Comer Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comer Industries Bundle

Navigate the complex external forces shaping Comer Industries with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact their operations and future growth. Gain a strategic advantage by leveraging these critical insights. Download the full PESTLE analysis now to unlock actionable intelligence and make informed decisions.

Political factors

Government policies significantly shape the market for Comer Industries' power transmission systems. For instance, the United States Department of Agriculture's Farm Production and Conservation programs, which include support for agricultural machinery, directly influence demand for tractors and other equipment powered by Comer's products. Similarly, incentives for renewable energy projects, such as the Inflation Reduction Act's tax credits for solar and wind energy in the US, can boost the need for specialized gearboxes in wind turbines and other green energy applications.

In 2024, the agricultural sector in many developed nations continues to see government support aimed at modernization and efficiency, which bodes well for agricultural machinery sales. Furthermore, global efforts to transition to renewable energy sources are accelerating, with many countries setting ambitious targets. For example, the European Union's REPowerEU plan aims to significantly increase renewable energy capacity, driving demand for components like those supplied by Comer.

International trade agreements, tariffs, and import/export regulations are critical for Comer Industries, impacting its global supply chain and market access. For instance, the United States’ imposition of tariffs on steel and aluminum in 2018, while partially rolled back for some allies, demonstrated how such policies can directly increase input costs for manufacturers like Comer.

Shifts in trade policies, such as new tariffs on manufactured components or finished agricultural equipment, can significantly elevate production expenses, diminish competitive pricing, or restrict entry into promising new international markets. For example, a hypothetical 10% tariff on imported hydraulic components could add millions to Comer's cost of goods sold annually, depending on sourcing volumes.

Staying ahead of these evolving trade landscapes is paramount for Comer Industries' strategic foresight and operational resilience. The company must actively analyze potential impacts from ongoing trade negotiations, such as those involving the European Union or emerging Asian markets, to safeguard its market position and explore opportunities effectively.

Comer Industries' global operations are significantly influenced by geopolitical stability. Regions where the company sources materials, manufactures products, or sells its goods face varying levels of political risk. For instance, ongoing geopolitical tensions in Eastern Europe, which escalated significantly in 2022 and continued through 2023 and into 2024, have impacted energy prices and supply chain logistics, affecting manufacturing costs and potentially market demand for industrial equipment.

Political unrest or conflict in key markets can directly disrupt operations and sales. A notable example is the impact of regional conflicts on commodity prices, which are crucial inputs for many of Comer Industries' products. The company's strategy to mitigate these risks includes diversifying its sourcing locations and market presence, aiming to reduce over-reliance on any single politically unstable region. This approach was particularly relevant in 2024 as several emerging markets experienced significant political transitions and associated economic volatility.

Regulatory Environment for Manufacturing

Changes in manufacturing regulations, particularly around product safety and environmental impact, directly affect Comer Industries. For instance, stricter emissions standards implemented in major markets could necessitate costly redesigns for their hydraulic systems and power take-offs, potentially impacting production timelines and costs. Compliance with evolving international standards, such as those from ISO or specific regional bodies, is crucial for maintaining global market access and avoiding fines.

The manufacturing sector in 2024 and 2025 is navigating a complex web of regulations. For Comer Industries, this means staying ahead of potential shifts in areas like material sourcing, worker safety protocols, and end-of-life product disposal. For example, the European Union's ongoing review of its Ecodesign Directive could introduce new requirements for energy efficiency and repairability for manufactured goods, directly influencing product development cycles.

- Environmental Compliance: Increased scrutiny on emissions and waste management could lead to higher operational costs for manufacturing facilities.

- Product Safety Standards: Evolving safety regulations, especially for equipment used in critical sectors like agriculture and construction, require continuous product testing and potential re-engineering.

- Trade and Tariffs: Shifting international trade policies and tariffs can impact the cost of raw materials and the competitiveness of finished goods in global markets.

- Labor Regulations: Changes in labor laws concerning wages, working conditions, and unionization can affect manufacturing labor costs and operational flexibility.

Government Support for Innovation

Governmental backing for innovation, particularly in advanced manufacturing and sustainable technologies, presents significant opportunities for Comer Industries. For instance, in 2024, the U.S. Department of Commerce's National Institute of Standards and Technology (NIST) continued to offer grants through its Advanced Manufacturing Technology Consortia (AMTech) program, aiming to foster collaboration and technological advancement within the sector. Such initiatives can directly support Comer's product development and market positioning.

Partnerships with public research institutions or the ability to tap into innovation grants can significantly accelerate Comer Industries' progress. These support mechanisms are crucial for staying ahead in competitive fields like mechatronics. For example, European Union funding programs, such as Horizon Europe, allocated substantial budgets in 2024-2025 for research and development in areas directly relevant to industrial automation and green technologies, offering potential avenues for collaboration and funding.

