Conagra Brands Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conagra Brands Bundle

Conagra Brands masterfully crafts its product portfolio, from iconic frozen meals to pantry staples, ensuring broad consumer appeal. Their pricing strategies balance accessibility with perceived value, while their extensive distribution network places their brands within reach of nearly every household. Want to uncover the specific promotional tactics that amplify their market presence and drive consumer loyalty?

Dive deeper into Conagra Brands' strategic brilliance by exploring their complete 4Ps Marketing Mix Analysis. This comprehensive report details their product innovation, pricing architecture, channel strategy, and communication mix, offering actionable insights for your own business planning or academic research.

Product

Conagra Brands showcases a robust and diverse product portfolio, encompassing everything from convenient frozen meals and popular snacks to essential condiments and complete meal solutions. This breadth allows them to cater to a wide range of consumer needs and preferences across various food categories.

The company’s commitment to innovation is a cornerstone of its strategy, ensuring its offerings remain relevant and competitive. In 2024, Conagra continued to invest in product development, aiming to align with evolving consumer tastes, such as the growing demand for plant-based options and healthier ingredient profiles.

Conagra Brands is actively reshaping its product offerings to cater to the growing consumer demand for healthier choices. This strategic shift is evident in their commitment to modernizing their portfolio, with a particular focus on ingredient transparency and nutritional improvements.

A significant step in this direction is Conagra's goal to eliminate certified Food, Drug & Cosmetic colors (FD&C colors) from its entire U.S. frozen product lineup by the end of 2025. This move directly addresses consumer concerns about artificial ingredients.

This initiative is a cornerstone of Conagra's broader strategy to support consumer health and wellness aspirations. The company is increasingly emphasizing plant-based and gluten-free options, alongside efforts to reduce sodium and sugar content across various brands.

Conagra Brands is actively pursuing sustainable packaging, aiming to make 100% of its current plastic packaging renewable, recyclable, or compostable by 2025. This commitment reflects a growing consumer demand for eco-friendly products and aligns with Conagra's broader environmental, social, and governance (ESG) goals. For instance, in fiscal year 2023, the company reported progress in reducing virgin plastic use, though specific quantitative data on the percentage of packaging meeting these criteria is still being finalized for the 2024-2025 period.

Key to this strategy is the development of innovative plant-based packaging solutions, offering alternatives to traditional petroleum-based plastics. Furthermore, Conagra is standardizing the inclusion of How2Recycle labels across its product lines. This initiative empowers consumers with clear disposal instructions, fostering greater participation in recycling programs and contributing to a more circular economy. The company's investment in these areas is seen as crucial for long-term brand value and market competitiveness.

Responding to Consumer Preferences

Conagra Brands' innovation strategy is deeply rooted in understanding what consumers want, prioritizing convenience, affordability, and nutrition. This focus is evident in their product development, aiming to meet evolving dietary needs and lifestyle choices.

The company actively responds to significant market trends. For instance, Conagra has expanded its offerings to include plant-based and gluten-free options, tapping into growing consumer demand for these categories. They are also addressing the increasing importance of sustainability and ethical sourcing in their product lines.

- Convenience and Affordability: Conagra continues to develop ready-to-eat meals and snacks that fit busy schedules and budget-conscious consumers.

- Health and Nutrition: Product lines are being enhanced with healthier ingredients and nutritional information clearly communicated to consumers.

- Plant-Based Growth: In 2023, the plant-based food market saw continued expansion, with Conagra introducing new items like Gardein Ultimate Plant-Based Burgers.

- Sustainability Focus: The company is increasing its use of sustainable packaging and highlighting responsibly sourced ingredients across its brands.

Portfolio Optimization through Divestitures

Conagra Brands is actively refining its product portfolio by divesting brands that are not central to its long-term growth strategy. This strategic move allows the company to channel investment and management focus towards its most promising and profitable offerings. For instance, in fiscal year 2024, Conagra completed the divestiture of its legacy frozen seafood business, including brands like Van de Kamp's and Mrs. Paul's, which had been underperforming. This aligns with their objective to bolster resources for brands demonstrating stronger market potential and higher margins.

The divestiture strategy enables Conagra to concentrate on its core, high-growth segments. Key brands such as Healthy Choice, Birds Eye, and Marie Callender's are slated to receive increased attention and investment. This focus is crucial for driving innovation and market share gains in categories where Conagra sees significant opportunity. The company's fiscal year 2024 results indicated a continued commitment to this strategy, with reported net sales from continuing operations reflecting this portfolio adjustment.

