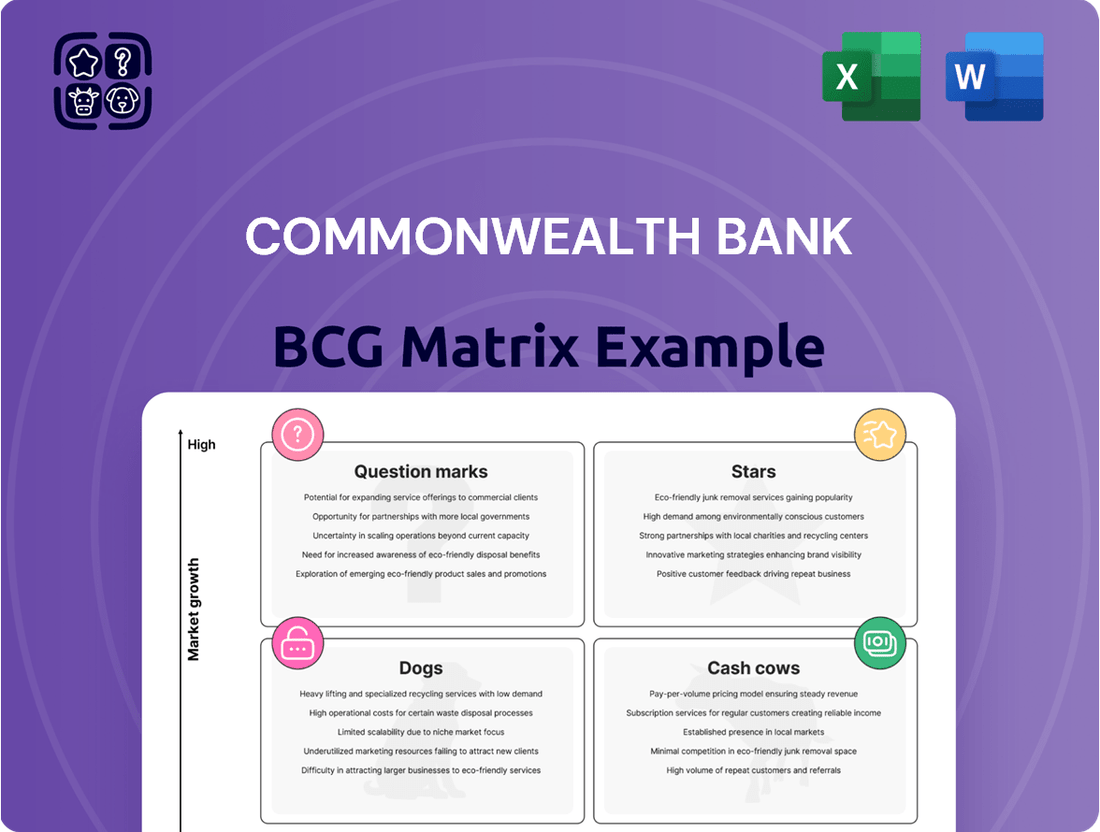

Commonwealth Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commonwealth Bank Bundle

Uncover the strategic positioning of Commonwealth Bank's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are driving growth and which require careful consideration, giving you a clear picture of their market performance.

This preview offers a glimpse into Commonwealth Bank's market dynamics. Purchase the full BCG Matrix report to gain in-depth insights into each quadrant, data-backed recommendations, and a strategic roadmap for optimizing your investments and product development.

Stars

The CommBank app stands out as a significant Star for Commonwealth Bank, having garnered over 8.5 million active users. This impressive user base translates into a substantial portion of the bank's customer interactions, with daily log-ins showing consistent growth. This high adoption rate and engagement underscore its strong position in the digital banking market.

Commonwealth Bank's commitment to innovation fuels the CommBank app's success. The bank actively invests in developing its digital capabilities, regularly introducing new features. These enhancements, such as AI-powered personalization and advanced security measures, are crucial for maintaining its competitive edge and driving continued growth in digital engagement.

