Commonwealth Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commonwealth Bank Bundle

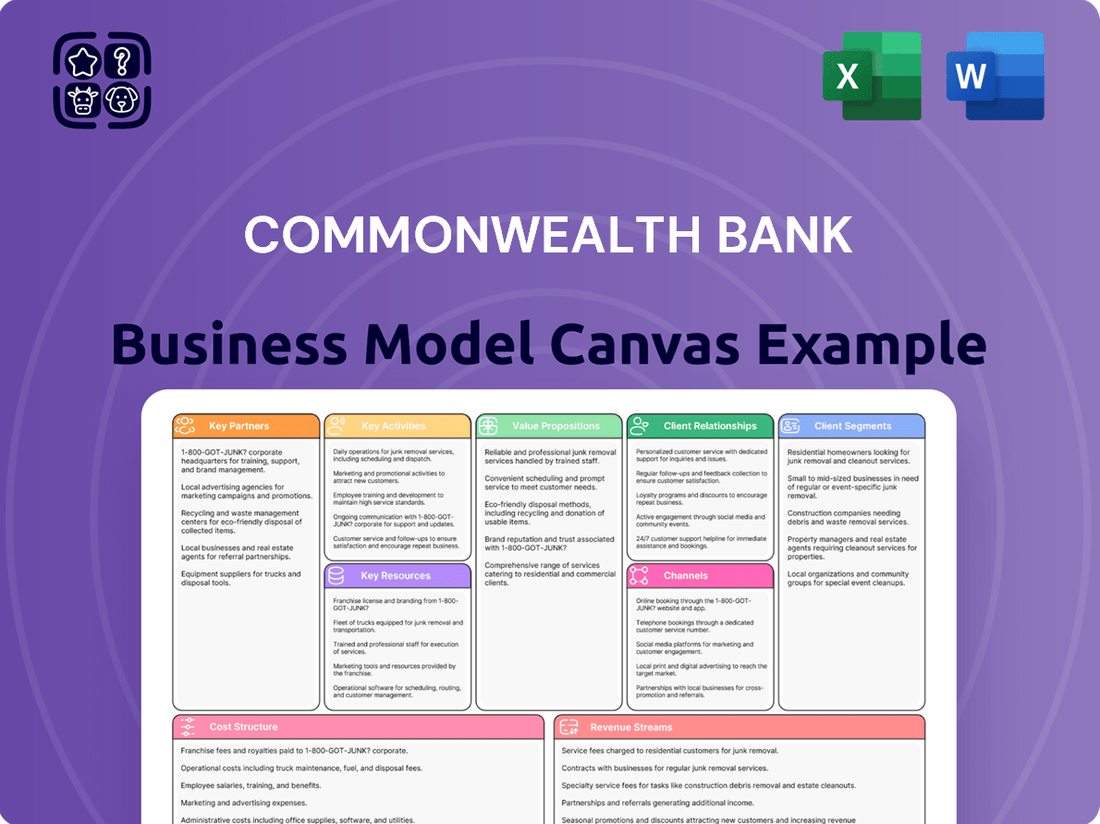

Explore the core components of Commonwealth Bank's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Dive in and discover the strategic framework that fuels their growth.

Partnerships

Commonwealth Bank actively collaborates with technology and fintech partners to bolster its digital services and operational agility. These strategic alliances allow the bank to embed advanced solutions, such as AI for data analysis and robust payment systems, ensuring it remains competitive in the fast-paced digital financial environment.

Commonwealth Bank's strategic alliances with global payment networks like Visa and Mastercard, alongside local processors, are fundamental. These partnerships ensure customers can transact smoothly, with widespread acceptance of the bank's cards and efficient processing of electronic payments, both within Australia and across borders.

Commonwealth Bank actively engages with government and regulatory bodies, including the Reserve Bank of Australia and the Australian Prudential Regulation Authority. This ensures adherence to crucial banking laws and financial stability regulations. For instance, in 2023, the bank reported significant capital adequacy ratios, well above regulatory minimums, demonstrating its commitment to financial resilience and public trust.

Industry Associations and Alliances

Commonwealth Bank actively collaborates with industry associations like the Australian Banking Association. This partnership allows them to influence industry standards and advocate for beneficial policy changes.

These alliances are crucial for fostering a robust financial ecosystem and collectively addressing sector-wide challenges. For instance, in 2024, the Australian Banking Association continued to engage with government on issues like responsible lending and digital finance.

Key benefits derived from these partnerships include:

- Influence on Regulatory Frameworks: Direct input into policy discussions impacting the banking sector.

- Knowledge Sharing and Best Practices: Access to and contribution to industry-wide learning and operational improvements.

- Enhanced Advocacy Power: A unified voice for addressing common industry concerns and promoting sector growth.

Third-Party Service Providers and Vendors

Commonwealth Bank leverages a broad ecosystem of third-party service providers to support its extensive operations. These partnerships are crucial for areas like IT infrastructure, where companies like IBM and Accenture have historically played significant roles in managing and modernizing the bank's technology. In 2024, the bank continued to invest heavily in digital transformation, relying on these vendors for cloud computing, data analytics, and cybersecurity solutions.

These collaborations enable Commonwealth Bank to outsource specialized functions, ensuring access to cutting-edge technology and expertise without the overhead of maintaining these capabilities in-house. For instance, cybersecurity vendors are essential for protecting sensitive customer data and financial transactions, a critical aspect of banking operations. Property management and marketing services are also outsourced to specialized firms to optimize efficiency and reach.

