Comer Industries Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comer Industries Bundle

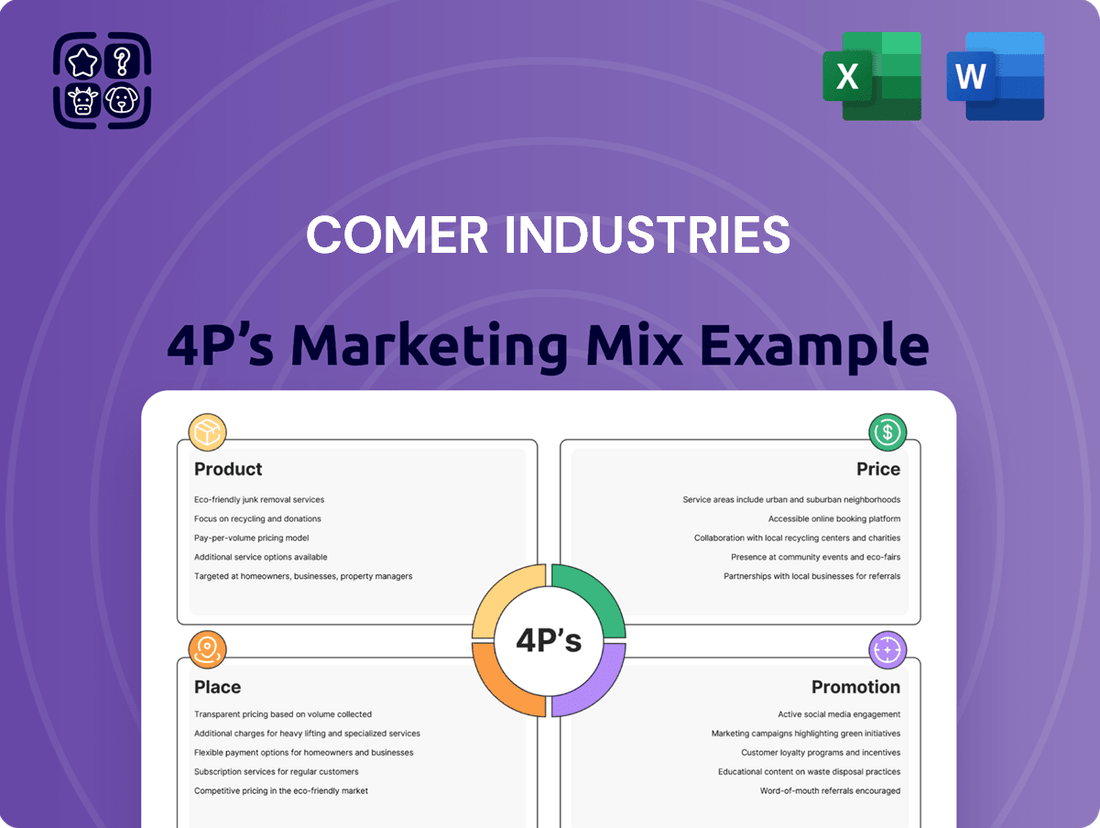

Discover how Comer Industries leverages its Product, Price, Place, and Promotion strategies to dominate the market. This analysis reveals the core elements of their success, offering valuable insights for your own business planning.

Go beyond the surface and gain a comprehensive understanding of Comer Industries' marketing mix. Our detailed report breaks down each P, providing actionable strategies and real-world examples to elevate your marketing efforts.

Save time and gain a competitive edge with our ready-made 4Ps Marketing Mix Analysis for Comer Industries. Get instant access to professionally written, editable content perfect for strategic planning, presentations, or academic research.

Product

Advanced Engineering Systems represent Comer Industries' core product offering, focusing on sophisticated power transmission solutions like gearboxes and transmissions. These systems are crucial for machinery performance, with the company emphasizing integrated mechatronic solutions designed to boost efficiency and power output.

In 2024, Comer Industries continued to invest in advanced engineering, with R&D spending projected to be around 5-7% of revenue, reflecting a commitment to innovation in these critical systems. Their advanced engineering systems are vital for sectors like agriculture and construction, where enhanced power transmission directly impacts operational effectiveness and fuel economy.

Comer Industries demonstrates a robust Diverse Sector Focus, catering to critical markets like agriculture, industrial applications, and the burgeoning renewable energy sector. This broad reach allows them to leverage their engineering prowess across varied demands, fostering innovation in machinery design and functionality.

