CNIM Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNIM Group Bundle

CNIM Group boasts significant strengths in its engineering expertise and diversified portfolio, particularly in renewable energy and industrial sectors. However, navigating global economic uncertainties and intense competition presents considerable challenges. Understanding these dynamics is crucial for any investor or strategist.

Dive deeper into CNIM Group's strategic landscape with our comprehensive SWOT analysis. This report illuminates their unique market position, potential growth avenues, and critical risk factors, offering invaluable insights for informed decision-making.

Unlock the full potential of your strategic planning. Our complete SWOT analysis provides an in-depth examination of CNIM Group's internal capabilities and external market forces, empowering you to capitalize on opportunities and mitigate threats effectively.

Ready to move beyond the highlights? Purchase the full SWOT analysis to gain access to a professionally crafted, editable report and an accompanying Excel matrix, designed to equip you with actionable intelligence for competitive advantage.

Strengths

CNIM Group’s strength lies in its broad industrial and engineering portfolio, touching key sectors like environment, energy, defense, and high technology. This spread across areas such as waste-to-energy facilities, thermal power plants, naval equipment, and advanced scientific instruments significantly reduces reliance on any single market. For instance, in 2023, the environmental division continued to secure projects for waste-to-energy plants, contributing to a stable revenue base.

This diversification provides resilience, as downturns in one sector can be offset by stability or growth in others. Their involvement in defense, particularly naval equipment and bridging systems, offers a consistent demand, especially in the current geopolitical climate. CNIM’s extensive experience in constructing large-scale projects, like components for fusion research facilities, showcases their advanced engineering capabilities.

Furthermore, CNIM offers end-to-end solutions, covering engineering, procurement, construction, and even long-term operation and maintenance. This comprehensive approach allows them to capture value across the entire project lifecycle, fostering strong client relationships and recurring revenue opportunities. Their expertise in handling complex, multi-faceted projects is a significant competitive advantage.

CNIM Group's commitment to technological innovation is a significant strength, consistently driving the development of advanced solutions. This is clearly seen in their recent unveilings of next-generation Motorized Floating Bridges (PFM) and the ROCUS unmanned system, showcasing their forward-thinking approach.

Their defense sector capabilities are bolstered by offerings like the AUROCH 8x8 vehicle, highlighting a strategic focus on high-demand markets. This innovation extends to specialized manufacturing expertise, including electron beam welding and large dimension metrology.

Furthermore, CNIM's proficiency in clean room integration is crucial for high-stakes industries such as space and nuclear, demonstrating a capacity for precision and reliability in the most demanding environments. This technological prowess positions them as a leader in specialized engineering and manufacturing.

CNIM Systèmes Industriels leverages its strong standing in the defense sector, a market experiencing robust global growth. Their active participation in key industry events like Eurosatory 2024 and the upcoming Techterre 2025 demonstrates their commitment to showcasing advanced capabilities. This visibility is crucial in a sector where technological prowess and established relationships are paramount.

Securing contracts for amphibious landing craft from the French Ministry of Armed Forces underscores CNIM's recognized expertise and reliability in supplying critical military equipment. This contract, valued in the hundreds of millions of euros, positions them as a key supplier for a major NATO nation's naval modernization efforts. Such achievements solidify their reputation and provide a strong foundation for future defense-related business.

Furthermore, CNIM's established role as a major player in military floating bridges highlights their contribution to essential logistical and operational support for armed forces worldwide. The demand for robust and rapidly deployable bridging solutions remains high, particularly with ongoing geopolitical shifts and increased military exercises. This specialization offers a consistent revenue stream and reinforces their strategic importance.

Their engagement with critical defense infrastructure and equipment development signifies a deep understanding of the sector's demanding requirements. With global defense spending projected to exceed $2.4 trillion in 2024, CNIM's focus on specialized, high-value segments like amphibious craft and bridging solutions places them in a strategically advantageous position to capitalize on this expanding market.

Expertise in Waste-to-Energy (WTE) Solutions

CNIM possesses a significant strength in Waste-to-Energy (WTE) solutions, backed by over six decades of experience. This deep expertise allows them to provide comprehensive services, from optimizing and maintaining existing plants to renovating them for improved environmental performance and profitability. Their work directly contributes to cleaner energy, with a focus on reducing environmental impact, a critical factor in today's sustainability-focused world.

