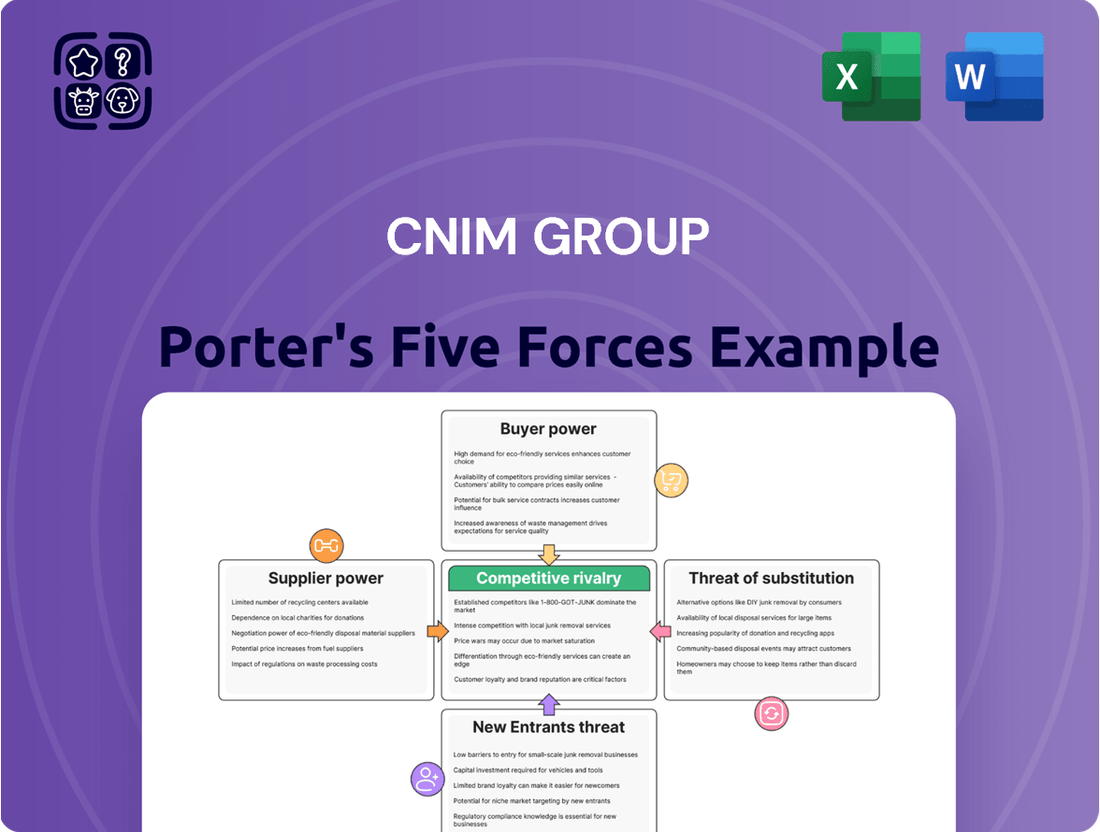

CNIM Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNIM Group Bundle

The CNIM Group operates within a dynamic industrial landscape, where understanding the interplay of competitive forces is crucial for strategic success. Our Porter's Five Forces analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the ever-present danger of substitute products or services. This framework illuminates the core challenges and opportunities CNIM Group faces in its various sectors.

The complete report reveals the real forces shaping CNIM Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CNIM heavily depends on suppliers for highly specialized components and advanced technologies essential for its intricate industrial undertakings, including waste-to-energy facilities and naval systems. The distinct nature of these required inputs can give considerable leverage to a select group of specialized providers, especially when substitute options are limited. This dynamic is especially pronounced for high-precision parts or proprietary defense-related technologies.

CNIM Group's operations heavily rely on a specialized workforce, particularly in engineering, construction, and high-tech fields. The scarcity of highly skilled engineers, experienced project managers, and specialized technicians directly amplifies the bargaining power of these professionals or their supplying agencies. This can translate into increased labor costs, impacting project budgets and timelines, especially given CNIM's core engineering-centric business model.