This robust digital platform solidifies the CommBank app's leadership in the rapidly changing banking sector. Its ability to attract and retain a vast customer base through a seamless and feature-rich digital experience is a key differentiator. The app's performance is a testament to the bank's strategic focus on digital transformation.

Commonwealth Bank's (CBA) business lending is a strong performer, fitting the Star category in the BCG Matrix. CBA's business lending has experienced robust growth, exceeding overall system growth. For instance, during the first half of 2024, CBA reported a significant increase in its business lending portfolio.

The bank's strategic focus on expanding its business banking segment has been a key driver. This expansion is evidenced by a substantial rise in business transaction accounts, indicating increased engagement with business clients. This growing market share in a dynamic sector highlights its Star status.

The strong performance in business finance contributes significantly to CBA's overall financial results. This segment's growth and market position solidify its role as a key Star product, generating substantial revenue and reinforcing CBA's competitive advantage in the business banking market.

Commonwealth Bank is making significant strides in AI, integrating it across its services to boost customer interactions and streamline operations. Their commitment to AI is evident in their recognition as a leader in banking AI maturity, showcasing a strong foundation for future growth.

The bank's strategic deployment of AI for enhanced financial insights and personalized services places it in a prime position for market leadership. For instance, in 2023, CBA reported a substantial increase in digital transactions, partly attributed to AI-driven personalization, demonstrating the tangible impact of these investments.

Customer Recognition Programs (e.g., CommBank Yello)

CommBank Yello, a prominent customer recognition program, is a key component of Commonwealth Bank's strategy. It's deeply integrated into the CommBank app, making it easily accessible for millions of users. This program is designed to foster stronger customer relationships by offering tangible rewards and personalized experiences.

The program's success is evident in its widespread adoption. As of recent data, over 5.1 million active retail customers are engaging with CommBank Yello. This high level of participation underscores its effectiveness in driving customer loyalty and engagement. The program's ability to offer benefits such as cashbacks and discounts directly translates into increased value for customers.

- CommBank Yello's rapid adoption: Over 5.1 million active retail customers are using the program.

- Customer engagement driver: Offers personalized benefits like cashbacks and discounts.

- Market share enhancement: Strengthens customer loyalty and improves value propositions.

- Growth indicator: Demonstrates a high-growth area in customer relationship management.

Strategic Partnerships for Digital Solutions

Commonwealth Bank (CBA) actively pursues strategic partnerships to bolster its digital solutions portfolio, a key indicator for its position within a BCG Matrix framework. These collaborations are designed to accelerate innovation and market penetration in high-growth digital segments.

CBA's alliance with Paydock for its PowerBoard platform exemplifies this strategy. This partnership allows CBA to offer advanced payment processing capabilities, aiming to capture a significant share of the merchant services market. In 2024, the digital payments sector continued its robust expansion, with global transaction volumes projected to exceed $2 trillion.

Furthermore, the collaboration with MRI Software for Smart Real Estate Payments showcases CBA's focus on specialized, high-potential industries. This initiative aims to simplify and automate payment processes within the real estate sector, a market ripe for digital transformation. Real estate technology, or proptech, saw substantial investment in 2024, with funding rounds reaching billions globally.

- Partnership Focus: CBA leverages strategic alliances to enhance its digital payment offerings, targeting specialized and high-growth market segments.

- Market Expansion: Collaborations like those with Paydock and MRI Software are designed to quickly expand CBA's reach within specific digital payment ecosystems, such as merchant services and real estate.

- Innovation Driver: By integrating external expertise, CBA accelerates the development and deployment of innovative solutions, positioning itself competitively in the rapidly evolving digital landscape.

- Sector Growth: These partnerships are strategically aligned with the strong growth trajectories observed in the digital payments and proptech sectors in 2024.

Commonwealth Bank's (CBA) business lending is a strong performer, fitting the Star category in the BCG Matrix. CBA's business lending has experienced robust growth, exceeding overall system growth. For instance, during the first half of 2024, CBA reported a significant increase in its business lending portfolio.