The company is also a leader in developing innovative, modular, and decentralized WTE plants. This forward-thinking approach addresses the evolving demands of waste management on a global scale. Such solutions are vital as countries worldwide seek to manage growing waste streams more efficiently and sustainably.

- 60+ years of experience in WTE plant optimization, maintenance, and renovation.

- Global leadership in developing modular and decentralized WTE plant solutions.

- Enhanced environmental performance and profitability for WTE operations.

- Contribution to cleaner energy production and reduced carbon footprint.

Established Reputation and Long History

CNIM Group's strength lies in its deeply entrenched legacy, dating back to its founding in 1856. This long history has cultivated an established reputation as a premier French industrial engineering contractor and manufacturer of specialized equipment. Their extensive experience in executing complex, large-scale projects globally provides a significant competitive advantage, fostering trust and reliability among clients and partners.

This proven track record is not merely about longevity but about consistent delivery and adaptation within the industrial sector. For instance, CNIM has been instrumental in major infrastructure and energy projects, showcasing their capability. Their commitment to corporate social responsibility (CSR) is also a notable strength, recognized through various initiatives and certifications, which bolsters their brand image and strengthens relationships with stakeholders, including investors and employees.

Key aspects of CNIM Group's established reputation include:

- Decades of Project Execution: Since 1856, CNIM has successfully delivered numerous complex industrial projects across diverse sectors like energy, environment, and defense.

- Global Presence and Expertise: The group operates internationally, demonstrating a broad understanding of varied market demands and regulatory landscapes.

- Commitment to Sustainability: CNIM's focus on CSR, evidenced by their environmental and social governance (ESG) performance, enhances its appeal to a growing segment of socially conscious investors and clients.

- Technological Innovation: A history of engineering excellence implies a continuous drive for innovation in developing advanced industrial solutions.

CNIM Group's diverse industrial and engineering portfolio, spanning environment, energy, defense, and high technology, is a core strength. This diversification across sectors like waste-to-energy, naval equipment, and scientific instruments provides significant market resilience. In 2023, the environmental division continued to secure waste-to-energy projects, contributing to revenue stability.

Their involvement in defense, specifically naval equipment and bridging systems, benefits from consistent demand, particularly in the current geopolitical landscape. CNIM's extensive experience in large-scale projects, such as components for fusion research facilities, demonstrates advanced engineering capabilities. Furthermore, their end-to-end solutions, from engineering to long-term maintenance, allow value capture across the project lifecycle, fostering client relationships and recurring revenue.

The company's commitment to innovation is evident in its development of advanced solutions like next-generation Motorized Floating Bridges (PFM) and the ROCUS unmanned system. Their defense sector offerings include the AUROCH 8x8 vehicle, targeting high-demand markets, and specialized manufacturing expertise such as electron beam welding. CNIM's proficiency in clean room integration is crucial for high-stakes industries like space and nuclear, highlighting precision and reliability.

CNIM Systèmes Industriels benefits from the robust global growth in the defense sector, as demonstrated by their participation in Eurosatory 2024 and planned presence at Techterre 2025. Securing contracts for amphibious landing craft from the French Ministry of Armed Forces, valued in the hundreds of millions of euros, solidifies their reputation as a key supplier for naval modernization. Their established role in military floating bridges provides a consistent revenue stream, reinforced by the high demand for deployable bridging solutions amid shifting geopolitical dynamics.

CNIM possesses over six decades of experience in Waste-to-Energy (WTE) solutions, offering comprehensive services from optimization to renovation for enhanced environmental performance and profitability. They are a leader in developing innovative, modular, and decentralized WTE plants, addressing global waste management needs. Their work contributes to cleaner energy production and reduced carbon footprints.

