Commonwealth Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commonwealth Bank Bundle

Commonwealth Bank operates in a highly competitive banking landscape, facing significant pressure from rivals and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for its strategic positioning. This brief overview hints at the complexities, but the full analysis delves deeper.

The complete report reveals the real forces shaping Commonwealth Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Commonwealth Bank, like many large financial institutions, depends on a select group of technology and software providers for its critical operational systems. This reliance means these specialized vendors hold considerable sway, as their offerings are fundamental to CBA's ability to function and innovate digitally.

The bank's significant investment in technology, with an estimated IT expenditure of around $2.5 billion in 2024, highlights the critical nature of these supplier relationships. This substantial spending power for vendors allows them to exert influence over pricing structures and contractual agreements, impacting CBA's operational costs and strategic flexibility.

The availability of skilled labor, especially in high-demand fields like technology and data science, significantly influences Commonwealth Bank's (CBA) operational efficiency and innovation capacity. A tight labor market, where specialized talent is scarce, naturally elevates the bargaining power of employees. This means banks like CBA must actively compete by offering attractive compensation packages and robust benefits to secure and retain top-tier professionals.

In 2024, the demand for cybersecurity experts, for instance, remained exceptionally high, with reports indicating a global shortage. This pressure necessitates that CBA invests heavily in its human capital, ensuring its remuneration and development programs are competitive. The bank's Career Comeback program, with initiatives planned for 2025, underscores a strategic focus on attracting diverse talent and reinforcing its commitment to a skilled and adaptable workforce.

Commonwealth Bank, like other major Australian banks, taps into both customer deposits and wholesale debt markets for funding. In 2024, the cost of these funds is significantly shaped by the Reserve Bank of Australia's monetary policy decisions and broader global financial market conditions. While a substantial deposit base offers some insulation, competitive pressures, particularly as interest rates climbed in 2024 and are projected to remain elevated into 2025, can grant depositors a degree of bargaining power.

Regulatory and Compliance Service Providers

The Australian financial services sector faces a complex and constantly shifting regulatory environment. This complexity means banks like Commonwealth Bank must rely heavily on specialized legal, accounting, and consulting firms. These experts are crucial for navigating compliance, anti-money laundering (AML/CTF), and cybersecurity requirements.

These specialized service providers possess significant bargaining power. Their unique expertise and the critical nature of their services, which ensure regulatory adherence and prevent costly penalties, give them leverage. The demand for these services is expected to remain high, with significant regulatory changes anticipated through 2025.

- Expertise in Compliance: Specialized firms offer in-depth knowledge of financial regulations, a resource banks cannot easily replicate internally.

- Critical Nature of Services: Failure to comply with regulations can result in substantial fines and reputational damage, making these services indispensable.

- Evolving Regulatory Landscape: Ongoing and upcoming regulatory changes in Australia, particularly in areas like data privacy and financial crime, increase the dependence on these external experts.

- High Demand: The continuous need for up-to-date compliance and cybersecurity advice strengthens the bargaining position of these providers.

Payment Infrastructure Providers

Payment infrastructure providers, including card networks and real-time payment platforms like Australia's New Payments Platform (NPP), wield significant bargaining power. Their essential role in facilitating transactions means banks like Commonwealth Bank (CBA) are heavily reliant on their services. As Australia continues its shift towards digital and real-time payments, this dependence is set to increase, potentially giving these suppliers more leverage in negotiating terms and fees.

The NPP, for instance, has seen substantial growth. By the end of 2023, over 100 financial institutions were connected, processing billions of transactions annually. This widespread adoption underscores the critical nature of such infrastructure, strengthening the position of its providers.

- Essential Role: Payment networks and real-time platforms are critical for enabling transactions, making them indispensable to banks.

- Growing Dependence: The increasing adoption of digital and real-time payment methods in Australia amplifies reliance on these infrastructure providers.

- Increased Leverage: This heightened dependence can translate into greater bargaining power for suppliers regarding service pricing and conditions.

- NPP Growth: The New Payments Platform's expansion, with billions of transactions processed by numerous connected institutions, highlights the critical infrastructure's importance.