The bank's strategic focus on expanding its business banking segment has been a key driver. This expansion is evidenced by a substantial rise in business transaction accounts, indicating increased engagement with business clients. This growing market share in a dynamic sector highlights its Star status.

The strong performance in business finance contributes significantly to CBA's overall financial results. This segment's growth and market position solidify its role as a key Star product, generating substantial revenue and reinforcing CBA's competitive advantage in the business banking market.

Commonwealth Bank's commitment to innovation fuels the CommBank app's success. The bank actively invests in developing its digital capabilities, regularly introducing new features. These enhancements, such as AI-powered personalization and advanced security measures, are crucial for maintaining its competitive edge and driving continued growth in digital engagement.

This robust digital platform solidifies the CommBank app's leadership in the rapidly changing banking sector. Its ability to attract and retain a vast customer base through a seamless and feature-rich digital experience is a key differentiator. The app's performance is a testament to the bank's strategic focus on digital transformation.

CommBank Yello, a prominent customer recognition program, is a key component of Commonwealth Bank's strategy. It's deeply integrated into the CommBank app, making it easily accessible for millions of users. This program is designed to foster stronger customer relationships by offering tangible rewards and personalized experiences.

The program's success is evident in its widespread adoption. As of recent data, over 5.1 million active retail customers are engaging with CommBank Yello. This high level of participation underscores its effectiveness in driving customer loyalty and engagement. The program's ability to offer benefits such as cashbacks and discounts directly translates into increased value for customers.

Commonwealth Bank is making significant strides in AI, integrating it across its services to boost customer interactions and streamline operations. Their commitment to AI is evident in their recognition as a leader in banking AI maturity, showcasing a strong foundation for future growth.

The bank's strategic deployment of AI for enhanced financial insights and personalized services places it in a prime position for market leadership. For instance, in 2023, CBA reported a substantial increase in digital transactions, partly attributed to AI-driven personalization, demonstrating the tangible impact of these investments.

Commonwealth Bank (CBA) actively pursues strategic partnerships to bolster its digital solutions portfolio, a key indicator for its position within a BCG Matrix framework. These collaborations are designed to accelerate innovation and market penetration in high-growth digital segments.

CBA's alliance with Paydock for its PowerBoard platform exemplifies this strategy. This partnership allows CBA to offer advanced payment processing capabilities, aiming to capture a significant share of the merchant services market. In 2024, the digital payments sector continued its robust expansion, with global transaction volumes projected to exceed $2 trillion.

Furthermore, the collaboration with MRI Software for Smart Real Estate Payments showcases CBA's focus on specialized, high-potential industries. This initiative aims to simplify and automate payment processes within the real estate sector, a market ripe for digital transformation. Real estate technology, or proptech, saw substantial investment in 2024, with funding rounds reaching billions globally.

| Product/Service | BCG Category | Key Performance Indicators (2024 Data) | Strategic Rationale | Market Outlook |

| CommBank App | Star | 8.5M+ active users, consistent daily login growth | High user adoption and engagement, digital market leadership | Continued growth in digital banking adoption |

| Business Lending | Star | Exceeding overall system growth, substantial increase in portfolio | Strategic focus on business segment expansion, growing market share | Dynamic sector with increasing demand for business finance |

| AI Integration | Star | Leader in banking AI maturity, 2023 digital transaction increase via AI personalization | Enhanced customer insights, personalized services, operational efficiency | AI adoption in finance is a significant growth driver |

| CommBank Yello | Star | 5.1M+ active retail customers, high participation in rewards | Strengthens customer loyalty and engagement, enhances value proposition | Customer relationship management and loyalty programs are crucial |

| Digital Payment Partnerships (Paydock, MRI Software) | Star | Targeting merchant services and proptech, digital payments sector growth | Accelerates innovation, expands market reach in high-growth digital segments | Digital payments and proptech are experiencing substantial global investment and growth |

What is included in the product

The Commonwealth Bank BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear Commonwealth Bank BCG Matrix overview eliminates confusion about business unit performance, easing strategic decision-making.

