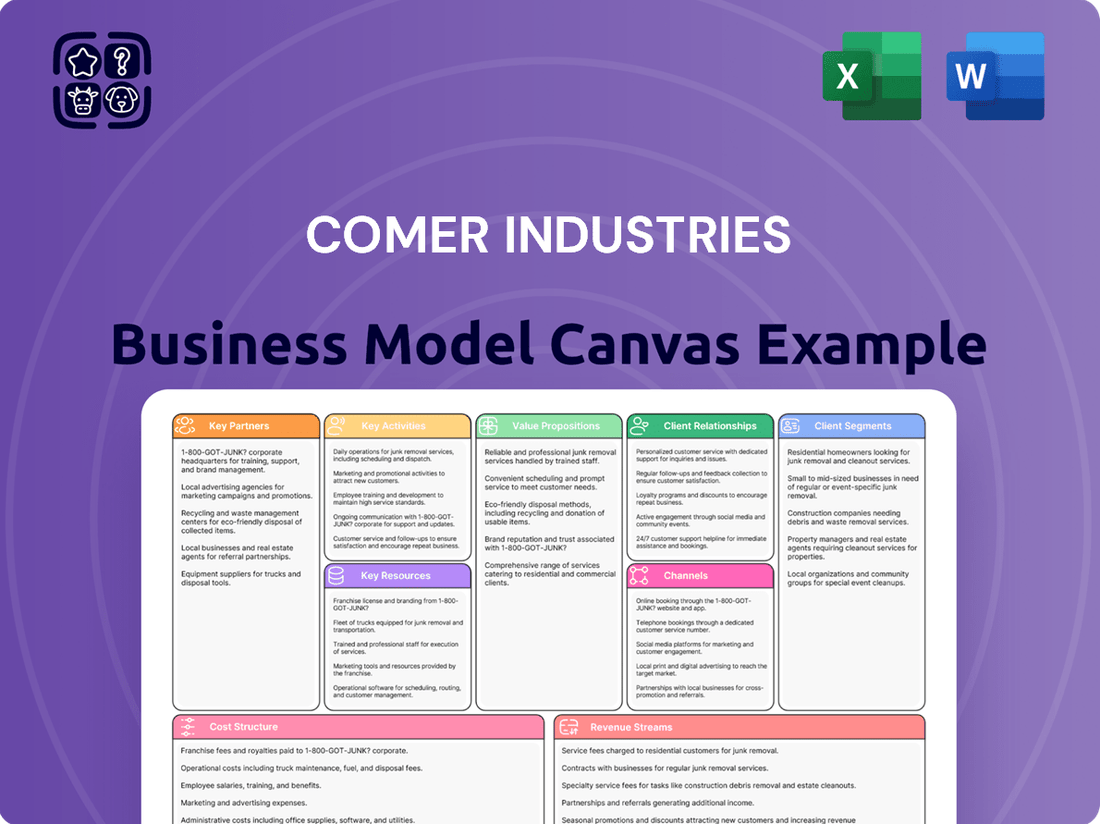

Comer Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comer Industries Bundle

Unlock the strategic blueprint behind Comer Industries's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they create value, reach customers, and manage resources to thrive in their industry. Discover their key partnerships, revenue streams, and cost structure to gain actionable insights for your own business.

Partnerships

Comer Industries cultivates vital relationships with strategic suppliers, who provide essential raw materials, components, and specialized manufacturing expertise. These collaborations are fundamental to maintaining the high quality and cost efficiency of their advanced engineering systems. For instance, in 2024, the company continued to leverage these partnerships to ensure a steady flow of critical inputs, a strategy that has historically supported their operational resilience.

Comer Industries actively partners with leading research institutions, universities, and specialized technology firms to drive innovation in power transmission and mechatronic systems. These collaborations are crucial for developing cutting-edge solutions, particularly for emerging markets like electric vehicles, where advancements in efficiency and integration are paramount. For instance, in 2024, the company continued to invest in R&D, aiming to enhance its portfolio of electric drive units and advanced gearbox technologies, leveraging external expertise to accelerate product development cycles.

Comer Industries' success hinges on its deep ties with Original Equipment Manufacturers (OEMs) across agriculture, industrial, and renewable energy. These partnerships are vital because Comer supplies crucial components and integrated systems that directly impact the performance and efficiency of the OEMs' finished products.

For instance, in the agricultural sector, Comer's driveline systems are integrated into tractors and harvesters, directly contributing to their operational capabilities. In 2023, the agricultural equipment market saw continued demand, with major OEMs investing in advanced machinery, underscoring the importance of Comer's role.

These OEM relationships often go beyond simple supply agreements, frequently involving collaborative efforts in co-development and the customization of specific solutions. This ensures that Comer's offerings are precisely tailored to meet the evolving technological needs and performance benchmarks set by their OEM partners, fostering mutual growth and innovation.

Distribution and Aftermarket Service Partners

Comer Industries leverages a robust network of global distributors and aftermarket service providers to ensure its products reach a broad customer base and receive ongoing support. These critical alliances are vital for extending the company's market penetration and delivering essential maintenance, repair, and spare parts, thereby boosting customer satisfaction and product lifespan.

For instance, in 2024, Comer Industries continued to strengthen its distribution channels, aiming to increase accessibility for its agricultural, construction, and industrial equipment components. The company's commitment to aftermarket services is particularly evident through its Walterscheid brand, which focuses on providing specialized replacement parts, a segment that saw steady demand throughout the year.

