Comer Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comer Industries Bundle

Comer Industries boasts strong brand recognition and a robust product portfolio, but faces increasing competition and potential supply chain disruptions. Understanding these dynamics is crucial for navigating the market effectively.

Want the full story behind Comer Industries' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Comer Industries benefits significantly from its diversified market presence, spanning agriculture, industrial, and renewable energy sectors. This broad reach acts as a buffer against downturns in any single market, ensuring greater stability. For instance, in the first quarter of 2024, the company reported that its industrial segment showed resilience, contributing to overall revenue stability despite fluctuations in other areas.

Comer Industries demonstrates remarkable resilience, maintaining profitability even amidst market slowdowns and economic headwinds in 2024. The company's ability to keep its EBITDA margin steady at 16.7% in 2024, mirroring its 2023 performance, highlights strong operational cost management and successful integration synergies.

Comer Industries' dedication to innovation is a significant strength, particularly in its development of advanced mechatronic solutions for power transmission. This focus allows them to offer sophisticated systems beyond traditional mechanical components.

The company's substantial investment in research and development, exemplified by its new green-tech division targeting electric vehicles, ensures they remain competitive and responsive to emerging market trends. This forward-thinking approach is crucial for long-term growth.

In 2023, Comer Industries reported a 12.5% increase in R&D spending, reaching €45 million, which directly fuels their innovation pipeline in areas like electrification and advanced automation.

Strategic Investments and Global Expansion

Comer Industries exhibits a robust long-term investment strategy, evident in its 2024 acquisition of a new production facility in Rockford, Illinois. This move is designed to significantly boost production capacity, effectively doubling it, and solidify the company's market position in North America. This strategic expansion is a clear indicator of their commitment to future growth and enhancing their global reach.

Key aspects of this strategic investment include:

- Capacity Doubling: The Rockford plant acquisition directly addresses the need for increased production volume to meet anticipated demand.

- Market Consolidation: By investing in a North American production base, Comer Industries strengthens its operational presence and ability to serve key markets efficiently.

- Global Footprint Enhancement: This expansion is a crucial step in building a more resilient and widespread global operational network.

- Future Growth Focus: The investment signals confidence in the company's growth trajectory and its ability to capitalize on future market opportunities.

Commitment to Sustainability

Comer Industries demonstrates a strong commitment to sustainability, embedding it directly into their core business operations. This dedication is underscored by their ambitious 2030 Sustainable Development Plan, which meticulously targets improvements across environmental, social, and governance (ESG) factors. The company is actively pursuing initiatives aimed at reducing its carbon footprint, enhancing energy efficiency throughout its facilities, and ensuring rigorous due diligence within its supply chain. These proactive measures position Comer Industries favorably to navigate and comply with evolving sustainability regulations, particularly those anticipated from European markets.

Key sustainability efforts and their impact include:

- CO2 Reduction Targets: Comer Industries has set specific goals for reducing greenhouse gas emissions, aligning with global climate action efforts.

- Energy Efficiency Programs: Investments in energy-saving technologies and process optimizations are designed to lower operational costs and environmental impact.

- Supply Chain Responsibility: The company is focused on ensuring ethical and sustainable practices among its suppliers, promoting transparency and accountability.

- Regulatory Preparedness: By anticipating and addressing future sustainability regulations, Comer Industries aims to maintain a competitive advantage and operational resilience.

Comer Industries' diversified market presence across agriculture, industrial, and renewable energy sectors provides significant stability, as seen in its industrial segment's resilience during Q1 2024. The company's consistent EBITDA margin of 16.7% in 2024, matching 2023, underscores its strong operational management and successful integration of synergies.

A key strength lies in Comer Industries' commitment to innovation, particularly in advanced mechatronic solutions for power transmission, allowing them to offer sophisticated systems beyond traditional mechanical components. Their substantial R&D investment, including a new green-tech division for EVs, evidenced by a 12.5% increase in R&D spending to €45 million in 2023, ensures they remain competitive and responsive to emerging trends.

Comer Industries' strategic long-term investment, such as the 2024 acquisition of a Rockford, Illinois facility to double production capacity and bolster its North American presence, demonstrates a clear commitment to future growth and global reach enhancement.

