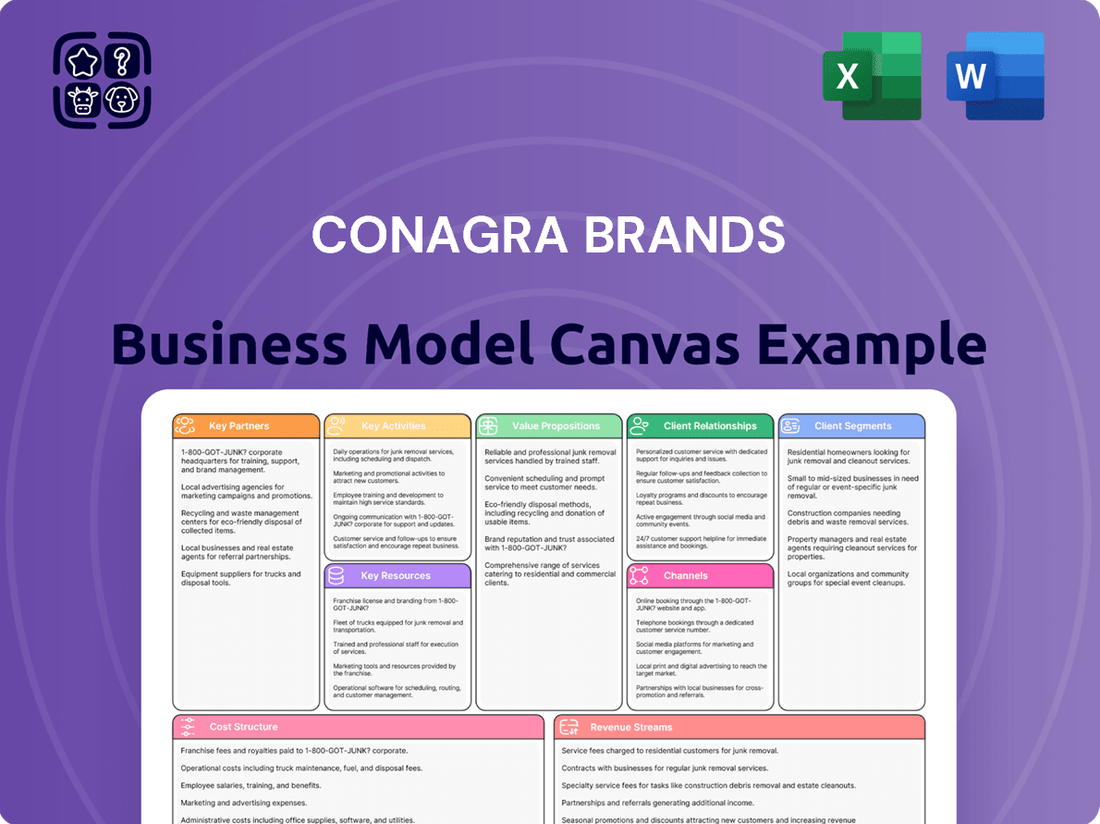

Conagra Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conagra Brands Bundle

Uncover the strategic engine driving Conagra Brands's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, key resources, and revenue streams, offering a clear roadmap to their market dominance. Perfect for anyone aiming to understand or replicate their winning formula.

Partnerships

Conagra Brands' success hinges on its vital connections with major retailers, with Walmart being a prime example, representing about 28% of its consolidated net sales in fiscal year 2024. These alliances ensure Conagra's extensive product reach, covering supermarkets, mass merchandisers, and online marketplaces.

Furthermore, relationships with foodservice distributors are equally important, enabling Conagra to supply its products to restaurants, schools, and other institutional settings, thereby broadening its market presence beyond retail consumers.

Conagra Brands relies heavily on a robust network of ingredient and packaging suppliers to ensure the consistent quality and availability of its diverse product portfolio. These partnerships are fundamental to maintaining operational efficiency and meeting consumer demand. In 2024, Conagra continued to emphasize strong supplier relationships to navigate fluctuating commodity prices and supply chain complexities.

Collaborations with these key partners allow Conagra to effectively manage costs, a critical factor in the competitive food industry. By working closely with suppliers, Conagra can negotiate favorable terms and explore innovative packaging solutions that reduce waste and improve sustainability. For instance, ongoing efforts in 2024 focused on increasing the use of recycled content in packaging materials, a direct result of these supplier dialogues.

These supplier relationships also play a crucial role in upholding Conagra's commitment to product quality and safety. By ensuring a consistent supply of high-grade ingredients, Conagra can maintain the trusted taste and nutritional value consumers expect from its brands. This focus on quality extends to responsible sourcing practices, with Conagra actively engaging its suppliers in 2024 to promote ethical labor and environmental stewardship throughout the supply chain.

Conagra Brands leverages co-manufacturing for specific product lines to enhance production efficiency and flexibility, allowing them to scale operations without significant capital investment in owned facilities. This strategy was particularly evident as they navigated supply chain complexities in 2024, ensuring consistent product availability.

For warehousing and transportation, Conagra relies on third-party logistics (3PL) providers. These partnerships are crucial for managing their extensive distribution network, optimizing inventory levels, and reducing overall supply chain costs. In 2024, the company continued to refine these relationships to improve delivery times and responsiveness to market demand.

Innovation and Technology Partners

Conagra Brands actively partners with external innovation firms and technology providers to drive product development and process improvements. These collaborations are crucial for staying ahead in a dynamic market, focusing on areas like advanced food science and novel packaging solutions. For instance, in 2024, Conagra continued to invest in R&D, with a significant portion allocated to exploring new ingredients and sustainable packaging technologies to meet growing consumer preferences for healthier and more eco-friendly options.

