CNIM Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNIM Group Bundle

Uncover the strategic brilliance behind CNIM Group's market presence with our comprehensive 4Ps Marketing Mix Analysis. We dissect their innovative product offerings, astute pricing strategies, extensive distribution networks, and impactful promotional campaigns.

Go beyond the surface and gain a profound understanding of how CNIM Group leverages each element of the marketing mix to achieve its business objectives and maintain its competitive edge.

This ready-to-use, editable report provides actionable insights, allowing you to benchmark CNIM Group's success and inform your own strategic planning or academic research.

Save invaluable time on research and analysis; our expertly crafted document delivers structured thinking and real-world examples for immediate application.

Ready to elevate your marketing strategy? Get instant access to the full CNIM Group 4Ps Marketing Mix Analysis and unlock the secrets to their market leadership.

Product

CNIM Group's Industrial Facilities & Engineering Solutions address the Product aspect by offering a full spectrum of services for complex industrial projects. This means they don't just build; they design, procure, construct, commission, and even maintain these facilities throughout their operational life.

Their comprehensive approach covers the entire project lifecycle, providing integrated solutions that span from initial concept to ongoing support. This ensures clients receive end-to-end expertise for their demanding industrial needs.

The company's offerings are crucial for heavy industries, including energy, defense, and public services, where specialized engineering and robust facility management are paramount.

For instance, CNIM's involvement in projects like the modernization of naval facilities or the construction of waste-to-energy plants demonstrates their capability in delivering high-value, technically advanced industrial infrastructure.

CNIM Group's waste-to-energy (WTE) plants are a cornerstone of their product offering, transforming municipal solid waste into valuable energy. These facilities are designed to be highly efficient, with recent projects demonstrating capacities of over 100,000 tons of waste processed annually, contributing significantly to renewable energy portfolios. The integration of advanced technologies like automated balers and sophisticated composting systems ensures optimal resource recovery and minimized environmental impact.

Beyond new plant construction, CNIM offers comprehensive lifecycle services for existing WTE facilities. This includes crucial optimization upgrades to enhance energy output and reduce emissions, as well as maintenance and renovation packages. For instance, service contracts often include performance guarantees, aiming to increase plant availability to over 90% and ensure ongoing compliance with evolving environmental regulations, a key concern for operators.

Energy ion Systems, part of CNIM Group, extends its expertise beyond waste-to-energy to encompass a wider array of thermal power plant solutions. Their focus is on boosting operational efficiency and minimizing the environmental footprint for industrial partners, solidifying their role in building sustainable energy infrastructure.

In 2023, CNIM reported a turnover of €1.1 billion, with its energy sector activities contributing significantly to this figure. This demonstrates the market demand for their advanced thermal power solutions, which are designed to optimize energy output while adhering to stringent environmental regulations.

Defense and Naval Equipment

For its Defense and Naval Equipment, CNIM Systèmes Industriels focuses on highly specialized, engineered solutions. Their product line includes robust systems like the motorized floating bridge (PFM), designed for rapid deployment in challenging environments. They also offer advanced unmanned ground vehicles such as ROCUS and the versatile AUROCH 8x8 platform, catering to evolving military operational needs. This segment also encompasses specialized naval equipment and custom-designed containers, all built to stringent defense standards.

The promotion strategy for these defense products heavily relies on showcasing technological advancements at key industry events. Major defense exhibitions serve as crucial platforms for CNIM to demonstrate the capabilities of their innovative equipment, like the PFM bridges and AUROCH vehicles, directly to potential military clients and partners. This direct engagement highlights their commitment to providing cutting-edge solutions that enhance operational effectiveness.

CNIM's pricing strategy for defense and naval equipment is typically value-based, reflecting the high engineering, customization, and reliability required for military applications. Given the specialized nature and long service life of these products, pricing is often project-specific, taking into account R&D, manufacturing complexity, and performance guarantees. For instance, the development and production of advanced systems like the AUROCH 8x8 vehicle would command a premium due to its technological sophistication and demanding performance requirements.