Understanding and leveraging these government support structures is vital for Comer Industries' strategic advantage. Key areas of focus include:

- Research and Development Funding: Accessing grants for new technologies in areas like electrification and automation.

- Public-Private Partnerships: Collaborating with universities and research centers on cutting-edge projects.

- Tax Incentives: Utilizing R&D tax credits to offset innovation costs.

- Regulatory Support: Navigating and benefiting from policies that encourage advanced manufacturing adoption.

Government policies directly influence Comer Industries' operational landscape, from agricultural subsidies that bolster equipment demand to renewable energy incentives that drive sales of specialized gearboxes. For instance, the 2024 Farm Bill in the US continues to shape agricultural practices and machinery needs, while the EU's Green Deal initiatives encourage investment in sustainable technologies, impacting Comer's product development and market focus.

Trade policies and international regulations are critical, as demonstrated by ongoing trade disputes and evolving tariffs that can affect raw material costs and market access. Comer must navigate these complexities, such as potential shifts in US-China trade relations, to maintain competitive pricing and supply chain stability. The company's ability to adapt to these dynamic trade environments is key to its global performance.

Geopolitical stability and manufacturing regulations also play a significant role. For example, political instability in regions where Comer sources materials or operates manufacturing facilities can disrupt supply chains and increase costs. Furthermore, stricter environmental and safety regulations, like those being updated in the EU for machinery, necessitate continuous adaptation and investment in compliance, impacting product design and production processes.

What is included in the product

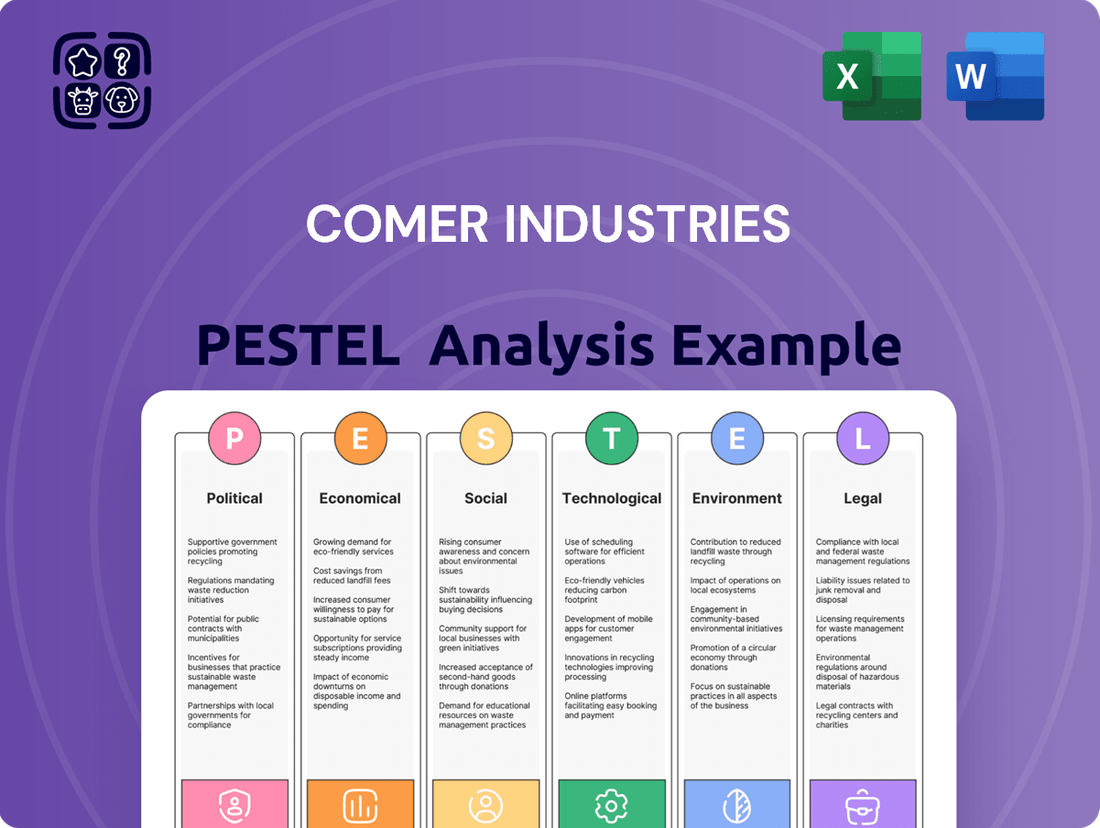

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Comer Industries, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Comer Industries' operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic discussions.

Economic factors

Global economic growth significantly impacts Comer Industries. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that directly correlates with demand for industrial equipment. Stronger growth generally means higher industrial production and increased capital expenditure by businesses, which translates to more orders for Comer's machinery.

Conversely, economic slowdowns or recessions can dampen demand. A projected dip in global growth, or localized economic contractions in key markets, could lead to reduced sales and potentially longer sales cycles for Comer Industries. Economic forecasts are therefore vital for accurate sales projections and inventory management.

