Conagra Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conagra Brands Bundle

Conagra Brands navigates a complex competitive landscape, where buyer power and the threat of substitutes significantly shape its market. Understanding these forces is crucial for any stakeholder looking to grasp Conagra's strategic positioning.

The complete report reveals the real forces shaping Conagra Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Conagra Brands' reliance on a concentrated supplier base for key agricultural commodities like grains and certain proteins significantly amplifies supplier bargaining power. When only a few entities control the supply of essential inputs, they can dictate terms, potentially increasing costs for Conagra.

For instance, disruptions in the supply of specific frozen vegetables or poultry in 2023 and early 2024 have demonstrably constrained Conagra's production capabilities, highlighting the leverage these concentrated suppliers hold. This limited sourcing for critical ingredients directly translates to higher input costs and potential impacts on Conagra's profit margins.

Conagra Brands faces potential supplier power if switching suppliers proves expensive. This could stem from long-term contracts, the need for specialized equipment, or stringent quality control measures that make transitioning to a new supplier difficult. For instance, if Conagra relies on a supplier for a unique ingredient or a proprietary processing technique, their ability to switch is diminished, increasing that supplier's leverage.

While Conagra likely maintains a broad supplier base to mitigate risk, specific product lines might involve ingredients or processes that are not easily replicated by other vendors. This specialization can create dependencies, thereby strengthening the bargaining power of those particular suppliers. For example, a supplier providing a key component for a popular frozen meal could command higher prices if alternatives are scarce or require significant retooling.

Conagra is actively working to enhance its supply chain efficiency and reduce overall costs. These investments, which could include diversifying sourcing options or developing more standardized ingredient specifications, aim to lessen the impact of high switching costs. By streamlining operations and potentially building in-house capabilities, Conagra can gradually reduce its reliance on any single supplier, thereby moderating supplier power over time.

When suppliers provide unique or highly differentiated inputs that are crucial for Conagra Brands' products and lack readily available substitutes, their bargaining power increases. This can manifest in specialized ingredients, proprietary processing techniques, or advanced packaging solutions that are difficult for Conagra to source elsewhere.

The food industry in 2024 is grappling with significant input cost inflation, especially for key commodities like proteins. This inflationary environment naturally shifts leverage towards suppliers who can command higher prices for their essential materials, directly impacting Conagra's cost structure.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power. If suppliers can credibly threaten to move into Conagra Brands' core business of packaged food production, they gain leverage in negotiations.

While direct agricultural commodity suppliers are less likely to fully integrate into complex consumer packaged goods, specialized ingredient suppliers, particularly those providing unique or high-value components, could pose this threat. For instance, a supplier of a proprietary flavor enhancer or a novel plant-based protein could potentially develop their own branded food products, directly competing with Conagra.

- Supplier Integration Risk: While not a widespread issue for bulk agricultural inputs, specialized ingredient providers with unique, high-value offerings could theoretically integrate forward into finished food products.

- Example Scenario: A supplier of a patented, highly sought-after natural sweetener might consider launching its own line of low-sugar beverages, leveraging its key ingredient advantage.

- Impact on Conagra: Such a move would intensify competition and give the supplier greater pricing power over Conagra if its ingredient remains critical and difficult to substitute.

Importance of Conagra to the Supplier

Conagra Brands' significance to its suppliers is a key factor in determining supplier bargaining power. If Conagra constitutes a small percentage of a supplier's revenue, that supplier holds greater leverage because they are not heavily reliant on Conagra's business. However, when Conagra is a substantial client, its own bargaining power over the supplier is amplified.

As a leading packaged food company, Conagra Brands is almost certainly a major customer for a vast number of its suppliers. For instance, in 2023, Conagra reported over $12 billion in net sales, indicating substantial purchasing volume across its supply chain. This scale means many suppliers depend on Conagra for a significant portion of their income, thereby reducing the supplier's ability to dictate terms.

- Reduced Supplier Dependence: If a supplier's sales to Conagra are minimal, they are less vulnerable to Conagra's demands.

- Conagra's Purchasing Power: Conagra's large revenue base, exceeding $12 billion in 2023, gives it considerable clout with its suppliers.

