CNIM Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNIM Group Bundle

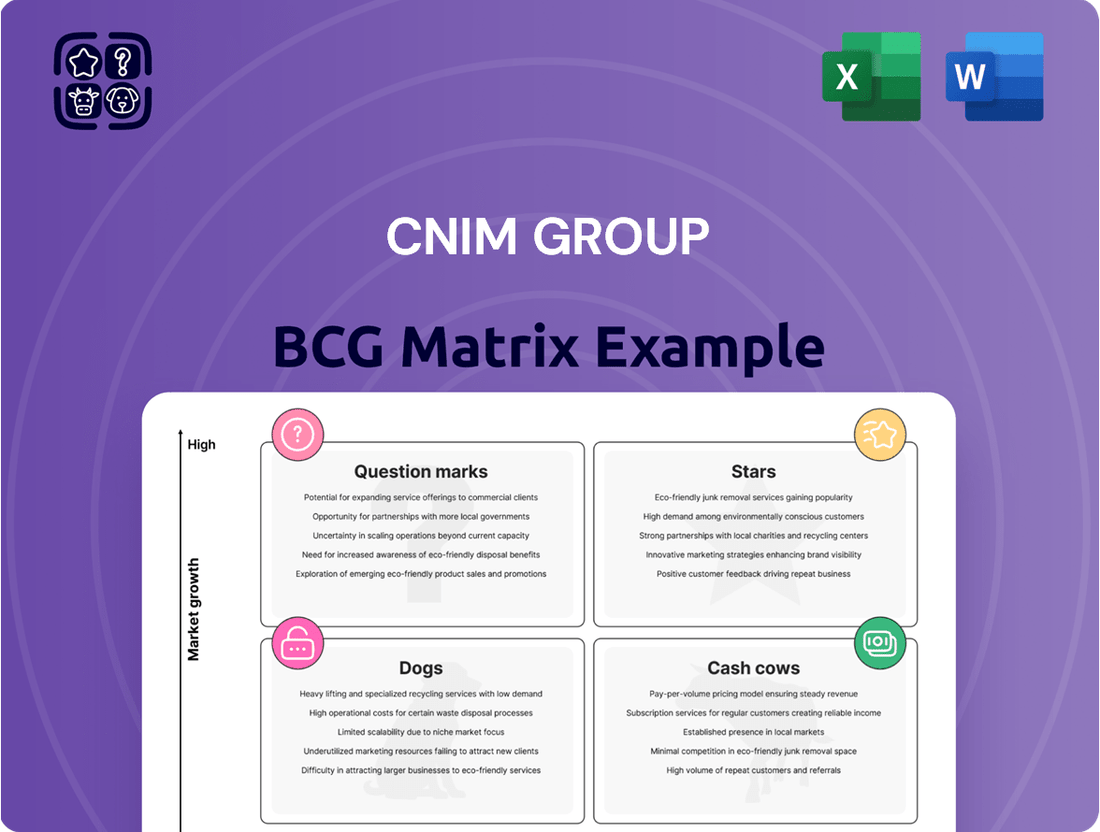

Curious about CNIM Group's strategic positioning? Our preview offers a glimpse into its potential Stars, Cash Cows, Dogs, and Question Marks. Understand how their diverse portfolio is performing and where future growth might lie. To truly unlock CNIM Group's strategic roadmap and make informed decisions, invest in the complete BCG Matrix. It's your key to detailed quadrant analysis and actionable insights.

Stars

CNIM's Waste-to-Energy (WtE) solutions are positioned as a strong contender in a sector anticipated to see substantial growth, with market projections indicating a significant expansion from 2025 to 2035. This surge is driven by global trends like increasing urbanization and a corresponding rise in waste generation, creating a robust demand for effective waste management and energy recovery. CNIM's integrated approach, covering everything from initial engineering to ongoing operations and maintenance, highlights its commitment to providing end-to-end services.

