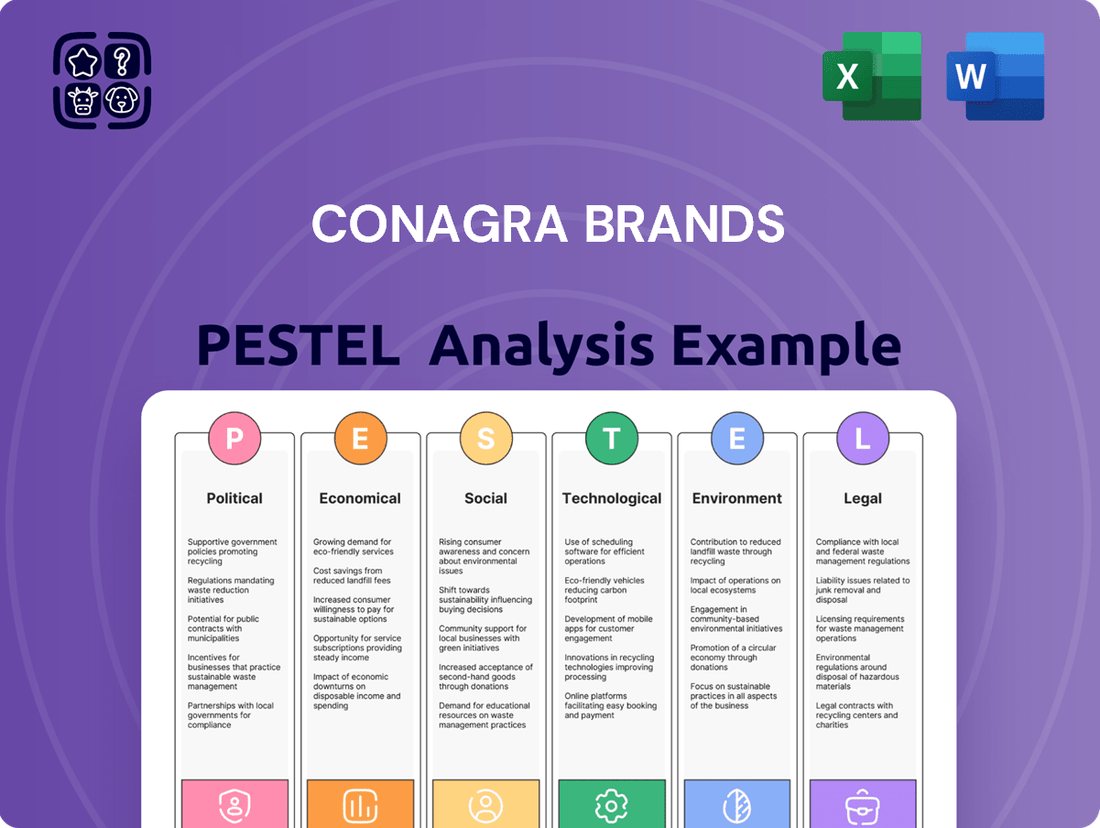

Conagra Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conagra Brands Bundle

Conagra Brands operates within a dynamic landscape shaped by evolving political regulations, economic fluctuations, and rapid technological advancements. Understanding these external forces is crucial for forecasting market trends and identifying strategic opportunities.

Gain a competitive edge by delving into the intricate PESTLE factors impacting Conagra Brands. Our comprehensive analysis provides actionable intelligence to inform your investment decisions and strategic planning. Download the full version now for an unparalleled understanding of the market.

Political factors

Conagra Brands operates under strict government regulations concerning food safety and labeling, a critical aspect for any major food producer. These rules dictate everything from ingredient sourcing to how products are presented to consumers.

Evolving regulations, such as increased demands for ingredient transparency or more detailed allergen information, directly influence Conagra's product development, packaging choices, and marketing campaigns. Adapting to these changes often necessitates substantial financial outlays for compliance and reformulation efforts. For example, Conagra has achieved a significant milestone, with 100% of its production facilities holding Global Food Safety Initiative (GFSI)-recognized certification, demonstrating a commitment to meeting high safety standards.

Changes in international trade policies and the introduction of tariffs can significantly impact Conagra's expenses and its supply chain operations. For instance, tariffs on essential materials like tin plate steel and aluminum, used in packaging, are projected to substantially raise Conagra's costs in fiscal year 2026. These tariffs alone could add approximately 3% to cost inflation, requiring careful adjustments to sourcing strategies and product pricing.