Cash Cows

Commonwealth Bank's retail banking everyday accounts are a classic cash cow. They hold a massive market share in Australia for transaction accounts, making them the go-to for many. This stability means they generate a reliable, consistent flow of cash.

The sheer size of their customer base, coupled with the frequent use of the CommBank app for daily banking, highlights their entrenched market position. In 2023, Commonwealth Bank reported over 16 million customers, with a significant portion utilizing their everyday banking services.

Commonwealth Bank's home lending division operates as a classic Cash Cow within its BCG Matrix. As Australia's largest home lender, CBA commands a substantial market share, boasting a total mortgage book valued at approximately AUD 556 billion as of March 2024. This dominant position, supported by a vast and loyal customer base, generates consistent and significant cash flow, even if growth rates have recently moderated, sometimes lagging behind the broader market.

Traditional Business Banking Services within Commonwealth Bank's portfolio are firmly positioned as Cash Cows. The bank's deep penetration, serving as the primary financial institution for a significant portion of Australian businesses, underpins this classification.

These services, encompassing essentials like business transaction accounts and conventional lending, consistently generate substantial and dependable revenue streams. This maturity in the market ensures a stable and predictable cash flow for the bank.

Commonwealth Bank's established relationships with approximately a quarter of all Australian businesses solidify the ongoing, reliable income from this segment, highlighting its Cash Cow status.

Core Deposit Franchise

Commonwealth Bank's (CBA) core deposit franchise acts as a significant cash cow, providing a stable and cost-effective funding base. This strong foundation is crucial for its overall profitability.

Household deposits have shown consistent growth, reinforcing CBA's financial stability. For instance, as of June 30, 2024, CBA reported a substantial increase in its customer deposit base, which is a testament to its market position.

This large and sticky deposit base generates reliable net interest income with limited need for aggressive marketing spend. It represents a mature business unit that consistently returns value.

- Stable Funding Source: CBA's deposit franchise provides a reliable and low-cost way to fund its lending activities.

- Household Deposit Growth: Continued increases in household deposits, a key metric for 2024, highlight customer trust and market share.

- Consistent Profitability: The low-risk nature and established market position of this segment translate into predictable earnings.

- Minimal Investment Required: As a mature cash cow, it requires less capital for growth compared to other business units.

Wealth Management and Superannuation

Commonwealth Bank's Wealth Management and Superannuation offerings act as significant cash cows. These segments provide a steady stream of recurring revenue through funds management, superannuation accounts, and insurance products for both individuals and businesses.

While precise segment growth rates fluctuate, their established market position and the inherent nature of financial services contribute to stable, predictable income for CBA. This stability is a hallmark of a cash cow, allowing the bank to allocate resources to other areas.

- Diversified Income: The broad range of products caters to a wide customer base, ensuring consistent revenue.

- Recurring Fees: Superannuation and funds management generate ongoing fees, providing a reliable income stream.

- Established Client Base: A large, loyal customer base minimizes acquisition costs and maximizes lifetime value.

- Stable Cash Flow: These mature businesses are less susceptible to market volatility, offering dependable cash generation.

Commonwealth Bank's mortgage portfolio, particularly its established home lending business, functions as a prime cash cow. As Australia's largest mortgage provider, holding roughly AUD 556 billion in mortgages as of March 2024, it generates substantial and consistent net interest income. While growth may be moderate, the sheer scale and customer loyalty ensure a reliable cash flow, requiring minimal reinvestment for expansion.

The bank's core deposit franchise is another significant cash cow, serving as a stable and low-cost funding source. With a growing customer deposit base as of June 30, 2024, this segment provides predictable earnings through net interest income, demanding little in terms of aggressive marketing or new product development.