In 2023, Comer Industries reported total revenues of €1.5 billion, with a significant portion stemming from its diverse end markets. For instance, the agricultural sector, a key focus, saw continued demand for advanced powertrain solutions, while the industrial segment benefited from infrastructure development projects. The renewable energy sector, particularly in wind turbine components, has shown strong growth potential, contributing to the company's overall resilience and market penetration.

Comer Industries is actively embracing electrification and green technologies, a significant expansion of its product portfolio. This strategic move is underscored by the launch of a dedicated green-tech division, aiming to capture growth in the evolving sustainable mobility market.

The company's commitment to this sector is further solidified by strategic acquisitions, notably Sitem and Benevelli. These acquisitions bring specialized expertise in electric vehicle motors and transmissions, directly supporting Comer's pivot towards environmentally conscious solutions.

This expansion into electric vehicle components reflects a broader industry trend, with the global electric vehicle market projected to reach over $1.5 trillion by 2030, according to recent market analyses. Comer Industries is positioning itself to be a key supplier within this rapidly expanding ecosystem.

Customized and Proprietary Solutions

Customized and proprietary solutions are central to Comer Industries' strategy, with approximately 70% of its sales derived from these offerings. This focus on tailored products, often co-developed with clients, fosters significant entry barriers for competitors. For instance, in the demanding agricultural sector, Comer Industries leverages specialized technological expertise and established long-term relationships to solidify its position as an exclusive supplier for many customers.

This deep customization not only differentiates Comer Industries but also builds client loyalty. The company's ability to deliver unique solutions, rather than off-the-shelf products, means it’s deeply integrated into its clients' operational success. This integration is particularly evident in sectors requiring highly specialized equipment and engineering support.

- 70% of sales from customized and co-developed products

- High entry barriers for competitors due to specialized skills

- Exclusive provider status for many clients, especially in agriculture

- Long-term relationships built on technological collaboration

Comprehensive Portfolio

Comer Industries' product portfolio is a significant strength, offering a wide array of components designed for various industrial applications. Their extensive range includes axles, drive shafts, and advanced e-mobility solutions, catering to evolving market demands. This breadth allows them to serve a diverse customer base, from manufacturers of aerial work platforms to producers of agricultural machinery.

The company provides specialized items like Rockford Fan Clutches, a variety of gearboxes, and hydrostatic traction drives, demonstrating a commitment to specialized engineering. Furthermore, their offerings extend to PTO drive shafts and clutches, alongside tractor attachment systems, highlighting their comprehensive approach to powertrain solutions. This extensive product mix is crucial for meeting the multifaceted needs of their global clientele.

Key aspects of Comer Industries' product offering include:

- Broad Component Range: Axles, drive shafts, e-mobility solutions, fan clutches, gearboxes, hydrostatic traction drives, PTO components, and tractor attachments.

- Diverse Application Support: Serving sectors from aerial platforms to agricultural and construction equipment.

- Specialized Solutions: Including Rockford Fan Clutches and hydrostatic traction drives for specific performance needs.

- Powertrain Integration: Offering systems that enhance the functionality and efficiency of powered machinery.

For instance, in 2023, Comer Industries reported net sales of €312.8 million, with a significant portion attributed to their extensive product lines supporting off-highway vehicles. This financial performance underscores the market's reliance on their comprehensive product suite.

Comer Industries' product strategy centers on advanced engineering systems, particularly power transmission solutions like gearboxes and transmissions. They emphasize integrated mechatronic systems designed to boost machinery efficiency and power output, with a significant portion of their sales, around 70%, coming from customized and co-developed products. This focus on tailored solutions creates high entry barriers and fosters client loyalty, especially in demanding sectors like agriculture where they often serve as exclusive suppliers.

The company offers a broad spectrum of components, including axles, drive shafts, and e-mobility solutions, alongside specialized items like Rockford Fan Clutches and hydrostatic traction drives. This diverse product range supports various applications, from aerial work platforms to agricultural and construction equipment, underscoring their comprehensive approach to powertrain solutions.

Comer Industries is actively expanding into electrification and green technologies through a dedicated division and strategic acquisitions like Sitem and Benevelli, positioning itself within the rapidly growing electric vehicle market. This strategic pivot is supported by continued investment in R&D, with projected spending around 5-7% of revenue in 2024, aimed at enhancing these critical systems.