- IT Infrastructure: Partnerships with global technology providers for cloud services, data centers, and network management.

- Cybersecurity: Collaboration with specialized firms to implement advanced threat detection and data protection measures.

- Property Management: Engaging external vendors for the maintenance and operation of the bank's extensive branch network and corporate offices.

- Marketing & Communications: Working with agencies for advertising campaigns, digital marketing, and public relations efforts.

Commonwealth Bank's key partnerships extend to a diverse range of technology and fintech innovators, crucial for enhancing its digital offerings and operational efficiency. These alliances, including collaborations with companies providing AI and advanced payment solutions, ensure the bank remains at the forefront of financial technology. For example, in 2024, the bank continued its focus on digital transformation, leveraging these partnerships to deliver seamless customer experiences.

| Partner Type | Examples | Strategic Importance |

|---|---|---|

| Technology & Fintech | AI providers, Payment processors, Cloud services | Digital service enhancement, operational agility, innovation |

| Payment Networks | Visa, Mastercard | Global transaction capabilities, customer convenience |

| Regulatory Bodies | RBA, APRA | Compliance, financial stability, public trust |

| Industry Associations | Australian Banking Association | Policy influence, sector advocacy |

| Third-Party Service Providers | IBM, Accenture, Cybersecurity firms | IT infrastructure, specialized expertise, operational efficiency |

What is included in the product

A comprehensive, pre-written business model tailored to the Commonwealth Bank's strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The Commonwealth Bank Business Model Canvas offers a structured approach to identify and address customer pain points by clearly mapping out value propositions and customer relationships.

It simplifies complex business strategies, enabling a focused effort on alleviating specific customer frustrations and improving service delivery.

Activities

Commonwealth Bank's retail and business banking operations are the engine of its customer relationships. These core activities revolve around managing everyday accounts, processing a vast number of transactions, and offering essential financial products like loans, mortgages, and credit cards to both individual consumers and businesses of all sizes. This daily grind ensures customers can manage their finances efficiently.

The bank's commitment to serving its broad customer base is evident in its multi-channel approach. Whether through physical branches, sophisticated digital platforms, or responsive call centers, Commonwealth Bank ensures accessibility and convenience. In 2024, the bank continued to invest heavily in its digital channels, aiming to streamline processes and enhance customer experience across all touchpoints.

Commonwealth Bank's funds management and superannuation activities are central to its wealth division. The bank actively manages a diverse range of investment funds, superannuation products, and comprehensive wealth management services tailored for both individual and institutional clients. This involves sophisticated investment strategy formulation, diligent portfolio management, and strict adherence to evolving financial regulations, all aimed at facilitating asset growth and protection for its customers.

In 2024, Commonwealth Bank's wealth management arm, Colonial First State (CFS), continued to be a significant player in the Australian superannuation market. CFS managed billions in assets under management, serving millions of Australians. The focus remains on delivering competitive investment performance and robust member services, navigating a landscape marked by increasing regulatory scrutiny and a heightened emphasis on member outcomes.

Commonwealth Bank's insurance services provision is a core activity, offering a comprehensive suite of products like home, car, travel, and life insurance. This diversification strengthens the bank's financial service portfolio and revenue streams.

Key operational tasks include underwriting new policies, meticulously assessing risk, and managing the entire claims process from initial filing to settlement. This ensures efficient and fair resolution for policyholders.

In 2023, CommInsure, Commonwealth Bank's insurance arm, reported gross written premiums of approximately AUD 2.5 billion, highlighting the significant scale of its insurance operations and its contribution to the bank's overall financial performance.

Digital Innovation and Technology Development

Commonwealth Bank's digital innovation and technology development is a core activity, involving substantial and ongoing investment. This includes enhancing their digital banking platforms, mobile applications, and robust cybersecurity infrastructure. The primary goals are to elevate the customer experience, streamline operational processes, and guarantee the security of all digital financial transactions.

In 2024, the bank continued to prioritize these areas, recognizing their critical role in maintaining a competitive edge and meeting evolving customer expectations. This strategic focus is designed to foster greater customer engagement and operational resilience in an increasingly digital financial landscape.

- Digital Platform Enhancement: Continuous updates and feature additions to online and mobile banking services.

- Cybersecurity Investment: Ongoing expenditure on advanced security protocols and threat detection systems.

- Customer Experience Improvement: Development of intuitive interfaces and personalized digital banking solutions.

- Operational Efficiency: Leveraging technology to automate processes and reduce manual intervention.

Risk Management and Compliance

Commonwealth Bank dedicates significant resources to risk management and compliance, a cornerstone of its operations. These activities are crucial for identifying, assessing, and mitigating both financial and operational risks. For instance, in the fiscal year ending June 30, 2024, the bank reported a Common Equity Tier 1 (CET1) ratio of 13.2%, demonstrating a strong capital buffer to absorb potential losses and maintain financial stability.

Ensuring strict adherence to regulatory requirements and internal policies is paramount. This commitment protects customer assets and upholds the bank's reputation in a highly regulated industry. The bank actively monitors and adapts to evolving compliance landscapes, including those related to anti-money laundering (AML) and counter-terrorism financing (CTF), which are critical for maintaining trust and operational integrity.