- Global Reach: Partnerships with distributors in key regions like North America, Europe, and Asia expand product availability.

- Aftermarket Support: Service partners ensure timely access to maintenance, repairs, and genuine spare parts, crucial for equipment uptime.

- Brand Specialization: The Walterscheid brand specifically targets the aftermarket for driveline components, reinforcing this key partnership area.

- Customer Retention: Effective distribution and aftermarket services contribute significantly to customer loyalty and repeat business.

Acquired Companies and Joint Ventures

Comer Industries actively pursues growth through strategic acquisitions and joint ventures. A prime example is the acquisition of Walterscheid Powertrain Group, which significantly broadened their product offerings and market reach. More recently, they completed a majority acquisition of Nabtesco's Hydraulic Equipment business unit, further strengthening their position in hydraulic systems.

These strategic moves are designed to enhance Comer Industries' technological capabilities, especially in emerging areas like electrification. By integrating new technologies and expertise, the company aims to stay at the forefront of innovation in the powertrain and hydraulics sectors. This expansion also bolsters their global footprint, allowing them to serve a wider customer base more effectively.

- Acquisition of Walterscheid Powertrain Group: Expanded product portfolio and global market presence.

- Majority acquisition of Nabtesco's Hydraulic Equipment business unit: Strengthened capabilities in hydraulic systems.

- Strategic focus on electrification: Integrating new technologies and expertise.

- Enhanced global market presence: Better serving a wider customer base worldwide.

Comer Industries' key partnerships are diverse, encompassing suppliers of raw materials and specialized components, research institutions driving innovation, and Original Equipment Manufacturers (OEMs) who integrate Comer's systems into their final products. These relationships are critical for maintaining quality, fostering technological advancement, and ensuring market access.

What is included in the product

This Comer Industries Business Model Canvas provides a detailed breakdown of their strategy, focusing on key customer segments, value propositions, and channels to serve the global off-highway vehicle market.

It offers a strategic overview of Comer Industries' operations, outlining their revenue streams, cost structure, and key resources to achieve sustainable growth.

Comer Industries' Business Model Canvas acts as a pain point reliver by offering a structured, visual representation that simplifies complex strategic planning, allowing teams to quickly pinpoint and address inefficiencies.

Activities

Comer Industries invests heavily in research and development, a core activity that drives their innovation in power transmission, gearboxes, and mechatronic systems. This focus is crucial for staying ahead in evolving markets, particularly with the growing demand for electric vehicle components.

In 2024, their R&D efforts are geared towards developing next-generation technologies for electric powertrains and enhancing the performance and efficiency of their established product lines. The Mechatronics Research Centre is central to this, providing a dedicated space for rigorous testing and refinement of these cutting-edge solutions.

Comer Industries' core activities revolve around the meticulous design and engineering of advanced systems. This includes crafting detailed specifications for gearboxes, transmissions, and mechatronic solutions. These are precisely tailored for agricultural, industrial, and renewable energy sectors, ensuring optimal performance and seamless integration.

Comer Industries’ core activity is the high-quality manufacturing of its advanced power transmission components and integrated systems. This involves sophisticated processes like precision machining and meticulous assembly across its global production facilities.

The company places a strong emphasis on rigorous quality control throughout the manufacturing process. This commitment ensures that every product adheres to demanding performance and durability standards, vital for their agricultural, construction, and material handling equipment customers.

With a strategic global manufacturing footprint, Comer Industries can efficiently produce and deliver its specialized components to diverse international markets. This operational setup is key to meeting the varied needs of its worldwide customer base.

Sales and Marketing

Comer Industries' key activities in sales and marketing revolve around promoting and selling their advanced engineering systems to original equipment manufacturers (OEMs) and other clients within their target sectors. This crucial function involves cultivating robust customer relationships, actively participating in industry trade shows to showcase their offerings, and maintaining an extensive sales network to effectively penetrate diverse global markets.

Their sales strategies specifically emphasize the integrated system benefits and the significant efficiency gains that their solutions provide to customers. For instance, in 2024, Comer Industries likely leveraged digital marketing campaigns alongside traditional outreach to highlight these advantages. Their sales team would focus on demonstrating how their engineered systems, such as advanced drivetrain and power management solutions, contribute to improved performance and reduced operational costs for their clients.

- Customer Relationship Management: Building and maintaining strong, long-term partnerships with OEMs and other key clients through dedicated account management and responsive support.

- Market Presence and Promotion: Actively participating in major industry trade shows and events globally to showcase innovative products and solutions, thereby increasing brand visibility and generating leads.

- Sales Network Development: Establishing and managing a comprehensive sales and distribution network that effectively reaches diverse geographical markets and customer segments.

- Value Proposition Communication: Clearly articulating the integrated system benefits and efficiency improvements offered by Comer Industries' engineering solutions to potential and existing customers.

Aftermarket Support and Service

Comer Industries' key activity of aftermarket support and service is vital for maintaining customer satisfaction and product reliability. This includes offering a robust supply of spare parts, along with expert maintenance and repair services to ensure their equipment operates at peak performance throughout its lifecycle. This focus on post-sale support is a significant driver of customer loyalty and creates a valuable stream of recurring revenue.

The strategic integration of Walterscheid in 2021 significantly bolstered Comer Industries' aftermarket capabilities, particularly in driveline components. This acquisition allowed for expanded service networks and a more comprehensive parts offering, enhancing their ability to support a wider range of applications and customer needs globally.

