Commonwealth Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commonwealth Bank Bundle

Uncover the critical political, economic, and technological forces shaping Commonwealth Bank's strategic landscape. Our PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and identify opportunities. Download the full report now to gain a competitive advantage and make informed decisions.

Political factors

Commonwealth Bank navigates a stringent regulatory landscape in Australia, with key oversight from the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC). Changes in regulations, for instance, those affecting capital adequacy, operational risk management frameworks like CPS 230, and cybersecurity standards under CPS 234, have a direct bearing on the bank's operational efficiency, compliance expenditures, and overall financial performance.

APRA's strategic focus for 2024-25 includes reinforcing capital and liquidity requirements for financial institutions, bolstering operational resilience, and elevating cyber risk mitigation strategies, all of which will shape Commonwealth Bank's strategic planning and investment priorities.

Australia's long-standing political stability provides a bedrock of predictability for Commonwealth Bank (CBA), bolstering investor confidence and ensuring a secure environment for its domestic operations. This consistent policy landscape is crucial for long-term financial planning and risk management.

While Australia enjoys a stable political climate, CBA's international presence means it must remain vigilant. For instance, disruptions in global trade policies or geopolitical tensions in regions where CBA has significant investments, such as Asia, could introduce volatility and impact its overseas asset valuations. As of early 2024, Australia's sovereign credit rating remained strong, reflecting this political stability.

The Australian government is keeping a close eye on major banks, including Commonwealth Bank, focusing on areas like mortgage pricing, the availability of physical branches, cash services, and how transparent they are about fees. This heightened attention is often fueled by public perception when banks announce significant profits while many households are struggling with increased living expenses.

Political pressure is also mounting for banks to fully pass on any interest rate reductions announced by the Reserve Bank of Australia (RBA). For instance, following the RBA's decision to hold the cash rate steady at 4.35% in early 2024, there was immediate public and political expectation for banks to adjust their variable mortgage rates accordingly.

Geopolitical Volatility and Trade Tensions

Commonwealth Bank, like many global institutions, operates within an economic landscape marked by considerable geopolitical volatility and a rise in economic nationalism. These forces directly shape trade policies and international relations, creating a complex operating environment.

The bank's international footprint means it must actively manage the uncertainties arising from these shifts, which can influence global trade volumes and the overall stability of financial systems. For instance, ongoing trade disputes, such as those between major economic blocs, can disrupt cross-border capital flows and impact currency valuations, areas critical to banking operations.

KPMG's insights for Australian businesses in the 2024-25 period underscore these concerns, identifying potential crises and the broader implications of deglobalization as significant risks. This suggests a need for robust scenario planning and risk mitigation strategies within Commonwealth Bank to address potential disruptions to its international business and customer base.

- Global Trade Disruptions: Geopolitical tensions can lead to tariffs, sanctions, and trade barriers, impacting the volume and cost of international trade, which directly affects the bank's trade finance and foreign exchange services.

- Financial System Resilience: Increased geopolitical risk can heighten volatility in global financial markets, potentially impacting the bank's investment portfolios and its ability to access international funding.

- Economic Nationalism Impact: Policies driven by economic nationalism may favor domestic financial institutions, potentially creating a less favorable competitive landscape for Commonwealth Bank in certain overseas markets.

Consumer Data Right and Open Banking

The Australian government's Consumer Data Right (CDR) legislation, the foundation for Open Banking, is a significant driver for the nation's digital economy. Commonwealth Bank is a participant in this framework, giving its customers more command over their financial information. This regulatory environment fosters new ideas and boosts competition within financial services.

As of early 2024, the CDR has expanded beyond banking to sectors like energy and telecommunications, indicating a broader government commitment to data portability. Commonwealth Bank's engagement means it must facilitate secure data sharing, potentially leading to more personalized financial products and services for its customers. This shift also presents opportunities for fintech companies to innovate by leveraging shared data, provided customer consent is obtained.

- CDR Expansion: The CDR framework is progressively being rolled out across various Australian sectors, not just banking.

- Customer Control: Commonwealth Bank's participation empowers customers with greater control and access to their financial data.

- Innovation Driver: The regulatory push for Open Banking encourages new product development and increased competition in the financial sector.

- Data Security: Robust security measures are paramount as Commonwealth Bank facilitates the secure sharing of customer data under the CDR.

Political stability in Australia provides a predictable environment for Commonwealth Bank, supporting long-term planning and investor confidence, though geopolitical shifts globally can introduce volatility. The Australian government's increased scrutiny on major banks regarding pricing transparency and fee structures, alongside expectations to pass on RBA rate changes, directly influences CBA's public relations and operational strategies.