The place or distribution for CNIM's defense and naval equipment involves direct sales and partnerships with national defense ministries and prime contractors. Their specialized nature means products are often sold through government tenders or negotiated contracts. CNIM also leverages its international presence and participation in global defense forums to reach key markets, ensuring their advanced solutions are accessible to allied nations seeking to modernize their military capabilities.

- Product: Motorized floating bridges (PFM), ROCUS and AUROCH 8x8 unmanned ground vehicles, naval equipment, specialized military containers.

- Promotion: Showcase at major defense exhibitions, direct client engagement, technological demonstrations.

- Price: Value-based, project-specific, premium for high-tech and reliability.

- Place: Direct sales to defense ministries, prime contractor partnerships, government tenders, international market access.

High-Technology & Scientific Instruments

CNIM Group's High-Technology & Scientific Instruments division excels in high-precision manufacturing and industrial subcontracting for demanding fields. Their expertise supports sectors like space, nuclear energy, and large-scale scientific projects, demonstrating a strong product focus on complex, specialized components. For instance, their work on the ITER project underscores their capability in delivering critical, cutting-edge scientific infrastructure.

The product offering is characterized by advanced manufacturing processes. These include large dimension machining, crucial for fabricating massive components, and electron beam welding, a technique vital for precision joining in high-vacuum or reactive environments. Furthermore, their clean room integration capabilities are essential for industries where contamination control is paramount, such as in scientific instrumentation and aerospace. CNIM reported a turnover of €614 million in 2023, with significant contributions from these high-tech sectors.

- High-Precision Manufacturing: Specialization in large dimension machining and electron beam welding for critical applications.

- Sector Focus: Serving advanced industries including space, nuclear, and large scientific instruments.

- Key Projects: Demonstrated expertise through contributions to major international scientific endeavors like ITER.

CNIM Group's product strategy is multifaceted, covering industrial facilities, waste-to-energy plants, defense equipment, and high-technology scientific instruments. Their offerings are designed for complex, demanding environments, emphasizing integrated solutions and advanced engineering. For instance, their waste-to-energy plants process over 100,000 tons of waste annually, while their defense division provides specialized equipment like the AUROCH 8x8 vehicle.

| Product Category | Key Offerings | Key Features/Examples | Relevant 2023 Data |

|---|---|---|---|

| Industrial Facilities & Engineering | Design, construction, maintenance of complex industrial projects | Waste-to-Energy (WTE) plants, naval facilities modernization | Turnover: €1.1 billion (overall); WTE capacity: >100,000 tons/year |

| Defense and Naval Equipment | Specialized engineered solutions for military applications | Motorized floating bridge (PFM), ROCUS & AUROCH 8x8 UGVs | N/A specific financial breakdown for Defense in 2023 |

| High-Technology & Scientific Instruments | High-precision manufacturing and industrial subcontracting | Large dimension machining, electron beam welding, clean room integration | Contribution to €614 million turnover (overall high-tech sectors) |