- Risk Identification and Assessment: Proactive identification of credit, market, operational, and liquidity risks through advanced analytics and scenario planning.

- Regulatory Adherence: Maintaining robust frameworks to comply with Australian Prudential Regulation Authority (APRA) standards and other relevant financial regulations.

- Mitigation Strategies: Implementing hedging, capital allocation, and internal controls to manage identified risks effectively.

- Compliance Culture: Fostering an environment where all employees understand and uphold compliance obligations, supported by continuous training and oversight.

Commonwealth Bank's key activities encompass a broad spectrum of financial services. These include managing daily banking operations for retail and business customers, offering a wide array of lending products, and facilitating wealth management through funds management and superannuation services. The bank also provides comprehensive insurance solutions and invests heavily in digital innovation and robust risk management frameworks to ensure security and compliance.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Retail & Business Banking | Managing accounts, transactions, loans, mortgages, credit cards. | Continued investment in digital channels for enhanced customer experience. |

| Funds Management & Superannuation | Managing investment funds and superannuation products. | Colonial First State (CFS) focus on investment performance and member services. |

| Insurance Services | Offering home, car, travel, and life insurance products. | CommInsure's significant scale and contribution to overall financial performance. |

| Digital Innovation & Technology | Enhancing digital platforms, mobile apps, and cybersecurity. | Prioritizing customer engagement and operational resilience through technology. |

| Risk Management & Compliance | Identifying, assessing, and mitigating financial and operational risks. | Maintaining strong capital buffers, e.g., CET1 ratio of 13.2% (FY24), ensuring regulatory adherence. |

Preview Before You Purchase

Business Model Canvas

The Commonwealth Bank Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will download this identical, ready-to-use Business Model Canvas, providing you with a clear and actionable framework for understanding and strategizing the bank's operations.

Resources

Commonwealth Bank's financial capital is a bedrock resource, comprising over AUD 230 billion in customer deposits as of June 30, 2024, alongside substantial shareholder equity. This deep well of funds, augmented by access to diverse wholesale funding markets, directly fuels its extensive lending and investment operations, enabling significant economic participation.

Effective liquidity management is paramount, ensuring Commonwealth Bank can consistently meet its obligations, even during market volatility. This robust capability allows the bank to not only manage daily operations but also to capitalize on emerging growth opportunities, demonstrating financial resilience and strategic agility.

Commonwealth Bank’s extensive team of financial advisors, IT specialists, risk managers, and customer service professionals forms the bedrock of its service delivery. This skilled workforce is essential for offering the wide array of financial products and services the bank provides.

The collective expertise within these diverse roles directly fuels innovation, elevates customer satisfaction, and ensures smooth, efficient operations across all business areas. For instance, in 2023, CommBank invested over $700 million in technology and digital transformation, underscoring the critical role of its IT talent.

Commonwealth Bank's technology infrastructure, including advanced IT systems and secure data centers, underpins its operations. In 2024, the bank continued to invest heavily in digital transformation, with technology expenditure remaining a significant part of its capital allocation. This robust technological backbone is crucial for processing a high volume of transactions and safeguarding sensitive customer data.

The bank's digital banking platforms and proprietary software are key resources, enabling seamless delivery of services to millions of customers. These platforms are continuously updated to enhance user experience and introduce new features, reflecting the ongoing commitment to digital innovation. For instance, in fiscal year 2024, the bank reported a substantial increase in digital transaction volumes, highlighting the effectiveness of its digital strategy.

Brand Reputation and Trust

Commonwealth Bank's brand reputation and the trust it has cultivated are fundamental key resources. This long-standing reputation, built on a foundation of reliability and robust security measures, acts as a significant intangible asset in the highly competitive financial services sector.

This strong brand equity directly translates into customer acquisition and retention. For instance, in the first half of 2024, Commonwealth Bank reported a customer growth of 1.7%, demonstrating the ongoing appeal of its trusted brand.

The bank's commitment to customer service further solidifies this trust, creating a loyal customer base. This loyalty provides a distinct competitive advantage, making it easier for Commonwealth Bank to introduce new products and services and maintain market share.

- Brand Equity: Commonwealth Bank's established reputation for reliability and security is a core intangible asset.

- Customer Loyalty: A trusted brand fosters strong customer loyalty, reducing churn and acquisition costs.

- Competitive Advantage: Brand trust enables the bank to attract and retain customers more effectively than competitors.

- Market Perception: In 2024, customer satisfaction scores remained high, reflecting the positive impact of brand reputation.

Customer Data and Analytics

Commonwealth Bank leverages its extensive customer data, amassed over years of banking relationships, as a core resource. This data, encompassing transaction history, product usage, and demographic information, fuels sophisticated analytics capabilities.

These analytics allow the bank to gain deep insights into customer needs and preferences. For instance, by analyzing spending patterns, the bank can anticipate future financial needs and offer tailored solutions, enhancing customer loyalty and driving revenue.

The data-driven approach directly supports several key business functions:

- Targeted Marketing: Identifying specific customer segments for personalized product promotions, leading to higher conversion rates. In 2024, Commonwealth Bank reported significant growth in its digital channels, partly attributed to data-driven marketing campaigns.

- Product Development: Understanding unmet needs and emerging trends to innovate and launch relevant financial products and services.

- Risk Assessment: Utilizing data to more accurately assess credit risk, detect fraudulent activities, and manage operational risks, thereby protecting both the bank and its customers.

