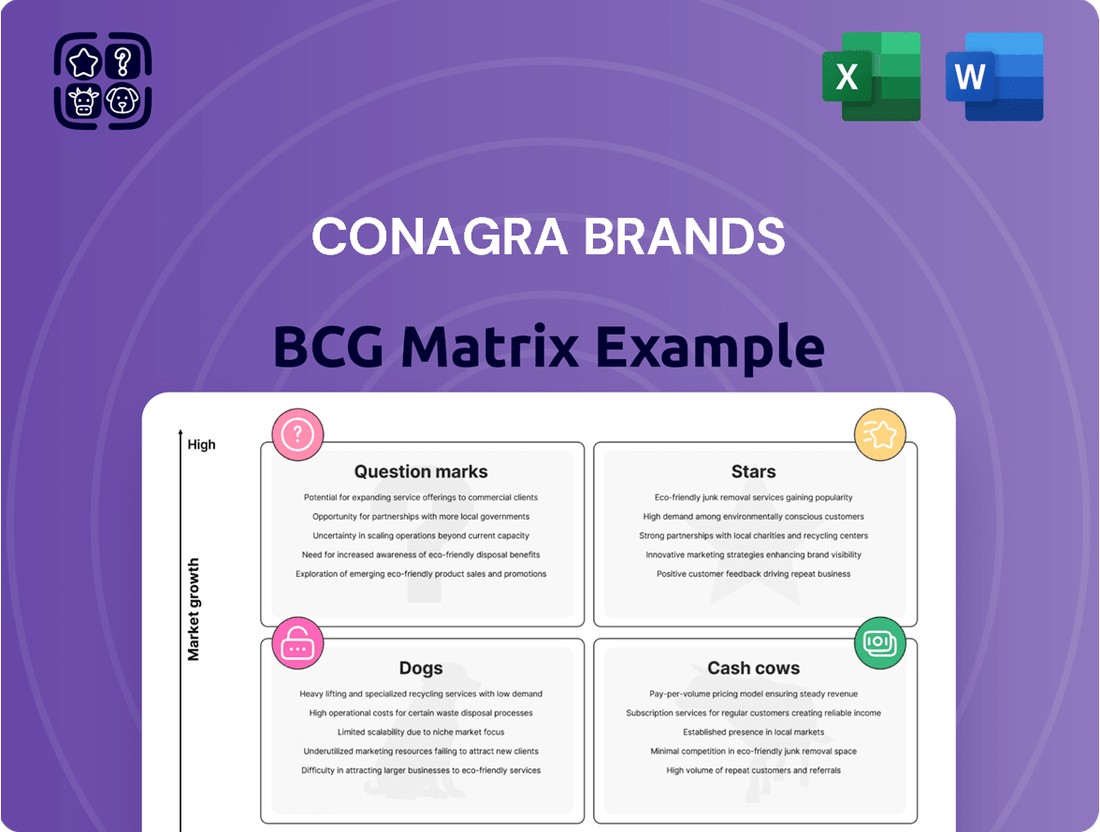

Conagra Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Conagra Brands Bundle

Conagra Brands' diverse portfolio includes established brands that likely function as Cash Cows, generating consistent revenue, alongside newer or niche products that may be Question Marks requiring strategic investment. Understanding which of their iconic brands are Stars poised for growth and which might be Dogs needing divestment is crucial for any investor.

Dive deeper into Conagra Brands' BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Conagra Brands' frozen single-serve meals, including popular names like Healthy Choice, Marie Callender's, and P.F. Chang's Home Menu, are performing exceptionally well. These brands are capturing more market share within the expanding frozen food sector. In fiscal year 2024, Conagra reported continued strength in its frozen meals segment, driven by innovation and consumer demand for convenient, healthier, and globally inspired options.

Slim Jim, a powerhouse in the meat snack arena, stands as America's leading meat stick, capitalizing on a market segment experiencing robust expansion. The bite-sized meat snack sub-category, in particular, is showing the most impressive growth rates.

Conagra Brands' entire snack division, with Slim Jim as a key player, consistently demonstrates impressive volume sales increases. This performance underscores Slim Jim's significant market share within a high-growth industry, positioning it favorably within the BCG Matrix as a potential star.

