence, including active engagement across major social media platforms. This multi-channel strategy aims to build brand awareness and foster customer loyalty through consistent messaging and direct interaction.

Sales and discounts, particularly during events like store closing events, are key promotional tools designed to drive immediate purchases and manage inventory. Observed initial discounts of 30-50% are used to create urgency and attract customers, aligning with a strategy to offer value and drive traffic.

| Promotional Tactic | Description | Impact/Data Point |

|---|---|---|

| Proprietary Credit Program | Offers flexible financing, a key selling point. | Approx. 70% of sales financed through Conn's credit in Q1 2024. |

| Multi-Channel Marketing | Combines traditional and digital (social media) outreach. | Active presence on Twitter, Instagram, Facebook, YouTube, LinkedIn. |

| Sales and Discounts | Utilized for inventory management and to stimulate purchases. | Initial discounts observed at 30-50% during key sales events. |

| Brand Heritage & Loyalty | Leverages history (since 1890) and customer service. | Focus on customer-centricity and reliable product repair. |

Price

Conn's pricing strategy heavily features flexible in-house financing, a key differentiator that makes substantial purchases like appliances and electronics attainable for a broader customer base, particularly those with less-than-perfect credit. This approach is fundamental to their sales volume and customer retention, directly addressing affordability concerns.

These financing programs allow for manageable monthly payments, effectively lowering the barrier to entry for high-ticket items. For example, in the fiscal year ending January 31, 2024, Conn's reported that approximately 70% of its retail sales were financed through its own credit offerings, highlighting the program's critical role in their business model.

Conn's aims to position its pricing competitively, enabling customers to easily compare its offerings against other brands. This approach is crucial in a market where price sensitivity often influences purchasing decisions. For instance, during their Q1 2024 earnings call, Conn's noted that strategic pricing adjustments were part of their plan to improve merchandise margins, indicating a focus on this competitive aspect.

The company's pricing strategy is carefully crafted to align with the perceived value of its extensive product selection, which includes furniture, mattresses, appliances, electronics, and home office products. By emphasizing quality and branded goods, Conn's seeks to justify its price points and resonate with consumers looking for reliable, desirable items. This is reflected in their ongoing efforts to curate a product mix that appeals to their target demographic's expectations of value and performance.

Conn's frequently utilizes discounts and promotional pricing, especially during significant sales events. For instance, during their 2024 holiday sales, they advertised savings of up to 50% on select appliances and electronics, a common tactic to boost immediate sales volume.

These price reductions serve a dual purpose: stimulating demand and clearing out existing inventory efficiently. This strategy is particularly effective in attracting a broader customer base, including those highly attuned to price changes.

The company's approach often involves aggressive markdowns, sometimes reaching 30-50% off original prices, during liquidation phases or special promotional periods. This helps them move product quickly and maintain a competitive edge.

Lease-to-Own and Third-Party Financing Options

Conn's leverages its own credit operations alongside third-party financing and lease-to-own programs to broaden accessibility. This multi-pronged approach to payment options is crucial for reaching a wider customer demographic, particularly those who might not qualify for traditional financing. For instance, in the first quarter of fiscal year 2025, Conn's reported that approximately 59% of its credit portfolio was originated through its own direct-to-consumer credit program, highlighting the importance of these diverse financing solutions in driving sales.

These flexible payment avenues allow Conn's to cater to a spectrum of financial capacities. The lease-to-own model, in particular, can be attractive to customers seeking lower upfront costs and the ability to build ownership over time. This strategy directly addresses potential affordability barriers, enabling more consumers to acquire necessary home goods and electronics. In fiscal year 2024, Conn's noted that its lease-to-own program continued to be a significant contributor to its overall sales performance, reflecting its effectiveness in attracting and retaining customers.

- Diverse Financing: Conn's offers in-house credit, third-party financing, and lease-to-own options.

- Expanded Customer Base: These programs make products accessible to a wider range of financial situations.

- Fiscal Year 2025 Q1 Data: Approximately 59% of Conn's credit portfolio was from its direct-to-consumer program.

- Lease-to-Own Impact: This model remains a key driver of sales performance for the company.

Impact of Interest Rates on Financing Costs

Conn's, like many retailers offering in-house financing, directly feels the pinch of rising interest rates. When the Federal Reserve increases the federal funds rate, borrowing costs for companies, including Conn's, tend to go up. This directly impacts the cost of servicing their existing debt and any new debt they might take on to fund operations or expansion. For instance, if Conn's relies on revolving credit facilities or term loans, higher benchmark rates translate to higher interest expenses, eating into profit margins.

The company's ability to offer competitive financing to its customers is also tied to these external rate environments. If Conn's financing costs rise significantly, they face a strategic decision: either absorb some of the increased cost, reducing their own profitability, or pass it on to customers through higher Annual Percentage Rates (APRs) on their credit offerings. This latter option could make Conn's financing less attractive compared to competitors or traditional credit card options, potentially impacting sales volume, especially for big-ticket items where financing is crucial.

Navigating these fluctuating interest rate landscapes requires Conn's to be agile in its financial management.

- Interest Rate Sensitivity: Conn's financing programs are directly influenced by prevailing interest rates, impacting their cost of capital and profitability.

- Debt Obligations: Higher interest rates increase the expense of servicing Conn's existing debt, potentially reducing net income.

- Customer Financing: Changes in interest rates can affect the competitiveness and appeal of Conn's customer financing options.

- Adaptable Strategies: Economic shifts necessitate flexible pricing and credit management to maintain financial stability and customer engagement.

Conn's pricing strategy is deeply intertwined with its robust in-house financing options. These programs, including direct credit and lease-to-own, are central to making purchases accessible, particularly for major appliances and electronics. For instance, in the first quarter of fiscal year 2025, Conn's reported that approximately 59% of its credit portfolio originated from its direct-to-consumer program, underscoring its importance.

The company actively uses promotional pricing and discounts, especially during key sales periods. Examples include significant savings advertised during holiday sales, with discounts sometimes reaching 30-50% on select items during liquidation or special promotions. This tactic is designed to boost immediate sales volume and attract price-sensitive customers.

Conn's pricing aims to be competitive, allowing for easy comparison with other brands. They also focus on aligning prices with the perceived value of their product assortment, which includes furniture, appliances, and electronics. This involves curating a product mix that meets customer expectations for quality and reliability.

| Financing Channel | Percentage of Credit Portfolio (Q1 FY25) | Key Feature |

|---|---|---|

| Direct-to-Consumer Credit | 59% | In-house financing, key sales driver |

| Third-Party Financing | N/A | Broader accessibility |

| Lease-to-Own | Significant Contributor (FY24) | Lower upfront costs, builds ownership |

4P's Marketing Mix Analysis Data Sources

Our Conn's 4P's analysis is grounded in a blend of proprietary retail data, official financial disclosures, and comprehensive market research. We incorporate insights from Conn's internal sales figures, promotional calendars, and product line updates alongside industry benchmarks and competitor pricing strategies.