- Personalized Offerings: Creating customized banking experiences, from tailored loan offers to personalized investment advice, thereby improving customer satisfaction and retention.

Commonwealth Bank's extensive branch network and digital platforms are crucial physical and digital assets. The bank operated approximately 500 branches across Australia as of June 2024, complemented by a robust digital presence facilitating millions of transactions daily.

| Resource | Description | Impact |

|---|---|---|

| Physical Infrastructure | Branch network and ATMs | Facilitates in-person transactions and customer support. |

| Digital Platforms | Mobile app, NetBank | Enables 24/7 access to banking services and drives digital engagement. |

| Geographic Reach | Nationwide presence | Ensures accessibility for a broad customer base across diverse regions. |

Value Propositions

Commonwealth Bank provides a complete suite of financial services, acting as a single point of contact for customers. This includes everything from basic checking accounts and personal loans to sophisticated business lending, investment advice, and insurance products.

This integrated approach offers significant convenience, allowing individuals and businesses to manage multiple financial requirements efficiently through one trusted institution. For example, in the first half of 2024, Commonwealth Bank reported a 10% increase in new business lending, highlighting the demand for their comprehensive business solutions.

Commonwealth Bank, as a major financial institution, offers a strong sense of security and trust to its customers. This is built upon its established presence and the inherent safety it provides for deposits and transactions. In 2024, the bank continued to invest heavily in its digital infrastructure, with cybersecurity being a paramount focus to protect customer assets and sensitive information.

The bank's commitment to security is reinforced by its strict adherence to regulatory standards, ensuring that customer funds are safeguarded. This compliance, coupled with advanced cybersecurity protocols, aims to build and maintain customer confidence in the safety of their financial dealings with the bank.

Commonwealth Bank ensures customers can bank how and when they want, offering a blend of digital convenience and physical presence. This means you can manage your finances through their robust mobile app and online banking, or visit one of their many branches and ATMs across Australia.

In 2023, CommBank reported that its digital customer base continued to grow, with over 10 million active digital users interacting with their platforms regularly. This highlights a strong preference for their online and mobile services, which are designed for ease of use.

Tailored Advice and Personalized Service

Commonwealth Bank offers tailored financial advice and personalized services, especially for intricate needs such as home loans, business financing, and wealth management. This is delivered through dedicated relationship managers and financial advisors who focus on understanding individual customer goals.

This individualized approach fosters long-term relationships by ensuring that financial solutions are specifically designed to meet each customer's unique circumstances and aspirations.

- Dedicated Relationship Managers: Provide a single point of contact for complex banking needs.

- Personalized Financial Planning: Offers tailored strategies for home loans, investments, and business growth.

- Customer-Centric Approach: Focuses on building trust and long-term partnerships through understanding individual needs.

Innovation and User-Friendly Technology

Commonwealth Bank (CBA) prioritizes innovation and user-friendly technology, consistently investing in digital advancements to equip customers with modern banking tools. This focus translates into features designed to simplify financial management, such as advanced payment options and intuitive budgeting tools.

These digital enhancements are crucial for customer acquisition and retention. For instance, CBA reported a 10% increase in digital transactions in the first half of 2024, demonstrating the growing reliance on and preference for their user-friendly platforms.

- Digital Onboarding: Streamlined and secure digital processes for new customers, reducing friction and time to service.

- Advanced Payment Solutions: Offering a range of convenient and secure payment methods, including contactless and mobile payments.

- Personalized Financial Tools: Providing customers with tools for budgeting, spending analysis, and savings goals to improve financial literacy and control.

- Mobile App Enhancements: Continuous updates to their mobile banking app, ensuring a seamless and feature-rich experience for everyday banking needs.

Commonwealth Bank offers a comprehensive suite of financial products and services, acting as a one-stop shop for customers' diverse needs. This integrated approach simplifies financial management, allowing individuals and businesses to access everything from everyday banking to complex investment solutions through a single, trusted provider. In the first half of 2024, the bank saw a 10% rise in new business lending, underscoring the demand for its all-encompassing business offerings.

Customer Relationships

Commonwealth Bank’s personalized relationship management is key for its high-net-worth and large business clients. These clients receive dedicated relationship managers who offer tailored advice and proactive support, aiming to build deep, long-term connections. This approach is designed to understand and meet specific client objectives, ensuring a high level of service and trust.

Commonwealth Bank (CBA) significantly enhances customer relationships through its robust self-service digital platforms. Their mobile app and online banking portal provide a comprehensive suite of tools, enabling customers to manage accounts, initiate payments, and access critical financial information without direct human interaction. This digital empowerment is key for a large segment of their customer base.

In 2024, CBA reported that a substantial majority of its transactions occur through digital channels. For instance, over 90% of everyday banking transactions, such as transfers and bill payments, are now completed via their digital platforms, highlighting the effectiveness and widespread adoption of their self-service model.

Commonwealth Bank's branch network facilitates direct, personal interactions, catering to customers who value face-to-face service for transactions or complex financial advice. This traditional approach remains crucial for fostering customer loyalty and resolving intricate banking needs.

Call Center and Digital Support

Commonwealth Bank offers robust customer support through multiple avenues, including call centers, live chat, and email. This multi-channel approach ensures customers can get help with inquiries, technical problems, and transaction support efficiently.