The company's proprietary boiler technology is a key differentiator, lauded for its high efficiency. This technological advantage not only enhances CNIM's competitive edge but also reinforces its strong market standing within this dynamic, high-growth WtE sector. For instance, by 2024, the global WtE market was valued at over $35 billion, with expectations to surpass $50 billion by 2030, underscoring the immense opportunities available.

Naval Landing Craft & Bridging Systems represent a significant strength for CNIM Group. The company boasts a substantial share in the defense sector, especially with its cutting-edge naval equipment. This includes next-generation landing craft and sophisticated bridging systems, crucial for modern military operations.

The global naval shipbuilding market is on an upward trajectory, fueled by increasing geopolitical concerns and widespread military modernization programs. This robust market expansion directly benefits CNIM’s offerings in this domain, positioning them for continued success.

CNIM's commitment is clearly demonstrated by its role as a primary supplier for the French Navy's EDA-S landing craft program. Furthermore, their active presence at major defense exhibitions, such as those planned for 2025, underscores their leadership and the high growth potential inherent in this specialized market segment.

CNIM Systèmes Industriels is a powerhouse in high-precision manufacturing, specifically targeting demanding sectors like Nuclear and Big Science. Their expertise is crucial for projects requiring extreme accuracy and specialized handling.

The market for scientific instruments is set for significant expansion, with projections indicating dynamic growth between 2025 and 2034. This surge is largely attributed to escalating research and development budgets globally and a growing need for sophisticated analytical equipment.

CNIM's advanced capabilities, such as their proficiency in clean room integration and large dimension metrology, are key differentiators. These specialized skills firmly establish them as a frontrunner in this high-value, rapidly expanding market segment.

Advanced Absorption Chillers & Heat Pumps

CNIM's advanced absorption chillers and heat pumps are positioned as a strong contender in the industrial energy efficiency market. These systems are designed to meet the increasing demand from industries looking to reduce their environmental footprint and optimize energy usage. The company's integrated energy recovery solutions are particularly relevant as businesses increasingly focus on capturing and reusing waste heat.

The market for such technologies is expanding rapidly, driven by global energy transition initiatives and stringent environmental regulations. For instance, the global absorption chiller market was valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030, highlighting a significant opportunity for players like CNIM.

- High-Performance Solutions: CNIM provides absorption chillers and integrated energy recovery systems that offer substantial energy savings.

- Energy Transition Alignment: These offerings directly address the growing industrial need for energy efficiency and reduced environmental impact.

- Market Demand: The company is capitalizing on the trend of industries seeking to optimize consumption and recover heat.

- Turnkey Offerings: CNIM's comprehensive approach delivers significant energy performance, positioning them well in a critical growth sector.

Specialized Defense Payload Management Systems

CNIM's Specialized Defense Payload Management Systems are a prime example of a 'Star' in its BCG matrix. These systems, crucial for naval operations like amphibious landings, handle complex, heavy loads in demanding conditions, highlighting their high market share in a growing defense sector. For instance, the global defense market was projected to reach approximately $750 billion in 2024, with specialized naval systems representing a significant and technologically advanced segment.

The critical nature of these payload solutions, ensuring operational reliability and top-tier technical performance, solidifies CNIM's strong position. Their adherence to stringent military classification standards further enhances their competitive edge in this high-value niche.

- High Market Share: These specialized systems cater to a critical, albeit niche, defense sector with demanding requirements.

- High Growth Potential: The global defense market's continued expansion, particularly in naval capabilities, suggests strong future growth for these offerings.

- Technological Sophistication: CNIM's expertise in extreme environment handling and transfer solutions positions them as a leader in a technically advanced segment.

- Strategic Importance: These systems are vital for national security and power projection, ensuring consistent demand and strategic value for CNIM.

CNIM's Waste-to-Energy (WtE) solutions are a strong performer, exhibiting high growth and a significant market share. Their proprietary boiler technology and end-to-end service model provide a competitive advantage. The WtE market is projected to grow substantially, exceeding $50 billion by 2030, driven by global urbanization and waste management needs.