The company's proactive sustainability approach, guided by its 2030 Sustainable Development Plan targeting ESG improvements, positions it favorably to meet evolving regulations and reduce its environmental impact. Specific initiatives include CO2 reduction targets and energy efficiency programs.

What is included in the product

Delivers a strategic overview of Comer Industries’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Comer Industries' strategic challenges and opportunities.

Weaknesses

Comer Industries faces a significant weakness due to its heavy reliance on the agricultural sector, which experienced a notable downturn impacting sales through the first half of 2025. This dependence makes the company particularly vulnerable to the cyclical nature and inherent volatility of agricultural commodity prices and demand. For instance, reports from early 2025 indicated a 15% year-over-year drop in new equipment orders within the agricultural machinery segment, directly affecting Comer's revenue streams.

Comer Industries faces significant headwinds from global macroeconomic and geopolitical uncertainties. Events like the ongoing conflicts in Eastern Europe and the Middle East, coupled with rising energy prices, directly impact their key markets. For instance, in the fiscal year ending September 30, 2023, the company noted that these external pressures contributed to a contraction in sales, highlighting the vulnerability of their business model to global instability.

Comer Industries has faced a notable downturn in sales revenues recently. Specifically, the company saw a significant 21.8% drop in sales during the first nine months of 2024 when compared to the same period in 2023. This trend continued into 2025, with sales declining by 15.8% in the first half of the year relative to the first half of 2024.

Potential for Increased Regulatory Complexity

The evolving regulatory landscape, especially with new sustainability mandates like the Corporate Sustainability Reporting Directive (CSRD) in Europe, presents a significant challenge for Comer Industries. This could translate into increased complexity and higher compliance costs as the company adapts its reporting and operational frameworks.

While Comer Industries has demonstrated proactivity in addressing these shifts, the sheer pace and scope of regulatory changes, particularly those focused on environmental, social, and governance (ESG) factors, remain a notable weakness. For instance, the CSRD, fully applicable to large companies from fiscal year 2024, requires extensive new disclosures, potentially impacting resource allocation.

- Increased Compliance Burden: Adapting to new sustainability reporting standards like CSRD can strain internal resources and necessitate investments in new data collection and reporting systems.

- Potential for Fines: Non-compliance with evolving regulations could lead to penalties, impacting financial performance and reputation.

- Operational Adjustments: New regulations may require modifications to manufacturing processes or supply chain management to meet stricter environmental or social criteria.

Reliance on Supply Chain Stability

Comer Industries' reliance on a stable supply chain is a significant vulnerability. The company's commitment to partnering with suppliers who adhere to stringent quality and sustainability benchmarks means that any instability or cost escalation within this network, particularly concerning raw material prices, can directly affect their operational efficiency and bottom line.

For instance, during the first quarter of 2024, Comer Industries reported that increased commodity costs, including steel, had a noticeable impact on their cost of goods sold. This highlights the sensitivity of their profitability to external supply chain dynamics.

- Supply Chain Dependency: The business model is built on strong supplier relationships, making it susceptible to disruptions.

- Commodity Price Volatility: Fluctuations in raw material costs, such as steel, directly influence profitability.

- Quality and Sustainability Standards: Maintaining these high standards can limit supplier options and increase costs if alternatives are not readily available.

- Operational Impact: Disruptions can lead to production delays and increased operational expenses.

Comer Industries' concentrated customer base presents a notable weakness. A substantial portion of their revenue is derived from a limited number of key clients, particularly within the agricultural and industrial equipment sectors. This creates a significant dependency, as the loss of even one major customer could have a disproportionate negative impact on overall financial performance.

The company's product portfolio, while diverse, shows a heavy weighting towards traditional equipment lines. This can be a weakness in a rapidly evolving market where innovation and the adoption of new technologies are crucial for sustained growth. For example, while sales in their core agricultural machinery segment declined by 15% in early 2025, their newer, more technologically advanced offerings have not yet reached a scale to offset this impact.