- Supplier Reliance: Many suppliers likely count Conagra as a critical customer, limiting their bargaining strength.

Conagra Brands faces moderate bargaining power from its suppliers, largely due to the nature of the food industry's supply chain. While Conagra's substantial purchasing volume, evidenced by over $12 billion in net sales in 2023, gives it leverage, the concentration of suppliers for certain key agricultural commodities and specialized ingredients can shift power. For example, disruptions in the supply of specific frozen vegetables or proteins in early 2024 highlighted the leverage concentrated suppliers can wield, impacting production and costs.

The threat of forward integration by specialized ingredient suppliers, though not a widespread concern for bulk commodities, presents a potential avenue for increased supplier power. If a supplier of a unique component, like a patented natural sweetener, were to launch its own branded food products, it could intensify competition and strengthen its pricing leverage over Conagra, especially if that ingredient remains critical and difficult to substitute.

Switching costs also play a role; if Conagra relies on suppliers for proprietary processing techniques or specialized ingredients that are difficult to replicate, these suppliers gain leverage. This is particularly true in an inflationary environment like the one seen in 2024 for key commodities such as proteins, where suppliers can more easily command higher prices.

| Factor | Impact on Conagra | Mitigation Strategies |

|---|---|---|

| Supplier Concentration (Key Commodities) | Moderate to High Leverage | Diversifying sourcing, long-term contracts, building strategic partnerships |

| Switching Costs (Specialized Ingredients/Processes) | Moderate Leverage | Ingredient standardization, exploring alternative technologies, in-house capabilities |

| Supplier Forward Integration Threat (Specialized Suppliers) | Low to Moderate Potential Leverage | Monitoring market trends, developing alternative ingredient sources, strong supplier relationships |

| Conagra's Purchasing Volume (>$12B Net Sales in 2023) | Reduces Supplier Leverage | Leveraging scale for better pricing, volume commitments |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Conagra Brands' position in the packaged food industry.