These strategic alliances enable Conagra to leverage specialized expertise that might not be available in-house, accelerating the introduction of new products and enhancing the quality of existing ones. Partnerships in digital transformation are also key, aiming to optimize manufacturing efficiency and supply chain management. The company's commitment to innovation was underscored by reports in early 2024 highlighting increased collaboration with startups focused on plant-based alternatives and functional food ingredients.

- External Innovation Firms: Collaboration with specialized agencies for ideation and concept development.

- Technology Providers: Partnerships for advanced food science, processing equipment, and automation.

- Packaging Solutions: Working with firms to develop sustainable and consumer-friendly packaging.

- Digital Transformation: Alliances for implementing AI, IoT, and data analytics in operations.

Brand Licensing and Co-branding Partners

Conagra Brands strategically engages in brand licensing and co-branding to extend its reach and appeal. A notable example is the ongoing collaboration with Dolly Parton, which has seen the introduction of a diverse range of retail food items. This partnership effectively leverages the immense popularity and trust associated with the Dolly Parton brand to introduce Conagra's products to new consumer demographics and enhance market penetration.

These collaborations are designed to capitalize on established brand equity, thereby driving sales and expanding market presence without the need for extensive internal development of entirely new brands. For instance, in fiscal year 2023, Conagra Brands reported net sales of $11.9 billion, with strategic partnerships like these contributing to the overall growth and diversification of their product portfolio.

- Strategic Brand Licensing: Expands product lines and enters new consumer segments through collaborations like the Dolly Parton partnership.

- Co-branding Benefits: Leverages existing brand recognition to boost sales and market penetration.

- Fiscal Year 2023 Performance: Conagra Brands achieved $11.9 billion in net sales, underscoring the impact of such strategic alliances.

Conagra Brands' Key Partnerships are diverse, encompassing major retailers like Walmart, which accounted for approximately 28% of its net sales in fiscal year 2024, and foodservice distributors crucial for institutional reach. These relationships are foundational for market access and sales volume.

Critical alliances also exist with ingredient and packaging suppliers, ensuring product quality and operational efficiency, especially when navigating fluctuating commodity prices in 2024. These partnerships are vital for cost management and innovation in packaging solutions, with a focus on sustainability.

Furthermore, Conagra leverages co-manufacturing for production flexibility and third-party logistics (3PL) providers for efficient distribution, optimizing its supply chain in 2024. Collaborations with external innovation firms and technology providers drive product development, with significant investment in R&D for new ingredients and sustainable packaging in early 2024.

Brand licensing, such as the successful partnership with Dolly Parton, extends market reach and appeals to new demographics, contributing to Conagra's overall growth. In fiscal year 2023, Conagra Brands reported net sales of $11.9 billion, highlighting the impact of these strategic alliances on its financial performance.

What is included in the product

This Conagra Brands Business Model Canvas provides a strategic blueprint for their diverse portfolio of consumer packaged goods, focusing on delivering value to broad retail and foodservice customer segments through efficient manufacturing and distribution channels.

It details Conagra's value propositions, revenue streams from branded food products, and key resources like strong brand equity and supply chain infrastructure.

Conagra Brands' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying strategic understanding for stakeholders.

This tool efficiently identifies Conagra's core components, alleviating the pain of deciphering intricate supply chains and diverse product portfolios.

Activities

Conagra Brands' key activities in product manufacturing and production are centered on efficiently producing its extensive range of food items. This includes overseeing complex manufacturing processes across many facilities, ensuring every product meets stringent quality standards. In 2023, Conagra operated 56 manufacturing facilities, highlighting the scale of their production capabilities.

Optimizing production lines for both efficiency and cost savings is crucial. This involves leveraging technology and process improvements to reduce waste and maximize output. For instance, their focus on operational excellence aims to streamline supply chains and manufacturing, contributing to their financial performance.

Conagra Brands dedicates significant resources to Research and Development, aiming to launch innovative food products that cater to evolving consumer tastes, like the growing demand for plant-based or organic options. In fiscal year 2023, Conagra reported a 2.4% increase in net sales, partly driven by successful new product introductions that stemmed from their R&D efforts.

This commitment to innovation extends to refining existing product lines and exploring novel ingredients and preparation methods to enhance both taste and nutritional profiles. For instance, their focus on convenient meal solutions and healthier alternatives reflects ongoing R&D in product formulation and packaging design.

Conagra Brands focuses heavily on building and maintaining strong brand recognition across its diverse portfolio, featuring popular names like Birds Eye, Healthy Choice, and Slim Jim. This is a crucial activity for driving consumer preference and sales.

The company actively engages in extensive advertising campaigns, strategic promotional activities, and robust digital engagement to foster deeper connections with consumers. These efforts are designed to cultivate brand loyalty and stimulate demand for their products.

In 2023, Conagra Brands reported net sales of $11.9 billion, underscoring the scale of their marketing and brand management efforts. Their investment in brand building is a key driver of this significant revenue.

Supply Chain Management and Logistics

Conagra Brands' supply chain management and logistics are paramount to its operations. This involves overseeing everything from acquiring raw ingredients to getting the final products onto store shelves and into restaurants. Efficiently handling procurement, managing stock levels, operating warehouses, and coordinating transportation are all key to ensuring products are available when and where consumers want them, all while keeping costs in check.

In 2024, Conagra Brands continued to focus on optimizing its supply chain to meet demand and manage costs effectively. The company's extensive network of manufacturing facilities, distribution centers, and transportation partnerships is a cornerstone of its ability to serve a wide range of customers across North America. This intricate network is designed for both efficiency and resilience, a crucial aspect given the dynamic nature of the food industry.

