Commonwealth Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commonwealth Bank Bundle

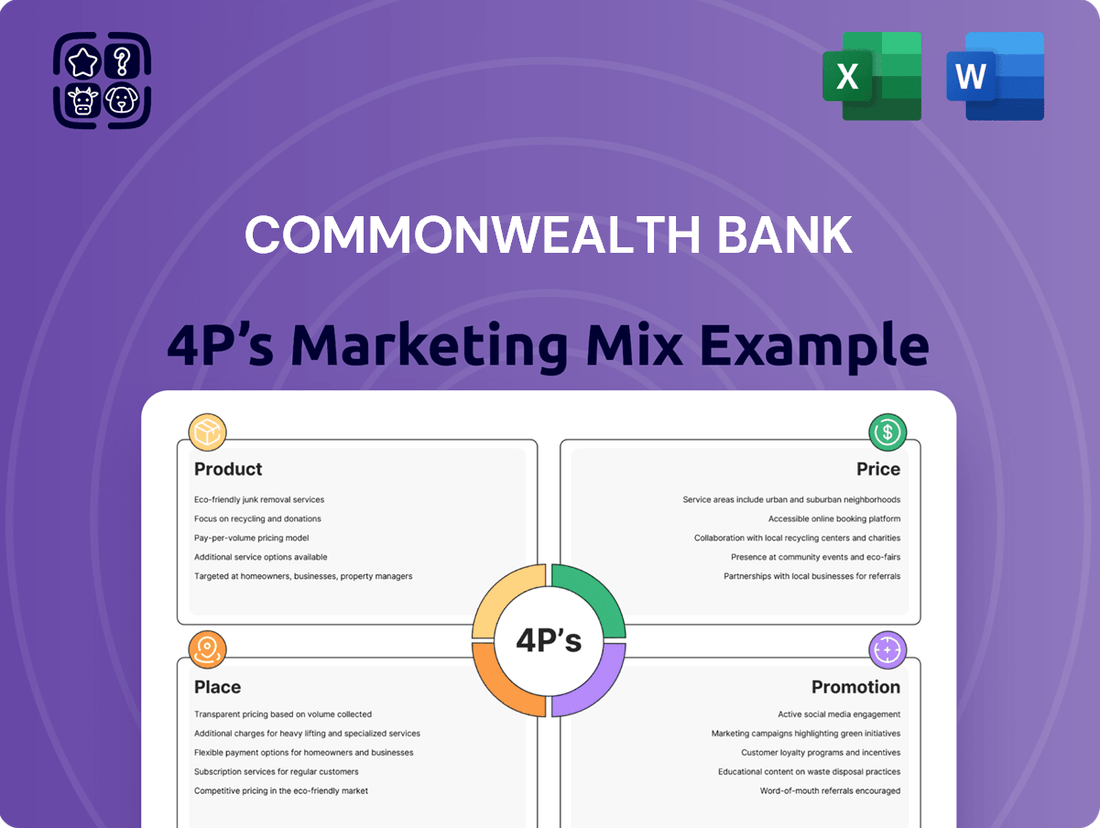

Discover how Commonwealth Bank masterfully leverages its Product, Price, Place, and Promotion strategies to dominate the Australian financial landscape. This analysis delves into their innovative product offerings, competitive pricing, extensive distribution network, and impactful promotional campaigns.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into one of Australia's leading banks.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning related to the banking sector.

Product

Commonwealth Bank's Business Transaction Accounts focus on the Product element of the marketing mix by offering versatile options designed for diverse business needs. These accounts include choices with no monthly fees for online-centric businesses or those preferring in-branch services, demonstrating flexibility in pricing.

The accounts provide unlimited electronic transactions, a key feature that directly benefits businesses with high transaction volumes, such as many small to medium enterprises (SMEs) in Australia. This unlimited aspect aims to reduce operational costs for these businesses.

Furthermore, the inclusion of a Business Visa Debit Card with these accounts enhances convenience for daily business operations. As of early 2024, Commonwealth Bank remains a dominant player in the Australian banking sector, serving millions of business customers, underscoring the market relevance of these product offerings.