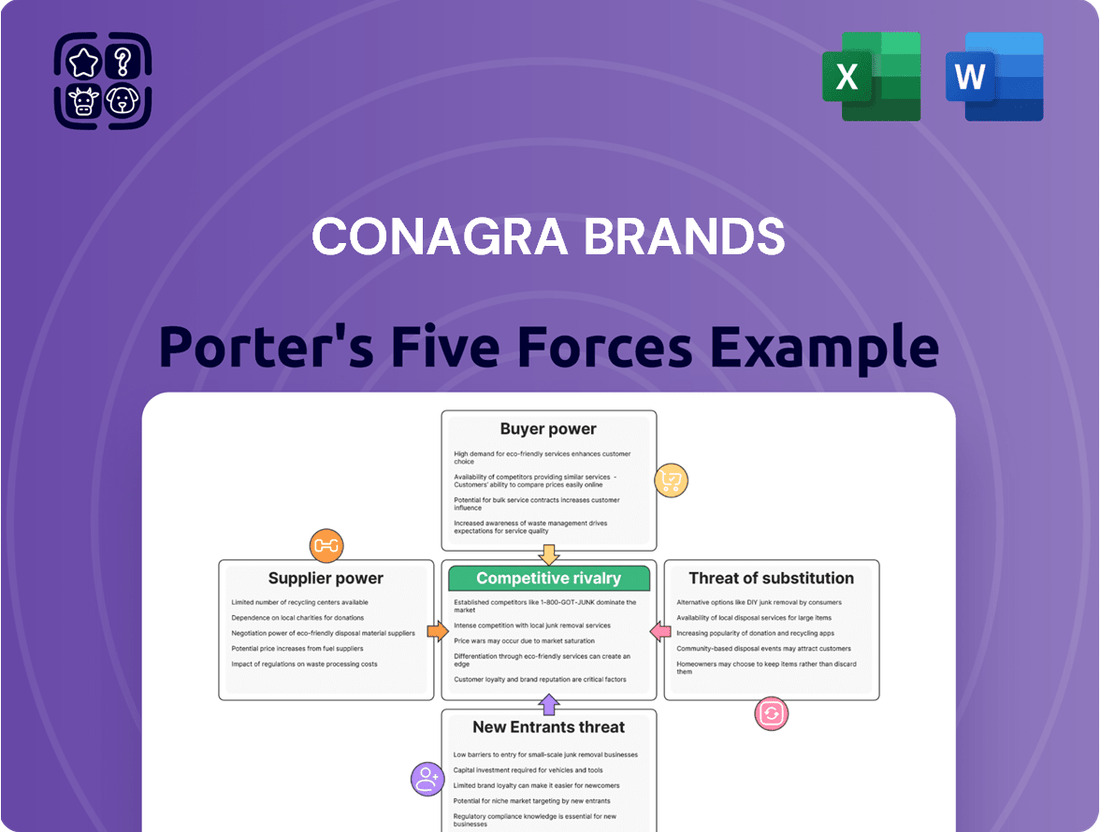

Quickly identify and address competitive threats by visualizing Conagra Brands' Porter's Five Forces with an intuitive interactive dashboard.

Customers Bargaining Power

Conagra Brands faces considerable customer concentration, with its largest customer, Walmart, Inc. and its affiliates, representing a substantial portion of its business. In fiscal year 2025, Walmart accounted for roughly 29% of Conagra's consolidated net sales, a figure that was 28% in fiscal year 2024. This significant reliance on a single major retailer grants Walmart considerable leverage in negotiations.

This high concentration of sales with Walmart translates directly into significant bargaining power for the retail giant. Walmart can exert influence over Conagra's pricing strategies, promotional activities, and even the allocation of shelf space within its stores. Consequently, Conagra must carefully manage this relationship to mitigate the impact of Walmart's strong negotiating position on its profitability and market access.

Consumers in the packaged food sector are showing heightened price sensitivity, a trend exacerbated by persistent inflation and evolving economic landscapes. This means they are more likely to shop around for the best deals.

The sheer volume of competing brands and product options available in the market significantly amplifies this consumer power. With so many choices, shoppers can easily switch to a competitor if they perceive better value elsewhere, directly impacting Conagra Brands.

For instance, in early 2024, consumer spending on food away from home saw a slight increase compared to the previous year, indicating a potential shift in budget allocation and a heightened focus on value for at-home food purchases. This dynamic forces Conagra to carefully manage its pricing strategies to remain competitive.

The availability of numerous substitute products significantly bolsters customer bargaining power for Conagra Brands. Consumers can easily opt for private label brands, fresh produce, or entirely different meal solutions if Conagra's offerings don't align with their price expectations or taste preferences. This wide selection allows them to switch suppliers with minimal effort, pressuring Conagra on pricing and product innovation.

Low Switching Costs for Consumers

For most packaged food items sold by Conagra Brands, the financial and effort-based cost for a consumer to switch from one brand to another is minimal. This low barrier to switching significantly enhances the bargaining power of customers. They can easily choose a competitor's offering based on price fluctuations, promotional deals, or a perceived better value proposition without incurring substantial inconvenience or expense. For example, in 2024, the average consumer spent approximately $150 per month on packaged foods, making brand loyalty less entrenched when alternatives are readily available and cheaper.

This ease of switching is a critical factor in the packaged food industry. Consumers can readily explore different brands for staple items like pasta, cereal, or canned goods. This dynamic means Conagra Brands must constantly innovate and offer competitive pricing to retain its customer base. The ability for consumers to easily compare and switch means that even small price increases or a lack of appealing promotions can lead to a noticeable shift in market share.

- Low Switching Costs: Consumers face negligible costs when moving between brands of packaged foods.

- Consumer Power Amplified: This ease of switching directly increases customer leverage over manufacturers like Conagra.

- Price and Promotion Sensitivity: Purchasing decisions are heavily influenced by immediate price points and promotional offers.

- Market Dynamics: The packaged food sector sees frequent brand exploration by consumers due to low switching friction.

Customer Information and Transparency

Customers today have unprecedented access to information, significantly bolstering their bargaining power. Online reviews, detailed nutritional data readily available on packaging and company websites, and sophisticated price comparison tools empower consumers to make highly informed purchasing decisions. This transparency means customers can easily scrutinize ingredients, evaluate health claims, and compare pricing across a multitude of brands, including Conagra's portfolio.