Commonwealth Bank's bargaining power with its suppliers is influenced by the concentration of specialized technology providers and the critical nature of their services. Given CBA's substantial IT investment, estimated at $2.5 billion in 2024, these vendors hold considerable leverage due to the essential role their software and systems play in the bank's operations and digital innovation.

| Supplier Type | Dependence Level | Bargaining Power Indicator | 2024 Impact |

|---|---|---|---|

| Technology & Software Providers | High | Concentration & Specialization | Influence on pricing, contracts, operational costs |

| Specialized Legal & Consulting Firms | High | Regulatory Complexity & Expertise | Leverage in compliance, AML/CTF, cybersecurity |

| Payment Infrastructure Providers | High | Essential Transaction Facilitation | Increased leverage in fees and service conditions |

What is included in the product

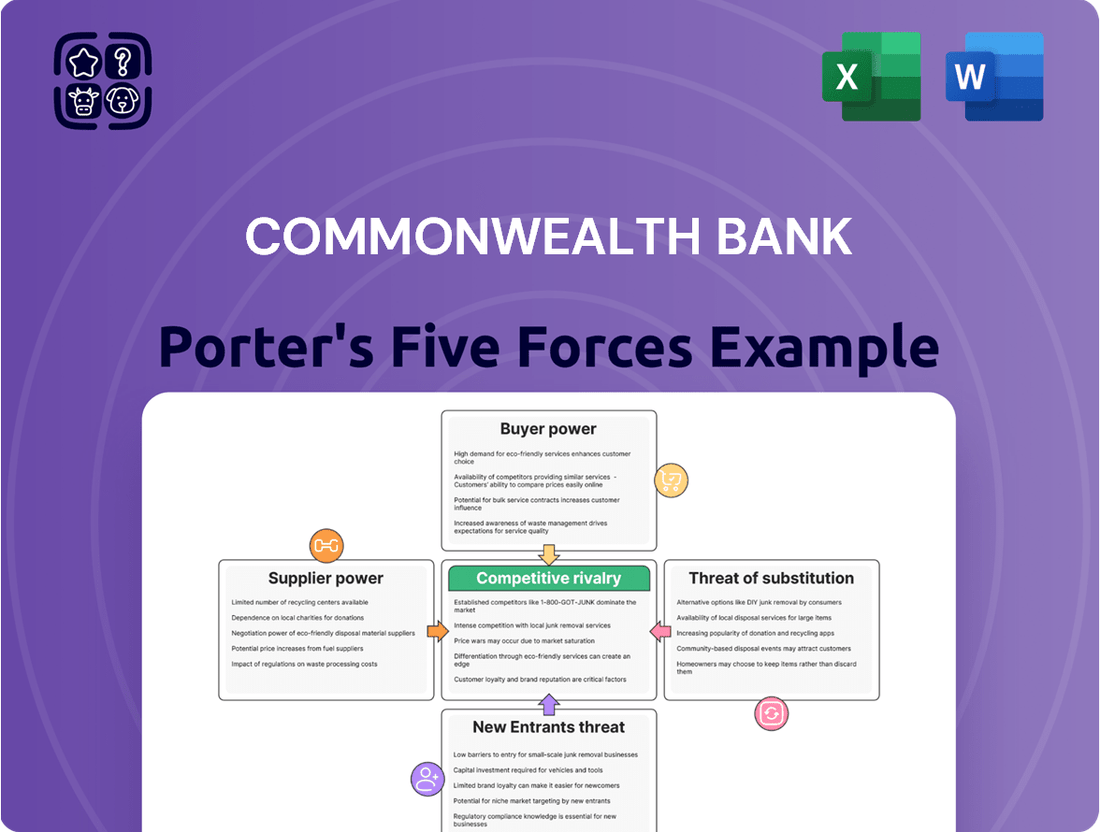

Tailored exclusively for Commonwealth Bank, this analysis dissects the intensity of rivalry, bargaining power of customers and suppliers, threat of new entrants, and the impact of substitutes on its competitive landscape.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments to alleviate market pressure.