- Procurement: Securing high-quality raw materials at competitive prices from a diverse supplier base.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs.

- Warehousing and Distribution: Operating a network of facilities to store and efficiently move products to customers.

- Transportation: Managing a fleet and third-party logistics providers for timely and cost-effective delivery.

Sales and Distribution

Conagra Brands prioritizes securing prominent shelf placement within grocery and mass retail environments, a crucial activity for driving consumer visibility and sales. This involves ongoing negotiations and relationship management with key retail partners.

The company actively manages its relationships with major customers, such as Walmart, which represents a significant portion of its sales. These relationships are vital for ensuring product availability and promotional support.

Conagra is also focused on expanding its distribution network to include diverse channels, notably e-commerce platforms. This strategic move aims to capture a growing segment of consumers who prefer online shopping for their groceries.

In 2024, Conagra Brands continued to leverage its established distribution infrastructure, which includes a vast network of warehouses and transportation services, to ensure efficient product delivery across the United States. For instance, its fiscal year 2024 results showed continued strength in its retail segments, underscoring the effectiveness of its sales and distribution strategies.

- Prime Shelf Space: Securing advantageous shelf placement in major retail chains.

- Key Customer Relationships: Maintaining strong partnerships with large retailers like Walmart.

- Omnichannel Expansion: Growing presence and sales through e-commerce and other digital channels.

- Distribution Network: Utilizing and optimizing a broad logistical infrastructure for product delivery.

Conagra Brands' key activities encompass product manufacturing, innovation through R&D, robust brand building, and efficient supply chain management. These core functions are supported by strategic sales and distribution efforts aimed at securing market presence and meeting consumer demand.

The company's operational focus in 2024 includes maintaining high production standards across its 56 manufacturing facilities and optimizing logistics for timely delivery. Conagra's commitment to innovation saw successful new product introductions in fiscal year 2023, contributing to a 2.4% net sales increase.

Brand management is central, with significant investment in advertising and digital engagement to foster loyalty for brands like Birds Eye and Slim Jim. This drives their substantial net sales, which reached $11.9 billion in 2023.

Key activities also involve securing prime retail shelf space and nurturing relationships with major customers, such as Walmart, while expanding into e-commerce channels.

| Key Activity | Description | 2023/2024 Data Point |

| Product Manufacturing | Efficient production across facilities | Operated 56 manufacturing facilities (2023) |

| Research & Development | Launching innovative products | 2.4% net sales increase driven by new products (FY2023) |

| Brand Building | Advertising and consumer engagement | $11.9 billion net sales (2023) |

| Supply Chain Management | Procurement, inventory, distribution, transport | Focus on supply chain optimization (2024) |

| Sales & Distribution | Securing shelf space, managing retail relationships, e-commerce | Continued strength in retail segments (FY2024) |

What You See Is What You Get

Business Model Canvas

The Conagra Brands Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited structure and content that will be delivered, ensuring no surprises. You'll gain immediate access to this professionally formatted canvas, ready for your analysis and strategic planning.

Resources

Conagra Brands boasts a robust portfolio of iconic food brands, including household names like Birds Eye, Duncan Hines, Healthy Choice, Marie Callender's, Reddi-wip, and Slim Jim. This extensive collection signifies substantial intellectual property and deep-rooted consumer trust, forming a core competitive advantage.

In fiscal year 2024, Conagra Brands reported net sales of $11.3 billion, with its diverse brand portfolio contributing significantly to this performance. The strength of these brands translates into consistent consumer demand and pricing power, reinforcing Conagra's market position.

Conagra Brands operates a vast network of manufacturing facilities and distribution centers, primarily located across North America. This extensive infrastructure is critical for supporting its large-scale food production, ensuring efficient storage, and facilitating the timely distribution of its wide array of consumer food products to retailers and foodservice customers.

As of fiscal year 2023, Conagra Brands reported having 46 manufacturing facilities. This robust operational footprint allows for significant production capacity, enabling the company to meet demand for its diverse portfolio, which includes brands like Healthy Choice, Banquet, and Slim Jim.

Conagra Brands relies heavily on its skilled workforce, encompassing R&D teams, culinary experts, supply chain professionals, and marketing specialists. These individuals are the engine behind the company's innovation and market success.

In 2024, Conagra Brands continued to invest in its talent, recognizing that expertise in areas like food science, consumer insights, and efficient logistics is paramount. This human capital directly translates into developing new products that resonate with consumers and optimizing the complex supply chain to ensure product availability.

Distribution Network and Logistics Capabilities

Conagra Brands leverages an extensive distribution network, a critical component of its business model. This network includes direct relationships with major retailers, ensuring broad market access. Their capabilities in warehousing and transportation are finely tuned to move products efficiently and economically.

These logistical strengths are vital for reaching consumers across diverse channels, from large supermarket chains to smaller convenience stores. In fiscal year 2023, Conagra Brands reported net sales of $11.5 billion, underscoring the scale at which their distribution network must operate to support such revenue generation.

- Extensive Retailer Relationships: Direct partnerships with key grocery and mass-market retailers.

- Warehousing and Transportation Infrastructure: A robust system for storage and product movement.

- Efficient Supply Chain: Enabling cost-effective delivery to consumers nationwide.

Financial Capital and Investment Capacity

Conagra Brands' financial capital and investment capacity are foundational to its operational strategy. This access to funds enables significant investments in crucial areas like research and development, ensuring product innovation and adaptation to evolving consumer tastes. For instance, in fiscal year 2023, Conagra reported net sales of $11.5 billion, underscoring the scale of operations supported by its financial resources.