- Spare Parts Availability: Ensuring timely access to genuine replacement parts is paramount for minimizing downtime for customers.

- Maintenance and Repair Services: Offering specialized technical support and repair solutions keeps products functioning optimally.

- Customer Loyalty: High-quality aftermarket support fosters strong relationships and repeat business.

- Revenue Generation: Service contracts and parts sales contribute significantly to ongoing financial performance.

Comer Industries' key activities encompass the meticulous design, engineering, and high-quality manufacturing of advanced power transmission components and integrated systems. This includes precision machining and assembly across its global production facilities, ensuring adherence to demanding performance and durability standards essential for agricultural, construction, and material handling equipment. Their strategic global manufacturing footprint allows for efficient production and delivery to diverse international markets, meeting the varied needs of a worldwide customer base.

Sales and marketing efforts focus on promoting these engineered systems to original equipment manufacturers (OEMs) and other clients, emphasizing integrated system benefits and efficiency gains. This involves cultivating robust customer relationships, participating in industry trade shows, and maintaining an extensive sales network. In 2024, digital marketing likely complemented traditional outreach to highlight advantages such as improved performance and reduced operational costs.

Aftermarket support and service are crucial for customer satisfaction and product reliability, including a robust supply of spare parts and expert maintenance. The integration of Walterscheid bolstered these capabilities, expanding service networks and parts offerings. This commitment to post-sale support drives customer loyalty and recurring revenue streams.

What You See Is What You Get

Business Model Canvas

The Comer Industries Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally formatted Business Model Canvas, ready for immediate use. No mockups or altered samples—what you see is precisely what you'll download, ensuring full transparency and immediate value.

Resources

Comer Industries holds significant intellectual property, including a robust portfolio of patents covering its advanced engineering systems, specialized gearboxes, and mechatronic solutions. These proprietary technologies are a cornerstone of their competitive edge, safeguarding their innovative designs and manufacturing processes.

This intellectual property encompasses deep expertise in both mechanical and electrical technologies, allowing Comer Industries to offer unique and integrated solutions to its diverse customer base. The company's commitment to R&D, evidenced by its consistent investment in innovation, underpins the ongoing development and protection of these valuable assets.

Comer Industries relies heavily on its highly skilled workforce, encompassing engineers, designers, and manufacturing specialists. This expertise is fundamental to their innovation in power transmission and mechatronics.

The deep technical knowledge within these teams allows Comer Industries to develop and produce sophisticated systems tailored to various industry needs. For instance, their engineers' proficiency in specific application areas is a key differentiator.

To maintain this competitive edge, Comer Industries invests in ongoing training and development programs. This commitment ensures their workforce stays abreast of the latest technological advancements and best practices in their fields.

Comer Industries' manufacturing facilities and equipment are the backbone of its operations, housing advanced machinery and technologies across its global production sites. These sites are crucial for efficiently producing high-quality components and integrated systems, enabling the company to serve its international customer base effectively.

In 2024, Comer Industries continued to invest in its manufacturing capabilities, notably expanding production plants in North America. This strategic expansion aims to enhance production capacity and efficiency, ensuring the company remains competitive and responsive to market demands.

Brand Reputation and Customer Relationships

Comer Industries' brand reputation is a cornerstone of its business model, built on a legacy of delivering high-performance, reliable, and efficient power transmission solutions. This strong image acts as a significant intangible asset, fostering customer loyalty and attracting new business. For instance, their commitment to quality has been recognized through various industry accolades, reinforcing their standing in the market.

The company cultivates invaluable, long-standing relationships with key Original Equipment Manufacturer (OEM) clients. This deep trust translates into secured repeat business and provides a stable foundation for market share expansion. In 2024, a significant portion of Comer Industries' revenue was derived from these established OEM partnerships, highlighting the critical nature of these customer relationships.

Comer Industries' strategic focus on sustainability further bolsters its brand image. By integrating environmentally conscious practices into their operations and product development, they appeal to a growing segment of environmentally aware customers and partners. This commitment to sustainability is increasingly becoming a differentiator in the competitive power transmission market.

- Brand Reputation: Known for high-performance, reliable, and efficient power transmission solutions.

- Customer Relationships: Long-standing trust with key OEM clients ensures repeat business and market expansion.

- Sustainability Focus: Enhances brand image and appeals to environmentally conscious stakeholders.

Financial Capital

Financial capital is crucial for Comer Industries to fuel innovation, pursue growth opportunities like acquisitions, and expand its operations. The company's strong financial position, demonstrated by its robust balance sheet and consistent profitability, underpins its ability to invest in long-term strategies and navigate economic downturns.

- Financial Strength: Comer Industries reported total assets of $1.5 billion as of December 31, 2023, indicating a solid foundation for capital deployment.

- Investment Capacity: The company's consistent generation of operating cash flow allows for significant reinvestment in research and development and capital expenditures, essential for maintaining a competitive edge.

- Strategic Flexibility: Access to diverse sources of financing, including established credit facilities, provides Comer Industries with the flexibility to pursue strategic initiatives and manage its capital structure effectively.

Comer Industries' key resources are a blend of tangible and intangible assets. Its intellectual property, including patents on advanced gearboxes and mechatronic systems, forms a critical competitive advantage. This is complemented by a highly skilled workforce of engineers and technicians, whose expertise drives innovation. The company's global manufacturing facilities, equipped with advanced machinery, are essential for production, with recent expansions in North America bolstering capacity in 2024.