Suppliers of critical raw materials such as steel and concrete hold considerable bargaining power, particularly when global commodity prices are volatile or when supply chains face disruptions. For CNIM Group, whose projects are inherently large-scale, even minor escalations in the cost of these essential inputs can substantially affect project expenditures and overall profitability.

The price of steel, a cornerstone material for CNIM's infrastructure and industrial projects, experienced significant fluctuations in 2024. For instance, global rebar prices, a key steel product, saw increases of up to 15% in certain regions during the first half of the year due to strong demand from construction sectors and ongoing geopolitical tensions impacting supply routes.

Effective management of these material costs is paramount for CNIM. The company must employ strategies such as forward purchasing, hedging, and diversifying its supplier base to mitigate the impact of raw material price volatility and secure favorable terms.

Proprietary Software and IT Solutions

CNIM's reliance on specialized proprietary software and IT solutions in its high-technology engineering operations significantly strengthens the bargaining power of its suppliers. Companies providing advanced design, simulation, and project management software, especially those with unique functionalities and limited alternatives, can leverage their position to negotiate favorable terms. This dependence is a common challenge in sectors requiring cutting-edge digital tools, impacting operational costs and the pace of innovation.

The suppliers of these critical digital tools hold considerable sway. For instance, in 2024, the global market for engineering software was valued at approximately $14.7 billion, with a compound annual growth rate projected to remain robust. Suppliers of niche, high-performance software, often protected by strong intellectual property rights, can dictate pricing and licensing agreements. This can lead to increased expenditures for CNIM if alternative solutions are scarce or require substantial integration efforts.

- High Switching Costs: Implementing new software systems in complex engineering environments often involves significant upfront investment in licenses, training, and integration, making it costly for CNIM to switch suppliers.

- Limited Supplier Pool: For highly specialized engineering software, the number of providers is often small, concentrating power in the hands of a few key vendors.

- Intellectual Property: Suppliers with patented or unique software algorithms and features can command premium prices due to their exclusive offerings.

- Criticality of Software: The essential nature of these IT solutions for CNIM's design, manufacturing, and project execution processes means that disruptions or unfavorable terms from suppliers can have substantial operational consequences.

Long-term Maintenance and Spares Providers

For its long-term operation and maintenance services, CNIM depends on suppliers for crucial spare parts and specialized tools. If these suppliers hold a monopoly on essential components or if CNIM faces high switching costs due to custom-designed equipment, their bargaining power escalates, particularly over the lifespan of an industrial plant. This dynamic directly affects the cost and dependability of CNIM's service agreements.

This reliance can be particularly acute for older or highly specialized equipment where few, if any, alternative suppliers exist. For instance, if a key supplier of a proprietary control system for a waste-to-energy plant increases its prices significantly, CNIM's maintenance costs for that facility would rise proportionally, potentially impacting the profitability of its service contracts.

- High switching costs for specialized components can lock CNIM into specific suppliers.

- Sole providers of critical spare parts can dictate terms and pricing.

- The lifecycle cost of maintenance is directly influenced by supplier pricing power.

- Reliability of service delivery can be compromised if suppliers face production issues or increase lead times.

CNIM Group faces significant bargaining power from suppliers of specialized components and advanced technologies, particularly in niche markets with limited alternatives. The criticality of these inputs for complex projects like waste-to-energy plants and naval systems means that suppliers of high-precision parts or proprietary defense technologies can exert considerable leverage, especially when substitute options are scarce.

The cost of essential raw materials like steel and concrete also significantly impacts CNIM. In 2024, global rebar prices, a key steel product for construction, saw increases of up to 15% in some regions due to robust demand and supply chain disruptions, directly affecting CNIM's project expenditures and profitability.

Furthermore, CNIM's reliance on specialized proprietary software for its high-technology engineering operations strengthens the bargaining power of software providers. The global engineering software market, valued at approximately $14.7 billion in 2024, features niche vendors with unique functionalities that can command premium prices, leading to increased operational costs for CNIM.

| Factor | Impact on CNIM | 2024 Data/Context |

|---|---|---|

| Specialized Components | High leverage for suppliers with limited alternatives | Niche markets for high-precision parts/proprietary defense tech |

| Raw Materials (Steel) | Significant cost fluctuations impact project budgets | Rebar prices up to 15% increase in H1 2024 |

| Proprietary Software | Suppliers can dictate terms due to critical, unique offerings | Engineering software market ~$14.7 billion in 2024 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CNIM Group's diverse industrial sectors.