Their product portfolio is vital across key markets such as agriculture, industrial applications, and renewable energy. For instance, in 2023, Comer Industries reported net sales of €312.8 million, with a substantial contribution from their extensive product lines supporting off-highway vehicles, highlighting market reliance on their comprehensive offerings.

| Product Focus | Key Offerings | Customization & Innovation | Market Penetration | Recent Performance Indicator |

|---|---|---|---|---|

| Advanced Power Transmission Systems | Gearboxes, Transmissions, Axles, Drive Shafts | 70% of sales from customized/co-developed products | Agriculture, Industrial, Renewable Energy | €312.8 million net sales (2023) |

| Mechatronic Solutions | Integrated systems for efficiency | High entry barriers due to specialized skills | Aerial Work Platforms, Agricultural Machinery | R&D investment 5-7% of revenue (2024 proj.) |

| Electrification & Green Tech | Electric vehicle motors and transmissions | Strategic acquisitions (Sitem, Benevelli) | Sustainable Mobility Market | Growing contribution from electric solutions |

| Specialized Components | Rockford Fan Clutches, Hydrostatic Traction Drives | Long-term client relationships | Off-highway vehicles | Significant portion of sales from off-highway lines |

What is included in the product

This analysis provides a comprehensive review of Comer Industries' marketing strategies, examining their Product, Price, Place, and Promotion tactics to offer insights into their market positioning.

Simplifies Comer Industries' marketing strategy by clearly outlining Product, Price, Place, and Promotion, alleviating the complexity of understanding their market approach.

Place

Comer Industries maintains a significant global manufacturing footprint, with 11 production facilities strategically located across 6 countries. This expansive network underpins their 'local-for-local' production strategy, ensuring products are manufactured and delivered efficiently to meet specific regional market needs. For instance, their European presence, including facilities in Italy and Germany, allows them to serve the robust agricultural and construction sectors within the EU effectively.

Comer Industries has significantly bolstered its presence in North America, a key market, by investing in a new production plant in Rockford, Illinois. This facility, which began operations in October 2024, represents a strategic move to enhance market penetration and customer service.

The Rockford plant is engineered to effectively double the company's production capacity, allowing Comer Industries to better meet the growing demand for its specialized components and systems. This expansion is crucial for solidifying its competitive edge and driving future growth within the region.

Comer Industries' expansion into Asian markets, particularly through the acquisition of Nabtesco's Hydraulic Equipment business unit, is a significant step in their global strategy. This move bolsters their presence in a crucial growth region.

The addition of four new production facilities in Japan, China, and Thailand dramatically enhances Comer Industries' manufacturing and distribution capabilities across Asia. This strategic footprint allows for more efficient service and deeper market penetration.

This expansion directly addresses the Place element of the marketing mix, enabling Comer Industries to be physically closer to a larger customer base in Asia. It signifies a commitment to serving these markets with localized production and supply chains.

Strong OEM Partnerships

Comer Industries strategically leverages strong Original Equipment Manufacturer (OEM) partnerships to bolster its market presence. A prime example is the recent agreement with CNH, a leading agricultural and construction equipment manufacturer. This collaboration centers on the production of axles for CNH's entire Steiger tractor line, with manufacturing taking place at Comer's new Rockford facility.

These OEM relationships are crucial for Comer Industries, ensuring consistent demand and a direct channel to major industry players. The CNH deal, for instance, will see Comer supply axles for a significant portion of the Steiger tractor market, a segment that saw robust sales in 2024, with industry-wide tractor sales showing resilience.

- OEM Collaboration: Key partnerships with global OEMs like CNH are central to Comer's strategy.

- Product Focus: Supply agreements, such as for Steiger tractor axles, secure significant production volumes.

- Market Access: Direct relationships with OEMs provide stable demand and market penetration.

- Growth Driver: These partnerships are vital for driving revenue and expanding Comer's footprint in the agricultural equipment sector.

Efficient Supply Chain and Logistics

Comer Industries places a strong emphasis on supply chain resilience and efficiency. This is evident in their reported delivery times, which typically range from 16 to 20 weeks. This operational focus ensures that their specialized equipment and components reach customers reliably, thereby optimizing availability and sales opportunities.

This commitment to getting products to market promptly, despite extended lead times, is crucial for their diverse customer base. By managing logistics effectively, Comer Industries aims to minimize disruptions and maintain customer satisfaction.

- Delivery Lead Times: 16-20 weeks, highlighting a focus on specialized production and global logistics.

- Supply Chain Strategy: Prioritizing resilience and efficiency to ensure product availability.

- Customer Impact: Maximizing convenience and optimizing sales potential through reliable delivery.

Comer Industries' global manufacturing network, with 11 facilities across 6 countries, supports its local-for-local production strategy. The recent expansion into Asia, including four new facilities in Japan, China, and Thailand following the Nabtesco acquisition, significantly enhances their ability to serve these key growth markets with localized production and supply chains.