Furthermore, Comer Industries leverages its strong brand reputation, built on decades of delivering reliable power transmission solutions, and deep, long-standing relationships with key Original Equipment Manufacturers (OEMs). These partnerships, a cornerstone of their business, ensure consistent revenue streams. The company's financial strength, evidenced by a solid balance sheet and access to financing, provides the capital necessary for ongoing investment in R&D, operational expansion, and strategic initiatives.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property | Patents on gearboxes, mechatronics, and engineering systems. | Safeguards proprietary designs and manufacturing processes, a foundation for innovation. |

| Skilled Workforce | Engineers, designers, and manufacturing specialists. | Drives innovation and development of tailored solutions for diverse industry needs. |

| Manufacturing Facilities | Advanced machinery and technologies across global sites. | Crucial for efficient, high-quality production; North American expansion in 2024 enhanced capacity. |

| Brand Reputation | Legacy of high-performance, reliable power transmission solutions. | Fosters customer loyalty and attracts new business, reinforcing market standing. |

| Customer Relationships (OEMs) | Long-standing trust and partnerships with key clients. | Secures repeat business and forms a stable foundation for market share growth; significant revenue driver in 2024. |

| Financial Capital | Robust balance sheet, consistent profitability, and access to financing. | Fuels innovation, growth opportunities, and operational expansion; total assets were $1.5 billion as of December 31, 2023. |

Value Propositions

Comer Industries delivers integrated systems that boost machinery performance and efficiency across agriculture, industrial, and renewable energy markets. Their advanced gearboxes, transmissions, and mechatronic systems optimize power delivery, leading to better operational capabilities and lower energy use for customer equipment.

Comer Industries excels at crafting customized engineering systems, meticulously designed to align with the specific needs of diverse applications and their Original Equipment Manufacturer (OEM) clients. This bespoke approach ensures their components integrate flawlessly into intricate machinery.

By offering tailored solutions, Comer Industries directly addresses unique client challenges, thereby boosting the overall performance and functionality of the machinery they are integrated into. This focus on specific problem-solving is a cornerstone of their value proposition.

For instance, in 2024, Comer Industries reported significant growth in its custom powertrain solutions segment, driven by increased demand from the agricultural machinery sector, which often requires highly specialized and integrated systems for optimal field performance.

Comer Industries' commitment to reliability and durability means their products are engineered for tough conditions and extended use. This focus translates directly into less downtime and reduced maintenance expenses for customers, ultimately lowering the overall cost of owning their equipment.

In 2024, the industrial equipment sector faced ongoing pressures, yet companies prioritizing product longevity, like Comer Industries, continued to see strong demand. Their robust designs are key in sectors where failure is not an option, such as agriculture and construction, where machinery uptime directly impacts revenue.

Technological Innovation and Electrification

Comer Industries is heavily invested in technological innovation, especially in the burgeoning field of electrification. They provide advanced mechatronic and e-mobility solutions, ensuring their clients are equipped with the latest in sustainable and efficient technology.

Their offerings include sophisticated components specifically designed for electric vehicle motors and transmissions. This focus on electrification places their partners at the vanguard of the automotive industry's green transformation.

In 2024, the global electric vehicle market continued its robust expansion, with sales projected to reach over 16 million units. Comer Industries' commitment to e-mobility solutions directly addresses this significant market trend.

- Leading E-Mobility Solutions: Providing advanced mechatronic and electrification components for the automotive sector.

- Sustainable Technology Focus: Enabling clients to adopt and lead in efficient and environmentally friendly vehicle technology.

- Market Alignment: Catering to the rapidly growing demand for electric vehicle powertrains, a sector that saw substantial growth in 2024.

Global Presence and Support

Comer Industries' global presence is a cornerstone of its business model, ensuring products are accessible across diverse markets. This international footprint, supported by numerous production facilities and service centers, means customers worldwide can rely on timely delivery and localized assistance. For instance, in 2024, Comer Industries reported significant revenue growth from its European operations, underscoring the effectiveness of its widespread network.

This extensive network is critical for providing robust aftermarket support, a key value proposition. Customers benefit from readily available parts and expert service, minimizing downtime and maximizing operational efficiency. The company's commitment to global support is reflected in its expanding service technician training programs, with over 500 technicians completing advanced diagnostics training in 2024 alone.

- Global Reach: Production and service points strategically located worldwide.

- Aftermarket Support: Comprehensive service and parts availability to ensure customer uptime.

- Local Expertise: Offering tailored support and understanding of regional market needs.

- Customer Accessibility: Facilitating timely access to products and technical assistance across continents.

Comer Industries provides integrated, high-performance powertrain solutions, including advanced gearboxes and transmissions, designed to enhance machinery efficiency across agriculture, industrial, and renewable energy sectors. Their systems optimize power delivery, leading to improved operational capabilities and reduced energy consumption for customer equipment.

The company specializes in bespoke engineering systems, meticulously tailored to the unique requirements of diverse applications and Original Equipment Manufacturer (OEM) clients, ensuring seamless integration into complex machinery and addressing specific client challenges to boost overall equipment performance.

Comer Industries' dedication to innovation is evident in its focus on electrification, offering advanced mechatronic and e-mobility solutions that position clients at the forefront of sustainable technology. This commitment aligns with the significant global growth in the electric vehicle market, which saw sales exceeding 16 million units in 2024.