The Consumer Data Right (CDR) legislation, or Open Banking, is a key political initiative fostering data portability and competition, requiring CBA to enhance data security and potentially develop more personalized offerings. Furthermore, evolving regulations from APRA and ASIC, such as CPS 230 and CPS 234, necessitate ongoing investment in operational resilience and cybersecurity, shaping the bank's strategic priorities for 2024-25.

What is included in the product

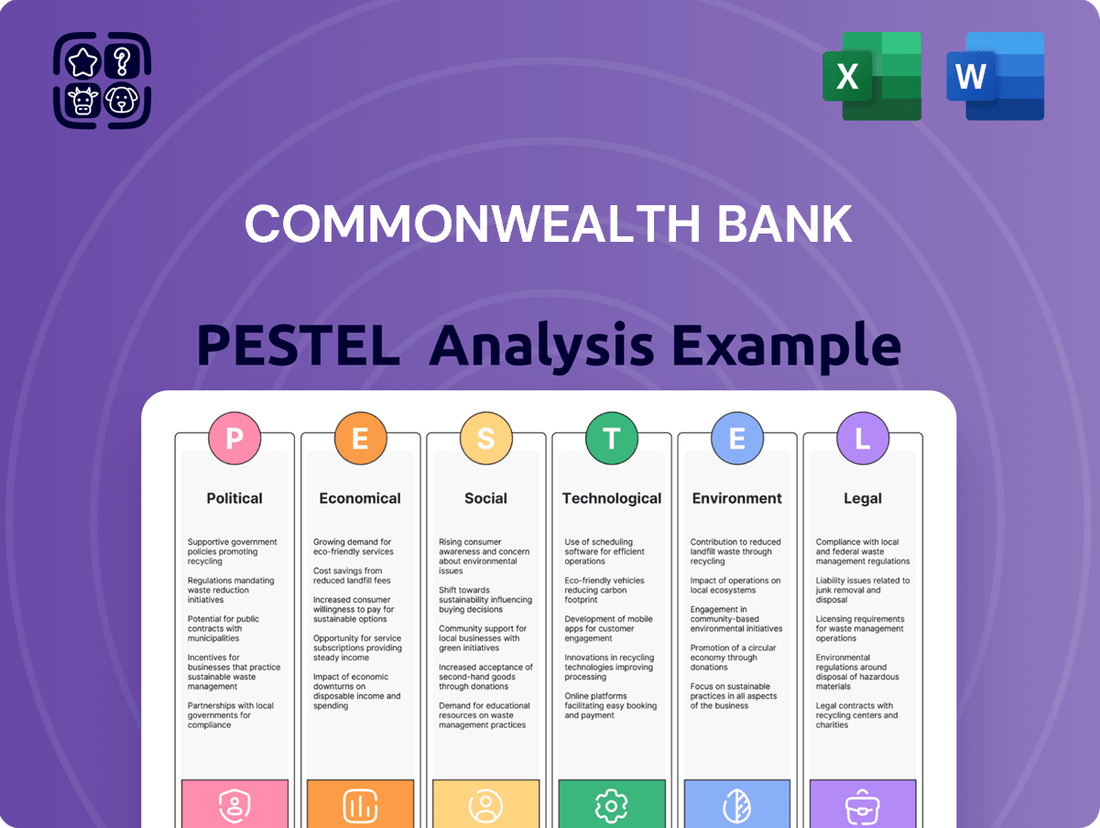

This PESTLE analysis examines the Commonwealth Bank's operating environment by detailing the impact of political, economic, social, technological, environmental, and legal factors.

It provides a comprehensive overview to identify strategic opportunities and mitigate potential risks for the bank.

Provides a concise version of the Commonwealth Bank's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

Australia's economy is currently navigating a period of elevated inflation, which significantly shapes consumer spending habits and the demand for loans from institutions like Commonwealth Bank. This inflationary pressure directly affects household budgets and, consequently, their borrowing capacity.

The Reserve Bank of Australia's (RBA) monetary policy decisions, particularly adjustments to the official cash rate, have a direct and substantial impact on Commonwealth Bank's (CBA) net interest margins. Higher rates generally boost margins, but also influence the affordability of loans for customers.

Looking ahead, CBA economists project that the RBA will implement further cash rate cuts throughout 2025. This anticipated easing of monetary policy is intended to stimulate household consumption by making borrowing more affordable, thereby supporting economic growth as inflation is expected to moderate.