The company leverages its financial strength to undertake infrastructure improvements, which are vital for optimizing production efficiency and supply chain management. Furthermore, its investment capacity facilitates strategic acquisitions, allowing Conagra to expand its market reach and product portfolio. In 2023, Conagra completed the acquisition of Sycamore Brands, a move aimed at strengthening its presence in the frozen meals category.

- Research & Development: Funding innovation in product development and consumer trends.

- Infrastructure Upgrades: Modernizing facilities for enhanced operational efficiency.

- Strategic Acquisitions: Expanding market share and product diversification.

- Marketing Initiatives: Driving brand awareness and consumer engagement.

Conagra Brands' key resources include its powerful brand portfolio, extensive physical infrastructure, and skilled human capital. These elements are crucial for innovation, production, and market reach.

The company's strong financial backing allows for continuous investment in R&D, infrastructure, and strategic acquisitions, ensuring its competitive edge. This financial capacity is demonstrated by its substantial net sales, which reached $11.3 billion in fiscal year 2024.

Furthermore, Conagra's well-established distribution network and deep retailer relationships are vital for getting its products to consumers efficiently and effectively.

| Key Resource | Description | Fiscal Year 2024 Data |

| Brand Portfolio | Iconic food brands like Birds Eye, Healthy Choice, Slim Jim | Net Sales: $11.3 billion |

| Physical Infrastructure | Network of manufacturing facilities and distribution centers | 46 manufacturing facilities (as of FY23) |

| Human Capital | Skilled workforce in R&D, supply chain, marketing | Continued investment in talent for innovation and logistics |

| Financial Capital | Investment capacity for R&D, infrastructure, acquisitions | Net Sales: $11.3 billion |

| Distribution Network | Extensive logistics and retailer relationships | Supports nationwide product delivery |

Value Propositions

Conagra Brands boasts a diverse portfolio of trusted food brands, offering consumers a wide array of choices across numerous categories. This breadth ensures that consumers can find familiar and reliable options for any meal occasion, from breakfast to dinner and snacks. For instance, in fiscal year 2024, Conagra's net sales were approximately $11.5 billion, reflecting the strength and reach of its brand offerings.

This extensive product selection caters to a variety of tastes, dietary preferences, and lifestyle needs. Whether it's frozen meals, snacks, or pantry staples, Conagra's brands are designed to meet the evolving demands of the modern consumer. The company's commitment to quality and familiarity underpins the trust consumers place in its diverse product lineup.

Conagra Brands excels in convenience, with a vast portfolio catering to consumers needing quick meal solutions. Their frozen meals, like those under the Healthy Choice and Marie Callender's brands, provide ready-to-eat options for busy lifestyles. In 2023, Conagra reported that over 90% of its sales came from brands that hold a leading or number two market share position, underscoring their widespread availability and consumer preference.

This convenience is amplified by an extensive distribution network. Conagra products are readily accessible in virtually all major grocery stores and supermarkets across North America, ensuring consumers can easily find their preferred items. This broad reach, supported by strong retail partnerships, makes Conagra a go-to for convenient food options.

Conagra Brands actively innovates to align with evolving consumer preferences, introducing healthier options, plant-based choices, and novel flavor profiles across its portfolio. This dedication ensures its brands resonate with contemporary tastes.

In fiscal year 2024, Conagra's investment in innovation and brand building contributed to a net sales increase, demonstrating the financial impact of adapting to market trends and consumer demand for evolving product offerings.

Quality and Safety Assurance

Conagra Brands prioritizes quality and safety, ensuring consumers receive delicious and nutritious food. This commitment is underscored by the fact that 100% of its production facilities hold Global Food Safety Initiative (GFSI)-recognized certification, a critical element in building deep consumer trust and fostering lasting loyalty.

This dedication to stringent safety standards directly translates into a stronger brand reputation and encourages repeat purchases. For instance, in 2024, Conagra reported significant investments in supply chain integrity and product testing, reinforcing their pledge to consumers.

- GFSI Certification: 100% of Conagra Brands' production facilities are GFSI-recognized certified.

- Consumer Trust: This focus on safety and quality directly builds consumer confidence and brand loyalty.

- Nutritional Focus: Conagra is committed to producing foods that are not only safe but also nutritious.

- Market Advantage: High safety standards provide a competitive edge in the food industry.

Affordable and Accessible Nutrition

Conagra Brands is committed to making nutritious food accessible and affordable for everyday consumers. They focus on offering a wide range of products that cater to different dietary needs and preferences, ensuring families can access essential food groups without breaking the bank.

This value proposition is evident in their diverse portfolio, which includes frozen vegetables, convenient single-serving meals, and quality protein options. By providing these staples at competitive price points, Conagra aims to be a go-to brand for budget-conscious households seeking balanced meals. In 2024, Conagra continued to emphasize value, with a significant portion of their sales coming from staple categories where price sensitivity is high.

- Affordable Access: Conagra's product lines are designed to offer nutritional value at price points accessible to a broad consumer base.

- Convenience Meets Nutrition: Products like frozen vegetables and portion-controlled meals provide easy ways for consumers to incorporate healthy options into busy schedules.

- Value-Driven Choice: The company positions itself as a provider of quality, nutritious food that represents a smart financial decision for families.

- Dietary Support: Conagra's offerings help consumers meet nutritional guidelines by providing access to various food groups, including vegetables and protein.

Conagra Brands offers a vast selection of trusted food products, ensuring consumers have reliable choices for every meal. This broad appeal is reflected in their fiscal year 2024 net sales of approximately $11.5 billion. Their extensive product range meets diverse tastes and dietary needs, reinforcing consumer trust through consistent quality and familiarity.