Customers Bargaining Power

Australian retail banking customers, encompassing individuals and households, wield moderate to significant bargaining power. This is largely driven by intensifying competition within the sector and a notable reduction in the costs associated with switching financial institutions.

The proliferation of digital banking platforms, widespread adoption of mobile wallets, and the implementation of the Consumer Data Right (CDR) have collectively amplified customer choice and simplified the process of comparing banking products and services. For instance, as of late 2023, data indicated a substantial increase in digital transaction volumes across major Australian banks, reflecting this shift in customer behavior and expectation.

In response, banks like Commonwealth Bank (CBA) are increasingly adopting customer-centric strategies. Initiatives such as the CommBank Yello loyalty program aim to foster customer retention by offering personalized rewards and benefits, directly addressing the heightened bargaining power of their customer base.

Business banking customers, from small enterprises to large corporations, are increasingly vocal about their needs for integrated, flexible, and user-friendly financial services. This growing demand is putting pressure on traditional institutions to adapt.

The rise of fintech solutions offering tailored payment systems and lending options is a key factor. These agile competitors are forcing established banks to accelerate their innovation cycles to remain competitive, especially as Australian corporate banking revenue hit around $25 billion in 2024.

The digital revolution has dramatically shifted power to customers in the banking sector. With over 99% of Australian banking transactions now digital, customers expect seamless, fast, and secure experiences across various platforms like mobile wallets and online banking. This high level of digital adoption means customers can easily switch to banks offering superior digital services.

Banks that fail to keep pace with digital advancements face a significant risk of customer attrition. Competitors, especially newer digital-only banks, are often more agile and can quickly introduce innovative features that attract customers away from traditional institutions. This competitive pressure forces established banks to continuously invest in their digital capabilities to retain market share and meet evolving customer demands.

Interest Rate Sensitivity and Price Comparison

Customers' bargaining power is amplified by interest rate sensitivity, particularly as they actively compare offerings for deposits and loans. This heightened awareness, especially in 2024 with increasing household savings and intense competition in the home lending and deposit markets, allows consumers to more readily seek out superior financial products and rates. Banks like Commonwealth Bank face the challenge of balancing their profitability margins with the necessity of offering competitive pricing to secure and maintain their customer base.

In 2024, the Australian mortgage market saw significant competition, with major banks and non-bank lenders vying for market share. For instance, average variable mortgage rates hovered around 6.5% to 7.5% for owner-occupiers, prompting customers to actively switch providers for even minor rate differences. Similarly, deposit rates for savings accounts saw a notable increase, with some institutions offering up to 5.00% p.a. for bonus saver accounts, further empowering customers to shop around.

- Increased Rate Vigilance: Customers are more likely to switch banks for better deposit yields or lower loan rates.

- Competitive Market Dynamics: Intense competition in home lending and deposits in 2024 empowers customers to demand better terms.

- Price Sensitivity: As interest rates fluctuate, customers become more sensitive to pricing differences, impacting customer retention.

- Balancing Act for Banks: Institutions like Commonwealth Bank must offer competitive rates to attract and retain customers without compromising profitability.

Regulatory Protections and Consumer Data Right (CDR)

Ongoing regulatory reforms are significantly shifting the balance of power towards customers in the financial sector. Initiatives like the expansion of the Consumer Data Right (CDR) are a prime example, directly increasing customer bargaining power by granting them greater control and transparency over their financial data. This allows individuals to more easily compare offerings and switch providers, fostering a more competitive market landscape.

These reforms, including those focused on consumer protection and combating scams, are designed to ensure fairer practices across the industry. By empowering customers with more information and easier ways to move their business, these regulatory changes directly enhance their ability to negotiate better terms and services from financial institutions like Commonwealth Bank.

- Increased Transparency: Regulations like CDR mandate data sharing, making it easier for customers to compare products and fees.

- Enhanced Data Control: Consumers gain the right to access and share their financial data, facilitating switching.

- Greater Competition: These measures encourage new entrants and existing players to offer more competitive products to retain customers.

- Informed Decision-Making: Customers are better equipped to make choices that align with their financial needs and preferences.