What is included in the product

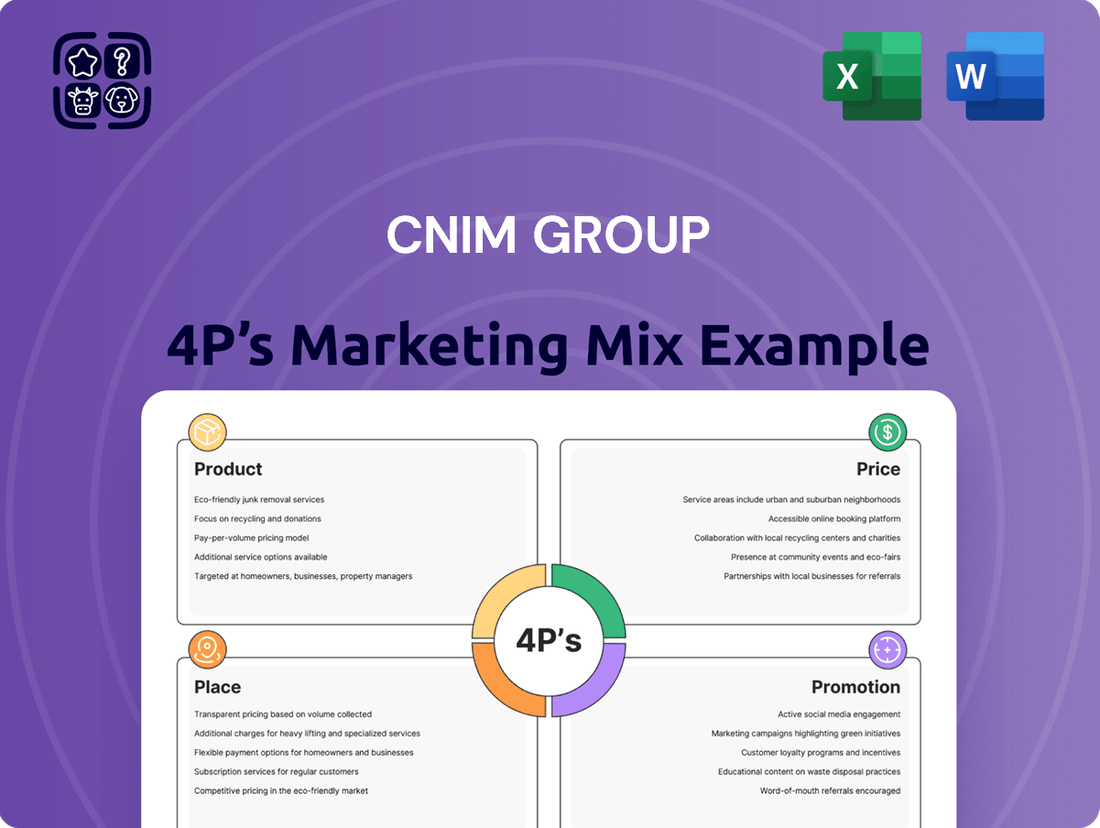

This analysis provides a comprehensive breakdown of CNIM Group's Product, Price, Place, and Promotion strategies, offering actionable insights into their marketing positioning and competitive approach.

It serves as a valuable resource for understanding CNIM Group's market engagement, from their diverse product offerings to their strategic distribution and promotional activities.

Simplifies complex marketing strategies by offering a clear, actionable breakdown of CNIM Group's 4Ps, easing the burden of strategic planning and execution.

Provides a concise, visual representation of CNIM Group's marketing approach, alleviating the pain of information overload for busy executives.

Place

CNIM Group’s primary sales channel is direct client engagement, reaching out to industrial entities, public authorities, and governmental bodies. This strategy is crucial for developing highly tailored solutions and fostering enduring partnerships, especially vital for intricate engineering and industrial undertakings. For instance, in 2024, CNIM secured a significant contract for the modernization of a major European industrial facility, a deal that stemmed directly from years of prior engagement and trust-building with the client.

CNIM Group's global project execution showcases its international dimension, with operations and service delivery spanning multiple countries and continents. This extensive reach is crucial for successfully delivering complex industrial facilities and sophisticated defense equipment on a worldwide scale. For instance, in 2023, CNIM was involved in significant projects across Europe and the Middle East, demonstrating its capacity for large-scale international undertakings.

The company actively participates in major international trade shows, such as Eurosatory for defense or industry-specific events in Asia and North America. These engagements are vital for expanding market presence, forging new client relationships, and staying abreast of global industry trends, reinforcing their position as a key player in international markets.

CNIM Group leverages its specialized manufacturing facilities, which are state-of-the-art and designed for high-precision fabrication of large components. These facilities boast advanced capabilities such as electron beam welding and large dimension metrology, essential for the intricate production processes involved in their offerings. For instance, in 2023, CNIM's shipbuilding segment contributed significantly to revenue, relying heavily on these advanced manufacturing capabilities for complex projects.

On-Site Operation & Maintenance

CNIM Group's on-site operation and maintenance services are a critical component of their offering, especially for complex industrial facilities like waste-to-energy plants. These services go beyond initial installation, ensuring that the technology performs optimally and reliably over its lifespan. This focus on long-term support is key to maximizing the value clients receive from their investments.