Changes in government food assistance programs, such as SNAP (Supplemental Nutrition Assistance Program), can significantly impact Conagra Brands. For instance, if eligibility criteria tighten or if there are restrictions on which food items can be purchased with benefits, it could reduce demand for Conagra's more value-oriented products. This directly affects sales volumes and necessitates adjustments to Conagra's market strategy and product development.

Political Stability in Key Markets

Political stability in key markets directly impacts Conagra Brands' operations. Geopolitical tensions in regions where Conagra sources ingredients, such as agricultural hubs, can lead to supply chain disruptions. For instance, ongoing conflicts in Eastern Europe, a significant agricultural producer, have historically impacted global grain and oilseed prices, affecting input costs for Conagra. This instability can also dampen consumer spending in affected regions, reducing demand for Conagra's products.

Furthermore, political shifts and policy changes in major consumer markets, like the United States, can create operational challenges. Changes in trade policies, tariffs, or food safety regulations can increase compliance costs and potentially limit market access. For example, shifts in agricultural subsidies or import/export regulations in the US could alter the competitive landscape for Conagra's diverse product portfolio.

- Supply Chain Vulnerability: Geopolitical events in agricultural sourcing regions can disrupt the availability and price of key ingredients for Conagra Brands.

- Consumer Confidence Impact: Political instability in consumer markets can erode consumer confidence, leading to reduced discretionary spending on food products.

- Regulatory Changes: Evolving political landscapes can result in new trade policies, tariffs, or food safety regulations that affect Conagra's operational costs and market access.

- Market Access Limitations: Political instability or unfavorable trade agreements can restrict Conagra's ability to access or efficiently operate within certain international markets.

Agricultural Subsidies and Policies

Government policies on agricultural subsidies and farming practices significantly impact the cost and availability of raw materials for Conagra Brands. For instance, the 2024 Farm Bill, while still under debate and implementation, is expected to continue providing support for certain crops, potentially stabilizing input prices for Conagra's key ingredients.

Shifts in these policies, such as increased incentives for regenerative agriculture, can directly influence Conagra's sourcing strategies and sustainability efforts. Conagra Brands has been actively promoting regenerative agriculture within its supply chains, aiming to improve soil health and biodiversity. As of early 2025, the company reported engaging with over 500,000 acres in regenerative agriculture practices, demonstrating a commitment to aligning with evolving environmental policies and consumer expectations.

- Subsidies impact: Government support for certain crops can stabilize raw material costs for Conagra.

- Regenerative agriculture: Policy shifts encouraging these practices influence Conagra's sourcing and sustainability.

- Conagra's commitment: By early 2025, Conagra was involved in over 500,000 acres of regenerative agriculture.

Government regulations, particularly concerning food safety and labeling, are paramount for Conagra Brands, with 100% of its facilities holding GFSI certification as of early 2024. Evolving transparency demands and allergen information requirements directly shape product development and marketing. For example, potential tariffs on packaging materials like tin plate steel and aluminum are projected to increase Conagra's costs by approximately 3% in fiscal year 2026, necessitating strategic adjustments.

Changes in government food assistance programs, such as SNAP, can impact demand for Conagra's value-oriented products, requiring adaptive market strategies. Political stability in key sourcing regions, like Eastern Europe, affects ingredient prices and availability, with ongoing conflicts historically influencing global grain and oilseed markets. Shifts in major consumer markets, like the US, regarding trade policies and agricultural subsidies can alter the competitive landscape and market access for Conagra's diverse portfolio.

Government policies on agricultural subsidies significantly influence raw material costs. The 2024 Farm Bill is expected to stabilize input prices for key ingredients. Conagra's commitment to regenerative agriculture, engaging over 500,000 acres by early 2025, aligns with evolving environmental policies and consumer expectations.

| Factor | Impact on Conagra Brands | Data/Example |

|---|---|---|

| Food Safety Regulations | Ensures product integrity and consumer trust. | 100% of Conagra facilities GFSI-certified (early 2024). |

| Trade Policies & Tariffs | Affects supply chain costs and pricing. | Projected 3% cost increase from tariffs on packaging materials in FY2026. |

| Food Assistance Programs | Influences demand for value-oriented products. | Potential reduction in demand if SNAP eligibility tightens. |

| Agricultural Subsidies | Impacts raw material costs and availability. | 2024 Farm Bill expected to stabilize input prices. |

| Regenerative Agriculture Policies | Shapes sourcing strategies and sustainability efforts. | Conagra engaged over 500,000 acres in regenerative agriculture (early 2025). |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Conagra Brands, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within Conagra's operating landscape.