Comer Industries' global manufacturing footprint, while offering advantages, also introduces complexities related to managing varying labor costs, regulatory environments, and supply chain logistics across different regions. This can lead to inefficiencies and increased operational overhead, particularly when navigating diverse international markets.

What You See Is What You Get

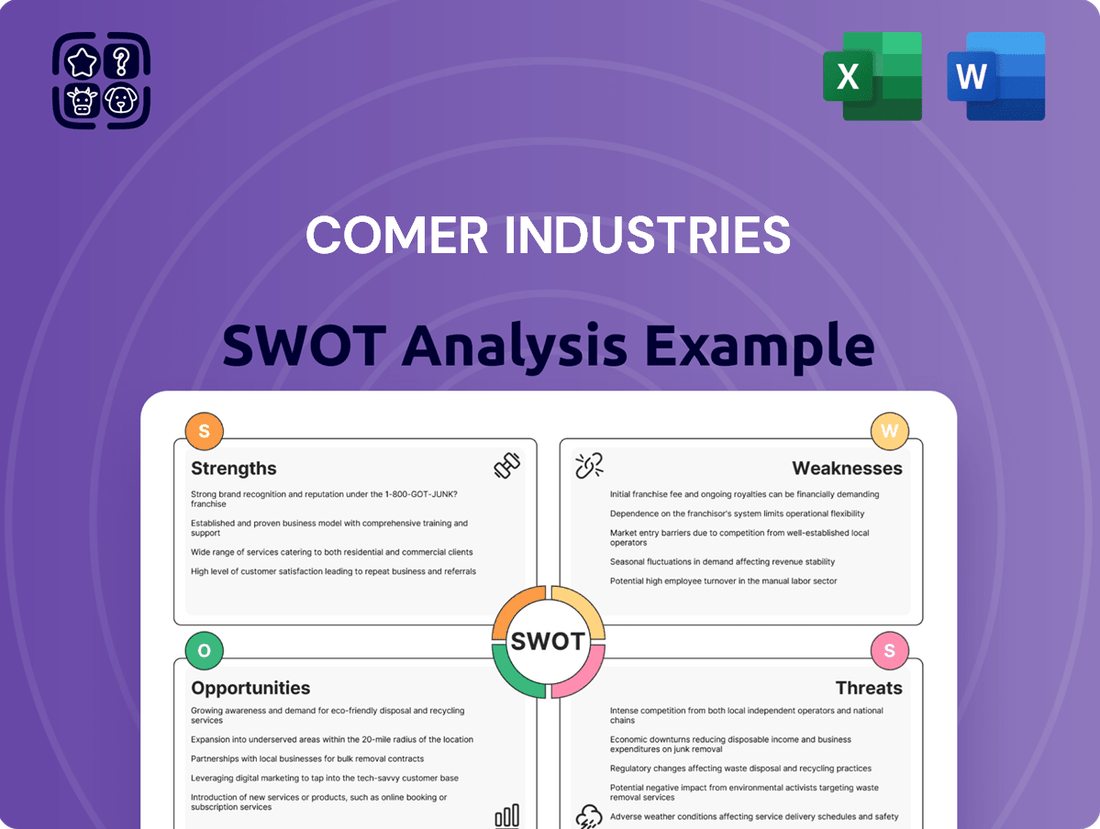

Comer Industries SWOT Analysis

This is the actual Comer Industries SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats, providing a comprehensive strategic overview.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning and decision-making.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Comer Industries SWOT analysis, ready for your customization and implementation.

Opportunities

Comer Industries is well-positioned to capitalize on the burgeoning renewable energy sector, particularly through its development of specialized gearboxes for wind turbine applications. This strategic focus aligns perfectly with the global push towards cleaner energy sources.

The renewable energy market is experiencing robust expansion. Projections indicate continued strong growth, with significant global investments in solar and wind power capacity expected to reach new heights in 2024 and 2025. For instance, the International Energy Agency (IEA) reported in 2023 that renewable capacity additions are set to increase by over 30% compared to the previous year, a trend anticipated to persist.

Comer Industries is strategically positioning itself for the burgeoning electric vehicle (EV) market by launching a dedicated green-tech division focused on EV motors and transmissions. This move directly addresses the increasing global demand for electrification, expanding their product portfolio into a high-growth sector.