Fluctuations in interest rates directly impact Comer Industries' cost of borrowing and the ability of its customers to finance equipment purchases. For instance, if the Federal Reserve maintains its benchmark interest rate around the 5.25%-5.50% range seen in early 2024, this elevated cost of capital can make new machinery and infrastructure projects less attractive for Comer's clientele, potentially slowing sales.

Conversely, periods of lower interest rates, such as those experienced in previous years, can significantly stimulate demand for capital goods by reducing the financial burden on buyers. This access to affordable capital is also crucial for Comer Industries itself, underpinning its capacity for investments in research and development and its own strategic expansion initiatives throughout 2024 and into 2025.

Comer Industries' international operations expose it to significant exchange rate volatility. Fluctuations in currency values directly affect the cost of raw materials sourced from abroad and the competitiveness of its exported goods. For instance, if the US dollar strengthens against other major currencies, Comer's products become more expensive for international buyers, potentially dampening sales.

Conversely, a weaker dollar can increase the cost of imported components, squeezing profit margins. In 2024, the US dollar has shown resilience against several trading partners, impacting companies with substantial import needs. This necessitates careful financial management and potentially the use of hedging instruments to mitigate these risks.

Raw Material Price Volatility

The cost of essential materials like steel, aluminum, and specialized alloys, critical for producing Comer Industries' gearboxes and transmissions, can fluctuate significantly. For instance, global steel prices saw considerable ups and downs throughout 2023 and early 2024, influenced by factors such as energy costs and geopolitical events. These price swings directly impact profit margins if not mitigated through strategic pricing or efficient supply chain management.

To counter this, Comer Industries likely employs strategies such as securing long-term supply contracts to lock in prices and optimizing inventory levels to avoid holding excessive stock during price downturns. Effective management of raw material costs is paramount for maintaining competitive pricing and profitability in the heavy equipment manufacturing sector.

- Global steel prices, a key input for Comer Industries, experienced an average increase of approximately 8% in the first half of 2024 compared to the same period in 2023, according to industry reports.

- Aluminum prices also showed volatility, with LME aluminum futures trading in a range that reflected supply concerns and demand from various industrial sectors throughout 2023 and into 2024.

- Supply chain disruptions, such as those seen in 2021-2022, can exacerbate raw material price volatility, underscoring the need for robust inventory and supplier relationship management.

- Companies like Comer Industries often hedge against price increases by entering into forward contracts for key commodities, aiming to stabilize input costs for their manufacturing processes.

Inflationary Pressures

Inflationary pressures directly impact Comer Industries by increasing the costs of essential inputs like raw materials, energy, and labor. For instance, the Producer Price Index (PPI) for manufactured goods saw a significant rise in 2024, indicating that manufacturers are facing higher production expenses. This can squeeze profit margins if these increased costs cannot be fully passed on to customers, especially in competitive markets.

The purchasing power of Comer Industries' customer base is also affected by inflation. When consumers and businesses face higher prices for everyday goods and services, their discretionary spending may decrease, potentially leading to reduced demand for Comer Industries' products. For example, if consumer confidence dips due to persistent inflation, as seen in some economic indicators throughout early 2025, it can dampen sales volumes.

Effective financial planning for Comer Industries necessitates close monitoring of inflation trends. Strategies to mitigate the impact include hedging against commodity price volatility, optimizing supply chains for cost efficiency, and carefully managing pricing strategies. The Consumer Price Index (CPI) data, which showed an annual increase of 3.5% in the US as of April 2025, provides a key benchmark for understanding the broader economic environment.

- Rising Input Costs: Increased costs for labor, energy, and materials directly affect Comer Industries' cost of goods sold.

- Reduced Consumer Spending: Inflation erodes purchasing power, potentially leading to lower demand for manufactured goods.

- Pricing Challenges: Difficulty in passing on all cost increases to customers can negatively impact profitability.

- Financial Planning Imperative: Continuous monitoring of inflation metrics like CPI and PPI is crucial for strategic decision-making.

Economic stability is a cornerstone for Comer Industries. Global economic growth forecasts, such as the IMF's projection of 3.2% for 2024, directly influence demand for industrial equipment. Conversely, economic downturns can lead to reduced sales and longer sales cycles, making accurate economic forecasting vital for Comer's planning.

Interest rates significantly affect Comer's cost of capital and customer financing. With the Federal Reserve maintaining rates around 5.25%-5.50% in early 2024, higher borrowing costs can temper demand for new machinery. Lower rates historically stimulate capital goods purchases, benefiting both Comer and its clients.

Exchange rate volatility impacts Comer Industries' international competitiveness and raw material costs. A strong US dollar, as seen in 2024, makes exports pricier, while a weaker dollar increases the cost of imported components. Hedging strategies are essential to manage these currency risks.