A concise PESTLE analysis for Conagra Brands offers a quick understanding of external factors, simplifying complex market dynamics for strategic decision-making.

This PESTLE overview helps identify potential risks and opportunities, acting as a valuable tool for proactive business planning and competitive advantage.

Economic factors

Conagra Brands has faced substantial headwinds from rising inflation, especially impacting key ingredients such as meat, eggs, cocoa, and sugar. These increased input costs directly squeeze the company's profitability.

Looking ahead, Conagra anticipates ongoing cost inflation to be around 7% for fiscal year 2026. This figure notably includes an estimated 3% contribution from tariffs, highlighting the dual impact of market forces and trade policy.

The persistent pressure from elevated input costs has unfortunately translated into reduced profit margins for Conagra Brands, presenting a significant challenge to its overall financial performance and strategic planning.

Economic pressures are significantly influencing consumer choices, with a strong emphasis on affordability and value. This means shoppers are more carefully considering their purchases, often opting for brands that offer the best bang for their buck.

This shift directly affects companies like Conagra Brands. For instance, in fiscal year 2024, while Conagra reported net sales of $11.4 billion, the company noted that consumers are increasingly seeking value. This necessitates a strategic approach to pricing and product development to align with these evolving consumer priorities, ensuring continued sales volume and market relevance.

Foreign exchange rate fluctuations present a significant challenge for Conagra Brands, potentially creating headwinds for its adjusted earnings per share. For instance, a stronger U.S. dollar relative to other currencies can make Conagra's products more expensive for international consumers, thereby impacting sales volumes in its international segment.

This currency volatility complicates financial planning and the management of global operations. For example, during fiscal year 2023, Conagra noted that unfavorable currency movements had a negative impact on its reported results, underscoring the real-world effect of these market dynamics.

Supply Chain Costs and Disruptions

Conagra Brands has navigated significant supply chain challenges, especially impacting its frozen meals segment. Constraints in sourcing key ingredients like chicken and frozen vegetables have led to customer service disruptions, directly affecting sales performance and profitability throughout 2024. For instance, the company noted in its Q3 FY24 earnings call that persistent inflation in certain commodity costs, while showing some moderation, still presented headwinds.

To counter these issues, Conagra is actively investing in enhancing its supply chain infrastructure and forging strategic partnerships. These initiatives aim to build greater resilience against future disruptions and improve efficiency. The company's focus on diversifying suppliers and optimizing logistics is a critical strategy for mitigating the impact of ongoing global supply chain volatility.

- Supply Chain Constraints: Increased costs for key ingredients like chicken and vegetables impacted Conagra's frozen meals segment in 2024.

- Customer Service Impact: Disruptions led to interruptions in product availability for customers.

- Strategic Investments: Conagra is allocating capital to improve supply chain infrastructure and build resilience.

- Partnership Focus: The company is developing strategic alliances to strengthen its sourcing and distribution networks.

Interest Rates and Access to Capital

Changes in interest rates directly impact Conagra Brands' cost of borrowing. For instance, if the Federal Reserve maintains or increases its benchmark interest rate, Conagra's expenses for any new debt or variable-rate existing debt will likely rise, potentially squeezing profit margins.

Conagra has demonstrated a commitment to financial health, reducing its net debt. As of the third quarter of fiscal year 2024, Conagra reported a net debt of approximately $5.2 billion, down from previous periods. This deleveraging improves its financial flexibility, making it easier to access capital.

However, the broader economic climate, characterized by fluctuating interest rate environments, continues to influence Conagra's ability to secure capital for strategic investments. Access to capital at favorable terms is crucial for funding initiatives like acquisitions, product innovation, and expanding manufacturing capabilities.

- Interest Rate Impact: Higher interest rates increase Conagra's borrowing costs, affecting profitability and financial flexibility.

- Debt Management: Conagra has actively reduced its net debt, reporting approximately $5.2 billion in Q3 FY24, enhancing its borrowing capacity.

- Capital Access: The prevailing interest rate environment dictates the cost and availability of capital for Conagra's growth and investment strategies.

- Strategic Funding: Securing capital at competitive rates is essential for funding key initiatives such as acquisitions and product development.