This heightened awareness translates into a stronger demand for value and quality. For instance, as of early 2024, consumer interest in plant-based ingredients and sustainable sourcing continues to grow, with many actively seeking out brands that align with these preferences. Conagra Brands, like its competitors, faces pressure to meet these evolving demands, influencing product development and marketing strategies.

- Informed Decisions: Consumers can now easily compare Conagra products against competitors based on price, ingredients, and health benefits.

- Demand for Value: Increased transparency allows customers to negotiate better value, pushing companies to optimize pricing and product quality.

- Influence on Product Development: Consumer feedback and readily available information on market trends, like the demand for healthier options, directly influence Conagra's innovation pipeline.

Conagra Brands' bargaining power with customers is significantly influenced by its reliance on major retailers, particularly Walmart. In fiscal year 2025, Walmart represented approximately 29% of Conagra's net sales, a slight increase from 28% in fiscal year 2024. This substantial customer concentration grants Walmart considerable leverage in negotiations regarding pricing, promotions, and product placement.

The packaged food market is characterized by high consumer price sensitivity, amplified by inflation and economic uncertainty. Consumers actively seek value, readily switching brands for better deals. With numerous competing brands and readily available substitutes, including private labels, Conagra faces pressure to maintain competitive pricing and offer compelling promotions to retain market share.

The ease with which consumers can switch between packaged food brands, with minimal cost or effort, further enhances their bargaining power. For example, the average consumer spent around $150 monthly on packaged foods in 2024, indicating that brand loyalty can be fragile when faced with cheaper alternatives. This low switching cost compels Conagra to focus on continuous innovation and attractive pricing strategies.

| Customer Segment | Reliance Level (FY25) | Impact on Bargaining Power |

|---|---|---|

| Walmart | ~29% of Net Sales | High; significant influence on pricing and promotions. |

| General Consumers | Broad Market | Moderate to High; driven by price sensitivity, low switching costs, and information access. |

Preview the Actual Deliverable

Conagra Brands Porter's Five Forces Analysis

This preview showcases the comprehensive Conagra Brands Porter's Five Forces Analysis, detailing the competitive landscape of the food industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing actionable insights into the forces shaping Conagra's market position. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The packaged food sector is a crowded marketplace, with Conagra Brands facing a multitude of competitors, including larger entities possessing significantly more financial and marketing muscle. This dynamic means Conagra constantly contends with established giants who can leverage greater economies of scale and broader distribution networks.

Conagra's competitive landscape includes a wide array of offerings, from heavily advertised, household-name brands to the increasingly popular private label and custom food products. This diversity in product types intensifies rivalry, as consumers have numerous choices across different price points and quality perceptions. For instance, in 2024, the private label share of the U.S. grocery market continued to be substantial, often exceeding 20%, putting direct pressure on branded manufacturers like Conagra.

While the global packaged food market is expected to see growth, Conagra Brands has encountered headwinds, reporting declining organic net sales and volumes in its fiscal year 2025. This presents a challenging environment where companies must actively vie for market share.

A slower growth rate in the industry means that expansion is not simply a matter of capturing a piece of a rapidly expanding pie. Instead, it forces companies like Conagra to compete more fiercely for existing consumer demand.

Conagra Brands navigates competitive rivalry by focusing on quality, innovation, and value, aiming to build strong brand loyalty. In 2023, Conagra reported net sales of $11.6 billion, highlighting the scale of its operations and the importance of differentiation in capturing market share.

While Conagra strives for differentiation through continuous product innovation, some categories within the food industry exhibit low product differentiation. In these instances, competition frequently escalates to price wars, which can put pressure on profit margins. Conagra's ongoing investment in research and development, evidenced by its new product launches, is a key strategy to maintain brand relevance and consumer engagement.

High Fixed Costs and Storage Costs

The packaged food sector, including companies like Conagra Brands, is characterized by substantial fixed costs. These include investments in manufacturing plants, extensive distribution networks, and significant marketing expenditures. For example, in 2023, Conagra Brands reported capital expenditures of $588 million, largely directed towards enhancing its manufacturing and supply chain capabilities.