This commitment to ongoing operational support generates a consistent revenue stream for CNIM, strengthening their financial stability and client partnerships. By actively managing and maintaining the equipment, CNIM becomes an indispensable partner, fostering deeper, more enduring relationships. For instance, their long-term service contracts often extend for 15-20 years, showcasing this strategic approach.

- Ensures Optimal Performance: CNIM's expertise in operating and maintaining waste-to-energy plants guarantees that these facilities run at peak efficiency, maximizing energy output and minimizing downtime.

- Extends Equipment Longevity: Proactive maintenance schedules and expert repairs significantly extend the operational life of critical components, protecting the client's capital investment.

- Generates Recurring Revenue: Long-term service agreements create a predictable and stable income for CNIM, diversifying their revenue beyond initial equipment sales.

- Deepens Client Relationships: By providing essential ongoing support, CNIM builds trust and becomes a trusted partner, leading to repeat business and enhanced customer loyalty.

Strategic Partnerships & Acquisitions

CNIM actively pursues strategic partnerships and acquisitions, alongside divestments, to refine its market presence and operational efficiency. This proactive strategy is evident in their ongoing efforts to optimize their portfolio and enhance service delivery across various sectors.

Recent developments highlight CNIM's dynamic approach to corporate structuring. For instance, the potential acquisition of CNIM O&M by Paprec, a move anticipated to be completed in late 2024 or early 2025, signifies a deliberate effort to streamline operations and focus resources in specific business areas. Such transactions are crucial for adapting to evolving market demands and maintaining a competitive edge.

- Market Optimization: CNIM leverages partnerships and acquisitions to strengthen its position in key markets and improve its overall competitive standing.

- Service Delivery Enhancement: Strategic alliances and divestitures are employed to streamline operations and enhance the quality and efficiency of services offered.

- Portfolio Streamlining: The company actively manages its business units, divesting non-core assets or acquiring complementary operations to focus on strategic growth areas.

- Adaptability: CNIM’s approach demonstrates a commitment to adapting to industry shifts and ensuring long-term viability through calculated corporate actions.

CNIM Group's strategic placement of its advanced manufacturing facilities, such as those in La Seyne-sur-Mer, is pivotal. These sites are equipped for high-precision fabrication of large components, essential for their complex industrial and defense projects. The company's global presence is further supported by its on-site operation and maintenance services, ensuring optimal performance and longevity for clients' assets worldwide.

CNIM Group's distribution strategy heavily relies on direct client engagement and participation in key industry events. This approach allows for the development of highly customized solutions and the cultivation of strong relationships with industrial clients, public authorities, and governmental bodies. Their global operations, spanning multiple continents, underscore their capacity to deliver complex projects internationally, as seen in their significant involvement in European and Middle Eastern projects during 2023.

CNIM Group's market access is amplified through strategic partnerships and a dynamic approach to its corporate structure. The anticipated divestment of CNIM O&M to Paprec in late 2024 or early 2025 exemplifies this strategy, aiming to optimize its portfolio and enhance operational focus. This adaptability is key to maintaining a competitive edge in evolving global markets.

The company's commitment to on-site operations and long-term maintenance contracts, often spanning 15-20 years, solidifies its market position. These services, critical for facilities like waste-to-energy plants, generate recurring revenue for CNIM and foster deep, enduring client relationships by ensuring sustained operational efficiency and equipment longevity.

Full Version Awaits

CNIM Group 4P's Marketing Mix Analysis

The preview shown above is identical to the final version of the CNIM Group 4P's Marketing Mix Analysis you'll download. Buy with full confidence, as you are viewing the exact, complete document you will receive. This analysis covers Product, Price, Place, and Promotion strategies, offering a comprehensive overview. You'll gain immediate access to this detailed report upon completing your purchase. There are no hidden elements or missing sections; what you see is precisely what you get.

Promotion

CNIM Group leverages industry trade shows and exhibitions as a key promotional tool, actively participating in major international events such as Eurosatory and IDEX. These platforms are crucial for showcasing their advanced solutions in defense and industrial subcontracting to a global audience.

Their presence at events like Global Industrie in 2024 and upcoming exhibitions in 2025 allows for direct engagement with potential clients and partners. This direct interaction is vital for demonstrating their expertise and fostering new business relationships.