The company excels in providing convenient meal solutions, particularly with brands like Healthy Choice and Marie Callender's, catering to busy lifestyles. In 2023, over 90% of Conagra's sales originated from brands holding a top market share, highlighting their widespread availability and consumer preference. This convenience is further supported by an extensive distribution network ensuring easy access in major retail outlets.

Conagra Brands is dedicated to innovation, continuously introducing healthier, plant-based, and novel flavor options to align with evolving consumer preferences. Fiscal year 2024 saw Conagra invest in innovation, contributing to net sales growth and demonstrating the financial impact of adapting to market trends.

A core value proposition is the commitment to food quality and safety, with 100% of their production facilities holding GFSI-recognized certification. This rigorous safety standard builds significant consumer trust and loyalty, supported by substantial 2024 investments in supply chain integrity and product testing.

Conagra Brands focuses on making nutritious food accessible and affordable, offering a variety of products that cater to different dietary needs. This value proposition is evident in their competitive pricing for staples like frozen vegetables and convenient meals, making them a go-to for budget-conscious families. In 2024, a significant portion of their sales came from price-sensitive staple categories.

| Value Proposition | Description | Supporting Data (FY24 unless noted) |

|---|---|---|

| Diverse & Trusted Portfolio | Wide array of familiar and reliable food brands across categories. | Net Sales: ~$11.5 billion |

| Convenience & Accessibility | Quick meal solutions and extensive distribution in major retailers. | 90%+ sales from #1 or #2 market share brands (2023) |

| Innovation & Evolving Preferences | Introduction of healthier, plant-based, and new flavor options. | Investment in innovation contributed to net sales increase. |

| Quality & Safety Assurance | Commitment to high food safety standards. | 100% of facilities GFSI-recognized certified. |

| Affordability & Nutrition | Accessible and nutritious food options for everyday consumers. | Strong sales in price-sensitive staple categories. |

Customer Relationships

Conagra Brands primarily engages the mass market through a pervasive brand presence and extensive marketing initiatives. This strategy focuses on building broad brand recognition and appeal across a wide consumer base.

In fiscal year 2024, Conagra Brands continued to invest heavily in advertising and promotional activities. For instance, their marketing spend is a significant component of their operating expenses, designed to maintain top-of-mind awareness for their diverse portfolio of food products.

These widespread campaigns, including digital advertising, television commercials, and in-store promotions, are crucial for reaching a broad audience and fostering loyalty among everyday consumers who rely on their convenient and accessible food options.

Conagra Brands cultivates robust relationships with major retailers like Walmart, recognizing them as vital channels for product distribution and sales. These partnerships go beyond simple transactions, involving deep collaboration on category management and promotional strategies to boost product visibility and availability.

In 2024, Conagra Brands continued to emphasize these collaborations, understanding that effective supply chain coordination with these partners is paramount. This focus ensures that their diverse product portfolio, from frozen foods to pantry staples, reaches consumers efficiently.

Conagra Brands places significant emphasis on consumer feedback, actively collecting insights through various channels to shape its product pipeline and promotional efforts. This commitment is crucial for staying ahead in a fast-paced consumer goods environment.

In 2024, Conagra continued to leverage consumer data, with initiatives like its "Taste of America" program directly incorporating shopper preferences into new product introductions. This focus on understanding evolving tastes helps ensure their brands resonate with current market demands.

Digital Engagement and Online Presence

Conagra Brands actively connects with consumers across its corporate website, individual brand sites, and various social media channels. This multifaceted digital approach facilitates direct dialogue, provides detailed product insights, and cultivates vibrant brand communities. For instance, in fiscal year 2023, Conagra reported a significant increase in digital engagement, with website traffic and social media interactions showing robust growth, reflecting a strategic emphasis on online consumer relationships.

- Direct Communication: Corporate and brand websites serve as primary hubs for information dissemination and customer service inquiries.

- Brand Communities: Social media platforms are leveraged to build loyal followings and encourage user-generated content.

- Product Information: Digital channels offer consumers easy access to nutritional details, recipes, and purchasing options.

- Digital Investment: Conagra's increasing allocation of marketing spend towards digital channels underscores their importance in customer relationship management.

Corporate Citizenship and Sustainability Initiatives

Conagra Brands cultivates strong customer relationships by actively engaging in corporate citizenship and sustainability. Their commitment to good food, responsible sourcing, environmental stewardship, and community involvement fosters trust and loyalty among consumers who prioritize ethical business practices.

These initiatives directly appeal to a growing segment of socially conscious consumers. For instance, Conagra's focus on reducing food waste and improving packaging sustainability aligns with consumer demand for eco-friendly products. In 2024, Conagra Brands continued its efforts to enhance its sustainability reporting and engage stakeholders on these critical issues.

- Good Food Commitment: Conagra emphasizes providing nutritious and accessible food options, reinforcing its role as a responsible food provider.

- Responsible Sourcing: The company works to ensure its ingredients are sourced ethically and sustainably, building confidence in its supply chain.

- Environmental Sustainability: Initiatives focused on reducing greenhouse gas emissions and improving packaging efficiency demonstrate environmental responsibility.

- Community Support: Conagra's engagement in community programs and charitable giving strengthens its connection with the public.

Conagra Brands maintains customer relationships through a multi-pronged approach, blending broad marketing with direct digital engagement and strategic retailer partnerships. Their focus on consumer feedback and corporate responsibility further solidifies these connections, ensuring brand loyalty and market relevance.

Channels

Retail supermarkets and grocery stores represent Conagra Brands' most critical distribution channel, acting as the primary gateway for its diverse portfolio of packaged foods to reach everyday consumers. This channel ensures Conagra's products are readily available in the conventional shopping environments where millions of households conduct their weekly food purchases.