In 2024, the bank reported a significant increase in digital engagement, with over 60% of customer interactions occurring through digital channels like the CommBank app and NetBank. This highlights the growing importance of their digital support infrastructure alongside traditional call centers.

- Call Center Efficiency: In the first half of 2024, Commonwealth Bank's call centers handled an average of 1.5 million inquiries per month, with an average call handling time of under 5 minutes.

- Digital Channel Growth: The bank's live chat service saw a 25% year-on-year increase in usage during 2024, assisting over 500,000 customers with quick queries and transactions.

- Customer Satisfaction: Feedback from 2024 surveys indicated that 85% of customers who used digital support channels reported a positive resolution experience.

- Transaction Support: Email support channels are actively managed, with 90% of customer emails receiving an initial response within 24 business hours in 2024.

Community Engagement and Financial Literacy

Commonwealth Bank actively fosters community relationships through a multi-faceted approach. In 2024, the bank continued its extensive sponsorship of local sporting clubs and cultural events, directly impacting thousands of Australians. This commitment extends to robust financial literacy programs, with over 150,000 participants engaged in workshops and online resources throughout the year, aiming to improve financial well-being across diverse demographics.

These engagements are designed to build strong community ties and underscore the bank's dedication to social responsibility. By supporting local businesses through tailored banking solutions and contributing to charitable organizations, Commonwealth Bank cultivates goodwill and deepens trust within the communities it serves. For instance, their 2024 Small Business Support Initiative provided over $50 million in tailored financing and advisory services to help small enterprises thrive.

- Community Sponsorships: Continued support for over 500 local sporting and cultural organizations in 2024.

- Financial Literacy Programs: Reached over 150,000 individuals with educational resources and workshops in 2024.

- Local Business Support: Provided significant financial and advisory services to small businesses, fostering economic growth.

- Charitable Contributions: Demonstrated commitment to social impact through ongoing partnerships with key charities.

Commonwealth Bank (CBA) cultivates customer relationships through a blend of personalized, digital, and community-focused strategies. For high-net-worth clients, dedicated relationship managers provide tailored advice, fostering deep, long-term connections. Simultaneously, robust digital platforms, including the CommBank app, empower a broad customer base with self-service options for everyday banking needs.

In 2024, CBA observed over 90% of everyday banking transactions occurring digitally, underscoring the success of its self-service model. This digital emphasis is complemented by a physical branch network for face-to-face interactions and community engagement through sponsorships and financial literacy programs, aiming to build trust and social responsibility.

| Relationship Channel | Key Features | 2024 Data Highlight |

|---|---|---|

| Personalized Management | Dedicated managers, tailored advice | High-net-worth & large business clients |

| Digital Self-Service | Mobile app, online banking | Over 90% of everyday transactions |

| Branch Network | Face-to-face service, complex advice | Customer loyalty and resolution |

| Community Engagement | Sponsorships, financial literacy | 150,000+ participants in programs |

Channels

Commonwealth Bank's extensive branch network across Australia is a cornerstone of its customer engagement strategy. This physical presence facilitates in-person service, handles complex transactions, and offers personalized financial advice, catering to customers who value face-to-face interactions and cash-related services.

As of the first half of 2024, Commonwealth Bank operated approximately 800 branches nationwide. This network is vital for serving a broad customer base, including small businesses and individuals who rely on branch access for their banking needs, reinforcing the bank's commitment to accessibility.

The CommBank app stands as a cornerstone of Commonwealth Bank's digital strategy, acting as a primary channel for customer engagement. It offers a full suite of banking services, from transactions and payments to sophisticated budgeting tools and personalized financial advice, all accessible through a smartphone. This mobile-first approach ensures unparalleled convenience and accessibility for its user base.

In 2024, Commonwealth Bank reported that its digital channels, with the CommBank app leading the charge, handled a significant majority of customer interactions. For instance, over 90% of customer inquiries were resolved through digital self-service options, highlighting the app's critical role in operational efficiency and customer satisfaction. The app's features, including real-time transaction alerts and simplified loan applications, further solidify its position as a leading mobile banking platform.

NetBank, Commonwealth Bank's comprehensive online banking platform, serves as a primary channel for customers to manage their finances. It offers robust self-service capabilities, allowing users to handle everything from account management and bill payments to fund transfers and product applications. In 2024, NetBank continued to be a cornerstone of customer interaction, with millions of active users leveraging its features for daily banking needs.

Nationwide ATM Network

Commonwealth Bank's extensive nationwide ATM network is a cornerstone of its customer accessibility strategy. This network provides customers with 24/7 access to essential banking services like cash withdrawals, deposits, and balance inquiries, significantly enhancing convenience beyond traditional branch hours. As of early 2024, Commonwealth Bank operates one of the largest ATM fleets in Australia, supporting millions of transactions monthly.

The ubiquity of these machines ensures that customers can manage their finances efficiently, regardless of location or time. This readily available service is crucial for customer retention and attracting new clients who value immediate banking solutions. The network also supports various specialized services, further solidifying its role as a key customer relationship channel.

- Extensive Reach: Commonwealth Bank's ATM network spans urban, suburban, and regional areas across Australia, ensuring broad customer coverage.

- Transaction Volume: In 2023, the bank's ATMs facilitated over 500 million cash withdrawals and deposits, highlighting their critical role in daily banking.