Raw material price fluctuations, particularly for steel and aluminum, directly affect Comer's profit margins. For instance, steel prices saw significant volatility in early 2024, influenced by energy costs and geopolitical factors. Strategic sourcing and inventory management are key to mitigating these impacts.

Inflationary pressures increase production costs for Comer Industries, with the PPI for manufactured goods rising in 2024. This necessitates careful pricing strategies to maintain profitability. Furthermore, inflation erodes customer purchasing power, potentially reducing demand for capital equipment, as indicated by a 3.5% annual CPI increase in the US as of April 2025.

| Economic Factor | Impact on Comer Industries | 2024/2025 Data/Trend |

| Global Economic Growth | Influences demand for industrial equipment. | IMF projected 3.2% global growth in 2024. |

| Interest Rates | Affects cost of borrowing and customer financing. | Federal Reserve rate range of 5.25%-5.50% in early 2024. |

| Exchange Rates | Impacts export competitiveness and import costs. | US dollar showed resilience against trading partners in 2024. |

| Raw Material Costs | Affects profit margins for manufactured goods. | Steel prices volatile; aluminum prices reflected supply/demand in 2023-2024. |

| Inflation | Increases production costs and erodes purchasing power. | PPI for manufactured goods rose in 2024; US CPI at 3.5% YoY in April 2025. |

Preview the Actual Deliverable

Comer Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Comer Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Comer Industries' strategy and market position.

Sociological factors

Global workforce demographics are shifting, with aging populations in many developed nations like Japan and Germany presenting challenges for talent acquisition. This demographic trend, coupled with persistent skill gaps in advanced manufacturing and specialized engineering roles, directly affects Comer Industries' capacity to find and keep skilled workers. For instance, the U.S. Bureau of Labor Statistics projected a shortage of mechanical engineers in the coming years, a critical field for industrial equipment manufacturers.

Societal expectations are increasingly steering consumers and businesses toward environmentally responsible products and manufacturing. Comer Industries' commitment to improving machinery efficiency directly addresses this, positioning them favorably in a market that values sustainability. For instance, a 2024 survey indicated that 70% of consumers consider sustainability when making purchasing decisions for industrial equipment.

Societal acceptance of automation and smart technology is rapidly increasing, with consumers and businesses alike embracing efficiency gains. This trend is particularly evident in sectors where Comer Industries operates, such as agriculture and industrial manufacturing. For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow significantly, demonstrating a clear demand for the mechatronic solutions Comer Industries provides.

The growing reliance on the Internet of Things (IoT) and interconnected systems fuels the need for robust and integrated mechatronic components. As industries strive for operational optimization, Comer Industries is well-positioned to leverage its expertise in developing solutions that seamlessly integrate with smart infrastructure. The company's focus on user-friendliness and reliability in these advanced systems is crucial for widespread adoption and continued demand.

Corporate Social Responsibility (CSR)

Customers, investors, and the wider community increasingly expect companies like Comer Industries to demonstrate strong corporate social responsibility. This expectation translates into a demand for ethical labor practices, active community engagement, and robust environmental stewardship that goes beyond basic legal compliance.

A positive CSR profile directly impacts brand reputation, acting as a magnet for socially conscious stakeholders. For instance, in 2024, a significant majority of consumers, estimated at over 70%, reported that they consider a company's social and environmental impact when making purchasing decisions. This trend is projected to continue growing through 2025.

Comer Industries' commitment to CSR can be strategically leveraged to attract and retain investors who prioritize Environmental, Social, and Governance (ESG) factors. As of early 2025, ESG-focused funds continue to see substantial inflows, with global sustainable investment assets estimated to exceed $50 trillion. Companies with strong ESG performance, including robust CSR initiatives, are often viewed as less risky and more resilient.

- Ethical Labor Practices: Comer Industries is expected to uphold fair wages, safe working conditions, and prohibit child or forced labor throughout its supply chain.

- Community Engagement: Demonstrating commitment through local job creation, philanthropic efforts, and support for community development projects is crucial.

- Environmental Stewardship: Initiatives focusing on reducing carbon emissions, waste management, and promoting sustainable resource utilization are increasingly important.

- Stakeholder Expectations: Meeting the evolving demands of customers, investors, and employees for transparent and responsible business operations is key to long-term success.

Urbanization and Infrastructure Development

Global urbanization continues its upward trajectory, with projections indicating that by 2050, 68% of the world's population will reside in urban areas, up from 56% in 2021 according to the UN. This surge in urban living directly fuels demand for construction machinery and industrial equipment essential for building and maintaining modern infrastructure like transportation networks, housing, and utilities. Comer Industries can strategically align its product development and sales efforts to capitalize on these urban expansion projects, offering specialized machinery for efficient urban construction and development.