Instantly identify and address competitive pressures with a clear, actionable breakdown of the CNIM Group's market landscape.

Customers Bargaining Power

CNIM's key customers, often governments and large industrial conglomerates, wield significant bargaining power. Their substantial project commitments, such as defense contracts or major infrastructure developments, represent a large portion of CNIM's revenue, allowing them to negotiate favorable terms. For instance, the value of major defense contracts can run into billions, directly impacting CNIM's profitability per project.

For CNIM Group, the project-based procurement model significantly amplifies customer bargaining power. Because large-scale projects like power plants or naval vessels are typically awarded through competitive bidding, customers gain considerable leverage to negotiate lower prices and more favorable contract terms from all potential suppliers.

This competitive bidding process inherently drives down costs for customers. For instance, in the European offshore wind sector, average EPC (Engineering, Procurement, and Construction) contract values for substations have seen competitive pricing pressures, with successful bids often reflecting optimized cost structures from multiple bidders.

Furthermore, the distinct nature of each project allows customers to avoid long-term supplier lock-in. If a client undertakes multiple, separate projects, they have the opportunity to diversify their supplier base, which further strengthens their position to demand competitive pricing and superior service on each new engagement.

While the initial procurement of complex industrial facilities or specialized defense equipment can be competitive, customers of CNIM Group often face substantial switching costs once these assets are integrated. For instance, in the defense sector, a nation investing heavily in CNIM's naval platforms or integrated combat systems would incur massive expenses and operational delays to transition to a competitor for future upgrades or maintenance. This inherent lock-in significantly reduces the bargaining power of these customers.

Consider the long-term operational and maintenance contracts that typically accompany CNIM's large-scale projects. These agreements, often spanning decades, are designed to ensure ongoing support and expertise, further entrenching the customer's reliance on CNIM. For example, a municipal waste-to-energy plant built by CNIM would likely have a multi-year service agreement, making it financially prohibitive and operationally disruptive to switch maintenance providers mid-contract.

Customer's Technical Sophistication

CNIM's customers, especially in sectors like defense and advanced industrial solutions, often bring a high degree of technical knowledge to the table. This means they can meticulously assess CNIM's proposals, articulate precise technical specifications, and rigorously oversee project progress. Their understanding of complex engineering means they can effectively negotiate terms based on deep insight into the value and feasibility of CNIM's offerings, thereby amplifying their bargaining power.

- Informed Demands: Customers can specify detailed technical requirements, leaving less room for ambiguity and more leverage for negotiation.

- Quality Scrutiny: Sophisticated clients can closely monitor project execution, ensuring adherence to stringent quality standards and potentially withholding payment or seeking concessions for deviations.

- Alternative Solution Awareness: Technical expertise often correlates with awareness of competing technologies or solutions, enabling customers to compare offerings more effectively.

- Long-Term Partnership Influence: The technical capabilities of major clients can shape CNIM's product development and service offerings, reflecting the customers' informed influence on the market.

Regulatory and Public Scrutiny

CNIM Group's operations, particularly in sectors like waste-to-energy and defense, face significant regulatory and public scrutiny. This means customers often operate under strict governmental guidelines and public expectations for safety, environmental impact, and performance efficiency. For instance, in 2024, the European Union continued to emphasize stringent emissions standards for waste management facilities, directly impacting the performance requirements set by CNIM's clients in this area.

This heightened oversight empowers customers by giving them leverage to demand adherence to precise technical specifications and operational benchmarks. Failure to meet these can result in substantial penalties, making CNIM's ability to satisfy these rigorous demands critical for project success and future contracts. The pressure to maintain compliance and public approval effectively strengthens the bargaining power of CNIM's clientele.

- Stringent Regulations: Many projects, especially in waste-to-energy, are governed by strict environmental and safety regulations, requiring high performance from suppliers like CNIM.