These high fixed costs create pressure for companies to operate at or near full capacity. When demand falters, the need to cover these overheads can escalate price competition. This is particularly evident in the grocery aisle, where promotions and discounts are common tactics to drive volume and mitigate the impact of underutilized assets.

- High Capital Investment: The food manufacturing industry requires significant upfront investment in plant, property, and equipment.

- Distribution Network Costs: Maintaining a broad and efficient distribution system to reach diverse retail channels incurs substantial ongoing expenses.

- Marketing and Brand Building: Extensive advertising and promotional activities are necessary to build and sustain brand recognition in a crowded market.

- Inventory and Storage: Holding inventory of raw materials and finished goods, especially for perishable or shelf-stable items, adds to storage and management costs.

Exit Barriers

The packaged food industry, where Conagra Brands operates, typically presents significant exit barriers. These can include highly specialized manufacturing equipment, substantial investments in brand building, and long-term supply agreements with retailers. These factors make it difficult and costly for companies to leave the market, even if they are not performing well. This can lead to a situation where less profitable entities remain active, thus intensifying competitive rivalry for everyone. For instance, the capital expenditure required for food processing plants can be immense, making a complete divestiture challenging.

While specific data on Conagra's exit barriers isn't publicly detailed, the industry's nature suggests these challenges are present. Companies might also face contractual obligations with suppliers or distributors that are difficult to break. Furthermore, the social implications of closing down plants, such as job losses in local communities, can also act as a deterrent to exiting the market.

- Specialized Assets: Food processing plants and specialized machinery represent significant sunk costs.

- Long-Term Contracts: Agreements with suppliers and distributors can lock companies into operations.

- Brand Investment: Extensive marketing and brand development create a barrier to simply walking away.

- Social Considerations: Plant closures can have significant community impacts, discouraging exit.

Conagra Brands operates in a highly competitive packaged food market, facing pressure from large corporations with greater resources and a proliferation of private label options. In 2024, private label brands continued to capture a significant share of the U.S. grocery market, often exceeding 20%, directly challenging branded manufacturers like Conagra. This intense rivalry is further fueled by high fixed costs in manufacturing and distribution, which can lead to price competition when demand softens.

The industry's slow growth rate means companies must fight harder for existing market share, with Conagra reporting declining organic net sales and volumes in fiscal year 2025. While Conagra invests in innovation, some product categories lack strong differentiation, increasing the likelihood of price wars. The substantial capital expenditures, such as Conagra's $588 million in 2023 for supply chain enhancements, also contribute to the pressure to maintain sales volumes.

Significant exit barriers, including specialized assets and brand investment, keep less profitable companies in the market, intensifying competition for all players. This environment necessitates continuous efforts in quality, innovation, and value to maintain brand loyalty and market position.

SSubstitutes Threaten

Consumers are increasingly choosing fresh, unprocessed foods over packaged options, directly impacting Conagra's core business. This shift means items like fresh produce and meats are becoming strong substitutes for Conagra's frozen dinners, entrees, and snacks. For example, the U.S. retail grocery market saw a notable increase in sales for fresh produce in 2023, with consumers actively seeking healthier alternatives.

The increasing prominence of private label brands poses a significant threat of substitution for Conagra Brands. These store-owned brands, often priced considerably lower than national brands, present a compelling alternative for consumers, particularly those who are budget-conscious. This trend can directly impact Conagra's sales volume and market share as shoppers opt for more economical choices.

During periods of economic pressure, such as the inflation experienced in 2023 and continuing into early 2024, consumers are more inclined to switch to private label options. For instance, reports from late 2023 indicated that private label sales growth outpaced national brands in several key grocery categories, demonstrating this consumer behavior shift. This dynamic directly challenges Conagra's ability to maintain premium pricing and customer loyalty.

The rising tide of health consciousness and evolving dietary preferences presents a significant threat of substitution for Conagra Brands. Consumers are increasingly seeking out foods aligned with 'modern health' trends, which include diets influenced by GLP-1 medications, a focus on gut health, and a growing adoption of plant-based alternatives. This shift can lead consumers to bypass traditional packaged goods in favor of options that better align with these new wellness goals.