Commonwealth Bank's Business Savings and Investment Accounts focus on offering flexible and rewarding options for businesses. Products like the Business Online Saver provide competitive interest rates, aiming to attract deposits by offering strong returns on idle cash. For instance, as of mid-2024, the Business Online Saver was offering an attractive tiered interest rate structure, designed to incentivize higher balances.

The Flexi Business Investment Account further enhances the product offering by providing liquidity. This account allows businesses to access a portion of their term deposit funds without incurring penalties, a significant advantage for managing short-term cash flow needs. This feature directly addresses a key concern for businesses: balancing the need for investment growth with the imperative of readily available capital.

Commonwealth Bank's Product strategy for business lending focuses on a broad spectrum of solutions, catering to diverse business needs. This includes their innovative Biz Express online platform, designed for faster approvals and accessible financing. The bank also offers specialized products like equipment finance, supporting businesses in acquiring essential assets.

The Product element is further strengthened by Commonwealth Bank's commitment to supporting businesses throughout their lifecycle. For instance, in the first half of 2024, the Biz Express platform facilitated a substantial increase in loan origination, with loan values growing by over 20% compared to the previous year, demonstrating a strong market reception and effective product delivery.

Payment Solutions and eCommerce

Commonwealth Bank (CBA) offers robust payment solutions designed to empower businesses in the evolving eCommerce landscape. Their product suite includes advanced Smart EFTPOS terminals and comprehensive online payment gateways, ensuring merchants can accept a wide array of payment methods seamlessly. This focus on diverse payment facilitation is crucial, especially as digital transactions continue to surge. In 2024, Australian eCommerce sales were projected to reach over $70 billion, highlighting the critical need for reliable payment infrastructure.

CBA is also innovating with industry-specific tools to enhance merchant efficiency. The rollout of solutions like Smart Health for Pharmacies exemplifies this strategy, aiming to streamline transactions and improve operational workflows within specialized sectors. This targeted approach addresses unique business needs, making payment processing more efficient and user-friendly for specific industries. By offering tailored solutions, CBA supports businesses in adapting to changing consumer preferences and market demands.

Key aspects of CBA's Payment Solutions and eCommerce offering include:

- Smart EFTPOS Terminals: Enabling secure and versatile in-person payment acceptance.

- eCommerce Solutions: Providing online payment gateways for digital sales channels.

- Merchant Support: Offering dedicated assistance to businesses managing their payment operations.

- Industry-Specific Tools: Developing specialized payment solutions like Smart Health for targeted sectors.

Integrated Business Tools and Services

Commonwealth Bank's integrated business tools and services extend well beyond traditional banking. They offer seamless integration with popular accounting software such as MYOB and Xero, streamlining financial management for businesses. This focus on digital integration aims to simplify operations and provide greater efficiency for their commercial clients.

Furthermore, the bank provides valuable business insight tools, equipping entrepreneurs with data-driven analytics to inform strategic decisions. These insights can help businesses understand market trends, customer behavior, and financial performance more effectively. For example, CommBank's business insights dashboard can provide real-time data on cash flow and spending patterns.

Commonwealth Bank also enhances its product offering through loyalty and benefit programs like CommBank Yello. This program provides eligible customers with access to discounts on a range of business-related purchases, from office supplies to technology, adding tangible value to their banking relationship. In 2024, CommBank Yello members reported an average saving of over $500 annually on essential business expenses.

- Seamless Integration: Connects with MYOB and Xero for efficient accounting.

- Business Insights: Offers data analytics tools to aid strategic decision-making.

- CommBank Yello Benefits: Provides discounts on business-related purchases.

- Enhanced Value: Aims to simplify operations and reduce costs for clients.

Commonwealth Bank's product strategy for business accounts emphasizes versatility and cost-efficiency, offering options like unlimited electronic transactions and no monthly fees for certain account types. These products are designed to support businesses of all sizes, particularly SMEs, by reducing operational expenses and providing essential tools like a Business Visa Debit Card.

The bank also focuses on wealth creation through its savings and investment accounts, such as the Business Online Saver, which offers competitive tiered interest rates as of mid-2024. Additionally, the Flexi Business Investment Account provides crucial liquidity by allowing penalty-free access to term deposit funds, balancing growth with immediate capital needs.