Customers in the Australian banking sector, both individuals and businesses, hold significant bargaining power. This is fueled by a highly competitive market, the ease of switching providers due to digital advancements, and increasing customer awareness of available options. For instance, in 2024, the intense competition in the home loan market saw average variable rates for owner-occupiers ranging from 6.5% to 7.5%, encouraging customers to switch for even minor rate improvements.

| Factor | Impact on Customer Bargaining Power | Example (2024 Data) |

|---|---|---|

| Digitalization & Ease of Switching | High | Over 99% of Australian banking transactions are digital, simplifying comparison and switching. |

| Interest Rate Sensitivity | High | Savings account rates up to 5.00% p.a. offered by some institutions, driving customers to seek better yields. |

| Regulatory Reforms (e.g., CDR) | Increasing | CDR empowers customers with data control, facilitating easier product comparison and provider changes. |

| Fintech Competition | Moderate to High | Tailored solutions from fintechs pressure traditional banks to innovate and offer competitive pricing. |

Preview Before You Purchase

Commonwealth Bank Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for the Commonwealth Bank, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, offering actionable insights without any alterations or placeholders.

Rivalry Among Competitors

The Australian banking landscape is heavily influenced by the 'Big Four' – Commonwealth Bank, Westpac, ANZ, and NAB – which collectively control a substantial portion of the market. Commonwealth Bank itself is a dominant force, with nearly one-third of Australians identifying it as their primary financial institution.

Despite CBA's leading position, the competition among these four giants remains fierce. This intense rivalry plays out across all banking services, pushing for continuous innovation and putting downward pressure on pricing, which directly affects the net interest margins for all involved.

The Australian financial landscape is being reshaped by digital banks and fintech companies. These new entrants are leveraging mobile-first strategies and AI to offer competitive, low-cost banking solutions, directly challenging established players like Commonwealth Bank.

These disruptors are winning over younger customers with their convenience and innovative features. While their current market share remains modest, their rapid growth signals an intensifying competitive rivalry that traditional banks must actively address.

Competition in the mortgage and deposit markets is particularly fierce, directly impacting the net interest margins for major banks. This intense rivalry means institutions are constantly vying for both new borrowers and savers.

For instance, in 2024, Australian banks continued to face pressure on their net interest margins due to this competition. Commonwealth Bank, in particular, has been noted for its strategy of utilizing direct channels to acquire customers, aiming to reduce reliance on mortgage brokers and thereby protect its profit margins.

This aggressive pursuit of market share compels banks to innovate rapidly, not only in the products they offer but also in their pricing strategies to remain competitive.

Technological Advancements and Digital Transformation

The banking sector is experiencing intense rivalry fueled by rapid technological advancements. Companies are pouring resources into digital transformation, aiming to improve customer interactions and operational efficiency through technologies like AI and automation. For instance, in 2024, Australian banks collectively invested billions in digital capabilities, with Commonwealth Bank of Australia (CBA) itself highlighting significant spending on its digital platforms to enhance user experience and introduce new services.

This technological race means that banks successfully adopting new digital solutions to meet changing customer expectations are poised to gain a significant advantage. Real-time payment systems, for example, are becoming a standard expectation, forcing all players to adapt or risk falling behind. CBA's commitment to innovation, evident in its ongoing development of digital banking features, underscores the critical role technology plays in maintaining competitiveness in this dynamic environment.

- AI and Automation Investment: Banks are increasingly investing in AI for fraud detection and customer service, with global spending on AI in financial services projected to reach hundreds of billions by 2025.

- Digital-First Products: The development of mobile-first banking apps and online-only services is a key battleground, with major banks like CBA continually updating their digital offerings.

- Real-Time Payments Adoption: The push for instant payment systems, like the New Payments Platform in Australia, necessitates continuous technological upgrades across the industry.

- Customer Experience Enhancement: Digital transformation efforts are largely driven by the need to provide seamless and personalized customer journeys, a critical differentiator in 2024.

Regulatory Scrutiny and Compliance Costs

The Australian financial sector is experiencing heightened regulatory oversight, with significant compliance costs impacting operations. These costs are particularly pronounced for major institutions like Commonwealth Bank, influencing their strategic decisions and efficiency.