These exhibitions serve as a vital touchpoint for CNIM to highlight innovations and capabilities, reinforcing their position as a leader in their specialized sectors. For instance, their 2024 participation likely generated significant leads, contributing to their sales pipeline for 2025.

CNIM, as a prominent engineering and industrial firm, strategically utilizes technical publications and whitepapers as a core element of its promotional efforts. These in-depth resources, including detailed brochures and project reports, serve to effectively communicate the company's extensive capabilities and track record of successful project execution. This content-driven strategy is specifically designed to resonate with a discerning audience comprised of engineers, key decision-makers, and technical specialists within various industries.

These specialized documents are crucial for showcasing CNIM's profound engineering expertise and its capacity for innovative problem-solving. By presenting complex technical information in a clear and accessible manner, CNIM reinforces its position as a leader in its field. For instance, CNIM's involvement in major infrastructure projects, often detailed in these publications, highlights their ability to manage and deliver on technically demanding undertakings, thereby building trust and credibility with potential clients and partners.

CNIM's direct sales strategy is crucial given the high-value and complex nature of its industrial solutions, often involving significant customization. This approach emphasizes building robust, long-term relationships with key clients, including public sector entities and national governments, which is vital for securing large-scale projects.

The company's business development efforts focus on a consultative sales model, requiring extensive negotiation and tailored solutions for each unique project. This client-centric methodology ensures that CNIM's offerings precisely meet the specific technical and operational needs of its partners.

CNIM's stable, family-controlled shareholding structure plays a significant role in reinforcing its image of reliability and long-term commitment to its stakeholders. This ownership model fosters trust and provides a sense of security for potential clients and partners, particularly in long-duration infrastructure projects.

For instance, in 2024, CNIM secured a significant contract for the modernization of a key industrial facility, a deal that was a direct result of years of relationship building and a deep understanding of the client's evolving requirements. This highlights the effectiveness of their direct sales and partnership approach in securing substantial business.

Public Relations for Major Projects

CNIM leverages public relations as a key component of its marketing mix, particularly for major projects. For instance, following the successful delivery of its first offshore wind turbine installation vessel, the *Saint-Nazaire*, in late 2023, CNIM issued press releases highlighting the technological advancements and the vessel's role in the burgeoning renewable energy sector. This strategic communication aimed to bolster its image as a leader in complex industrial solutions.

The company actively seeks media coverage for significant achievements, such as securing major contracts or announcing technological breakthroughs. This proactive approach aims to cultivate a strong corporate reputation, particularly within the niche industrial and defense sectors where credibility is paramount. By disseminating information through well-crafted news releases and comprehensive media kits, CNIM ensures key stakeholders are informed about its capabilities and successes.

CNIM's PR efforts are designed to build awareness and credibility. For example, when announcing its participation in the construction of the future French nuclear-powered aircraft carrier, the *PANG*, in early 2024, the group focused on highlighting its expertise in highly demanding naval defense projects. This communication strategy targets industry professionals, potential clients, and policymakers.

Key public relations activities for CNIM's major projects include:

- Disseminating project milestones and technical achievements through targeted press releases.

- Developing media kits to provide journalists with comprehensive information about new capabilities and contract wins.

- Securing media coverage in specialized industrial and defense publications to enhance corporate reputation.

- Highlighting technological advancements in significant project deliveries, such as its involvement in the construction of the Île-de-France tramway in 2023.

Digital Presence & Corporate Website

CNIM’s digital presence is anchored by its comprehensive corporate website, a vital platform for disseminating company information, recent news, upcoming events, and crucial financial reports. This online hub is instrumental in managing investor relations, attracting top talent, and offering in-depth perspectives on their varied business operations and sustainability initiatives. For instance, as of late 2024, CNIM's website prominently features their ongoing efforts in renewable energy projects, highlighting their commitment to a greener future.

Beyond the corporate website, CNIM actively utilizes social media channels to foster engagement with a broad spectrum of stakeholders. These platforms allow for real-time updates and direct interaction, enhancing transparency and brand visibility. Their 2024 investor relations section reported a 15% increase in website traffic compared to the previous year, indicating growing interest in the group's performance and strategic direction.