CBA's lending products, including the streamlined Biz Express platform and specialized equipment finance, demonstrate a commitment to supporting businesses throughout their growth phases. In the first half of 2024, Biz Express saw loan origination values increase by over 20% year-on-year, reflecting strong product adoption.

Payment solutions are a key product area, with advanced Smart EFTPOS terminals and online gateways catering to the booming eCommerce sector, projected to exceed $70 billion in Australian sales in 2024. Industry-specific tools, like Smart Health for pharmacies, further tailor offerings to enhance merchant efficiency.

| Product Category | Key Features | Target Audience | 2024/2025 Data Point |

|---|---|---|---|

| Business Transaction Accounts | Unlimited electronic transactions, no monthly fees option, Business Visa Debit Card | SMEs, online businesses | Millions of business customers served |

| Savings & Investment Accounts | Competitive tiered interest rates (Business Online Saver), penalty-free access to funds (Flexi Business Investment) | Businesses seeking to grow idle cash | Attractive tiered rates offered mid-2024 |

| Business Lending | Biz Express online platform, equipment finance | Businesses requiring capital for growth or assets | Biz Express loan origination up >20% H1 2024 |

| Payment & eCommerce Solutions | Smart EFTPOS, online payment gateways, industry-specific tools | Businesses accepting digital and in-person payments | Australian eCommerce projected >$70 billion in 2024 |

What is included in the product

This analysis provides a comprehensive breakdown of the Commonwealth Bank's marketing strategies, examining its Product offerings, Pricing structures, Place (distribution) channels, and Promotion activities.

It offers a deep dive into how Commonwealth Bank leverages its 4Ps to maintain its competitive edge in the financial services market.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of information overload for busy executives.

Provides a clear, concise overview of the Commonwealth Bank's 4Ps, alleviating the struggle to quickly understand and communicate marketing effectiveness.

Place

Commonwealth Bank boasts an extensive physical presence, operating over 700 branches across Australia as of early 2024. This vast network offers unparalleled in-person banking services, including crucial support for business clients and widespread ATM accessibility for everyday transactions.

Commonwealth Bank offers a comprehensive suite of digital banking platforms designed to cater to diverse customer needs. For smaller businesses and sole traders, NetBank provides a robust online banking solution. CommBiz is tailored for larger businesses, offering customizable access controls and enhanced security features for multiple users.

The CommBank app acts as a central hub, allowing customers to manage both their personal and business accounts seamlessly. This integrated approach significantly boosts digital engagement and convenience. As of the first half of 2024, CommBank reported a 10% increase in digital transactions across its platforms, highlighting strong customer adoption.

Commonwealth Bank offers an extensive ATM network across Australia, facilitating convenient cash withdrawals and deposits. This physical presence is complemented by transaction accounts engineered for seamless management of both in-branch and electronic financial activities, ensuring accessibility for diverse customer needs.

International Presence and Services

Commonwealth Bank (CBA) extends its reach beyond Australia and New Zealand, maintaining international offices to support its global client base. This presence is crucial for facilitating cross-border commerce.

CBA's international services are particularly vital for businesses engaged in global trade. They offer streamlined solutions for international payments and currency management, ensuring efficient transactions for companies operating on a global scale.

Supporting its international operations, CBA reported significant volumes in its international payment services. For instance, in the fiscal year 2023, the bank processed billions of dollars in cross-border transactions, highlighting its role in enabling global business activities for its Australian and New Zealand customers.

- Global Reach CBA maintains a strategic international presence with offices in key financial hubs to serve its customers worldwide.

- Cross-Border Facilitation The bank specializes in international payment services, aiding businesses in managing their global financial operations smoothly.

- Transaction Volume In FY23, CBA facilitated a substantial volume of international transactions, underscoring its importance in international trade for its clientele.

Partnerships for Accessibility

Commonwealth Bank actively cultivates corporate partnerships, like its collaboration with the Mount Gambier Chamber of Commerce. This strategic alliance aims to equip local enterprises with essential tools and resources, thereby broadening their market presence and reinforcing community support. These initiatives are crucial for fostering a robust local economy.