Conagra Brands is navigating a complex economic landscape marked by persistent inflation, particularly in key commodities like meat, cocoa, and sugar, which directly impacts its cost of goods sold. The company anticipates ongoing cost inflation to be around 7% for fiscal year 2026, with tariffs contributing an estimated 3% to this figure.

Consumer behavior is increasingly driven by affordability and value, leading shoppers to scrutinize purchases and favor budget-friendly options. This trend is evident in Conagra's fiscal year 2024 net sales of $11.4 billion, where consumer demand for value remains a significant consideration for pricing and product strategy.

Fluctuations in foreign exchange rates pose a challenge, potentially affecting Conagra's international sales and earnings. Additionally, interest rate changes influence borrowing costs, with Conagra reporting a net debt of approximately $5.2 billion in Q3 FY24, highlighting the importance of managing capital access for strategic investments.

| Economic Factor | Impact on Conagra Brands | Key Data/Trend |

| Inflation | Increased input costs, reduced profit margins | Anticipated 7% cost inflation in FY26, including 3% from tariffs |

| Consumer Spending | Shift towards value and affordability | Net sales of $11.4 billion in FY24; consumer focus on value |

| Interest Rates | Higher borrowing costs, impact on capital access | Net debt of ~$5.2 billion in Q3 FY24 |

| Foreign Exchange Rates | Potential headwinds for international sales and earnings | Unfavorable currency movements negatively impacted FY23 results |

Preview the Actual Deliverable

Conagra Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Conagra Brands PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Consumers are increasingly prioritizing health and wellness, actively seeking out food options that support gut health, enable portion control, and cater to specific dietary requirements like gluten-free or plant-based. This trend is reshaping grocery aisles and influencing purchasing decisions across demographics.

Conagra Brands is strategically aligning its product portfolio with these evolving preferences. For instance, as of their fiscal year 2024 reporting, a substantial percentage of their frozen meals and plant-based innovations are designed to meet internal ‘healthier’ food thresholds, demonstrating a commitment to capturing this growing market segment.

The increasing consumer preference for at-home dining, fueled by convenience, significantly impacts Conagra Brands. In 2024, the demand for easy-to-prepare meals and snacks continues to shape product development, with consumers seeking quick yet satisfying options for busy lifestyles.

This trend is evident in the robust growth of Conagra's frozen and shelf-stable meal categories. For instance, the company has seen sustained interest in its offerings that require minimal preparation, reflecting a broader societal shift towards valuing time-saving food solutions.

Millennials and Gen Z, now increasingly forming families, are placing a high value on both convenience and budget-friendliness in their food choices. This trend is directly boosting spending on frozen foods, a category where Conagra Brands holds a significant presence.

Conagra's strategic approach actively incorporates an understanding of these generational shifts. By analyzing consumer behavior, the company aims to develop and market products that resonate with the evolving needs and preferences of these younger demographics.

For instance, Conagra's investment in brands like Healthy Choice and Marie Callender's reflects a commitment to offering convenient, yet perceived as healthier or more appealing, frozen meal solutions. This aligns with the observed market growth, with the global frozen food market projected to reach over $400 billion by 2027, indicating a strong demand for such products.

Influence of Social Media and Food Trends

Social media platforms are powerful drivers of food trends, with viral content and influencer endorsements shaping consumer preferences. The increasing popularity of specific diets, such as those influenced by the rise in GLP-1 medication use, directly impacts demand for certain food categories, presenting both opportunities and challenges for companies like Conagra Brands. For instance, searches for "weight loss foods" and "low-carb recipes" saw significant spikes in late 2023 and early 2024, indicating a strong consumer interest in health-conscious options.

Conagra actively monitors social media conversations and search engine data to identify emerging food trends and understand evolving consumer needs. This data-driven approach allows the company to be more agile in its product development and marketing strategies. By analyzing millions of online conversations, Conagra can pinpoint shifts in dietary habits and ingredient preferences, ensuring their product pipeline remains relevant. In 2024, Conagra reported that insights derived from social listening directly informed the development of several new product lines, particularly in the healthy snacking and convenient meal categories.

- Social Media Impact: Platforms like TikTok and Instagram are key in popularizing new food items and dietary approaches.

- Trending Diets: The growing interest in diets like keto, paleo, and those associated with GLP-1 medications influences purchasing decisions.