Conagra is actively addressing this by innovating within its product portfolio. For instance, the company is investing in its frozen foods segment, aiming to offer more convenient and health-forward options that cater to these changing consumer demands. This strategic pivot is crucial for mitigating the impact of substitutes and retaining market share in a dynamic food landscape.

Home Cooking and Meal Preparation Kits

The ongoing trend of home cooking, fueled by a desire for budget-friendly options and personalized nutrition, presents a significant substitute for Conagra Brands' pre-packaged meal offerings. Consumers are increasingly choosing to prepare their own meals, impacting demand for convenience foods.

Meal preparation kits have also emerged as a strong substitute, providing a middle ground between fully prepared meals and cooking from scratch. These kits offer convenience while still allowing for a fresh, customized dining experience, directly competing with Conagra's product lines.

In 2024, the market for meal kits continued to show robust growth. For instance, the U.S. meal kit delivery service market was projected to reach approximately $11.4 billion, indicating a substantial consumer shift towards these alternatives.

- Home Cooking Trend: Consumers prioritize cost savings and customization, making home-prepared meals a direct substitute for convenience foods.

- Meal Kit Popularity: Services offering pre-portioned ingredients and recipes provide a convenient, yet fresh, alternative to pre-packaged meals.

- Market Data: The U.S. meal kit delivery market's projected value of over $11 billion in 2024 highlights the competitive pressure from this substitute category.

Foodservice and Restaurant Options

The threat of substitutes for Conagra Brands' packaged food products is substantial, particularly from the foodservice and restaurant sector. Dining out or opting for takeout and delivery services presents a direct alternative to preparing meals at home using Conagra's offerings. This is especially true for consumers prioritizing convenience or seeking specific dining experiences that packaged foods may not fully replicate.

In 2024, the U.S. foodservice industry continued its robust recovery, with sales projected to reach over $1 trillion, indicating strong consumer preference for out-of-home dining. This trend directly competes with in-home meal solutions. For instance, the National Restaurant Association reported that restaurant sales in 2023 exceeded $1 trillion, a figure expected to grow. This highlights the significant portion of consumer food spending that bypasses the packaged goods market.

- Restaurant Spending Dominance: In 2024, U.S. restaurant sales are projected to surpass $1 trillion, demonstrating a strong consumer inclination towards dining out.

- Convenience Factor: Consumers often choose restaurant meals for convenience, a factor that directly substitutes the need for preparing meals with packaged goods.

- Experiential Value: Restaurants offer culinary experiences and variety that can be a more appealing substitute than home preparation for certain consumer segments.

The threat of substitutes for Conagra Brands is amplified by the growing popularity of ready-to-eat meals and specialty food items. These products offer convenience and unique flavor profiles that can draw consumers away from traditional packaged goods. For instance, the market for prepared meals, including frozen and refrigerated options, saw continued growth in 2023 and early 2024 as consumers sought quick and easy meal solutions.

The increasing availability of diverse ethnic and gourmet food options also presents a substitute threat. Consumers are more willing to explore international cuisines and artisanal products, which can be sourced from specialty stores or directly from smaller producers, bypassing large packaged food companies like Conagra. This trend reflects a desire for novelty and higher quality ingredients.

The rise of direct-to-consumer (DTC) food brands, particularly in niche categories like plant-based alternatives or premium snacks, further intensifies the substitute threat. These brands often build strong online communities and offer personalized experiences, appealing to consumers seeking alternatives to mass-market products. For example, the DTC food market has experienced significant expansion, with many emerging brands capturing market share.

| Substitute Category | Key Characteristics | Impact on Conagra | Market Trend (2023-2024) |

|---|---|---|---|

| Ready-to-Eat Meals | Convenience, diverse flavors | Direct competition for meal occasions | Continued strong growth, driven by busy lifestyles |

| Specialty & Ethnic Foods | Unique tastes, premium ingredients | Appeals to adventurous consumers, potentially reducing demand for standard offerings | Increasing consumer interest in global cuisines and artisanal products |

| Direct-to-Consumer (DTC) Brands | Niche focus, personalization, community building | Captures specific consumer segments, challenges brand loyalty | Significant expansion in plant-based, gourmet, and health-focused categories |

Entrants Threaten

The significant capital needed to establish a presence in the packaged food sector acts as a substantial deterrent to potential new competitors. Building out the necessary manufacturing capabilities, securing robust distribution channels, and launching impactful marketing campaigns all demand considerable financial outlay. For instance, a new entrant would likely need to invest hundreds of millions, if not billions, of dollars to compete effectively with established players like Conagra Brands.