These partnerships often translate into tangible benefits for small and medium-sized enterprises (SMEs). For instance, in 2024, CBA's SME banking division reported a 7% increase in digital adoption among businesses that participated in its partnership programs, indicating a direct impact on operational efficiency and reach.

The bank’s approach to partnerships for accessibility is multifaceted, focusing on:

- Community Engagement: Collaborating with local chambers and business associations to understand and address specific community needs.

- Resource Provision: Offering access to digital tools, financial literacy workshops, and tailored banking solutions.

- Network Expansion: Facilitating connections between businesses, fostering collaboration and mutual growth.

- Digital Transformation Support: Assisting businesses in adopting new technologies to improve customer engagement and operational effectiveness.

Commonwealth Bank's physical "Place" strategy is anchored by its extensive Australian branch network, exceeding 700 locations as of early 2024. This robust physical footprint ensures accessibility for diverse customer needs, from in-person business support to widespread ATM services. Furthermore, CBA extends its reach globally with international offices, facilitating cross-border commerce and supporting its multinational client base. These physical touchpoints, both domestic and international, are integral to delivering comprehensive banking solutions and fostering strong customer relationships.

| Aspect | Description | Data Point (Early 2024/H1 2024) |

|---|---|---|

| Domestic Branch Network | Extensive physical presence across Australia | Over 700 branches |

| Digital Platform Integration | Seamless management of personal and business accounts | 10% increase in digital transactions (H1 2024) |

| International Offices | Support for global client base and cross-border commerce | Billions of dollars in international payments processed (FY23) |

What You Preview Is What You Download

Commonwealth Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Commonwealth Bank 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain a complete understanding of their market approach without any hidden elements.

Promotion

Commonwealth Bank actively uses digital marketing and social media platforms such as LinkedIn, Instagram, and Facebook to connect with its customer base. These channels are crucial for fostering engagement and strengthening the bank's brand identity.

In 2024, Commonwealth Bank reported a significant increase in its digital customer interactions, with over 10 million active digital users. This highlights the effectiveness of their online presence in reaching and serving a broad audience.

The bank's social media strategy often features educational content, product updates, and interactive campaigns designed to build community and provide value, contributing to a more personalized customer experience.

CommBank Yello is a key element in Commonwealth Bank's strategy to foster customer loyalty. This program, which offers discounts on business expenses and other perks, was notably expanded to include small and medium-sized businesses, demonstrating a commitment to a broader customer base.

The program's value proposition is clear: reward and retain customers by providing tangible benefits. For instance, in the 2023 financial year, CommBank reported a significant increase in customer engagement with its digital platforms, where Yello benefits are often accessed, suggesting the program's growing impact on customer interaction.

Commonwealth Bank (CBA) leverages sponsorships to boost its brand presence and connect with communities. A prime example is their significant investment in Football Australia, encompassing naming rights for the CommBank Matildas and Socceroos, as well as CommBank Stadium. This strategy aims to embed the CBA brand within popular sporting events and foster a sense of national pride and association.

The bank's recent decision to end its long-standing partnership with Cricket Australia in late 2023, after decades of association, signals a strategic shift in their sponsorship portfolio. This move likely reflects a re-evaluation of marketing investments to align with evolving brand objectives and target audience engagement, potentially focusing on growth areas like women's sports.

Targeted Advertising Campaigns

Commonwealth Bank leverages targeted advertising campaigns as a key element of its marketing strategy. A prime example is the 'Doubt Never Did' platform, designed to foster self-belief among Australians. This campaign aims to resonate with a broad audience by focusing on overcoming personal challenges, aligning with the bank's broader brand messaging.

Furthermore, the bank actively promotes its small business customers through initiatives like featuring the CommBank Matildas. This strategic partnership not only enhances brand visibility but also directly supports the small business ecosystem, a crucial segment for economic growth. In 2024, Commonwealth Bank reported a net profit after tax of AUD 10.4 billion, underscoring the effectiveness of its diverse marketing efforts.

- Targeted Campaign Focus: 'Doubt Never Did' aims to inspire self-belief, while the CommBank Matildas initiative champions small businesses.

- Brand Alignment: These campaigns connect with customer aspirations and support key business segments.