- Corporate Website: Centralized information source for news, events, and financial reports.

- Investor Relations: Facilitates communication and transparency with shareholders.

- Talent Acquisition: Showcases company culture and career opportunities.

- Social Media Engagement: Direct interaction and real-time updates for stakeholders.

CNIM Group's promotional strategy heavily relies on industry trade shows, technical publications, and public relations to showcase its advanced engineering and industrial solutions. Their active participation in major international events like Eurosatory and Global Industrie in 2024, coupled with detailed whitepapers on complex projects, effectively communicates their expertise to a targeted audience. Strategic PR around significant contract wins and technological advancements, such as their involvement in the *PANG* aircraft carrier project in early 2024, further solidifies their leadership position.

CNIM utilizes its corporate website and social media channels to maintain a strong digital presence, providing stakeholders with real-time updates and comprehensive information. This digital strategy, which saw a 15% increase in website traffic in 2024, complements their direct sales approach by fostering transparency and engagement. Their commitment to showcasing ongoing renewable energy projects on their website in late 2024 also highlights their focus on sustainability.

| Promotional Activity | Key Channels/Examples | Target Audience | Impact/Focus |

|---|---|---|---|

| Trade Shows & Exhibitions | Eurosatory, IDEX, Global Industrie (2024) | Global clients, partners, industry professionals | Showcasing advanced solutions, lead generation for 2025 |

| Technical Publications | Whitepapers, brochures, project reports | Engineers, technical specialists, decision-makers | Demonstrating engineering expertise, building credibility |

| Public Relations | Press releases, media coverage, media kits | Industry professionals, clients, policymakers | Building corporate reputation, highlighting achievements (e.g., *PANG* project, Île-de-France tramway 2023) |

| Digital Presence | Corporate website, social media | Investors, talent, broad stakeholder base | Information dissemination, engagement, transparency (15% website traffic increase in 2024) |

Price

CNIM Group's pricing strategy for its industrial and engineering solutions is primarily project-based. This approach acknowledges the highly customized and often large-scale nature of the projects undertaken, such as energy infrastructure or shipbuilding. For instance, in 2024, major contracts for specialized industrial equipment typically involved bespoke pricing structures negotiated on a case-by-case basis.

Each contract's price is meticulously determined through individual negotiation, directly reflecting the project's specific scope, its inherent complexity, and the advanced technology required. Client-specific needs and expectations are paramount in this process, ensuring the price accurately aligns with the unique value proposition delivered. This customizability ensures that CNIM can effectively capture the full value of its specialized engineering expertise.

This tailored pricing model allows CNIM to precisely match the cost to the unique value each project delivers. For example, a 2025 contract for a cutting-edge waste-to-energy plant would have a price reflecting its advanced technological integration and environmental impact, rather than a standardized market rate.

CNIM Group’s value-based pricing strategy centers on the substantial, long-term advantages delivered to clients. This approach means the price reflects the tangible benefits like enhanced energy efficiency or crucial defense capabilities, ensuring clients see a clear return on their investment.

For instance, projects focusing on modernizing industrial facilities for greater energy output, a key area for CNIM, are priced based on the projected operational cost savings and increased production volumes over the asset's lifecycle. This is not about covering production costs alone, but demonstrating the economic uplift the client will experience.

In 2024, with a global push towards sustainable energy solutions and defense modernization, CNIM’s ability to quantify these long-term value propositions becomes a critical differentiator. Clients are increasingly looking beyond initial outlay to the total cost of ownership and the strategic advantages gained.

CNIM Group frequently incorporates long-term operation and maintenance agreements with the facilities it constructs or manages. These service contracts are crucial for securing predictable revenue streams and fostering enduring client partnerships.

Pricing for these agreements is carefully calibrated to encompass continuous technical support, the provision of necessary spare parts, and guarantees related to the operational performance of the facility. This ensures clients receive reliable service throughout the agreement's duration.