Urbanization also indirectly impacts agricultural practices. As urban centers expand, agricultural land is often repurposed, leading to changes in farming methods and potentially increasing the need for advanced, efficient agricultural machinery that can maximize output on smaller or more technologically managed plots. Comer Industries can explore opportunities to supply equipment that supports precision agriculture and vertical farming, catering to the evolving needs of food production in and around urbanized regions. These shifts present significant long-term market opportunities for companies that can adapt their offerings.

- Urban Population Growth: Expected to reach 68% globally by 2050 (UN data).

- Infrastructure Demand: Urbanization drives significant investment in construction and industrial equipment.

- Agricultural Adaptation: Increased need for efficient machinery to support evolving farming practices in urban-influenced areas.

- Market Opportunity: Comer Industries can tailor products for urban development and modern agriculture.

Societal shifts towards sustainability and ethical business practices are paramount. Comer Industries' focus on efficient machinery aligns with consumer demand for environmentally conscious products, with a 2024 survey showing 70% of consumers prioritizing sustainability in purchasing decisions for industrial equipment. This growing awareness also influences investor sentiment, as ESG-focused funds saw substantial inflows in early 2025, with global sustainable investment assets projected to exceed $50 trillion.

Furthermore, the increasing societal acceptance of automation, driven by the projected growth of the industrial automation market to over $200 billion in 2023, directly benefits Comer Industries' mechatronic solutions. This acceptance, coupled with a growing reliance on IoT, underscores the demand for integrated and user-friendly advanced systems, positioning Comer Industries favorably.

The increasing urbanization trend, with the UN projecting 68% of the global population in urban areas by 2050, fuels demand for construction and agricultural machinery. Comer Industries can leverage this by developing specialized equipment for urban infrastructure projects and efficient agricultural machinery for evolving farming practices.

| Sociological Factor | Impact on Comer Industries | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Sustainability Demand | Increased market for efficient machinery | 70% of consumers consider sustainability in industrial equipment purchases (2024 survey) |

| Automation Acceptance | Growth in demand for mechatronic solutions | Industrial automation market valued at ~$200 billion (2023), projected significant growth |

| Urbanization | Demand for construction and agricultural equipment | UN: 68% global population in urban areas by 2050; Comer can target infrastructure and precision agriculture needs |

| ESG Investing | Attracts socially conscious investors | Global sustainable investment assets >$50 trillion (early 2025) |

Technological factors

Comer Industries' product capabilities are significantly boosted by rapid advancements in mechatronics, which seamlessly combine mechanical, electronic, and software engineering. This integration allows for more sophisticated and efficient industrial power transmission solutions.

The widespread adoption of the Internet of Things (IoT) is transforming machinery into smart, connected systems. For Comer Industries, this translates to components that can offer predictive maintenance insights and real-time performance monitoring, reducing downtime and optimizing operational efficiency.

In 2024, the global industrial IoT market was valued at approximately $100 billion and is projected to grow substantially. By strategically leveraging these mechatronic and IoT advancements, Comer Industries can solidify its competitive edge in the evolving industrial landscape.

Breakthroughs in materials science are continually enhancing the performance of heavy equipment components. For instance, the development of advanced high-strength steel alloys and composite materials offers the potential to significantly reduce the weight of Comer Industries' gearboxes and transmissions, a critical factor for fuel efficiency and payload capacity.

These innovations allow for increased power density, meaning more power can be delivered from a smaller, lighter package. This translates directly into extended product lifespans and improved operational efficiency for the end-user, driving continuous product improvement for Comer Industries.

Comer Industries can significantly boost its production efficiency and lower costs through advanced automation and robotics, mirroring trends seen across the manufacturing sector. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a widespread adoption of these technologies. This adoption allows for greater precision and consistency, directly impacting product quality.

Embracing Industry 4.0 principles, including the use of digital twins and smart factory concepts, is crucial for Comer Industries to remain competitive. By 2025, it's estimated that over 70% of large enterprises will have implemented IoT technologies in their manufacturing operations, demonstrating a clear industry shift towards interconnected and data-driven production environments. This move also unlocks greater flexibility for customized product offerings.

Electrification and Hybrid Powertrain Development

The global automotive industry, and increasingly the off-highway and industrial equipment sectors, are undergoing a significant transformation driven by electrification. This shift presents a critical technological factor for Comer Industries, demanding adaptation and innovation in powertrain development. For instance, the electric vehicle market is projected to reach over 30% of global passenger car sales by 2030, a trend that will inevitably influence the demand for components in commercial and industrial applications.

Comer Industries must prioritize research and development into electric and hybrid power transmission solutions to stay competitive. This includes leveraging their existing expertise in gear manufacturing and driveline systems to create robust and efficient components for these new energy sources. The company's ability to adapt its established engineering capabilities to the unique demands of electric and hybrid powertrains will be key to its future success.

The development of these new powertrains involves several key areas for Comer Industries:

- Electric Axles: Designing and manufacturing integrated electric drive axles that combine motors, gearboxes, and differentials for electric vehicles.