- Public Scrutiny: Public opinion and environmental activism can influence project approval and operational standards, adding pressure on customers to ensure compliance.

- Performance Demands: Customers, driven by regulatory and public pressure, impose rigorous performance standards and contractual penalties for non-compliance, increasing their bargaining power.

- Sectoral Focus: The defense sector also involves significant governmental oversight and specific technical requirements, further solidifying customer power in these contracts.

CNIM's customers, particularly those in large-scale industrial and defense projects, exhibit substantial bargaining power. This is driven by the significant portion of CNIM's revenue these contracts represent, enabling customers to negotiate favorable terms and pricing. For instance, in 2024, major infrastructure projects often involve multi-billion euro commitments, giving clients considerable leverage.

The project-based procurement model, common in sectors like defense and energy, further amplifies customer power. Competitive bidding for complex projects, such as naval vessels or waste-to-energy plants, allows clients to secure lower prices and better contract conditions from multiple suppliers. For example, in the offshore wind sector, EPC contract values for substations have reflected intense price competition, with bids often optimized to win these significant deals.

Customers' technical expertise also plays a crucial role, enabling them to scrutinize proposals and negotiate based on a deep understanding of CNIM's offerings. This informed approach, coupled with awareness of alternative solutions, strengthens their position. Furthermore, regulatory and public scrutiny in sectors like waste-to-energy, with stringent 2024 EU emissions standards, empower customers to demand precise compliance and impose penalties for deviations, directly increasing their bargaining power.

Full Version Awaits

CNIM Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the CNIM Group, detailing the intensity of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This meticulous analysis provides actionable insights into the industry landscape, enabling strategic decision-making for CNIM. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

CNIM Group navigates a landscape characterized by diverse and fragmented market segments, meaning its competitive environment isn't monolithic. For instance, in waste-to-energy, while there are significant global players, other sectors CNIM operates in, like specialized defense components or high-tech industrial equipment, often feature a more diffuse collection of smaller, specialized firms. This fragmentation implies that CNIM faces a broad spectrum of competitors, from large, established companies in some areas to niche specialists in others, rather than a handful of universally dominant rivals across its entire portfolio.

The industrial and engineering sectors, where CNIM Group operates, demand substantial investments in research and development, specialized machinery, and highly skilled labor. These significant upfront expenditures create a barrier to entry and necessitate a focus on securing large, long-term projects to achieve economies of scale and spread costs effectively. For instance, major infrastructure projects, often in the tens or hundreds of millions of euros, are critical for companies like CNIM to recoup their investments.

This reliance on large-scale contracts intensifies competition among established players. CNIM and its peers are constantly vying for these high-value opportunities, leading to a rigorous bidding process. The pressure to win these contracts can result in slimmer profit margins as companies may offer more competitive pricing to secure market share and ensure their operational capacity is utilized.

The drive for large projects also means that companies are often competing for a limited number of available contracts. This scarcity fuels a highly competitive environment where established firms with proven track records and financial stability, like CNIM, have an advantage. However, even for these players, the need to constantly secure new business to cover high fixed costs puts them in direct rivalry with each other, impacting overall profitability.

Competitive rivalry within CNIM Group's sectors is significantly fueled by technological differentiation and the relentless pursuit of innovation. Companies like Hitachi Zosen and Veolia are prominent innovators in the waste-to-energy (WtE) market, constantly developing more efficient processes. For instance, advancements in WtE technologies can lead to higher energy recovery rates, a critical factor for utilities and municipalities selecting partners.

CNIM's emphasis on R&D is therefore paramount to staying ahead. Rivals actively invest in developing superior or more cost-effective technologies, putting pressure on existing market players to upgrade or differentiate their offerings. This technological arms race means that companies must continuously innovate to maintain their competitive edge and market share, as seen in the ongoing improvements in gasification and plasma technologies for waste treatment.

Global Competition and Market Entry

CNIM Group operates globally, meaning it faces rivals from all corners of the world in every sector it serves. This widespread competition is a defining characteristic of its operating environment. For instance, in the naval sector, CNIM competes with major European shipyards but also increasingly with Asian manufacturers who often benefit from different cost structures and government support.