Conagra's portfolio optimization through divestitures is a key component of its overall marketing strategy. By shedding less profitable or non-core assets, the company aims to improve its financial performance and strengthen its market position. This approach is supported by data showing that companies with more focused portfolios often exhibit higher profitability and better stock performance. For example, Conagra's strategic review process identified specific brands for divestiture to enhance overall operational efficiency and shareholder value.

- Portfolio Focus: Divesting brands like Van de Kamp's and Mrs. Paul's to concentrate on high-growth segments.

- Resource Allocation: Directing capital and management expertise to core brands such as Healthy Choice and Birds Eye.

- Financial Impact: Aiming to improve overall profitability and operational efficiency through strategic asset management.

- Market Position: Strengthening market share and competitive advantage in key consumer food categories.

Conagra Brands' product strategy centers on a diverse portfolio that balances established favorites with an increasing focus on health, convenience, and plant-based alternatives. The company is actively streamlining its offerings through divestitures, sharpening its focus on high-growth segments and core brands like Healthy Choice and Birds Eye. This strategic pruning, exemplified by the 2024 divestiture of its legacy frozen seafood business, aims to enhance profitability and market competitiveness.

Conagra is committed to aligning its products with evolving consumer demands, particularly the push for healthier ingredients and transparency. A notable initiative is the planned elimination of FD&C colors from its U.S. frozen product lineup by the end of 2025, directly responding to consumer preferences for cleaner labels. This aligns with their broader efforts to reduce sodium and sugar, and expand plant-based and gluten-free options.

Sustainability is also a key product pillar, with Conagra targeting 100% of its plastic packaging to be renewable, recyclable, or compostable by 2025. This includes developing innovative plant-based packaging and standardizing How2Recycle labels to aid consumer disposal. These product-level sustainability efforts are crucial for maintaining brand relevance and meeting ESG goals.

| Product Strategy Focus | Key Initiatives/Examples | Target Year |

| Portfolio Optimization | Divestiture of legacy frozen seafood business (Van de Kamp's, Mrs. Paul's) | FY2024 |

| Health & Nutrition | Elimination of FD&C colors from U.S. frozen products; reduced sodium/sugar | End of 2025 |

| Plant-Based Expansion | Introduction of new plant-based items (e.g., Gardein Ultimate Plant-Based Burgers) | Ongoing (FY2023 noted expansion) |

| Sustainable Packaging | 100% renewable, recyclable, or compostable plastic packaging; How2Recycle labels | 2025 |