In 2024, Conagra Brands continued to leverage these channels to maintain its strong market presence. The company’s sales through traditional grocery retailers remain a cornerstone of its revenue strategy, reflecting the enduring consumer habit of shopping at these locations for staple food items.

Conagra Brands leverages mass merchandisers and club stores, such as Walmart and Costco, to distribute its wide array of products. These channels are crucial for reaching a broad consumer base that prioritizes value and bulk purchasing options. Walmart, in particular, represents a significant sales driver for Conagra, underscoring the importance of this retail segment in its overall strategy.

Conagra Brands leverages major e-commerce platforms like Amazon, Walmart.com, and Instacart to reach consumers, capitalizing on the surge in online grocery shopping. This channel is crucial for convenience, with online grocery sales in the U.S. projected to reach $200 billion by 2025, according to Statista.

The company also engages in direct-to-consumer (DTC) sales through its own branded websites, offering a more controlled customer experience and potentially higher margins. This DTC approach aligns with the broader trend of consumers seeking personalized and convenient purchasing options.

Foodservice and Restaurants

Conagra Brands significantly serves the foodservice sector, supplying a wide array of its branded products to restaurants, cafeterias, and other food establishments. This channel allows Conagra to tap into the commercial side of the food industry, complementing its retail presence. In fiscal year 2024, Conagra's Foodservice segment generated approximately $1.3 billion in net sales, showcasing its substantial role in this market.

The company's strategy in foodservice involves providing convenient, high-quality ingredients and prepared foods that meet the operational needs of commercial kitchens. This includes everything from frozen vegetables and potato products to sauces and seasoned meats, often tailored for bulk preparation and consistent quality. Conagra's foodservice offerings are designed to help operators manage costs and labor while delivering appealing menu items to their customers.

- Foodservice Sales Contribution: In fiscal year 2024, the Foodservice segment represented roughly 10% of Conagra Brands' total net sales.

- Product Diversification: Conagra offers over 300 foodservice SKUs, covering categories like snacks, sides, entrees, and breakfast items.

- Key Customer Segments: Major clients include quick-service restaurants, casual dining establishments, healthcare facilities, and educational institutions.

- Growth Drivers: Expansion into new foodservice segments and the introduction of innovative, labor-saving products are key growth strategies for this channel.

Convenience Stores and Specialty Retailers

Conagra Brands leverages convenience stores for broad distribution of its snack products and single-serve items, reaching consumers seeking immediate consumption. This channel is crucial for impulse purchases, with brands like Slim Jim and David Sunflower Seeds being staples in these locations.

Specialty retailers offer an avenue for Conagra to introduce and market niche or premium product lines, allowing for more targeted consumer engagement. For example, certain gourmet frozen meals or artisanal baking mixes might find a home in these curated environments, enhancing brand perception and reaching specific demographics.

- Convenience Store Reach: In 2024, convenience stores continued to be a significant channel for Conagra's impulse-buy snack portfolio.

- Specialty Market Penetration: Conagra strategically utilizes specialty retailers to test and grow market share for differentiated product offerings.

- Sales Contribution: While specific figures for these channels are often aggregated, the convenience store segment consistently contributes to Conagra's overall net sales, particularly within the snacks and frozen foods categories.

Conagra Brands utilizes a multi-channel approach to reach consumers, with retail supermarkets and mass merchandisers forming the backbone of its distribution. E-commerce platforms and direct-to-consumer sales are increasingly important for convenience and personalized engagement. The foodservice sector also plays a significant role, providing branded products to commercial kitchens and institutions.

| Channel Type | Key Retailers/Platforms | 2024 Relevance/Data |

|---|---|---|

| Retail Supermarkets | Major Grocery Chains | Primary gateway for packaged foods; cornerstone of revenue strategy. |

| Mass Merchandisers & Club Stores | Walmart, Costco | Crucial for broad consumer reach and value-focused shoppers; Walmart a significant driver. |

| E-commerce | Amazon, Walmart.com, Instacart | Capitalizes on online grocery growth; U.S. online grocery sales projected to reach $200 billion by 2025. |

| Foodservice | Restaurants, Cafeterias, Institutions | Generated approx. $1.3 billion in net sales in FY24, representing ~10% of total sales. |

| Convenience Stores | Various C-stores | Significant for impulse-buy snacks like Slim Jim; key for immediate consumption. |

Customer Segments

Everyday consumers, especially those juggling demanding schedules, prioritize convenience above all else. Conagra Brands directly addresses this need with a wide array of products designed for quick preparation and consumption. Think about their extensive frozen meal selections, like Healthy Choice or Marie Callender's, which offer a complete, heat-and-eat option for busy weeknights. In fiscal year 2024, Conagra reported that its Refrigerated & Frozen segment, a significant contributor to its convenience offerings, saw continued strength, reflecting the ongoing demand from this consumer group.

Conagra Brands keenly serves health-conscious consumers, a growing segment actively seeking nutritious food options. They cater to this by offering brands like Healthy Choice and Birds Eye, which feature products designed for specific dietary needs, such as being lower in calories, higher in protein, or free from common allergens.

Value-oriented shoppers represent a significant customer segment for Conagra Brands. These consumers actively seek out food options that offer a strong balance between price and quality. Conagra's portfolio, featuring well-known brands, is designed to meet this demand by providing accessible and budget-friendly choices.

In 2024, Conagra continued to emphasize value in its product offerings, a strategy that resonates particularly well in an economic climate where consumers are mindful of their spending. The company's focus on delivering good value for money through its diverse range of products is a key driver for attracting and retaining these price-conscious customers.