The threat of new international competitors is significant. Emerging economies, in particular, are a source of new entrants often possessing lower operational costs. These companies can quickly disrupt markets by offering more competitive pricing, directly impacting CNIM's market share and profitability. This necessitates continuous monitoring of emerging players and their strategies.

CNIM's global footprint means it must remain constantly aware of potential new market entrants from diverse geographical regions. Each new player brings unique competitive advantages, whether it’s technological innovation, cost efficiency, or a deep understanding of specific regional markets. Staying ahead requires agility and a proactive approach to competitive intelligence.

- Global Reach, Global Rivals: CNIM's international operations mean it contends with competitors across all its business segments worldwide.

- Emerging Economy Threat: New entrants from emerging markets, often with lower cost bases, pose a significant challenge by intensifying price competition.

- Market Share Pressure: The influx of global competitors can erode established market positions, requiring CNIM to constantly defend and adapt its strategies.

- Constant Vigilance: Operating globally demands continuous monitoring of potential new entrants from various regions to anticipate and counter competitive threats.

Consolidation and Strategic Partnerships

The competitive landscape for CNIM Group is actively shaped by ongoing consolidation and strategic alliances among its rivals. These moves can significantly redistribute market power and influence the overall structure of the industry.

While CNIM has navigated its own financial restructuring, the broader industry trend involves mergers and acquisitions that create larger, more powerful competitors. For example, in 2023, the European industrial sector saw significant M&A activity, with deals totaling over €200 billion, often involving established players seeking to expand their capabilities or market reach.

These consolidations can lead to several key outcomes:

- Increased Market Power: Larger entities resulting from mergers often command greater negotiating leverage with suppliers and customers.

- Broader Service Offerings: Strategic partnerships and acquisitions allow competitors to integrate diverse technologies and services, offering more comprehensive solutions.

- Enhanced R&D Capabilities: Merged companies can pool resources for research and development, accelerating innovation and potentially creating technological barriers for smaller players.

- Shifted Competitive Dynamics: The emergence of larger, more integrated rivals necessitates that companies like CNIM adapt their strategies to compete effectively on a larger scale or focus on niche markets where they possess a distinct advantage.

Competitive rivalry for CNIM Group is intense, driven by a fragmented market structure where specialized firms compete alongside larger, established players. This dynamism is amplified by significant R&D investments required for technological differentiation, leading to a constant innovation race. The global nature of CNIM's operations means it faces rivals worldwide, including emerging market entrants with cost advantages, necessitating continuous strategic adaptation and market vigilance.

| Competitor Type | Key Characteristic | Impact on CNIM | Example (2024/2025 Context) |

|---|---|---|---|

| Established Global Players | Large scale, broad service offerings, strong brand recognition | Intense competition for major contracts, pressure on margins | Veolia, Suez (in specific environmental engineering segments) |

| Niche Specialists | High technical expertise in specific areas, agility | Challenge established positions through targeted innovation | Smaller firms in specialized naval components or advanced materials |

| Emerging Market Entrants | Lower cost structures, often government-backed | Price-based competition, potential market share erosion | Asian conglomerates expanding into industrial equipment sectors |

| Consolidated Entities | Increased market power post-merger, broader capabilities | Shifted competitive dynamics, need for strategic alliances or focus on differentiation | Hypothetical post-merger entity in defense manufacturing |

SSubstitutes Threaten

For CNIM's waste-to-energy (WtE) operations, the threat of substitutes is considerable. Landfilling remains a primary alternative, though increasingly restricted by environmental regulations and capacity limits. Recycling and composting are gaining traction, directly diverting materials that could otherwise fuel WtE plants. In 2023, global recycling rates varied significantly, with some developed nations exceeding 40%, impacting the volume of waste available for WtE.

Advancements in sorting technologies and policy incentives for circular economy initiatives further bolster these substitute options. For instance, the European Union's push for higher recycling targets and waste prevention can decrease the waste stream destined for WtE. This strategic shift away from traditional waste disposal methods directly challenges the market share of WtE technologies like those offered by CNIM.