What is included in the product

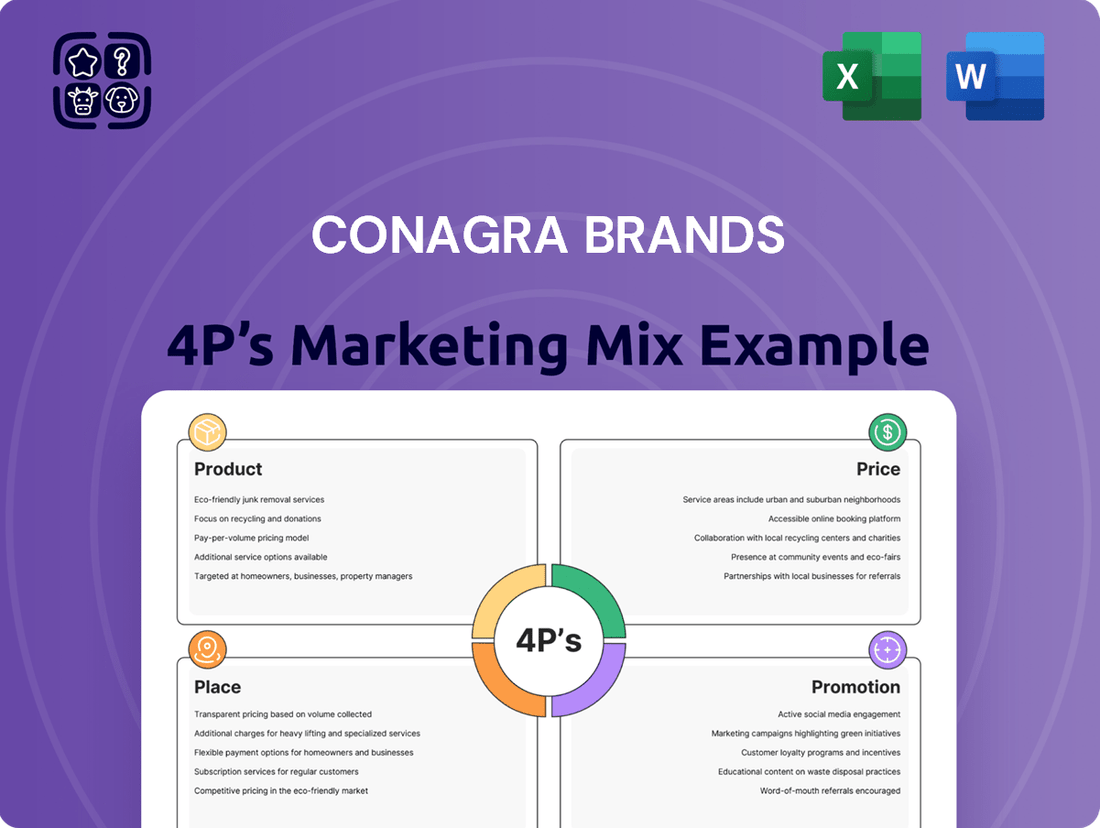

This analysis provides a comprehensive examination of Conagra Brands' marketing strategies, dissecting their Product portfolio, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It offers a deep dive into how Conagra Brands leverages its 4Ps to maintain market position and drive consumer engagement.

Streamlines Conagra Brands' 4P marketing strategy into a clear, actionable framework, alleviating the complexity of market analysis for faster decision-making.

Place

Conagra Brands leverages an extensive retail distribution network, reaching consumers through a wide array of channels. This includes major players like chain and wholesale grocery stores, alongside value-oriented retailers, cooperatives, and club stores. In 2024, Conagra's commitment to broad accessibility was evident as they continued to strengthen relationships with these diverse retail partners, ensuring their brands are readily available on shelves across North America.

The company's distribution strategy also encompasses pharmacy and drug stores, as well as convenience stores, further broadening their market penetration. This multi-channel approach is critical for a company with a diverse product portfolio, as it caters to different shopping habits and occasions. By maintaining a strong presence in these varied retail environments, Conagra aims to maximize product visibility and sales opportunities throughout 2025.

Conagra Brands extends its reach far beyond grocery aisles, actively serving a diverse foodservice sector. This includes supplying everything from ingredients to prepared meals for restaurants, bars, schools, healthcare facilities, and even government agencies. This broad foodservice presence allows Conagra to tap into both at-home and away-from-home eating trends, a strategy that proved resilient. For instance, in fiscal year 2023, Conagra reported that its foodservice segment experienced a notable increase in sales, reflecting the ongoing demand for convenient and quality food solutions across various out-of-home channels.

Conagra Brands is significantly expanding its e-commerce footprint, making its diverse product portfolio readily accessible on major online retail platforms and direct-to-consumer channels. This strategic move caters to the growing segment of digitally native consumers and embraces the accelerated shift towards online grocery purchases, a trend that saw significant acceleration in 2024.

By actively engaging with digital marketplaces, Conagra aims to capture a larger share of the online grocery market, which analysts project will continue its robust growth trajectory through 2025. This digital presence allows the company to connect with a wider audience, particularly younger demographics who increasingly rely on online shopping for their household needs.

Strategic Customer Relationships

Conagra Brands places significant emphasis on its strategic customer relationships, with Walmart, Inc. and its affiliates being a cornerstone of its distribution network. This key partnership represents a substantial portion of Conagra's consolidated net sales, highlighting the critical role major retailers play in the company's go-to-market strategy. The company's ability to maintain and leverage these strong relationships is vital for ensuring product visibility and accessibility across a vast consumer base.

The ongoing collaboration with major retailers like Walmart is essential for Conagra Brands' success. For instance, in fiscal year 2023, Conagra Brands reported that net sales to Walmart represented approximately 17% of its total net sales. This concentration underscores the need for Conagra to continually adapt its offerings and supply chain to meet the demands of such significant partners.

- Key Retailer Dependence: Walmart accounts for a significant percentage of Conagra's net sales, demonstrating the importance of strong retail partnerships.

- Distribution Strategy: The relationship with Walmart is integral to Conagra's overall distribution and market penetration efforts.

- Fiscal Year 2023 Data: Walmart represented about 17% of Conagra's total net sales, underscoring its crucial role.

Supply Chain Management and Infrastructure Investment

Conagra Brands places a strong emphasis on supply chain management and infrastructure investment to ensure its products are readily available to consumers. This involves meticulous logistics and inventory control, particularly crucial for popular items. For instance, the company is actively upgrading its facilities and forging collaborations to bolster production and mitigate potential disruptions, especially in high-demand sectors like frozen vegetables and chicken meals.