Key areas of focus include anti-money laundering (AML), cybersecurity, and consumer protection. For instance, in 2023, Australian banks collectively spent billions on compliance, with a substantial portion allocated to AML and KYC (Know Your Customer) initiatives.

- Increased AML/CTF spending: Banks are investing heavily in systems to detect and prevent financial crime.

- Cybersecurity investments: Protecting customer data and systems from evolving threats is a major cost driver.

- Consumer protection mandates: Adhering to new consumer rights and fair lending practices adds to operational expenses.

- Regulatory fines: Non-compliance can result in substantial penalties, impacting profitability and reputation.

The competitive rivalry within the Australian banking sector is intense, primarily driven by the dominance of the 'Big Four' and the increasing disruption from digital-only banks and fintechs. This dynamic forces established players like Commonwealth Bank to constantly innovate and compete aggressively on pricing and customer experience to maintain market share and profitability.

In 2024, this rivalry intensified as banks continued to invest heavily in digital transformation, with Commonwealth Bank of Australia (CBA) highlighting significant spending on its digital platforms. This focus on technology, including AI and real-time payment systems, is crucial for meeting evolving customer expectations and staying ahead in a market where convenience and competitive offerings are paramount.

The pressure on net interest margins remains a key consequence of this fierce competition, particularly in the mortgage and deposit markets. Commonwealth Bank's strategy of leveraging direct customer acquisition channels in 2024 reflects the ongoing efforts to manage costs and protect profitability amidst this aggressive market share pursuit.

The banking sector is also grappling with substantial compliance costs related to regulations like anti-money laundering and cybersecurity, which add another layer of operational expense and strategic consideration for major institutions like CBA. These regulatory demands, coupled with the need for technological investment, underscore the complex competitive environment.

| Competitor Type | Key Competitive Actions | Impact on CBA |

|---|---|---|

| Big Four Banks (Westpac, ANZ, NAB) | Price wars on mortgages and deposits, digital product innovation, customer acquisition campaigns. | Pressure on net interest margins, need for continuous service and product improvement, direct customer channel competition. |

| Digital Banks & Fintechs | Mobile-first offerings, AI-driven services, lower cost structures, agile product development. | Erosion of market share among younger demographics, demand for enhanced digital user experience, potential for disintermediation. |

| Regulatory Environment | Increased compliance burdens (AML, cybersecurity), consumer protection mandates. | Higher operational costs, strategic resource allocation towards compliance, potential for fines impacting profitability. |

SSubstitutes Threaten

The threat of substitutes for Commonwealth Bank's traditional payment services is elevated by the widespread adoption of digital payment platforms and mobile wallets. Services like Apple Pay and Google Pay provide consumers with highly convenient, often instant, transaction methods, diminishing the need for traditional banking channels for everyday purchases.

This trend is clearly visible in Australia, where mobile wallets accounted for a substantial 44% of device-present transactions in 2024. This significant market share demonstrates a clear consumer preference shift away from legacy payment methods, directly impacting the demand for traditional banking-based payment solutions.

Buy Now, Pay Later (BNPL) services are increasingly acting as a substitute for traditional banking products like credit cards and personal loans, especially for everyday consumer spending. This shift is particularly noticeable in Australia, where the BNPL market is experiencing significant growth, offering consumers more adaptable payment structures.

The appeal of BNPL, particularly among younger consumers, stems from its perceived ease of use and the flexibility it provides. While the regulatory landscape is evolving, with BNPL providers now falling under a credit licensing framework, their established user base and ongoing innovation continue to present a competitive challenge to conventional credit offerings from established institutions like Commonwealth Bank.

Fintech lenders and alternative financing platforms are increasingly offering business loans, personal credit, and mortgages, effectively bypassing traditional banks like Commonwealth Bank. These digital-first providers often use technology to streamline approvals and create customized financial products, attracting customers seeking speed and specialized solutions.

The expanding reach of non-bank lenders, particularly in specialized market segments, represents a significant substitute threat. For instance, by mid-2024, fintech platforms had captured an estimated 15% of the Australian mortgage market, a figure that has steadily climbed over recent years, demonstrating their growing impact on traditional banking services.