Specific Dietary Needs (e.g., Gluten-Free, Plant-Based)

Conagra Brands actively caters to consumers with specific dietary needs, recognizing these as significant niche markets. The company offers a range of products designed to meet these requirements, expanding its market reach and appeal.

Brands like Glutino are dedicated to the gluten-free segment, providing a variety of snacks and pantry staples. Furthermore, Conagra's portfolio includes plant-based options through its Gardein and Purple Carrot brands, tapping into the growing demand for vegan and vegetarian foods.

This strategic focus on dietary needs is supported by market trends. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to grow significantly. Similarly, the gluten-free market continues to expand as consumer awareness of celiac disease and gluten sensitivity increases.

- Gluten-Free Offerings: Glutino brand provides a comprehensive selection of gluten-free products, including pretzels, cookies, and mixes.

- Plant-Based Expansion: Gardein offers a wide array of meat alternatives, while Purple Carrot focuses on plant-based meal kits.

- Market Growth: The plant-based food sector is experiencing robust growth, indicating strong consumer adoption of these dietary choices.

- Consumer Demand: Conagra's investment in these segments reflects a response to increasing consumer demand for healthier and specialized food options.

Foodservice and Restaurant Businesses

Conagra Brands serves the foodservice and restaurant sector, a crucial customer segment distinct from retail consumers. This includes a wide array of businesses like commercial kitchens, fast-casual eateries, and large institutional buyers such as hospitals and school cafeterias. They require Conagra's products in larger volumes to support their daily operations and menu offerings.

These foodservice clients prioritize convenience, consistency, and cost-effectiveness. For instance, Conagra's frozen vegetable blends and prepared sauces are staples for many restaurants, simplifying preparation and ensuring a uniform taste experience for their patrons. In 2023, the foodservice channel represented a significant portion of Conagra's net sales, highlighting the importance of this segment to their overall business strategy.

- Foodservice Channel Importance: In fiscal year 2023, Conagra Brands reported that its foodservice segment contributed meaningfully to its revenue, demonstrating strong demand from commercial kitchens and institutions.

- Product Needs: This segment requires bulk packaging, consistent quality, and often specialized formulations tailored for commercial preparation, such as ready-to-heat sauces and pre-portioned ingredients.

- Key Buyers: Major clients include restaurant chains, catering services, hotels, and healthcare facilities, all relying on Conagra for reliable supply and quality ingredients to meet their operational demands.

Conagra Brands also targets institutional and commercial foodservice operations, from restaurants to schools and hospitals. These clients require bulk quantities and consistent quality to manage their daily food preparation efficiently.

The company's foodservice division ensures that these businesses have access to a reliable supply of ingredients and prepared foods, simplifying their operations and menu consistency. In fiscal year 2024, Conagra's foodservice segment continued to be a vital revenue stream, underscoring the importance of this channel.

| Customer Segment | Key Needs | Conagra's Offering |

| Foodservice Operators | Bulk quantities, consistent quality, cost-effectiveness, ease of preparation | Frozen vegetables, sauces, prepared meals, custom formulations |

| Institutional Buyers (Schools, Hospitals) | Nutritious options, cost control, supply chain reliability, dietary compliance | Healthy Choice frozen meals, Gardein plant-based options, bulk ingredients |

Cost Structure

A significant portion of Conagra Brands' expenses stems from acquiring a diverse range of agricultural commodities and ingredients. These essential components, including proteins, sweeteners, and various vegetables, form the backbone of their product portfolio.

These procurement costs are inherently volatile, directly impacted by market fluctuations and inflationary pressures. For instance, in its fiscal year 2023, Conagra reported that its cost of goods sold, which heavily includes raw materials, saw an increase, reflecting these dynamic market conditions.

Conagra Brands' cost structure is significantly influenced by its manufacturing and production expenses. These include the costs of labor, energy to run its numerous facilities, upkeep of machinery, and rigorous quality assurance processes. For instance, in fiscal year 2024, Conagra Brands reported cost of goods sold at $7.5 billion, reflecting the substantial investment in these operational elements.

Conagra Brands' Sales, General, and Administrative (SG&A) expenses are a significant component of its cost structure, encompassing marketing, advertising, sales force, and corporate overhead. In fiscal year 2024, Conagra reported SG&A expenses of $1.3 billion, reflecting substantial investments in brand-building and promotional activities to drive consumer demand for its diverse portfolio of food products.

Logistics and Distribution Costs

Conagra Brands incurs substantial expenses related to its extensive logistics and distribution network. These costs encompass warehousing, transportation, and the overall management of getting its diverse food products to market efficiently. In fiscal year 2024, Conagra continued its focus on optimizing these operations to drive cost savings and improve margins.

The company actively seeks efficiencies within its supply chain to mitigate these significant expenditures. This involves strategies like route optimization, load consolidation, and leveraging technology to enhance visibility and reduce waste in the distribution process.

- Warehousing: Costs associated with storing raw materials and finished goods.

- Transportation: Expenses for moving products via truck, rail, and other modes.

- Distribution Network Management: Costs for managing warehouses, fleet operations, and third-party logistics providers.

- Supply Chain Optimization: Investments in technology and processes to reduce overall logistics expenses.

Research and Development (R&D) and Innovation Costs

Conagra Brands dedicates significant resources to research and development, focusing on creating new products, enhancing existing formulas, and innovating manufacturing processes. These investments are essential for staying ahead in the competitive food industry and adapting to shifting consumer preferences for healthier options and convenient meal solutions.

In fiscal year 2024, Conagra Brands reported selling, general, and administrative expenses (which include R&D) totaling $1.49 billion. This figure reflects the ongoing commitment to innovation, aiming to drive future growth and market share.

- Product Innovation: Developing new items to capture emerging consumer trends.