CNIM's Naval Landing Craft & Bridging Systems also stand out as Stars. This segment benefits from a growing global naval shipbuilding market, fueled by geopolitical shifts and military modernization. CNIM's role as a primary supplier for the French Navy's EDA-S program underscores its leadership and the high growth potential in this specialized defense area.

The Specialized Defense Payload Management Systems are a clear Star. These critical systems for naval operations command a high market share in a growing defense sector, projected to reach around $750 billion in 2024. CNIM's technological sophistication and adherence to military standards solidify its leading position in this vital niche.

CNIM's absorption chillers and heat pumps are positioned as Stars within the industrial energy efficiency market. With the global absorption chiller market valued around $1.5 billion in 2023 and growing, CNIM's focus on energy savings and environmental impact aligns perfectly with market demand and global energy transition initiatives.

What is included in the product

CNIM Group BCG Matrix: Analyzing their portfolio for strategic growth.

CNIM Group BCG Matrix offers a clear visual roadmap, easing the pain of strategic uncertainty by categorizing business units.

Cash Cows

CNIM's long-term operation and maintenance (O&M) for waste-to-energy (WtE) plants is a prime example of a Cash Cow within the BCG matrix. With over 60 years of industry experience, CNIM provides essential services that ensure the continuous and efficient operation of these facilities.

This segment generates a stable and recurring revenue stream through long-term contracts, which are critical for the ongoing functionality of existing WtE infrastructure. In 2024, the global WtE market continued to see steady demand for O&M services, driven by the need for reliable waste management and energy production solutions.

While the growth rate for this specific service segment might be considered low compared to emerging technologies, its high market share and the consistent cash generation from established plants solidify its Cash Cow status. CNIM's established presence and expertise in this mature market allow for efficient operations and predictable cash flows.

The established waste processing and treatment plant EPC business within CNIM Group is a prime example of a Cash Cow. This sector, where CNIM has a long and successful track record, is mature with steady demand. While not experiencing explosive growth, CNIM's strong brand and proven project execution secure a significant market share, ensuring consistent revenue generation.

This segment reliably provides substantial and predictable cash flows for CNIM. For instance, in 2024, CNIM secured a major contract for the construction of a waste-to-energy plant in the UK, a testament to their ongoing strength in this established market. These earnings are crucial for funding investments in more dynamic business units.

CNIM's Foundational Industrial Engineering & Manufacturing segment, a cornerstone of its operations since its inception, consistently generates substantial cash flow. This segment benefits from decades of experience, dating back to 1856, enabling it to offer specialized industrial subcontracting and the fabrication of large-scale components for diverse clients.

Despite being a mature market with modest growth prospects, this business unit thrives due to deeply entrenched client relationships and exceptionally integrated manufacturing facilities. For instance, in 2024, the company continued to secure significant contracts for specialized industrial components, underscoring the stability of this revenue stream.

Proprietary Thermal Boiler Manufacturing for WtE

CNIM's proprietary thermal boilers for waste-to-energy (WtE) plants, featuring their unique four-pass design and Martin grate, are a prime example of a cash cow within the CNIM Group's BCG Matrix. These boilers have seen substantial internal development and manufacturing, establishing a strong foothold in the market. Their proven efficiency and technological edge translate into robust profit margins for CNIM.

- High Market Share: CNIM's boilers are a core offering in their WtE projects, indicating a significant market share within this segment.

- Strong Profitability: The established technology and efficiency of the four-pass design and Martin grate contribute to high profit margins.

- Mature Product: This product line represents a mature, high-share offering within the broader waste-to-energy value chain.

- 2024 Market Context: In 2024, the global WtE market continued its growth trajectory, with a projected CAGR of over 5% through 2030, underscoring the sustained demand for efficient boiler technology like CNIM's. For instance, European countries continue to rely heavily on WtE, with countries like Germany processing over 65 million tonnes of waste annually in 2023, a trend expected to persist.

General Naval Equipment Overhauls & Upgrades

CNIM's General Naval Equipment Overhauls & Upgrades represent a classic cash cow. This division leverages deep, established relationships with various navies, ensuring a consistent demand for its services. The business thrives on the perpetual cycle of fleet modernization and essential maintenance, a necessity for any active navy.