Australian economic growth and consumer spending, while demonstrating resilience, are navigating a complex environment. Consumer confidence remained subdued in early 2024, reflecting ongoing economic uncertainties.

Commonwealth Bank's Household Spending Insights (HSI) Index offers a valuable real-time perspective on these trends, revealing a cautious uptick in discretionary spending as households adapt.

Looking ahead, GDP growth is anticipated to strengthen, with projections indicating an improvement to an annual rate of 2.2% by the close of 2025, suggesting a more robust economic outlook.

The housing market's upward price trend, driven by construction sector constraints and low productivity, presents a key economic dynamic. For Commonwealth Bank (CBA), this means navigating a landscape where lending to first home buyers remains a significant focus within the owner-occupier segment.

The transition from fixed to variable-rate home loans is increasing financial pressure on households. This requires CBA to carefully manage its customer support obligations against potential credit risks, a balancing act crucial in the current economic climate.

Global Economic Outlook

Commonwealth Bank's economic outlook acknowledges a global landscape that has moved away from predictable stability, reminiscent of the economic turbulence experienced in the 1970s. This shift means navigating a more complex and potentially volatile environment.

For 2025, global growth is anticipated to moderate, yet demonstrate resilience, with the United States economy expected to be a primary driver. However, this projected growth is occurring against a backdrop defined by ongoing geopolitical conflicts, market volatility, and a rise in economic nationalism.

- Global growth forecast: IMF projects 3.2% growth for 2025, a slight slowdown from 3.3% in 2024.

- US economic resilience: The US economy continues to show strength, supported by robust consumer spending and a tight labor market.

- Geopolitical risks: Ongoing conflicts and trade tensions pose significant risks to global supply chains and international trade.

Cost of Living Pressures

Australian households are experiencing significant cost-of-living pressures, with inflation impacting essential goods and services. This economic environment directly affects consumer confidence and discretionary spending. For instance, the Australian Bureau of Statistics reported that in the March quarter of 2024, the Consumer Price Index (CPI) rose by 1.0% in the quarter and 3.6% annually, indicating ongoing inflationary trends.

These sustained pressures mean that many households are re-evaluating their budgets, potentially reducing spending on non-essential items. This can translate into a greater demand for financial support from institutions like Commonwealth Bank (CBA).

In response, CBA has been proactive in offering enhanced support to customers facing financial hardship. This includes initiatives aimed at improving access to hardship assistance programs and providing tailored financial guidance.

- Inflationary Impact: Annual CPI reached 3.6% in March 2024, a key indicator of rising living costs.

- Consumer Behavior: Increased cost-of-living pressures lead to reduced discretionary spending by Australian households.

- Banking Sector Response: Banks like CBA are enhancing customer support through improved hardship assistance programs.

- Demand for Support: Financial strain is likely to drive increased demand for banking services related to financial hardship.

Australia's economic trajectory in 2024-2025 is marked by moderating inflation and a projected strengthening of GDP growth to 2.2% by the end of 2025. The Reserve Bank of Australia (RBA) is expected to cut cash rates throughout 2025, aiming to boost household consumption by making borrowing more affordable. Despite these positive indicators, consumer confidence remained subdued in early 2024 due to ongoing economic uncertainties and cost-of-living pressures, which saw the annual CPI reach 3.6% in March 2024.

| Economic Indicator | 2024 Projection | 2025 Projection | Source |

|---|---|---|---|

| Australian GDP Growth | ~1.8% | ~2.2% | CBA Economists |

| Annual CPI (Australia) | ~3.5% | ~2.5% | CBA Economists |

| RBA Official Cash Rate | ~4.35% (end of year) | ~3.85% (end of year) | CBA Economists |

| Global GDP Growth | 3.3% | 3.2% | IMF |

Preview Before You Purchase

Commonwealth Bank PESTLE Analysis

The preview shown here is the exact Commonwealth Bank PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This detailed analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Commonwealth Bank, delivered exactly as shown, no surprises.

The content and structure you see in this preview is the same comprehensive Commonwealth Bank PESTLE Analysis document you’ll download after payment.

Sociological factors

Australian consumers are rapidly shifting towards digital banking. In 2024, Commonwealth Bank reported a substantial increase in mobile banking engagement, with over 70% of customer transactions occurring digitally. This trend underscores a growing demand for speed and convenience.