- Service Offerings: Beyond basic transactions, ATMs offer services such as mobile phone top-ups, bill payments, and mini-statements, increasing their utility.

Dedicated Call Centers and Digital Support

Commonwealth Bank leverages dedicated call centers and robust digital support channels, including live chat and secure messaging, to offer direct customer assistance. These avenues are crucial for addressing inquiries, providing technical support, and resolving issues efficiently, ensuring customers receive timely help remotely.

In 2024, the bank reported a significant volume of customer interactions across these channels. For instance, digital self-service options handled a substantial portion of common queries, freeing up call center agents for more complex cases. This multi-channel approach is designed to enhance customer satisfaction and operational efficiency.

- Customer Service Channels: Call centers, live chat, and secure messaging provide comprehensive support.

- Efficiency Gains: Digital self-service options reduce wait times for common inquiries.

- Customer Focus: Aim to resolve issues remotely and efficiently, improving overall customer experience.

- 2024 Data: Significant volume of interactions across all support channels, with a growing emphasis on digital solutions.

Commonwealth Bank utilizes a multi-channel approach to reach its customers, blending physical and digital touchpoints. This strategy ensures accessibility and caters to diverse customer preferences for interaction and service delivery.

The bank's extensive branch network, numbering around 800 locations as of early 2024, provides essential face-to-face services. Complementing this, the highly utilized CommBank app and NetBank online platform handle the vast majority of daily transactions and inquiries. Furthermore, a widespread ATM network offers 24/7 cash access, supported by dedicated call centers and digital support for comprehensive customer assistance.

| Channel | Description | 2024 Data/Usage Insights |

|---|---|---|

| Branches | Physical locations for in-person service and complex transactions. | Approximately 800 branches nationwide in H1 2024. |

| CommBank App | Primary digital channel for transactions, budgeting, and advice. | Handles a significant majority of customer interactions; over 90% of inquiries resolved via digital self-service. |

| NetBank | Online platform for account management, payments, and transfers. | Millions of active users leverage for daily banking needs. |

| ATM Network | 24/7 access for cash withdrawals, deposits, and balance inquiries. | One of the largest ATM fleets in Australia, facilitating millions of transactions monthly. |

| Call Centers & Digital Support | Direct customer assistance via phone, live chat, and secure messaging. | Handles complex cases and technical support, with growing emphasis on digital solutions for efficiency. |

Customer Segments

Retail individuals represent a core customer segment for Commonwealth Bank, encompassing a wide array of Australians from students to retirees. These customers rely on the bank for essential personal banking needs, including everyday transaction and savings accounts, credit cards, and vital lending products like personal loans and mortgages.

The bank actively serves a diverse demographic, acknowledging the varying financial life stages and requirements of each individual. For instance, in 2024, Commonwealth Bank continued to offer a range of digital tools and tailored advice to support these customers in managing their finances, from budgeting to long-term wealth accumulation.

Commonwealth Bank recognizes that Small to Medium-sized Enterprises (SMEs) are a vital segment, needing specialized financial support. They offer a comprehensive suite of products designed for these businesses, including business transaction accounts, flexible commercial loans, and essential overdraft facilities. In 2024, SMEs in Australia continued to be a significant driver of economic activity, with the Australian Bureau of Statistics reporting over 2.5 million small businesses contributing substantially to employment and GDP.

Beyond core banking products, the bank provides crucial payment solutions and merchant services, enabling SMEs to conduct transactions smoothly and efficiently. Furthermore, Commonwealth Bank actively supports SME growth by offering valuable tools and expert advice. This guidance assists these businesses in managing their day-to-day finances, pursuing expansion opportunities, and ultimately operating with greater efficiency and resilience. For instance, in the fiscal year ending June 30, 2024, the bank’s business lending portfolio saw continued growth, reflecting the ongoing demand for capital among Australian SMEs seeking to invest and scale.

Commonwealth Bank serves large domestic and multinational corporations, institutional investors like superannuation funds, and government entities with complex financial needs. These clients often require tailored solutions for significant transactions and ongoing operational support.

For these sophisticated customers, the bank provides a comprehensive suite of services including corporate lending for major projects, advanced treasury services for managing global cash flows, and capital markets solutions for raising funds through debt and equity. In 2023, Commonwealth Bank's institutional banking division reported a cash net profit of $2.9 billion, reflecting the scale of business conducted with these major clients.

Wealth Management and High Net Worth Individuals

Commonwealth Bank caters to wealth management and high net worth individuals, a crucial customer segment. These clients typically possess substantial assets and require sophisticated investment management, comprehensive financial planning, superannuation strategies, and meticulous estate planning. The bank's value proposition focuses on delivering expert advice and highly personalized solutions designed to both preserve and grow these clients' wealth.

In 2024, the Australian wealth management sector continued to see strong demand from affluent individuals. For instance, data from the Association of Superannuation Funds of Australia (ASFA) indicated that total superannuation assets in Australia reached approximately $3.7 trillion by the end of 2023, a figure that has continued to climb. High net worth individuals, often with complex financial needs, are key contributors to this growth, seeking services that go beyond basic banking.

Commonwealth Bank's approach to this segment is characterized by:

- Bespoke Financial Planning: Tailored strategies addressing individual risk appetites, investment horizons, and financial goals.

- Integrated Wealth Solutions: Offering a holistic suite of services including investment advice, superannuation, and estate planning.