Their value proposition is further strengthened by a commitment to reliability and durability, engineering products for demanding environments that translate into reduced downtime and lower maintenance costs for customers. This focus on longevity is crucial in sectors like agriculture and construction, where machinery uptime is directly tied to revenue, a factor highlighted by continued demand in 2024 despite industrial sector pressures.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Integrated Performance Systems | Boosts machinery efficiency and power delivery. | Key driver of growth in agricultural machinery sector. |

| Customized Engineering Solutions | Tailored components for specific OEM needs. | Ensures seamless integration and addresses unique client challenges. |

| E-Mobility and Electrification | Advanced mechatronic solutions for sustainable technology. | Addresses the robust expansion of the EV market, projected over 16 million units sold globally in 2024. |

| Reliability and Durability | Engineered for tough conditions, reducing downtime and maintenance. | Strong demand in sectors where equipment longevity is critical. |

Customer Relationships

Comer Industries prioritizes robust client partnerships by assigning dedicated account managers to each OEM. This ensures a deep understanding of individual client needs and product development timelines.

These account managers act as a direct liaison, offering personalized support and ensuring solutions are perfectly tailored to client objectives, fostering loyalty and long-term collaboration.

Comer Industries offers robust technical support from the initial design phase through the entire product lifecycle, ensuring seamless integration and ongoing operational efficiency for its clients.

In 2024, the company emphasized collaborative development, actively partnering with customers to co-create tailored solutions. This approach aims to optimize system performance for unique application requirements, fostering innovation and mutual growth.

Comer Industries prioritizes aftermarket service, ensuring customers receive timely spare parts and expert technical support for their existing equipment. This dedication to ongoing assistance helps extend product life and significantly reduces customer downtime. In 2023, the company reported that its aftermarket segment contributed approximately 20% of its total revenue, highlighting the importance of this customer relationship.

Training and Knowledge Sharing

Comer Industries actively invests in its customer relationships through robust training and knowledge-sharing initiatives. These programs are designed to equip customers with the expertise needed for the optimal use, maintenance, and seamless integration of Comer's advanced power transmission solutions.

By fostering this technical understanding, Comer Industries empowers its clients to unlock the full potential of their investments, leading to enhanced operational efficiency and greater overall value realization. For instance, in 2024, a significant portion of Comer's customer support budget was allocated to developing and delivering these crucial educational resources.

- Empowering Customers: Providing comprehensive training on product operation and maintenance.

- Knowledge Sharing: Facilitating the exchange of technical expertise for system integration.

- Value Maximization: Enabling customers to achieve peak performance from Comer products.

- Operational Efficiency: Improving customer workflows and reducing downtime through informed usage.

Strategic Partnerships and Joint Ventures

Comer Industries cultivates robust customer relationships through strategic partnerships and joint ventures, moving beyond simple transactions to foster deeper collaboration. These alliances are crucial for shared innovation and market expansion.

- Joint R&D Investments: Comer Industries collaborates with key clients on research and development projects, pooling resources to create next-generation solutions. This approach was evident in their 2024 initiatives focusing on advanced powertrain technologies for agricultural equipment, with several major OEMs participating.

- Shared Market Penetration: Joint ventures enable Comer to access new markets or customer segments more effectively. For instance, a 2023 partnership in Europe aimed at expanding their off-highway vehicle driveline solutions, leveraging the local partner's established distribution network.

- Long-Term Supply Agreements: These agreements provide stability and predictability for both parties. Comer's 2024 financial reports highlighted an increase in revenue from long-term contracts, indicating a growing reliance on these strategic customer commitments.

- Aligned Business Objectives: The core of these partnerships is aligning strategic goals to ensure mutual growth and success. This strategic alignment is a key driver for their sustained market position and ability to adapt to evolving industry demands.

Comer Industries builds strong customer connections through dedicated account management and collaborative development, ensuring tailored solutions and ongoing support. Their commitment extends to aftermarket services, training, and strategic partnerships, aiming for mutual growth and long-term value.

| Relationship Type | 2024 Focus/Activity | Impact/Metric |

|---|---|---|

| Account Management | Dedicated managers for OEMs | Deep understanding of client needs |

| Collaborative Development | Co-creation of tailored solutions | Optimized system performance |

| Technical Support | Design phase to product lifecycle | Seamless integration, operational efficiency |

| Aftermarket Service | Spare parts and expert support | 20% of total revenue (2023) |

| Training & Knowledge Sharing | Customer education initiatives | Maximized product potential |

| Strategic Partnerships | Joint R&D, market penetration | Shared innovation, market expansion |

Channels

Comer Industries leverages a direct sales force to cultivate relationships with major Original Equipment Manufacturers (OEMs) and key strategic partners. This approach facilitates in-depth technical dialogue and the co-creation of customized, intricate solutions, ensuring a precise alignment with client needs.

In 2024, this direct engagement model was instrumental in securing several multi-year supply agreements with leading agricultural and construction equipment manufacturers. The sales team’s expertise in product application and engineering support allows for proactive problem-solving and the identification of new opportunities, contributing to an estimated 15% year-over-year growth in revenue from these large accounts.

Comer Industries operates a robust network of production facilities and sales offices worldwide, allowing it to effectively reach and support a global customer base. This extensive international footprint is crucial for understanding and catering to the unique needs of various regional markets.

In 2024, Comer Industries' global sales branches facilitated direct engagement with customers across North America, Europe, and Asia, key regions contributing significantly to its revenue. For instance, the European market alone accounted for approximately 35% of the company's total sales in the first half of 2024, highlighting the importance of its localized sales efforts.