Cryptocurrencies and Blockchain Solutions

Cryptocurrencies and blockchain technology represent a nascent but growing threat of substitutes for traditional banking services. While not yet dominant for everyday transactions, their potential in areas like cross-border payments and asset management is significant. For instance, the global cross-border payments market was valued at over $150 trillion in 2023, a segment where blockchain solutions could offer more efficient alternatives.

As these decentralized financial solutions gain wider acceptance and regulatory frameworks mature, they present alternative avenues for value storage, transfer, and management. This disruption could impact conventional banking models by offering new ways for individuals and businesses to conduct financial activities outside traditional channels.

- Disruptive Potential: Blockchain and cryptocurrencies offer alternatives to traditional banking for payments and asset management, particularly in cross-border transactions where efficiency gains are substantial.

- Growing Adoption: While still developing, the increasing acceptance and potential for regulatory clarity bolster the threat of these digital assets as substitutes for conventional financial services.

- Market Value: The global cryptocurrency market capitalization reached over $2 trillion in early 2024, indicating substantial investor interest and the growing viability of these digital assets as stores of value and mediums of exchange.

Embedded Finance and Non-Financial Company Offerings

The growing trend of embedded finance poses a substantial threat. Non-financial companies are increasingly integrating financial services, like payments or lending, directly into their customer journeys. For instance, a retail platform might offer its own buy-now-pay-later option, bypassing traditional lenders.

This integration can disintermediate banks from their customers. By offering seamless financial solutions within their existing products, these companies can capture a significant portion of the market. In 2024, the embedded finance market was projected to reach over $7 trillion globally, highlighting its rapid expansion and potential to reshape financial services.

- Retailers offering integrated payment solutions.

- Automotive companies providing financing for vehicle purchases.

- Tech platforms embedding banking-like services.

- The global embedded finance market expected to exceed $7 trillion in 2024.

The threat of substitutes for Commonwealth Bank's services is significant, driven by digital payment platforms, Buy Now Pay Later (BNPL) schemes, fintech lenders, and embedded finance. These alternatives offer convenience, flexibility, and often faster processing, directly challenging traditional banking models.

Mobile wallets captured 44% of device-present transactions in Australia in 2024, illustrating a clear shift. Fintechs held an estimated 15% of the Australian mortgage market by mid-2024, while the global embedded finance market was projected to exceed $7 trillion in 2024, underscoring the broad impact of these substitutes.

| Substitute Type | Key Characteristics | 2024 Impact/Projection | Example |

| Digital Payments/Mobile Wallets | Convenience, speed, contactless | 44% of device-present transactions (Australia) | Apple Pay, Google Pay |

| Buy Now, Pay Later (BNPL) | Payment flexibility, interest-free options | Growing market share, challenging credit cards | Afterpay, Zip |

| Fintech Lenders | Streamlined approvals, specialized products | 15% of Australian mortgage market (mid-2024) | Prospa, Athena Home Loans |

| Embedded Finance | Integration into non-financial platforms | Projected >$7 trillion global market | Retailer financing, platform payments |

| Cryptocurrencies/Blockchain | Decentralized transactions, potential efficiency | >$2 trillion global market cap (early 2024) | Cross-border payments, asset management |

Entrants Threaten

The Australian banking sector presents a formidable threat of new entrants, largely due to high regulatory and capital requirements. Bodies like the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) enforce strict rules designed to safeguard financial stability and protect consumers. These regulations necessitate significant upfront investment in compliance infrastructure, robust risk management systems, and substantial capital reserves, creating a substantial barrier for aspiring competitors.

APRA's ongoing work on a three-tiered approach to proportionality in banking regulation, expected to be further clarified in 2024, may offer some relief for smaller institutions by potentially adjusting capital requirements. However, for major players and those seeking to enter at scale, the overall capital and compliance hurdles remain exceptionally high, effectively deterring many potential new entrants from challenging established banks like Commonwealth Bank.