This segment is characterized by its maturity, exhibiting low market growth but a dominant market share for CNIM. The predictable nature of these overhauls and upgrades translates into a reliable stream of cash flow. For instance, in 2024, the defense sector globally saw continued investment in fleet readiness and upgrades, with naval segment spending projected to remain robust due to geopolitical tensions and the aging of existing naval assets.

- Steady Revenue Generation: This business unit consistently generates significant revenue due to the ongoing need for naval asset upkeep and modernization.

- High Market Share: CNIM's expertise and history with naval equipment allow it to command a substantial portion of the overhaul and upgrade market.

- Low Growth, High Profitability: While not a high-growth area, the segment benefits from high margins and predictable cash flow, making it a vital contributor to CNIM's overall financial health.

- Strategic Importance: Maintaining these capabilities is crucial for national defense, ensuring CNIM's long-term relevance and partnership with navies.

CNIM's expertise in waste-to-energy (WtE) plant operation and maintenance represents a significant Cash Cow, drawing on over six decades of experience. This segment consistently delivers stable, recurring revenue through long-term contracts, vital for the ongoing functionality of existing WtE infrastructure.

The global WtE market in 2024 demonstrated sustained demand for O&M services, driven by essential waste management needs and energy production. While growth may be moderate, CNIM's high market share and consistent cash generation from established plants firmly place this in the Cash Cow category.

CNIM's established waste processing and treatment plant EPC business is another prime Cash Cow, benefiting from a mature market with steady demand and CNIM's strong brand. This sector reliably provides substantial and predictable cash flows, as evidenced by significant contract wins in 2024, reinforcing its role in funding other business units.

The Foundational Industrial Engineering & Manufacturing segment, a long-standing pillar since 1856, acts as a Cash Cow by generating substantial cash flow through specialized industrial subcontracting and large-scale component fabrication. Deep client relationships and integrated facilities in this mature market ensure stable revenue streams, with significant contracts secured in 2024.

CNIM's proprietary thermal boilers, with their unique four-pass design and Martin grate, are a strong Cash Cow in the WtE sector, offering robust profit margins due to proven efficiency and a significant market share. The global WtE market’s continued growth in 2024, with a projected CAGR over 5% through 2030, highlights the enduring demand for such advanced boiler technology.

General Naval Equipment Overhauls & Upgrades constitute a classic Cash Cow for CNIM, driven by consistent demand from navies for fleet modernization and maintenance. This mature segment, despite low market growth, boasts a dominant market share for CNIM, ensuring a reliable cash flow stream, supported by robust defense spending in 2024 amidst geopolitical considerations.

| CNIM Group Business Segment | BCG Matrix Category | Key Characteristics | 2024 Market Insight |

|---|---|---|---|

| WtE Plant O&M | Cash Cow | Stable, recurring revenue; high market share; low growth | Steady demand in global WtE market for essential services. |

| Waste Processing & Treatment Plant EPC | Cash Cow | Predictable cash flows; strong brand; mature market | Continued significant contract wins in established markets. |

| Foundational Industrial Engineering & Manufacturing | Cash Cow | Substantial cash flow; deep client relationships; mature market | Secured significant contracts for specialized components. |

| WtE Thermal Boilers (Four-Pass Design, Martin Grate) | Cash Cow | High profit margins; established technology; significant market share | Global WtE market growth supports demand for efficient boiler tech. |

| Naval Equipment Overhauls & Upgrades | Cash Cow | Reliable cash flow; dominant market share; low market growth | Robust demand driven by naval fleet readiness and geopolitical factors. |

What You’re Viewing Is Included

CNIM Group BCG Matrix

The preview you are currently viewing represents the complete and unaltered CNIM Group BCG Matrix analysis you will receive immediately after your purchase. This document is not a sample or a demo; it is the final, professionally formatted report, ready for your strategic decision-making. Rest assured, no watermarks or extraneous content will be present in the version you download, ensuring a clean and usable output for your business planning needs.