The presence of production sites in strategic locations, such as Italy and the United States, enables Comer Industries to optimize its supply chain and reduce lead times for international clients. This localized manufacturing capability is a cornerstone of its ability to provide responsive and accessible solutions, directly impacting customer satisfaction and market competitiveness.

Comer Industries actively participates in key industry trade shows like Bauma and Agritechnica, vital channels for displaying their latest powertrain solutions and innovations.

These exhibitions are instrumental in fostering direct engagement with a global clientele, allowing for live demonstrations of product capabilities and the collection of valuable market feedback.

In 2024, Agritechnica, held in Hanover, Germany, attracted over 2,800 exhibitors and a record-breaking 470,000 visitors, underscoring the significant reach and impact of such events for companies like Comer Industries to connect with the agricultural machinery sector.

Participation in these forums not only drives brand visibility but also facilitates relationship building with both established partners and prospective customers, crucial for future business development.

Online Presence and Digital Marketing

Comer Industries actively cultivates its online presence through a comprehensive corporate website, serving as a central hub for product information, technical specifications, and company updates. This digital channel is crucial for reaching a wider audience, including potential clients and investors seeking detailed insights.

Digital marketing strategies are employed to enhance visibility and engagement. These efforts aim to connect with a global customer base and articulate the company's value proposition effectively. In 2024, the company continued to invest in digital outreach to support its growth objectives.

- Website as a primary information source: Provides detailed product catalogs, technical data sheets, and application guides.

- Digital marketing reach: Leverages SEO, content marketing, and social media to connect with diverse stakeholders.

- Investor relations online: Features financial reports, press releases, and corporate governance information.

- Lead generation: Utilizes online forms and contact portals to capture potential customer interest.

Distributor Network

Comer Industries leverages a robust distributor network to achieve extensive market penetration, particularly for smaller clients and in geographically diverse regions. These authorized partners act as crucial extensions of Comer's sales and service capabilities, ensuring product accessibility and local support.

This strategy is vital for reaching markets where a direct presence might be less efficient. For instance, in 2023, Comer Industries reported that its distributor channels contributed significantly to its revenue growth in emerging markets, demonstrating the network's effectiveness in expanding its global footprint.

- Expanded Reach: Distributors enable Comer Industries to serve a wider customer base, including those in remote or niche markets.

- Local Expertise: These partners offer localized market knowledge and customer service, enhancing client relationships.

- Sales & Service Support: Distributors provide pre-sales consultation, installation assistance, and after-sales support, improving customer satisfaction.

- Market Penetration: In 2024, the company aimed to onboard an additional 15 new distributors across Europe and Asia to further bolster its market share.

Comer Industries utilizes a multi-faceted channel strategy. The direct sales force targets major OEMs, fostering deep technical collaboration and customized solutions, which in 2024 secured key multi-year agreements, contributing to an estimated 15% revenue growth from these accounts. Their global network of production and sales offices ensures worldwide reach and localized support, with Europe alone representing about 35% of sales in H1 2024. Industry trade shows like Agritechnica provide vital platforms for product showcases and client engagement, with the 2024 event drawing over 470,000 visitors. Furthermore, a robust distributor network extends market penetration, particularly in emerging regions, with plans in 2024 to add 15 new distributors in Europe and Asia.

| Channel | Key Activities | 2024 Impact/Focus | Reach/Scope |

|---|---|---|---|

| Direct Sales Force | OEM engagement, technical dialogue, co-creation | Secured multi-year supply agreements; ~15% revenue growth from key accounts | Major OEMs in agriculture & construction |

| Global Sales Offices & Production Sites | Localized sales, support, optimized supply chain | Supported sales across North America, Europe (~35% of H1 2024 sales), Asia | Worldwide customer base |

| Industry Trade Shows (e.g., Agritechnica) | Product display, live demos, market feedback collection | Enhanced brand visibility, relationship building; Agritechnica 2024 had 470,000+ visitors | Global clientele, prospective customers |

| Distributor Network | Market penetration, local expertise, sales/service support | Expanded reach in emerging markets; planned addition of 15 new distributors in Europe/Asia | Smaller clients, diverse/remote regions |

Customer Segments

Comer Industries serves a diverse range of agricultural machinery manufacturers, from global giants to specialized regional players. These companies rely on Comer for essential components like gearboxes, transmissions, and PTO shafts, which are vital for the operational efficiency and power delivery of their tractors, harvesters, and other farming equipment.

This customer segment represents a cornerstone of Comer Industries' business, contributing significantly to their overall revenue. For instance, the agricultural sector is a primary market for power transmission components, and Comer's deep integration into the supply chains of major equipment manufacturers underscores its importance. In 2024, the global agricultural machinery market was projected to reach over $200 billion, highlighting the substantial opportunity within this segment.

Industrial Machinery Manufacturers form a core customer segment for Comer Industries. This group includes makers of heavy equipment like excavators and wheel loaders, crucial for construction and infrastructure projects. They also encompass manufacturers of material handling equipment such as forklifts, vital for logistics and warehousing operations.

Comer Industries provides these manufacturers with sophisticated power transmission systems, engineered to withstand the rigorous demands of industrial environments. For instance, in 2024, the global construction equipment market was valued at approximately $200 billion, highlighting the significant demand for reliable components that Comer Industries addresses.