- Hybrid Drivetrains: Developing specialized transmissions and power take-off units that can seamlessly integrate internal combustion engines with electric motors.

- Battery Cooling Systems: Engineering thermal management solutions for batteries and electric motors to ensure optimal performance and longevity.

- Software Integration: Collaborating on the development of control software that manages power flow between electric and combustion sources in hybrid systems.

Cybersecurity for Integrated Systems

As Comer Industries increasingly integrates mechatronic solutions, the necessity for robust cybersecurity across connected components becomes critical. Protecting intellectual property, sensitive customer information, and the operational continuity of smart machinery from evolving cyber threats is a top priority. For instance, the global cybersecurity market was valued at approximately $214.5 billion in 2023 and is projected to reach $358.8 billion by 2028, highlighting the significant investment and focus in this area.

The integrity of Comer Industries' connected systems, from manufacturing equipment to end-user applications, relies heavily on advanced cybersecurity protocols. Failure to implement comprehensive defenses could lead to operational disruptions, data theft, and reputational damage. Reports from 2024 indicate a rise in sophisticated attacks targeting industrial control systems, emphasizing the need for proactive security measures.

Investing in and maintaining strong cybersecurity frameworks not only safeguards against financial and operational losses but also cultivates essential trust with clients and partners. This trust is fundamental for the adoption of new, interconnected technologies. The economic impact of cybercrime globally is substantial, with estimates suggesting it could cost the world $10.5 trillion annually by 2025, underscoring the financial imperative for effective cybersecurity.

- Increased reliance on connected systems elevates cybersecurity risks for integrated solutions.

- Protection of proprietary designs, customer data, and operational integrity is paramount.

- Global cybersecurity market growth underscores the increasing investment in security solutions.

- Proactive cybersecurity measures are essential to prevent costly breaches and maintain customer trust.

Technological advancements in mechatronics and IoT are enhancing Comer Industries' industrial power transmission solutions, enabling smart, connected systems with predictive maintenance capabilities.

The global industrial IoT market's projected growth, coupled with breakthroughs in materials science for lighter, stronger components, positions Comer Industries for improved product performance and efficiency.

Automation, robotics, and Industry 4.0 principles are vital for Comer Industries to boost production efficiency and offer flexible, customized products, mirroring widespread industry adoption.

The electrification trend in automotive and industrial sectors necessitates Comer Industries' innovation in electric and hybrid powertrains, including electric axles and advanced battery cooling systems.

| Technology Area | Key Advancement | Impact on Comer Industries | Market Data/Projection |

| Mechatronics & IoT | Integration of mechanical, electronic, and software engineering; connected machinery | Sophisticated, efficient solutions; predictive maintenance, real-time monitoring | Global Industrial IoT Market: ~$100 billion (2024), substantial growth projected |

| Materials Science | Advanced high-strength steel alloys, composites | Lighter, stronger components; increased power density, extended product life | N/A (specific material impact) |

| Automation & Robotics | Robotic manufacturing, digital twins, smart factories | Increased production efficiency, precision, cost reduction, flexibility | Global Industrial Robotics Market: ~$50 billion (2023), substantial growth projected |

| Electrification | Electric and hybrid powertrains | Need for electric axles, hybrid drivetrains, battery cooling systems | EV market to exceed 30% of global passenger car sales by 2030 |

| Cybersecurity | Advanced protocols for connected systems | Protection of IP, data, operational continuity; building customer trust | Global Cybersecurity Market: ~$214.5 billion (2023) to $358.8 billion (2028) |

Legal factors

Comer Industries faces significant legal obligations regarding product liability and safety. In 2024, the global product liability market is projected to continue its growth, driven by increased consumer awareness and regulatory scrutiny. Failure to meet these standards, such as ensuring components consistently meet performance specifications, can result in substantial financial penalties and damage to brand trust.

Adherence to evolving international safety regulations is paramount for Comer Industries. For instance, in the automotive sector, regulations like Euro 7, which began implementation discussions in 2023 and are expected to be finalized and enforced in the coming years, will impose stricter emissions and safety requirements on components. Non-compliance with such evolving standards can lead to costly product recalls and legal battles, impacting the company's financial health and market access.

Protecting Comer Industries' intellectual property, such as patents for its advanced engineering systems and mechatronic solutions, is vital for sustaining its competitive advantage. Vigilant enforcement of these patent rights and proactive strategies to deter infringement are essential for securing its market position.

This also necessitates meticulous management of trade secrets and proprietary knowledge, ensuring that sensitive information remains confidential and provides a distinct edge in the marketplace.

Comer Industries navigates a complex web of global labor and employment laws, impacting everything from minimum wage requirements to unionization rights across its operating regions. For instance, in 2024, the European Union continued to strengthen worker protections, with directives focusing on work-life balance and transparent working conditions, which Comer must integrate into its HR practices.