Commonwealth Bank's traditional business banking services, including transaction accounts and standard lending, are firmly established cash cows. Serving about a quarter of Australian businesses, these mature offerings deliver consistent and dependable revenue streams, benefiting from deep market penetration and long-standing client relationships.

| Business Segment | BCG Matrix Classification | Key Characteristics | Supporting Data (as of latest available) |

|---|---|---|---|

| Home Lending | Cash Cow | Dominant market share, stable net interest income, high customer loyalty. | AUD 556 billion mortgage book (March 2024). |

| Core Deposit Franchise | Cash Cow | Low-cost funding, consistent net interest income, growing deposit base. | Substantial increase in customer deposits (June 30, 2024). |

| Traditional Business Banking | Cash Cow | Deep market penetration, reliable revenue from core services, established client relationships. | Serves approx. 25% of Australian businesses. |

Delivered as Shown

Commonwealth Bank BCG Matrix

The Commonwealth Bank BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just a comprehensive strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix report you see here is the exact final version you will download upon completing your purchase. It's meticulously crafted to provide actionable insights into the Commonwealth Bank's business units, enabling informed strategic decision-making.

What you're previewing is the actual, professionally designed Commonwealth Bank BCG Matrix file that will be yours after purchase. This means you'll receive a complete, analysis-ready document that you can instantly edit, print, or present to stakeholders.

Dogs

Commonwealth Bank has strategically divested certain international assets, such as PT Bank Commonwealth in Indonesia, as part of its portfolio realignment. This move suggests a focus on optimizing resource allocation towards more promising ventures.

These divestitures are indicative of shedding operations in markets where the bank likely faced challenges such as low market share or limited growth prospects. For instance, the sale of its Indonesian subsidiary in 2023 was a deliberate step to exit a market that did not align with its core strategic direction.

Such divested assets would typically be classified as Dogs within the BCG Matrix framework. They are assets that consume resources without generating significant returns or exhibiting substantial growth potential, prompting the bank to divest to improve overall portfolio efficiency.

Legacy IT systems at Commonwealth Bank, while not products, can function as Stars in a BCG Matrix context. These systems demand substantial ongoing investment for maintenance and upgrades, consuming resources without generating new revenue streams or driving future growth. For instance, in FY23, CBA continued its significant investment in technology, with a considerable portion likely allocated to maintaining and modernizing these older platforms to prevent them from becoming drains.

Within Commonwealth Bank's extensive wealth management operations, certain specialized or legacy investment portfolios might be experiencing sluggish growth or operating in mature, low-demand sectors. These would likely represent a small fraction of the bank's overall market share in their respective niches.

Such underperforming portfolios, characterized by low growth and limited market presence, would be categorized as 'Dogs' in the BCG Matrix. For instance, a portfolio heavily invested in a declining industry, perhaps a specific type of legacy bond fund, could fit this description.

In 2024, Commonwealth Bank's wealth management division reported a net profit after tax of AUD 1.2 billion, with a significant portion driven by its core, high-growth offerings. Portfolios falling into the 'Dog' category would dilute overall profitability and consume resources without contributing substantially to strategic objectives.

Therefore, these niche, underperforming portfolios would be prime candidates for divestment or a comprehensive strategic overhaul to either revitalize their performance or exit the market to reallocate capital to more promising ventures.

Non-Core, Low-Return Physical Branch Locations in Declining Areas

In the current banking landscape, Commonwealth Bank's physical branches situated in areas with declining populations or low customer traffic could be classified as 'Dogs' within the BCG Matrix. These locations often carry substantial operational expenses, including rent and staffing, while contributing minimally to new business generation or customer interaction, especially when contrasted with the efficiency of digital platforms.

For instance, while specific data for CBA's underperforming branches isn't publicly detailed, the broader trend shows a significant shift. By the end of 2023, Australian banks collectively closed hundreds of branches, reflecting this move away from physical footprints in less viable areas. This consolidation is driven by the increasing preference for digital banking, with a substantial portion of routine transactions now conducted online or via mobile apps.

- Operational Costs: Branches in declining areas incur fixed costs for rent, utilities, and personnel, often without commensurate revenue generation.

- Low Engagement: Customer footfall and transaction volumes are typically low, indicating limited market share or customer interest in these specific locations.

- Digital Channel Dominance: The rise of mobile and online banking has reduced the necessity for extensive physical networks, particularly in less populated or economically stagnant regions.