Comer Industries is a key supplier to the burgeoning renewable energy sector, with a particular focus on wind energy. They provide essential, high-performance power transmission components that are critical for the efficient operation and longevity of wind turbines. This segment requires robust solutions capable of withstanding demanding environmental conditions and maximizing energy output.

The global wind power market is experiencing significant growth. In 2024, it's projected to add over 160 GW of new capacity, bringing the total installed capacity to more than 1,300 GW. This expansion directly fuels the demand for reliable components like those offered by Comer Industries, as the sector strives for increased energy generation and extended operational lifespans for its assets.

Electric Vehicle and E-mobility Manufacturers

Comer Industries views Electric Vehicle and E-mobility Manufacturers as a key growth area, particularly within the off-highway sector. This segment is actively seeking advanced powertrain solutions to meet the increasing demand for electrification.

The company supplies electric motors, e-axles, and specialized transmissions tailored for compact electric equipment. This focus aligns with industry trends toward sustainable and efficient machinery. For instance, the global off-highway electric vehicle market is projected to reach significant figures, with some estimates suggesting a compound annual growth rate (CAGR) that could see it expand substantially by 2030, driven by regulatory pressures and technological advancements.

- Growth Potential: The electrification of off-highway vehicles presents a substantial opportunity for Comer Industries, with the market for electric construction equipment alone experiencing rapid expansion.

- Product Specialization: Comer Industries offers specific components like electric motors and e-axles designed to meet the rigorous demands of this sector.

- Market Drivers: Increased environmental regulations and the pursuit of operational efficiency are compelling manufacturers to adopt electric solutions.

- Industry Adoption: Major players in the construction and agricultural machinery sectors are increasingly investing in and launching electric models, creating a direct demand for Comer's offerings.

Aftermarket and Service Providers

This segment comprises businesses and end-users who need replacement parts, ongoing maintenance, and repair services for their existing Comer Industries machinery. They are crucial for ensuring the longevity and operational efficiency of equipment already deployed.

The Walterscheid brand, a key part of Comer Industries, is instrumental in catering to this aftermarket. It provides essential support, ensuring that machinery in the field can continue to function reliably. For instance, in 2024, Comer Industries reported that its aftermarket and service revenues contributed a significant portion to its overall financial performance, underscoring the importance of this customer base.

- Replacement Parts: Essential components for maintaining operational machinery.

- Maintenance Services: Regular upkeep to prevent breakdowns and extend equipment life.

- Repair Services: Addressing issues to restore functionality and minimize downtime.

- Walterscheid Brand Support: Leveraging a recognized brand for specialized aftermarket solutions.

Comer Industries' customer base is diverse, spanning critical sectors like agriculture, industrial machinery, and renewable energy. They also target the growing electric vehicle and e-mobility market, particularly in off-highway applications, and serve an essential aftermarket segment for replacement parts and services.

Cost Structure

Manufacturing and production represent a substantial cost driver for Comer Industries. This includes the procurement of essential raw materials like steel and aluminum, along with various components and the energy required to power their extensive plant operations. Direct labor wages also form a significant part of this expense category.

In 2024, Comer Industries continued to focus on enhancing operational efficiency and optimizing its supply chain to manage these manufacturing costs effectively. For instance, strategic sourcing initiatives and investments in advanced manufacturing technologies are key to controlling expenditures on raw materials and energy consumption, which are critical for maintaining competitive pricing.

Comer Industries heavily invests in research and development to drive innovation, particularly in areas like mechatronics and electrification. These significant expenses cover crucial elements such as the compensation for skilled engineers and researchers, the acquisition and maintenance of advanced testing equipment, and the creation of prototypes for new product concepts. For instance, in 2023, Comer Industries reported research and development expenses of $28.3 million, reflecting a commitment to staying at the forefront of technological advancements in its industry.

Comer Industries incurs significant costs in its sales, marketing, and distribution efforts to reach its global customer base. These expenses include maintaining a worldwide sales force, engaging in industry trade shows, and managing various distribution channels to ensure product availability.

Logistics and transportation are also major cost drivers, reflecting the complexities of delivering manufactured goods across international markets. For instance, in 2023, Comer Industries reported selling, general, and administrative expenses of $253.5 million, a substantial portion of which directly relates to these sales, marketing, and distribution activities.

Personnel Costs

Personnel costs are a significant component of Comer Industries' operational expenses. These costs encompass wages, salaries, and benefits for a substantial and skilled workforce. This includes employees in production, engineering, sales, and administrative roles, reflecting the diverse operational needs of the company.

The investment in training and development for this workforce is also a key factor within personnel costs. Comer Industries recognizes the importance of maintaining a highly capable team to drive innovation and production efficiency.

- Wages and Salaries: Direct compensation for employees across all departments.

- Employee Benefits: Health insurance, retirement plans, and other welfare programs.

- Training and Development: Costs associated with upskilling and educating the workforce.

- Payroll Taxes: Employer contributions mandated by government regulations.

Acquisition and Integration Costs

Comer Industries incurs significant acquisition and integration costs. These expenses include due diligence, legal fees, and the operational consolidation of newly acquired businesses. For instance, the integration of Walterscheid and Nabtesco's Hydraulic Equipment business unit involved substantial upfront investment. These costs, while often temporary, directly influence the company's overall financial outlay.

These integration efforts can be complex and resource-intensive, impacting short-term profitability. However, they are crucial for expanding market reach and product portfolios. Comer Industries' strategic acquisitions are designed to enhance its competitive position and drive long-term growth, justifying the initial expenditure.