These investments are designed to streamline operations and enhance resilience. Conagra's commitment to this area is evident in its ongoing efforts to modernize its network, ensuring efficiency from sourcing raw materials to delivering finished goods. The company understands that a robust supply chain is fundamental to meeting consumer needs and maintaining a competitive edge.

- Investment in Automation: Conagra is investing in automated warehousing and distribution centers to improve speed and accuracy in order fulfillment.

- Strategic Partnerships: The company is forming alliances with logistics providers and technology firms to optimize transportation routes and inventory visibility.

- Capacity Expansion: Infrastructure upgrades include expanding production lines for key product categories, such as frozen vegetables, to meet growing demand.

- Resilience Planning: Conagra is implementing strategies to diversify suppliers and build buffer inventory for critical components to counter potential supply chain shocks.

Conagra Brands' "Place" strategy focuses on ensuring its products are where consumers shop, both physically and digitally. This includes a robust presence in traditional grocery stores, mass merchandisers like Walmart, and even convenience stores, aiming for maximum accessibility. The company is also aggressively expanding its e-commerce capabilities, recognizing the significant shift towards online grocery shopping, a trend that continued its strong growth through 2024 and is projected to expand further into 2025.

The company's distribution network is extensive, covering a wide range of retail formats across North America. This multi-channel approach is crucial for reaching diverse consumer segments and catering to various shopping occasions. Conagra's strategic partnerships, particularly with major retailers, are fundamental to its market penetration, ensuring its brands are consistently available on shelves and online.

Furthermore, Conagra Brands actively serves the foodservice sector, supplying ingredients and prepared meals to restaurants, schools, and healthcare facilities. This dual focus on both at-home and away-from-home consumption provides a resilient market presence. The company's investment in supply chain and infrastructure, including automation and strategic partnerships, underpins its ability to meet demand and maintain product availability across all these channels.

| Distribution Channel | Key Characteristics | 2024/2025 Focus |

|---|---|---|

| Traditional Grocery & Mass Merchandisers | Extensive reach, high volume sales, strong partnerships (e.g., Walmart) | Strengthening relationships, ensuring shelf presence, leveraging data analytics for promotions |

| Convenience & Drug Stores | Impulse purchases, smaller format, immediate need fulfillment | Optimizing product assortment for smaller footprints, targeted promotions |

| E-commerce (Online Retailers & DTC) | Growing consumer preference, convenience, expanded reach for niche products | Investing in digital marketing, optimizing online product listings, enhancing direct-to-consumer capabilities |

| Foodservice | B2B sales, ingredients to prepared meals, diverse client base (restaurants, institutions) | Expanding product offerings for foodservice, focusing on convenience and quality solutions |

Preview the Actual Deliverable

Conagra Brands 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Conagra Brands 4P's Marketing Mix Analysis provides a detailed breakdown of their strategies. You'll gain immediate access to the full, ready-to-use content upon completing your order.

Promotion

Conagra Brands continues to leverage traditional advertising channels, including television, radio, and print, to support its flagship brands. These established platforms are crucial for reaching a wide audience and reinforcing brand legacy. For instance, campaigns for Orville Redenbacher's popcorn and Hunt's tomatoes often emphasize decades of quality and taste, aiming to connect with consumers who value heritage and reliability.

Conagra Brands is actively boosting its digital marketing spend, particularly on social media channels like Instagram, TikTok, and YouTube. This strategic move targets younger demographics with engaging, often humorous, content, exemplified by their successful Slim Jim campaigns.

In 2024, Conagra Brands reported a notable increase in digital advertising, with a significant portion allocated to social media platforms to foster direct consumer interaction and brand loyalty among tech-native audiences.

The company's social media strategy focuses on creating shareable, entertaining content designed to resonate with Gen Z and Millennials, driving both brand awareness and product trial, as seen in the viral success of their recent TikTok initiatives.

Conagra Brands heavily relies on data-driven marketing and consumer insights to sharpen its advertising and boost customer engagement. This approach allows them to understand what resonates most with their audience, making their marketing spend more effective.

By partnering with analytics firms, Conagra refines its targeting strategies. This collaboration helps them reach the right consumers with the right message, a crucial factor in today's competitive market. For instance, in fiscal year 2024, Conagra reported a significant increase in digital marketing effectiveness, directly attributing it to enhanced consumer segmentation.