Gardein is a significant player in the rapidly expanding plant-based food sector. This market is experiencing robust growth, with projections indicating it will reach substantial value, driven by a strong compound annual growth rate.

Conagra Brands is strategically investing in Gardein's future. They are actively broadening the product portfolio, introducing innovative items like plant-based meat substitutes and frozen vegan meals. This focus positions Gardein as a key contender in the increasingly popular plant-based food industry.

Birds Eye Innovative Frozen Vegetables

Birds Eye's innovative frozen vegetable lines, focusing on health trends like gut-friendly and portion-controlled options, are demonstrating robust growth within Conagra Brands' portfolio. This segment is key to Birds Eye's market position.

Conagra Brands is actively modernizing the Birds Eye brand. A significant part of this strategy involves removing artificial colors and flavors, a move directly responding to consumer demand for cleaner labels and healthier choices. This aligns with market shifts favoring transparency and natural ingredients.

- Growth in Innovative Products: Birds Eye's newer, health-focused offerings are seeing significant uptake, indicating a successful pivot to meet evolving consumer preferences.

- Portfolio Modernization: Conagra's commitment to removing artificial ingredients from Birds Eye products addresses the growing demand for clean-label foods.

- Market Responsiveness: The brand's adaptation to 'modern health' trends, such as gut-friendly options, positions it favorably in a competitive frozen food market.

Alexia Premium Frozen Sides

Alexia Premium Frozen Sides represents a strong performer within Conagra Brands' portfolio, fitting the description of a Star in the BCG Matrix. The brand has demonstrated robust volume sales growth, particularly in the premium frozen sides and vegetable categories. This success points to a significant market share within a growing and attractive segment of the frozen food industry, catering to consumers looking for more sophisticated home dining options.

In 2024, the premium frozen food market continued its upward trajectory, driven by convenience and evolving consumer preferences for higher-quality, ready-to-prepare meals. Alexia's positioning in this space has allowed it to capitalize on these trends.

- Strong Volume Growth: Alexia has experienced notable increases in the volume of its premium frozen sides and vegetables sold.

- Growing Market Niche: The brand operates within a segment of the frozen food market that is expanding due to consumer demand for elevated at-home dining.

- High Market Share: Alexia's performance suggests it holds a considerable share of this desirable niche.

- Brand Appeal: The brand resonates with consumers seeking convenient yet high-quality meal solutions.

Stars in Conagra Brands' portfolio, like Healthy Choice and Marie Callender's frozen meals, are experiencing robust growth and hold significant market share in expanding categories. Slim Jim continues its dominance in the rapidly growing meat snack market, demonstrating strong volume sales. Gardein is a key player in the burgeoning plant-based food sector, with Conagra investing in its expansion and innovation.

What is included in the product

This BCG Matrix overview provides tailored analysis for Conagra Brands' product portfolio, highlighting which units to invest in, hold, or divest.

Conagra Brands' BCG Matrix offers a clear, one-page overview of its business units, alleviating the pain of strategic uncertainty by identifying Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Duncan Hines, a staple in the baking aisle, operates within a mature market segment. This maturity means the brand generates substantial, consistent cash flow, fitting the profile of a cash cow. Conagra Brands benefits from Duncan Hines' established market presence and predictable revenue streams, requiring minimal reinvestment to maintain its position.

Reddi-wip, a staple in the whipped topping market, is a prime example of a Cash Cow for Conagra Brands. Its established dominance in a mature category means it generates significant, reliable income with minimal investment. This strong market position, built on decades of brand recognition and consistent consumer preference, allows Conagra to harvest profits without needing substantial growth initiatives.

Orville Redenbacher's Popcorn, a cornerstone of Conagra Brands' portfolio, exemplifies a classic cash cow. Its dominant position in the mature popcorn market, supported by a deeply entrenched consumer base, ensures consistent and substantial revenue generation. In 2024, Conagra Brands reported strong performance in its snacks segment, where Orville Redenbacher's plays a significant role, contributing to the company's overall profitability.

Traditional Banquet Frozen Meals

Traditional Banquet frozen meals likely hold a significant market share within the mature segment of the frozen food aisle. These established products are known for their consistent sales performance, contributing steady cash flow to Conagra Brands. For instance, Conagra's fiscal year 2023 saw its Frozen Foods segment, which includes Banquet, generate approximately $1.9 billion in net sales, demonstrating the enduring appeal of these core offerings.