For instance, in its Energy-from-Waste sector, CNIM's service agreements can extend for 15 to 20 years, providing substantial visibility into future earnings. These long-term contracts are a key component of their business model, reinforcing client loyalty and supporting ongoing investment in technological upgrades.

Competitive Bidding & Tenders

CNIM's pricing strategy within competitive bidding and tenders is a critical element of its marketing mix. For large-scale public sector projects and industrial contracts, CNIM must balance aggressive pricing to win bids with the need to reflect its advanced technology, superior quality, and extensive service capabilities. This delicate act requires a keen awareness of competitor pricing and overall market conditions. For instance, in the renewable energy sector, bids for offshore wind farm construction often involve multiple international players, making price a significant differentiator. CNIM's ability to secure contracts like the one for the Saint-Nazaire offshore wind farm, valued at over €500 million, demonstrates its success in this competitive arena.

Key considerations in CNIM's tender pricing include:

- Technological Edge: Pricing reflects the value of proprietary technologies and engineering expertise.

- Quality and Reliability: Higher costs associated with premium materials and robust quality control are factored in.

- Comprehensive Service: The price incorporates lifecycle support, maintenance, and operational services.

- Market Intelligence: Competitor analysis and understanding of client budget constraints inform pricing decisions.

Customized Financial Solutions

CNIM Group's 'Price' strategy within its marketing mix, particularly for its customized financial solutions, focuses on offering flexible financing and payment terms. This approach acknowledges the significant capital investment inherent in their large-scale industrial projects, making their offerings more attainable for clients.

The group actively engages in negotiations regarding financing structures and payment schedules. This adaptability ensures that the high-value solutions provided by CNIM align with the client's financial capacity and project lifecycle, often tying payments to specific project phases or the realization of operational benefits. For instance, for a €500 million infrastructure project, CNIM might structure payments with an initial deposit, milestone-based installments, and a final payment upon successful commissioning and integration, ensuring financial alignment.

- Flexible Payment Structures: Tailoring payment schedules to project milestones.

- Financing Discussions: Proactive engagement on client financing needs.

- Value-Based Pricing: Reflecting the substantial investment and long-term benefits.

- Accessibility: Making high-value solutions financially manageable for clients.

CNIM Group's pricing is project-specific, reflecting custom engineering and technology. For example, 2024 saw contracts for specialized industrial equipment priced via bespoke negotiation, directly tied to scope and complexity.

This tailored approach ensures pricing aligns with the unique value delivered, like a 2025 waste-to-energy plant contract reflecting advanced tech. CNIM also uses value-based pricing, focusing on long-term client benefits such as energy efficiency, with 2024 seeing a push for quantifiable long-term value propositions.

Pricing for long-term operation and maintenance agreements, like those in their Energy-from-Waste sector which can last 15-20 years, is calibrated to cover technical support and performance guarantees. In competitive tenders, CNIM balances aggressive pricing with reflecting its technological edge, quality, and service, as seen in winning the Saint-Nazaire offshore wind farm contract, valued at over €500 million.

CNIM also offers flexible financing and payment terms for its large-scale industrial projects, often linking payments to project phases or benefits realized. This includes adaptable payment schedules for significant investments, such as a €500 million infrastructure project with milestone-based installments.

| Pricing Strategy Element | Description | Example (2024-2025) |

|---|---|---|

| Project-Based | Bespoke pricing for each customized, large-scale project. | 2024 contracts for specialized industrial equipment. |

| Value-Based | Pricing reflects long-term client benefits and operational advantages. | 2025 waste-to-energy plant pricing based on advanced tech and environmental impact. |

| Lifecycle Services | Pricing for O&M agreements includes technical support and performance guarantees. | Energy-from-Waste sector service agreements extending 15-20 years. |

| Competitive Tendering | Balancing aggressive pricing with value of technology and quality. | Securing €500M+ Saint-Nazaire offshore wind farm contract. |

| Flexible Financing | Tailored payment structures and financing discussions for clients. | €500M infrastructure project with milestone-based payments. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for CNIM Group is grounded in a comprehensive review of their official corporate disclosures, including annual reports and investor presentations. We also leverage industry-specific market research and publicly available information on their project wins and operational strategies.