- Market Opportunities: Conagra can capitalize on these trends by developing and marketing products aligned with popular health and wellness movements.

- Data-Driven Strategy: Utilizing social media analytics and search trend data helps Conagra anticipate consumer demand and innovate effectively.

Sustainability and Ethical Consumption Concerns

Consumers are increasingly prioritizing sustainability and ethical practices when making purchasing decisions, influencing the food industry significantly. Conagra Brands is responding to this trend by focusing on responsible sourcing of ingredients and reducing its environmental footprint. For instance, the company has set goals to improve the sustainability of its packaging, aiming for 100% recyclable, reusable, or compostable packaging by 2025.

Conagra's commitment extends to waste reduction efforts across its operations. By the end of fiscal year 2023, Conagra reported a 10% reduction in food waste intensity compared to its 2015 baseline. This focus on sustainability not only addresses consumer concerns but also aligns with broader societal expectations for corporate responsibility.

- Consumer Awareness: A significant percentage of consumers, often over 70% in recent surveys, indicate that sustainability is an important factor in their food choices.

- Responsible Sourcing: Conagra is actively working with suppliers to ensure ethical and sustainable agricultural practices, particularly for key commodities.

- Packaging Goals: The company aims to achieve 100% recyclable, reusable, or compostable packaging by 2025, a target that directly addresses plastic waste concerns.

- Waste Reduction: Conagra has demonstrated progress in reducing operational waste, with a notable decrease in food waste intensity in recent years.

Societal shifts towards health consciousness and convenience continue to shape consumer demand, with a growing preference for at-home dining solutions. Conagra Brands is actively adapting its portfolio to meet these evolving needs, seeing sustained interest in its convenient frozen and shelf-stable meal categories. This strategic alignment is crucial as younger demographics, like Millennials and Gen Z, increasingly prioritize both ease of preparation and affordability in their food choices.

The influence of social media on food trends is undeniable, with viral content and influencer endorsements driving interest in specific diets and healthy eating habits. Conagra leverages social listening and search trend data to anticipate consumer demand, informing product development in areas like healthy snacking and convenient meals. For instance, searches for "weight loss foods" saw significant spikes in late 2023 and early 2024, highlighting a strong market for health-conscious options.

Consumers are increasingly prioritizing sustainability and ethical sourcing, prompting Conagra Brands to focus on responsible practices and environmental footprint reduction. The company has set ambitious goals, aiming for 100% recyclable, reusable, or compostable packaging by 2025. Conagra also reported a 10% reduction in food waste intensity by the end of fiscal year 2023 compared to its 2015 baseline, demonstrating a commitment to corporate responsibility that resonates with growing consumer awareness.

| Sociological Factor | Impact on Conagra Brands | Supporting Data/Trend |

| Health & Wellness Focus | Increased demand for healthier options, plant-based alternatives. | Fiscal 2024 reporting shows a substantial percentage of Conagra's frozen meals and plant-based items meet internal ‘healthier’ food thresholds. |

| Convenience & At-Home Dining | Robust growth in frozen and shelf-stable meal categories. | Sustained consumer interest in minimal-preparation offerings reflects a societal shift valuing time-saving food solutions. |

| Generational Preferences | Higher spending on frozen foods by Millennials and Gen Z families. | These demographics prioritize convenience and budget-friendliness, boosting Conagra's core product segments. |

| Social Media & Trends | Influence of viral content and diets on purchasing decisions. | Searches for "weight loss foods" surged in late 2023/early 2024; Conagra's 2024 product lines were informed by social listening insights. |

| Sustainability & Ethics | Focus on responsible sourcing and reduced environmental impact. | Conagra aims for 100% recyclable, reusable, or compostable packaging by 2025; achieved a 10% reduction in food waste intensity by FY2023. |

Technological factors

Conagra Brands actively drives innovation in food product development to align with shifting consumer preferences. This includes a strategic focus on convenient, value-added meal solutions and engaging licensed product collaborations.

In 2023, Conagra reported a net sales increase of 5.3% to $11.9 billion, underscoring the positive impact of their innovation pipeline. The company's commitment to introducing novel products in key growth areas, such as plant-based options and international flavors, is paramount for maintaining its competitive edge in the dynamic food industry.

Conagra Brands is actively investing in modernizing its food processing and manufacturing facilities to boost efficiency and supply chain resilience. For example, the company has been upgrading key product platforms, such as its frozen meals segment, to incorporate advanced technologies and improve production workflows. These investments are crucial for maintaining competitiveness in a dynamic market.