This digital adoption fuels the need for enhanced online and mobile banking platforms. Commonwealth Bank, in response, continues to invest heavily in improving its digital user experience, aiming to provide seamless and intuitive services. For instance, their app consistently ranks high for user satisfaction.

While digital is dominant, a segment of the population still values in-person interactions. Commonwealth Bank maintains its branch network, recognizing the importance of catering to diverse customer preferences, ensuring accessibility for all demographics.

Australia's population is aging, with the proportion of people aged 65 and over projected to reach 22% by 2050, according to the Australian Institute of Health and Welfare. This demographic shift creates opportunities for Commonwealth Bank to develop specialized financial products and services catering to retirement planning, aged care financing, and wealth management for seniors. The increasing diversity, with over 300 ancestries reported in the 2021 Census, also presents a chance to offer tailored banking solutions for multicultural communities, fostering greater financial inclusion and loyalty.

Public sentiment towards major banks, including Commonwealth Bank, is increasingly critical, especially when profits are high during periods of household financial strain. In 2023, for instance, Australian banks reported significant profits, which often drew public scrutiny amid cost-of-living pressures. Maintaining public trust and a strong reputation is therefore paramount for Commonwealth Bank’s continued success.

This requires unwavering transparency regarding fees, a commitment to fair lending practices, and a demonstrable sense of accountability to the public. A strong reputation underpins customer loyalty and can significantly influence regulatory relationships, making it a vital sociological asset for Commonwealth Bank in the 2024-2025 period.

Financial Literacy and Inclusion

As financial services become increasingly intricate and digital, fostering financial literacy and ensuring broad financial inclusion are paramount. Commonwealth Bank recognizes this, with initiatives like CommSec Pocket designed to simplify investing, especially for younger, digitally native individuals. This approach directly addresses the growing need for accessible financial tools in a rapidly evolving market.

These efforts are crucial given the current landscape. For instance, in 2024, the Australian Securities and Investments Commission (ASIC) reported that while digital banking adoption is high, a significant portion of the population still struggles with understanding complex financial products. Commonwealth Bank's commitment to education and accessible platforms, such as CommSec Pocket which saw a 30% increase in new users in the first half of 2024, directly tackles this gap.

- Financial Literacy Gap: Despite advancements, a notable percentage of Australians, particularly those from lower-income backgrounds, exhibit low financial literacy, impacting their ability to manage finances effectively.

- Digital Divide: While digital financial services are expanding, ensuring access and understanding for all demographics, including older Australians and those in regional areas, remains a challenge.

- Youth Engagement: Initiatives like CommSec Pocket are vital for engaging younger generations in investing early, with data from 2024 showing a 25% rise in investment account openings by individuals under 30.

- Inclusion Goals: Commonwealth Bank's strategies aim to broaden financial inclusion, supporting government objectives to reduce financial exclusion by 2025.

Workforce Evolution and Skills

The banking sector's swift digital shift demands a workforce that can keep pace, with a strong emphasis on attracting and keeping individuals skilled in AI, data analytics, and cybersecurity. Commonwealth Bank, like its peers, faces the challenge of bridging the skills gap to remain competitive.

Internal investment in employee development and new capabilities is crucial. For instance, by 2024, the Australian banking sector saw a significant rise in demand for tech-related roles, with cybersecurity specialists seeing a 30% increase in job postings compared to the previous year. Commonwealth Bank's commitment to upskilling its existing staff and recruiting new talent in these critical areas directly addresses this evolving need.

This focus on workforce evolution is not just about filling roles; it's about building a resilient organization capable of navigating the complexities of the modern financial landscape. The bank's strategic initiatives, such as its internal digital academies and partnerships with educational institutions, aim to cultivate a future-ready workforce. By 2025, Commonwealth Bank aims to have over 70% of its workforce participating in ongoing digital skills training programs.

- Digital Skills Gap: The Australian banking industry reported a shortage of approximately 15,000 cybersecurity professionals by the end of 2024.

- Investment in Talent: Commonwealth Bank allocated over AUD $100 million in 2024 towards employee training and development, with a significant portion dedicated to digital and data capabilities.

- AI & Data Analytics Demand: Job advertisements for data scientists and AI specialists in Australian finance doubled between 2023 and 2024.

- Cybersecurity Focus: Commonwealth Bank reported a 25% increase in cybersecurity-related training for its employees in the first half of 2025.

Sociological factors significantly influence Commonwealth Bank's operations, driven by evolving consumer behaviors and societal expectations. The rapid digital migration of Australian consumers, with over 70% of transactions occurring digitally in 2024, highlights a demand for convenience that banks must meet through advanced platforms.