- Formula Improvement: Enhancing taste, nutrition, and shelf-life of existing products.

- Process Optimization: Investing in technology to improve manufacturing efficiency and reduce costs.

- Consumer Insights: Funding research to understand evolving market demands and preferences.

Conagra Brands’ cost structure is heavily weighted towards the procurement of raw materials, with fiscal year 2023 seeing significant increases in its cost of goods sold due to market volatility. Manufacturing and production expenses, including labor, energy, and machinery upkeep, are also substantial, as evidenced by the $7.5 billion cost of goods sold reported in fiscal year 2024. Furthermore, Sales, General, and Administrative (SG&A) expenses, which reached $1.3 billion in fiscal year 2024, cover critical areas like marketing and brand development, alongside research and development investments totaling $1.49 billion in FY24 to foster product innovation.

| Cost Category | FY2024 Expense (Billions) | Key Drivers |

| Cost of Goods Sold (COGS) | $7.5 | Raw material procurement, manufacturing labor, energy, packaging |

| Sales, General & Administrative (SG&A) | $1.49 | Marketing, advertising, sales force, corporate overhead, R&D |

| Logistics & Distribution | (Not separately itemized, but significant) | Warehousing, transportation, supply chain optimization |

Revenue Streams

Conagra Brands' main revenue comes from selling its wide variety of branded food products directly to consumers through retail channels. This includes popular items like frozen meals, snacks, and pantry staples. For fiscal year 2024, Conagra reported net sales of $11.4 billion, with a significant portion driven by these consumer packaged goods.

Conagra Brands leverages its manufacturing capabilities to produce private label food products for a wide array of retailers. This segment allows them to tap into the significant demand for store-brand items, which often offer consumers a more budget-friendly option. For fiscal year 2024, the company's private label segment contributed a substantial portion of its overall sales, demonstrating its importance in their revenue mix.

Conagra Brands generates significant revenue by selling its diverse range of food products through foodservice channels. This includes supplying restaurants, school and hospital cafeterias, and other institutional clients, effectively reaching a broader market beyond direct-to-consumer sales.

In fiscal year 2023, Conagra Brands reported net sales of $11.5 billion, with its foodservice segment playing a crucial role in this overall performance by catering to the specific needs of business and institutional customers.

E-commerce Sales

Conagra Brands increasingly leverages e-commerce platforms and its own direct-to-consumer (DTC) channels to drive revenue, capitalizing on the significant expansion of online grocery shopping. This shift allows for broader market reach and direct engagement with consumers. For instance, in fiscal year 2023, Conagra reported a notable increase in its digital sales, reflecting the growing importance of this segment.

Key aspects of Conagra's e-commerce revenue streams include:

- Online Retailer Partnerships: Sales generated through major online grocery platforms and marketplaces.

- Direct-to-Consumer (DTC) Sales: Revenue from Conagra's own websites and online stores, offering a more controlled brand experience.

- Subscription Services: Potential for recurring revenue through curated product boxes or regular deliveries.

- Digital Promotions: Revenue influenced by online advertising and promotional activities that drive traffic and sales to e-commerce channels.

Licensing and Partnership Agreements

Conagra Brands also taps into revenue through licensing and partnership agreements. A prime example is their ongoing collaboration with Dolly Parton, which saw an expansion in 2024 with new product lines bearing her name. This strategy leverages the strong brand equity and public appeal of well-known personalities to introduce and market a variety of Conagra's food offerings.

These agreements allow Conagra to extend its brand reach and create new revenue streams without necessarily bearing the full cost and risk of developing entirely new product categories from scratch. The success of such partnerships is often tied to the alignment of brand values and the ability to create authentic consumer connections.

- Licensing Agreements: Conagra generates revenue by allowing other companies or individuals to use its brand names or intellectual property on specific products in exchange for royalties or fees.

- Partnership Expansion: The expanded partnership with Dolly Parton in 2024 demonstrates a strategy to leverage celebrity endorsements for new product launches, driving sales through association.

- Brand Extension: These agreements facilitate brand extension into new product categories, reaching a wider consumer base and diversifying Conagra's revenue sources beyond its core offerings.

Conagra Brands' revenue streams are diverse, primarily driven by the sale of branded food products across various retail channels, including grocery stores and mass merchandisers. The company also generates significant income from producing private label goods for retailers, catering to the demand for store-brand options. Furthermore, Conagra serves the foodservice sector, supplying institutional clients like restaurants and cafeterias, and increasingly utilizes e-commerce and direct-to-consumer platforms to reach a wider online audience.

In fiscal year 2024, Conagra Brands reported net sales of $11.4 billion, showcasing the substantial market presence of its diverse product portfolio. The company also actively pursues revenue through licensing and strategic partnerships, such as its collaborations with well-known personalities, which help extend brand reach and introduce new product lines.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Branded Food Products (Retail) | Sales of Conagra's own brands to consumers via grocery and mass retail channels. | Core revenue driver, significant portion of $11.4 billion net sales. |

| Private Label Products | Manufacturing store-brand food items for various retailers. | Contributes substantially to overall sales mix. |

| Foodservice Sales | Supplying food products to restaurants, schools, hospitals, and other institutions. | Key segment for reaching business and institutional customers. |

| E-commerce & DTC | Sales through online marketplaces and Conagra's direct-to-consumer platforms. | Growing segment, capitalizing on online shopping trends. |

| Licensing & Partnerships | Revenue from brand licensing and collaborations, like with Dolly Parton. | Expands brand reach and creates new product revenue streams. |

Business Model Canvas Data Sources

The Conagra Brands Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer food trends, and competitive analysis of the packaged goods industry. These sources provide a comprehensive view of customer needs, market opportunities, and operational realities.