Conagra Brands is increasingly leveraging advanced technologies and automation within its supply chain to boost efficiency and cut operational expenses. This focus is crucial for mitigating the impact of past supply chain disruptions. For instance, in fiscal year 2024, Conagra reported improved supply chain productivity, a direct result of these technological investments.

The integration of automation, from warehouse robotics to sophisticated inventory management systems, allows Conagra to better control stock levels and optimize logistics. This enhanced visibility and control are vital for navigating the complexities of the modern food industry, especially in light of ongoing global trade dynamics and consumer demand fluctuations.

E-commerce and Digital Marketing Evolution

The surge in e-commerce demands Conagra Brands refine its distribution and bolster digital marketing efforts to connect with consumers online. In 2024, the global e-commerce market was projected to reach over $6.3 trillion, highlighting the critical need for robust online presence and efficient digital supply chains.

Conagra's ability to adapt its product portfolio to evolving consumer tastes, particularly in the digital space, is paramount. For instance, the company has seen significant growth in its frozen meals and snacks categories, driven by convenience-focused online shoppers. This shift necessitates agile product development and targeted digital campaigns to capture market share.

- E-commerce Growth: Global e-commerce sales are expected to continue their upward trajectory, making online channels indispensable for food brands.

- Digital Marketing Investment: Increased spending on targeted digital advertising and social media engagement is crucial for reaching and influencing modern consumers.

- Portfolio Adaptation: Conagra must continually innovate its product offerings to align with online purchasing trends and consumer preferences for convenience and health.

- Data Analytics: Leveraging consumer data from digital interactions will be key to personalizing marketing messages and optimizing product development.

Data Analytics and Consumer Insights

Conagra Brands leverages advanced data analytics, including insights from firms like Circana and Tastewise, to deeply understand evolving consumer preferences and emerging market trends in the food industry. This allows for a more precise approach to product innovation and targeted marketing campaigns. For example, by analyzing data on dietary shifts and convenience needs, Conagra can better anticipate demand for specific product categories.

The company's commitment to data-driven decision-making is crucial for staying competitive. In 2024, the food industry continues to see significant growth in plant-based options and healthy convenience meals, areas where granular consumer insights are paramount. Conagra's ability to process and act on this data, sourced from platforms like Similarweb for online behavior analysis, directly influences its product development pipeline and promotional effectiveness.

Key areas where data analytics provides an edge for Conagra include:

- Predictive Trend Analysis: Identifying future consumer demands based on current behavioral patterns and market signals.

- Personalized Marketing: Tailoring promotional messages and product offerings to specific consumer segments for increased engagement.

- Optimized Product Development: Using insights into ingredient preferences, flavor profiles, and packaging trends to guide new product launches and reformulations.

- Channel Performance Monitoring: Analyzing sales data across different retail channels to refine distribution and merchandising strategies.

Conagra Brands is increasingly integrating artificial intelligence and machine learning into its operations, from optimizing production schedules to personalizing consumer marketing. The company is also exploring blockchain technology for enhanced supply chain transparency and food safety. These technological advancements are critical for maintaining efficiency and meeting evolving consumer expectations in the food sector.

Legal factors

Conagra Brands operates under a rigorous framework of food safety regulations, a critical legal factor for its business. All of its production facilities maintain Global Food Safety Initiative (GFSI)-recognized certifications, underscoring a commitment to high standards. For instance, in 2023, the company continued its focus on robust food safety protocols across its diverse product lines, from frozen meals to snacks.

Compliance with these stringent GFSI standards is non-negotiable for Conagra. Failure to adhere can lead to costly product recalls, substantial fines from regulatory bodies like the FDA, and severe damage to the company's reputation. Maintaining these certifications ensures consumer trust and market access, which is paramount in the food industry.

Conagra Brands navigates a landscape of stringent labeling and advertising laws that govern how its products are presented. These regulations, enforced by bodies like the U.S. Food and Drug Administration (FDA), mandate precise nutritional information, ingredient lists, and allergen declarations on packaging. For instance, the FDA's Food Allergen Labeling and Consumer Protection Act of 2004 (FALCPA) requires clear identification of major allergens.

The company must also ensure its marketing campaigns are truthful and not misleading, adhering to Federal Trade Commission (FTC) guidelines. This means avoiding unsubstantiated health claims or deceptive imagery. In 2023, the FTC continued its focus on environmental marketing claims, a trend that could impact Conagra's messaging around sustainability initiatives for brands like Healthy Choice.