Failure to adhere to these varied regulations, such as differing overtime pay structures or wrongful termination statutes, can lead to costly litigation and significant reputational damage. In 2025, companies operating in the US, for example, face ongoing scrutiny over wage and hour compliance, with potential penalties for misclassification of employees and unpaid overtime, a risk Comer actively mitigates.

Consequently, a proactive approach to adapting human resource policies to align with local legal frameworks is paramount for Comer Industries. This includes staying abreast of legislative changes, such as potential updates to worker safety standards or new data privacy regulations affecting employee information, ensuring continuous compliance and fostering positive employee relations.

Antitrust and Competition Laws

Comer Industries, a significant entity in the power transmission sector, must navigate a complex web of antitrust and competition laws across various jurisdictions. Ensuring compliance means actively avoiding practices that could stifle fair market competition, such as price-fixing cartels or exclusive dealing arrangements that lock out rivals. For instance, the European Union's competition policy, a key market for many industrial manufacturers, actively investigates and penalizes companies for abuses of dominant market positions, with fines potentially reaching 10% of a company's global annual turnover.

Failure to adhere to these regulations can result in severe repercussions. Comer Industries could face substantial fines, as seen in various global antitrust cases where penalties have run into hundreds of millions of dollars. Beyond financial penalties, non-compliance can lead to market access restrictions, mandated changes to business operations, and significant reputational damage, impacting future business opportunities and investor confidence.

- Antitrust Compliance: Comer Industries must actively monitor and ensure its sales agreements, distribution networks, and pricing strategies do not violate national and international competition laws.

- Abuse of Dominance: The company needs to be vigilant against any practices that could be construed as exploiting a dominant market position, which could lead to regulatory scrutiny.

- Merger Control: Any future acquisitions or mergers by Comer Industries will be subject to antitrust review by relevant authorities to prevent undue market concentration.

- Unfair Trade Practices: Adherence to fair trade practices is essential to avoid accusations of predatory pricing or other methods that disadvantage competitors unfairly.

Data Privacy Regulations

As Comer Industries increasingly integrates digital and mechatronic solutions, managing operational and customer data becomes critical. Compliance with evolving data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is paramount for responsible data handling. These regulations, which have seen significant enforcement actions and updates in recent years, necessitate robust data governance frameworks to protect sensitive information and avoid substantial penalties. For instance, by the end of 2023, GDPR fines had already exceeded €1.5 billion since its implementation, highlighting the financial risks of non-compliance.

Comer Industries must ensure its data practices align with these legal mandates to maintain trust and operational integrity.

- Data Minimization: Collecting and processing only necessary data.

- Consent Management: Obtaining clear consent for data usage.

- Security Measures: Implementing strong technical and organizational safeguards.

- Data Subject Rights: Enabling individuals to access, rectify, or erase their data.

Comer Industries' legal landscape is shaped by product safety, intellectual property, and labor laws. Navigating global regulations, like stricter automotive emissions standards expected in 2025, is crucial to avoid costly recalls and legal disputes. Protecting patents and trade secrets is essential for maintaining a competitive edge in its advanced engineering markets.

Environmental factors

Comer Industries faces increasing pressure from evolving emissions and energy efficiency regulations, particularly impacting the agricultural, construction, and material handling sectors it serves. For instance, the European Union's Stage V emissions standards for non-road mobile machinery, implemented in 2019 and continuing to shape product development, mandate significant reductions in particulate matter and nitrogen oxides. This directly influences the design of powertrain components, pushing for greater efficiency and lower environmental impact in Comer's drivelines and gearboxes.

To address these mandates, Comer Industries is likely investing in technologies that optimize fuel consumption and reduce overall energy usage in the equipment powered by their systems. This could involve advanced gearing, improved lubrication, or integration with hybrid or electric powertrains, aligning with global trends towards decarbonization. For example, the growing demand for electric tractors in agriculture, a key market for Comer, necessitates the development of specialized transmission solutions capable of handling electric motor torque and speed characteristics.

Comer Industries faces increasing demand for environmentally conscious manufacturing. This means embracing greener production methods and materials across its operations. For instance, the industrial sector saw a 5% increase in demand for sustainable components in 2024, according to a recent industry report.

Key to this is minimizing waste, improving energy efficiency in facilities, and reducing the overall environmental impact of their manufacturing. In 2023, Comer Industries reported a 3% reduction in energy consumption per unit produced, a step towards these goals.

A strong commitment to sustainability can significantly bolster Comer Industries' brand reputation. Consumers and business partners alike are increasingly prioritizing companies with demonstrable environmental responsibility, making this a crucial strategic consideration.

Global climate change policies are a major tailwind for Comer Industries, as they directly fuel investment and expansion in the renewable energy sector. For instance, the U.S. Inflation Reduction Act of 2022 alone is projected to drive over $1.7 trillion in clean energy investments by 2030, creating substantial demand for the specialized power transmission components Comer supplies for wind and solar projects.