- Strategic Re-evaluation: CBA, like its peers, continually assesses its branch network to optimize costs and resource allocation, potentially leading to the consolidation or repurposing of 'Dog' category locations.

Outdated or Low-Demand Niche Lending Products

Outdated or low-demand niche lending products can become a drag on Commonwealth Bank's portfolio. As market needs evolve and new regulations emerge, some specialized offerings might see their relevance diminish. If CBA continues to support these products with minimal customer uptake and little prospect for future growth, they would be classified as 'Dogs' in the BCG Matrix.

For these 'Dog' products, the strategic approach typically involves minimizing further investment. The bank would likely focus on managing these offerings efficiently, perhaps by streamlining operations or reducing marketing spend. Ultimately, the aim is to eventually phase out these underperforming assets to reallocate resources to more promising areas of the business.

- Low Uptake: For example, a niche mortgage product designed for a specific, now-declining industry might see its application numbers drop significantly. In 2024, reports indicated a general slowdown in specialized lending segments that haven't adapted to digital transformation.

- Limited Growth Potential: These products often lack a clear path to expansion, especially if the underlying market shrinks or is disrupted by newer, more agile competitors.

- Resource Reallocation: By identifying and divesting from these 'Dogs', CBA can free up capital and operational capacity to invest in growth areas like digital banking solutions or sustainable finance.

- Phased Exit Strategy: A gradual withdrawal, perhaps by not accepting new applications or limiting servicing, allows for a controlled exit without alienating existing customers.

Commonwealth Bank's 'Dogs' represent business units or products with low market share and low growth prospects. These are often legacy assets that consume resources without contributing significantly to profitability or strategic goals. The bank's strategy typically involves minimizing investment in these areas and planning for eventual divestment or phasing out.

Examples include certain niche lending products with declining demand or physical branches in areas with low customer traffic. In 2024, the trend of branch consolidation continued across the Australian banking sector, with many institutions exiting less viable locations, a clear indicator of shedding 'Dog' assets.

The financial impact of these 'Dogs' is their drain on resources, such as operational costs for branches or maintenance for outdated systems. By identifying and managing these segments, CBA aims to reallocate capital to higher-growth areas, enhancing overall portfolio efficiency.

The divestment of international subsidiaries, like PT Bank Commonwealth in Indonesia, also falls under this classification. These were strategic exits from markets where growth prospects were limited, freeing up resources for more strategic domestic initiatives.

| BCG Category | Characteristics | Commonwealth Bank Examples | Strategic Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Underperforming niche lending products, select physical branches in low-traffic areas, divested international subsidiaries | Minimize investment, manage for cash flow, divest or phase out |

Question Marks

Commonwealth Bank is actively integrating Generative AI (GenAI), exemplified by Australia's first GenAI-powered customer messaging service, aiming to revolutionize customer interactions and internal efficiencies. This strategic move targets high-growth areas like personalized banking, but the long-term market adoption and definitive impact on market share remain uncertain as these technologies mature.

The significant investments in scaling these advanced AI solutions are crucial for unlocking their full potential, positioning them as potential stars in the BCG matrix. For instance, in 2024, financial institutions globally were projected to spend billions on AI, with customer service applications being a major focus, indicating a strong market trend towards these capabilities.

Commonwealth Bank's introduction of new digital payment systems like Smart Real Estate Payments and PowerBoard places them in a position that resembles a Question Mark within the BCG Matrix. These innovative solutions are targeting established sectors, aiming to streamline processes in areas such as rental payments and merchant services.

While these platforms offer significant potential to disrupt existing markets, their current market share and rapid growth are still developing. For instance, the adoption rate of such specialized payment systems can be slow initially, requiring substantial marketing and user education efforts to gain traction.

To transition from a Question Mark to a Star, these digital payment systems would need to demonstrate a clear path to increased market share and revenue growth. This often involves overcoming user inertia and demonstrating superior value propositions compared to existing payment methods, a process that requires significant ongoing investment.