Despite this digital surge, a segment of the population still prefers in-person banking, necessitating the maintenance of a physical branch network to cater to diverse needs. Furthermore, Australia's aging demographic, projected to reach 22% aged 65+ by 2050, presents opportunities for specialized financial services for seniors, while increasing cultural diversity calls for tailored solutions to foster inclusion.

Public sentiment is increasingly critical, especially when banks report high profits amidst household financial strain, as seen with significant profits reported by Australian banks in 2023. Maintaining public trust through transparency and fair practices is therefore paramount for Commonwealth Bank's reputation and customer loyalty.

The growing complexity of financial services also emphasizes the need for enhanced financial literacy and accessible tools, such as Commonwealth Bank's CommSec Pocket, which saw a 30% user increase in early 2024, to empower all demographics.

Technological factors

Commonwealth Bank is making substantial investments in financial technology, pouring significant funds annually into areas like artificial intelligence, cloud computing, and advanced data analytics. This strategic focus on technological advancement is directly contributing to an enhanced customer experience and more efficient internal operations.

The bank's commitment to FinTech is evident in the impressive growth of its digital banking user base, which has seen a considerable increase. For instance, by the end of fiscal year 2023, CBA reported that over 7.5 million customers were actively using its digital platforms, a testament to the success of these technology-driven initiatives.

Commonwealth Bank (CBA) is heavily investing in its digital banking capabilities, aiming to solidify its market leadership in Australia. This focus includes using data, artificial intelligence, and machine learning to craft more personalized and seamless digital customer journeys.

The bank has seen a significant uplift in digital engagement, with digital transactions accounting for a substantial portion of its overall customer interactions. For instance, in the first half of 2024, CBA reported that over 80% of its customer transactions were conducted digitally.

Commonwealth Bank is heavily investing in Artificial Intelligence and Machine Learning, notably establishing an 'AI Factory' with AWS. This strategic move is designed to deliver highly personalized customer experiences and speed up the creation of AI-driven tools, ultimately boosting operational efficiency.

By leveraging Gen AI and ML, the bank aims to create more contextualized interactions for its customers. This focus on advanced technology is crucial for staying competitive in the rapidly evolving financial services landscape, with many institutions reporting significant efficiency gains from AI adoption in 2024.

Cybersecurity and Data Resilience

Commonwealth Bank is heavily investing in cybersecurity and data resilience due to its increasing reliance on digital platforms. This focus is driven by regulatory mandates, such as APRA's CPS 230 and CPS 234, which underscore the importance of robust cyber risk management and operational resilience. These standards require banks to actively address findings from independent security assessments.

In 2024, the financial sector, including Commonwealth Bank, faces escalating cyber threats. For instance, the Australian Cyber Security Centre reported a significant increase in ransomware attacks targeting businesses. Commonwealth Bank's commitment to data resilience means implementing advanced threat detection, data backup, and recovery systems to ensure continuity of services and protect sensitive customer information.

The bank's proactive approach to cybersecurity is crucial for maintaining customer trust and regulatory compliance. Key initiatives include:

- Enhanced threat intelligence gathering and analysis to anticipate and counter evolving cyberattacks.

- Regular security testing and vulnerability assessments to identify and remediate potential weaknesses.

- Implementing multi-factor authentication and advanced encryption for all digital transactions and data storage.

- Developing comprehensive incident response plans and conducting regular drills to ensure readiness.

Open Banking and Data Sharing

Commonwealth Bank is a key player in Australia's Open Banking initiative, part of the Consumer Data Right (CDR) framework. This allows for secure sharing of customer data, fostering innovation and competition within the financial sector. For CBA, this means they can access and utilize customer data to create more tailored and personalized banking experiences. For instance, by mid-2024, over 130 accredited data recipients were active under CDR, demonstrating the growing ecosystem.

This regulatory shift is a significant technological factor, pushing banks like CBA to develop new digital services and improve existing ones. By leveraging shared data, the bank can gain deeper insights into customer needs and preferences. This enables the development of innovative products, such as personalized budgeting tools or tailored loan offers, directly addressing customer pain points and enhancing user engagement. The growth in data sharing requests, reaching millions by early 2025, underscores the increasing adoption and impact of Open Banking.

- Open Banking Adoption: Commonwealth Bank is actively participating in Australia's Consumer Data Right (CDR) framework.

- Innovation Driver: This regulatory environment encourages the development of new, customer-centric financial services.