The rise of renewable energy sources like solar and wind presents a significant threat to traditional thermal power plants, a core area for CNIM. As global energy policies increasingly favor decarbonization, the demand for new thermal plant construction or even the continued operation of existing ones is diminishing. This trend is accelerating, with renewable energy capacity continuing to expand rapidly. For instance, in 2023, renewable energy sources accounted for approximately 83% of new power capacity additions globally, a stark contrast to fossil fuels.

The defense sector, a key area for CNIM Group, faces a significant threat from substitutes due to evolving military strategies and budget allocations. As global defense priorities shift, there's a growing possibility that investments will move towards alternative technologies. For example, increased spending on drone warfare or advanced cyber defense capabilities could reduce the demand for traditional naval and land-based equipment, directly impacting CNIM's core offerings.

This dynamic is particularly relevant given the rapid pace of change in modern warfare. Procurement decisions are increasingly influenced by the need for agility and technological superiority in new domains. Nations are re-evaluating their defense postures, and this re-evaluation can lead to a redirection of funds away from established systems and towards emerging solutions, creating a potent substitution threat.

Modular and Off-the-Shelf Solutions

In sectors like high-technology and industrial facilities, modular and off-the-shelf solutions present a distinct threat to companies like CNIM Group. These standardized offerings, while potentially less tailored, can be significantly more cost-effective and faster to implement, directly competing with CNIM's specialized, integrated engineering projects. For clients with tighter budgets or less complex requirements, these simpler alternatives become attractive options.

This dynamic is a recurring challenge for custom solution providers. For instance, the global modular construction market was valued at approximately $127.9 billion in 2023 and is projected to grow, indicating a substantial appetite for standardized building solutions across various industries. CNIM's strength lies in its bespoke approach, but this can be a disadvantage when clients prioritize speed and cost over unique customization.

The availability of these alternatives can limit CNIM's pricing power and market share in segments where standardization is feasible. Companies that can deliver functional, albeit less specialized, solutions at a lower price point or with a quicker turnaround time can capture a significant portion of the market. This forces CNIM to continually emphasize the unique value proposition of its highly engineered, integrated systems.

- Threat of Substitutes: Modular and Off-the-Shelf Solutions

- Impact on CNIM: Competition arises from standardized, less customized solutions that may offer lower costs and faster deployment, particularly in industrial and high-tech sectors.

- Market Trends: The modular construction market, valued around $127.9 billion in 2023, demonstrates a strong demand for standardized approaches across industries.

- Client Considerations: Clients with budget constraints or less complex needs may opt for these simpler, more economical alternatives over CNIM's bespoke engineering.

Advancements in Materials and Design

Innovations in materials science and design are introducing potential substitutes that could impact CNIM Group's traditional industrial processes. For instance, the development of lighter, stronger materials in construction, such as advanced composites or high-performance alloys, might offer alternatives to current steel-intensive engineering and construction methods. This shift could reduce the demand for CNIM's specialized fabrication and installation services.

The increasing adoption of modular construction and prefabrication techniques, driven by new design methodologies and material efficiencies, presents another avenue for substitution. These approaches can streamline project timelines and potentially lower costs, offering a competitive alternative to CNIM's more conventional, on-site heavy industrial construction. For example, in large infrastructure projects, the ability to assemble modules built with novel materials off-site could bypass some of the integrated services CNIM traditionally provides.

- Emerging Materials: Advancements in composite materials and advanced alloys are creating stronger, lighter alternatives for structural components, potentially reducing reliance on traditional steel fabrication.

- Modular Construction: Prefabricated and modular building techniques, enhanced by new materials, offer faster project completion and cost efficiencies, acting as a substitute for conventional, site-intensive construction.

- 3D Printing: Additive manufacturing technologies are enabling the creation of complex components with novel materials, which could disrupt traditional manufacturing and construction processes where CNIM operates.

- Design Software: Sophisticated design and simulation software allows for optimization of structures using fewer or different materials, potentially decreasing the volume of work for traditional heavy engineering firms like CNIM.

The threat of substitutes for CNIM Group's waste-to-energy (WtE) business is significant, with landfilling, recycling, and composting posing direct alternatives. While regulations curb landfilling, recycling rates, which reached over 40% in some developed nations in 2023, are increasing, diverting waste feedstock. Furthermore, policy support for circular economy initiatives in regions like the EU is actively promoting waste prevention and higher recycling targets, directly impacting the volume of waste available for WtE processes.