Commonwealth Bank's (CBA) move into sustainable finance products, like the Business Green Loan, signals a strategic pivot towards an evolving market. While this segment is experiencing rapid growth globally, CBA's current market share in these emerging green financing areas is likely still in its early stages.

The bank's commitment to fostering a sustainable economy is evident through these new offerings. For instance, in 2023, the global sustainable bond market reached a record $1.3 trillion, highlighting the significant opportunity for financial institutions to participate and lead.

To truly capitalize on this burgeoning sector, CBA must undertake substantial investment in marketing and demonstrating the tangible benefits of its green finance products. This proactive approach is essential for these initiatives to transition from nascent offerings to more established and widely adopted financial solutions.

Blockchain and Digital Asset Initiatives (e.g., Project Acacia)

Commonwealth Bank's engagement in blockchain and digital assets, exemplified by Project Acacia, positions it within the 'Question Marks' category of the BCG Matrix. This reflects a strategic focus on a high-growth, potentially disruptive sector of finance.

While the overall digital asset market is expanding rapidly, with global digital asset market capitalization reaching trillions of dollars in recent years, CBA's current market share in these nascent areas is minimal. The bank is investing in these initiatives to improve operational efficiency and bolster risk management within its financial infrastructure.

- High Market Growth Potential: The blockchain and digital asset space is experiencing significant innovation and adoption, indicating substantial future growth opportunities.

- Low Current Market Share: CBA's presence and market penetration in this experimental domain are currently limited, reflecting the early stage of its involvement.

- Significant Investment & Uncertain Returns: These initiatives require considerable investment, with the potential for high future returns but also carrying inherent risks due to market volatility and regulatory uncertainty.

- Strategic Importance: Exploring these technologies is crucial for CBA to remain competitive and adapt to evolving financial landscapes.

Targeted Fintech Investments via x15ventures

Commonwealth Bank's venture-scaling arm, x15ventures, actively invests in and nurtures startups that align with the bank's overarching strategic objectives, with a notable recent emphasis on artificial intelligence.

These strategic investments, exemplified by companies like Splashup and OwnHome, target high-growth fintech sectors. While these ventures are in promising areas, their individual market share remains relatively small when contrasted with CBA's established core banking operations.

These are essentially strategic bets for Commonwealth Bank, requiring ongoing support and development to potentially evolve into future Stars within the BCG matrix framework. For instance, in 2024, x15ventures continued to build its AI portfolio, seeking to integrate innovative solutions into the broader CBA ecosystem.

- Strategic Alignment: x15ventures focuses on startups that complement CBA's strategic direction, particularly in AI-driven fintech solutions.

- Growth Potential: Investments like Splashup and OwnHome target high-growth fintech markets, aiming for significant future market penetration.

- BCG Matrix Positioning: These ventures are considered Question Marks, requiring further investment and development to transition into Stars or Cash Cows.

- 2024 Focus: The arm's 2024 activities underscored a commitment to building out AI capabilities through targeted startup investments.

Commonwealth Bank's initiatives in digital payment systems and sustainable finance products represent classic Question Marks within the BCG Matrix. These ventures are in rapidly expanding markets, but their current market share is still developing, necessitating significant investment and strategic nurturing.

The bank's exploration of blockchain and digital assets, alongside its venture-scaling arm x15ventures' investments in AI-focused startups, also fall into this category. These represent high-growth potential areas where CBA is establishing an early presence, with uncertain but potentially high future returns.

For these Question Marks to evolve into Stars, they require substantial capital injection and focused strategies to capture market share and drive revenue growth. The success of these ventures hinges on their ability to adapt to market dynamics and demonstrate a clear competitive advantage.

| Initiative | Market Growth | Current Market Share | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Digital Payment Systems | High | Low | High | Star or Dog |

| Sustainable Finance | High | Low | High | Star or Dog |

| Blockchain & Digital Assets | Very High | Very Low | Very High | Star or Dog |

| x15 Ventures (AI Startups) | High | Low (Individual) | High | Star or Dog |

BCG Matrix Data Sources

Our Commonwealth Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.