The new Rockford, Illinois plant, operational since October 2024, doubles production capacity in North America, a crucial market. This facility is key to fulfilling OEM partnerships, such as the agreement to produce axles for CNH's entire Steiger tractor line, reinforcing Comer's position in the agricultural sector.

| Manufacturing Facilities | Countries | Key Expansion Areas | Recent Capacity Increase | Typical Delivery Lead Time |

| 11 | 6 | North America (Rockford, IL), Asia (Japan, China, Thailand) | Doubled in North America | 16-20 weeks |

Full Version Awaits

Comer Industries 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Comer Industries 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Comer Industries actively broadcasts its dedication to sustainability through programs like 'OUR BRIGHT IMPACT'. This initiative highlights their efforts in environmental stewardship and social responsibility, aiming to create positive change. For instance, in their 2023 Sustainability Report, they detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline.

Transparency is a cornerstone of Comer Industries' sustainability communication, evidenced by their annually published Sustainability Reports. These reports, which are publicly accessible on their corporate website, undergo external review, ensuring credibility and alignment with international standards like the Global Reporting Initiative (GRI). The 2023 report also noted a 20% increase in renewable energy usage across their manufacturing facilities.

Comer Industries prioritizes transparency through its robust Investor Relations portal, offering easy access to consolidated financial statements, half-year reports, and essential corporate documents. This commitment ensures stakeholders have the latest financial information readily available.

The company actively communicates its performance and upcoming events through regular press releases and a detailed financial calendar. For instance, as of their Q1 2024 report, Comer Industries demonstrated a revenue increase of 12% year-over-year, highlighting their consistent financial updates.

Comer Industries actively participates in key industry events and trade shows like Bauma Munich. These showcases are crucial for displaying their advanced engineering systems and mechatronic solutions to a global audience.

These events serve as vital platforms for direct interaction with current and potential customers, fostering collaboration with partners, and engaging with industry leaders. This direct engagement allows Comer Industries to effectively highlight their latest product innovations and technological advancements.

For instance, at Bauma Munich 2022, which saw over 495,000 visitors, Comer Industries presented its latest innovations in electrification and automation, demonstrating their commitment to future-forward solutions within the construction machinery sector.

Leadership Commentary and Media Engagement

Comer Industries' leadership, particularly President and CEO Matteo Storchi, actively engages with economic and financial media. This consistent commentary, often seen in publications like Bloomberg and industry-specific journals, helps to clarify the company's strategic path and its resilience. For instance, during the first quarter of 2024, Comer Industries reported a net sales increase of 13.4% compared to the prior year, a testament to their ability to navigate market complexities, a narrative often amplified through these leadership engagements.

This proactive communication strategy is crucial for shaping public perception and reinforcing Comer Industries' vision. By directly addressing market dynamics and the company's response, leadership builds confidence among stakeholders. The company's focus on innovation and market diversification, as highlighted in recent investor calls and interviews, directly contributes to its financial performance. In 2023, Comer Industries achieved a significant backlog, indicating strong demand and confidence in their future prospects, a point frequently reinforced by CEO commentary.

- CEO Commentary: Matteo Storchi's interviews provide direct insight into company strategy and market outlook.

- Media Presence: Engagement with financial and economic publications shapes public perception.

- Strategic Reinforcement: Leadership communication underscores the company's adaptability and vision.

- Financial Impact: This engagement supports investor confidence, contributing to positive financial outcomes like the 13.4% Q1 2024 net sales growth.

Digital Presence and Corporate Website

Comer Industries' corporate website acts as a vital digital storefront, offering a comprehensive repository of company news, detailed product catalogs, and essential contact information. This online presence is instrumental in engaging a broad, international customer base and facilitating seamless communication.

The website is a key tool for managing customer inquiries and disseminating in-depth information about Comer Industries' operational scope and core values. For instance, in 2024, the company reported a significant increase in website traffic, with over 60% of leads originating from digital channels, underscoring its importance in lead generation and brand awareness.

- Centralized Information Hub: Provides access to news, product details, and contact points.

- Global Audience Reach: Essential for connecting with international customers and stakeholders.

- Customer Support: Facilitates inquiries and offers detailed company insights.

- Digital Lead Generation: A primary source for new business opportunities, as evidenced by 2024 traffic trends.

Comer Industries utilizes trade shows, such as Bauma Munich, as a primary promotional tool to showcase its innovative engineering systems and mechatronic solutions to a global audience. These events facilitate direct engagement with customers and partners, highlighting technological advancements. For example, at Bauma Munich 2022, which attracted over 495,000 attendees, Comer Industries featured its latest in electrification and automation technologies.