Dogs

Certain aspects of CNIM's industrial subcontracting, especially those focused on less specialized manufacturing, might be categorized as Dogs in the BCG Matrix. These operations typically contend with intense competition and minimal differentiation. For instance, in 2024, the global industrial subcontracting market saw significant price pressures, with some segments experiencing growth rates below 3%.

These commoditized areas often result in lower profit margins for CNIM. They may struggle to gain substantial market share due to the lack of unique value propositions. The overall contribution of these segments to the group's growth and profitability is often limited, requiring careful management to avoid becoming a drag on resources.

CNIM's legacy involvement in constructing conventional thermal power plants, particularly those reliant on fossil fuels, positions this segment as a potential 'Dog' within the BCG framework. The global push for decarbonization and the increasing adoption of renewable energy sources are significantly curtailing new project pipelines for these types of facilities, especially in developed economies.

This decline in demand directly impacts growth prospects, as evidenced by the International Energy Agency's 2024 report projecting a substantial decrease in new coal-fired power capacity additions globally. Consequently, CNIM's competitive advantage in this specific, non-waste-to-energy thermal power construction area faces considerable headwinds, leading to limited market share expansion opportunities.

CNIM Group's older technologies or product lines that haven't kept pace with market evolution are likely underperforming. These segments, potentially facing reduced demand and shrinking market share, demand significant resources for upkeep while generating minimal returns. For instance, if a particular industrial equipment line from CNIM relies on outdated manufacturing processes, it might struggle against newer, more efficient competitors. In 2024, companies that fail to innovate in their core product offerings often see their market position erode rapidly.

Small, Non-Strategic Niche Projects

CNIM Group might undertake very small, niche projects that don't align with their main growth strategies. These could be geographically isolated or serve very specific markets. While they utilize CNIM's expertise, these ventures often lack substantial scale or future growth potential, potentially diverting resources from more impactful opportunities.

These small-scale, non-strategic niche projects can become resource drains for CNIM. For instance, a project in a remote region with limited market penetration might require significant logistical investment for a return that barely covers costs. Such initiatives can dilute the company's focus, pulling attention away from core areas with higher growth prospects and strategic importance.

- Limited Market Presence: CNIM's market share in these small niches is often negligible, making it difficult to achieve economies of scale.

- Resource Allocation: These projects can tie up valuable personnel and capital that could be better deployed in high-potential segments.

- Low ROI Potential: The financial returns from these niche endeavors are typically modest, failing to contribute significantly to overall profitability.

- Strategic Dilution: Engaging in too many disparate small projects can weaken CNIM's strategic focus and brand clarity in its primary markets.

Underperforming Services with Limited Scalability

Within CNIM Group's portfolio, certain services might be categorized as Dogs due to their underperformance and limited scalability. These are typically offerings that are highly labor-intensive, struggle with automation, or are tied to a very niche client base with no obvious growth avenues. For instance, highly specialized, project-based repair or maintenance services for legacy industrial equipment, where each engagement requires significant manual effort and is limited to a handful of existing clients, could fall into this category.

These services often operate at razor-thin margins or may even be loss-making, consuming valuable resources without generating substantial returns or contributing to the group's strategic expansion. In 2024, such services might represent a small fraction of CNIM's overall revenue, perhaps less than 5%, while demanding a disproportionate amount of management attention and capital expenditure for minimal strategic benefit. The lack of clear pathways for increasing efficiency or broadening the customer base makes them a drag on overall profitability.

Consider these characteristics for services falling into the Dog quadrant:

- High labor dependency: Services requiring extensive, skilled manual labor with little room for technological enhancement.

- Limited market reach: Offerings catering to a small, stagnant, or declining client segment.

- Low profitability: Margins that barely cover costs, or are consistently negative.

- Lack of growth potential: No clear strategy or market opportunity for scaling up operations or increasing revenue.