- Personalization: CBA can leverage ingested customer data to offer highly personalized banking solutions.

- Competitive Landscape: Open Banking fosters increased competition, driving technological advancements across the industry.

Commonwealth Bank's technological strategy is heavily focused on digital transformation and AI integration. The bank is investing significantly in cloud computing, data analytics, and artificial intelligence to enhance customer experience and operational efficiency. By mid-2024, over 7.5 million customers were actively using CBA's digital platforms, demonstrating the success of these tech-driven initiatives.

The bank's commitment to leveraging AI, particularly Generative AI and Machine Learning, is demonstrated by its 'AI Factory' initiative with AWS. This aims to deliver highly personalized customer interactions and accelerate the development of AI tools, with many financial institutions reporting significant efficiency gains from AI adoption in 2024.

CBA is also a key participant in Australia's Open Banking framework, part of the Consumer Data Right (CDR). This allows for secure data sharing, fostering innovation and personalization. By early 2025, millions of data sharing requests were being processed, indicating the growing impact of this technological shift.

Cybersecurity and data resilience are paramount, driven by regulatory requirements like APRA's CPS 230 and CPS 234. In 2024, the rise in cyber threats, such as ransomware attacks, underscores the importance of CBA's investments in advanced threat detection and data recovery systems.

| Technology Focus | Key Initiatives | Data/Impact (as of mid-2024/early 2025) |

|---|---|---|

| Digital Transformation | AI, Cloud Computing, Data Analytics | 7.5M+ active digital users |

| Artificial Intelligence | 'AI Factory' with AWS, Gen AI, ML | Accelerated AI tool development, personalized experiences |

| Open Banking (CDR) | Secure Data Sharing, Personalization | Millions of data sharing requests processed |

| Cybersecurity & Resilience | Threat Detection, Data Backup/Recovery | Compliance with APRA CPS 230/234, mitigating cyber threats |

Legal factors

Commonwealth Bank operates under the stringent prudential oversight of the Australian Prudential Regulation Authority (APRA). APRA mandates rigorous standards for capital adequacy, liquidity management, and overall risk control, directly impacting the bank's operational framework and strategic planning.

For the 2024-25 period, APRA's Corporate Plan highlights key priorities including bolstering bank capital, enhancing operational resilience via CPS 230, and fortifying cyber risk management under CPS 234. These directives are crucial for maintaining financial stability and customer trust.

Failure to adhere to APRA's prudential requirements can result in significant consequences, ranging from heightened supervisory scrutiny to formal enforcement actions, underscoring the critical importance of compliance for Commonwealth Bank.

The Australian Securities and Investments Commission (ASIC) plays a crucial role in overseeing consumer protection and market conduct, directly impacting Commonwealth Bank. ASIC's strategic priorities for the 2024-2025 period include enhancing consumer outcomes, managing climate change risks within the financial system, improving retirement savings, and bolstering digital and data security. These areas are critical for Commonwealth Bank, as they shape regulatory expectations and potential enforcement actions.

ASIC's enforcement focus for 2025 highlights key areas of concern for financial institutions like Commonwealth Bank. These include tackling misconduct that unfairly impacts superannuation savings, ensuring licensees uphold robust cybersecurity measures, and combating greenwashing. For instance, in the 2023-2024 financial year, ASIC took significant action against greenwashing claims, demonstrating a commitment to holding companies accountable for misleading environmental marketing. This regulatory scrutiny means Commonwealth Bank must ensure its product offerings and communications are transparent and compliant.

The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) are collaborating on the Financial Accountability Regime (FAR). This initiative is designed to ensure that individuals and institutions are held responsible for substandard practices within the financial services industry.

With the insurance and superannuation sectors set to adopt the FAR from March 2025, the banking sector can anticipate further enhancements to its governance and accountability frameworks. This aligns with a broader trend of increased regulatory oversight and a focus on individual responsibility within financial institutions.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Laws

Commonwealth Bank, like all major financial institutions, operates under rigorous Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. These regulations are paramount for safeguarding the financial system from illicit activities. In 2024, Australian banks, including Commonwealth Bank, continued to invest heavily in compliance, with operational costs for AML/CTF programs often running into hundreds of millions of dollars annually to maintain robust detection and reporting frameworks.

Compliance with these evolving legal frameworks necessitates significant investment in technology and personnel. For instance, the Know Your Customer (KYC) and Customer Due Diligence (CDD) processes are central to these efforts, requiring ongoing updates to identify and verify customer identities and assess risks. Failure to adhere to these laws can result in substantial penalties, reputational damage, and even loss of operating licenses.