- Financial Performance Context: Commonwealth Bank's AUD 10.4 billion net profit after tax in 2024 reflects successful strategic marketing.

- Customer Engagement: The initiatives aim to build emotional connections and provide tangible support to customers.

Content Marketing and Financial Education

Commonwealth Bank (CBA) actively invests in content marketing and financial education to build customer trust and engagement. Initiatives like The Brighter Side TV series and Brighter magazine offer practical advice on managing finances and navigating cost-of-living challenges, fostering greater financial confidence among Australians.

This educational approach directly supports CBA's 'Promotion' strategy by providing value beyond traditional banking products. By equipping customers with knowledge, CBA aims to strengthen relationships and position itself as a supportive financial partner.

CBA's commitment to financial literacy is evident in its reach. In 2023, for example, the bank reported that its digital platforms saw a significant increase in customer engagement with educational content, with millions of Australians accessing resources designed to improve their financial well-being.

- Content Ecosystems: The Brighter Side TV series and Brighter magazine provide accessible financial information.

- Customer Empowerment: Focuses on money management, cost-of-living support, and building financial confidence.

- Engagement Strategy: Aims to educate and engage customers, fostering loyalty and trust.

- Data-Driven Impact: Millions of Australians accessed CBA's financial education resources in 2023, demonstrating broad reach.

Commonwealth Bank's promotional efforts are multifaceted, encompassing digital engagement, loyalty programs, strategic sponsorships, targeted advertising, and financial education. These initiatives aim to build brand awareness, foster customer loyalty, and position the bank as a trusted financial partner.

The bank's digital presence is robust, with over 10 million active digital users in 2024, underscoring the effectiveness of its online outreach. CommBank Yello rewards customers, and significant sponsorships like Football Australia embed the brand within popular culture.

Targeted campaigns such as 'Doubt Never Did' and content marketing through The Brighter Side series further enhance customer connection by offering value and inspiration.

| Promotional Activity | Key Initiative/Platform | 2023/2024 Data Point | Objective |

|---|---|---|---|

| Digital Engagement | Social Media & Active Users | 10+ million active digital users (2024) | Brand identity, customer interaction |

| Loyalty Program | CommBank Yello | Expanded to SMEs | Customer retention, tangible benefits |

| Sponsorships | Football Australia | Naming rights for Matildas, Socceroos, CommBank Stadium | Brand presence, community connection |

| Advertising | 'Doubt Never Did' campaign | Focus on self-belief | Broad audience resonance, brand messaging |

| Financial Education | The Brighter Side (TV/Magazine) | Millions accessed educational content (2023) | Customer trust, financial confidence |

Price

Commonwealth Bank recognizes that businesses have diverse banking needs, so they offer flexible account fee structures. For instance, their business transaction accounts can come with a $0 monthly fee for businesses primarily operating online, which is a significant cost saving.

Alternatively, a $10 monthly fee option provides a set number of complimentary staff-assisted transactions, catering to businesses that still require in-person banking services. This tiered approach ensures that businesses only pay for the services they actually use, making their banking costs more predictable and manageable.

Commonwealth Bank's pricing strategy for transaction and withdrawal fees is designed to encourage digital engagement while covering costs for more involved services. For instance, while local electronic transfers and Australian ATM cash withdrawals are typically free, reflecting the bank's push towards digital channels, fees are levied for staff-assisted transactions. This tiered approach incentivizes customers to utilize self-service options, thereby optimizing operational efficiency.

The bank also applies fees for specific services like cheque processing and QuickCash deposits, acknowledging the manual effort involved. Furthermore, international transfers incur a notable 3.5% charge, a common practice across financial institutions to cover the complexities and currency conversion costs associated with cross-border transactions. This fee structure directly impacts the 'Price' element of the 4Ps by clearly delineating the cost of various banking activities.

Commonwealth Bank (CBA) actively attracts business deposits by offering competitive interest rates on its savings and investment products. For instance, the Business Online Saver account, a key component of their pricing strategy, aims to provide businesses with a straightforward way to earn returns on their operating cash. This focus on attractive rates is crucial for drawing in and retaining business clientele.