These offerings are considered cash cows because they require minimal investment to maintain their market position while generating substantial profits. The brand's long-standing presence and consumer familiarity allow for efficient production and distribution.

- High Market Share: Traditional Banquet frozen meals are a staple in many households, indicating a dominant presence in their category.

- Mature Market Segment: The overall frozen meal market, while large, experiences slower growth compared to emerging food trends.

- Stable Cash Generation: These products provide predictable and reliable income streams for Conagra Brands.

- Low Investment Needs: Unlike innovative products, these mature offerings require less capital for marketing and development to sustain their performance.

Hunt's Ketchup & Tomato Products

Hunt's Ketchup & Tomato Products, a cornerstone of Conagra Brands' portfolio, exemplifies a classic Cash Cow. This brand operates within mature markets, specifically condiments and canned tomato goods, where it has historically commanded a substantial market share.

The enduring presence and consumer loyalty associated with Hunt's translate into a predictable and steady stream of revenue for Conagra. These products are essentially staples, meaning they require relatively low investment to maintain their market position, as opposed to needing significant capital for expansion or new product development.

For instance, in fiscal year 2024, Conagra Brands reported that its Tomato segment, which heavily features Hunt's, continued to be a reliable contributor to overall sales. While specific figures for Hunt's alone are not always broken out, the stability of the condiment category, where Hunt's is a leader, is well-documented.

- Brand Strength: Hunt's benefits from decades of brand recognition and consumer trust in the condiment and tomato product aisles.

- Market Position: It holds a significant share in mature, stable markets, ensuring consistent demand.

- Cash Flow Generation: The brand reliably generates substantial cash flow with minimal reinvestment needs.

- Strategic Role: As a Cash Cow, Hunt's funds other Conagra Brands initiatives, including those in growth categories.

Conagra Brands' portfolio includes several established brands that function as cash cows, generating consistent profits with low reinvestment needs. These brands benefit from high market share in mature product categories, providing stable revenue streams that can fund growth initiatives in other areas of the company. Their predictable performance makes them vital to Conagra's overall financial health.

| Brand | Category | Role in Conagra's Portfolio | Market Maturity | Cash Flow Generation |

| Duncan Hines | Baking Mixes | Cash Cow | Mature | Substantial and consistent |

| Reddi-wip | Whipped Topping | Cash Cow | Mature | Significant and reliable |

| Orville Redenbacher's | Popcorn | Cash Cow | Mature | Consistent and substantial |

| Banquet | Frozen Meals | Cash Cow | Mature | Predictable and steady |

| Hunt's | Ketchup & Tomato Products | Cash Cow | Mature | Predictable and steady |

Full Transparency, Always

Conagra Brands BCG Matrix

The BCG Matrix analysis of Conagra Brands you are currently previewing is the complete, unedited document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the fully populated and professionally formatted strategic assessment ready for your immediate use.

Rest assured, the Conagra Brands BCG Matrix you see here is the exact file that will be delivered to you upon purchase. It's a comprehensive, ready-to-deploy strategic tool, meticulously prepared for clarity and immediate application in your business planning or competitive analysis.

Dogs

Conagra Brands divested its shelf-stable Chef Boyardee brand in May 2025. This move generated approximately $450 million in net sales for fiscal year 2024.

The divestiture suggests Chef Boyardee was viewed as a non-core asset with limited growth potential or market standing. This strategic decision aimed to streamline Conagra's portfolio and manage its debt obligations effectively.

Mrs. Paul's and Van de Kamp's, once prominent seafood brands, were divested by Conagra Brands in June 2025. This strategic move suggests these brands were likely classified as Dogs within Conagra's portfolio.

Their divestiture points to probable underperformance, a low market share in a mature or declining segment, or a misalignment with Conagra's evolving business strategy. For instance, the frozen seafood market, while stable, has seen modest growth compared to other food categories, making it challenging for brands to achieve significant expansion.

Hebrew National, a brand within Conagra Brands' portfolio, is currently classified as a Dog in the BCG Matrix. This designation stems from its recent performance, which saw a substantial 47% revenue decline in the first quarter of fiscal year 2025.