- Regulatory Scrutiny: Commonwealth Bank faces ongoing oversight from regulators like AUSTRAC, ensuring adherence to AML/CTF obligations.

- Compliance Costs: The bank allocates substantial resources to technology, training, and staffing dedicated to AML/CTF compliance, impacting operational expenditure.

- Transaction Monitoring: Advanced systems are employed to detect and report suspicious transactions, a core component of preventing financial crime.

- International Standards: Commonwealth Bank must align its practices with global AML/CTF standards to facilitate international transactions and maintain correspondent banking relationships.

Class Actions and Litigation

Commonwealth Bank has navigated significant legal challenges, including class actions and ongoing litigation. These often stem from past practices in financial advice and insurance claims, impacting the bank's operational and financial landscape. For instance, in 2023, the bank continued to manage provisions related to past misconduct, reflecting the ongoing financial implications of these legal battles.

The financial ramifications of these legal issues are substantial. The bank must allocate significant resources to legal defense and potential settlements or judgments. For example, in the 2023 financial year, Commonwealth Bank reported provisions for customer-related remediation and litigation that directly impacted its profitability, highlighting the direct cost of these legal entanglements.

The potential for future litigation also remains a key consideration. Regulatory scrutiny and evolving consumer protection laws mean that banks like Commonwealth Bank must remain vigilant. The outcomes of these proceedings can lead to substantial financial penalties, reputational damage, and increased compliance costs, influencing strategic decision-making and risk management frameworks.

Key legal factors impacting Commonwealth Bank include:

- Ongoing class actions: The bank faces potential class actions related to historical financial advice and product sales, which can result in significant financial provisions and legal expenses.

- Litigation costs: Defending against numerous legal claims incurs substantial legal fees and operational costs, impacting short-term profitability.

- Reputational risk: Adverse judgments or settlements can damage the bank's reputation, affecting customer trust and market perception.

- Regulatory compliance: Evolving regulations necessitate continuous adaptation and investment in compliance measures to mitigate future litigation risks.

Commonwealth Bank operates under the stringent oversight of the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC). These bodies enforce capital adequacy, operational resilience, and consumer protection, with APRA's 2024-25 Corporate Plan focusing on capital bolstering and cyber risk management under CPS 234, while ASIC's priorities include climate risk and digital security. The upcoming Financial Accountability Regime (FAR), set to expand to banking from March 2025, will further emphasize individual and institutional responsibility.

The bank also faces significant legal challenges, including ongoing class actions and litigation stemming from past practices, which incurred substantial provisions for customer remediation in FY23. Compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws is critical, with Australian banks investing heavily in these areas, often in the hundreds of millions annually, to maintain robust detection and reporting frameworks and adhere to international standards.

| Regulatory Body | Key Focus Areas (2024-2025) | Impact on Commonwealth Bank |

| APRA | Capital adequacy, operational resilience (CPS 230), cyber risk (CPS 234) | Mandates rigorous standards for financial stability and risk control. |

| ASIC | Consumer outcomes, climate risk, retirement savings, digital security | Shapes regulatory expectations and potential enforcement actions; addresses greenwashing. |

| AUSTRAC | AML/CTF compliance | Requires significant investment in technology and personnel for transaction monitoring and customer due diligence. |

Environmental factors

Commonwealth Bank is actively addressing climate change, aiming to support Australia's 2050 net-zero goal. This involves strategically managing both the risks and opportunities presented by a changing climate.

The bank has established concrete targets for reducing financed emissions across various sectors and is also working to lower its own operational emissions. For instance, their 2024 Climate Report outlines specific metrics and governance structures put in place to achieve these environmental objectives.

Commonwealth Bank (CBA) is actively embedding environmental, social, and governance (ESG) standards into its core lending practices. This means that ESG factors are not an afterthought but a fundamental requirement for any loan consideration.

This strategic integration allows CBA to proactively identify and evaluate the ESG risks associated with its clients. For instance, in 2023, CBA reported a significant increase in the number of clients assessed against its climate risk framework, demonstrating a tangible commitment to this approach.

By aligning lending decisions with its established environmental and social framework, CBA aims to foster sustainable business practices across its portfolio. This commitment is further underscored by its 2024 target to increase financing for renewable energy projects by a substantial margin, reflecting a clear shift towards supporting environmentally responsible ventures.