Conagra Brands benefits significantly from strong brand loyalty, with a portfolio of recognizable names that resonate with consumers. This loyalty makes it challenging for new entrants to capture market share without substantial marketing investment. For instance, Conagra's brands like Slim Jim and Healthy Choice have cultivated decades of consumer trust, a difficult asset for newcomers to replicate.

Conagra Brands, like many established food manufacturers, benefits significantly from economies of scale. This means they can produce goods at a lower cost per unit due to their large-scale operations in procurement, manufacturing, and distribution. For instance, their substantial purchasing power allows them to negotiate better prices for raw materials, which directly impacts their cost of goods sold.

New companies entering the packaged food market would find it incredibly challenging to match these cost efficiencies. Without the same volume, they cannot secure the same bulk discounts on ingredients or spread their fixed production and marketing costs over as many units. This cost disadvantage makes it difficult for new entrants to compete on price with established players like Conagra, thus acting as a significant barrier.

Regulatory Hurdles and Food Safety Standards

The food industry, including segments where Conagra Brands operates, faces significant regulatory hurdles and demanding food safety standards. New entrants must invest heavily in compliance, including robust quality control systems, obtaining necessary certifications, and securing legal expertise, all of which substantially increase the cost and complexity of market entry.

For example, the U.S. Food and Drug Administration (FDA) enforces regulations like the Food Safety Modernization Act (FSMA), which requires preventive controls and rigorous traceability. In 2024, companies continue to grapple with evolving FSMA requirements, impacting operational costs and the capital needed to establish compliant facilities. These stringent requirements act as a substantial barrier, deterring many potential new competitors.

- FSMA Compliance Costs: Businesses face ongoing expenses for implementing FSMA-mandated preventive controls and supply chain oversight.

- Certification Investments: Obtaining certifications like HACCP (Hazard Analysis and Critical Control Points) or GFSI (Global Food Safety Initiative) requires significant upfront and ongoing investment.

- Legal and Consulting Fees: Navigating the complex regulatory landscape necessitates specialized legal and consulting services, adding to entry barriers.

- Capital Expenditures for Safety: New entrants must allocate substantial capital to build or retrofit facilities to meet modern food safety infrastructure standards.

Access to Raw Materials and Supply Chains

New companies entering the food industry face significant hurdles in securing consistent and cost-effective access to a wide array of raw materials. This includes everything from grains and produce to specialized ingredients, all of which can be subject to price volatility and availability issues. For example, in 2024, global commodity prices for key agricultural inputs like wheat and corn saw fluctuations impacting production costs across the sector.

Conagra Brands, with its established presence, benefits from long-standing supplier relationships and significant purchasing power. This allows them to negotiate favorable terms and ensure a stable supply of necessary ingredients, a key advantage over nascent competitors. Their ongoing investments in supply chain optimization, including advanced logistics and inventory management, further solidify this position.

- New entrants struggle with the capital and expertise needed to build robust supply chains for diverse food inputs.

- Conagra's established supplier network, built over decades, offers preferential pricing and guaranteed supply.

- The company's 2023 fiscal year saw continued focus on supply chain resilience, mitigating risks from global disruptions.

The threat of new entrants for Conagra Brands is moderate, primarily due to the substantial capital requirements and established brand loyalty in the packaged food industry. Building manufacturing, distribution, and marketing infrastructure demands hundreds of millions to billions of dollars. For instance, a new entrant would need significant funding to challenge Conagra's established brands like Slim Jim, which have cultivated decades of consumer trust.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Conagra Brands is built upon a foundation of robust data, including their annual reports, SEC filings, and investor presentations. We supplement this with insights from industry-specific market research reports and trade publications to capture a comprehensive view of the competitive landscape.