In the energy sector, renewable sources like solar and wind are rapidly replacing traditional thermal power, a key area for CNIM. Renewables accounted for approximately 83% of new global power capacity additions in 2023, highlighting a decisive shift away from thermal energy generation. This trend intensifies the substitution threat for CNIM's thermal power plant operations.

The defense sector faces substitution threats from evolving military strategies and technologies. Increased investment in areas like drone warfare and cyber defense, rather than traditional naval and land systems, could diminish demand for CNIM's established offerings, especially as nations prioritize agile, technologically superior solutions.

Modular and off-the-shelf solutions in high-technology and industrial facilities also present a challenge. The global modular construction market, valued at around $127.9 billion in 2023, signifies a strong client preference for cost-effective, rapidly deployable standardized options over CNIM's bespoke engineering projects.

| Sector | Substitute Threat | Key Factors | 2023/2024 Data/Trends |

| Waste-to-Energy | Landfilling, Recycling, Composting | Environmental regulations, circular economy initiatives, rising recycling rates | Recycling rates >40% in developed nations (2023) |

| Thermal Power | Renewable Energy (Solar, Wind) | Decarbonization policies, cost competitiveness | Renewables comprised 83% of new global capacity additions (2023) |

| Defense | Drone Warfare, Cyber Defense | Shifting military strategies, technological advancements | Increased global defense spending, focus on emerging domains |

| Industrial/High-Tech | Modular & Off-the-Shelf Solutions | Cost-effectiveness, speed of deployment, standardization | Modular construction market valued at $127.9 billion (2023) |

Entrants Threaten

CNIM Group operates in sectors demanding immense upfront capital. For instance, establishing a new waste-to-energy plant, a core CNIM business, can easily run into hundreds of millions of euros for construction and technology acquisition. Similarly, the defense sector requires massive investments in research, development, and highly specialized, secure manufacturing infrastructure. These substantial financial hurdles effectively limit the pool of potential new entrants, creating a significant barrier.

CNIM Group thrives in sectors demanding highly specialized engineering expertise and proprietary technologies, making new market entry a formidable challenge. For instance, in the realm of complex industrial equipment and shipbuilding, the learning curve and capital investment required to match CNIM's established capabilities are immense. New entrants would need years, if not decades, to develop the same level of technical know-how and operational efficiency.

The substantial investment in research and development, coupled with stringent quality control processes, further elevates the barrier. CNIM's decades of accumulated intellectual capital and a proven track record in delivering high-stakes projects represent a significant competitive advantage. This deep reservoir of experience is not easily replicated by emerging companies, effectively deterring potential new competitors from entering these specialized markets.

Stringent regulatory and certification hurdles significantly deter new entrants in sectors where CNIM Group operates, such as defense, nuclear, and waste-to-energy. These industries demand extensive certifications, permits, and unwavering adherence to rigorous safety and environmental standards. For instance, obtaining necessary approvals for nuclear projects can take years and involve multi-billion euro investments, creating a formidable barrier.

The lengthy and costly process of meeting these regulatory requirements acts as a powerful deterrent for potential new competitors. Navigating complex legal frameworks and securing the requisite licenses demands substantial upfront capital and specialized expertise, often beyond the reach of smaller or less established firms. Compliance is not a one-time achievement but a continuous, evolving challenge demanding ongoing investment and meticulous attention to detail.

Established Client Relationships and Reputation

CNIM Group benefits from deeply entrenched client relationships, particularly with major public and private sector entities in France and globally. These long-standing connections, built over decades, foster significant trust and a proven track record of reliability in executing complex, high-stakes projects. This makes it exceptionally difficult for new market entrants to quickly establish credibility and secure the substantial contracts that CNIM is accustomed to. For instance, in 2024, CNIM continued its significant involvement in critical infrastructure projects, further solidifying these incumbent advantages.