Commonwealth Bank is actively financing renewable energy and low-carbon projects, demonstrating a commitment to environmental sustainability. This strategy directly supports Australia's national energy transition goals, which necessitate substantial annual deployment of renewable power to achieve its 2030 targets.

The bank's pledge to source renewable energy for its own operations further solidifies its environmental stewardship. Meeting these ambitious targets requires an estimated AU$320 billion in investment in clean energy infrastructure by 2030, a significant opportunity for financial institutions like Commonwealth Bank.

Physical Climate Risks

Commonwealth Bank must actively assess and manage the physical climate risks that can affect its customers, employees, communities, and its own infrastructure. This involves understanding how events like extreme weather can lead to increased insurance claims and impact loan portfolios, particularly in sectors like agriculture and property. For instance, the Australian Bureau of Meteorology reported a significant increase in the frequency and intensity of extreme weather events in recent years, directly influencing the operational and financial resilience of businesses and individuals.

The financial implications of climate change are becoming increasingly critical in the bank's decision-making. This includes evaluating the potential for increased loan defaults due to climate-related damage and the impact on asset valuations. For example, a 2024 report by APRA highlighted that climate change could lead to substantial increases in insurance liabilities for Australian banks, underscoring the need for robust risk management frameworks.

- Increased frequency of severe weather events, such as floods and bushfires, directly impacting customer loan repayments and insurance claims.

- Potential for significant asset devaluation in regions highly susceptible to climate change impacts, affecting collateral for loans.

- Growing need for climate-resilient infrastructure investment, which can present both risks and opportunities for the bank's lending and investment strategies.

Stakeholder Expectations and Greenwashing Scrutiny

Stakeholder expectations around environmental responsibility are intensifying, placing banks like Commonwealth Bank under greater scrutiny. Environmental campaign groups and regulators are closely examining the climate commitments and actual actions taken by financial institutions. This heightened awareness means that any misrepresentation of environmental credentials, often termed greenwashing, faces significant backlash.

The Australian Securities and Investments Commission (ASIC) has explicitly identified greenwashing misconduct as a key enforcement priority. This focus is expected to extend beyond initial targets, potentially encompassing listed entities and superannuation funds. Consequently, Commonwealth Bank and similar organizations must ensure their environmental, social, and governance (ESG) claims are both clear and demonstrably accurate to avoid regulatory penalties and reputational damage.

- ASIC's 2023 enforcement priorities highlighted greenwashing as a significant concern.

- Failure to substantiate ESG claims can lead to regulatory action and fines.

- Investor and consumer demand for genuine sustainability initiatives is growing.

Commonwealth Bank is committed to supporting Australia's net-zero ambitions by managing climate-related risks and opportunities. The bank has set targets to reduce financed emissions across sectors and its own operations, as detailed in its 2024 Climate Report.

CBA is integrating ESG standards into its lending, assessing clients against its climate risk framework, as seen in a significant increase in assessments in 2023. This aligns with a goal to increase financing for renewable energy projects, supporting the nation's energy transition.

The bank must also manage physical climate risks, like extreme weather events which have increased in frequency and intensity according to the Australian Bureau of Meteorology. These events impact loan portfolios and insurance claims, and APRA's 2024 report highlights potential increases in insurance liabilities for banks due to climate change.

Stakeholder scrutiny on environmental responsibility is rising, with ASIC prioritizing greenwashing enforcement. CBA must ensure its ESG claims are accurate to avoid regulatory action and reputational damage, as investor and consumer demand for genuine sustainability grows.

| Environmental Factor | Impact on Commonwealth Bank | Supporting Data/Action |

|---|---|---|

| Climate Change & Net-Zero Goals | Managing risks and opportunities, reducing financed emissions. | Aiming for Australia's 2050 net-zero goal; 2024 Climate Report details metrics. |

| Extreme Weather Events | Increased insurance claims, impact on loan portfolios, asset devaluation. | Australian Bureau of Meteorology reports increased frequency/intensity of events. |

| Regulatory Scrutiny (Greenwashing) | Need for accurate ESG claims, risk of penalties and reputational damage. | ASIC's 2023 enforcement priorities include greenwashing; failure to substantiate claims leads to action. |

| Renewable Energy Financing | Opportunity to support energy transition, align with sustainability goals. | Target to increase financing for renewable energy projects; AU$320 billion needed for clean energy by 2030. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Commonwealth Bank is grounded in data from official government reports, financial regulatory bodies, and leading economic research institutions. We incorporate insights from industry-specific publications and reputable market analysis firms to ensure a comprehensive understanding of the macro-environment.