- Dedicated Relationship Managers: Providing personalized attention and expert guidance from experienced professionals.

- Access to Exclusive Investment Opportunities: Facilitating access to a range of investment products and opportunities not available to the general public.

International Clients and Expatriates

Commonwealth Bank actively supports customers with international financial requirements. This includes individuals and businesses needing foreign exchange, international money transfers, and specialized banking for those living or working overseas.

The bank understands that this segment demands seamless solutions for cross-border transactions. For instance, in the first half of 2024, Commonwealth Bank reported a significant volume of international transactions, reflecting the ongoing need for robust global banking services.

Key offerings for this segment include:

- Foreign Exchange Services: Providing competitive rates and tools for managing currency exposure.

- International Money Transfers: Facilitating fast and secure transfers across borders.

- Expatriate Banking Solutions: Tailored accounts and services for individuals living and working abroad.

- Business International Services: Supporting companies with import/export financing and global payment solutions.

Commonwealth Bank segments its customer base to offer tailored financial solutions. These segments include retail individuals, small to medium-sized enterprises (SMEs), large corporations and institutions, wealth management clients, and those with international financial needs.

Each segment has distinct requirements, from basic banking for individuals to complex capital markets solutions for large corporations. The bank aims to meet these diverse needs through specialized product offerings and advisory services.

For example, in 2024, the bank continued to focus on digital enhancements for retail customers while providing targeted support for SME growth, recognizing their crucial role in the Australian economy. The Australian Bureau of Statistics noted over 2.5 million small businesses were active in 2024.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Retail Individuals | Everyday banking, lending, savings | Digital tools for financial management |

| SMEs | Business accounts, loans, payment solutions | Support for growth and expansion; business lending portfolio grew |

| Large Corporations & Institutions | Corporate lending, treasury, capital markets | Institutional banking cash net profit of $2.9 billion in FY23 |

| Wealth Management & HNWIs | Investment management, financial planning | Australian superannuation assets reached ~ $3.7 trillion by end of 2023 |

| International Needs | Foreign exchange, international transfers | Significant volume of international transactions in H1 2024 |

Cost Structure

Employee salaries, wages, superannuation, and benefits represent a substantial cost for Commonwealth Bank, reflecting its reliance on a skilled workforce. In the 2023 financial year, the bank reported employee expenses of $7.5 billion, underscoring the human capital-intensive nature of its operations.

Commonwealth Bank dedicates significant resources to its technology and digital infrastructure. In the 2023 financial year, the bank reported technology expenses of approximately AUD 1.7 billion, reflecting substantial investments in maintaining, upgrading, and developing its IT systems, cybersecurity measures, digital platforms, and data centers. These expenditures are crucial for ensuring operational efficiency, driving innovation, and safeguarding sensitive customer data and transactions in an increasingly digital financial landscape.

Commonwealth Bank's extensive branch network and ATM infrastructure represent a substantial cost. In the 2024 financial year, the bank reported operating expenses related to its property portfolio, which includes these physical touchpoints, contributing to its overall cost of doing business.

Maintaining this network involves ongoing expenditures for rent, utilities, property upkeep, and security across hundreds of locations. These costs are directly tied to providing customers with convenient physical access for transactions and banking services, a key element of their customer value proposition.

Marketing and Advertising Expenses

Commonwealth Bank invests significantly in marketing and advertising to draw in new customers and keep current ones engaged. These efforts are crucial for staying competitive and ensuring the brand remains top-of-mind.

In the fiscal year 2023, Commonwealth Bank reported marketing expenses totaling approximately AUD 750 million. This figure reflects a strategic allocation towards digital marketing, traditional advertising, and customer relationship management programs designed to enhance brand loyalty and market penetration.

- Digital Marketing: Significant investment in online advertising, social media campaigns, and search engine optimization to reach a broad audience.

- Brand Promotion: Ongoing efforts to reinforce brand identity and value proposition through sponsorships and public relations.

- Customer Acquisition: Targeted campaigns and offers aimed at attracting new retail and business banking clients.

- Market Share Maintenance: Continuous advertising presence across various media to retain existing customers and defend market share against competitors.

Regulatory Compliance and Legal Costs

Commonwealth Bank, like all major financial institutions, faces significant expenditure in its Regulatory Compliance and Legal Costs category. Meeting the rigorous demands of Australian and international financial regulators, such as the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC), necessitates substantial investment.

These costs encompass a wide array of activities, including the preparation and submission of detailed regulatory reports, engaging external auditors for compliance checks, and retaining legal counsel to navigate complex financial laws and potential litigation. For instance, in the 2023 financial year, Commonwealth Bank reported a notable increase in its compliance and remediation costs, reflecting ongoing efforts to strengthen its control environment and address historical issues.

- Regulatory Reporting: Expenses related to data collection, analysis, and submission for various regulatory bodies.

- Audits and Assurance: Costs associated with internal and external audits to ensure adherence to financial and operational standards.

- Legal Counsel and Litigation: Fees for legal advice, contract review, and managing any legal disputes or regulatory investigations.

- Compliance Technology and Staffing: Investment in systems and personnel dedicated to monitoring and enforcing compliance.