CNIM's operations in conventional thermal power plant construction, particularly those relying on fossil fuels, are increasingly positioned as Dogs in the BCG Matrix. The global energy transition, prioritizing renewables, significantly shrinks the market for new fossil fuel plants. In 2024, new coal-fired power capacity additions saw a projected global decline, impacting CNIM's growth prospects in this area.

Certain legacy industrial subcontracting activities, characterized by low differentiation and intense price competition, also fit the Dog category. These segments often yield lower profit margins and struggle to expand market share due to a lack of unique value propositions, potentially acting as a drag on CNIM's overall resources.

Older product lines or technologies within CNIM that haven't adapted to market advancements are likely underperforming Dogs. These may face reduced demand and shrinking market share, requiring resources for upkeep with minimal returns, a scenario exacerbated in 2024 by the rapid pace of technological innovation.

CNIM's engagement in very small, niche projects, often geographically isolated or serving specific, limited markets, can also be classified as Dogs. These ventures, while utilizing expertise, often lack scale and future growth potential, potentially diverting resources from more strategically important and profitable areas.

| CNIM Segment Example | BCG Category | Market Growth | Relative Market Share | Key Challenges |

| Conventional Thermal Power Plant Construction (Fossil Fuel) | Dog | Low (Declining due to energy transition) | Low to Moderate (Depends on legacy contracts) | Decreasing demand, regulatory shifts, competition from renewables |

| Commoditized Industrial Subcontracting | Dog | Low (Below 3% in some segments in 2024) | Low | Intense price pressure, lack of differentiation, low margins |

| Outdated Industrial Equipment Lines | Dog | Low (Shrinking market for legacy tech) | Low | Technological obsolescence, competition from modern solutions |

| Small, Non-Strategic Niche Projects | Dog | Low (Limited scalability) | Negligible | Resource drain, lack of strategic focus, low ROI potential |

Question Marks

CNIM is actively involved in the industrialization of innovative wind-assisted propulsion systems, like wing-sails for cargo ships. This places them in a rapidly expanding, yet still developing, segment of the renewable energy and maritime industries. The potential for growth here is substantial.

While the market for these advanced propulsion systems is poised for significant expansion, CNIM's current market share in this specific, cutting-edge technology is likely still quite small. Achieving a leading position will necessitate considerable investment to scale up production and adoption.

For context, the global market for wind-assisted propulsion systems is projected to reach billions of dollars by 2030, with many industry analysts forecasting double-digit annual growth rates. For example, reports from maritime research firms in late 2023 and early 2024 indicated a surge in interest and pilot projects for various wind-assist technologies.

CNIM Group's strategic push into new, untapped geographic markets for its core waste-to-energy and high-tech solutions fits squarely into the 'Question Mark' category of the BCG Matrix. These markets, often characterized by intense competition and the need to build brand presence from the ground up, demand substantial upfront investment. For instance, entering a market like Southeast Asia, where established players already hold significant sway, requires CNIM to develop tailored strategies and invest heavily in local partnerships and marketing to gain traction.

The potential reward in these regions is substantial, given the projected growth in waste management infrastructure and advanced industrial technologies. However, the inherent risks are equally significant, stemming from regulatory uncertainties, differing consumer preferences, and the challenge of establishing a competitive edge against incumbents. CNIM's success in these ventures hinges on its ability to accurately assess market dynamics and allocate resources effectively to overcome these hurdles.

For example, in 2024, the global waste-to-energy market was estimated to be worth over $30 billion, with significant growth anticipated in emerging economies. CNIM's expansion into such markets represents a calculated risk, aiming to capture a share of this expanding pie. The group must therefore demonstrate a clear path to profitability and market penetration, supported by robust financial projections and a deep understanding of the local economic and political landscape.

CNIM's initiatives in advanced digitalization and AI integration for industrial solutions, aligning with the Industry 4.0 movement, would likely place them in the question mark category of the BCG matrix. These advanced technologies offer significant growth potential, aiming to boost efficiency and unlock new service opportunities within their industrial offerings. For instance, by 2024, the global industrial automation market was projected to reach over $250 billion, indicating substantial room for players like CNIM to capture market share.