Founded in 1856, CNIM Group has a long-standing reputation as a premier French industrial engineering contractor. Their proven track record in executing complex, large-scale projects globally provides a significant competitive advantage. The company's commitment to corporate social responsibility (CSR) and its focus on ESG performance enhance its appeal to socially conscious investors and clients.

| Strength Area | Description | Key Facts/Data (2023-2025) |

| Diversified Portfolio | Broad industrial and engineering presence across key sectors. | Continued project wins in waste-to-energy in 2023. |

| Defense Sector Expertise | Strong capabilities in naval equipment and bridging systems. | Secured multi-million euro contract for French Ministry of Armed Forces amphibious landing craft. Active participation in defense industry events (Eurosatory 2024). |

| Waste-to-Energy Leadership | Over 60 years of experience in WTE plant optimization and development. | Global leadership in modular and decentralized WTE solutions. Focus on enhanced environmental performance and cleaner energy. |

| Project Execution & Reputation | Long history (since 1856) of delivering complex industrial projects globally. | Established reputation for reliability and expertise. Strong commitment to CSR and ESG. |

| Technological Innovation | Development of advanced solutions and specialized manufacturing. | Unveiled next-generation Motorized Floating Bridges (PFM) and ROCUS unmanned system. Expertise in electron beam welding and clean room integration. |

What is included in the product

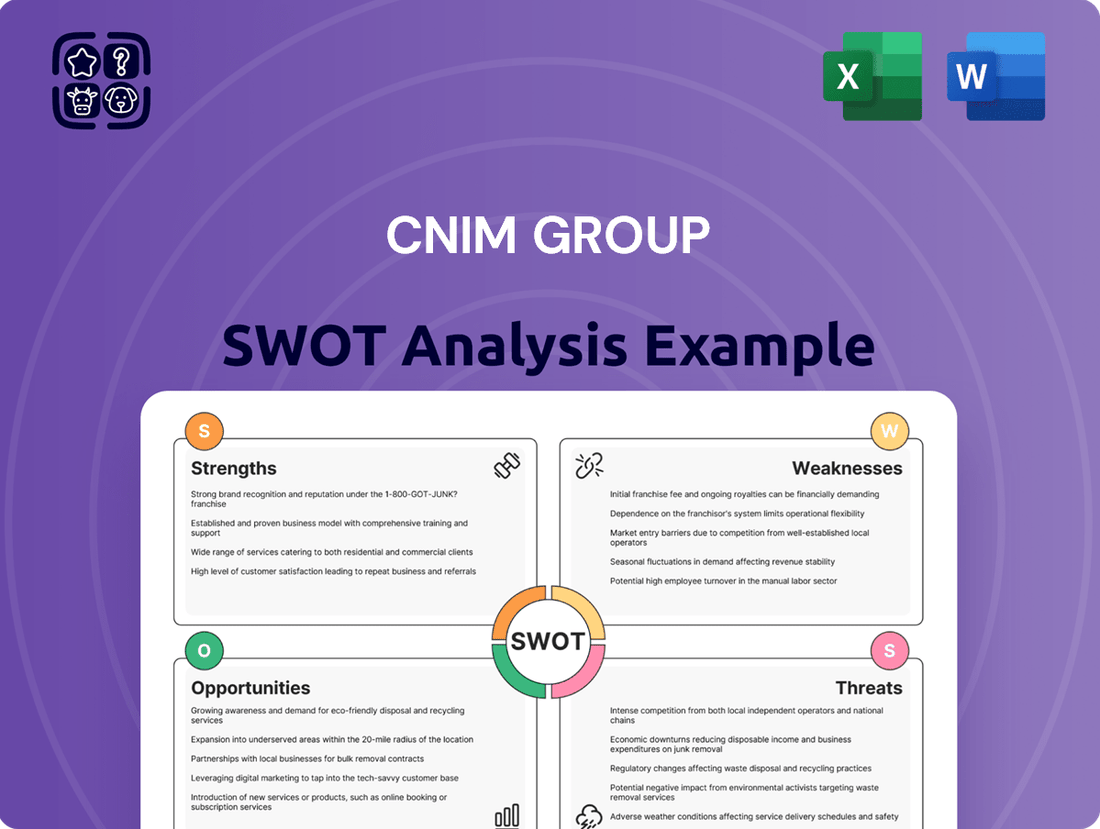

Delivers a strategic overview of CNIM Group’s internal and external business factors, highlighting key strengths in its industrial expertise and market position, while addressing weaknesses in diversification and potential threats from economic volatility and competition.