These optimized targeting efforts translate into tangible improvements in campaign performance. Conagra has seen higher attribute awareness for its brands and a notable uplift in purchase intent among targeted demographics. This data-centric approach ensures their marketing dollars work harder to drive sales and brand loyalty.

Brand-Building Investments

Conagra Brands is strategically investing in brand-building initiatives, encompassing advertising, innovation, and merchandising, to foster growth and capture consumer interest. This robust plan aims to create sustained momentum for its portfolio. For instance, in fiscal year 2024, Conagra reported a net sales increase of 5.4% to $12.3 billion, underscoring the impact of such strategic investments.

These brand-building efforts are fundamental to driving sales volumes and positioning Conagra for long-term success in a competitive market. The company's focus on innovation, such as introducing new product lines or reformulating existing ones, directly supports this objective. In Q3 FY24, Conagra's organic sales saw a 5.2% increase, reflecting positive consumer response to its brand investments.

- Advertising: Increased media spend to enhance brand visibility and recall.

- Innovation: Launching new products and line extensions to meet evolving consumer preferences.

- Merchandising: Strategic in-store promotions and placement to drive trial and purchase.

- Consumer Demand: Aligning marketing and product development with current consumer trends and needs.

Public Relations and Corporate Citizenship

Conagra Brands actively engages in public relations as a key promotional tool, notably through its annual Citizenship Report. This report details the company's efforts in areas like good food, responsible sourcing, environmental stewardship, and community support, underscoring its dedication to corporate social responsibility.

In its 2023 Citizenship Report, Conagra Brands highlighted specific achievements, such as a 19% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline. The company also reported that 97% of its key raw materials were sourced responsibly in fiscal year 2023, demonstrating tangible progress in its sustainability commitments.

- Environmental Impact: Conagra aims to reduce its environmental footprint, with progress reported on greenhouse gas emission reductions.

- Responsible Sourcing: The company emphasizes responsible sourcing of key agricultural ingredients, a critical aspect of its supply chain.

- Community Engagement: Conagra's initiatives often focus on strengthening communities through various programs and partnerships.

- Transparency: The annual Citizenship Report serves as a primary vehicle for communicating these efforts and progress to stakeholders.

Conagra Brands utilizes a multi-faceted promotional strategy, blending traditional and digital advertising to reach diverse consumer segments. Their approach emphasizes brand heritage for established products like Hunt's, while employing engaging social media campaigns, particularly on platforms like TikTok, to connect with younger demographics. This digital push, with increased spend in 2024, aims to foster direct interaction and brand loyalty among tech-savvy audiences.

Data-driven insights are central to Conagra's promotional effectiveness, allowing for refined targeting and optimized marketing spend. This focus on consumer segmentation, highlighted by a significant increase in digital marketing effectiveness in fiscal year 2024, translates into improved campaign performance, including higher attribute awareness and purchase intent among key demographics.

Beyond advertising, Conagra invests in comprehensive brand-building initiatives that include product innovation and strategic merchandising. These efforts, coupled with a focus on aligning with current consumer trends, are designed to drive sales volumes and ensure long-term market positioning. The company reported a 5.4% net sales increase to $12.3 billion in fiscal year 2024, demonstrating the impact of these integrated strategies.

Public relations, particularly through their annual Citizenship Report, plays a vital role in Conagra's promotion by showcasing their commitment to corporate social responsibility. This includes tangible progress in environmental stewardship, such as a 19% reduction in Scope 1 and 2 greenhouse gas emissions by 2023, and responsible sourcing practices, reinforcing brand reputation and consumer trust.

| Promotional Tactic | Key Focus | 2024/2025 Data/Observation | Impact |

|---|---|---|---|

| Traditional Advertising | Brand legacy, wide reach | Continued use for brands like Orville Redenbacher's | Reinforces heritage and reliability |

| Digital Marketing | Younger demographics, engagement | Increased spend in 2024, focus on social media (TikTok, Instagram) | Drives brand awareness and loyalty among Gen Z/Millennials |

| Data-Driven Marketing | Consumer insights, targeting | Enhanced consumer segmentation leading to increased digital marketing effectiveness (FY24) | Improves campaign performance, purchase intent |

| Brand Building | Innovation, merchandising, consumer trends | Net sales increased 5.4% to $12.3 billion (FY24) | Drives sales volumes, market positioning |

| Public Relations | Corporate Social Responsibility | 19% reduction in Scope 1 & 2 GHG emissions (vs. 2019 baseline) by 2023 | Enhances brand reputation and consumer trust |

Price

Conagra Brands employs competitive pricing strategies to ensure its products are attractive and accessible, particularly given the price sensitivity common in the packaged food sector. For instance, during fiscal year 2024, Conagra focused on optimizing its price-to-value equation across its portfolio, a move that resonated with consumers seeking affordability without compromising quality.