While the strategic importance of AI and digitalization is clear, CNIM's current market penetration and competitive standing in these nascent areas are probably still being established. This means they are investing in future growth but haven't yet solidified a dominant market position. Early adoption of AI in predictive maintenance for industrial equipment, for example, could significantly reduce downtime, a key selling point in 2024's competitive industrial services landscape.

Niche High-Tech Components for Semiconductors Industry

CNIM Systèmes Industriels operates within the niche high-tech components segment of the semiconductor industry. This sector, while experiencing robust growth, requires substantial and continuous investment in research and development, alongside production scaling, to capture significant market share. For instance, the global semiconductor market was projected to reach approximately $670 billion in 2024, a testament to its expansion.

CNIM's specialized components, though crucial for advanced semiconductor manufacturing, may represent a smaller portion of their overall business. The high growth potential of this niche is undeniable, but it also presents challenges in terms of R&D intensity and the capital expenditure needed to compete effectively. The demand for advanced packaging solutions, a key area for high-tech components, is forecast to grow significantly, with some estimates suggesting a CAGR of over 10% in the coming years.

- High Growth Potential: The semiconductor industry continues its upward trajectory, fueled by demand for AI, 5G, and IoT devices.

- R&D Intensive: Success in this niche demands ongoing innovation and significant investment in developing next-generation components.

- Capital Expenditure Needs: Scaling production to meet industry demand requires substantial financial resources for advanced manufacturing equipment.

- Competitive Landscape: While niche, this segment is highly competitive, with established players and emerging technologies constantly vying for market position.

Development of Next-Generation Defense Technologies

CNIM Group's investment in next-generation defense technologies positions it within the "Stars" quadrant of the BCG Matrix. The company is actively channeling significant capital into research and development for advanced systems, anticipating substantial future growth in this sector. This strategic focus is crucial for maintaining a competitive edge in a rapidly evolving defense landscape.

The development of these cutting-edge technologies requires substantial upfront investment, characteristic of "Stars." For instance, in 2024, CNIM allocated a notable portion of its R&D budget towards areas like autonomous systems and advanced electronic warfare capabilities. These investments are designed to create a strong market position for future revenue generation.

Key areas of development for CNIM's next-generation defense technologies include:

- Autonomous and Unmanned Systems: Development of unmanned ground vehicles (UGVs) and unmanned aerial vehicles (UAVs) with enhanced operational capabilities.

- Cybersecurity and Electronic Warfare: Advancements in protecting critical defense infrastructure and developing sophisticated electronic countermeasures.

- Directed Energy Weapons: Research into high-energy laser and microwave systems for defensive and offensive applications.

- Advanced Materials and Propulsion: Innovation in lightweight, high-strength materials and more efficient propulsion systems for military platforms.

CNIM Group's ventures into novel maritime technologies, like their wing-sail systems for cargo ships, clearly fall into the Question Mark quadrant of the BCG Matrix. These represent high-growth potential markets where CNIM is still establishing its presence.

The global market for wind-assisted propulsion systems, for example, was projected to experience significant expansion, with some forecasts indicating it could reach several billion dollars by 2030, showing a strong growth trajectory. However, CNIM's current market share in this pioneering field is likely nascent, necessitating substantial investment to scale production and secure market adoption.

This strategic positioning demands significant upfront investment to develop and commercialize these innovative solutions, with the inherent risk of uncertain market acceptance and intense competition from established and emerging players. For instance, in 2024, the maritime industry saw increased pilot programs for various green technologies, highlighting both opportunity and the need for early movers to invest heavily.

The success of these Question Mark initiatives hinges on CNIM's ability to navigate regulatory landscapes, adapt to evolving client needs, and effectively allocate capital to gain a competitive foothold in these burgeoning sectors.

BCG Matrix Data Sources

Our CNIM Group BCG Matrix leverages comprehensive market data, including financial disclosures, industry growth rates, and competitor analysis, to provide strategic insights.