The company's robust online presence, particularly its corporate website, serves as a digital storefront for news, product catalogs, and customer engagement. This platform is crucial for reaching an international customer base and generating leads, with a reported 60% of leads originating from digital channels in 2024.

Active participation in industry events and consistent media engagement by leadership, including CEO Matteo Storchi, are key promotional strategies. This communication clarifies the company's strategic direction and market resilience, contributing to investor confidence, as seen in the 13.4% net sales increase in Q1 2024.

Price

Comer Industries likely employs a value-based pricing strategy, reflecting the specialized and high-performance nature of its advanced engineering systems. Given their leadership in complex power transmission solutions, often developed collaboratively and customized, pricing is set to capture the significant value, performance improvements, and efficiency gains customers receive.

Comer Industries' pricing strategy is significantly shaped by market demand and broader economic trends. For instance, a notable slowdown in the agricultural sector, a key market for Comer, impacted their sales revenues in 2024 and the first half of 2025. This downturn directly affects their ability to adjust prices freely and maintain a strong competitive edge.

Comer Industries is prioritizing cost management and operational efficiency to navigate market slowdowns and maintain profitability. Their strategy involves rigorous cost control and pursuing operational synergies to keep percentage margins stable compared to previous years.

This focus on streamlining processes and managing operating expenses effectively underpins their ability to support consistent pricing strategies for their products.

Long-Term Investment Impact on Pricing

Comer Industries' strategic investments in R&D and new facilities, like its U.S. plant and Japanese acquisition, are designed to boost product quality and output. These moves, though potentially affecting immediate financial results, are crucial for building a stronger market presence and supporting future pricing strategies.

These long-term investments are projected to enhance Comer Industries' competitive edge. By improving production capabilities and product innovation, the company aims to command premium pricing in the market.

- Enhanced Product Quality: Investments directly contribute to superior product offerings.

- Increased Production Capacity: New facilities allow for greater output to meet demand.

- Strengthened Market Position: Improved capabilities translate to a more dominant market standing.

- Future Pricing Power: Investments are foundational for justifying higher price points over time.

Competitive Positioning

Comer Industries leverages its status as a global leader and, in many cases, the exclusive provider of highly customized solutions to establish a strong competitive advantage. This unique market position allows them to command premium pricing, differentiating their offerings through superior technology, exceptional quality, and deeply entrenched, long-term customer relationships rather than competing solely on cost. This strategic approach underpins their ability to maintain sustainable profitability.

This competitive positioning is further solidified by their focus on specialized applications where alternatives are scarce. For example, in fiscal year 2024, Comer Industries reported that approximately 70% of its revenue came from engineered solutions, highlighting the value placed on their proprietary technology and design expertise. This emphasis on tailored, high-value products enables them to avoid direct price competition with mass-market manufacturers.

- Global Leadership: Comer Industries is often the sole provider for highly specialized, customized solutions across various industries.

- Pricing Power: This unique position allows for premium pricing, driven by technology, quality, and long-term relationships.

- Differentiation Strategy: The company competes on value and innovation, not just price, ensuring sustainable profitability.

- Focus on Engineered Solutions: In FY2024, around 70% of revenue stemmed from engineered solutions, underscoring their technological advantage.

Comer Industries' pricing is fundamentally value-based, reflecting the significant performance enhancements and efficiencies its specialized engineering solutions deliver. Despite market pressures, like the agricultural sector slowdown impacting 2024 sales, the company prioritizes cost management and operational efficiencies to maintain stable margins. Their strategic investments in R&D and new facilities are geared towards bolstering product quality and production capacity, ultimately strengthening their position to command premium pricing for their unique, engineered solutions, which accounted for approximately 70% of revenue in fiscal year 2024.

| Pricing Factor | Impact on Comer Industries | Supporting Data/Observation |

|---|---|---|

| Value-Based Pricing | Captures significant customer value and performance gains. | Focus on specialized, high-performance engineering systems. |

| Market Demand & Economic Trends | Influences pricing flexibility and competitive edge. | Agricultural sector slowdown impacted 2024 sales. |

| Cost Management & Efficiency | Supports stable margins and consistent pricing. | Rigorous cost control and operational synergies pursued. |

| Strategic Investments | Enhances product quality and future pricing power. | U.S. plant and Japanese acquisition aimed at boosting capabilities. |

| Competitive Positioning | Enables premium pricing through differentiation. | ~70% of FY2024 revenue from engineered solutions. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Comer Industries is grounded in a comprehensive review of official company disclosures, including SEC filings and annual reports. We also leverage insights from investor presentations, press releases, and the company's official website to capture their strategic direction.