This SWOT analysis for CNIM Group offers a clear, actionable framework to identify and address potential challenges, turning strategic insights into tangible solutions.

Weaknesses

CNIM Group has grappled with substantial financial headwinds, most notably in late 2021. The CNIM Environnement & Énergie EPC subsidiary initiated a preventive procedure, a safeguard against bankruptcy, due to escalating cash flow issues and project delays. This challenging period was marked by late penalties and a slowdown in securing new contracts, highlighting significant operational and financial strain.

The financial difficulties culminated in the delisting of CNIM Group's shares from the Paris Stock Exchange in January 2023. This move signaled a critical juncture for the company, necessitating rigorous financial restructuring and a renewed focus on stability and operational efficiency. The delisting underscores the importance of robust financial governance and a clear recovery strategy for the group moving forward.

CNIM's reliance on large, capital-intensive projects presents a significant weakness. These projects, often in the energy and environment sectors, have extended sales cycles and face fierce competition, directly impacting revenue predictability. For instance, securing a major infrastructure contract can take years, creating periods of cash flow strain.

The sheer scale and complexity of these undertakings demand considerable upfront investment and robust risk mitigation strategies. Delays or cost overruns, which are common in such ventures, can severely affect CNIM's profitability and overall financial health. This dependency makes the company vulnerable to economic downturns that might slow down public and private investment in large infrastructure.

CNIM Group navigates a crowded marketplace, encountering a multitude of active competitors across its diverse business segments on a global scale. This intense competitive environment can directly impact pricing strategies and the company's ability to maintain healthy profit margins.

While CNIM holds a significant position, its ranking of 17th out of 74 competing entities indicates that it does not consistently command a leading market share across all its operational domains. This suggests potential challenges in securing new contracts against more dominant players.

The pressure from numerous competitors can also affect CNIM's capacity for innovation and investment in research and development, as resources may be diverted to maintain competitive pricing and market presence.

Potential for Project-Specific Risks

CNIM Group’s involvement in large-scale industrial and defense projects inherently exposes it to significant project-specific risks. These can include the common issues of project scope creep, where a project's requirements expand beyond initial agreements, leading to increased costs and timelines. Additionally, the delivery of defective products or services, a critical concern in high-stakes sectors, can result in substantial financial penalties and damage to CNIM's reputation. For instance, a significant project overrun or a quality issue in a defense contract could have far-reaching consequences.

The very nature of complex engineering demands means that industrial accidents, despite stringent safety protocols, remain a persistent operational risk. CNIM’s dedication to health and safety and environmental standards is robust, yet the inherent complexities of its projects mean that unforeseen incidents can still occur. Such events not only pose a direct threat to personnel and the environment but can also trigger severe financial repercussions, including fines, legal liabilities, and costly project stoppages, impacting overall profitability and market standing.

- Project Drift: Risk of expanding project scope leading to cost and time overruns.

- Product/Service Defects: Potential for quality issues impacting deliverables and client satisfaction.

- Industrial Accidents: Exposure to operational hazards despite strong safety measures.

- Financial Penalties: Consequences of project failures or safety breaches.

- Reputational Damage: Impact of operational issues on brand image and future contract opportunities.

Geographical Concentration and Regulatory Exposure

CNIM Group's significant reliance on France and Europe, especially for defense contracts, presents a key weakness. This geographical concentration means the company is highly susceptible to economic downturns or shifts in policy within these specific regions. For instance, changes in French defense spending or EU regulatory frameworks could disproportionately impact CNIM's revenue streams and strategic direction.

This concentration also means that CNIM may have less exposure to faster-growing emerging markets, potentially limiting its long-term growth trajectory. While operating internationally, the core of its business remains tied to established European markets, making it vulnerable to localized geopolitical tensions or trade policy changes. The company's strong ties to the French government, while beneficial, also create a dependency that can hinder diversification efforts.

- Geographic Concentration: A substantial portion of CNIM's revenue is derived from France and Europe, particularly in the defense sector.