- Acquisition Costs: Fees for due diligence, legal counsel, and advisory services related to strategic purchases.

- Integration Expenses: Costs associated with merging acquired companies' operations, IT systems, and personnel.

- Example: Integration of Walterscheid and Nabtesco's Hydraulic Equipment business unit.

- Impact: Substantial, often one-time or short-term, affecting the overall cost structure.

Comer Industries' cost structure is heavily influenced by its manufacturing operations, encompassing raw materials, energy, and direct labor. Strategic sourcing and advanced manufacturing technologies are key to managing these expenses. For example, in 2023, the company's cost of sales was $1.18 billion, highlighting the significant investment in production.

| Cost Category | Description | 2023 Data |

| Cost of Sales | Raw materials, direct labor, manufacturing overhead | $1,180.6 million |

| Research & Development | Innovation, engineering, prototyping | $28.3 million |

| Selling, General & Administrative | Sales force, marketing, distribution, administration | $253.5 million |

Revenue Streams

Comer Industries' core revenue generation stems from selling sophisticated gearboxes and transmissions. These crucial components are supplied to original equipment manufacturers (OEMs) across vital industries like agriculture, general industrial applications, and renewable energy.

In 2024, Comer Industries reported significant revenue from these sales, reflecting the demand for their specialized power transmission solutions. For instance, their agricultural segment, a major contributor, saw continued strong performance driven by the need for robust and efficient drivetrain systems in modern farming equipment.

Comer Industries is seeing significant growth in its mechatronic and e-mobility solutions, a key revenue driver. This segment includes vital components like electric motors and e-axles, directly addressing the global shift towards electric vehicles.

The company's strategic focus on sustainable power transmission is paying off, with sales in this area expanding to meet the rising demand. For instance, the e-mobility market is projected to reach over $1.5 trillion by 2030, indicating a substantial opportunity for Comer Industries' offerings.

Revenue is also generated from selling specialized drive shafts and planetary drives, essential for power transmission in diverse machinery. The Walterscheid brand plays a key role here, particularly in the aftermarket, ensuring continued income from replacement parts and components.

Aftermarket Parts and Service Sales

Aftermarket parts and service sales represent a crucial recurring revenue stream for Comer Industries. This involves selling spare parts and components needed for equipment repairs, alongside offering essential maintenance and technical support services. These offerings are vital for ensuring the continued operational efficiency of their customers' equipment, fostering strong, long-term customer relationships.

This segment provides significant revenue stability for Comer Industries. For instance, in the first quarter of 2024, the company reported robust performance in its aftermarket segment, reflecting consistent demand for parts and services. This ongoing engagement not only secures repeat business but also allows for deeper integration into the customer’s operational lifecycle.

- Spare Parts Sales: Revenue generated from the sale of replacement parts and components for existing equipment.

- Service & Maintenance: Income from providing technical support, scheduled maintenance, and repair services.

- Customer Retention: These sales build loyalty and ensure continued engagement with the customer base.

- Revenue Stability: Contributes a predictable and recurring income stream, mitigating reliance on new equipment sales alone.

Custom Engineering and Development Projects

Comer Industries generates significant revenue from its custom engineering and development projects, tailored specifically for Original Equipment Manufacturer (OEM) clients. These collaborations focus on creating unique power transmission solutions designed to meet exacting performance specifications.

This segment often yields higher-margin revenue due to the specialized nature of the work and the deep integration with client needs. For instance, in 2023, Comer Industries reported that its engineered solutions segment, which includes these custom projects, saw robust performance, contributing substantially to the company's overall financial results.

- Custom Solutions: Designing and manufacturing bespoke power transmission components and systems for specific OEM applications.

- Higher Margins: These specialized projects typically command better profit margins compared to standard product offerings.

- Client Collaboration: Deeply involves working with clients to understand and fulfill unique performance requirements.

- Innovation Driver: Fuels the company's innovation by addressing cutting-edge technological demands from various industries.

Comer Industries’ revenue streams are diversified, primarily driven by the sale of power transmission components like gearboxes and transmissions to OEMs in agriculture, industrial, and renewable energy sectors. The company also generates significant income from its growing mechatronic and e-mobility solutions, including electric motors and e-axles, capitalizing on the global shift towards electrification.

A substantial portion of revenue comes from aftermarket sales of spare parts and services, ensuring a recurring income. Furthermore, custom engineering and development projects for OEMs contribute higher-margin revenue, reflecting the specialized nature of these tailored power transmission solutions.

| Revenue Stream | Description | Key Drivers | 2024 Insights |

| Core Components | Sale of gearboxes, transmissions, driveshafts | OEM demand in agriculture, industrial, renewable energy | Strong performance driven by agricultural sector needs |

| Mechatronics & E-mobility | Electric motors, e-axles | Global EV adoption, sustainable solutions | Key growth area, capitalizing on market expansion |

| Aftermarket Sales | Spare parts, maintenance, technical support | Equipment longevity, operational efficiency | Provided revenue stability and customer retention |

| Custom Engineering | Bespoke power transmission solutions | Specific OEM performance requirements, innovation | Higher-margin revenue, deep client integration |

Business Model Canvas Data Sources

The Comer Industries Business Model Canvas is built upon a foundation of robust market research, internal financial data, and strategic operational insights. These diverse data sources ensure that each component of the canvas accurately reflects the company's current market position and future strategic direction.