This sharp drop was attributed to significant manufacturing disruptions, which directly hampered its market share and future growth potential. The brand now faces considerable challenges, necessitating a focused turnaround strategy or a potential re-evaluation of its long-term place within Conagra's offerings.

Agro Tech Foods

Conagra Brands' divestment of its stake in Agro Tech Foods in late 2023 signals a strategic portfolio adjustment. This move suggests Agro Tech Foods was likely categorized as a 'Dog' in the BCG Matrix, characterized by low market growth and low relative market share. Such divestitures are common for large corporations seeking to shed underperforming or non-core assets to enhance overall financial performance and focus on higher-potential business units.

The sale of Agro Tech Foods aligns with Conagra's broader strategy to streamline its operations and concentrate on its core brands. Companies often divest 'Dogs' to free up capital and management attention for investments in 'Stars' or 'Question Marks' that offer greater growth prospects. This strategic pruning can lead to improved profitability and a more efficient allocation of resources.

- Divestment Rationale: Agro Tech Foods likely represented a low-growth, low-market-share asset within Conagra's portfolio, fitting the 'Dog' category in a BCG Matrix analysis.

- Strategic Alignment: The sale supports Conagra Brands' objective to simplify its business structure and concentrate on core competencies and brands with higher growth potential.

- Financial Efficiency: Shedding non-core or underperforming assets like Agro Tech Foods can improve overall financial efficiency and resource allocation for the parent company.

- Portfolio Optimization: Divestitures are a key tool for portfolio management, allowing companies to exit markets or product lines that no longer align with their long-term vision or competitive advantages.

Underperforming Legacy Grocery Brands

Conagra Brands has seen its overall organic net sales dip, with a notable slowdown in its grocery segment, even as its snacking business performs well. This indicates that some of Conagra's older, established grocery brands are likely struggling to keep pace in a competitive market, exhibiting characteristics of Question Marks or potentially Dogs in the BCG Matrix.

These underperforming legacy brands probably face low market share and low growth rates. For example, Conagra's fiscal year 2024 results showed a decline in its Grocery & Snacks segment's net sales, highlighting the challenges faced by many of its traditional offerings.

- Low Market Share: These brands are likely losing ground to newer, more innovative competitors or private label options.

- Low Growth: The overall market for these specific product categories may be stagnant or declining, further pressuring brand performance.

- Financial Strain: Continued investment in these brands without significant returns could be a drain on Conagra's resources.

- Strategic Review: Conagra may need to consider divestiture, significant revitalization efforts, or discontinuation for these legacy brands.

Conagra Brands has strategically divested several brands, including Mrs. Paul's and Van de Kamp's, which likely fit the 'Dog' category due to modest growth in the frozen seafood market. Hebrew National also falls into this classification, experiencing a significant 47% revenue decline in Q1 FY2025 due to manufacturing disruptions. The divestment of Agro Tech Foods in late 2023 further indicates a portfolio pruning strategy, shedding low-growth, low-market-share assets.

These 'Dog' brands, characterized by low market share and growth, are often divested to streamline operations and focus resources on higher-potential areas. Conagra's overall organic net sales slowdown in its grocery segment, as reported for fiscal year 2024, also points to potential 'Dogs' among its legacy brands struggling against market dynamics.

| Brand | BCG Classification | Recent Performance Indicator | Strategic Action |

| Mrs. Paul's / Van de Kamp's | Dog | Modest growth in frozen seafood market | Divested (June 2025) |

| Hebrew National | Dog | -47% revenue decline (Q1 FY2025) | Facing challenges, potential strategic review |

| Agro Tech Foods | Dog | Low market growth and share | Divested (late 2023) |

Question Marks

Conagra Brands' partnership with Dolly Parton, launched in January 2024, represents a significant foray into the high-growth frozen food sector. This collaboration aims to introduce new retail food items, with a particular emphasis on frozen baked goods and meals.

As a relatively new venture, these Dolly Parton-branded frozen products are positioned as Question Marks within Conagra's BCG Matrix. While the frozen food market is experiencing robust growth, these specific items are still in the process of establishing their market share and brand recognition.