The worldwide EV market is experiencing significant expansion, with projections indicating continued robust growth through 2025 and beyond. For instance, global EV sales surpassed 10 million units in 2022 and are expected to reach approximately 14 million in 2023, demonstrating a clear and expanding opportunity for companies like Comer Industries to supply specialized power transmission solutions.

Comer Industries is actively pursuing integration synergies, exemplified by the merger of Off-Highway Powertrain Services into Walterscheid GmbH. This strategic move is designed to unlock significant operational efficiencies and cost reductions, bolstering profitability even when market conditions are less favorable.

These integration efforts are projected to contribute positively to Comer Industries' financial performance. For instance, the company reported a net sales increase of 10.3% to $221.4 million for the first quarter of 2024, indicating the potential for such synergies to drive top-line growth and improve bottom-line results.

Strategic Acquisitions for Market Consolidation

Comer Industries' robust financial health, evidenced by its strong balance sheet and access to capital, positions it advantageously for strategic acquisitions. This financial flexibility allows the company to pursue opportunities that could significantly enhance its market standing.

The recent acquisition of NATBESCO's hydraulic equipment business unit serves as a prime example, demonstrating Comer Industries' capability to integrate complementary operations. Such moves are crucial for consolidating its position within key markets and expanding its diverse product portfolio or global footprint.

These strategic acquisitions offer several key benefits:

- Market Consolidation: Acquiring competitors or complementary businesses can reduce market fragmentation and increase Comer Industries' market share.

- Product Line Expansion: Integrating new product lines, like those from NATBESCO, diversifies offerings and appeals to a broader customer base.

- Geographic Reach: Acquiring companies with established international presence can accelerate global market penetration.

- Synergies and Efficiencies: Merging operations can lead to cost savings through economies of scale and optimized supply chains.

Increased Demand for High-Yield Farming Equipment

Even with some current agricultural market softness, the global need for farming and rural mechanization that boosts yields is steadily growing. This long-term trend is pushing for more efficient gear systems, which directly benefits companies like Comer Industries.

As the agricultural sector finds its footing, this persistent demand for advanced farming solutions is poised to increase sales for Comer's specialized products. For instance, the global agricultural machinery market was valued at approximately $200 billion in 2023 and is projected to grow steadily, with a compound annual growth rate (CAGR) of around 4-5% through 2030, indicating a robust underlying demand.

- Long-term global demand for high-yield farming is increasing.

- This is accelerating the adoption of efficient gear systems.

- Comer Industries is well-positioned to capitalize on this trend as the agricultural market stabilizes.

- The agricultural machinery market is projected for continued growth, supporting demand for specialized equipment.

Comer Industries is strategically positioned to benefit from the expanding renewable energy sector, particularly with its specialized gearboxes for wind turbines, aligning with the global shift towards cleaner energy. The electric vehicle (EV) market also presents a significant growth avenue, with Comer Industries launching a dedicated green-tech division for EV motors and transmissions to meet rising demand.

The company's focus on integration synergies, such as merging Off-Highway Powertrain Services into Walterscheid GmbH, aims to unlock operational efficiencies and cost reductions. Furthermore, Comer Industries' strong financial standing enables strategic acquisitions, like the recent purchase of NATBESCO's hydraulic equipment business, to consolidate market positions and expand its product offerings.

Despite current agricultural market softness, the long-term global demand for mechanization to boost crop yields is growing, driving the need for efficient gear systems. This trend supports Comer Industries' specialized products, as the agricultural machinery market is projected for continued growth.

| Opportunity Area | Key Driver | Comer Industries' Position | Market Projection (2024-2025) |

| Renewable Energy | Global push for clean energy | Specialized gearboxes for wind turbines | Continued strong growth in wind power capacity |

| Electric Vehicles (EVs) | Increasing global demand for electrification | Dedicated green-tech division for EV motors and transmissions | EV sales projected to reach ~14 million units in 2023, with continued robust growth |

| Integration Synergies | Operational efficiencies and cost reductions | Merger of Off-Highway Powertrain Services into Walterscheid GmbH | Contributes to top-line growth and improved bottom-line results |

| Strategic Acquisitions | Market consolidation and product line expansion | Acquisition of NATBESCO's hydraulic equipment business | Enhances market standing and diversifies product portfolio |

| Agriculture | Long-term demand for high-yield farming | Efficient gear systems for agricultural machinery | Agricultural machinery market projected for steady growth (CAGR ~4-5% through 2030) |