Comer Industries is well-positioned to capitalize on government initiatives promoting clean energy technologies like wind and solar power. These technologies inherently require robust and specialized power transmission systems, a core area of expertise for Comer, translating into significant, sustained market opportunities for the company's products.

Waste Management and Recycling Requirements

Environmental regulations, particularly those surrounding waste management and recycling, are tightening globally. Comer Industries, like many manufacturers, faces increasing scrutiny regarding the end-of-life management of its industrial components and by-products.

This necessitates a proactive approach to product design and manufacturing processes, aiming to minimize waste and maximize the potential for material reuse and recycling. Embracing circular economy principles, where materials are kept in use for as long as possible, is becoming a strategic imperative.

Considerations include:

- Compliance with evolving waste disposal laws: Staying abreast of and adhering to national and international regulations such as the EU's Waste Framework Directive, which sets targets for recycling and waste reduction.

- Implementing product take-back programs: Developing systems to collect and process end-of-life products, facilitating their refurbishment or recycling. For example, the European Green Deal aims for a cleaner and more circular economy, impacting how products are designed and managed after use.

- Investing in advanced recycling technologies: Exploring and adopting innovative methods for recycling complex industrial materials, potentially reducing reliance on virgin resources.

- Reducing manufacturing by-products: Optimizing production processes to generate less waste, with a focus on material efficiency and byproduct valorization.

Resource Scarcity and Sustainable Sourcing

The increasing scarcity of key raw materials, such as rare earth metals vital for some advanced manufacturing processes, directly impacts Comer Industries' supply chain. For instance, global demand for critical minerals like lithium and cobalt, essential for electric vehicle components that Comer Industries may supply, has seen significant price volatility. This scarcity, coupled with a heightened consumer and regulatory demand for ethically and sustainably sourced materials, forces Comer to re-evaluate its procurement strategies to ensure long-term operational resilience.

Comer Industries must prioritize securing a reliable and responsible supply of essential materials. This could involve diversifying its supplier base to mitigate risks associated with single-source dependencies, particularly for materials facing geopolitical supply chain disruptions. Furthermore, exploring and investing in the development or adoption of alternative materials that offer similar performance characteristics but with more sustainable sourcing profiles is becoming a strategic imperative for operational stability and competitive advantage.

Water and energy usage are also critical environmental factors affecting Comer Industries. In 2023, global energy prices saw fluctuations, and water scarcity is becoming a more pronounced issue in many industrial regions. Comer's operational efficiency and cost management are directly tied to its ability to manage these resources sustainably. For example, optimizing water usage in manufacturing processes and investing in energy-efficient technologies can lead to significant cost savings and a reduced environmental footprint.

Key considerations for Comer Industries regarding resource scarcity and sustainable sourcing include:

- Supply Chain Diversification: Reducing reliance on single-source suppliers for critical components and raw materials.

- Material Innovation: Investing in research and development for alternative, more sustainable materials.

- Water Management: Implementing water-efficient technologies and practices in manufacturing.

- Energy Efficiency: Adopting energy-saving measures and exploring renewable energy sources.

Environmental regulations continue to shape Comer Industries' product development, pushing for greater emissions control and energy efficiency in agricultural and construction equipment. The ongoing implementation of stricter emissions standards, like the EU's Stage V, directly influences the design of powertrain components, driving innovation in drivelines and gearboxes towards lower environmental impact.

Comer Industries is actively investing in technologies that improve fuel consumption and reduce energy usage, aligning with the global push for decarbonization. The increasing demand for electric agricultural machinery, for example, requires Comer to develop specialized transmission solutions tailored for electric motor performance.

The company also faces growing expectations for sustainable manufacturing practices, including waste reduction and improved energy efficiency in its facilities. In 2023, Comer Industries achieved a 3% reduction in energy consumption per unit produced, demonstrating a commitment to greener operations.

Global climate policies are a significant driver for Comer Industries, particularly in the renewable energy sector. The U.S. Inflation Reduction Act of 2022, for instance, is projected to stimulate over $1.7 trillion in clean energy investments by 2030, creating substantial demand for Comer's specialized power transmission components used in wind and solar projects.

| Environmental Factor | Impact on Comer Industries | Key Trend/Data Point |

| Emissions Regulations | Drives product design for efficiency and lower emissions | EU Stage V standards mandate reductions in particulate matter and NOx |

| Decarbonization Push | Increases demand for electric powertrain solutions | Growing market for electric tractors in agriculture |

| Sustainable Manufacturing | Requires focus on waste reduction and energy efficiency | 3% reduction in energy consumption per unit produced (2023) |

| Climate Policies | Boosts opportunities in renewable energy sector | US IRA projected to drive $1.7T+ in clean energy investment by 2030 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Comer Industries is meticulously crafted using data from reputable sources such as government economic reports, industry-specific market research, and global regulatory databases. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.