Established players like Commonwealth Bank (CBA) leverage significant economies of scale, which translates to lower per-unit costs in operations and service delivery. For instance, CBA's extensive branch network and digital infrastructure, built over many years, are costly for new entrants to replicate. This scale advantage allows them to offer competitive pricing, making it harder for newcomers to undercut them and attract customers.

New entrants often struggle to secure the consistent, low-cost funding that established banks like Commonwealth Bank (CBA) benefit from due to their vast deposit bases. For instance, in 2024, major Australian banks continued to leverage their significant retail deposit holdings, which typically represent a cheaper funding source compared to wholesale markets that new players might rely on.

Building a robust distribution network, encompassing both physical branches and sophisticated digital platforms, demands considerable capital and time. While digital banking offers a more accessible entry point, replicating the widespread reach and customer trust established by incumbents like CBA, which in 2024 maintained a substantial branch and ATM network alongside its advanced digital offerings, remains a significant barrier.

Technological Investment and Infrastructure

While fintech innovations can democratize certain aspects of financial services, the substantial capital required to build and maintain a secure, scalable technological infrastructure remains a significant barrier. Legacy institutions like Commonwealth Bank have already committed billions to their IT systems, creating a high bar for new entrants. For instance, in 2023, major banks globally continued to pour significant funds into digital transformation, with many reporting IT spending in the billions of dollars to upgrade core banking systems and enhance cybersecurity.

New players must invest heavily in sophisticated platforms capable of processing vast transaction volumes and offering a wide array of financial products reliably and securely. This often translates to substantial upfront costs for software development, cloud infrastructure, and robust cybersecurity measures, making it challenging to compete with established players who have already amortized much of their technological investment.

- High Capital Expenditure: Building a secure, scalable, and compliant financial technology platform requires millions, if not billions, in initial investment for software, hardware, and specialized talent.

- Ongoing Maintenance and Upgrades: Continuous investment is necessary to maintain system integrity, adapt to evolving regulatory requirements, and stay ahead of cyber threats.

- Cybersecurity Demands: The financial sector faces constant threats, necessitating significant and ongoing expenditure on advanced cybersecurity solutions to protect customer data and assets.

Consumer Data Right (CDR) and Open Banking

The Consumer Data Right (CDR) and the push for open banking are significant developments that could lower barriers for new players entering the financial services sector. By allowing easier access to customer data, these initiatives aim to foster greater competition and innovation. For instance, in Australia, the CDR framework is progressively expanding, with banking data being the first sector to be fully open, and other sectors like energy and telecommunications following suit.

While CDR and open banking can reduce the initial hurdles for new entrants by providing access to essential customer information, they don't guarantee success. New competitors must still develop attractive product offerings and establish credibility to win over consumers. Building trust remains a critical factor, even with facilitated data sharing.

The actual impact of CDR on the threat of new entrants is still unfolding. While the potential for disruption is clear, the long-term effect will depend on how effectively new businesses can leverage the data and build sustainable competitive advantages. As of early 2024, the landscape is dynamic, with ongoing refinements to the CDR rules and the emergence of new data-driven services.

Key aspects of CDR and open banking impacting new entrants include:

- Reduced information asymmetry: CDR allows consumers to share their banking data with accredited third parties, leveling the playing field for new service providers.

- Lower switching costs: Easier data portability can reduce the effort for consumers to switch providers, potentially benefiting agile new entrants.

- Facilitation of new business models: The framework encourages the development of innovative financial products and services that leverage shared data.

- Ongoing regulatory evolution: The full ramifications of CDR are still being realized as the framework expands and matures.

The threat of new entrants into the Australian banking sector, including Commonwealth Bank, remains relatively low due to substantial barriers. These include stringent regulatory capital requirements and the need for extensive, costly infrastructure. While open banking initiatives like the Consumer Data Right (CDR) aim to reduce information asymmetry and facilitate new business models, building customer trust and replicating the scale of established players are still significant hurdles.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Commonwealth Bank leverages data from the bank's annual reports, investor presentations, and ASX filings. We also incorporate insights from industry-specific research from firms like IBISWorld and financial data providers such as S&P Capital IQ.