CBA’s Flexi Business Investment Account further exemplifies their pricing approach, designed to offer potentially higher yields for businesses willing to commit funds for specific terms. As of mid-2024, while specific advertised rates fluctuate, these accounts are positioned to be competitive within the Australian market, often benchmarked against the Reserve Bank of Australia's cash rate and competitor offerings, ensuring businesses can maximize their cash holdings.

Lending Rates and Financing Options

Commonwealth Bank's pricing for business loans and financing is dynamic, influenced by factors like loan amount, term, borrower creditworthiness, and prevailing market conditions. They offer a spectrum of options, from flexible overdrafts to structured term loans, ensuring businesses can find a suitable fit for their unique operational and growth requirements.

As of early 2024, business loan interest rates at major Australian banks, including Commonwealth Bank, have generally hovered in the range of 7% to 12% for secured lending, with unsecured options or those for higher-risk profiles potentially reaching higher figures. This reflects the Reserve Bank of Australia's cash rate movements and the bank's own cost of funds.

- Variable Rate Business Loans: Often tied to the RBA cash rate, offering flexibility but with potential for payment fluctuations.

- Fixed Rate Business Loans: Provide payment certainty for a set period, ideal for budgeting.

- Equipment Finance: Tailored financing for purchasing business assets, often with the asset serving as security.

- Overdrafts: Short-term, flexible credit lines to manage day-to-day cash flow fluctuations.

Value-Added Benefits and Discounts

Commonwealth Bank enhances customer value through its Price strategy by offering tangible benefits and discounts, particularly through programs like CommBank Yello for Business. This initiative provides businesses with access to discounted offers from various providers on essential business purchases, directly impacting their bottom line by reducing operational expenses. These value-added benefits extend beyond standard banking services, positioning the bank as a partner in business growth.

The CommBank Yello for Business program exemplifies this strategy by curating a selection of deals designed to support small and medium-sized enterprises. For instance, in 2024, businesses utilizing the program could find savings on services ranging from IT solutions to office supplies. These discounts are not merely promotional; they represent a calculated effort to lower the total cost of doing business for their clientele.

- CommBank Yello for Business: Offers discounted provider deals on business-related purchases.

- Cost Reduction: Directly helps businesses lower operational costs.

- Value Beyond Banking: Extends financial support through savings on essential services.

- 2024 Focus: Provided savings on critical business expenditures like technology and supplies.

Commonwealth Bank's pricing strategy for business accounts is tiered to match diverse needs, with options like a $0 monthly fee for online-focused businesses and a $10 fee for those requiring staff-assisted transactions. This approach ensures customers pay for services utilized, offering cost predictability.

The bank incentivizes digital transactions, making local electronic transfers and Australian ATM withdrawals generally free, while charging for manual services like cheque processing and international transfers (typically 3.5%). This structure encourages self-service and covers the costs of more complex operations.

CBA offers competitive interest rates on business savings and investment accounts, such as the Business Online Saver and Flexi Business Investment Account, to attract and retain clients. As of mid-2024, these rates are positioned to be competitive within the Australian market, often benchmarked against the RBA cash rate.

Business loan pricing at CBA is dynamic, influenced by loan size, term, creditworthiness, and market conditions, with rates for secured lending generally ranging from 7% to 12% in early 2024. The CommBank Yello for Business program further adds value by offering discounts on essential business purchases, directly reducing operational costs for clients.

| Service Category | Pricing Feature | Example Benefit (2024 Data) |

|---|---|---|

| Transaction Accounts | Tiered Monthly Fees | $0 for online-primary, $10 for staff-assisted |

| Digital Transactions | Free Local Transfers | Encourages digital engagement |

| International Transfers | Percentage Fee | 3.5% charge |

| Business Savings Accounts | Competitive Interest Rates | Aimed at maximizing cash holdings |

| Business Loans | Variable Market Rates | 7%-12% for secured lending (early 2024) |

| Value-Added Programs | Discounts via CommBank Yello | Savings on IT solutions and office supplies |

4P's Marketing Mix Analysis Data Sources

Our Commonwealth Bank 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including official annual reports, investor relations materials, and public product and service descriptions. We also incorporate insights from reputable financial news outlets, industry analysis reports, and competitive benchmarking to ensure a holistic view of their strategy.