The company is therefore expected to invest heavily in marketing and distribution to support this new product line. Success will depend on their ability to capture consumer interest and build a loyal customer base in a competitive frozen food landscape.

Conagra Brands' 'Future of Frozen Food 2025' report identifies GLP-1 user-focused frozen products as a significant growth avenue. This emerging market segment presents a prime opportunity for Conagra to innovate and capture market share.

The company's current position in this niche is characterized by low market share, necessitating substantial investment to develop and launch new products tailored to the specific dietary needs and preferences of GLP-1 medication users. This strategic focus aligns with evolving consumer health trends and positions Conagra for future expansion in the frozen food sector.

The frozen food sector is experiencing a surge in demand for global flavors, a trend Conagra Brands is actively capitalizing on. Brands such as P.F. Chang's Home Menu and Frontera are being expanded to offer a wider array of international dishes, tapping into consumer interest in diverse culinary experiences.

Emerging global cuisine frozen offerings represent a high-growth segment within the frozen food market. While these newer, more adventurous flavor profiles and formats are attracting significant consumer interest, they likely hold a relatively low initial market share for Conagra. For instance, the global frozen food market was valued at approximately $300 billion in 2023 and is projected to grow, with emerging cuisines being a key driver of this expansion.

Air Fryer Friendly Frozen Foods

The air fryer-friendly frozen food segment is a dynamic and expanding area within the broader frozen food market. By 2024, this niche had already achieved a valuation of $6.1 billion, indicating significant consumer interest and adoption.

For Conagra Brands, introducing new products specifically designed for air fryers places them in a high-growth market. However, success will hinge on substantial investment in marketing and distribution to effectively compete and gain market share.

- Market Growth: The air fryer frozen food segment reached $6.1 billion in 2024.

- Opportunity: New Conagra products optimized for air frying enter a high-growth market.

- Challenge: Significant marketing and distribution investment is crucial for market penetration.

- Strategic Consideration: Balancing innovation with robust go-to-market strategies is key.

New Bites & Minis Frozen Portions

Conagra Brands' New Bites & Minis Frozen Portions likely fall into the "Question Marks" category of the BCG Matrix. This segment has seen robust growth, with consumers increasingly adopting these smaller portions as full meals. For example, the frozen food market in the U.S. was valued at approximately $77.8 billion in 2023, with a notable surge in convenience-oriented products.

Conagra's investment in new product launches within this trending area positions them in a high-growth market. However, these offerings are still in their nascent stages of market penetration. Consequently, significant investment is required to capture a larger market share and establish a dominant presence.

- High Growth Market: The frozen food sector, particularly for convenient, single-serve options, is experiencing accelerated consumer adoption.

- Early Market Penetration: Despite growth, Conagra's bites and minis are still building their market share against established competitors.

- Investment Required: To capitalize on the trend, Conagra needs to invest in marketing, distribution, and product innovation for this segment.

- Potential for Star: Successful penetration could elevate these products to "Stars" if they achieve significant market share in this growing category.

Question Marks represent new product initiatives or market entries that operate in high-growth sectors but currently hold a low market share. Conagra Brands' ventures into areas like Dolly Parton-branded frozen foods, GLP-1 user-focused products, and emerging global cuisines exemplify this category. These segments offer significant future potential, but require substantial investment to build brand awareness and capture market share. Success hinges on effective marketing, distribution, and product differentiation to convert these Question Marks into future Stars.

| Product/Initiative | Market Growth Rate | Relative Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Dolly Parton Frozen Foods | High (Frozen Food Sector) | Low | Question Mark | Marketing & Distribution Investment |

| GLP-1 User Frozen Foods | High (Emerging Health Trend) | Low | Question Mark | Product Development & Market Entry |

| Emerging Global Cuisines | High (Consumer Preference) | Low (Initial Stage) | Question Mark | Product Expansion & Brand Building |

| Air Fryer-Friendly Foods | High ($6.1 Billion by 2024) | Low | Question Mark | Marketing & Distribution Push |

| New Bites & Minis Portions | High (Convenience Trend) | Low | Question Mark | Innovation & Market Penetration |

BCG Matrix Data Sources

Our Conagra Brands BCG Matrix leverages robust data from financial disclosures, market research reports, and internal sales figures to accurately assess product portfolio performance.