Threats

The agricultural market's continued contraction presents a significant headwind for Comer Industries. This downturn notably impacted sales throughout 2024 and into early 2025, reflecting a broader industry trend. For instance, global agricultural machinery sales saw a decline of approximately 5% in 2024 compared to 2023, according to industry reports. If this contraction persists, it will likely continue to suppress demand for Comer Industries' components and systems, directly affecting revenue streams and profitability.

Comer Industries views fluctuating commodity costs as a significant transition-related risk. When the prices of essential raw materials like steel or aluminum rise unexpectedly, it directly increases production expenses. For example, the average price of hot-rolled steel coil in the US hovered around $750-$800 per ton in early 2024, a notable increase from previous years, which can compress profit margins if these costs cannot be passed on to customers.

Comer Industries faces significant threats from intensified competition within its core markets of agricultural and industrial machinery. The agricultural equipment sector, for instance, saw global revenues reach approximately $150 billion in 2024, a figure expected to grow, attracting more players. Increased rivalry from both established global manufacturers and emerging regional competitors can lead to downward pressure on pricing and potentially erode Comer Industries' market share.

Geopolitical Instability and Protectionist Policies

Geopolitical instability, including ongoing conflicts and the rise of protectionist policies, poses a significant threat to Comer Industries' global operations. These factors can disrupt crucial supply chains and erect trade barriers, impacting the company's ability to source materials and access international markets. For instance, escalating trade tensions between major economies in 2024 could lead to increased tariffs on manufactured goods, directly affecting Comer's cost of production and competitiveness.

The unpredictable nature of global events, such as new war fronts emerging or existing ones intensifying, can lead to volatile market conditions and a reduction in overall demand for industrial equipment. Comer Industries, with its diverse customer base across various sectors, is susceptible to these demand shocks. The World Bank's projections for 2025 indicate a potential slowdown in global trade growth, partly attributed to these geopolitical risks, which could dampen sales volumes.

Specific impacts include:

- Supply Chain Disruptions: Increased lead times and higher logistics costs due to conflict zones or trade restrictions.

- Market Access Limitations: Tariffs and non-tariff barriers making it harder to sell products in certain regions.

- Reduced Demand: Economic uncertainty stemming from geopolitical events can cause customers to delay or cancel capital expenditures.

Technological Changes Requiring Large Investments

Significant technological shifts in product design and manufacturing processes present a notable threat. Comer Industries must be prepared for substantial capital expenditures to adopt new technologies and maintain its competitive edge in the market. For instance, the increasing demand for advanced materials and digital integration in off-highway vehicle components could require significant upgrades to existing production lines.

While Comer Industries actively invests in research and development, the pace of technological evolution can outstrip planned budgets. This could lead to unexpected needs for capital to implement cutting-edge innovations, potentially impacting financial flexibility. The company's 2023 R&D spending was approximately $37.5 million, a figure that may need to increase to keep pace with rapid advancements in areas like electrification and autonomous systems.

- Rapid advancements in electrification and autonomous technology for off-highway vehicles necessitate significant R&D and capital investment.

- The need for advanced materials and digital integration in components could require costly upgrades to manufacturing processes.

- Unforeseen technological disruptions might demand substantial, unplanned capital outlays to remain competitive.

The agricultural sector's ongoing contraction poses a significant threat, with global machinery sales down approximately 5% in 2024, impacting Comer's demand. Rising commodity costs, exemplified by steel prices around $750-$800 per ton in early 2024, squeeze profit margins. Intensified competition in the $150 billion agricultural equipment market further pressures pricing and market share.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Comer Industries' official financial reports, comprehensive market research, and expert industry analysis to provide a thorough and accurate strategic overview.