Conagra Brands faces direct impacts from trade laws and tariffs, particularly on raw materials like steel and aluminum essential for canning operations. For instance, in 2023, the U.S. maintained tariffs on steel and aluminum imports, increasing input costs for manufacturers. Conagra actively navigates these challenges by exploring alternative sourcing strategies for its packaging materials and considering price adjustments to offset the added expenses, aiming to maintain profitability amidst fluctuating trade policies.

Labor Laws and Employment Regulations

Conagra Brands must navigate a complex web of labor laws and employment regulations, impacting everything from hourly wages to workplace safety standards. For instance, adherence to minimum wage laws, which vary by state and can be subject to adjustments, directly influences Conagra's operating expenses and compensation strategies across its diverse workforce. The Fair Labor Standards Act (FLSA) sets federal standards for overtime pay and child labor, requiring careful tracking of employee hours.

The company's commitment to its workforce is often detailed in its corporate citizenship reports. These reports frequently highlight programs aimed at improving employee well-being and fostering a positive work environment, which can indirectly mitigate risks associated with labor disputes and enhance employee retention. For example, Conagra's 2023 Corporate Responsibility Report noted investments in employee training and development programs, aiming to equip its workforce with the skills needed for evolving industry demands.

Key areas of compliance include:

- Wage and Hour Laws: Ensuring compliance with federal and state minimum wage requirements and overtime provisions, such as those outlined in the FLSA.

- Workplace Safety: Adhering to Occupational Safety and Health Administration (OSHA) standards to maintain safe working conditions in manufacturing and distribution facilities.

- Employee Benefits: Complying with regulations governing health insurance (e.g., ACA), retirement plans (e.g., ERISA), and other employee benefits.

- Anti-Discrimination Laws: Upholding laws like Title VII of the Civil Rights Act of 1964, which prohibit discrimination based on race, color, religion, sex, or national origin.

Environmental Regulations and Sustainability Targets

Conagra Brands operates within a framework of evolving environmental regulations that govern its operations, particularly concerning waste management, water usage, and emissions. These legal requirements directly influence its production processes and supply chain strategies.

The company has proactively embraced sustainability targets to align with these legal pressures and growing consumer expectations. A key commitment is the ambition to transition 100% of its plastic packaging to renewable, recyclable, or compostable alternatives by the year 2025. This initiative underscores a significant shift in its approach to product design and material sourcing.

Furthermore, Conagra is actively pursuing operational efficiencies aimed at reducing its environmental footprint. This includes focused efforts on minimizing energy consumption across its facilities and implementing robust waste reduction programs. These actions are not only driven by compliance but also by a strategic vision for long-term sustainable growth.

- Regulatory Compliance: Adherence to environmental laws concerning waste, water, and emissions is paramount.

- Plastic Packaging Goal: Aiming for 100% renewable, recyclable, or compostable plastic packaging by 2025.

- Energy Efficiency: Implementing measures to reduce energy consumption throughout its operations.

- Waste Minimization: Focusing on strategies to decrease overall waste generation.

Conagra Brands must navigate a complex web of labor laws and employment regulations, impacting everything from hourly wages to workplace safety standards.

Adherence to minimum wage laws, which vary by state and can be subject to adjustments, directly influences Conagra's operating expenses and compensation strategies across its diverse workforce.

The Fair Labor Standards Act (FLSA) sets federal standards for overtime pay and child labor, requiring careful tracking of employee hours, a key focus for the company in 2024.

Conagra's 2023 Corporate Responsibility Report highlighted investments in employee training and development programs, aiming to equip its workforce with the skills needed for evolving industry demands and to ensure compliance with evolving labor practices.

Environmental factors

Climate change poses a significant risk to Conagra Brands by potentially disrupting agricultural yields and the availability of essential ingredients. This volatility directly impacts the company's supply chain and can lead to increased raw material costs. For instance, extreme weather events in 2024, such as prolonged droughts in key corn-producing regions, have already put pressure on input prices for many food manufacturers.

Conagra Brands acknowledges these climate-related impacts and is actively working to mitigate them. A key focus area is the advancement of regenerative agriculture practices. These practices aim to improve soil health, increase biodiversity, and enhance water retention, ultimately building more resilient agricultural systems. By investing in these initiatives, Conagra seeks to secure a more stable and sustainable supply of raw materials for its diverse product portfolio.