The challenge for newcomers lies not just in matching technical capabilities but in replicating the years of trust and demonstrated success that CNIM possesses. New entrants must overcome the hurdle of proving their worth in sectors where failure can have severe consequences, a barrier that established players like CNIM have already surmounted. This deep reservoir of client loyalty and established reputation acts as a powerful deterrent, significantly raising the barriers to entry for potential competitors in CNIM's core markets.

- Long-standing Partnerships: CNIM has cultivated relationships with key clients over many years, fostering loyalty and repeat business.

- Reputation for Reliability: The group's consistent delivery on complex projects builds a strong reputation, which is difficult for new firms to match quickly.

- Client Inertia: Existing clients often prefer to continue working with trusted partners due to the perceived risks and costs associated with onboarding new suppliers for critical projects.

- Access to Information: Established relationships can provide incumbents with early insights into upcoming projects and client needs, giving them a competitive edge in bidding processes.

Integration and Project Management Complexity

The CNIM Group's strength lies in its ability to provide complete solutions, encompassing everything from initial engineering and design to ongoing operation and maintenance. This end-to-end service model demands highly sophisticated project integration and management skills, making it a significant hurdle for potential new entrants. Replicating this complex ecosystem, which involves managing intricate global supply chains, coordinating numerous subcontractors, and overseeing lengthy project lifecycles, presents a substantial barrier.

CNIM’s capacity to deliver turnkey solutions acts as a critical differentiator in the market. For instance, in 2024, the company continued to secure and execute large-scale projects, such as the ongoing development of waste-to-energy plants and naval defense systems, which by their nature require a level of integrated management that is difficult for newcomers to match. This integrated approach allows CNIM to control quality and timelines more effectively, a key advantage in sectors with high stakes and long investment horizons.

- Integrated Service Model: CNIM’s comprehensive approach from engineering to operations presents a high barrier to entry.

- Project Management Expertise: Managing complex supply chains, multiple subcontractors, and long project durations requires specialized capabilities.

- Turnkey Solution Delivery: The ability to offer complete, ready-to-operate solutions is a significant competitive advantage.

The threat of new entrants for CNIM Group is significantly mitigated by the immense capital requirements across its operational sectors, such as waste-to-energy and defense, where project costs easily reach hundreds of millions of euros. Furthermore, the need for highly specialized engineering expertise, proprietary technologies, and decades of accumulated intellectual capital creates a steep learning curve and operational efficiency barrier that new firms struggle to overcome.

Stringent regulatory and certification hurdles, particularly in defense, nuclear, and waste-to-energy industries, demand years of approvals and substantial investments, acting as a powerful deterrent. Coupled with deeply entrenched client relationships, built on trust and a proven track record of reliability in delivering complex projects, these factors make it exceedingly difficult for new market entrants to gain traction and secure substantial contracts, especially considering CNIM's continued involvement in critical infrastructure in 2024.

CNIM's integrated, end-to-end service model, encompassing everything from initial engineering to ongoing maintenance, requires sophisticated project integration and management skills, including the coordination of global supply chains and numerous subcontractors. This turnkey solution delivery capability represents a critical differentiator and a substantial barrier, as demonstrated by CNIM's ongoing execution of large-scale projects in 2024.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment for technology, R&D, and infrastructure (e.g., €100M+ for a waste-to-energy plant). | Severely limits the number of potential entrants. |

| Specialized Expertise & Technology | Proprietary technologies and decades of accumulated technical know-how. | Requires years of development and significant investment to replicate. |

| Regulatory & Certification Hurdles | Extensive permits and adherence to strict safety/environmental standards in defense, nuclear, waste-to-energy. | Lengthy and costly compliance processes deter new firms. |

| Entrenched Client Relationships | Long-standing trust and proven reliability with major public/private sector entities. | Difficult for newcomers to establish credibility and secure contracts; CNIM's 2024 project involvement reinforces this. |

| Integrated Service Model | Turnkey solutions from design to operations, requiring complex project management. | High barrier due to the need for sophisticated supply chain and subcontractor management. |

Porter's Five Forces Analysis Data Sources

Our CNIM Group Porter's Five Forces analysis is built upon a foundation of credible data, incorporating publicly available financial statements, industry-specific market research reports, and regulatory filings. This ensures a comprehensive understanding of the competitive landscape.