The company’s approach balances the perceived value of its brands with their market positioning. This often involves strategic promotional activities and tiered product offerings to cater to different consumer segments and price points, a tactic that has historically supported market share. For example, in Q3 FY24, Conagra reported a net sales increase, partly attributed to effective pricing and promotional strategies that enhanced consumer purchasing intent.

Conagra Brands' pricing strategy is directly impacted by the volatile costs of key commodities like meat, eggs, cocoa, and sugar. For instance, in early 2024, cocoa prices surged significantly, impacting confectionery and baking ingredients.

To navigate these market shifts, Conagra has signaled a willingness to implement targeted price adjustments. This approach aims to mitigate the impact of rising ingredient expenses, especially during periods of widespread inflation, ensuring profitability without alienating consumers with broad price hikes.

Economic pressures have significantly amplified consumer value-seeking behaviors, prompting Conagra Brands to strategically adjust its pricing. This often translates to more frequent price cuts and promotional offers across its product portfolio, a direct response to consumers prioritizing affordability. For instance, during fiscal year 2024, Conagra observed continued consumer focus on value, influencing their promotional cadence.

Adjusted Earnings and Operating Margin Outlook

Conagra Brands has updated its financial outlook for fiscal year 2025, projecting a decrease in organic net sales. This adjustment is a direct response to ongoing supply chain disruptions and shifts in foreign exchange rates, which are impacting the company's top-line performance.

The company's operating margin forecast has also been revised. This recalibration considers the need for increased promotional spending to maintain market share and drive sales volumes in a competitive environment. Conagra is navigating these headwinds to optimize profitability.

Key financial guidance points for fiscal 2025 include:

- Organic Net Sales: Expected to decline in the low-single-digit percentage range.

- Adjusted Operating Margin: Projected to be between 15.5% and 16.5%.

- Supply Chain and FX Impacts: These factors are cited as primary drivers for the adjusted guidance.

Strategic Investments and Long-Term Financial Performance

Conagra Brands is strategically investing in its future, even with current price adjustments. These investments are focused on innovation and enhancing its supply chain to ensure long-term growth and market position. For instance, in fiscal year 2024, Conagra reported a net sales increase of 5.2% to $11.4 billion, demonstrating resilience and a commitment to its strategic goals.

The company's dedication to product development and infrastructure upgrades is designed to bolster its competitive edge. These efforts are expected to translate into stronger pricing power over time, benefiting its overall financial performance. Conagra's focus remains on creating value for shareholders through sustained operational improvements and market leadership.

- Innovation Investment: Continued focus on new product development and line extensions to meet evolving consumer demands.

- Supply Chain Enhancement: Investments in efficiency and resilience to mitigate disruptions and control costs.

- Infrastructure Upgrades: Modernizing manufacturing facilities to improve productivity and reduce operational expenses.

- Long-Term Value Creation: Strategic capital allocation aimed at driving sustainable revenue growth and profitability.

Conagra Brands navigates a dynamic pricing environment, balancing consumer affordability with rising input costs. The company's strategy involves targeted price adjustments rather than broad increases, aiming to maintain value perception. This approach is crucial in the price-sensitive packaged food market, especially given economic pressures that amplify consumer value-seeking behavior.

For fiscal year 2025, Conagra anticipates a low-single-digit decline in organic net sales, influenced by supply chain issues and foreign exchange rates. This outlook reflects an increased need for promotional spending to preserve market share amid competitive pressures. The company's operating margin is projected between 15.5% and 16.5% for FY25.

| Metric | FY24 (Actual) | FY25 (Projected) |

|---|---|---|

| Organic Net Sales | $11.4 billion (5.2% increase) | Low-single-digit decline |

| Adjusted Operating Margin | N/A (Focus on optimization) | 15.5% - 16.5% |

4P's Marketing Mix Analysis Data Sources

Our Conagra Brands 4P's analysis is grounded in a comprehensive review of company disclosures, including SEC filings and investor reports, alongside direct observation of product offerings and pricing strategies across major retail channels. We also incorporate data from industry market research and competitive intelligence platforms to capture distribution and promotional activities.