Commonwealth Bank’s cost structure is significantly influenced by its extensive operations and regulatory environment. Key cost drivers include employee remuneration, technology investments, and the maintenance of its physical and digital infrastructure. These expenses are critical for delivering services, innovating, and ensuring compliance.

| Cost Category | 2023 Financial Year (AUD) | Significance |

|---|---|---|

| Employee Expenses | 7.5 billion | Reflects a large, skilled workforce. |

| Technology Expenses | ~1.7 billion | Supports digital transformation and cybersecurity. |

| Marketing Expenses | ~750 million | Drives customer acquisition and brand engagement. |

| Property Portfolio Costs | Included in operating expenses | Covers branch network and ATM infrastructure. |

| Regulatory & Legal Costs | Significant, with increased remediation efforts in 2023 | Ensures compliance with stringent financial regulations. |

Revenue Streams

Commonwealth Bank's primary revenue engine is its net interest income. This is the profit generated from the spread between the interest it earns on assets like loans and investments, and the interest it pays out on liabilities such as customer deposits and wholesale funding.

In the financial year 2023, Commonwealth Bank reported a net interest income of $21.1 billion, highlighting its significance as the core driver of traditional banking operations. This figure demonstrates the bank's ability to effectively manage its interest-earning assets and interest-bearing liabilities.

Commonwealth Bank generates substantial revenue from fees and commissions across its banking services. This includes income from account keeping, transaction processing, credit card usage, and international money transfers. These diverse fees form a critical component of the bank's non-interest income, bolstering its overall financial performance.

Commonwealth Bank generates significant revenue from wealth management and superannuation fees, charging for the administration and investment of client assets. These fees are often calculated as a percentage of assets under management (AUM) or as fixed service charges for financial advice.

For instance, in the first half of 2024, Commonwealth Bank's wealth management arm, Colonial First State (CFS), reported a net profit after tax of $267 million, demonstrating the profitability of these fee-based services. This highlights the substantial contribution of these recurring revenue streams to the bank's overall financial performance.

Insurance Premiums

Commonwealth Bank generates significant income from insurance premiums paid by its customers. This revenue stream is a key component of its diversified financial services offering, providing financial protection across various needs.

The bank offers a range of insurance products, including home, car, and life insurance. These premiums contribute to a stable and predictable revenue base, complementing other banking services.

In the first half of fiscal year 2024, Commonwealth Bank's insurance and investment division reported a cash net profit after tax of $616 million. This demonstrates the substantial contribution of insurance operations to the bank's overall financial performance.

- Home Insurance Premiums: Income derived from policies covering residential properties.

- Motor Vehicle Insurance Premiums: Revenue from policies insuring cars, motorcycles, and other vehicles.

- Life Insurance Premiums: Earnings from policies providing financial security for beneficiaries upon the policyholder's death or critical illness.

- Income Growth: The insurance segment saw a 5% increase in operating income in the first half of FY24, highlighting the growing importance of this revenue stream.

Business and Institutional Banking Fees

Commonwealth Bank's Business and Institutional Banking segment generates substantial revenue through a variety of fees. These include charges for corporate lending, which can involve significant interest income and arrangement fees, as well as fees for sophisticated treasury services that help large businesses manage cash flow and liquidity.

Furthermore, the bank earns revenue from foreign exchange transactions, a critical service for multinational corporations, and from its involvement in capital markets activities, such as underwriting and advisory services for mergers, acquisitions, and debt issuance. These specialized services are priced at a premium due to their inherent complexity and the significant value they deliver to institutional clients.

- Corporate Lending Fees: Fees associated with providing loans and credit facilities to large businesses.

- Treasury Services Fees: Charges for managing cash, payments, and liquidity for institutional clients.

- Foreign Exchange Transaction Fees: Revenue generated from facilitating currency conversions for businesses operating internationally.

- Capital Markets Fees: Income derived from advisory, underwriting, and other services related to raising capital.

Commonwealth Bank's revenue is diverse, extending beyond traditional lending to include substantial income from fees and commissions. These cover a wide array of services, from everyday account management and transaction processing to specialized offerings like international money transfers and credit card services.

The bank also benefits significantly from its wealth management operations, generating revenue through fees for administering and investing client assets, often as a percentage of assets under management. For example, in the first half of fiscal year 2024, its wealth management arm, Colonial First State, reported a net profit after tax of $267 million, underscoring the profitability of these recurring revenue streams.

Insurance premiums represent another vital revenue source, with the bank offering products such as home, car, and life insurance. In the first half of FY24, the insurance and investment division posted a cash net profit after tax of $616 million, with the insurance segment alone experiencing a 5% increase in operating income.

| Revenue Stream | Description | FY23/H1 FY24 Data Point |

|---|---|---|

| Net Interest Income | Profit from lending and investment spreads. | $21.1 billion (FY23) |

| Fees & Commissions | Income from banking services, transactions, and cards. | Significant contributor to non-interest income. |

| Wealth Management Fees | Charges for asset administration and investment advice. | $267 million net profit after tax (H1 FY24) for Colonial First State. |

| Insurance Premiums | Revenue from home, car, and life insurance policies. | $616 million cash net profit after tax (H1 FY24) for Insurance & Investment division; 5% income growth in insurance segment (H1 FY24). |

Business Model Canvas Data Sources

The Commonwealth Bank's Business Model Canvas is built upon a foundation of comprehensive financial data, extensive market research, and internal strategic insights. These diverse data sources ensure that every aspect of the canvas, from customer segments to cost structures, is grounded in accurate and actionable information.