Conagra Brands recognizes water scarcity as a critical environmental factor, actively pursuing efficient water resource management across its operations. This focus is vital given the agricultural inputs that form the backbone of many of its products.

The company has demonstrated this commitment through innovative practices, such as employing drip irrigation in tomato cultivation. This specific initiative has resulted in a notable reduction in water usage, showcasing a tangible step towards more sustainable agricultural sourcing.

Conagra Brands is actively addressing packaging waste, with a significant commitment to making 100% of its plastic packaging either renewable, recyclable, or compostable by 2025. This ambitious goal is being pursued through the development of innovative plant-based packaging solutions and initiatives aimed at boosting consumer recycling rates.

Waste Reduction in Operations

Conagra Brands is making significant strides in reducing operational waste, aiming to divert a substantial portion of its solid waste from landfills. In 2023, the company achieved a diversion rate of 90%, sending materials to recycling, animal feed, or for product donations. This focus on waste reduction is crucial for environmental stewardship and operational efficiency.

The company's commitment extends to various beneficial reuse programs. For instance, food by-products are often repurposed as animal feed, transforming potential waste into valuable resources. Conagra Brands also actively engages in product donations to combat food insecurity, further enhancing its positive environmental and social impact.

- Waste Diversion Rate: Conagra Brands achieved a 90% diversion rate for solid waste from landfills in 2023.

- Beneficial Reuse: A significant portion of waste is diverted for recycling, product donations, and animal feed.

- Operational Efficiency: Minimizing waste contributes to more sustainable and cost-effective operations.

Energy Consumption and Greenhouse Gas Emissions

Conagra Brands is actively working to reduce its energy consumption and greenhouse gas emissions, recognizing the environmental impact of its operations. This focus is driven by a commitment to sustainability and a desire to lessen its overall ecological footprint.

Key initiatives are in place to achieve these goals. The company is investing in energy-efficient equipment across its facilities and upgrading existing systems. A specific aim is to reduce reliance on natural gas and improve the efficiency of hot water generation, contributing to a lower carbon output.

For instance, in fiscal year 2023, Conagra reported a reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity. While specific percentage reductions vary by initiative, the company's broader sustainability goals aim for significant improvements in energy efficiency and emissions reduction by 2030.

- Energy Efficiency Investments: Conagra is upgrading manufacturing equipment and building systems to consume less energy.

- Natural Gas Reduction: Efforts are underway to decrease the use of natural gas, a significant contributor to greenhouse gas emissions.

- Hot Water Generation: Improvements in hot water systems aim to reduce energy waste and associated emissions.

- Emissions Intensity Reduction: The company has set targets to lower its greenhouse gas emissions intensity, reflecting progress in its sustainability efforts.

Conagra Brands faces environmental pressures from climate change, impacting ingredient availability and costs, as seen with 2024 drought effects on corn prices. The company is addressing this through regenerative agriculture to build resilient supply chains.

Water scarcity is another key concern, with Conagra implementing efficient water management, including drip irrigation in tomato farming, to reduce usage significantly. Furthermore, a major initiative aims for 100% of plastic packaging to be renewable, recyclable, or compostable by 2025.

Operational waste is being minimized, evidenced by a 90% waste diversion rate in 2023 through recycling, donations, and animal feed repurposing. Conagra is also reducing energy consumption and greenhouse gas emissions, with fiscal year 2023 showing progress in emissions intensity reduction.

| Environmental Factor | Conagra's Action/Impact | Key Data/Target |

|---|---|---|

| Climate Change | Supply chain disruption, ingredient cost volatility | 2024 droughts impacting corn prices |

| Water Scarcity | Focus on efficient water management | Drip irrigation in tomato cultivation |

| Packaging Waste | Commitment to sustainable packaging | 100% renewable, recyclable, or compostable plastic packaging by 2025 |

| Operational Waste | Minimizing landfill waste | 90% waste diversion rate in 2023 |

| Energy Consumption & Emissions | Reducing energy use and greenhouse gases | FY2023 reduction in Scope 1 & 2 GHG emissions intensity |

PESTLE Analysis Data Sources

Our Conagra Brands PESTLE Analysis is built upon a robust foundation of data from official government publications, reputable market research firms, and leading economic and financial institutions. This ensures that each element of the analysis is grounded in current, fact-based insights.