- Regulatory Exposure: Dependence on French government contracts and European Union regulations exposes CNIM to specific national and regional policy changes.

- Limited Market Agility: Concentration in a few key markets can reduce the company's ability to adapt quickly to global market shifts and opportunities.

- Vulnerability to Regional Shocks: Economic or political instability within France and Europe could have a significant negative impact on CNIM's performance.

CNIM Group's business model, centered on large, capital-intensive projects, inherently creates financial vulnerabilities. These projects often involve extended sales cycles and significant upfront investment, leading to potential cash flow strains, particularly when new contracts are slow to materialize. The company's financial struggles, including the preventive procedure initiated by CNIM Environnement & Énergie in late 2021 and subsequent delisting from the Paris Stock Exchange in January 2023, highlight the risks associated with this project dependency and the impact of delayed payments or cost overruns.

Full Version Awaits

CNIM Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file for CNIM Group. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout. This ensures you get exactly what you need for your strategic planning.

Opportunities

The global waste-to-energy (WTE) market is booming, projected to reach $75.1 billion by 2030, up from $51.2 billion in 2022, according to recent market analysis. This surge is fueled by escalating waste volumes and a strong push for sustainable energy sources. CNIM's established expertise in modular WTE technology positions it advantageously to capture a significant share of this expanding sector.

Governments worldwide are actively supporting WTE infrastructure development as a key strategy to achieve renewable energy targets and minimize reliance on landfills. For instance, the European Union aims to divert 65% of municipal waste from landfills by 2035, creating a fertile ground for WTE solutions like those offered by CNIM.

Rising global security concerns and ongoing rearmament efforts, especially in Europe, are creating a significant tailwind for CNIM's defense and security business. This heightened demand for military capabilities translates directly into increased opportunities for the group.

The French Ministry of Armed Forces, a crucial client for CNIM, has notably ramped up its procurement activities. For instance, early 2025 saw substantial orders, including significant contracts for amphibious landing craft, directly benefiting CNIM's shipbuilding division.

CNIM's portfolio of innovative defense solutions is particularly well-positioned to capitalize on military modernization needs. Their advancements in areas like new bridging systems and unmanned vehicles align perfectly with the evolving requirements of modern armed forces seeking greater technological superiority.

CNIM's expertise in manufacturing large, high-precision components, coupled with its cleanroom integration capabilities, creates significant opportunities in high-tech fields like space and nuclear energy. The company's involvement in projects such as supplying beam tubes for the ITER upgrade program, a fusion energy experiment, highlights its critical role in advanced scientific endeavors. This positions CNIM to capitalize on the growing global demand for sophisticated scientific instruments and essential infrastructure. For instance, the global nuclear energy market is projected to reach $133.2 billion by 2028, growing at a CAGR of 3.1%, presenting a substantial opportunity for CNIM's specialized services.

Leveraging Sustainable and Environmentally Friendly Technologies

CNIM Group's expertise in environmental and energy sectors, particularly in cleaner energy production and minimizing industrial pollution, perfectly positions it to capitalize on the growing global demand for sustainable solutions. This focus aligns directly with increasingly stringent environmental regulations worldwide, creating a favorable market environment.

The company's ongoing investments in energy efficiency and waste recovery technologies are key opportunities. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, is driving significant investment in these areas. CNIM's commitment to Corporate Social Responsibility (CSR) further enhances its attractiveness to clients prioritizing green credentials, potentially leading to new project acquisitions funded by environmental mandates and sustainability-focused initiatives.

- Alignment with Global Trends: CNIM's core business directly addresses the increasing global emphasis on sustainability and environmental protection.

- Regulatory Tailwinds: Stricter environmental regulations globally create a growing market for CNIM's cleaner energy and waste reduction solutions.

- Investment in Green Technologies: Continued investment in energy efficiency and waste recovery technologies positions CNIM to secure projects driven by environmental mandates.

- Enhanced Client Appeal: Proactive CSR initiatives strengthen CNIM's brand image, attracting clients seeking environmentally responsible partners.

Strategic Partnerships and Acquisitions for Market Penetration

CNIM Group can leverage strategic partnerships and targeted acquisitions to accelerate market penetration and technological advancement. For instance, collaborations similar to the ROCUS unmanned system development with MILREM Robotics allow for rapid integration of new capabilities and access to different geographical or industry sectors without the lengthy process of in-house research and development. This approach proved successful in the defense sector, hinting at similar potential in other CNIM business areas like energy or industrial services.

These alliances can provide immediate access to established distribution channels or customer bases, significantly shortening the time to market for new products or services. By strategically aligning with companies possessing complementary technologies or market reach, CNIM can achieve synergistic growth, enhancing its overall competitive standing. For example, acquiring a specialized engineering firm could bolster its offerings in renewable energy infrastructure, a sector projected for substantial growth in the coming years.

Consider these potential avenues for growth:

- Acquire niche technology providers: Target companies with innovative solutions in areas like advanced materials or digital twins to integrate cutting-edge capabilities.

- Form joint ventures in emerging markets: Partner with local entities to navigate regulatory landscapes and gain immediate market access in high-growth regions.

- Collaborate on large-scale infrastructure projects: Join forces with other industrial conglomerates to bid on and execute complex projects, sharing risks and resources.

CNIM is well-positioned to capitalize on the expanding waste-to-energy market, with global projections reaching $75.1 billion by 2030, driven by waste reduction mandates like the EU's goal to divert 65% of municipal waste from landfills by 2035. The group's expertise in modular WTE technology offers a distinct advantage in this growing sector.

Heightened global security and rearmament efforts are creating significant opportunities for CNIM's defense business, particularly with increased procurement from key clients like the French Ministry of Armed Forces, which saw substantial orders in early 2025 for items such as amphibious landing craft. CNIM's advanced defense solutions, including new bridging systems and unmanned vehicles, align with military modernization needs.

The company's capabilities in high-precision manufacturing and cleanroom integration open doors in high-tech fields like space and nuclear energy. With the nuclear energy market projected to reach $133.2 billion by 2028, CNIM's involvement in projects like the ITER fusion energy experiment highlights its potential to contribute to advanced scientific infrastructure.

Strategic partnerships and acquisitions offer accelerated market entry and technological development, as seen with the ROCUS unmanned system collaboration. These alliances can provide access to new markets and technologies, potentially boosting growth in sectors like renewable energy.

| Opportunity Area | Market Projection/Growth Factor | CNIM Relevance |

| Waste-to-Energy (WTE) | Global market to reach $75.1B by 2030; EU landfill diversion targets. | Modular WTE expertise. |

| Defense & Security | Increased global defense spending; military modernization. | Advanced defense solutions, key client contracts. |

| High-Tech Sectors (Space, Nuclear) | Nuclear market to reach $133.2B by 2028. | High-precision manufacturing, cleanroom integration, ITER involvement. |

| Strategic Alliances | Access to new markets and technologies. | Partnerships for accelerated growth and capability integration. |

Threats

CNIM faces a formidable competitive landscape, with 74 active players vying for market share in the industrial and engineering sectors. This intense rivalry, particularly from larger global corporations, directly threatens CNIM's ability to maintain its current market position and can lead to significant pricing pressure on its projects.

The sheer number of competitors means that innovation and cost-efficiency are not just advantages but necessities for CNIM to remain competitive and secure future contracts. Failure to continuously improve operational performance and technological offerings could result in a gradual erosion of its market share.

CNIM Group's reliance on large, capital-intensive industrial projects exposes it to significant risks from economic downturns. For instance, a global recession in 2024 or anticipated slowdowns in 2025 could lead governments and corporations to slash infrastructure and industrial investment budgets. This directly translates to fewer project opportunities and potential delays or cancellations for CNIM, impacting its order pipeline and revenue streams.

Inflationary pressures, a key concern throughout 2024 and projected into 2025, can also erode the profitability of long-term contracts. Increased raw material and labor costs, if not adequately passed on, could squeeze CNIM's margins. Furthermore, shifts in government spending priorities, driven by fiscal constraints or political changes, can unpredictably affect demand for CNIM's specialized services and equipment.

CNIM Group faces significant challenges due to the complex and constantly changing regulations across its core sectors of energy, environment, and defense. These stringent rules necessitate substantial investment in compliance measures, impacting overall profitability.

For instance, evolving environmental standards in the energy sector, like stricter emissions controls, can force costly upgrades to existing facilities or new project designs. Similarly, shifts in defense procurement policies or enhanced safety requirements in the nuclear energy domain can lead to project delays and increased operational expenses.

The group’s 2021 preventive procedure underscored its vulnerability to external financial and operational pressures, which are often exacerbated by the need to adapt to new regulatory demands. These compliance costs can divert capital from strategic growth initiatives, presenting a notable threat to CNIM’s long-term competitiveness.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, including ongoing conflicts like the war in Ukraine, directly impacts CNIM Group's operations. These tensions can significantly disrupt global supply chains, leading to increased costs for raw materials and components essential for CNIM's projects. For instance, disruptions in the metals and energy markets in 2024-2025 have been a persistent concern for industrial groups.

CNIM's involvement in defense contracts means its business is intrinsically tied to international relations and political decisions. Fluctuations in government spending on defense and shifts in geopolitical alliances can create unpredictable demand and project cancellations. The company's award for the Fonds Ukraine in 2024 highlights its direct engagement with such geopolitical events, showcasing both opportunity and inherent risk.

Trade disputes and protectionist policies, which have been on the rise globally, further exacerbate supply chain vulnerabilities. These can lead to tariffs, import restrictions, and increased logistical complexities for CNIM's international projects, potentially impacting project timelines and profitability. The cost of shipping and logistics, already elevated in recent years, remains a critical factor sensitive to these geopolitical shifts.

- Supply Chain Volatility: Increased raw material costs and component shortages due to geopolitical tensions.

- Defense Contract Sensitivity: Business performance linked to unpredictable international relations and defense spending.

- Trade Policy Impact: Tariffs and restrictions affecting international project execution and logistics.

- Project Execution Risks: Delays and cost overruns on global projects stemming from instability.

Rapid Technological Obsolescence and R&D Pressure

In the high-technology and defense industries, staying ahead means constantly investing in research and development. CNIM Group, operating in these dynamic sectors, faces the threat of rapid technological obsolescence. Failure to keep pace with emerging innovations can quickly render existing products and services uncompetitive. This necessitates significant and ongoing R&D expenditure to ensure relevance and maintain a strong market position.

For instance, the defense sector is seeing rapid advancements in areas like artificial intelligence, autonomous systems, and advanced materials. Companies that don't allocate sufficient resources to R&D risk falling behind competitors who are integrating these new technologies. This pressure to innovate can strain financial resources, especially if market adoption of new technologies is slower than anticipated or if R&D projects do not yield the desired commercial results.

CNIM Group's commitment to innovation is crucial for its long-term viability. The group's 2023 annual report highlighted continued investment in R&D across its various divisions, aiming to develop next-generation solutions. However, the pace of technological change presents a persistent challenge, requiring strategic foresight and substantial financial commitment to avoid the threat of obsolescence and maintain its competitive edge.

- Technological Advancement Pace: The defense and high-tech sectors are characterized by accelerating innovation cycles, demanding continuous adaptation.

- R&D Investment Burden: Significant financial resources are required to fund research and development, which can be a strain on profitability if not managed effectively.

- Competitive Landscape: Competitors investing heavily in R&D can quickly gain market share if CNIM Group fails to match their pace of innovation.

- Obsolescence Risk: Products and services can become outdated rapidly, leading to a loss of revenue and market relevance if R&D efforts are insufficient.

CNIM faces intense competition from numerous players, with over 74 active companies in its sectors, leading to pricing pressures and the necessity for continuous innovation to maintain market share. Economic downturns and shifting government spending priorities, especially in 2024 and projected for 2025, directly threaten CNIM's order pipeline and revenue streams due to reduced investment in infrastructure and industrial projects.

SWOT Analysis Data Sources

This CNIM Group SWOT analysis is built on a foundation of credible data, drawing from their official financial filings, comprehensive market intelligence reports, and expert industry evaluations to ensure accurate and actionable strategic insights.